IBEX Technologies Inc. (“

IBEX” or

the “

Company”) (TSX Venture: IBT) is pleased

to announce that it has entered into a binding acquisition

agreement dated February 9, 2024

(the “

Acquisition Agreement”) and related

agreements with 15720273 Canada Inc.

(the “

Purchaser”), a newly-incorporated,

wholly-owned subsidiary of BBI Solutions OEM Limited

(“

BBI”), whereby BBI will acquire all of the

issued and outstanding shares of IBEX at a price of $1.45 per share

in cash. The transaction will be effected by way of an amalgamation

of IBEX and the Purchaser under the Canada Business Corporations

Act (the “

Amalgamation”) to form an

amalgamated corporation (“

Amalco”). Under the

Amalgamation, each issued and outstanding common share of IBEX will

be exchanged for one redeemable preferred share of Amalco, which

will immediately be redeemed for $1.45 cash per share. The total

consideration is approximately $37.9 million.

The purchase price of $1.45 per share represents

a 29.5% premium to the $1.12 closing price of IBEX’s common shares

on the TSX Venture Exchange on February 9, 2024, the last closing

price prior to the signing of the Acquisition Agreement, and a

28.3% premium to the volume-weighted average trading price of $1.13

of IBEX’s common shares on the TSX Venture Exchange for the 30

trading days ended February 9, 2024.

“The Board of Directors of IBEX believes that

this transaction will benefit all IBEX stakeholders. We are

extremely pleased that IBEX will join the BBI family,” said

Paul Baehr, Chairman, President and Chief Executive Officer of

IBEX. “In particular, we look forward to additional development

projects for IBEX and its Canadian partners,” Mr. Baehr

added.

“We are delighted to welcome IBEX’s employees to

BBI and to add its enzymes to our fast-growing portfolio of

recombinant proteins. We look forward to drawing on IBEX’s

considerable expertise and know-how as we combine our teams to the

benefit of our customers around the world,” said

Mario Gualano, Chief Executive Officer of BBI.

Annual and Special Meeting of

Shareholders

IBEX has called an Annual and Special Meeting of

shareholders (the “Meeting”) to be held in

Montreal, Québec on April 3, 2024, to vote on the

Amalgamation. The Amalgamation is subject to approval by at least

two-thirds of the votes cast by IBEX shareholders present in person

or represented by proxy and entitled to vote at the Meeting. IBEX

will prepare and file a detailed Management Information Circular

shortly after the record date of February 22, 2024 for the

Meeting. Subject to shareholders approving the Amalgamation, the

Amalgamation is expected to take effect shortly after the Meeting.

Upon completion of the Amalgamation, shareholders will cease to

hold shares of IBEX and IBEX will be delisted from the TSX Venture

Exchange.

The Board of Directors of IBEX, after

consultation with its financial and legal advisors, has unanimously

approved entering into the Acquisition Agreement. In doing so, the

Board of Directors determined that the Amalgamation is fair to the

shareholders of IBEX and in the best interests of IBEX, and

authorized the submission of the Amalgamation to shareholders for

their approval at the Meeting.

In making its determination, the Board of

Directors considered, among other things, an opinion from Fort

Capital Partners to the effect that, as of February 9, 2024

and based upon and subject to the limitations, assumptions and

qualifications contained therein, the consideration of $1.45 cash

per share to be received by the shareholders in the Amalgamation is

fair, from a financial point of view, to the shareholders. The

Board of Directors unanimously recommends that shareholders vote

for the special resolution.

Support and Voting Agreements

Representing 47.15% of Outstanding Shares

Paul Baehr, Chairman, President and Chief

Executive Officer of IBEX, and all of IBEX’s other directors and

senior officers, holding in the aggregate approximately 10.39% of

IBEX’s outstanding shares, have entered into Support and Voting

Agreements with the Purchaser under which they have each agreed

irrevocably to support and vote their shares in favour of the

Amalgamation. Under the Support and Voting Agreements, the

directors and senior officers have agreed, among other things, not

to take any action which may in any way adversely affect the

success of the Amalgamation.

