IBEX Technologies Inc. (TSX VENTURE:IBT), today reported its financial results

for the first quarter ended October 31, 2010.

FINANCIAL RESULTS FOR THE FIRST QUARTER OF FISCAL 2011

Sales for the quarter ended October 31, 2010 totaled $512,975, a decrease of 21%

as compared to $646,656 in the same period of the prior year. This net decrease

of $133,681 is mainly due to the weakness of the US dollar ($55,566) and to a

downturn in volume ($78,115), all of which can be accounted for by one customer

who had overestimated demand in 2010.

Excluding foreign exchange impact, expenses for the first quarter ended October

31, 2010 have increased by $125,110 to $690,863. This increase is attributable

to several factors such as new R&D projects, a non-cash expense related to stock

based compensation and other operational costs.

The net loss was $177,888 compared to net earnings of $71,877 for the same

period year ago. The decrease in net earnings is mainly due, as mentioned above,

to lower sales and the strengthening of the Canadian dollar versus the US dollar

(which negatively impacts the sales when converted into Canadian currency), and

to an increase in operating expenses.

Cash, cash equivalents, and marketable securities decreased 6% during the

quarter to $2,853,555 from $3,033,556. The Company's working capital was

$3,007,680 as at the end of the first quarter ended October 31, 2010 down from

$3,278,875 as at the end of the prior quarter ending July 31, 2010. This

decrease is due to a decrease in accounts receivable (due to lower sales).

"These results are consistent with previous guidance" said Paul Baehr, IBEX

President and CEO. "We expect to see softness in our business environment

through the balance of Fiscal 2011, before recovering in Fiscal 2012."

Financial Summary for the quarters ending

October 31, 2010 October 31, 2009

Revenues $512,975 $646,656

(Loss) Earning Before Interests, Tax,

Depreciation & Amortization ($144,476) $103,350

Depreciation & Amortization $35,324 $32,708

Net (Loss) Earnings ($177,888) $71,877

(Loss) Profit per Share ($0.01) $0.00

Cash, Cash Equivalents & Marketable

Securities $2,853,555 $2,661,569

Working Capital $3,007,680 $2,930,953

Outstanding shares at report date (Common

Shares) 24,703,244 24,703,244

LOOKING FORWARD

Fiscal 2011 looks to be a difficult year for IBEX's major US customers, and

therefore for IBEX. Additionally, the Canadian dollar is forecast to remain

strong against the US dollar, which does not work in our favour. We therefore do

not expect to have positive net earnings in Fiscal 2011, but expect to return to

profitability in Fiscal 2012, as the US economy improves.

Despite a difficult outlook for Fiscal 2011 we will continue to invest in the

future. IBEX is adding additional manufacturing capacity, and will continue with

the development of our improved immuno-assays, which are scheduled for

introduction in calendar 2011, with financial benefits accruing in Fiscal 2012.

ABOUT IBEX

The Company manufactures and markets a series of proprietary enzymes

(heparinases and chondroitinases). These enzymes are used in pharmaceutical

research, quality assurance, and in the case of Heparinase I, in diagnostic

devices which measure hemostasis in patients.

IBEX also manufactures and markets a series of arthritis assays which are widely

used in pharmaceutical research. These assays enable the measurement of both the

synthesis and degradation of cartilage components, and are powerful tools in the

study of osteo- and rheumatoid arthritis.

For more information, please visit the Company's web site at www.ibex.ca.

The TSX Venture Exchange does not accept responsibility for the adequacy or

accuracy of this release.

Safe Harbor Statement

All of the statements contained in this news release, other than statements of

fact that are independently verifiable at the date hereof, are forward-looking

statements. Such statements, based as they are on the current expectations of

management, inherently involve numerous risks and uncertainties, known and

unknown. Some examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry, changes in the

regulatory environment in the jurisdictions in which IBEX does business, stock

market volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual future

results may differ materially from the anticipated results expressed in the

forward- looking statements. IBEX disclaims any intention or obligation to

update these statements.

