Cornish Metals Inc. (

TSX-V/AIM:

CUSN) (“Cornish Metals” or the “Company”), a mineral

exploration and development company focused on its 100% owned and

permitted South Crofty tin project in Cornwall, United Kingdom, is

pleased to announce that it has released its unaudited financial

statements and management, discussion and analysis (“MD&A”) for

the six months ended June 30, 2024. The reports are available under

the Company’s profile on SEDAR+ (www.sedarplus.ca) and on the

Company’s website (www.cornishmetals.com).

Highlights for the six months ended June

30, 2024 and for the period ending August 14, 2024

(All figures expressed in Canadian dollars

unless otherwise stated)

-

Appointment of Don Turvey as Chief Executive Officer (“CEO”) (news

release dated August 11, 2024):

-

Mr. Turvey appointed as CEO and an executive director of the

Company effective September 1, 2024, subject to approval of a UK

work visa;

-

Mr. Turvey is an experienced mining executive with more than 40

years of experience, including successfully funding and advancing

new projects and historic mines through to production.

-

South Crofty Preliminary Economic Assessment (“PEA”) completed,

validating the Project’s economic viability (news release dated

April 30, 2024):

-

After-tax Net Present Value (“NPV”) of US$201 million and Internal

Rate of Return (“IRR”) of 29.8%;

-

Average annual tin production of over 4,700 tonnes for years two

through six, totaling 49,310 tonnes over a 14-year Life of Mine

(“LOM”);

-

Total after-tax cash flow of approximately US$626 million from

start of production.

-

Commencement of second phase of refurbishment of New Cook’s Kitchen

(“NCK”) shaft (news release dated July 10, 2024):

-

Shaft refurbishment progressing as planned with the on-schedule

installation of the Phase 2 work platform, enabling faster

replacement of old shaft timbers with new steel guides;

-

Winders and cages installed, fully commissioned and in operation,

and certified to allow for safe transport of equipment and workers

within NCK shaft;

-

Rephasing shaft refurbishment improves the functionality of NCK

shaft and enables larger equipment to access the mine at an earlier

stage in its re-development.

-

Mine dewatering continues with the submersible pumps and Water

Treatment Plant (“WTP”) operating to specifications (news release

dated July 10, 2024):

-

Water level in NCK shaft being maintained at approximately 280

meters below surface with the rate of dewatering being reduced to

allow shaft refurbishment and dewatering to proceed

concurrently;

-

Treated water being discharged to the Red River continues to exceed

the standards permitted by the Environment Agency.

-

Purchase of land totaling 7.7 acres located immediately adjacent to

South Crofty surface infrastructure (news release dated May 21,

2024):

-

The purchased land removes reliance on existing right-of-passage

agreements, providing the Company with direct access to all surface

infrastructure as well as additional space for future site works,

opportunities for potential operating cost savings, renewable

energy initiatives and improved overall property security.

-

Sale of Mactung and Cantung royalties for US$4.5 million in cash

consideration (news release dated July 21, 2024):

-

Completion of disposal of Company’s royalty interests on the

Mactung and Cantung tungsten projects located in Northern Canada to

Elemental Altus Royalties Corp. (“Elemental Altus”).

-

Sale of Nickel King property announced for a total consideration of

up to C$8.0 million (news release dated 16 June, 2024):

-

Entered into a binding letter of intent with Northera Resources

Ltd. ("Northera") for the sale of the Company's 100% interest in

the Nickel King Property for a total consideration of up to C$8

million;

-

Initial consideration of C$100,000 received on June 14, 2024, with

transfer of Nickel King Property conditional on receipt of next

tranche of consideration of C$900,000 by September 2024.

-

Samantha Hoe-Richardson joined the Board as independent

non-executive director effective January 8, 2024 (news release

dated January 8, 2024).

-

As at August 13, 2024 the Company’s cash position was C$7.9 million

(equivalent to £4.5 million).

