eMedia Announces Going-Private Transaction

November 22 2013 - 3:04PM

Marketwired Canada

eMedia Networks International Corporation (TSX VENTURE:EMM) ("eMedia" or the

"Company") today announced a proposal (the "Proposal") by Jasvir Athwal, Darren

Reiter and David Mears, all directors and officers of the Company, for the

Company to go private. Mr. Reiter states the following as reasons for the

Proposal: "Given the lack of liquidity of the Common Shares, the inability of

the Company to raise significant capital on the TSXV from Canadian investors,

and on the basis that the administrative burden associated with the Company's

status as a reporting company outweighs any benefits to the Company resulting

from that status, I sincerely believe that it is in the best interests of the

Company that it be taken private."

Under the Proposal, the going-private transaction (the "Transaction") will be

accomplished through the consolidation of the Company's issued and outstanding

common shares (the "Common Shares") on the basis of one new common share ("New

Common Share") for every 1,213,000 Common Shares now issued and outstanding (the

"Consolidation"). After effecting the Consolidation, those shareholders who

would receive less than one whole New Common Share will have their fractional

New Common Share purchased by the Company at a price of $0.045 in cash per

Common Share held by them immediately prior to the Consolidation, with the

result that following the Consolidation, the Company will have a small number of

holders of at least one whole New Common Share, including Jasvir Athwal, Darren

Reiter and David Mears, and fewer than 51 security holders in Canada in total.

Following completion of the Transaction, eMedia will apply to have the New

Common Shares delisted from the TSX Venture Exchange (the "TSXV") and it will

also apply to the applicable Canadian securities regulatory authorities to cease

to be a reporting issuer in each province in which it is currently a reporting

issuer.

The $0.045 price per pre-Consolidation Common Share represents a 34.6% premium

to the weighted average trading price of the Common Shares in the 10 trading

days prior to November 18, 2013 ($0.033), a 31.4% premium to the weighted

average trading price of the Common Shares in the 30 trading days prior to

November 18, 2013 ($0.034), as well as a -16% premium to the weighted average

trading price of the Common Shares in the 90 trading days prior to November 18,

2013 ($0.054).

The Proposal was considered by an independent special committee of the board of

directors composed of Gordon Anderson and Dan Fraser (the "Special Committee").

The Special Committee engaged Evans & Evans, Inc. ("Evans"), an independent

financial advisor, to prepare a fairness opinion with respect to the Transaction

(the "Fairness Opinion"). Subject to the qualifications, restrictions and

assumptions set forth in the Fairness Opinion, in the opinion of Evans, as at

November 19, 2013, the terms of the Transaction are fair, from a financial point

of view, to the minority shareholders of the Company (the "Minority

Shareholders").

After consideration of all of the circumstances, the Special Committee concluded

that the Proposal is in the best interests of the Company and fair to the

Minority Shareholders. Accordingly, the Special Committee recommended that the

Board resolve to agree to the terms expressed in the Proposal and to approve the

negotiation and execution of a formal agreement with Jasvir Athwal, Darren

Reiter and David Mears to implement the Transaction, subject to the receipt of

all required shareholder and regulatory approvals.

The Transaction is subject to shareholder approval by way of a special

resolution of the shareholders of the Company and by a majority of the votes

cast on the resolution by Minority Shareholders, and acceptance for filing by

the TSX Venture Exchange. The Company will be calling a meeting of the Company's

shareholders to be held in Vancouver, British Columbia at which the Transaction

will be voted upon by shareholders (the "Meeting"). Full details of the

Transaction and the Meeting will be included in a management information

circular which the Company is to send to shareholders shortly.

About eMedia Networks

eMedia provides custom music programming for in-store retail brands and other

consumer environments. Since 1991, eMedia has provided an end-to-end audio

solution for retailers that require custom selected music to play in their

stores. Through its low-cost emPlayer audio product, eMedia serves over 2,500

subscribers in North America. emPlayer is a proprietary audio player capable of

playing CD-quality music and custom audio content from playlists controlled

on-site or remotely through the Internet. The Company trades on the TSX Venture

Exchange under the symbol EMM. For more information, visit

www.emedianetworks.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Media and Investors: eMedia Networks International Corp.

Darren Reiter

CEO

+1 (604) 742-3344

President and Founder: eMedia Networks International Corp.

Jasvir Athwal

CFO

+1 (604) 742-3344

reiter@emedianetworks.com

www.emedianetworks.com

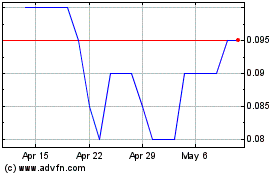

Giyani Metals (TSXV:EMM)

Historical Stock Chart

From Apr 2024 to May 2024

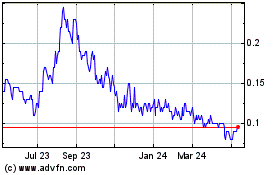

Giyani Metals (TSXV:EMM)

Historical Stock Chart

From May 2023 to May 2024