Latin Metals Inc. (

“Latin Metals”

or the

“Company”) -

(TSXV:

LMS) (OTCQB: LMSQF) announces that it has closed its

previously announced non-brokered private placement

(the “Financing”) for aggregate gross proceeds of $700,000

through the issuance of 10,000,000 units (each a “Unit”) at a

subscription price of $0.07 per Unit.

Each Unit consists of one common share in the

capital of Latin Metals (each, a “Share”) and one half of one

common share purchase warrant, with each whole warrant entitling

the holder thereof to purchase one Share at a price of

$0.15 per Share for a period of 24 months from the closing of

the Financing.

In connection with the

closing of the Financing, the Company paid finder’s fees on a

portion of the Financing to Leede Jones Gable Inc. consisting of a

$17,640 cash commission and 251,999 finder’s warrants. All

securities issued by the Company pursuant to the Financing are

subject to a hold period of four months and one day in Canada.

Certain officers, directors and a control person

of the Company (collectively, the “Related Parties”) participated

in the Financing pursuant to the terms described above, purchasing

in aggregate 4,300,000 Units. These constitute related party

transactions pursuant to Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). The Company relied on Sections 5.5(a) and

5.7(1)(a) of MI 61-101 for an exemption from the formal valuation

and minority shareholder approval requirements, respectively, as at

the closing of the Financing, neither the fair market value of the

Units issued in connection with the Financing, nor the fair market

value of the consideration received by the Company for same,

insofar as it involved the Related Parties, exceeded 25% of the

Company’s market capitalization.

The proceeds from the

Financing will support continued exploration and generative

activities across our project portfolio in Argentina and Peru,

alongside general working capital needs. The engagement of insiders

in the Financing highlights their ongoing support and confidence in

Latin Metals' strategic direction and exploration potential. The

closing of the Financing is subject to receipt of TSX Venture

Exchange final approval. Latin Metals thanks its investors and

stakeholders for their continued support and looks forward to

providing further updates on our exploration progress and strategic

partnerships.

Recap of Key

Projects and Strategic Initiatives for 2024.

Exploration

Projects

Generative work is at

the core of Latin Metals’ process and, in a sense, is the most

important step. Identifying, acquiring, and advancing exploration

projects must be done right to attract quality exploration

projects.

-

District-Scale Copper Exploration

Initiative: Latin Metals continues to

assemble district-scale exploration holdings prospective for

sediment-hosted copper. The recently acquired 68,000-hectare

Terraza Copper Project forms a significant part of Latin Metals’

broader exploration efforts, encompassing over 500,000 hectares

dedicated to sediment-hosted copper exploration across the region.

The Terraza Copper Project acquisition underscores our strategic

commitment to discovering and developing large-scale copper

resources, leveraging our extensive expertise and first-mover

presence in this emerging and highly prospective belt.

-

Project Pipeline: The Company is continually

reviewing new opportunities for acquisition with a view to

maintaining a healthy pipeline of projects. Companies or

individuals holding projects in Peru or Argentina are invited to

contact Latin Metals management via our website here.

Partner-Ready

Projects

The Company has

various projects available for option, some of which are summarized

below. Each project has a dedicated presentation on the Latin

Metals website here, which provides summary information, or

detailed data can be reviewed under a confidentiality agreement.

The Company aims in 2024 to secure quality option partners for each

of the Esperanza, Cerro Bayo, and Lacsha projects.

-

Esperanza Copper-Gold

Porphyry, Argentina: The

Esperanza copper-gold porphyry project is an advanced exploration

project where more than $4.5 million dollars have been deployed by

Latin Metals to explore the copper-gold potential of the project.

More than 8,500m of diamond drilling have been completed in total,

with the best intersection being 387m grading 0.57% copper and 0.27

g/t gold from the surface, with mineralization open for expansion

at depth and in all directions. The Project is in San Juan Province

at an elevation of less than 3,500m; it is drill-ready, road

accessible, and can be worked year-round.

- Cerro

Bayo Silver-Gold Epithermal,

Argentina: Exploration completed by

Barrick in 2022 and 2023 led to the definition of 8 drill target

areas at Cerro Bayo. The project is located in Santa Cruz Province

where exploration since 1990 has led to the discovery of almost 600

million ounces of silver and approximately 20 million ounces of

gold.