Ken Armstrong, Interim CEO and Director

of Cornish Metals, stated: “Momentum and activity levels

have remained high since the start of the year as the Cornish

Metals team continues to progress work plans and accomplish key

milestones, particularly the completion of the Preliminary Economic

Assessment of the South Crofty tin project that confirms the

Project’s potential to be a low-cost and long-life tin mining

operation. The sale of the Company’s assets in northern Canada

provides near-term liquidity and demonstrates our priority and

focus on advancing South Crofty towards commencement of production

in 2027.

We are delighted to welcome Don Turvey as CEO of

Cornish Metals and we are confident that he will capably lead the

Company forward to realise the best potential for our

stakeholders.”

Review of activities

Appointment of permanent CEO

On August 11, 2024, the Company announced the

appointment of Mr. Don Turvey as CEO and an executive director of

the Company. Regulatory approval has been obtained in relation to

the appointment, which is intended to be effective September 1,

2024, subject to approval of a UK work visa for Mr. Turvey, who

will relocate from South Africa to Cornwall, where he will be

based. Mr. Turvey is an experienced mining executive with more than

40 years of experience in the sector. He has been CEO of private,

ASX and AIM-listed mining companies where he has successfully

funded and taken new projects and historic mines through to

production, as well as leading a number of M&A transactions.

Following Mr. Turvey’s appointment, Patrick Anderson will return to

the position of non-executive Chair of the Board of Directors of

the Company, and Ken Armstrong as non-executive director.

Preliminary Economic Assessment completed for

South Crofty Project

The results of the South Crofty Project PEA were

released on April 30, 2024, validating the Project’s economic

viability and potential to be a low-cost and long-life tin mining

operation with a current 14-year LOM. South Crofty is expected to

produce a clean, high-grade tin concentrate and to be an important

tin producer in Europe, supplying into the growing demand for this

critical metal that is essential for the energy transition.

Key highlights from the PEA include:

-

After-tax NPV8% of US$201 million and 29.8% after-tax IRR at base

case tin price of US$31,000/tonne;

-

Pre-production capital requirement of US$177 million;

-

Capital pay-back period of three years after-tax;

-

Total after-tax cash flow of US$626 million from start of

production, peaking at US$82 million in second year of

production;

-

Average annual earnings before interest, taxes, depreciation and

amortization (“EBITDA”) of US$83 million and 62.1% EBITDA margin in

years two through six;

-

49,310 tonnes of tin metal in concentrate produced over a 14-year

LOM

-

Average annual tin production of over 4,700 tonnes for years two

through six, equivalent to approximately 1.6% of global mined tin

production;

-

LOM average all-in sustaining cash cost (“AISC”) of US$13,661/tonne

of payable tin, positioning South Crofty as a low cost tin

producer;

-

Growth opportunities from additional in-mine and near-mine

exploration with the potential to materially extend the mine life

and increase production; and

-

Potential to directly employ up to 320 people with permanent

high-skilled and well-paid jobs and create up to 1,000 indirect

jobs.

Further details can be found in the news release

dated April 30, 2024 and the Technical Report entitled “South

Crofty PEA” prepared in accordance with NI 43-101 and filed on

SEDAR+.

Refurbishment of New Cook’s Kitchen Shaft –

second phase commenced

Phase 2 of NCK shaft refurbishment is underway,

following the on-schedule installation of a new double-deck

equipping stage and modified main cage, providing a safe and stable

work platform enabling faster replacement of the old shaft timbers

with new steel buntons and guides (refer news release dated July

10, 2024). Rephasing shaft refurbishment, concurrent with mine

dewatering, will improve the functionality of NCK shaft, enable

larger equipment to access the mine at an earlier stage in its

re-development and ensure that high health and safety standards are

applied as the underground mine workings are accessed.

The NCK shaft winding engines and associated

winding apparatus, including the refurbished south headframe, have

been fully commissioned and, following successful third-party

compliance testing, have been certified for use. This system

enables safe access to NCK shaft for personnel and materials as

required to facilitate the shaft refurbishment works and subsequent

access to the dewatered deep workings of the mine. Mine dewatering

continues with the submersible pumps and water treatment plant

operating to specifications. The water level in NCK shaft is being

maintained at approximately 280 metres below surface and the

treated water being discharged to the Red River is consistently

well within the permitted standards.

