Fancamp Exploration Ltd. (“

Fancamp” or the

“

Company”) (TSX Venture Exchange:

FNC) is pleased to announce that it has entered

into an agreement (the “

Agreement”) with Lode Gold

Resources Inc. (“

Lode Gold”) (TSX Venture

Exchange:

LOD) and 1475039 B.C. Ltd.

(“

Spin Co”, also referred to as “

Gold

Orogen”), a wholly-owned subsidiary of Lode Gold, to

advance the exploration and development of certain mineral

properties located in the Yukon and New Brunswick.

Transaction Summary

- Lode

Gold will transfer all of its interests in its McIntyre Brook

mineral property located in New Brunswick (the “McIntyre

Brook Property”) and Fancamp will transfer all of its

interests in the Riley Brook mineral property located in New

Brunswick (the “Riley Brook Property”) to a newly

incorporated joint-venture entity (“JV Co”) in

which Fancamp and Spin Co will each own 50% of the outstanding

shares (the “JV Co Shares”), and for which Fancamp

will be the Operator (refer to Figure 1).

- Lode

Gold will transfer to Spin Co, Gold Orogen, both its Golden Culvert

mineral property located in Selwyn Basin, Tombstone Belt,

southeastern Yukon, and its nearby Win mineral property located in

the Tombstone Belt, southeastern Yukon (refer to Figure 3).

- Fancamp

will invest $2,500,000 into Spin Co (the “Fancamp

Investment”) in exchange for such number of common shares

of Spin Co (“Spin Co Shares”) as is equal to 19.9%

of the outstanding Spin Co Shares on an undiluted basis, after

completion of the Spin Out (defined below). A portion of the

Fancamp Investment will be completed through an indirect flow

through offering by Spin Co which result in Spin Co receiving

approximately $3,000,000 in proceeds.

- Spin Co

will raise $1,500,000 by way of equity private placement in

addition to the Fancamp Investment.

- An

aggregate amount of approximately $ 1.86 million will be allocated

for exploration activities for the New Brunswick JV and

approximately $ 1.56 million will be allocated for exploration

activities in Yukon.

- Fancamp

will invest $500,000 into Lode Gold in exchange for 14,285,714

special warrants (“Lode Gold Special Warrants”) on

a private placement basis, at an issue price of $0.035 per Lode

Gold Special Warrant, based on the terms set out below (the

“Private Placement”).

- Lode Gold

will undertake a spin-out transaction of Spin Co (the “Spin

Out”) pursuant to which each shareholder of Lode Gold will

receive Spin Co shares for each common share of Lode Gold (each, a

“Lode Gold Share”) held on the effective date of

the Spin Out, whereby Spin Co will become a reporting issuer.

Completion of the Transaction is subject to

approval of the TSX Venture Exchange (the

“TSX-V”).

Fancamp Investment

Rationale

New Brunswick Joint Venture:

The joint initiative with Lode Gold for the advancement and

exploration of one of the largest and underexplored land packages

in New Brunswick, within a highly prospective region for gold and

polymetallic mineral discovery, would position both firms as key

players of an emerging, district-scale, Au-Cu exploration play

(refer to Figure 2). Leveraging the Company’s recently acquired 309

km2 package of mineral claims, the Riley Brook property, combined

with Lode Gold’s 111 km2 McIntyre Brook holdings, Fancamp is able

to advance exploration initiatives across a dominant land package

in an underexplored sector in a geologic domain that hosts other

gold-focused firms such as Calibre Mining, New Found Gold and Puma

Exploration (refer to Figure 1).

Figure 1: Location of Fancamp’s Riley Brook

property and Lode Gold’s McIntyre Brook holdings in relation to

regional players.

Figure 2: Location of Fancamp’s Riley Brook

property and Lode Gold’s McIntyre Brook holdings.

