Fancamp's JV Partners Bold Ventures and KWG Resources Initiate $2M Exploration Program at the Koper Lake Project

January 14 2014 - 8:41AM

Marketwired

Fancamp's JV Partners Bold Ventures and KWG Resources Initiate $2M

Exploration Program at the Koper Lake Project

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 14, 2014) -

Fancamp Exploration Ltd. ("Fancamp" or the "Company")

(TSX-VENTURE:FNC) is pleased to report that based on an

announcement made KWG Resources Inc. ("KWG") and Bold Ventures Inc.

("Bold"), the joint venture partners that optioned Fancamp's Koper

Lake Polymetallic Project ("Koper Lake"), will resume drilling at

the Black Horse Chromite Occurrence ("Black Horse") (refer to

the January 6, 2014 news releases by KWG and Bold).

Mr. Jean Lafleur, Fancamp's President and CEO, stated "This

is encouraging for Fancamp as it indicates the strong interest that

Bold and KWG have in advancing the Koper Lake Project and moves the

joint venturers closer to the significant cash payments which would

be due to Fancamp should the participants move to the next phase of

the Joint Venture agreement."

KWG is financing a further $2 million program under its

agreement to earn from Bold Ventures Inc. an 80% interest in any

chromite discovered within the claims optioned by Bold from Fancamp

hosting Black Horse. As was recommended in the National Instrument

43-101 report commissioned by KWG following the winter 2013

drilling program, the possible down-dip extension of the resource

will be tested with a series of deep holes utilizing up to three

drills. Mobilization is under way and drilling is anticipated to

commence shortly. On-going metallurgical testwork has produced

encouraging results to indicate that the Black Horse chromite

appears to be amenable to reduction into metalized chrome and iron

using natural gas.

About the Bold Ventures Inc. - KWG Resources Inc. Option

Agreements

Under the original earn-in option agreement announced May 7,

2012, Bold could earn its initial 50% interest in Koper Lake from

Fancamp by making option payments totaling $1.5 million and

expending $8 million on exploration over 3 years after which a

50/50 joint venture would be formed between Bold and Fancamp. Bold

has already made the first C$300,000 option payment in 2013. Bold

could then earn a further 10% interest by making a further

C$700,000 option payment and delivering a positive feasibility

study. The remaining option payments may be made in cash or common

shares of Bold at Bold's option.

Upon completion of the conditions of the original option

agreement, as stated in a news release dated January 7, 2013, an

"additional option" can be initiated whereby Bold could earn a

further 20% interest in Koper Lake by paying Fancamp C$15 million

payable in equal instalments over 3 years with half of the amount

payable in cash and the balance payable, at Bold's option, through

the issuance of common shares of Bold at the market price at the

time the shares are issued. At that point, Fancamp would retain a

20% carried interest in Koper Lake. Bold would then have a further

option to acquire from Fancamp the remaining 20% carried interest

in exchange for a Gross Metal Royalty ("GMR") payable to Fancamp.

Bold would then hold a 100% interest in Koper Lake. The GMR would

entitle Fancamp to be paid 2% of the total revenue from the sale of

all metals and mineral products from the property from the

commencement of commercial production. Once all of the capital

costs to bring the project to the production stage have been

recovered, the GMR may be scaled up to a maximum of 4% of the total

revenue from the sale of all metals and mineral products from the

property contingent upon the prices of products sold from the

property.

On March 4, 2013, Bold signed an option and joint venture

agreement with KWG to option its interests in Koper Lake. Under the

terms of the option agreement, Bold would act as operator of the

exploration programs which are to be financed by KWG. KWG would

also make the option payments due under the agreement with Fancamp.

KWG could acquire an 80% interest in chromite produced from Koper

Lake by financing 100% of the costs to a feasibility study leaving

Bold and its co-venturer with a 20% carried interest, pro rata. For

nickel and other non-chromite minerals identified during the

exploration programs, the parties have agreed to form a joint

venture in which KWG would have a 20% participating interest and

Bold and its co-venturer would have an 80% participating interest,

pro rata. KWG would have a right of first refusal to purchase all

ores or concentrates produced by such joint venture whenever its

interest in the joint venture exceeds 50%.

The Koper Lake

Project

Koper Lake is situated in the emerging Ring of Fire

multi-mineral district, approximately 530 km northeast of Thunder

Bay in the James Bay Lowlands, Northern Ontario. The project lies

along the ultramafic Ring of Fire complex between the Eagle's Nest

nickel-copper-platinum-group-elements and the Blackbird chromite

deposits belonging to Noront Resources to the west and southwest,

respectively, and the Big Daddy and Black Thor chromite deposits

belonging to Cliffs Resources and KWG to the northeast. The project

offers a set of targets for magmatic Ni-Cu-PGE, chromite and

hydrothermal gold-copper (Au-Cu) mineralization. KWG published

mineral resources estimates from the Black Horse chromite deposit

of 46.5 million tonnes at a grade of 38.8% Cr2O3 in the Inferred

category using the CIM definition standards for classification of

Mineral Resources with the mineralization open to depth and along

strike to the east.

The technical information in the news release was reviewed

and approved by Jean Lafleur, M.Sc., P.Geo., Fancamp's President

and CEO, a Qualified Person under NI 43-101.

About Fancamp Exploration Ltd

(www.fancampexplorationltd.ca)

Fancamp Exploration Ltd. is a Canadian junior mineral

exploration company that continues to evolve into a holder of

shares in partner companies and royalties on near-term producing

mines. These assets are designed to generate free cash flow without

further shareholder dilution. Fancamp has an exceptional inventory

of resource projects at various stages of development covering more

than 1,710 km2 in three provinces. The commodities include

hematite-magnetite iron formations, titaniferous magnetite,

hematite, nickel/copper/PGM, chromite, Volcanogenic Massive

Sulphides and gold.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

S.E.C. Exemption: 12(g)3-2(b)

Fancamp Exploration Ltd.Jean Lafleur, M. Sc., P. Geo.President

and CEO, Director+1 514 975 3633pjlexpl@videotron.caFancamp

Exploration Ltd.Michael D'AmicoInvestor Relations+1 647 500

6023michaeldamico@rogers.comAberdeen Gould Advisory Services

Ltd.Roger RosmusBusiness Development+1 416 488 2887

x222roger@aberdeengould.com

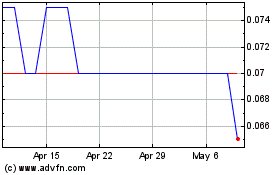

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Jan 2025 to Feb 2025

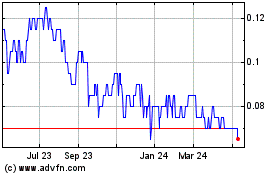

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Feb 2024 to Feb 2025