Shaft refurbishment and mine dewatering is

anticipated to reach the 195-fathom level (approximately 350 metres

below surface) in Q4-2024 and refurbishment of the 195-fathom pump

station and installation of permanent pumps is scheduled to be

completed in Q1-2025. Shaft refurbishment and mine dewatering are

expected to be complete by September 2025.

Land purchase adjacent to South Crofty surface

infrastructure

On May 21, 2024, the Company announced the

purchase of a 7.7 acre land package situated to the south of

Kerrier Way, immediately adjacent to important South Crofty surface

infrastructure. The land purchase removes reliance on existing

right-of-passage agreements, providing the Company with direct

access to all surface infrastructure, as well as additional space

for future site works, opportunities for potential operating cost

savings, renewable energy initiatives and improved overall property

security.

Exploration drill program at Carn Brea South

A 9,000-meter exploration drill program was

completed at the Wide Formation target in the Carn Brea South

exploration area in June 2024. The drill program was designed to

test the geometry and the continuity of tin mineralization

discovered by the Company at the Wide Formation target (refer news

release dated January 10, 2023).

The mineralization style in the Wide Formation,

comprising pervasive tourmaline and quartz (termed ‘blue peach’),

is similar in character to that associated with No. 8 Lode, one of

the most prolific tin producing lodes in the latter years of

operation of the South Crofty mine. The drill program tested an

area measuring 2,500 meters along strike (northeast to southwest)

and 800 meters downdip (north to south).

Drill results from the first six holes (refer

news release dated February 4, 2024) confirm the Wide Formation

structure over a 1.6km strike length, a downdip extent of at least

525 meters and thicknesses ranging from 1.8 meters – 4.8 meters.

The structure remains open. Notable tin intercepts from the Wide

Formation include 1.21 meters grading 0.87% Sn in CB23_004.

Drilling also identified a new mineralized

structure lying directly beneath the Great Flat Lode (named the

“Great Flat Lode Splay”), and several high-grade, steeply dipping

tin zones between the Great Flat Lode and the Wide Formation.

Notable tin intercepts from the newly identified Great Flat Lode

Splay include 3.38 meters grading 1.01% Sn in CB23_002.

Notable tin intercepts from multiple

steeply-dipping, high-grade tin zones mainly intersected between

the Great Flat Lode and the Wide Formation include 3.09 meters

grading 1.21% Sn in CB23_001.

All samples have been submitted for analysis and

final assay results will be reported when available.

Sale of Mactung and Cantung royalties

The Company completed the sale of its royalty

interests on the Mactung and Cantung tungsten projects located in

Northern Canada to Elemental Altus for a total cash consideration

of US$4.5 million (refer news release dated July 21, 2024). The

initial cash consideration of US$3.0 million was received by the

Company on August 1, 2024 (refer news release dated August 4,

2024), with the balance of US$1.5 million due by August 1,

2025.

Sale of Nickel King Property

On June 16, 2024, the Company entered into a

binding letter of intent with Northera for the sale of the

Company's 100% interest in the Nickel King Property for a total

consideration of up to C$8 million (refer news release dated June

16, 2024). Under the terms of the agreement, Northera made a

non-refundable cash payment of C$100,000 on June 14, 2024. Within

95 days of signing the agreement, the Company will transfer the

Nickel King Property upon receipt of a further non-refundable cash

payment of C$900,000. Upon completion of a go-public transaction by

Northera, resulting in a listing of securities on the TSX Venture

Exchange, or other stock exchange, Northera will issue to the

Company common shares in the capital of Northera having an

aggregate market value equal to C$7.0 million.