In addition, McLean Capital Inc. of Laval,

Québec, and entities managed and advised by MILFAM LLC,

holding in the aggregate approximately 36.76% of IBEX’s outstanding

shares, have entered into similar Support and Voting Agreements

with the Purchaser under which they have each agreed irrevocably to

support and vote their shares in favour of the Amalgamation. As a

result, shareholders holding in the aggregate approximately 47.15%

of IBEX’s outstanding shares have entered into Support and Voting

Agreements with the Purchaser.

The Acquisition Agreement contains

deal-protection provisions in favour of IBEX and the Purchaser

customary for a transaction of this kind. The Purchaser and IBEX

are at arm’s-length. IBEX will file a copy of the Acquisition

Agreement and related agreements on SEDAR+. In addition to

shareholder approval, the Amalgamation is subject to IBEX obtaining

required regulatory approvals and satisfaction of certain

conditions set out in the Acquisition Agreement.

Advisors

Fasken Martineau DuMoulin LLP is acting as

legal counsel to IBEX in connection with the Amalgamation.

Fort Capital Partners provided a fairness

opinion to the Board of Directors of IBEX in connection with the

Amalgamation.

Laurel Hill Advisory Group has been retained as

IBEX’s shareholder communications advisor.

About IBEX

IBEX manufactures and markets enzymes for

biomedical use through its wholly-owned subsidiary IBEX

Pharmaceuticals Inc. (Montréal, QC).

For more information, please visit the Company’s

website at www.ibex.ca.

About BBI

BBI is an international provider of immunoassay

products and services to the global diagnostics and life sciences

industries. The company offers high-performance recombinant and

native reagents across the entire immunodiagnostic workflow,

including antigens, antibodies, enzymes and complementary reagents.

It also offers a one-stop service for lateral flow assay

development and lateral flow point of care manufacturing. Our core

purpose is serving the science of diagnostics and in doing so we

supply the majority of the main IVD players globally.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Safe Harbor Statement

All of the statements contained in this news

release, other than statements of fact that are independently

verifiable at the date hereof, are forward-looking statements. Such

statements, as they are based on the current assessment or

expectations of management, inherently involve numerous risks and

uncertainties, known and unknown. Some examples of known risks are:

the impact of general economic conditions, general conditions in

the pharmaceutical industry, changes in the regulatory environment

in the jurisdictions in which IBEX does business, stock market

volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual

future results may differ materially from the anticipated results

expressed in the forward-looking statements. In particular,

completion of the proposed Amalgamation is subject to numerous

conditions, termination rights and other risks and uncertainties,

including the ability of IBEX to satisfy closing conditions for the

Amalgamation, which includes shareholder approval. Accordingly,

there can be no assurance that the proposed Amalgamation will

occur, or that it will occur on the timetable or on the terms and

conditions contemplated. IBEX disclaims any intention or obligation

to update these statements, except if required by applicable

laws.

Contact:

Paul Baehr, Chairman, President & CEO IBEX

Technologies Inc. 514-344-4004 x 143

Shareholder Questions

Shareholders who have questions relating to the

Amalgamation may also contact IBEX’s shareholder communications

advisor:

Laurel Hill Advisory GroupToll free:

1-877-452-7184 (+1-416-304-0211 outside North

America)Email: assistance@laurelhill.com

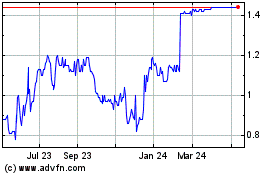

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

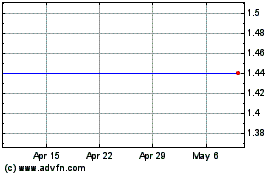

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025