- H1 2024-25 results in line with expectations

- Operating verticals revenues of €600m up 3.9%

like-for-like1

- Adjusted EBITDA margin of 55.2%

- FY 2024-25 objectives confirmed; capex estimate reduced by

c.€200m

- IRIS2 confirmation representing a key step in Eutelsat’s LEO

build-out strategy and defining roadmap for interim OneWeb

extension

Regulatory News:

The Board of Directors of Eutelsat Communications (ISIN:

FR0010221234 - Euronext Paris / London Stock Exchange: ETL),

chaired by Dominique D’Hinnin, reviewed the financial results for

the Half Year ended 31 December 2024.

Key Financial Data

6M to Dec. 2023

6M to Dec. 2024

Change

Change Pro Forma1

P&L

Revenues - €m

572.6

606.2

5.9%

4.4%

"Operating Verticals" revenues

reported - €m

571.1

599.9

5.0%

3.9%

Adjusted EBITDA - €m

365.6

334.9

-8.4%

4.9%

Adjusted EBITDA - %

63.8%

55.2%

-8.6 pts

0.3 pt

Operating income - €m

-134.4

-789.6

n.a.

-

Group share of net income -

€m

-191.3

-873.2

n.a.

-

Financial structure

Net debt - €m

2,619.1

2,695.8

+76.7 M€

-

Net debt/ Adjusted EBITDA - X

4.13

3.92

-0.21 pt

-

Backlog - €bn

3.9

3.7

-4.6%

Note: This press release contains

figures from the consolidated half-year accounts prepared under

IFRS and subject to a limited review by the Auditors. They were

reviewed by the Audit Committee on 12 February 2025 and approved by

the Board of Directors on 13 February 2025. Adjusted EBITDA,

adjusted EBITDA margin, Net debt / Adjusted EBITDA ratio and Gross

Capex are considered Alternative Performance Indicators. Their

definition and calculation are in Appendix 3 of this document. The

auditors’ review procedures have been carried out and the review

report is in the process of being issued.

Eva Berneke, Chief Executive Officer of Eutelsat Communications,

said: “First Half revenues and profitability were in line with

expectations, and enable us to confirm our objectives for the full

year, while our gross capex landing is now expected at €500-600

million, a reduction of c. €200 million relative to previous

estimates.

The past few months have seen the alignment of several factors

paving the way for Eutelsat’s LEO build-out strategy: first, the

exercise of the put option for the sale-and-lease-back of our

passive ground infrastructure, with proceeds due H1 calendar 2026

and second, confirmation of the European Union’s IRIS2 multi-orbit

constellation representing a key step in Eutelsat’s LEO strategy,

which in turn defines the road map for the interim LEO

constellation extension. We are actively working on a financing

plan in line with our strategic road map and longer term leverage

objective.”

