Cornish Metals Inc. (

AIM/TSX-V:

CUSN) (“Cornish Metals” or the “Company”), a mineral

exploration and development company focused on advancing its 100%

owned and permitted South Crofty tin project in Cornwall, United

Kingdom, is pleased to announce that, further to the Company’s news

release dated August 11, 2024 and following approval of a UK

work visa, Don Turvey’s appointment as Chief Executive Officer and

Executive Director of the Company is effective from October 9,

2024. Mr. Turvey is in the process of relocating from South Africa

to Cornwall, where he will be based.

Ken Armstrong has returned to the position of

Non-Executive Director. Patrick Anderson returned to the position

of Non-Executive Chair of the Board of Directors of the Company

effective 30 September 2024.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral

exploration and development company (AIM and TSX-V: CUSN) focused

on advancing the South Crofty high-grade, underground tin project

through to a construction decision, as well as exploring its

additional mineral rights, located in Cornwall, United Kingdom.

- South Crofty is a historical,

high-grade, underground tin mine that started production in 1592

and continued operating until 1998 following over 400 years of

continuous production;

- The Project possesses Planning

Permission for underground mining (valid to 2071), to construct new

processing facilities and all necessary site infrastructure, and an

Environmental Permit to dewater the mine;

- South Crofty is one of the highest

grade tin Mineral Resources globally and benefits from existing

mine infrastructure including multiple shafts that can be used for

future operations;

- The 2024 Preliminary Economic

Assessment for South Crofty validates the Project’s potential (see

news release dated April 30, 2024 and the Technical Report entitled

“South Crofty PEA”):

- US$201 million after-tax NPV8% and

29.8% IRR

- 3-year after-tax payback

- 4,700 tonnes average annual tin

production in years two through six

- Life of mine all-in sustaining cost

of US$13,660 /tonne of payable tin

- Total after-tax cash flow of US$626

million from start of production

- Tin is a Critical Mineral as

defined by the UK, American, and Canadian governments;

- Tin connects almost all electronic

and electrical infrastructure, making it critical to the energy

transition – responsible sourcing of critical minerals and security

of supply are key factors in the energy transition and technology

growth;

- Approximately two-thirds of the tin

mined today comes from China, Myanmar and Indonesia;

- There is no primary tin production

in Europe or North America;

- South Crofty benefits from strong

local community, regional and national government support.

- Cornish Metals has a growing team

of skilled people, local to Cornwall, and the Project could

generate up to 320 direct jobs.

The 2024 Preliminary Economic Assessment for

South Crofty is preliminary in nature and includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorised as mineral reserves. There is no certainty that

the 2024 Preliminary Economic Assessment will be realised. Mineral

resources that are not mineral reserves do not have demonstrated

economic viability.

TECHNICAL INFORMATION

This news release has been reviewed and approved

by Mr. Owen Mihalop, MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng, Chief

Operating Officer for Cornish Metals Inc. who is the designated

Qualified Person under NI 43-101 and the AIM Rules for Companies

and a Competent Person as defined under the JORC Code (2012). Mr.

Mihalop consents to the inclusion in this announcement of the

matters based on his information in the form and context in which

it appears.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Patrick F. N. Anderson”Patrick F. N.

Anderson

Engage with us directly at our investor hub.

Sign up at: https://investors.cornishmetals.com/link/6rkbNe

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.com |

|

|

|

Tel: +1 (604) 200 6664 |

|

SP Angel Corporate Finance LLP (Nominated Adviser

& Joint Broker) |

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Cavendish Capital Markets Limited(Joint

Broker) |

Derrick LeeNeil McDonaldLeif Powis |

Tel: +44 131 220 6939Tel: +44 207 220 0500 |

|

|

|

|

|

Hannam & Partners(Financial Adviser) |

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44

207 907 8500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim Blythe Megan Ray |

cornishmetals@blytheray.com Tel: +44 207 138 3204 |

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution regarding forward looking

statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”). Forward-looking

statements include predictions, projections, outlook, guidance,

estimates and forecasts and other statements regarding future plans

and operations, the realisation, cost, timing and extent of mineral

resource or mineral reserve estimates, estimation of commodity

prices, currency exchange rate fluctuations, estimated future

exploration expenditures, costs and timing of the development of

new deposits, success of exploration activities, permitting time

lines, requirements for additional capital and the Company’s

ability to obtain financing when required and on terms acceptable

to the Company, future or estimated mine life and other activities

or achievements of Cornish Metals, including but not limited to:

the balance of the cash consideration due to Cornish in respect of

the sale of the Mactung and Cantung royalty interests;

mineralisation at South Crofty, mine dewatering and construction

requirements; the development, operational and economic results of

the preliminary economic assessment, including cash flows, capital

expenditures, development costs, extraction rates, recovery rates,

mining cost estimates and returns; estimation of mineral resources;

statements about the estimate of mineral resources and production

of minerals; magnitude or quality of mineral deposits; anticipated

advancement of the South Crofty project mine plan; exploration

potential and project growth opportunities for the South Crofty tin

project and other Cornwall mineral properties, the Company’s

ability to evaluate and develop the South Crofty tin project and

other Cornwall mineral properties, strategic vision of Cornish

Metals and expectations regarding the South Crofty mine, timing and

results of projects mentioned. Forward-looking statements are

often, but not always, identified by the use of words such as

“seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”,

“expect”, “potential”, “project”, “target”, “schedule”, “budget”

and “intend” and statements that an event or result “may”, “will”,

“should”, “could”, “would” or “might” occur or be achieved and

other similar expressions and includes the negatives thereof. All

statements other than statements of historical fact included in

this news release, are forward-looking statements that involve

various risks and uncertainties and there can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Forward-looking statements are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the availability of financing;

the timing and content of upcoming work programmes; actual results

of proposed exploration activities; possible variations in Mineral

Resources or grade; outcome of any future feasibility studies;

projected dates to commence mining operations; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; changes in

national and local government regulation of mining operations, tax

rules and regulations. The list is not exhaustive of the factors

that may affect Cornish’s forward-looking statements.

Cornish Metals’ forward-looking statements are

based on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date such statements are made.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ from

those described in forward- looking statements, there may be other

factors that cause such actions, events or results to differ

materially from those anticipated. There can be no assurance that

forward-looking statements will prove to be accurate and

accordingly readers are cautioned not to place undue reliance on

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. Cornish Metals does

not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable law.

Caution regarding non-IFRS

measures

This news release contains certain terms or

performance measures commonly used in the mining industry that are

not defined under International Financial Reporting Standards

("IFRS"), including "all-in sustaining costs". Non-IFRS measures do

not have any standardized meaning prescribed under IFRS, and

therefore they may not be comparable to similar measures employed

by other companies. The data presented is intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS and should be read in conjunction with Cornish Metals’

consolidated financial statements and Management Discussion and

Analysis, available on its website and on SEDAR+ at

www.sedarplus.ca.

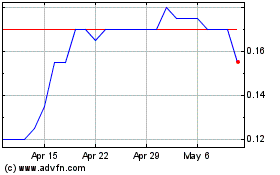

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025