Appointment of Samantha Hoe-Richardson as

independent non-executive director

On January 8, 2024, the Company announced that

Samantha Hoe-Richardson joined the Board of Directors as an

independent non-executive director (refer news release dated

January 8, 2024). Ms. Hoe-Richardson is an experienced

non-executive director from a global mining, infrastructure and

insurance background. She is currently a non-executive director of

WE Soda Ltd, Assured Guaranty UK Ltd, Ascot Underwriting Limited

and an independent advisor on climate change & sustainability

to Laing O’Rourke. Ms. Hoe-Richardson was Head of Environment &

Sustainable Development at Network Rail until 2017 and prior to

that spent 16 years at Anglo American plc, latterly as Head of

Environment. She previously worked in investment banking and audit.

Ms. Hoe-Richardson holds a Masters Degree in nuclear and electrical

engineering from the University of Cambridge, and is also a

non-practicing Chartered Accountant.

Financial highlights for the six months

ended June 30, 2024 and July 31, 2023

|

|

Six months ended (unaudited) |

|

|

June 30, 2024 |

July 31, 2023 |

|

(Expressed in Canadian dollars) |

|

|

|

Total operating expenses |

4,561,792 |

2,041,551 |

|

Loss for the period |

4,126,256 |

887,399 |

|

Net cash used in operating activities |

2,281,351 |

1,312,999 |

|

Net cash used in investing activities |

17,830,778 |

15,622,535 |

|

Net cash used in financing activities |

96,159 |

723 |

|

Cash at end of the period |

6,048,987 |

39,897,599 |

-

Increase in operating expenses impacted by higher travel and

marketing expenditure arising from increased investor & media

engagement and termination settlement payable to the former

CEO;

-

Expenditure of $1.7 million on new or replacement equipment for the

mine, including the final payments for the permanent pumps for the

underground pump station, cages and the new winders, and associated

commissioning costs;

-

Expenditure of $2.8 million on land adjacent to the surface

infrastructure at South Crofty;

-

Dewatering costs of $2.9 million for power, reagents, sludge

disposal and maintenance of the WTP;

-

Other project related expenditure of $6.1 million relating to the

advancement of South Crofty, primarily relating to the ongoing

feasibility study and NCK shaft re-access & refurbishment;

-

Costs of $1.6 million incurred for the completion of the

exploration program at the Wide Formation; and

-

Cash decreased by $20.2 million to $6.0 million at the period end

mainly due to ongoing development activities at the South Crofty

tin project.

The Company changed its financial year end from

January 31 to December 31 with effect from December 31, 2023 with

the result that the current period of reporting is the six months

ended June 30, 2024. The comparative period of reporting is the six

months ended July 31, 2023.

The Company has allocated funding for near term

opportunities to progress the project, the most significant being

the purchase of the land located immediately adjacent to South

Crofty surface infrastructure. As a consequence of pursuing these

opportunities, additional financing will be required before the end

of 2024.

Outlook

As described above, the Company is advancing the

South Crofty tin project towards the start of production in 2027.

By the end of December 2025, the Company’s objectives are as

follows:

-

Dewater South Crofty mine and refurbish NCK shaft by September

2025;

-

Advance basic and detailed project engineering studies;

-

Place deposits for long lead items of plant and equipment;

-

Commence early project works, including initial construction of the

groundworks for the processing plant; and

-

Arrange project financing in 2025.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral

exploration and development company (AIM and TSX-V: CUSN) focused

on advancing the South Crofty high-grade, underground tin project

through to a construction decision, as well as exploring its

additional mineral rights, located in Cornwall, United Kingdom.

- South Crofty is

a historical, high-grade, underground tin mine that started

production in 1592 and continued operating until 1998 following

over 400 years of continuous production;

- The Project

possesses Planning Permission for underground mining (valid to

2071), to construct new processing facilities and all necessary

site infrastructure, and an Environmental Permit to dewater the

mine;

- South Crofty is

one of the highest grade tin Mineral Resources globally and

benefits from existing mine infrastructure including multiple

shafts that can be used for future operations;

- The 2024

Preliminary Economic Assessment for South Crofty validates the

Project’s potential (see news release dated April 30, 2024 and the

Technical Report entitled “South Crofty PEA”):