KEY EVENTS

- First Half Operating Verticals revenues of €600 million up

3.9% 1

- Adjusted EBITDA margin of 55.2%, stable year-on-year

1

- Full Year 2024-25 Revenue and Adjusted EBITDA margin

objectives confirmed

- Gross Capex landing now expected lower at €500-600 million

related to timing of LEO investments and reinforced vigilance on

GEO

- Goodwill impairment of €535 million in respect of GEO

assets, reflecting lower expected future cashflows from these

assets

- Put option exercised for sale-and-lease-back of passive

ground infrastructure with c. €500 million net proceeds due H1

calendar 2026

- Confirmation of European Union’s IRIS2 multi-orbit

constellation project, delivering significant benefits at

compelling cost; representing a key step in shaping Eutelsat’s

strategic road map for the interim LEO constellation

extension

ANALYSIS OF REVENUES2

In € millions

6M to Dec. 2023

6M to Dec. 2024

Change

Reported

Like-for-like1

Video

331.1

309.2

-6.6%

-6.4%

Connectivity

240.0

290.7

21.1%

17.8%

Government Services

74.2

96.4

29.9%

21.9%

Mobile Connectivity

71.2

75.3

5.9%

7.1%

Fixed Connectivity

94.6

118.9

25.7%

22.2%

Total Operating

Verticals

571.1

599.9

5.0%

3.9%

Other Revenues

1.6

6.3

na

na

Total

572.6

606.2

5.9%

4.4%

EUR/USD exchange rate

1.08

1.09

Total revenues for the First Half of FY 2024-25 stood at €606.2

million, up by 5.9% on a reported basis and up by 4.4%

like-for-like1. Revenues of the four Operating Verticals (i.e.,

excluding ‘Other Revenues’) stood at €599.9 million. They were up

3.9% on a like-for-like1 basis, excluding a negative currency

impact of €2 million, with strong connectivity growth more than

offsetting the decline in video.

Second Quarter revenues stood at €306.5 million up 2.9%

like-for-like3. Revenues of the four Operating Verticals stood at

€303.2 million, up 2.4% year-on-year on a like-for-like3 basis, and

up 2.2% quarter-on-quarter.

In € millions

Q2 2023-24

Q2 2024-25

Change

Reported

Like-for-like3

Video

167.6

157.4

-6.1%

-5.6%

Connectivity

131.0

145.7

11.2%

12.7%

Government Services

41.1

50.1

21.7%

23.3%

Mobile Connectivity

35.6

33.3

-6.3%

-4.5%

Fixed Connectivity

54.3

62.3

14.8%

15.9%

Total Operating

Verticals

298.6

303.2

1.5%

2.4%

Other Revenues

0.1

3.3

na

na

Total

298.7

306.5

2.6%

2.9%

EUR/USD exchange rate

1.07

1.09

Note: Unless otherwise stated, all

variations indicated below are on an unaudited like-for-like basis,

ie, at constant currency and perimeter. The variation is calculated

as follows: i) H1 2024-25 USD revenues are converted at H1 2023-24

rates; ii) H1 2023-24 revenues are restated with the contribution

of OneWeb from 1st July 2023 to 30 September 2023; iii) Hedging

revenues are excluded.

Video (52% of revenues)

First Half Video revenues were down by 6.4% to €309.2

million, in line with the broader secular market decline.

Second Quarter revenues stood at €157.4 million down by

5.6% year-on-year, and up 3.8% on a sequential basis, reflecting

the linearisation of revenue recognition on certain contracts. This

trend does not alter the underlying cadence in Video of a

mid-single digit decline.

Professional Video revenues, which account for less than 10% of

the vertical, also declined reflecting ongoing structural

headwinds.

Connectivity (48% of revenues)

Total Connectivity revenues for the First Half of FY 2024-25

stood at €290.7 million, up by 21.1% on a reported basis and up by

17.8% like-for-like1.

Second Quarter revenues stood at €145.7 million up 12.7%

like-for-like3 year-on-year, and stable quarter-on-quarter.

Fixed Connectivity

First Half Fixed Connectivity revenues stood at €118.9 million,

up 22.2% year-on-year, mainly reflecting the continued growth of

LEO-enabled connectivity solutions as well as a one-off impact from

catch up revenues from a LEO customer.

Second Quarter revenues stood at €62.3 million, up 15.9%

year-on-year and by 9.9% on a sequential basis, mainly reflecting

the above-mentioned one-off impact.

Key contracts signed during the past quarter include a new

multi-year agreement with Q-KON to expand Low Earth Orbit (LEO)

satellite services across Sub-Saharan Africa, as well as a

multi-year, multi-million-dollar partnership with NIGCOMSAT to

deliver LEO satellite services in Nigeria.

Second Half revenues will reflect more challenging conditions

for GEO-enabled consumer broadband in Europe, and notably by the

temporary cessation of revenue recognition from a specific customer

on the KONNECT VHTS satellite. Against this backdrop, Eutelsat is

repurposing capacity on KONNECT VHTS to address a broader range of

applications, notably Mobile Connectivity.