-

Lacsha Copper Porphyry, Peru:

Since acquiring the Lacsha project through a staking initiative in

Peru, the Company has efficiently moved the project through

multiple phases of surface exploration, identified key drill

targets, signed a 3-year agreement with local stakeholders, and

secured a drill permit for testing of all targets.

-

Copper Project Portfolio,

Peru: In addition to the Lacsha project,

Latin Metals has a diverse portfolio of exploration projects in

Peru. These projects range from early-stage exploration to

drill-ready and are available for option.

Organullo Project,

Argentina

The Organullo project where an existing option

agreement with AngloGold Argentina Exploraciones S.A.

(“AngloGold”), a wholly owned subsidiary of AngloGold Ashanti plc.

provides AngloGold with an option to earn up to an 80% interest in

the Project.

As previously reported, AngloGold has completed

an airborne geophysical survey collecting magnetic and radiometric

data over most of the Project area and this extensive geophysical

survey is a significant step for the Organullo project. The data

and interpretation will be integrated with existing data collected

by AngloGold to help finalize drill targets. AngloGold Ashanti has

submitted a drill permit for 11,900m and plans to commence drilling

once this permit and other licenses are received.

Qualified Person

The technical content

of this release has been approved for disclosure by Keith J.

Henderson P.Geo, a Qualified Person as defined by NI 43-101 and the

Company’s CEO. Mr. Henderson is not independent of the

Company, as he is an employee of the Company and holds securities

of the Company.

About Latin

Metals

Latin Metals is a

mineral exploration company acquiring a diversified portfolio of

assets in South America. The Company operates with a Prospect

Generator model focusing on the acquisition of prospective

exploration properties at minimum cost, completing initial

evaluation through cost-effective exploration to establish drill

targets, and ultimately securing joint venture partners to fund

drilling and advanced exploration. Shareholders gain exposure to

the upside of a significant discovery without the dilution

associated with funding the highest-risk drill-based exploration.

On Behalf of the Board

of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company readers are

referred to the Company’s web site (www.latin-metals.com) and its

Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890999 West Hastings StreetVancouver, BC, V6C 2W2

Phone: 604-638-3456E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities legislation. All statements, other

than statements of historical fact, included herein, including,

without limitation, the use of proceeds from the Financing the

anticipated business plans and timing of future activities of the

Company, are forward-looking statements. Although the Company

believes that such statements are reasonable, it can give no

assurance that such expectations will prove to be correct.

Forward-looking statements are typically identified by words such

as: “believes”, “expects”, “anticipates”, “intends”, “estimates”,

“plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled”

or variations of such words and phrases and similar expressions,

which, by their nature, refer to future events or results that may,

could, would, might or will occur or be taken or achieved.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to differ materially

from any future results, performance or achievements expressed or

implied by the forward-looking information. Such risks and other

factors include, among others, statements as to the anticipated

business plans and timing of future activities of the Company, the

ability of the Company to obtain sufficient financing to fund its

business activities and plans, delays in obtaining governmental and

regulatory approvals (including of the TSX Venture Exchange for the

Financing), permits or financing, changes in laws, regulations and

policies affecting mining operations, currency fluctuations, title

disputes or claims, environmental issues and liabilities, risks

relating to epidemics or pandemics such as COVID–19, including the

impact of COVID–19 on the Company’s business, financial condition

and results of operations, changes in laws, regulations and

policies affecting mining operations, title disputes, the inability

of the Company to obtain any necessary permits, consents, approvals

or authorizations, the timing and possible outcome of any pending

litigation, environmental issues and liabilities, and risks related

to joint venture operations, and other risks and uncertainties

disclosed in the Company’s continuous disclosure documents. All of

the Company’s Canadian public disclosure filings may be accessed

via www.sedar.com and readers are urged to review these

materials.

Readers are cautioned not to place undue

reliance on forward-looking statements. The Company does not

undertake any obligation to update any of the forward-looking

statements in this news release or incorporated by reference

herein, except as otherwise required by law.

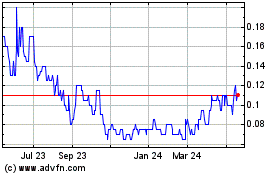

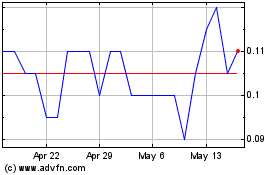

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Dec 2023 to Dec 2024