Los Andes Announces Filing of Preliminary Economic Assessment and Updated Mineral Resources for Vizcachitas

December 13 2013 - 5:30AM

Marketwired Canada

Los Andes Copper Ltd. ("Los Andes", or the "Company") (TSX

VENTURE:LA)(PINKSHEETS:LSANF) is pleased to announce that the Company has filed

a Preliminary Economic Assessment ("PEA") and an updated resource estimate on

its 100% owned Vizcachitas porphyry copper-molybdenum project ("Vizcachitas

Project") located in Region V, Chile.

The PEA was prepared by Coffey Consultoria y Servicios SpA (Coffey) and Alquimia

Conceptos S.A., and can be accessed under the Company's profile at www.sedar.com

and on the Company's website.

Resource Estimate Update

As part of the PEA the resource estimate for the Vizcachitas Project was updated

by Coffey. At a 0.3 % copper equivalent (Cu Eq) cut-off, the Indicated Resources

are 1,038 Mt @ 0.434 % Cu Eq (0.373 % Cu and 0.012 % Mo), containing an

estimated 8.5 billion pounds of copper and 281 million pounds of molybdenum, and

the Inferred Resources are 318 Mt @ 0.405 % Cu Eq (0.345 % Cu and 0.013 % Mo)

containing an estimated 2.4 billion pounds of copper and 88 million pounds of

molybdenum.

The estimate increases the Indicated Resources from the previous mineral

resources which had an effective date of June 9, 2008. The resource estimate was

based on a total of 146 drill holes and 40,383 metres drilled, including a total

of 16 drill holes and 5,128 metres of drilling completed after the June 9, 2008

resource estimate.

The Mineral Resource estimates for different cut-off grades with an effective

date of September 9, 2013 are shown in the tables below:

INDICATED

------------------------------------------------------------------------

Cu Mo

Cut-Off Tonnage Cu Eq Grade Grade Cu Mo

(Cu Eq %) Mt % % % Mlb Mlb

------------------------------------------------------------------------

0.20 1,317 0.396 0.341 0.011 9,913 318

------------------------------------------------------------------------

0.25 1,191 0.414 0.356 0.012 9,353 305

------------------------------------------------------------------------

0.30 1,038 0.434 0.373 0.012 8,539 281

------------------------------------------------------------------------

0.35 824 0.462 0.396 0.013 7,201 240

------------------------------------------------------------------------

0.40 566 0.501 0.431 0.014 5,374 179

------------------------------------------------------------------------

0.45 368 0.543 0.467 0.015 3,788 125

------------------------------------------------------------------------

0.50 244 0.588 0.509 0.016 2,515 79

------------------------------------------------------------------------

INFERRED

------------------------------------------------------------------------

Cu Mo

Cut-Off Tonnage Cu Eq Grade Grade Cu Mo

(Cu Eq %) Mt % % % Mlb Mlb

------------------------------------------------------------------------

0.20 521 0.343 0.296 0.010 3,407 111

------------------------------------------------------------------------

0.25 404 0.376 0.322 0.011 2,873 101

------------------------------------------------------------------------

0.30 318 0.405 0.345 0.013 2,415 88

------------------------------------------------------------------------

0.35 212 0.443 0.372 0.015 1,734 70

------------------------------------------------------------------------

0.40 130 0.488 0.402 0.018 1,152 51

------------------------------------------------------------------------

0.45 76 0.533 0.428 0.022 714 36

------------------------------------------------------------------------

0.50 40 0.584 0.466 0.024 415 22

------------------------------------------------------------------------

-- Copper equivalent grade has been calculated using the following

expression: Cu Eq (%) = CuT (%) + 4.95 x Mo (%), using the metal prices:

$ 2.75 / lb. Cu and $13.6 / lb. Mo.

-- Small discrepancies may exist due to rounding errors.

-- The quantities and grades of reported Inferred Mineral Resources are

uncertain in nature and further exploration may not result in their

upgrading to Indicated or Measured status.

-- Mineral Resources are reported within a Whittle pit shell based on: Mine

Cost - 2.25 USD/t, Process Cost - 6.94 USD/t, Copper Price - 3.00

USD/lb, Molybdenum Price - 13.6 USD/lb. Conc. Copper Sales Cost - 0.5537

USD/lb., Conc. Molybdenum Sales Cost - 1.60 USD/lb., Recovery Copper -

90 %, Recovery Molybdenum - 60 %, Slope Angles - 42 degrees to 47

degrees.

PEA Highlights

The PEA evaluated four mining scenarios feeding flotation facilities with a

throughput of 44 ktpd, 88 ktpd, 176 ktpd and 88 ktpd with a step up in

production to a final throughput of 176 ktpd. The 176 ktpd case was selected to

be the base case as it produced the highest net present values (NPV).