Government Services

First Half Government Services revenues stood at €96.4 million,

up by 21.9% year-on-year, reflecting the contribution from LEO

services. Second Quarter revenues stood at €50.1 million, up by

23.3% year-on-year and by 8.0% quarter-on-quarter.

The vertical is benefiting from improved US DoD renewals in the

latest campaigns as well as increased demand from non-US

governments.

Mobile Connectivity

First Half Mobile Connectivity revenues stood at €75.3 million,

up 7.1% year-on-year, mainly reflecting demand for LEO-based

solutions notably for maritime applications.

Second Quarter revenues stood at €33.3 million, down 4.5%

year-on-year and by 20.4% quarter-on-quarter. This decrease

reflected lower GEO revenues, as well as quarter-on-quarter, a

one-off contract in the First Quarter of c. €3 million, not

repeated in the Second, as well as higher equipment sales in the

First Quarter.

Other Revenues

Other Revenues amounted to €6.3 million versus €1.6 million a

year earlier. They included a €1 million positive impact from

hedging operations versus a negative impact of €2 million a year

earlier.

BACKLOG

The backlog stood at €3.7 billion on 31 December 2024 versus

€3.9 billion a year earlier. This decrease reflects the natural

erosion of the backlog, especially in the Video segment, partly

offset by the growing LEO backlog. The backlog was equivalent to

3.1 times FY 2023-24 revenues, with Connectivity representing 56%

of the total, and LEO now accounting for 48% of this segment.

31 Dec. 2023

30 June 2024

31 Dec. 2024

Value of contracts (in billions

of euros)

3.9

3.9

3.7

In years of annual revenues based

on prior fiscal year

3.5

3.5

3.1

Share of Connectivity

application

53%

56%

56%

Note: The backlog represents future revenues from

capacity or service agreements and can include contracts for

satellites under procurement. Managed services are not included in

the backlog.

PROFITABILITY

Reported Adjusted EBITDA stood at €334.9 million on 31

December 2024 compared with €365.6 million a year earlier down by

8.4%. On a like for like basis, Adjusted EBITDA was up 4.9%1.

The Adjusted EBITDA margin stood at 55.1% at

constant currency (55.2% reported) versus 54.8% on a like for like

basis1 (63.8% reported). It reflected ongoing strict cost control

measures as well as synergy benefits from the integration of

OneWeb.

Operating costs were €64.3 million higher than last

fiscal year reflecting the impact of the consolidation of OneWeb

for six months of the current Fiscal Year compared with only three

months for FY 2023-24. On a proforma basis, costs were up 3.7%1,

reflecting on one hand the embarkation of OneWeb at full

operational run rate, and on the other, cost control measures

implemented since the merger.

Group share of net income stood at -€873.2 million versus

-€191.3 million a year earlier. This reflected:

- Higher Other operating expenses of €690.8 million,

compared to €183.9 million last year. They include:

- A goodwill impairment €535 million in respect of GEO assets

based on the test performed 31 December 2024. It reflects the cash

flow forecasts adopted by the Group in its latest five-year plan,

embarking the lower future cash flows the Group expects to be able

to generate from its existing GEO assets. These take account of

increased competition in the connectivity market and a greater than

expected decline in demand for video services. This is consistent

with the impact already experienced by the Group in lower Video

customer renewal rates and more recently, the transfer of demand

from GEO to LEO connectivity services.

- €117 million in satellite impairments.

- Higher depreciation of €433.7 million versus €316.1

million a year earlier, reflecting the perimeter effect from OneWeb

as well as higher in-orbit and on-ground depreciation. (EUTELSAT

36D and 20 LEO spares entered service during the First Half).

- A net financial result of -€99.1 million versus -€60.7

million a year earlier, reflecting higher interest costs, partly

offset by favourable evolution of foreign exchange gains and

losses.

- A Corporate Tax expense of €7.6 million versus a tax

gain of €28.5 million a year earlier, implying an effective tax

rate of -0.9%. It reflects the non-recognition of deferred tax

assets relating to losses in France and the United Kingdom, the net

impact of the exemption mechanism for the share of Eutelsat S.A.'s

profits allocated to the satellites operated outside France,

including the related Pillar Two charge, the effect of the tax

rates of foreign subsidiaries as well as the impact of impairments

on the Group's satellites, particularly those in the Satmex

arc.