- US$201 million

after-tax NPV8% and 29.8% IRR

- 3-year after-tax

payback

- 4,700 tonnes

average annual tin production in years two through six

- Life of mine

all-in sustaining cost of US$13,660 /tonne of payable tin

- Total after-tax

cash flow of US$626 million from start of production

- Tin is a

Critical Mineral as defined by the UK, American, and Canadian

governments;

- Tin connects

almost all electronic and electrical infrastructure, making it

critical to the energy transition – responsible sourcing of

critical minerals and security of supply are key factors in the

energy transition and technology growth;

- Approximately

two-thirds of the tin mined today comes from China, Myanmar and

Indonesia;

- There is no

primary tin production in Europe or North America;

- South Crofty

benefits from strong local community, regional and national

government support.

- Cornish Metals

has a growing team of skilled people, local to Cornwall, and the

Project could generate up to 320 direct jobs.

The 2024 Preliminary Economic Assessment for

South Crofty is preliminary in nature and includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorised as mineral reserves. There is no certainty that

the 2024 Preliminary Economic Assessment will be realised. Mineral

resources that are not mineral reserves do not have economic

viability.

TECHNICAL INFORMATION

This news release has been reviewed and approved

by Mr. Owen Mihalop, MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng, Chief

Operating Officer for Cornish Metals Inc. who is the designated

Qualified Person under NI 43-101 and a Competent Person as defined

under the JORC Code (2012). Mr. Mihalop consents to the inclusion

in this announcement of the matters based on his information in the

form and context in which it appears.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Kenneth A. Armstrong”Kenneth A. Armstrong

P.Geo.

Engage with us directly at our investor hub.

Sign up at: https://investors.cornishmetals.com/link/0PQ3be

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.comTel: +1 (604) 200

6664 |

|

|

|

|

|

SP Angel Corporate Finance LLP (Nominated Adviser

& Joint Broker) |

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Cavendish Capital Markets Limited(Joint

Broker) |

Derrick LeeNeil McDonaldLeif Powis |

Tel: +44 131 220 6939Tel: +44 207 220 0500 |

|

|

|

|

|

Hannam & Partners(Financial Adviser) |

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44

207 907 8500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim Blythe Megan Ray |

cornishmetals@blytheray.comTel: +44 207 138 3204 |

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution regarding forward looking

statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”). Forward-looking

statements include predictions, projections, outlook, guidance,

estimates and forecasts and other statements regarding future plans

and operations, the realisation, cost, timing and extent of mineral

resource or mineral reserve estimates, estimation of commodity

prices, currency exchange rate fluctuations, estimated future

exploration expenditures, costs and timing of the development of

new deposits, success of exploration activities, permitting time

lines, requirements for additional capital and the Company’s

ability to obtain financing when required and on terms acceptable

to the Company, future or estimated mine life and other activities

or achievements of Cornish Metals, including but not limited to:

the balance of the cash consideration due to Cornish in respect of

the sale of the Mactung and Cantung royalty interests;

mineralisation at South Crofty, mine dewatering and construction

requirements; the development, operational and economic results of

the preliminary economic assessment, including cash flows, capital

expenditures, development costs, extraction rates, recovery rates,

mining cost estimates and returns; estimation of mineral resources;

statements about the estimate of mineral resources and production

of minerals; magnitude or quality of mineral deposits; anticipated

advancement of the South Crofty project mine plan; exploration

potential and project growth opportunities for the South Crofty tin

project and other Cornwall mineral properties, the Company’s

ability to evaluate and develop the South Crofty tin project and

other Cornwall mineral properties, strategic vision of Cornish

Metals and expectations regarding the South Crofty mine, timing and

results of projects mentioned. Forward-looking statements are

often, but not always, identified by the use of words such as

“seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”,

“expect”, “potential”, “project”, “target”, “schedule”, “budget”

and “intend” and statements that an event or result “may”, “will”,

“should”, “could”, “would” or “might” occur or be achieved and

other similar expressions and includes the negatives thereof. All

statements other than statements of historical fact included in

this news release, are forward-looking statements that involve

various risks and uncertainties and there can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Forward-looking statements are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the availability of financing;

the timing and content of upcoming work programmes; actual results

of proposed exploration activities; possible variations in Mineral

Resources or grade; outcome of any future feasibility studies;

projected dates to commence mining operations; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; changes in

national and local government regulation of mining operations, tax

rules and regulations. The list is not exhaustive of the factors

that may affect Cornish’s forward-looking statements.

