KMT-Hansa Announces Debt Conversion

December 04 2024 - 7:35PM

KMT-Hansa Corp. (the “

Corporation”) would like to

announce that it has agreed to settle (collectively, the

“

Debt Settlements”) an aggregate of $940,024.92

debt to four (4) arm’s length creditors. The Debt Settlements will

be comprised of:

|

(i) |

an aggregate of $400,000 debt through the issuance of a convertible

debenture (the “Debentures”); and |

|

(ii) |

an aggregate of $540,024.92 debt owed to four (4) arm’s length

creditors through the issuance of 13,500,623common shares (the

“Debt Shares”) at a deemed price of $0.04 per Debt

Share. |

|

|

The Debentures shall bear interest at 7% per

annum from the date of issuance and shall mature on the date that

is one (1) year from the date of issuance (the “Maturity

Date”). The Debentures will be convertible, in whole or in

part, into one (1) unit (each, a “Debenture Unit”)

in the capital of the Corporation at a conversion price (the

“Conversion Price”) equal to $0.04 per Debenture

Unit. All accrued and unpaid interest on the Debentures, up to the

earlier of the date of conversion and the Maturity Date, shall be

converted into Debenture Units at the Conversion Price.

Each Debenture Unit will consist of (i) one (1)

common share (each, a “Debenture Common Share”)

and; (ii) one (1) common share purchase warrant (each, a

“Debenture Warrant”). Each Debenture Warrant

entitles the holder thereof to purchase one Common Share at an

exercise price of $0.05 per share for a period of one (1) year from

the date of issuance.

The aggregate number of common shares issuable

pursuant to the Debt Settlements, assuming that all of the

Debentures are converted into Debenture Common Shares on the

Maturity Date and all of the Debenture Warrants are exercised, will

be approximately 34,200,623 common shares.

Closing of the Debt Settlements are subject to

customary closing conditions, approvals of applicable securities

regulatory authorities, including the TSX Venture Exchange. All

securities issued in connection with the Debt Settlements will be

subject to a hold period of four months plus a day from the date of

issuance and the resale rules of applicable securities

legislation.

For further information please contact:

Donald WuPresidentEmail: kmthansa@gmail.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities legislation. Generally, these forward-looking statements

can be identified by the use of forward-looking terminology such as

“plans”, “anticipated”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. KMT-Hansa is subject to

significant risks and uncertainties which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements contained in this

release. KMT-Hansa cannot assure investors that actual results will

be consistent with these forward-looking statements and KMT-Hansa

assumes no obligation to update or revise the forward-looking

statements contained in this release to reflect actual events or

new circumstances.

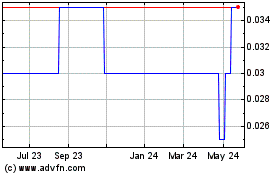

KMT Hansa (TSXV:KMC.H)

Historical Stock Chart

From Mar 2025 to Apr 2025

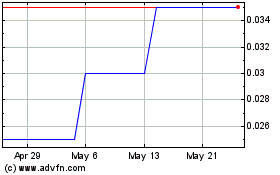

KMT Hansa (TSXV:KMC.H)

Historical Stock Chart

From Apr 2024 to Apr 2025