- Losses from associates of €1.0 million versus €23.0,

reflecting the contribution of the stake in OneWeb in the First

Quarter of FY 2023-24, now fully consolidated.

GROSS CAPEX

Gross Capex amounted to €174.8 million, versus €313.7 million

last year; this decrease reflects the GEO satellite program

delivery and launch last year as well as lower LEO on-ground Capex

versus last year.

First Half capex is not representative of expected FY 2024-25

outturn, which will embark the 100 LEO satellite batch order.

Nevertheless, Capex for the full year is now expected in the

€500-600 million range (vs €700-800 million previously) reflecting

the timing of LEO investments as well as increased vigilance on GEO

capex.

FINANCIAL STRUCTURE

On 31 December 2024, net debt stood at €2,695.8 million, up

€151.8 million versus end of June 2024. It was mainly due to

Capex-related movements and higher financial costs, partially

offset by net cash flow generated by activities.

The net debt to Adjusted EBITDA ratio stood at 3.92 times,

compared to 4.13 times at end-December 2023 and 3.79 times at

end-June 2024.

The average cost of debt after hedging stood at 4.84% (3.16% in

H1 2023-24). The weighted average maturity of the Group’s debt

stood at 3.0 years, compared to 3.0 years at end-December 2023.

Undrawn credit lines and cash stood at around €1.24 billion.

NEXT STEPS

Recent weeks have seen the alignment of several factors paving

the way for Eutelsat’s LEO build-out strategy:

Binding agreement on sale-and-lease-back of ground

infrastructure

Eutelsat exercised the put option with EQT Infrastructure

regarding the sale of a majority stake in its passive ground

infrastructure assets leading to the signing of a binding Share

Purchase Agreement. The transaction consists of the carve-out of

the Eutelsat’s passive ground infrastructure assets to form a

standalone company in which EQT will acquire 80% while Eutelsat

will remain committed as long-term shareholder, anchor tenant and

partner of the new company with a 20% holding. The transaction

values the new entity at an enterprise value of €790m with the

closing of the deal expected in the first half of calendar year

2026, delivering net proceeds of c. €500m, after tax, to Eutelsat

for the sale of 80%, which will strengthen its financial resources

and contribute to funding the LEO constellation extension.

Green light from the EU on the IRIS² constellation

The SpaceRISE consortium, of which Eutelsat is a key member,

received the go-ahead from the European Union to design, build, and

operate the IRIS² constellation, due to enter service in 2030,

under an initial 12-year concession.

The project is valued at some €10.6 billion, with public funding

representing c.60% of the total project cost, supplemented by

private financing from the consortium members. For its part,

Eutelsat will invest in the region of €2 billion, back-end loaded

to the later stages of the project, giving it:

- Access to additional sellable LEO capacity of 1.5 Tbps out of

total of 2 Tbps of LEO capacity

- Access to KaMil capacity not consumed by EU sovereign

needs

- Scale advantages of shared fixed costs and R&D investments

in new technologies

- Commitments from EU and Member States for IRIS2 capacity worth

several hundred of million euros

- Clearly capped financial commitment with strict milestones

providing for exit and compensation in the event of missed targets

compromising returns

Eutelsat is expected to generate revenues of at least € 6.5bn

over period of concession.

Eutelsat’s involvement in IRIS2 represents a key step in the

company’s strategy to develop and expand its low Earth orbit

capacities, and the extension of its existing OneWeb constellation

will be technologically compatible with the future IRIS²

assets.

Clearing road map for OneWeb extension

The confirmation of IRIS2 delivers a road map for Eutelsat to

plan the extension of its existing LEO constellation, including

technological compatibility with future IRIS2 assets. Following

confirmation of the IRIS² contract, Eutelsat procured the first

batch of 100 LEO satellites, for delivery by end of calendar-2026,

ensuring continuity and enhancement of service.

