Cornish Metals Announces Change of Registered Office

February 05 2025 - 12:00PM

Cornish Metals Inc. (

AIM/TSX-V:

CUSN) (“Cornish Metals” or the “Company”), a mineral

exploration and development company focused on advancing its 100%

owned and permitted South Crofty tin project in Cornwall, United

Kingdom, announces that it has moved its registered office to 1056

– 409 Granville Street, Vancouver, British Columbia, V6C 1T2,

Canada with effect from today’s date.

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.com |

|

|

|

Tel: +1 (604) 200 6664 |

|

SP Angel Corporate Finance LLP (Nominated Adviser

& Joint Broker) |

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Cavendish Capital Markets Limited(Joint

Broker) |

Derrick LeeNeil McDonald |

Tel: +44 131 220 6939 |

|

|

|

|

|

Hannam & Partners(Financial Adviser) |

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44

207 907 8500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim Blythe Megan Ray |

cornishmetals@blytheray.com Tel: +44 207 138 3204 |

|

|

|

|

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral

exploration and development company (AIM and TSX-V: CUSN) that is

advancing the South Crofty tin project towards production. South

Crofty:

- Is a historical,

high-grade, underground tin mine located in Cornwall, United

Kingdom and benefits from existing mine infrastructure including

multiple shafts that can be used for future operations;

- Is fully

permitted to commence underground mining (valid to 2071), construct

new processing facilities and for all necessary site

infrastructure;

- Has a 2024

Preliminary Economic Assessment that validates the Project’s

potential (see news release dated April 30, 2024 and the Technical

Report entitled “South Crofty PEA”):

- US$201 million

after-tax NPV8% and 29.8% IRR

- 3-year after-tax

payback

- 4,700 tonnes

average annual tin production in years two through six

- Life of mine

all-in sustaining cost of US$13,660 /tonne of payable tin

- Total after-tax

cash flow of US$626 million from start of production

- Would be the

only primary producer of tin in Europe or North America. Tin is a

Critical Mineral as defined by the UK, American, and Canadian

governments as it is used in almost all electronic devices and

electrical infrastructure. Approximately two-thirds of the tin

mined today comes from China, Myanmar and Indonesia;

- Benefits from

strong local community, regional and national government support

with a growing team of skilled people, local to Cornwall, and could

generate up to 320 direct jobs.

The 2024 Preliminary Economic Assessment for

South Crofty is preliminary in nature and includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorised as mineral reserves. There is no certainty that

the 2024 Preliminary Economic Assessment will be realised. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability.

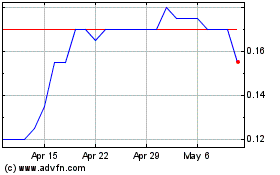

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025