Cornish Metals’ forward-looking statements are

based on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date such statements are made.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ from

those described in forward- looking statements, there may be other

factors that cause such actions, events or results to differ

materially from those anticipated. There can be no assurance that

forward-looking statements will prove to be accurate and

accordingly readers are cautioned not to place undue reliance on

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. Cornish Metals does

not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable law.

Caution regarding non-IFRS

measures

This news release contains certain terms or

performance measures commonly used in the mining industry that are

not defined under International Financial Reporting Standards

("IFRS"), including "all-in sustaining costs". Non-IFRS measures do

not have any standardized meaning prescribed under IFRS, and

therefore they may not be comparable to similar measures employed

by other companies. The data presented is intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS and should be read in conjunction with Cornish Metals’

consolidated financial statements and Management Discussion and

Analysis, available on its website and on SEDAR+ at

www.sedarplus.ca.

Market Abuse Regulation (MAR)

Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

CONSOLIDATED CONDENSED INTERIM

STATEMENTS OF FINANCIAL POSITION

(Unaudited)(Expressed in Canadian dollars)

|

|

June 30, 2024 |

|

December 31, 2023 |

|

|

|

|

|

|

ASSETS |

|

|

|

Current |

|

|

|

Cash |

$ |

6,048,987 |

|

|

$ |

25,791,552 |

|

|

Marketable securities |

|

2,839,060 |

|

|

|

2,665,454 |

|

|

Receivables |

|

847,899 |

|

|

|

1,112,638 |

|

|

Prepaid expenses |

|

561,510 |

|

|

|

591,264 |

|

|

Deferred financing fees |

|

416,449 |

|

|

|

135,242 |

|

|

|

|

10,713,905 |

|

|

|

30,296,150 |

|

|

|

|

|

|

Deposits |

|

73,209 |

|

|

|

85,954 |

|

|

Property, plant and equipment |

|

27,143,216 |

|

|

|

23,788,325 |

|

|

Exploration and evaluation assets |

|

64,739,056 |

|

|

|

50,050,323 |

|

|

|

|

|

|

|

$ |

102,669,386 |

|

|

$ |

104,220,752 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

Current |

|

|

|

Accounts payable and accrued liabilities |

$ |

4,714,065 |

|

|

$ |

5,063,940 |

|

|

|

|

4,714,065 |

|

|

|

5,063,940 |

|

|

NSR liability |

|

9,380,774 |

|

|

|

9,064,817 |

|

|

|

|

14,094,839 |

|

|

|

14,128,757 |

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

Capital stock |

|

128,394,652 |

|

|

|

128,394,652 |

|

|

Capital contribution |

|

2,007,665 |

|

|

|

2,007,665 |

|

|

Share-based payment reserve |

|

929,026 |

|

|

|

711,690 |

|

|

Foreign currency translation reserve |

|

3,760,618 |

|

|

|

1,369,146 |

|

|

Deficit |

|

(46,517,414 |

) |

|

|

(42,391,158 |

) |

|

|

|

|

|

|

|

88,574,547 |

|

|

|

90,091,995 |

|

|

|

|

|

|

|

$ |

102,669,386 |

|

|

$ |

104,220,752 |

|

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF LOSS AND

COMPREHENSIVE LOSS

(Unaudited) (Expressed in Canadian dollars)