Eutelsat estimates the extension of the LEO constellation up to

the availability of IRIS² will require a further 340 satellites on

top of this initial committed 100, equating to a total cost of the

extension program in the region of €2-2.2bn euros between FY

2024-25 and FY 2028-29.

As mentioned above, Eutelsat’s contribution to IRIS² will be

back-end loaded during the period ahead of the availability of the

constellation, beginning in FY 2028-29.

Eutelsat is actively working on a financing plan in line with

its strategic road map and longer term leverage objective.

FINANCIAL OBJECTIVES

The First Half performance was in line with our expectations. We

confirm our FY 2024-25 objectives, of FY 2025 Revenues of the four

operating verticals around the same level as FY 20244, and an

Adjusted EBITDA margin slightly below the level of FY 20245. These

objectives are confirmed despite the specific GEO consumer

broadband headwind mentioned above.

Gross capital expenditure in FY 2024-25 initially expected in a

range of €700-800 million euros is now expected c.€200 lower, in a

range of €500-600 million euros.

Eutelsat also continues to target leverage of c.3x in the medium

term.

Note: This outlook is based on the

nominal deployment plan. It assumes no further material

deterioration of revenues generated from Russian customers.

UPDATE ON IN-ORBIT ASSETS

Since 1st July 2024, the following changes have occurred in the

Geostationary fleet:

- EUTELSAT 36D entered service at 36°E on 23rd September

2024

- EUTELSAT 33E was deorbited in October 2024

- EUTELSAT 33F in service at 33°E, has started to be operated in

Inclined Orbit in November 2024

- EUTELSAT 50A (ex-EUTELSAT 36B) entered service at 50°E in

December 2024

Following these operations, the geostationary fleet stands at 35

satellites.

In October 2024, Eutelsat launched 20 satellites into low Earth

orbit (LEO), further strengthening the OneWeb constellation.

CORPORATE GOVERNANCE AND SOCIAL

RESPONSIBILITY

Corporate Governance

Changes to the composition of the Board of Directors

On 13th February 2025, Eutelsat announced changes to the

composition of its Board of Directors, aimed at fostering greater

agility in decision-making in the fast-evolving Satellite industry.

Four sitting directors, Mia Brunell, Esther Gaide, Cynthia Gordon

and Fleur Pellerin resigned from the Board. At the same time,

Michel Combes was appointed by the Board as an independent Board

Member until the next Annual General Meeting, where he will be

proposed for a full term. Following these changes, Eutelsat’s Board

of Directors is composed of 12 members, of which seven Independent

Directors. It includes five women, equating to a representation of

42%.

Elsewhere, Dominique D’Hinnin informed the Board of Directors of

his wish to retire from the Chairmanship and Board of Eutelsat

Group. The Nomination and Governance Committee has taken note of

Dominique’s intention and will undertake due process prior to

recommending a new Chairman to the Board of Directors.

Annual General Meeting

The Ordinary and Extraordinary Annual General Meeting of

Shareholders of Eutelsat Communications was held on 21 November

2024 in Paris. All the resolutions submitted were approved. They

included notably

- Approval of the accounts.

- Renewal of the mandate of Mrs Eva Berneke as a Board

member.

- Ratification of the appointment of Hanwha Systems UK Ltd

(represented by Mrs. Joo-Yong Chung) as a Board member.

- Appointment of Ernst & Young and Forvis Mazars SA as

statutory auditors for the certification of sustainability

reporting.

- Compensation of corporate officers and compensation

policy.

- Authorisation to the Board of Directors to purchase the

Company's shares and, if necessary, to cancel them.

- Authorisation to the Board of Directors to grant existing or

future free ordinary shares of the Company to its eligible

employees and corporate officers.

Changes to Eutelsat Group Executive Committee

- Mariam Kaynia was appointed as Chief Data and Information

Officer in November 2024, replacing David Bath.

- Fabio Mando was appointed as Chief Operations Officer in

November 2024, replacing Massimiliano Ladovaz.