Investment in Gold Orogen: The

transaction structure both benefits and positions the Company to

generate value from a multitude of verticals, as Fancamp becomes a

key strategic shareholder of Lode Gold in addition to a 19.9%

shareholder of Spin Co, Gold Orogen, which will have strategic

interests in four mineral exploration assets located across

emerging orogenic gold camps within mining-friendly jurisdictions,

the Yukon and the Appalachian region of New Brunswick. Exposure to

the Yukon properties means exposure to mineral assets in a highly

prospective territory the Company has yet to include within its

portfolio. These Yukon assets encompass a 99.5 km2 land package

across a 27-km strike length situated in a

high-grade-gold-mineralized trend within the Southern portion of

the Tombstone Gold Belt, which extends across the Yukon and is host

to numerous multi-million-ounce gold deposits such as Banyan Gold’s

AurMac deposits, Sitka Gold’s RC deposit, Hecla's Keno Hill mine

and Snowline Gold’s Tier 1 Valley deposit (refer to Figure 3). Lode

Gold’s cornerstone Yukon projects included in this agreement,

Golden Culvert, a confirmed gold endowment with average grades

collected from 93 surface samples reported as 13.3 g/t Au; up to

320 g/t Au (refer to Lode Gold’s press release dated July 15,

2024), and the Win property which hosts a confirmed Reduced

Intrusive Related Gold Systems (RIRGS) (refer to Stratabound

Minerals Corp. press release dated December 13, 2023), two projects

with excellent potential for growth and discovery in a very

attractive region of gold systems that form large world class

deposits.

Rajesh Sharma, President and Chief Executive

Officer of Fancamp Exploration stated, “This transaction is an

outcome of the Company’s quest for identifying accretive

opportunities by taking advantage of the difficult market

conditions while leveraging Fancamp’s strong balance sheet and

technical expertise. The New Brunswick joint venture combines the

assets of both the Companies to create a highly prospective and

substantial land package which will aim to be a leader in region.

Fancamp is also pleased to have strategic interest in the highly

prospective assets in Yukon. We look forward to collaborating with

Lode Gold to accomplish key exploration milestones in Yukon and New

Brunswick over the next 12 months.”

Wendy T. Chan, Chief Executive Officer and

Director of Lode Gold comments, “This strategic alliance between

Lode Gold and Fancamp is a transformative, value-generating

transaction, and a direct result of close collaboration and

teamwork between the firms, paving the way for the advancement of

key, cornerstone mineral projects. With Fancamp’s leadership and

operational expertise, as well as seasoned exploration team on the

ground, we are confident that in the upcoming months, we will be

able to execute and advance the projects to deliver value to both

of our shareholders.”

Figure 3: Location of Lode Gold’s Yukon

properties Golden Culvert and Win, now part of Gold Orogen,

including regional players on the Tombstone Gold Belt. Figure

provided by Lode Gold, reference website:

https://lode-gold.com/project/golden-culvert/.

Transaction Details

The Transaction includes the following material

components:

Property Transfers and Joint Venture

On or prior to the closing date of the

Transaction (the “Closing Date”):

- Lode

Gold will transfer to Spin Co, Gold Orogen, both its Golden Culvert

mineral property located in Selwyn Basin, Tombstone Belt,

southeastern Yukon and its Win mineral property located in the

Tombstone Belt, southeastern Yukon.

- Lode Gold

will transfer its interests in the McIntyre Brook Property and

Fancamp will transfer its interests in the Riley Brook Property to

JV Co, in which each of Spin Co and Fancamp will hold 50% of the

outstanding JV Co Shares.

- JV Co will grant to

Fancamp a 2% net smelter returns royalty on the Riley Brook

Property, which will be proportionally reduced in the event that

Spin Co secures reduced net smelter returns royalties and buy-back

terms on all, but not less than all, of the mineral claims

comprising the McIntyre Brook Property.

- Fancamp

and Spin Co will enter into a Shareholders’ Agreement

(“Shareholders’ Agreement”) to govern JV Co,

pursuant to which, among other terms:

- The Board

of Directors of JV Co shall consist of four (4) directors to be

comprised of two nominees of each of Fancamp and Spin Co;

- Fancamp

will act as the initial Operator of the mineral exploration work to

be conducted by JV Co;

- The

initial strategic budget for JV Co to cover work to be completed by

May 31, 2025 (the “Initial Strategic Budget”) will

total approximately $1.8 million to be funded by Fancamp and Spin

Co, pursuant to the terms of the Agreement, and will include

certain reimbursements to be paid by Spin Co and JV Co to Lode Gold

and Fancamp, and certain option payments on the McIntyre Brook

Property; and

- Each

party will be subject to straight line dilution, and should one

party be diluted to 10% or less, the interest of such party will

convert to a 1% net smelter returns royalty.

