LNG Energy Group Corp. (TSXV: LNGE) (TSXV: LNGE.WT) (OTCQB: LNGNF)

(FWB: E26) (the “

Company” or “

LNG Energy

Group”) today provided an update with respect to its

previously announced strategic review (the “

Strategic

Review”). As previously announced, the Board of Directors

of the Company has initiated, with the assistance of financial

advisors, a strategic review process to explore and evaluate a

broad range of potential options for the Company to enhance

shareholder value. This review process will assess strategic

alternatives that may include, but are not limited to financings,

strategic partnerships, strategic investments, accretive

acquisitions, a potential sale, merger or other business

combination.

Capital Strengthening and Financing

Update

The Company is in the process of farming out a

non-operating portion of its participating interest in the VIM-41

Block located onshore Colombia, and of pursuing a well development

financing (“JV Contribution”) in order to raise

capital to initiate the drilling of the B5 well located onshore

Colombia. Furthermore, the Company intends to review options to

optimize cash flow available for drilling vis a vis its financial

obligations.

In conjunction with its near-term development

plans, the Company has entered into an agreement with ECM Capital

Advisors Inc. in respect of the Strategic Review in order to assist

the Company in assessing all strategic alternatives, including

financings, asset sales other potential transactions. The

previously announced engagement agreement with Eight Capital has

been mutually terminated by the parties thereto.

Other Initiatives

In connection with the foregoing initiatives,

the Company is pleased to announce an amendment (the

“Amendment”) to the senior secured credit

agreement entered into by LNG Canada Holdco Inc. (the

“Borrower”), as borrower, Lewis Energy Colombia,

Inc., as guarantor (the “Guarantor” and together

with the Borrower, the “Loan Parties”) and

Macquarie Group Ltd., as administrative agent, and the other

lenders (the “Lenders”) dated August 15, 2023 (the

“Credit Agreement”). As of the date hereof, the

Company has amortized approximately U.S.$20 million of the initial

principal outstanding (approximately C$0.17 per common share

outstanding) and reaching an aggregate principal amount outstanding

in respect of the Credit Agreement of approximately U.S.$50

million. Pursuant to the terms of the Amendment, the Lenders have

agreed to certain covenant relief in order to allow for the

foregoing strategic initiatives to be entered into by the Company

and its subsidiaries, as well as funding of its drilling

program.

Neither the TSXV nor its Regulation

Services Provider accept responsibility for the adequacy or

accuracy of this news release.

About LNG Energy Group

The Company is focused on the acquisition and

development of natural gas production and exploration assets in

Latin America. For more information, please visit

www.lngenergygroup.com.

For more information please contact:

Angel Roa, Chief Financial OfficerLNG Energy

Group Corp.Website: www.lngenergygroup.comEmail:

investor.relations@lngenergygroup.com

Find us on social media:LinkedIn:

https://www.linkedin.com/company/lng-energy-group-inc/Instagram:

@lngenergygroup X: @LNGEnergyCorp

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING INFORMATION:

This news release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian securities laws. All statements other than statements of

historical fact are forward-looking statements, and are based on

expectations, estimates and projections as at the date of this news

release. Any statement that involves discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often using phrases such

as “expects”, “anticipates”, “plans”, “budget”, “scheduled”,

“forecasts”, “estimates”, “believes” or “intends”, or variations of

such words and phrases, or stating that certain actions, events or

results “may” or “could”, “would”, “should”, “might” or “will” be

taken to occur or be achieved, are not statements of historical

fact and may be forward-looking statements.

Specifically, this news release includes, but is

not limited to, forward-looking statements relating to: the

Company’s business plans, strategies, priorities and development

plans, including the strategic initiatives being considered by the

Company and the corporate reorganization and anticipated annual

savings therefrom; the application of the stimulation technology

used for the BN-1 well workover on other wells of the Company; the

anticipated benefits of the completion of various strategic

initiatives being considered by the Company; the completion of the

JV Contribution and completion of other options to optimize cash

flow; the ability of the Company to book additional reserves in the

future; the completion of any transactions relating to the

Strategic Review; receipt of all regulatory approvals, including

the approval of the TSXV, in connection with the Strategic Review;

the anticipated insider participation any financing; and the

anticipated use of proceeds from the transactions relating to the

Strategic Review. The Company’s actual decisions, activities,

results, performance, or achievement could differ materially from

those expressed in, or implied by, such forward-looking statements

and accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur or, if any of them do, what benefits that the Company will

derive from them. For more information regarding the Strategic

Review, please see the Company’s news release dated December 4,

2024.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties

and other factors which may cause actual results and future events

to differ materially from those expressed or implied by such

forward-looking statements. Such factors include: the Company's

ability to complete the Strategic Review on the terms described

herein or at all or to access sufficient capital from internal and

external sources, and/or inability to access sufficient capital on

favourable terms; and the delay or failure to receive regulatory or

other approvals, including any approvals of the TSXV and the

Company’s senior lenders, for the Offering; general business,

economic, competitive, political and social uncertainties; risks

related to the Company’s ability to complete any of the proposed

strategic initiatives described in this news release on the terms

described herein or at all; risks related to commodity prices;

delay or failure to receive any necessary board, shareholder or

regulatory approvals, factors may occur which impede or prevent LNG

Energy Group’s future business plans; and other factors beyond the

control of LNG Energy Group. The intended use of the proceeds of

the transactions relating to the Strategic Review by the Company

might change if the Board of Directors of the Company determines

that it would be in the best interests of LNG Energy Group. There

can be no assurance that such statements will prove to be accurate,

as actual results and future events could differ materially from

those anticipated in such statements. Accordingly, readers should

not place undue reliance on the forward-looking statements

contained in this news release. Except as required by law, LNG

Energy Group assumes no obligation to update the forward-looking

statements, whether they change as a result of new information,

future events or otherwise. There can be no guarantee that any

of the foregoing transactions, including the JV Contribution or any

transactions relating to the Strategic Review, will achieve a

satisfactory closing.

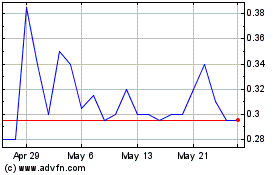

LNG Energy (TSXV:LNGE)

Historical Stock Chart

From Dec 2024 to Jan 2025

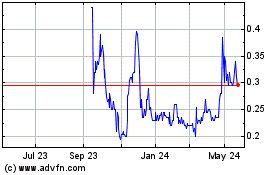

LNG Energy (TSXV:LNGE)

Historical Stock Chart

From Jan 2024 to Jan 2025