Corporate Social Responsibility

Communicating on the Group’s non-financial

performance

On 17 October 2024, Eutelsat Group published its Extra-Financial

Performance Statement for the fiscal year 2023-24, as part of its

Universal Registration Document. This report outlines the Group’s

environmental, social, and governance (ESG) commitments, detailing

its CSR policy, carbon footprint, and ESG performance indicators.

Check out the latest report. Eutelsat is already taking a proactive

approach to the upcoming Corporate Sustainability Reporting

Directive (CSRD) and is currently developing a double materiality

matrix in alignment with CSRD requirements.

Bridging the Digital Divide

By the end of December 2024, Eutelsat successfully fulfilled its

pledge under the Partner2Connect Digital Coalition, an initiative

led by the International Telecommunication Union (ITU). This

milestone—achieved two years ahead of schedule—has brought

high-speed internet to 1 million underserved people in Sub-Saharan

Africa via our Konnect Wi-Fi hotspots powered by EUTELSAT KONNECT

satellite. This achievement reinforces our commitment to bridging

the digital divide, a core pillar of our CSR strategy, and supports

progress toward the United Nations' 2030 Agenda for Sustainable

Development.

Science-Based Climate Commitments

On 21 January 2025, the Science Based Targets initiative (SBTi)

validated Eutelsat’s near-term environmental targets, marking a

major milestone in our climate strategy:

- A 50% absolute reduction in energy-related greenhouse gas (GHG)

emissions (Scope 1 and 2) by 2030, from a 2021 baseline.

- A 52% reduction in Scope 3 GHG emissions per satellite Mbit by

2030 within the same timeframe.

The SBTi’s Target Validation Team has confirmed that our Scope 1

and 2 targets are aligned with a 1.5°C trajectory, reflecting our

commitment to a science-based approach to emissions reduction.

Eutelsat is committed to upholding these efforts as it works toward

further reducing its environmental impact.

Expanding the Group’s solar energy capacity

During the first half of its fiscal year, the Group announced

that all solar panel systems installed at its sites had been fully

commissioned, are operational, and running at nominal capacity.

This initiative includes installations at sites in Turin and

Cagliari (Italy), Caniçal (Madeira), as well as Hermosillo and

Iztapalapa (Mexico). The total annual solar energy capacity from

these systems has reached 2,000,000 kWh, supplying around 8% of

Eutelsat Group's annual electricity consumption.

Half year results presentation

Eutelsat Group will present its results on Friday, February

14, 2025, by conference call and webcast at 9:00

CET.

Click here to attend the webcast

presentation. (The webcast link will remain available for

replay)

It is not necessary to dial into the conference call, unless you

are unable to join the webcast URL

If needed, please dial one of these numbers: +33 (0)1 7037

7166 (from France) +44 (0)33 0551 0200 (from the U.K)

Quote “Eutelsat” to the operator when connecting to the call.

Documentation

The consolidated half year accounts are available on the

www.eutelsat.com/investors website.

Financial calendar

The financial calendar below is provided for information

purposes only. It is subject to change and will be regularly

updated.

- 15 May 2025: Third quarter and nine month 2024-25 revenues

- 5 August 2025: Full Year 2024-25 results

About Eutelsat Group

Eutelsat Group is a global leader in satellite communications,

delivering connectivity and broadcast services worldwide. The Group

was formed through the combination of Eutelsat and OneWeb in 2023,

becoming the first fully integrated GEO-LEO satellite operator with

a fleet of 35 geostationary (GEO) satellites and a Low Earth Orbit

(LEO) constellation of more than 600 satellites.

The Group addresses the needs of customers in four key verticals

of Video, where it distributes more than 6,500 television channels,

and the high-growth connectivity markets of Mobile Connectivity,

Fixed Connectivity, and Government Services. Eutelsat Group’s

unique suite of in-orbit assets and on-ground infrastructure

enables it to deliver integrated solutions to meet the needs of

global customers. The Company is headquartered in Paris and

Eutelsat Group employs more than 1,500 people from more than 50

countries.

