Aston Bay Holdings Amends Strategic Deal for Drilling Equipment, Retains Renmark Financial Communications

June 11 2014 - 8:21AM

Access Wire

Vancouver, British

Columbia / ACCESSWIRE / June 11, 2014 /

Aston Bay Holdings Ltd. (TSX-V: BAY) ("Aston Bay" or the "Company")

is pleased to announce that further to its news

release of April 24, 2014, the Company has amended the Memorandum

of Understanding ("MOU") with Lyncorp International Ltd.

("Lyncorp"), a company wholly-owned by David Mullen, to purchase

equipment including four Christensen CS10 Core Drills and all

associated equipment (the "Equipment").

Aston Bay and

Lyncorp have agreed to modify the payment terms, such that the

Company will pay $300,000 in cash by July 10, 2014; $325,000 in

cash by August 10, 2014; and $375,000 in cash or stock (valued on

the previous 10-day weighted average prior to the date of payment),

which is to be made by July 10, 2015. The amended payment terms

allow for less effective dilution of the Company's stock, which is

currently trading higher than on the date of the original

MOU.

The closing of the

transaction will now take place after the end of the period of

exclusivity between the Company and a major mining company, as

previously announced on May 26, 2014.

The amended MOU

will be superseded by a definitive agreement that will be entered

into by Aston Bay and Lyncorp, and will be subject to receipt of

TSX Venture Exchange approval. Closing of the acquisition is also

subject to, among other things, receipt of an appraisal for the

Equipment and confirmation that title to the Equipment is in good

standing. A submission for TSX Venture Exchange approval for the

acquisition of the Equipment will be made following the execution

of a definitive agreement and the completion of an appraisal, as

noted above.

In addition, Aston

Bay has retained the services of Renmark Financial Communications

Inc. ("Renmark") to handle its investor relations

activities.

Renmark was

founded in 1999 by Henri Perron and has a head office located in

Montreal, Quebec. Renmark is a full service investor relations firm

representing public companies trading on all major North American

exchanges with a team of approximately 40 investor relations

professionals.

Renmark will

provide to the Company investor relations services such as roadshow

management, organization of events and distribution of corporate

information, and will also provide to the Company research and

feedback regarding market activity. Renmark does not have any

interest, directly or indirectly, in Aston Bay or its securities,

or any right or intent to acquire such an interest.

"We are pleased to

be working with Renmark to reinforce Aston Bay's profile in the

financial community and enhance the visibility of our project

portfolio. We chose Renmark because its standards and methodologies

fit best with the message we wish to communicate to the investing

public," noted Benjamin Cox, Chief Executive Officer of Aston

Bay.

The Company will

pay to Renmark a monthly retainer of $4,000USD starting June

11, 2014 for the first six months, and $6,000USD for

every month thereafter. The term of the agreement with Renmark is

on a month-to-month basis, and the agreement can be terminated by

either party by giving 10 days' written notice to the other

party.

About Aston Bay Holdings

Aston Bay Holdings

Ltd. (TSX-V: BAY) is a publicly traded mineral exploration company

focused on the 345,033 acre Storm Property located on northwest

Somerset Island, Nunavut. The property hosts the Storm Copper and

Seal Zinc prospects. Aston Bay holds the right to earn or buy up to

a 100% undivided interest in the Storm Property from Commander

Resources Ltd. (TSX-V: CMD).

On behalf of the

Board of Directors,

Benjamin Cox,

Chief Executive Officer

Telephone: (360)

262-6969

For further

information about Aston Bay Holdings Ltd or this news release,

please visit our website at www.astonbayholdings.com.

Neither the TSX Venture Exchange Inc. nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed "forward-looking statements". Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects",

"plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or

conditions "will", "would", "may", "could" or "should" occur.

Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results may differ materially from those in forward-looking

statements. Forward-looking statements are based on the beliefs,

estimates and opinions of the Company's management on the date the

statements are made. Except as required by law, the Company

undertakes no obligation to update these forward-looking statements

in the event that management's beliefs, estimates or opinions, or

other factors, should change.

SOURCE: Aston Bay Holdings Ltd.

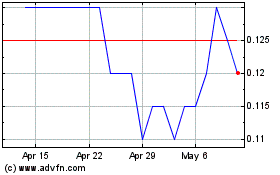

Aston Bay (TSXV:BAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

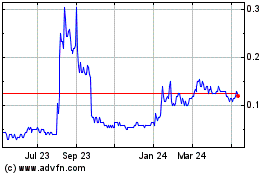

Aston Bay (TSXV:BAY)

Historical Stock Chart

From Dec 2023 to Dec 2024