Cornish Metals Inc. (

AIM/TSX-V:

CUSN) (“Cornish Metals” or the “Company”) is pleased to

provide an update on current activities at its 100% owned South

Crofty tin project located in Cornwall, United Kingdom.

Highlights

- The South Crofty

Preliminary Economic Assessment (“PEA”) is on track for completion

in Q2 2024.

- Refurbishment of

New Cook’s Kitchen (“NCK”) shaft is progressing as planned with the

two winders and cages now installed, fully commissioned and

certified to allow for safe transport of equipment and workers

within the shaft.

- Mine dewatering

continues with the submersible pumps and Water Treatment Plant

(“WTP”) operating to specifications. The water level in NCK shaft

is being maintained at approximately 280 metres below surface and

the treated water being discharged to the Red River continues to

exceed the standards permitted by the Environment Agency.

- Exploration

drilling of the Wide Formation target continues with nine holes

completed and approximately 7,200 metres drilled to date. Drill

holes 10 and 11 are currently in progress and samples for the

previous three holes have been submitted for assay. Results will be

reported when available.

- The tin price

has surpassed US$30,000 per tonne for the first time in over a

year, rising by over 25% year-to-date and outperforming other base

metals mainly reflecting ongoing supply disruptions amid an

expected improving demand outlook.

Ken Armstrong, Interim CEO of Cornish Metals,

commented “Work is well advanced on the South Crofty PEA, which

remains scheduled for delivery this quarter. The project team

continues to advance mine dewatering and NCK shaft refurbishment,

ventilation shaft and process plant design work, and stakeholder

engagement and outreach in support of a future Feasibility Study

and potential construction decision.”

Mr. Armstrong continued, “The timing of this

important work coincides with a strengthening tin price, which

reached over US$30,000 per tonne this past week, and an emerging

recognition of tin as a critical metal by the United Kingdom and

other national governments. Combined with the fact that there is

presently no primary tin production in Europe or North America,

these factors strongly support our thesis to fast-track work to, if

feasible, responsibly bring the South Crofty tin mine back into

production to the benefit of Cornwall, the United Kingdom and other

stakeholders.”

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral

exploration and development company (AIM and TSX-V: CUSN) focused

on advancing the South Crofty high-grade, underground tin project

through to a construction decision, as well as exploring its

additional mineral rights located in Cornwall, United Kingdom.

- South Crofty is

a historical, high-grade, underground tin mine that started

production in 1592 and continued operating until 1998 following

over 400 years of continuous production;

- The Project

possesses Planning Permission for underground mining (valid to

2071), to construct new processing facilities and all necessary

site infrastructure, and an Environmental Permit to dewater the

mine;

- South Crofty has

the 4th highest grade tin Mineral Resource globally and benefits

from existing mine infrastructure including multiple shafts that

can be used for future operations;

- Tin is a

Critical Mineral as defined by the UK, American, and Canadian

governments;

- Approximately

two-thirds of the tin mined today comes from China, Myanmar and

Indonesia;

- There is no

primary tin production in Europe or North America;

- Tin connects

almost all electronic and electrical infrastructure, making it

critical to the energy transition – responsible sourcing of

critical minerals and security of supply are key factors in the

energy transition and technology growth;

- South Crofty

benefits from strong local community, regional and national

government support;

- Cornish Metals

has a growing team of skilled people, local to Cornwall, and the

Project could generate 250 – 300 direct jobs.

TECHNICAL INFORMATION

The technical information in this news release

has been compiled by Mr. Owen Mihalop who has reviewed and takes

responsibility for the data and geological interpretation. Mr. Owen

Mihalop (MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng) is Chief

Operating Officer for Cornish Metals Inc. and has sufficient

experience relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined under the

JORC Code (2012) and as a Qualified Person under NI 43-101. Mr.

Mihalop consents to the inclusion in this announcement of the

matters based on his information in the form and context in which

it appears.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Kenneth A. Armstrong”Kenneth A. Armstrong

P.Geo.

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.cominfo@cornishmetals.comTel: +1 (604) 200

6664 |

|

|

|

|

|

SP Angel Corporate Finance LLP(Nominated Adviser

& Joint Broker) |

Richard MorrisonCharlie BouveratGrant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Cavendish Capital Markets Limited(Joint

Broker) |

Derrick LeeNeil McDonaldLeif Powis |

Tel: +44 131 220 6939Tel: +44 207 220 0500 |

|

|

|

|

|

Hannam & Partners(Financial Adviser) |

Matthew HassonAndrew ChubbJay Ashfield |

cornish@hannam.partnersTel: +44 207 907 8500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim BlytheMegan Ray |

tim.blythe@blytheray.commegan.ray@blytheray.comTel: +44 207 138

3204 |

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution regarding forward looking

statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”). Forward-looking

statements include predictions, projections, outlook, guidance,

estimates and forecasts and other statements regarding future

plans, the realisation, cost, timing and extent of mineral resource

or mineral reserve estimates, estimation of commodity prices,

currency exchange rate fluctuations, estimated future exploration

expenditures, costs and timing of the development of new deposits,

success of exploration activities, permitting time lines,

requirements for additional capital and the Company’s ability to

obtain financing when required and on terms acceptable to the

Company, future or estimated mine life and other activities or

achievements of Cornish Metals, including but not limited to:

mineralisation at South Crofty, mine dewatering expectations,

Cornish Metals’ exploration drilling programme, exploration

potential and project growth opportunities for the South Crofty tin

project and other Cornwall mineral properties and the timing

thereof, timing and results of Cornish Metals’ feasibility study,

the Company’s ability to evaluate and develop the South Crofty tin

project and other Cornwall mineral properties, strategic vision of

Cornish Metals and expectations regarding the South Crofty mine,

timing and results of projects mentioned. Forward-looking

statements are often, but not always, identified by the use of

words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”,

“forecast”, “expect”, “potential”, “project”, “target”, “schedule”,

“budget” and “intend” and statements that an event or result “may”,

“will”, “should”, “could”, “would” or “might” occur or be achieved

and other similar expressions and includes the negatives thereof.

All statements other than statements of historical fact included in

this news release, are forward-looking statements that involve

various risks and uncertainties and there can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Forward-looking statements are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the availability of financing;

the timing and content of upcoming work programmes; actual results

of proposed exploration activities; possible variations in Mineral

Resources or grade; outcome of the current Feasibility Study;

projected dates to commence mining operations; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; changes in

national and local government regulation of mining operations, tax

rules and regulations. The list is not exhaustive of the factors

that may affect Cornish’s forward-looking statements.

Cornish Metals’ forward-looking statements are

based on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date such statements are made.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ from

those described in forward- looking statements, there may be other

factors that cause such actions, events or results to differ

materially from those anticipated. There can be no assurance that

forward-looking statements will prove to be accurate and

accordingly readers are cautioned not to place undue reliance on

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. Cornish Metals does

not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable law.

Market Abuse Regulation (MAR)

Disclosure

The information contained within this

announcement is deemed by the Company to constitute inside

information pursuant to Article 7 of EU Regulation 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 as amended.

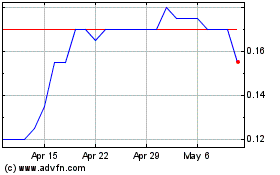

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025