Cornish Metals Inc, the mineral exploration and development company

focused on its 100% owned and permitted South Crofty tin project in

Cornwall, United Kingdom, is pleased to announce that, further to

the announcement made at 7:42am on 28 January 2025 (the

“

Launch Announcement”), it has successfully

concluded the Placing to raise gross proceeds of approximately £56

million (before expenses) through the conditional subscription of

an aggregate 700,000,000 new common shares of no par value each in

the Company (the “

Placing Shares”) at a price of 8

pence per Placing Share (the “

Issue Price”).

The Placing Shares of 115,448,000 new common

shares include 4,927,434 new common shares issued pursuant to the

Broker Option which was exercised by the Placing Agents.

Hannam & Partners and SP Angel acted as

joint bookrunners in connection with the Placing with Canaccord

Genuity acting as co-manager.

Separate announcements of the launch and result

of the Retail Offer will be made in due course. The result of the

Retail Offer will also confirm the final aggregate results of the

Fundraising.

Capitalised terms in this announcement have the

same meaning as in the Launch Announcement unless otherwise

indicated.

Don Turvey, CEO of Cornish Metals,

commented: “We are delighted to announce the successful

completion of this well supported fundraising. We are grateful for

the continued support of our existing shareholders, including

Vision Blue, and we are pleased to welcome the UK’s National Wealth

Fund and other new investors as shareholders in the Company. Having

achieved numerous important milestones in the last year, including

the progress of mine dewatering and shaft refurbishment, as well as

completion of a robust Preliminary Economic Assessment, this

financing enables the Company to maintain the strong momentum as we

continue to progress towards a restart of tin production at South

Crofty.”

Related Party

TransactionsCertain Directors of the Company, whose names

are set out below (the "Participating Directors")

have participated in the Fundraising and have conditionally

subscribed for the following Director Participation Shares at the

Issue Price as set out below:

|

Director |

No. of First Tranche Director Participation Shares

conditionally subscribed for |

No. of Second Tranche Director Participation Shares

conditionally subscribed for |

Expected shareholding in the Company's issued share capital

as enlarged by the Fundraise on Completion* |

|

|

Patrick F. N. Anderson |

59,212 |

10,726 |

0.05 |

% |

|

Lodewyk Daniel Turvey |

211,660 |

38,340 |

0.02 |

% |

|

Anthony Trahar |

658,497 |

119,281 |

0.16 |

% |

|

Samantha Hoe-Richardson |

105,830 |

19,170 |

0.01 |

% |

|

Stephen Gatley |

169,328 |

30,672 |

0.02 |

% |

|

Kenneth A. Armstrong |

88,818 |

16,089 |

0.03 |

% |

|

Donald Robert Njegovan |

59,212 |

10,726 |

0.10 |

% |

|

*Assuming no take up of the Retail Offer |

| |

Participation by the Participating Directors in

the Fundraising constitutes a Related Party Transaction pursuant to

Rule 13 of the AIM Rules for Companies. The Independent Director,

being John McGloin, having consulted with SP Angel Corporate

Finance LLP, the Company's nominated adviser, considers that the

participation by the Participating Directors is fair and reasonable

in so far as shareholders are concerned.

Participation by the Participating Directors

also constitutes a “related party transaction” within the meaning

of Policy 5.9 of the rules and policies of the TSX-V and

Multilateral Instrument 61-101 — Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

Vision Blue Resources Limited

("VBR"), the Company’s strategic investor and

substantial shareholder, as defined by the AIM Rules for Companies,

has exercised its Participation Right pursuant to the VBR 2022

Investment Agreement entered into with the Company on March 27,

2022. The Company and VBR have entered into the Debt Set Off

Agreement whereby they have conditionally agreed to set off amounts

owed by the Company to Vision Blue under the Facility against

amounts due from Vision Blue to the Company in respect of the

subscription of the VBR Participation Right Shares pursuant to the

VBR 2022 Investment Agreement.

For further details of the Debt Set Off

Agreement, please refer to the Launch Announcement.

Participation by VBR in the Fundraise

constitutes a Related Party Transaction pursuant to Rule 13 of the

AIM Rules for Companies. The Independent Directors, being in the

case of the VBR Subscription, all directors of the Company other

than Tony Trahar, having consulted with SP Angel Corporate Finance

LLP, the Company's nominated adviser, consider that the VBR

Subscription is fair and reasonable in so far as shareholders are

concerned. Tony Trahar is the VBR nominated director on the board

of the Company.

