Brixton Metals Corporation

(TSX-V: BBB, OTCQB:

BBBXF) (the “

Company” or

“

Brixton”) is pleased to announce it shall acquire

one hundred percent interest in mineral claims totaling 6446

hectares or 64.4 square kilometers within the Thorn Project, not

previously controlled, located north and northwest from the past

producing Golden Bear Mine.

Deal Terms

- Under a Purchase and Sale Agreement

with arm’s length private Vendors, Brixton shall pay the Vendors

CAD$75,000 and issue 1,250,000 common shares of Brixton upon

Exchange approval;

- Brixton shall grant the Vendors a

one percent Net Smelter Royalty Return (“NSR”) where Brixton holds

the right to buydown 50% of the NSR, half of 1% for CAD$1,000,000

prior to commercial production.

Chairman and CEO, Gary R. Thompson, stated, “We

are excited to further consolidate the Thorn Project by adding more

gold potential to the copper porphyry district play. Several gold

geochemical anomalies have been identified adjacent to and on trend

with a past producer of high-grade gold. Follow up exploration work

is planned on these newly acquired claims to define drill

targets.”

Figure 1. Thorn Project Location Map with Gold

Geochemistry.

Please see link for an interactive map of Gold

Geochem and Drilling for the Thorn Project here:

https://app.mininghub.com/sh/A0c138c6

Discussion

As shown in Figure 2, several gold-in-soil

geochemical anomalies have been identified and appear to be open

for expansion. The newly acquired claims are located north and

northwest from the past producing Golden Bear Mine.

Figure 2. Gold-in-soil Geochemistry on the Newly

Acquired Mineral Claims.

Previous operators include Chevron, Homestake,

North American Metals and Decoors Mining. Historic rock samples

collected returned 284 sample greater than 20 ppb Au with a high of

124.85 g/t gold and 77.47 g/t silver from the Shoulder Zone

collected by Homestake 1991 (Hamilton, 1994). In 1984, Chevron

collected a rock grab from the Spire Zone that returned 14.00 g/t

gold (Bruaset, 1984). The Honk Showing is a shear hosted

quartz-pyrite vein along a north-trending splay of the Ophir Break

returned 18.07 g/t gold and 64.80 g/t silver from a rock grab

sample (McBean, 1990). Limited drilling has returned mixed results.

One of the best values obtained from drilling was 1.1 g/t gold and

30.3 g/t silver over 4.0m from drillhole R90-7 (Allen, 1990).

Gold was mined from the Golden Bear Mine from

1990-2001 and is currently held by Newmont Corporation and the site

is under remediation and reclamation. The Golden Bear deposits,

located south and southeast from these newly acquired claims, are

Carlin-type and low sulphidation type gold deposits.

The 1987 Reserve Estimate for the Bear Main Zone, which was one

of six deposits, was proven and probable of 1.2 MT at 12 g/t

gold.

Source:

https://minfile.gov.bc.ca/Summary.aspx?minfilno=104K++079

On October 17, 1994, the owners of the Golden

Bear Mine announced the discovery of the Grizzly zone where it had

drilled 27 g/t Au over a true width of 3.9m and a 15.5m

intersection grading 14.4 g/t Au. Source: The Northern Miner news

publication, 1994.

Gold mineralization in the mine area is

structurally controlled as north-south to northwest structures. A

major north to northwest trending fault, known as the Ophir Break

Zone, extends through the area for over 10km and is defined by

areas of intense fracturing with abundant slickensides, areas of

carbonaceous and siliceous black siltstone and gouge, and linear

quartz-iron carbonate-pyrite- listwanites and quartz-dolomite

alteration zones.

Mineralization consists of pyrite, trace

arsenopyrite and scorodite, native gold, pyrrhotite, chalcopyrite,

stibnite and tetrahedrite. Pyrite occurs as late-stage veinlets and

as earlier breccia matrix filling, fragments within breccias.

Source:

https://minfile.gov.bc.ca/Summary.aspx?minfilno=104K++079

These newly acquired claims do not contain any

reserves or resources and are considered early-stage exploration

targets for its high-grade underground potential. There are no

assurances that future work will define resources or reserves.

Qualified Person (QP)

Mr. Gary Thompson, P.Geo., is Chairman and CEO

for the Company who is a qualified person as defined by National

Instrument 43-101. Mr. Thompson has verified the referenced data

but not the analytical results disclosed in this press release and

has approved the technical information presented herein.

About Brixton Metals

Corporation

Brixton Metals is a Canadian exploration company

focused on the advancement of its mining projects. Brixton wholly

owns four exploration projects: Brixton’s flagship Thorn

copper-gold-silver-molybdenum Project, the Hog Heaven

copper-silver-gold Project in NW Montana, USA, which is optioned to

Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel

Project in Ontario and the Atlin Goldfields Project located in

northwest BC which is optioned to Eldorado Gold Corporation.

Brixton Metals Corporation shares trade on the TSX-V under the

ticker symbol BBB, and on the OTCQB under the

ticker symbol BBBXF. For more information about

Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact:

Mr. Michael Rapsch, Senior Manager, Investor Relations. email:

michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707 Neither

the TSX Venture Exchange nor its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.Information set forth in this news release may involve

forward-looking statements under applicable securities laws.

Forward-looking statements are statements that relate to future,

not past, events. In this context, forward-looking statements often

address expected future business and financial performance, and

often contain words such as “anticipate”, “believe”, “plan”,

“estimate”, “expect”, and “intend”, statements that an action or

event “may”, “might”, “could”, “should”, or “will” be taken or

occur, including statements that address potential quantity and/or

grade of minerals, potential size and expansion of a mineralized

zone, proposed timing of exploration and development plans, or

other similar expressions. All statements, other than statements of

historical fact included herein including, without limitation,

statements regarding the use of proceeds. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results,

performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, among others, the following

risks: the need for additional financing; operational risks

associated with mineral exploration; fluctuations in commodity

prices; title matters; and the additional risks identified in the

annual information form of the Company or other reports and filings

with the TSXV and applicable Canadian securities regulators.

Forward-looking statements are made based on management’s beliefs,

estimates and opinions on the date that statements are made and the

Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other

circumstances should change, except as required by applicable

securities laws. Investors are cautioned against attributing undue

certainty to forward-looking statements.

Links:

https://brixtonmetals.com/wp-content/uploads/2024/09/Figure-1_10Sept2024.png

https://brixtonmetals.com/wp-content/uploads/2024/09/Figure-2_10Sept2024.png

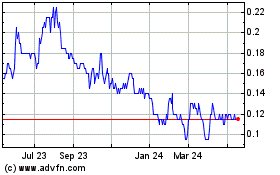

Brixton Metals (TSXV:BBB)

Historical Stock Chart

From Feb 2025 to Mar 2025

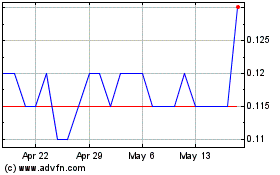

Brixton Metals (TSXV:BBB)

Historical Stock Chart

From Mar 2024 to Mar 2025