Avidian Gold Corp. (“

Avidian” or the

“

Company”) (TSX-V: AVG) is pleased to announce

that it has entered into a binding Stock Purchase Agreement (the

“

Agreement”) with Contango ORE, Inc.

(“

Contango”) (NYSE-A: CTGO) pursuant to which

Contango has agreed to purchase Avidian’s 100% owned Alaskan

subsidiary, Avidian Gold Alaska Inc. (“

Avidian

Alaska”) for initial consideration of US$2.4 million

(CDN$3.30 million), plus a potential future upside consideration of

US$1.0 million, for a total consideration of up to US$3.4 million

(CDN$4.68 million at current exchange rate of US$1 = CDN$1.376)

(the “

Transaction”). The consideration is a

combination of cash plus Contango shares, as more fully described

below.

Avidian Alaska owns and controls the Golden Zone

and Amanita NE gold properties and has an option agreement to

purchase 100% of the Amanita gold property. Golden Zone is a large,

prospective property in between Anchorage and Fairbanks near rail

and highway infrastructure. The Amanita and Amanita NE gold

properties border Kinross Gold Corporation’s Fort Knox operation

near Fairbanks.

Dino Titaro, Director and Chairman of

Avidian Gold states, “On behalf of the Board of Directors,

we are pleased to announce this transaction. We believe Avidian is

well served by both the cash consideration to immediately

strengthen its balance sheet and the Contango shares to better

participate in the continued strength in the gold price. Contango

is a soon to be producer of gold that is expected to be generating

cash flow by mid to late 2024 from the high grade Manh Choh Gold

Deposit, a 70:30 joint venture between Kinross Gold Corporation and

Contango. Contango has the financial and technical strength to

quickly advance these properties. We are of the opinion that this

acquisition will enhance their future production growth strategy,

which Avidian will participate in and greatly benefit from its

share ownership.

This transaction is a win-win, particularly

considering the current market investment climate for non-producing

junior exploration companies like Avidian. We believe the Alaska

properties will generate more value in Contango’s portfolio as a

near term producer, as evidenced by Contango’s acquisition of these

properties for a purchase price plus a future potential upside

payment that well exceeded Avidian’s market capitalization at the

time of negotiations, up to CDN$4.68 million vs a then market

capitalization of less than CDN$2.0 million. This at a time where

Avidian and most other junior explorers have not benefited by

improving gold prices and have not been able to raise the suitable

equity to adequately advance exploration.

At the conclusion of this transaction, should

Shareholders approve, Avidian will be debt free with a clean

balance sheet and will hold cash plus marketable securities, at

current equity prices, on the order of CDN$3.0 million dollars,

excluding the potential future upside payment on a production

decision of US$1.0 million. Avidian will then focus on a value

creation strategy for its 100% owned Jungo gold-copper project in

Nevada and continue ongoing evaluation of a number of possible

strategic opportunities/alternatives that could be transformational

for the Company.”

Transaction Details

- Contango to acquire 100% of the

capital stock of Avidian Gold Alaska Inc. from Avidian Gold

Corp.;

- Contango will pay Avidian an

initial purchase price of US$2,400,000 consisting of (i) US$400,000

in cash (the “Cash Consideration”) and (ii)

US$2,000,000 in shares of Contango common stock (the

(“Equity Consideration”). The Cash Consideration

shall be paid in the following tranches: (i) a deposit US$50,000

(that has been received) (ii) US$150,000 due on the Closing Date,

and (iii) US$200,000 due on or before the 6-month anniversary of

the Closing Date. The number of shares of common stock constituting

the Equity Consideration will be determined based on Contango’s

NYSE-A, 10-day volume-weighted average price immediately prior to

the Closing Date;

- If Contango makes a positive

production decision on either of the Amanita or Golden Zone

properties within 120 months of the Closing Date, Contango will pay

Avidian an additional US$1,000,000 within thirty (30) days of such

decision (the “Deferred Purchase Price”). The

Deferred Purchase Price can be paid in either cash or shares of

Contango at Contango’s sole discretion. If at any time prior to

this production decision, within the 120-month period, Contango

enters into a third party transaction on either of the Amanita or

Golden Zone properties, Avidian will receive 20% of the

consideration received by Contango (capped at US$500,000 per

property), to be credited against the total Deferred Purchase

Price; and

- The Transaction is subject to

Avidian Shareholder approval, as well as the receipt of all

required governmental and/or regulatory approvals, including that

of the Toronto Venture Exchange and NYSE-A. Should Avidian

Shareholders not approve this transaction the Agreement will

terminate and a termination fee of US$175,000 will be paid to

Contango, representing liquidated damages for the time, resources

and opportunities lost in facilitating this transaction.