The Group is committed to delivering safe, resilient, and

environmentally sustainable connectivity to help bridge the digital

divide. The Company is listed on the Euronext Paris Stock Exchange

(ticker: ETL) and the London Stock Exchange (ticker: ETL).

Find out more at www.eutelsat.com

Disclaimer

The forward-looking statements included herein are for

illustrative purposes only and are based on management’s views and

assumptions as of the date of this document.

Such forward-looking statements involve known and unknown risks.

For illustrative purposes only, such risks include but are not

limited to: risks related to the health crisis; operational risks

related to satellite failures or impaired satellite performance, or

failure to roll out the deployment plan as planned and within the

expected timeframe; risks related to the trend in the satellite

telecommunications market resulting from increased competition or

technological changes affecting the market; risks related to the

international dimension of the Group’s customers and activities;

risks related to the adoption of international rules on frequency

coordination and financial risks related, inter alia, to the

financial guarantee granted to the Intergovernmental Organization's

closed pension ’und, and foreign exchange risk.

Eutelsat Communications expressly disclaims any obligation or

undertaking to update or revise any projections, forecasts or

estimates contained in this document to reflect any change in

events, conditions, assumptions or circumstances on which any such

statements are based, unless so required by applicable law.

The information contained in this document is not based on

historical fact and should not be construed as a guarantee that the

facts or data mentioned will occur. This information is based on

data, assumptions and estimates that the Group considers as

reasonable.

APPENDICES

Appendix 1: Additional financial

data

Extract from the consolidated income statement (€ millions)

Six months ended December

31

2023

2024

Change (%)

Revenues

572.6

606.2

5.9%

Operating expenses

(207.0)

(271.3)

31.1%

Adjusted EBITDA

365.6

334.9

-8.4%

Depreciation and amortisation

(316.1)

(433.7)

37.2%

Other operating income

(expenses)

(183.9)

(690.8)

n.a.

Operating income

(134.4)

(789.6)

n.a.

Financial result

(60.7)

(99.1)

63.2%

Income tax expense

28.5

(7.6)

n.a.

Income / (loss) from

associates

(23.0)

(1.0)

-95.8%

Portion of net income

attributable to non-controlling interests

(1.8)

24.0

n.a.

Group share of net income

(191.3)

(873.2)

n.a.

Appendix 2: Quarterly revenues by

application

Quarterly Reported revenues FY 2023-24 and H1 2024-25

The table below shows quarterly reported revenues FY 2023-24 and

H1 2024-25.

In € millions

Q1

Q2

Q3

Q4

FY

Q1

Q2

2023-24

2023-24

2023-24

2023-24

2023-24

2024-25

2024-25

Video

163.5

167.6

160.2

159.3

650.6

151.8

157.4

Government Services

33.5

41.1

43.6

47.1

165.3

46.4

50.1

Mobile Connectivity

35.2

35.6

39.2

49.4

159.3

42.0

33.3

Fixed Connectivity

40.2

54.3

57.4

82.2

234.1

56.5

62.3

Total Operating Verticals

272.5

298.6

300.3

338.0

1,209.4

296.7

303.2

Other Revenues

1.5

0.1

0.5

1.6

3.7

3.0

3.3

Total

274.0

298.7

300.8

339.6

1,213.0

299.7

306.5

Appendix 3: Alternative performance

indicators

In addition to the data published in its accounts, the Group

communicates on three alternative performance indicators which it

deems relevant for measuring its financial performance: Adjusted

EBITDA, adjusted EBITDA margin, Net debt / Adjusted EBITDA ratio

and Gross Capex. These indicators are the object of reconciliation

with the consolidated accounts.