Vision Blue is also deemed to be a “related

party” of the Company pursuant to MI 61-101 given that it holds

more than 10% of the Company's issued share capital. The “related

party transaction” requirements under Policy 5.9 of the TSX-V and

MI 61-101 do not apply to the Participation Right, since the

subscription by Vision Blue of the VBR Participation Right Shares

satisfies the exclusion from such requirements under Section

5.1(h)(iii) of MI 61-101. The subscription by Vision Blue of the

VBR Additional Subscription Shares would constitute a “related

party transaction” of the Company under MI 61-101 and the rules and

policies of the TSX-V.

Further Details of the Placing, VBR

Subscription and Director Participations

The VBR Subscription, the Placing and the

Director Participations are being undertaken in two tranches as the

Company, at the date of the Launch Announcement, has insufficient

authorities from its shareholders to issue all of the New

Shares.

Accordingly, the Company plans to utilise the

share issuance authorities that it was granted at its annual

general and special meeting held on June 4, 2024 to issue the First

Tranche New Shares (being, up to a maximum of 133,817,678 new

common shares of the Company, and comprising: (i) 34,722,222 First

Tranche VBR Subscription Shares; (ii) 97,742,899 First Tranche

Placing Shares; and (iii) 1,352,557 First Tranche Director

Participation Shares.

None of the NWF Subscription Shares nor the

Retail Offer Shares will be issued in the first tranche of the

Fundraising.

Any new Common Shares of the Company which are

not issuable by the Company in the first tranche of the Fundraising

pursuant to the Company’s existing share issuance authorities shall

be issued by the Company conditional upon the Company obtaining new

share issuance authorities from shareholders at a special meeting

of shareholders of the Company to be held on or about 18 March 2025

(the “Special Meeting”).

Further details in respect of the Fundraising

will be included in a material change report to be filed by the

Company.

Special Meeting

Subject to receipt of the TSXV Conditional

Approval, the Company expects to file the management information

circular in respect of the Special Meeting on the Company’s profile

on SEDAR+ at www.sedarplus.ca on or about 18 February 2025,

providing further details of the Fundraising (including, the NWF

Subscription Agreement) and a notice convening the Special Meeting,

to seek the necessary shareholder approvals, including, to approve

the creation of NWF as a new “Control Person” of the Company and to

approve new share issuance authorities for the Fundraising.

Issue of Equity and

Admission

An application will be made to the London Stock

Exchange for admission of 133,817,678 New Shares, comprising

97,742,899 First Tranche Placing Shares, 34,722,222 First Tranche

VBR Subscription Shares and 1,352,557 First Tranche Director

Subscription Shares. The issuance of the First Tranche New Shares

is subject to conditional approval by the TSX Venture

Exchange. It is expected that First Admission will

become effective and trading will commence in the First Tranche New

Shares, at 8.00 a.m. on or around 6 February 2025 (or such later

date as may be agreed between the Company and the Joint

Bookrunners).

The First Tranche New Shares will rank pari

passu in all respects with the Company's existing Common Shares.

Following First Admission, the total number of Common Shares in the

Company in issue will be 669,088,390. The total number of voting

rights in the Company as at First Admission will therefore be

669,088,390 ("Total Voting Rights"). The Total Voting Rights may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in the Company under the

FCA's Disclosure and Transparency Rules. The Company does not hold

any shares in treasury.

A separate announcement will be made in due

course in respect of the admission to trading of the First Tranche

New Shares.

The New Shares: (i) have not been qualified for

distribution by prospectus in Canada, and (ii) may not be offered

or sold in Canada during the course of their distribution except

pursuant to a Canadian prospectus or in reliance on an available

prospectus exemption. Subject to completion of the Fundraise, all

the New Shares to be issued as part of the Fundraise will be

subject to a hold period of four months and one day from the date

of their issuance in accordance with applicable Canadian securities

legislation. Under applicable Canadian securities legislation, such

hold period will apply to a trade (as defined under applicable

Canadian securities legislation) of the New Shares in Canada or

through a market in Canada, such as the TSX-V.