Private Placement

- On the

Closing Date, Fancamp will invest $500,000 in exchange for

14,285,714 Lode Gold Special Warrants, at an issue price of $0.035

per Lode Gold Special Warrant, on the following terms:

- each Lode

Gold Special Warrant will be converted on the earlier of completion

of the Spin Out and March 31, 2025 into one (1) Lode Gold Share and

one (1) common share purchase warrant (a “Lode Gold

Warrant”);

- each Lode

Gold Warrant will be exercisable for one (1) Lode Gold Share at a

price of $0.05 for a period of five years from the date of issue;

and

Fancamp Investment

On the Closing Date:

- Fancamp

will complete the $2,500,000 Fancamp Investment into Spin Co in

consideration for such number of Spin Co Shares that is equal to

19.9% of the issued and outstanding Spin Co Shares on an undiluted

basis after completion of the Spin Out and before taking into

consideration any dilution as a result of a Spin Co Additional

Financing (as defined herein).

- Of the

$2.5 million Fancamp Investment, approximately $1.53 million of the

Spin Co Shares to be acquired will first be sold by Spin Co on a

“flow through basis” to certain beneficial purchasers for total

proceeds of $2,000,000, resulting in total proceeds to Spin Co of

approximately $3,000,000. These purchasers will resell the Spin Co

Shares to Fancamp for $1.53 million pursuant to the terms and

conditions of a purchase and sale agreement.

- Spin Co

will appoint one director nominated by Fancamp to its Board of

Directors until such time as the Spin Out is completed, following

which Fancamp shall have the right to nominate one member to the

board of directors of Spin Co for so long as Fancamp holds not less

than 10% of the outstanding Spin Co Shares.

Spin Co Private Placement

- After the

Closing Date but prior to the completion of the Spin Out, Spin Co

will raise an aggregate of $1,500,000, in addition to and not

including the Fancamp Investment (the “Spin Co

Private Placement”).

- In the

event that Spin Co fails to raise the $1,500,000 amount required

under the Spin Co Private Placement on or prior to such date that

is 30 days after the Outside Date, Spin Co shall transfer to

Fancamp between 7.5% to 15% of the issued and outstanding JV Co

Shares to be determined based on the amount of funds actually

raised by Spin Co under the Spin Co Private Placement.

Spin-Out Transaction

- As soon

as reasonably practicable following the Closing Date, Lode Gold

will commence the Spin Out and complete the Spin Out no later than

the Outside Date, whereby:

- each

shareholder of Lode Gold on the effective date of the Spin Out will

receive Spin Co Shares for each Lode Gold Share held; and

-

immediately after completion of the Spin Out, Fancamp will hold

19.9% of the issued and outstanding Spin Co Shares on an undiluted

basis.

- In the

event that Lode Gold fails to complete the Spin Out before the

Outside Date, Lode Gold at its election shall:

- cause

Spin Co to transfer to Fancamp such number of JV Co Shares as is

equal to 15% of JV Co’s issued and outstanding share capital;

or

- pay a

penalty to Fancamp (the “Penalty Payment”), equal

to an annual rate of 6% of $3,000,000 calculated on a pro rata

basis, for such number of days as the Spin Out has been delayed up

to a maximum of 60 days from the Outside Date (the

“Extension Period”), which Penalty Payment shall

be paid on the date that is the earlier of (A) the completion date

of the Spin Out, and (B) the last day of the Extension Period. In

the event Lode Gold fails to complete the Spin Out before the

expiry of the Extension Period, Spin Co shall transfer to Fancamp

such number of JV Co Shares as is equal to 15% of JV Co’s issued

and outstanding share capital.

- In the

event that Spin Co raises in excess of $1,500,000 pursuant to the

Spin Co Private Placement, Fancamp will have the right (but not the

obligation) to participate in the Spin Co Additional Financing to

maintain its interest in Spin Co.

- For so

long as Fancamp holds at least 10% of the outstanding shares of

Spin Co, Fancamp will have the right (but not the obligation) to

participate in any Spin Co equity financings to maintain its

proportionate interest in Spin Co at that time.

Qualified Person

The scientific and technical information

contained in this press release was reviewed and approved by

François Auclair, P Geo, M.Sc., Fancamp’s, Vice President

Exploration and Qualified Person, who is designated as a Qualified

Person under National Instrument 43-101.