|

|

Three months ended |

Six months ended |

|

|

June 30, 2024 |

July 31, 2023 |

June 30, 2024 |

July 31, 2023 |

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

Travel and marketing |

$ |

233,349 |

|

|

$ |

156,470 |

|

|

$ |

447,487 |

|

|

$ |

246,060 |

|

|

Insurance |

|

196,444 |

|

|

|

174,626 |

|

|

|

399,507 |

|

|

|

347,056 |

|

|

Office, miscellaneous and rent |

|

61,702 |

|

|

|

56,428 |

|

|

|

118,207 |

|

|

|

108,040 |

|

|

Professional fees |

|

533,674 |

|

|

|

335,578 |

|

|

|

808,767 |

|

|

|

536,314 |

|

|

Generative exploration expense |

|

4,513 |

|

|

|

2,626 |

|

|

|

5,704 |

|

|

|

5,233 |

|

|

Regulatory and filing fees |

|

22,396 |

|

|

|

22,148 |

|

|

|

51,661 |

|

|

|

55,422 |

|

|

Share-based compensation |

|

7,000 |

|

|

|

25,549 |

|

|

|

130,799 |

|

|

|

25,549 |

|

|

Salaries, directors’ fees and benefits |

|

743,516 |

|

|

|

344,006 |

|

|

|

2,599,660 |

|

|

|

717,877 |

|

|

|

|

|

|

|

|

Total operating expenses |

|

(1,802,594 |

) |

|

|

(1,117,431 |

) |

|

|

(4,561,792 |

) |

|

|

(2,041,551 |

) |

|

|

|

|

|

|

|

Interest income |

|

142,888 |

|

|

|

418,910 |

|

|

|

408,554 |

|

|

|

807,294 |

|

|

Foreign exchange gain (loss) |

|

(9,140 |

) |

|

|

10,987 |

|

|

|

(28,040 |

) |

|

|

381,878 |

|

|

Gain on receipt of non-refundable deposit |

|

91,296 |

|

|

|

- |

|

|

|

91,296 |

|

|

|

- |

|

|

Unrealized gain (loss) on marketable securities |

|

12,963 |

|

|

|

6,938 |

|

|

|

(36,274 |

) |

|

|

(35,020 |

) |

|

|

|

|

|

|

|

Loss for the period |

|

(1,564,587 |

) |

|

|

(680,596 |

) |

|

|

(4,126,256 |

) |

|

|

(887,399 |

) |

|

|

|

|

|

|

|

Foreign currency translation |

|

977,535 |

|

|

|

(334,156 |

) |

|

|

2,391,472 |

|

|

|

2,629,567 |

|

|

Total comprehensive income (loss) for the

period |

$ |

(587,052 |

) |

|

$ |

(1,014,752 |

) |

|

$ |

(1,734,784 |

) |

|

$ |

1,742,168 |

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share |

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

0.00 |

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding: |

|

535,270,712 |

|

|

|

535,270,712 |

|

|

|

535,270,712 |

|

|

|

535,267,950 |

|

CONSOLIDATED CONDENSED INTERIM

STATEMENTS OF CASH FLOWS

(Unaudited) (Expressed in Canadian dollars)