This announcement is not for publication or

distribution, directly or indirectly, in or into the United States.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

All references to time in this Announcement are

to London time, unless otherwise stated.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Lodewyk Daniel (Don) Turvey”Don Turvey

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.com |

|

|

|

Tel: +1 (604) 200 6664 |

|

SP Angel Corporate Finance LLP (Nominated Adviser,

Joint Bookrunner & Joint Broker) |

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Hannam & Partners(Joint Bookrunner and

Financial Adviser) |

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44 207 907 8500 |

|

Canaccord Genuity limited(Co-Manager) |

James AsensioCharlie HammondSam Lucas |

Tel: +44 207 523 8000 |

|

Cavendish Capital Markets Limited(Joint

Broker) |

Derrick LeeNeil McDonaldLeif Powis |

Tel: +44 131 220 6939Tel: +44 207 220 0500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim Blythe Megan Ray |

tim.blythe@blytheray.com megan.ray@blytheray.comTel: +44 207 138

3204 |

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

The person responsible for arranging the release

of this announcement on behalf of the Company is Don Turvey.

Early Warning Disclosure by National

Wealth Fund Limited, pursuant to National Instrument 62-103 - The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues

As a result of signing the NWF Subscription

Agreement, NWF will, on completion of the NWF Subscription,

beneficially own and control up to 356,911,283 NWF Subscription

Shares, resulting in NWF having an ownership interest of up to

28.89% of the issued and outstanding common shares of the Company,

assuming an aggregate Fundraising by the Company of £56 million

(including the NWF Subscription) and the issuance by the Company of

an aggregate of 700,000,000 common shares pursuant to the

Fundraising (including the NWF Subscription Shares). These figures

are the maximum position and assume that no funds are raised in the

Retail Offer.

Prior to signing the NWF Subscription Agreement,

NWF did not own or control any securities of the Company. The

aggregate value of the NWF Subscription Shares to be issued to NWF

on completion may be up £28,552,903 (equivalent to C$51,032,603,

using an exchange rate of £1:C$1.7873, based on the Bank of Canada

closing exchange rate on 24 January 2025 (the “Exchange

Rate”) (or 8 pence (C$0.143 per Subscription Share, using

the Exchange Rate). NWF entered into the NWF Subscription Agreement

to acquire the NWF Subscription Shares for investment purposes.

Depending on market conditions and other factors, NWF may from time

to time acquire and/or dispose of securities of the Company or

continue to hold its current position.

To obtain a copy of the early warning report to

be filed by NWF in connection with this press release, please

contact: James Whiteside at +44 (0) 7843 827 343. NWF’s address is

2 Whitehall Quay, Leeds, England, LS1 4HR.

Early Warning Disclosure by Vision Blue

Resources Limited, pursuant to National Instrument 62-103 - The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues

Prior to the Offering, Vision Blue held an

aggregate of 138,888,889 common shares of the Company representing

approximately 25.95% of the outstanding common shares on a

non-diluted basis. VBR also holds 138,888,889 common shares

purchase warrants (each, a “Warrant”) of the

Company. Each Warrant entitles the holder to purchase one

additional Common Share (a "Warrant Share") at a price of £0.27

(approximately C$0.485 based on the Bank of Canada's closing daily

exchange rate for British pounds on January 27, 2025 of C$1.7956

per £1.00) for each Warrant Share for a period of 36 months

expiring May 24, 2025.

VBR has agreed pursuant to the VBR Subscription

Agreement to subscribe at the Issue Price for such number of VBR

Participation Rights Shares which are required to maintain its

25.95% ownership interest in the Company. VBR has also agreed to

subscribe for a number of VBR Additional Subscription Shares, as

described above and in the Launch Announcement. The percentage of

the Company’s common shares owned and controlled by VBR may

increase as a result of the Fundraise.

The total number of shares which VBR will

subscribe for (which will comprise those exercised pursuant to the

Participation Right and, separately, the number of any VBR

Additional Subscription Shares), and the total number of common

shares to be held by VBR as a result of the Fundraise (and

resulting shareholding percentage) will be confirmed by the Company

following the results of the Retail Offer.

VBR is acquiring the VBR Subscription Shares for

investment purposes and intends to review its investment in the

Company on a continuing basis. VBR may, depending on market and

other conditions, increase or decrease its beneficial ownership,

control or direction, over securities of the Company through market

transactions, private agreements, treasury issuances or otherwise.

