KMT-Hansa Announces Private Placement

July 26 2024 - 7:00AM

KMT-Hansa Corp. (the “Corporation”) is pleased to announce that it

intends to raise gross proceeds of up to $350,000 through a

non-brokered private placement of up to 10,000,000 units (the

“Units”) of the Corporation at a price of $0.035 per Unit.

Each Unit shall consist of one common share

(“Share”) in the capital of the Corporation and one-half (½) of one

common share purchase warrant (“Warrant”). Each whole Warrant will

entitle the holder thereof to acquire one common share of the

Company (each a “Warrant Share”) at a price of $0.05 per Warrant

Share for a period of 12 months following the date of issuance.

Finder’s fees on a portion of the financing may

be payable in accordance with the policies of the TSX Venture

Exchange.

In connection with the issue and sale of the

Units, the Corporation may pay on closing certain arm’s-length

third parties (the “Finders”) a finder's fee of up to 10% of the

gross proceeds raised from the sale of the Units. In addition, the

Corporation may grant to the Finders compensation warrants (the

“Compensation Warrants”) entitling the Finders to purchase that

number of Units of the Corporation (the “Compensation Units”) as is

equal to 10% of the number of Units sold. The Compensation Warrants

may be exercised, in whole or in part, at any time on or before

5:00 p.m. (Toronto time) on the date that is twelve (12) months

following the closing of the private placement at an exercise price

of $0.05 per Compensation Unit.

The non-brokered private placement is subject to

all necessary regulatory approvals. The securities being issued in

the private placement will be subject to a four-month hold period

in accordance with applicable Canadian securities laws. The

Corporation intends to use the net proceeds for general working

capital.

For further information please contact:

Jay VieiraDirector and Chief Executive Officer

Email: kmthansa@gmail.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements

This news release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities legislation. Generally, these forward-looking statements

can be identified by the use of forward-looking terminology such as

“plans”, “anticipated”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. KMT-Hansa is subject to

significant risks and uncertainties which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements contained in this

release. KMT-Hansa cannot assure investors that actual results will

be consistent with these forward-looking statements and KMT-Hansa

assumes no obligation to update or revise the forward-looking

statements contained in this release to reflect actual events or

new circumstances.

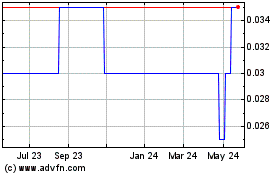

KMT Hansa (TSXV:KMC.H)

Historical Stock Chart

From Jun 2024 to Jul 2024

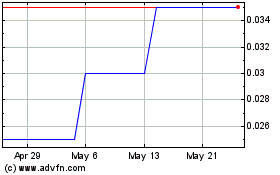

KMT Hansa (TSXV:KMC.H)

Historical Stock Chart

From Jul 2023 to Jul 2024