CONSOLIDATED BALANCE SHEETS

--------------------------------------------------------------------------

UNAUDITED October 31, 2010 July 31, 2010

--------------------------------------------------------------------------

$ $

ASSETS

Current assets

Cash and cash equivalents 2,153,555 2,333,556

Martketable securities 300,000 300,000

Accounts receivable 364,977 422,761

Inventories 211,995 226,364

Prepaid expenses 39,916 68,236

--------------------------------------------------------------------------

Sub-total current assets 3,070,443 3,350,917

Long term deposit 8,650 8,650

Martketable securities 400,000 400,000

Property and equipment 880,396 760,384

--------------------------------------------------------------------------

Total assets 4,359,489 4,519,951

--------------------------------------------------------------------------

LIABILITIES

Current liabilities

Accounts payable and accrued liabilities 462,763 472,042

--------------------------------------------------------------------------

Total liabilities 462,763 472,042

--------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Capital stock 52,660,078 52,660,078

Contributed surplus 549,465 522,760

Deficit (49,312,817) (49,134,929)

--------------------------------------------------------------------------

Total shareholders' equity 3,896,726 4,047,909

--------------------------------------------------------------------------

Total liabilities and shareholders'

equity 4,359,489 4,519,951

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT October 31, 2010 October 31, 2009

--------------------------------------------------------------------------

$ $

Balance - Beginning of period (49 134 929) (49,641,291)

Net (loss) profit for the period (177,888) 71,877

--------------------------------------------------------------------------

Balance - End of period (49,312,817) (49,569,414)

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF (LOSS)

EARNING AND COMPREHENSIVE INCOME

UNAUDITED

--------------------------------------------------------------------------

For the three months ended October 31st 2010 2009

--------------------------------------------------------------------------

$ $

Revenue 512,975 646,656

--------------------------------------------------------------------------

Operating expenses

Research and Development expenditures (56,774) -

Selling, general and administrative

expenses and cost of goods sold (562,212) (495,125)

Amortization of property and equipment (35,324) (32,768)

Other interest and bank charges (2,779) (3,468)

Foreign exchange (loss) gain (35,686) (44,712)

Investment income 1,912 1,294

--------------------------------------------------------------------------

Total operating expenses (690,863) (574,779)

--------------------------------------------------------------------------

Net (loss) profit and other

comprehensive income (177,888) 71,877

--------------------------------------------------------------------------

Net (loss) profit and other

comprehensive income per share

Basic and diluted $(0.01) $-

--------------------------------------------------------------------------

See accompanying notes

CONSOLIDATED CASH FLOW STATEMENTS

UNAUDITED

--------------------------------------------------------------------------

For the three months ended October 31st 2010 2009

--------------------------------------------------------------------------

$ $

Cash flows provided by (used in):

Operating activities

Net (loss) profit for the period (177,888) 71,877

Items not affecting cash -

Amortization of property and equipment 35,374 32,768

Stock-based compensation costs 26,705 -

--------------------------------------------------------------------------

Cash flow relating to operating

activities (115,809) 104,645

--------------------------------------------------------------------------

Net changes in non-cash working capital

items -

Decrease in accounts receivable 57,785 310,387

Decrease in inventories 14,369 24,686

Decrease in prepaid expenses 28,320 19,905

(Decrease) increase in accounts

payable and accrued liabilities (9,280) 5,089

--------------------------------------------------------------------------

Net changes in non-cash working capital

balances relating to operations 91,194 360,067

--------------------------------------------------------------------------

Cash flow relating to operating

activities (24,615) 464,712

--------------------------------------------------------------------------

Investing activities

Additions to property and equipment (155,386) (63,487)

--------------------------------------------------------------------------

Cash flow relating to financing

activities (155,386) (63,487)

--------------------------------------------------------------------------

(Decrease) Increase in cash and cash

equivalents during the quater (180,001) 401,225

Cash and cash equivalents - Beginning of

period 2,333,556 2,260,344

--------------------------------------------------------------------------

Cash and cash equivalents - End of

period 2,153,555 2,661,569

--------------------------------------------------------------------------

-

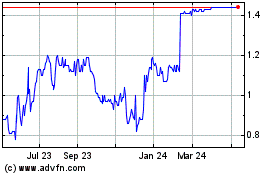

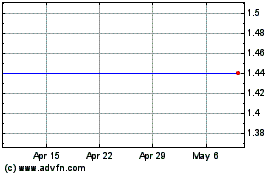

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025