About Fancamp Exploration Ltd. (TSX-V:

FNC)

Fancamp is a growing Canadian mineral

exploration company focused on creating value through medium term

growth and monetization opportunities with its strategic interests

in high potential mineral projects, royalty portfolio and mineral

properties. The Company is focused on an advanced asset play poised

for growth and selective monetization with a portfolio of mineral

claims across Ontario, Québec and New Brunswick, Canada; including

copper, gold, zinc, titanium, chromium, strategic rare-earth metals

and others. The Company continues to identify near term cash-flow

generating opportunities and in parallel aims to advance its

investments in strategic mineral properties. Fancamp has

investments in an existing iron ore operation in the

Quebec-Labrador Trough, a rare earth elements company, NeoTerrex

Minerals Inc., a copper–gold exploration company, Platinex Inc., in

addition to an investment in a near term cash flow generating zinc

mine, EDM Resources Inc. in Nova Scotia. The Company has future

monetization opportunities from its Koper Lake transaction in the

highly sought-after Ring of Fire in Northern Ontario. Fancamp is

developing an energy reduction and titanium waste recycling

technology with its advanced titanium extraction strategy. The

Company is managed by a focused leadership team with decades of

mining, exploration and complementary technology experience.

Further information on the Company can be found

at: www.fancamp.ca

Forward-Looking Statements

This news release contains certain

“forward-looking statements” or “forward-looking information”

(collectively referred to herein as “forward-looking

statements”) within the meaning of applicable securities

legislation. Such forward-looking statements include, without

limitation: the closing of the Transaction and the execution of all

documents and completion of all steps related thereto, including

but not limited to the completion of the Private Placement, the

Fancamp Investment and the Spin Out; the receipt of TSX-V approval

in respect of the Transaction; and the Company’s forecasts,

estimates, expectations and objectives for future.

Such forward-looking statements are based on a

number of assumptions, which may prove to be incorrect. Assumptions

have been made regarding, among other things: conditions in general

economic and financial markets; accuracy of assay results;

geological interpretations from drilling results, timing and amount

of capital expenditures; performance of available laboratory and

other related services; future operating costs; and the historical

basis for current estimates of potential quantities and grades of

target zones. The actual results could differ materially from those

anticipated in these forward-looking statements as a result of risk

factors, including the timing and content of work programs; results

of exploration activities and development of mineral properties;

the interpretation and uncertainties of drilling results and other

geological data; receipt, maintenance and security of permits and

mineral property titles; environmental and other regulatory risks;

project costs overruns or unanticipated costs and expenses;

availability of funds; failure to delineate potential quantities

and grades of the target zones based on historical data; and

general market and industry conditions.

Forward-looking statements are based on the

expectations and opinions of the Company’s management on the date

the statements are made. The assumptions used in the preparation of

such statements, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statements were

made. The Company undertakes no obligation to update or revise any

forward-looking statements included in this news release if these

beliefs, estimates and opinions or other circumstances should

change, except as otherwise required by applicable law.

For Further Information

|

Rajesh Sharma, President

& CEO+1 (604) 434 8829info@fancamp.ca |

Debra Chapman, CFO+1 (604) 434

8829info@fancamp.ca |

|

|

|

|

Tara Asfour, Director of Investor

Relations+1 (604) 434 8829tasfour@fancamp.ca |

|

|

|

|

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of

the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this news release.

Infographics accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d11278d7-9024-465c-bca9-26aa7fa4b97chttps://www.globenewswire.com/NewsRoom/AttachmentNg/f75c9c9e-1482-456c-8096-9f0c36bca60chttps://www.globenewswire.com/NewsRoom/AttachmentNg/ac0ec37f-bc2d-4f79-99f7-a4a90261d3b3

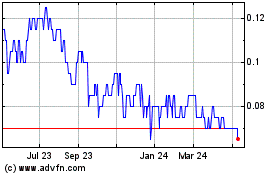

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Feb 2025 to Mar 2025

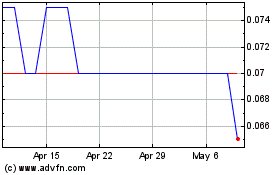

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Mar 2024 to Mar 2025