Vision Blue’s registered address is 1 Royal Plaza, Royal Avenue, St

Peter Port, GY1 2HL, Guernsey.

For more information, or to obtain a copy of the

subject early warning report, please contact: Aura Financial

info@vision-blue.com; +44 207 321 0000.

IMPORTANT INFORMATION

Caution regarding forward looking

statements

This news release may contain certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”). Forward-looking

statements include predictions, projections, outlook, guidance,

estimates and forecasts and other statements regarding future

plans, the realisation, cost, timing and extent of mineral resource

or mineral reserve estimates, estimation of commodity prices,

currency exchange rate fluctuations, estimated future exploration

expenditures, costs and timing of the development of new deposits,

success of exploration activities, permitting time lines,

requirements for additional capital and the Company’s ability to

obtain financing when required and on terms acceptable to the

Company, future or estimated mine life and other activities or

achievements of Cornish Metals, including but not limited to:

statements in connection with the Fundraise and the issuance of the

New Shares, including the timeline of certain events in respect

thereof, including the satisfaction of conditions for closing of

the Fundraise, including TSX-V Conditional Approval, related party

transaction matters and statements regarding the Special Meeting

(including the filing of the management information circular in

respect of the Special Meeting). Forward-looking statements are

often, but not always, identified by the use of words such as

“seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”,

“expect”, “potential”, “project”, “target”, “schedule”, “budget”

and “intend” and statements that an event or result “may”, “will”,

“should”, “could”, “would” or “might” occur or be achieved and

other similar expressions and includes the negatives thereof. All

statements other than statements of historical fact included in

this news release, are forward-looking statements that involve

various risks and uncertainties and there can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Forward-looking statements are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the availability of financing;

the timing and content of upcoming work programmes; actual results

of proposed exploration activities; possible variations in Mineral

Resources or grade; outcome of the current Feasibility Study;

projected dates to commence mining operations; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; changes in

national and local government regulation of mining operations, tax

rules and regulations. The list is not exhaustive of the factors

that may affect Cornish’s forward-looking statements.

Cornish Metals’ forward-looking statements are

based on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date such statements are made.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ from

those described in forward- looking statements, there may be other

factors that cause such actions, events or results to differ

materially from those anticipated. There can be no assurance that

forward-looking statements will prove to be accurate and

accordingly readers are cautioned not to place undue reliance on

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. Cornish Metals does

not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable law.

|

1 |

|

Details of the person discharging managerial

responsibilities / person closely associated |

|

a) |

Name |

1) Patrick Anderson2) Lodewyk

Daniel Turvey3) Tony Trahar4) Sam

Hoe-Richardson5) Steve

Gatley6) Ken Armstrong7) Don

Njegovan |

|

2 |

|

Reason for the notification |

|

a) |

Position/status |

1) Non-Executive Chairman2) Chief

Executive Officer3) Non-Executive

Director4) Non-Executive

Director5) Non-Executive

Director6) Non-Executive

Director7) Non-Executive Director |

|

b) |

Initial notification /Amendment |

Initial notification |

|

3 |

|

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name |

Cornish Metals Inc. |

|

b) |

LEI |

8945007GJ5APA9YDN221 |

|

4 |

|

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument, type of instrument |

Acquisition of common shares without par value |

|

Identification code |

CA21948L1040 |

|

|

|

|

b) |

Nature of the transaction |

Participation in Fundraising - First Tranche Director Participation

Shares only |

|

c) |

Price(s) and volume(s) |

|

|

|

|

Price(s) |

Volume(s) |

|

|

8 pence |

59,212 |

|

|

8 pence |

211,660 |

|

|

8 pence |

658,497 |

|

|

8 pence |

105,830 |

|

|

8 pence |

169,328 |

|

|

8 pence |

88,818 |

|

|

8 pence |

59,212 |

|

|

|

|

|

d) |

Aggregated information |

|

| -

Aggregated volume |

1,352,557 |

| -

Price |

8 pence |

|

|

|

|

e) |

Date of the transaction |

28 January 2025 |

|

f) |

Place of the transaction |

Outside of a trading venue |

| |

|

|

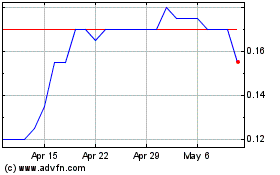

|

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025