|

|

For the six months ended |

|

|

June 30, 2024 |

July 31, 2023 |

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

Loss for the period |

$ |

(4,126,256 |

) |

|

$ |

(887,399 |

) |

|

Items not involving cash: |

|

|

|

Share-based compensation |

|

130,799 |

|

|

|

25,549 |

|

|

Unrealized loss on marketable securities |

|

36,274 |

|

|

|

35,020 |

|

|

Gain on receipt of non-refundable deposit |

|

(91,296 |

) |

|

|

- |

|

|

Foreign exchange loss (gain) |

|

28,040 |

|

|

|

(381,878 |

) |

|

|

|

|

|

Changes in non-cash working capital items: |

|

|

|

Decrease (increase) in receivables |

|

264,739 |

|

|

|

(298,864 |

) |

|

Decrease in prepaid expenses |

|

64,364 |

|

|

|

66,214 |

|

|

Increase in accounts payable and accrued liabilities |

|

1,411,985 |

|

|

|

128,359 |

|

|

|

|

|

|

Net cash used in operating activities |

|

(2,281,351 |

) |

|

|

(1,312,999 |

) |

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

Acquisition of property, plant and equipment |

|

(5,968,493 |

) |

|

|

(8,032,282 |

) |

|

Acquisition of exploration and evaluation assets |

|

(11,968,598 |

) |

|

|

(7,561,503 |

) |

|

Proceeds from disposal of mineral property |

|

91,296 |

|

|

|

- |

|

|

Decrease (increase) in deposits |

|

15,017 |

|

|

|

(28,750 |

) |

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(17,830,778 |

) |

|

|

(15,622,535 |

) |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

Increase in deferred financing fees |

|

(96,159 |

) |

|

|

- |

|

|

Lease payments |

|

- |

|

|

|

(723 |

) |

|

|

|

|

|

Net cash used in financing activities |

|

(96,159 |

) |

|

|

(723 |

) |

|

|

|

|

|

Change in cash during the period |

|

(20,208,288 |

) |

|

|

(16,936,257 |

) |

|

Cash, beginning of the period |

|

25,791,552 |

|

|

|

55,495,232 |

|

|

Impact of foreign exchange on cash |

|

465,723 |

|

|

|

1,338,624 |

|

|

|

|

|

|

Cash, end of the period |

$ |

6,048,987 |

|

|

$ |

39,897,599 |

|

|

|

|

|

|

Cash paid during the period for interest |

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

Cash paid during the period for income taxes |

$ |

- |

|

|

$ |

- |

|

CONSOLIDATED CONDENSED INTERIM

STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited) (Expressed in Canadian dollars)

|

|

|

Share |

|

|

Foreign |

|

|

|

|

Capital stock |

subscriptions |

|

Share-based |

currency |

|

|

|

|

Number of |

|

received in |

Capital |

payment |

translation |

|

Shareholders’ |

|

|

shares |

Amount |

advance |

contribution |

reserve |

reserve |

Deficit |

equity – total |

|

Balance at January 31, 2023 |

535,020,712 |

$ |

128,377,152 |

$ |

17,500 |

|

$ |

2,007,665 |

$ |

384,758 |

$ |

(648,962 |

) |

$ |

(39,677,003 |

) |

$ |

90,461,110 |

|

|

Warrant exercises |

250,000 |

|

17,500 |

|

(17,500 |

) |

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

Foreign currency translation |

- |

|

- |

|

- |

|

|

- |

|

- |

|

2,629,567 |

|

|

- |

|

|

2,629,567 |

|

|

Share-based compensation |

- |

|

- |

|

- |

|

|

- |

|

25,549 |

|

- |

|

|

- |

|

|

25,549 |

|

|

Loss for the period |

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

|

(887,399 |

) |

|

(887,399 |

) |

|

Balance at July 31, 2023 |

535,270,712 |

$ |

128,394,652 |

$ |

- |

|

$ |

2,007,665 |

$ |

410,307 |

$ |

1,980,605 |

|

$ |

(40,564,402 |

) |

$ |

92,228,827 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2023 |

535,270,712 |

$ |

128,394,652 |

$ |

- |

|

$ |

2,007,665 |

$ |

711,690 |

$ |

1,369,146 |

|

$ |

(42,391,158 |

) |

$ |

90,091,995 |

|

|

Foreign currency translation |

- |

|

- |

|

- |

|

|

- |

|

- |

|

2,391,472 |

|

|

- |

|

|

2,391,472 |

|

|

Share-based compensation |

- |

|

- |

|

- |

|

|

- |

|

217,336 |

|

- |

|

|

- |

|

|

217,336 |

|

|

Loss for the period |

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

|

(4,126,256 |

) |

|

(4,126,256 |

) |

|

Balance at June 30, 2024 |

535,270,712 |

$ |

128,394,652 |

$ |

- |

|

$ |

2,007,665 |

$ |

929,026 |

$ |

3,760,618 |

|

$ |

(46,517,414 |

) |

$ |

88,574,547 |

|

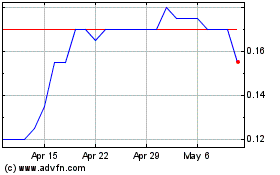

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Dec 2023 to Dec 2024