Both Avidian’s and Contango’s Board of Directors

have unanimously approved the Transaction. The Board of Directors

for Avidian unanimously recommends that shareholders vote in favor

of the Transaction. The Annual General and Special Meeting of

shareholders will be held on July 4, 2024. It is expected that

closing of this Transaction will happen as soon as practically

possible following the shareholder meeting that has approved the

Transaction.

About Contango ORE Inc.

Contango ORE, Inc. (NYSE-A: CTGO) owns a 30%

interest in the high grade Manh Choh gold project located in

Alaska, in partnership with a subsidiary of Kinross Gold

Corporation (“Kinross”). Kinross acts as manager

and operator. The Manh Choh project has received all Federal and

State permits and mining operations are underway. Mining started at

Manh Choh in August of 2023 with ore stockpiled at site.

Transportation of the ore from Manh Choh to Kinross' existing Fort

Knox mill complex located near Fairbanks, Alaska began in November

2023. Additional ore arrives daily to the stockpile at Fort Knox

and first gold production is planned for the second half of 2024.

Annual gold production is expected to be 225,000 ounces with 30%,

or approximately 67,500 ounces, credited to Contango’s account (see

Technical Summary Report on the Manh Choh project, dated May 12,

2023 at www.contangoore.com).

The use of the Fort Knox mill has accelerated

the development of the Manh Choh project and resulted in

meaningfully reduced environmental impact and upfront capital

without the need for separate milling and tailings storage

facilities in addition to a shorter permitting and development

timeline with less overall risk for the Manh Choh project. In

addition to Manh Choh, Peak Gold LLC, the 30/70 joint venture

between Contango and Kinross, has had a mining lease since 2008 on

675,000 acres of private lands owned by the Tetlin Tribe and

administered by the Tetlin Tribal Council, which offer excellent

exploration potential.Ore is currently being stockpiled at the Manh

Choh site and transported by highway ore haul trucks to a stockpile

area at the Fort Knox mill complex. A stockpile of approximately

250,000 tons is being built prior to the start of milling in mid

2024.

Contango also controls the Lucky Shot project

near Anchorage, Alaska, and through its subsidiary, has 100%

ownership of approximately 8,000 acres of peripheral State of

Alaska mining claims. The Lucky Shot project is a past high-grade

gold producer in which Contango has outlined an initial indicated

mineral resource of 226,963 tonnes at 14.5 grams per tonne (“g/t”)

gold (“Au”) and inferred mineral resource of 82,058 tonnes at 9.5

g/t Au (see Technical Summary Report on the Lucky Shot project,

dated May 26, 2023 at www.contangoore.com). Contango also owns a

100% interest in an additional 137,280 acres of State of Alaska

mining claims through its wholly owned subsidiary, providing

additional exploration potential.

For additional details see

www.contangoore.com.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of

project managers together with a focus on advanced-stage gold

exploration projects in Alaska. The Company’s district-scale (over

40sqkm) Golden Zone property hosts a NI 43-101 Indicated gold

resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus

an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at

0.83 g/t Au) within the Breccia Pipe Deposit. This resource is

exposed on the surface and was pit constrained for an open-pit

mining scenario. The Technical Report was filed on November 17,

2017, and was authored by Leon McGarry, B.Sc., P.Geo. and Ian D.

Trinder, M.Sc., P.Geo. Additional projects include the Amanita and

the Amanita NE gold properties which are both adjacent to Kinross

Gold’s Fort Knox gold mine in Alaska, and the Jungo gold-copper

property in Nevada.

