Regulatory News:

Maurel & Prom (Paris:MAU):

- Strong improvement in financial performance due to increased

production

- M&P working interest production in first-half 2024: 37,113

boepd, 35% and 29% increase respectively versus first-and

second-half 2023 (16% and 10% excluding Venezuela)

- Sales of $412 million in first-half 2024, up 38% on

first-half 2023 ($299 million)

- EBITDA $186 million; consolidated net income

$105 million; Group share of net income $101 million

- Strong cash flow generation and positive net cash

position

- $139 million in operating cash flow, $158 million in

free cash flow

- Positive net cash position of $27 million as at 30 June

2024, an increase of $147 million over the six months

($120 million in net debt as at 31 December 2023)

- Redistribution of created value to shareholders: dividend of

€0.30 per share ($65 million in total) paid at the start of

July

- Ramp-up of operations in Venezuela

- M&P Iberoamerica working interest oil production (40%) of

5,412 bopd in the Urdaneta Oeste field in the first half of

2024

- Rehabilitation of the compression facilities completed in July;

the well intervention campaign started in July, whilst preparations

are ongoing for the drilling campaign due to start in 2025.

- Five cargoes sold in the first half of 2024

- $29 million in dividends received by M&P Iberoamerica (80%

subsidiary of M&P) in the first half of 2024 thanks to the debt

repayment mechanism implemented in November 2023

Main financial indicators in H1

2024

in $ million

H1 2024

H1 2023

Variation

Income statement

Sales

412

299

+38%

Opex & G&A

-105

-88

Royalties and production taxes

-42

-37

Change in overlift/underlift position

-3

-9

Purchases of oil from third parties

-76

–

Other

–

–

EBITDA

186

164

+13%

Depreciation, amortisation and

provisions

-51

-54

Expenses on exploration assets

-1

-12

Other

-8

-5

Operating income

126

93

+35%

Net financial expenses

-8

-7

Income tax

-49

-51

Share of income/loss of associates

35

17

Consolidated net income

105

53

+99%

Of which recurring consolidated net

income

96

70

+37%

Of which Group share of net

income

101

53

+91%

Of which non-controlling

interests

4

-0

Cash flows

Cash flow before income tax

180

160

Income tax paid

-29

-33

Operating cash flow before change in

working capital

151

127

+19%

Change in working capital requirement

-12

-40

Operating cash flow

139

87

+60%

Development capex

-54

-57

Exploration capex

-10

-5

M&A

44

–

Dividends received

40

13

Free cash flow

158

38

+319%

Net debt service

-41

-39

Dividends paid

–

–

Other

1

0

Change in cash position

116

-1

N/A

Cash and debt

30/06/2024

31/12/2023

Closing cash

213

97

Closing gross debt

186

217

Closing net debt

-27

120

N/A

At its meeting of 2 August 2024, chaired by Mr Jaffee Suardin,

the Board of Directors of the Maurel & Prom Group (“M&P” or

“the Group”) approved the financial statements for the half year

ended 30 June 2024.

Olivier de Langavant, Chief Executive Officer at Maurel &

Prom, stated: “Our financial results are once again a reflection of

the very good health of our company. In a price environment that

has been stable for nearly a year, we have managed to significantly

improve our financial indicators thanks to the increase in our

production. The contribution from Venezuela is also starting to be

felt. The positive net cash position resulting from this

performance enables us to comfortably envisage growth projects

while continuing to return value to our shareholders.”

Financial performance

Group sales in the first half of 2024 were $412 million, up 38%

compared to the first half of 2023 ($299 million), due to the

combined effect of higher production (consolidated M&P share

production up 16% to 31,701 boepd) and a better average oil sale

price (up 12% to $84.0/b). Note that these sales include $77

million of oil trading for third parties.

Operating and administrative expenses for the period were -$105

million. Royalties and production taxes were -$42 million, and oil

purchases from third parties -$75 million.

EBITDA was $186 million. Depreciation charges and write-backs

were -$51 million and expenses on exploration assets were -$1

million. Operating income was $126 million, after accounting for

certain non-recurring costs of -$8 million.

Net of financial expense (structurally negative at -$8 million),

income tax (-$49 million), and the share of income from equity

associates ($35 million, $27 million of which for the Group’s

activities in Venezuela and $8 million related to the 20.46% stake

in Seplat Energy), the Group’s consolidated net income climbed to

$105 million in the first half of 2024 ($96 million of which in

recurring consolidated net income). The Group share of net income

was $101 million in the first half of 2024.

Turning to cash flows, operating activities generated $151

million in the first half 2024, before the change in working

capital requirement. The change in working capital requirement had

an impact of -$12 million over the period, resulting in cash flow

from operating activities of $139 million in the first half of

2024.