Adjusted EBITDA, Adjusted EBITDA margin and Net debt /

Adjusted EBITDA ratio

Adjusted EBITDA reflects the profitability of the Group before

Interest, Tax, Depreciation and Amortisation. It is a frequently

used indicator in the Fixed Satellite Services Sector and more

generally the Telecom industry. The table below shows the

calculation of Adjusted EBITDA based on the consolidated P&L

accounts for H1 2023-24 and H1 2024-25:

Six months ended December 31

(€ millions)

2023

2024

Operating income

(134.4)

(789.6)

+ Depreciation and

Amortisation

316.1

433.7

- Other operating income and

expenses

183.9

690.8

Adjusted EBITDA

365.6

334.9

The Adjusted EBITDA margin is the ratio of Adjusted EBITDA to

revenues. It is calculated as follows:

Six months ended December 31

(€ millions)

2023

2024

Adjusted EBITDA

365.6

334.9

Revenues

572.6

606.2

Adjusted EBITDA margin (as a %

of revenues)

63.8

55.2

At constant currency, the adjusted EBITDA margin stood at 55.1%

as of 31 December 2024.

The Net debt / adjusted EBITDA ratio is the ratio of net debt to

last-twelve months adjusted EBITDA. It is calculated as

follows:

Six months ended December 31

(€ millions)

2023

2024

Last twelve months adjusted

EBITDA

634.2

688.2

Closing net debt6

2,619.1

2,695.8

Net debt / adjusted

EBITDA

4.13x

3.92x

Gross Capex

Gross Capex covers the acquisition of satellites and other

tangible or intangible assets as well as payments related to lease

liabilities. If applicable it is net from the amount of insurance

proceeds.

The table below shows the calculation of Gross Capex for H1

2023-24 and H1 2024-25:

Six months ended December 31

(€ millions)

2023

2024

Acquisitions of satellites, other

property and equipment and intangible assets

(294.7)

(147.1)

Insurance proceeds

-

-

Repayments of lease

liabilities7

(19.0)

(27.6)

Gross Capex

(313.7)

(174.8)

_____________________ 1 Unaudited change at constant currency

and constant perimeter. The variation is calculated as follows: i)

H1 2024-25 USD figures are converted at H1 2023-24 rates; ii) H1

2023-24 figures are restated with the contribution of OneWeb from

1st July 2023 to 30 September 2023; iii) Hedging revenues are

excluded. 2 The share of each application as a percentage of total

revenues is calculated excluding “Other Revenues”. 3 Change at

constant currency. The variation is calculated as follows: i) Q2

2024-25 USD revenues are converted at Q2 2023-24 rates; ii) Hedging

revenues are excluded. 4 Outlook based on comparison with FY

2023-24 proforma basis as if OneWeb had been consolidated on July

1, 2023. Group’s FY 2023-24 revenues stood at 1,221m€ on a proforma

basis. 5 Outlook based on comparison with FY 2023-24 proforma basis

as if OneWeb had been consolidated on July 1, 2023. FY 2023-24

Adjusted EBITDA margin stood at 55.0% on a proforma basis. 6 Net

debt includes all bank debt, bonds and all liabilities from lease

agreements and structured debt as well as Forex portion of the

cross-currency swap, less cash and cash equivalents (net of bank

overdraft). Net Debt calculation will be available in the Note

6.4.3 of the appendices to the financial accounts. 7 Included in

line of “Repayment of lease liabilities” of cash-flow

statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213055647/en/

Media enquiries

Joanna Darlington Tel. +33 6 74 52 15 31

jdarlington@eutelsat.com

Anita Baltagi Tel. +33 6 43 93 01 78 abaltagi@eutelsat.com

Katie Dowd Tel. +1 202 271 2209 kdowd@oneweb.net

Investors

Joanna Darlington Tel. +33 6 74 52 15 31

jdarlington@eutelsat.com

Hugo Laurens-Berge Tel. +33 6 70 80 95 58

hlaurensberge@eutelsat.com

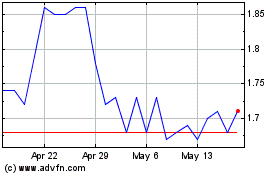

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From Jan 2025 to Feb 2025

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From Feb 2024 to Feb 2025