Avidian is a shareholder in High Tide Resources

(CSE: HTRC), which is focused on and committed to the development

of mineral projects critical to infrastructure development using

industry best practices combined with a strong social license from

local communities. Avidian Gold controls approximately 28% of High

Tide’s outstanding shares. High Tide owns a 100% interest in the

Labrador West Iron Project which hosts a NI 43-101 Inferred iron

resource of 654.9 Mt @ 28.84% Fe and is located adjacent to the

Iron Ore Company of Canada’s (“IOCC”) Carol Lake Mine in Labrador

City, NL operated by Rio Tinto PLC. This resource is exposed at

surface and was pit constrained for an open-pit mining scenario.

The Technical Report was filed on SEDAR on April 6, 2023 and was

authored by Ryan Kressall M.Sc., P. Geo, Matthew Herrington, M.Sc.,

P. Geo, Catharine Pelletier, P. Eng. and Jeffrey Cassoff P. Eng.

The Company also owns a 100% interest in the Lac Pegma

copper-nickel-cobalt deposit located 50 kilometres southeast of

Fermont, Quebec.

Further details on the Company and the

individual projects, including the NI 43-101 Technical reports on

the Golden Zone property, can be found on the Company’s website at

www.avidiangold.com.

For further information, please contact:

Steve RoebuckPresident & CEOMobile: (905) 741-5458Email:

sroebuck@avidiangold.com

or

Dino TitaroDirector, Chairman of the BoardMobile: (647) 283

7600Email: dtitaro@avidiangold.com

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Forward-looking information

This News Release includes certain

"forward-looking statements" which are not comprised of historical

facts, including statements regarding the use of proceeds.

Forward-looking statements include estimates and statements that

describe the Company’s future plans, objectives or goals, including

words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “believes”, “anticipates”, “expects”,

“estimates”, “may”, “could”, “would”, “will”, or “plan”. Since

forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Although these statements are

based on information currently available to the Company, the

Company provides no assurance that actual results will meet

management’s expectations. Risks, uncertainties and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward looking information in this news release

includes, but is not limited to, the progress, timing and potential

closing of the Transaction, the Company’s acquisition of shares in

Contango, the Company’s receipt of the Cash Consideration or any

part thereof, the Company’s potential receipt of the Deferred

Purchase Price, any receipt by the Company of shareholder, TSX

Venture Exchange, NYSE-A or any other applicable regulatory

approval of the Transaction or Agreement, the Company’s objectives,

goals or future plans, statements, exploration results, potential

mineralization, the estimation of mineral resources, exploration

and mine development plans, timing of the commencement of

operations by the Company or any other company in which it has an

interest, the material or financial outcomes of any such operations

so commenced, any anticipated benefit to the Company or its

shareholders resulting from the Company’s shareholdings, the

financial state of the Company should the Transaction be

successfully completed, the payment or non-payment of any

termination fee in connection with the Transaction, and estimates

of market conditions. Factors that could cause actual results to

differ materially from such forward-looking information include,

but are not limited to: the failure to complete the Transaction on

the terms provided or at all, failure to receive requisite

approvals in respect of the Transaction, failure to identify

mineral resources, failure to convert estimated mineral resources

to reserves, the inability to complete a feasibility study which

recommends a production decision, the preliminary nature of

metallurgical test results, delays in obtaining or failures to

obtain required governmental, environmental or other project

approvals, political risks, inability to fulfill the duty to

accommodate First Nations and other indigenous peoples,

uncertainties relating to the availability and costs of financing

needed in the future, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity prices, delays in the

development of projects, capital and operating costs varying

significantly from estimates and the other risks involved in the

mineral exploration and development industry, and those risks set

out in the Company’s public documents filed on SEDAR. Although the

Company believes that the assumptions and factors used in preparing

the forward-looking information in this news release are

reasonable, undue reliance should not be placed on such

information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. The Company disclaims any

intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, other than as required by law.

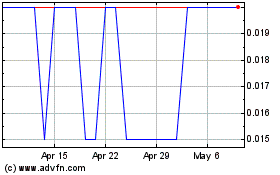

Avidian Gold (TSXV:AVG)

Historical Stock Chart

From Jan 2025 to Feb 2025

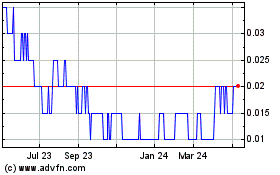

Avidian Gold (TSXV:AVG)

Historical Stock Chart

From Feb 2024 to Feb 2025