The Group recorded development capex of -$54 million (including

drilling expenses of -$37 million and licence renewals of -$6

million in Gabon, as well as -$8 million of development in Angola),

and exploration capex of -$10 million (mainly related to the Ezoe

discovery in Gabon). The $44 million cash inflow from M&A is

due to the repayment of certain amounts paid in advance for past

projects, as well as the exercise by TPDC of its call option for

20% in Mnazi Bay following the completion of the acquisition of

Wentworth Resources by M&P.

M&P received dividends of $40 million in the first half of

2024, including $29 million for its 40% interest in Petroregional

del Lago (“PRDL”) in Venezuela and $11 million for its 20.46%

interest in Seplat Energy.

Free cash flow for the first half of 2024 was $158 million, more

than quadruple the $38 million generated in the first half of

2023.

Net debt service was -$41 million, including -$31 million

repayment of principal. The change in cash position was therefore

$116 million.

The Group posted a positive net cash position of $27 million as

at 30 June 2024, in contrast with a net debt position of $120

million as at 31 December 2023.

The cash position at the end of June 2024 was $213 million.

Available liquidity as at 30 June 2024 was $280 million, including

an undrawn RCF tranche of $67 million.

Drawn gross debt amounted to $186 million at 30 June 2024,

including $122 million in bank loans and $64 million in shareholder

loans. M&P repaid a total of $31 million in gross debt in the

first half ($24 million in bank loans and $7 million in shareholder

loans).

It should be noted that this cash position is prior to the

payment of the dividend of €0.30 per share for the 2023 financial

year by M&P at the beginning of July (totalling $65

million).

Production activities

Q1 2024

Q2 2024

H1 2024

H1 2023

H2 2023

Change H1 2024 vs.

H1 2023

H2 2023

M&P working interest

production

Gabon (oil)

bopd

15,499

15,553

15,526

15,779

14,937

-2%

+4%

Angola (oil)

bopd

4,634

4,621

4,628

3,763

4,437

+23%

+4%

Tanzania (gas)

mmcfd

76.9

61.7

69.3

47.2

55.9

+47%

+24%

Total interests in consolidated

entities

boepd

32,953

30,450

31,701

27,406

28,697

+16%

+10%

Venezuela (oil)

bopd

5,353

5,472

5,412

N/A

N/A

N/A

N/A

Total production

boepd

38,305

35,922

37,113

27,406

28,697

+35%

+29%

Average sale price

Oil

$/bbl

84.3

83.6

84.0

74.8

83.2

+12%

+1%

Gas

$/mmBtu

3.91

3.89

3.90

3.77

3.76

+4%

+4%

Gabon

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 15,526 bopd for the first half of 2024, an increase

of 4% compared to the second half of 2023.

Drilling of the Ezoe exploration well in June led to a new

discovery, with gross reserves estimated by M&P to be

approximately 1.5 mmbbls. Production was started immediately, with

a second well also being drilled. Gross production potential on the

Ezanga permit currently stands at approximately 22,000 bopd, with

M&P working interest being 17,600 bopd (80%).

Tanzania

M&P’s working interest gas production (60%) on the Mnazi Bay

permit was 69.3 mmcfd for the first half of 2024, up 24% from the

second half of 2023.

Angola

M&P’s working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) in the first half of 2024 was 4,628 bopd, an increase

of 4% on the second half of 2023.

Venezuela

M&P Iberoamerica’s working interest oil production (40%) in

the Urdaneta Oeste field came to 5,412 bopd in the first half of

2024, unchanged from Q4 2023. The revision and rehabilitation of

the compression facilities was completed in July. The well

intervention campaign (with coiled tubing, snubbing unit and rig)

started in early July and will continue throughout 2025, whilst

preparations are ongoing for the drilling campaign which is due to

start in 2025.

Three new cargoes were sold by M&P on behalf of the mixed

company during Q2 2024, bringing the total to five cargoes in the

first half of 2024, and a sixth lifting was completed at the end of

July. During the first half of 2024, M&P Iberoamerica (80%

subsidiary of M&P) received $29 million in dividends for its

40% interest in PRDL thanks to the debt repayment mechanism

implemented in November 2023.

The situation in the country is being carefully monitored, and

operations are continuing normally.

Glossary

French

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

b

bbl

Barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By their very nature, forecasts involve risk and uncertainty

insofar as they are based on events or circumstances which may or

may not occur in the future. These forecasts are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production rates and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed on Euronext Paris

SBF 120 – CAC Mid 60 – CAC Mid & Small – CAC All-Tradable –

Eligible PEA-PME and SRD Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802257090/en/

Maurel & Prom Shareholder relations Tel.: +33 (0)1 53

83 16 45 ir@maureletprom.fr

NewCap Investor/media relations Tel.: +33 (0)1 44 71 98

53 maureletprom@newcap.eu

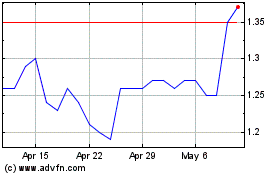

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2023 to Dec 2024