The results are presented with and without the inclusion of a 29 MW run-of-river

hydroelectric generation facility (Hydro Plant) located on a section of the

Rocin River where the Vizcachitas Project is located. The inclusion of the Hydro

Plant is contingent upon the closing of the acquisition of water rights and

studies for the Hydro Plant as described in the Filing Statement filed on SEDAR

on November 29, 2013.

The base case has a life of mine of 28 years, total capital expenditures of

$3.61 billion, and considered flat projected copper prices of $2.75/lb and

molybdenum prices of $13.64/lb.

On a pre-tax basis, the base case, including the Hydro Plant, results in an NPV

of $746 million, internal rate of return (IRR) of 11.4%, and an estimated

payback period from initial commercial operations (Payback Period) of 5.9 years.

On an unlevered after-tax basis, the base case, including the Hydro Plant,

results in an NPV of $274 million, IRR of 9.5%, and a Payback Period of 6.0

years.

On a pre-tax basis, the base case, excluding the Hydro Plant, results in an NPV

of $602 million, IRR of 10.9%, and a Payback Period of 6.3 years. On an

unlevered after-tax basis, the base case, excluding the Hydro Plant, results in

an NPV of $178 million, IRR of 9.0%, and a Payback Period of 6.4 years.

Note: The Preliminary Economic Assessment is considered preliminary in nature

and includes inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them that would

enable them to be categorized as mineral reserves, and there is no certainty

that the Preliminary Economic Assessment will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic viability.

An updated NI 43-101 compliant Technical Report on the Vizcachitas Copper

Molybdenum Porphyry Project has been filed on www.sedar.com and on the Company's

Internet site www.losandescopper.com.

The Technical Report is authored by independent Qualified Persons and prepared

in accordance with NI 43-101. The contents of this press release have been

approved by the following independent Qualified Persons:

John Wells BSc, MBA, FSAIMM.

Manuel Hernandez, BSc, FAusIMM.

Porfirio Cabaleiro, BSc, MAIG.

Roman Flores, BSc, Registered Member of Chilean Mining Commission.

Antony J. Amberg, M.Sc., CGeol., a qualified person as defined by National

Instrument 43-101, supervised the preparation of the technical information in

this news release.

Certain of the information and statements contained herein that are not

historical facts, constitute "forward-looking information" within the meaning of

the Securities Act (British Columbia), Securities Act (Ontario) and the

Securities Act (Alberta) ("Forward-Looking Information"). Forward-Looking

Information is often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend";

statements that an event or result is "due" on or "may", "will", "should",

"could", or might" occur or be achieved; and, other similar expressions. More

specifically, Forward-Looking Information involves known and unknown risks,

uncertainties and other factors which may cause the actual results, performance

or achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such Forward-Looking Information; including, without limitation, the achievement

and maintenance of planned production rates, the evolving legal and political

policies of Chile, the volatility in the Chilean economy, military unrest or

terrorist actions, metal and energy price fluctuations, favourable governmental

relations, the availability of financing for activities when required and on

acceptable terms,

the estimation of mineral resources and reserves, current and future

environmental and regulatory requirements, the availability and timely receipt

of permits, approvals and licenses, industrial or environmental accidents,

equipment breakdowns, availability of and competition for future acquisition

opportunities, availability and cost of insurance, labour disputes, land claims,

the inherent uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other risks and

uncertainties, including those described in Management's Discussion and Analysis

in the Company's financial statements. Such Forward-Looking Information is based

upon the Company's assumptions regarding global and Chilean economic, political

and market conditions and the price of metals and energy, and the Company's

production. Among the factors that have a direct bearing on the Company's future

results of operations and financial conditions are changes in project parameters

as plans continue to be refined, a change in government policies, competition,

currency fluctuations and restrictions and technological changes, among other

things. Should one or more of any of the aforementioned risks and uncertainties

materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from any conclusions, forecasts or projections described in

the Forward-Looking Information. Accordingly, readers are advised not to place

undue reliance on Forward-Looking Information. Except as required under

applicable securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Information, whether as a result of

new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Los Andes Copper Ltd.

Eduardo Covarrubias

President & CEO

(56-99) 323-3156

Los Andes Copper Ltd.

Michael Kuta

Corporate Secretary

604-697-6201

info@losandescopper.com

www.losandescopper.com

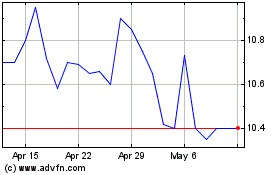

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From Apr 2024 to May 2024

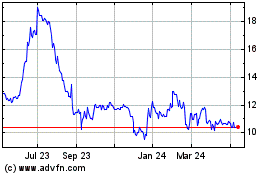

Los Andes Copper (TSXV:LA)

Historical Stock Chart

From May 2023 to May 2024