NurExone Biologic Inc. (TSXV: NRX), (OTCQB: NRXBF), (Germany: J90)

(the “

Company” or “

NurExone”), a

biopharmaceutical company developing exosome-based therapies for

the multi-billion dollar regenerative medicinei market, is pleased

to announce a non-brokered private placement of up to 3,636,363

units (“

Units”) at a price of $0.55 per Unit for

aggregate gross proceeds of up to $2,000,000 (the

“

Offering”) and will, on acceptance of the TSX

Venture Exchange (“

TSXV”), close on a first

tranche of the Offering for gross proceeds of $1,610,147.55. The

Company intends to use the proceeds of the Offering for working

capital purposes.

Dr. Lior Shaltiel, Chief Executive Officer of

the Company noted that, “we appreciate the continued support of our

existing shareholders, who recognize the milestones we’ve achieved

as we advance toward the use of loaded exosomes as regenerative

therapy for the multi-billion-dollar markets of acute spinal cord

injuries and optic nerve damage. Their participation in the

Offering reflects confidence in our strategic direction and

long-term growth potential, as we move ahead on the path to our

clinical and commercial goals.”

Each Unit will consist of (i) one common share

in the capital of the Company (each, a “Common

Share”), and (ii) one Common Share purchase warrant (each,

a “Warrant”). Each Warrant will entitle the holder

thereof to purchase one Common Share at a price of $0.70 per Common

Share for a period of 36 months, subject to acceleration. If the

daily volume weighted average trading price of the Common Shares on

the TSXV for any period of 10 consecutive trading days equals or

exceeds $1.05, the Company may, upon providing written notice to

the holders of the Warrants (the “Acceleration

Notice”), accelerate the expiry date of the Warrants to a

date not less than 30 days following the date of the Acceleration

Notice. If the Warrants are not exercised by the applicable

accelerated expiry date, the Warrants will expire and be of no

further force or effect.

Closing of the Offering is subject to receipt of

all necessary regulatory approvals, including TSXV, and all

securities issued thereunder will be subject to a statutory hold

period of four months and one day from the closing of the

Offering.

Related Party Transaction

The Offering may constitute a “related party

transaction”, as such term is defined in Multilateral Instrument

61-101 – Protection of Minority Shareholders in Special

Transactions (“MI 61-101”) as certain

insiders of the Company may subscribe in the Offering, and would

require the Company to receive minority shareholder approval for,

and obtain a formal valuation for the subject matter of, the

transaction in accordance with MI 61-101, prior to the completion

of each such transaction. However, the Company expects such

participation would be exempt from the formal valuation and

minority shareholder approval requirements of MI 61-101 as the fair

market value of the Units subscribed for by the insiders, nor the

consideration for the Units paid by such insiders, would exceed 25%

of the Company's market capitalization.

Closing of the First

Tranche

The Company is also pleased to announce the

closing of the first tranche of the Offering for gross proceeds of

$1,610,147.55 from the issuance of 2,927,541 Units. All securities

issued pursuant to the first tranche of the Offering are subject to

a statutory hold period of four months and one day.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this news release in the United States. Such

securities have not been, and will not be, registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), or any state securities laws, and,

accordingly, may not be offered or sold within the United States,

or to or for the account or benefit of persons in the United States

or “U.S. Persons”, as such term is defined in Regulation S

promulgated under the U.S. Securities Act, unless registered under

the U.S. Securities Act and applicable state securities laws or

pursuant to an exemption from such registration requirements.

About NurExone

NurExone Biologic Inc. is a TSXV, FSE and OTCQB

listed pharmaceutical company that is developing a platform for

biologically-guided exosome-based therapies to be delivered,

non-invasively, to patients who have suffered Central Nervous

System injuries. The Company’s first product, ExoPTEN for acute

spinal cord injury, was proven to recover motor function in 75% of

laboratory rats when administered intranasally. ExoPTEN has been

granted Orphan Drug Designation by the FDA. The NurExone platform

technology is expected to offer novel solutions to drug companies

interested in noninvasive targeted drug delivery for other

indications.

For additional information and a brief

interview, please watch Who is NurExone?,

visit www.nurexone.com or follow NurExone

on LinkedIn, Twitter, Facebook, or YouTube.

For more information, please contact:

Dr. Lior ShaltielChief Executive Officer and DirectorPhone:

+972-52-4803034Email: info@nurexone.com

Thesis Capital Inc.Investor Relations - CanadaPhone: +1

905-347-5569Email: IR@nurexone.com

Dr. Eva ReuterInvestor Relations - GermanyPhone:

+49-69-1532-5857Email: e.reuter@dr-reuter.eu

Allele Capital PartnersInvestor Relations - USPhone: +1

978-857-5075Email: aeriksen@allelecapital.com

FORWARD-LOOKING STATEMENTS

This press release contains certain

“forward-looking statements” that reflect the Company’s current

expectations and projections about its future results. Wherever

possible, words such as “may”, “will”, “should”, “could”, “expect”,

“plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or

“potential” or the negative or other variations of these words, or

similar words or phrases, have been used to identify these

forward-looking statements. Forward-looking statements in this

press release include, but are not limited to, statements relating

to the Company’s intention to complete the Offering on the terms,

timeline and with the subscribers indicated herein; the Company’s

intention to rely on the exemptions set out in MI 61-101; and the

NurExone platform technology offering novel solutions to drug

companies interested in noninvasive targeted drug delivery for

other indications.

These statements reflect management’s current

beliefs and are based on information currently available to

management as at the date hereof. In developing the forward-looking

statements in this press release, we have applied several material

assumptions, including the general business and economic conditions

of the industries and countries in which we operate; the general

market conditions; the ability to secure additional funding;

partnerships having their intended impact on the Company and its

business; patents safeguarding NurExone’s technology; the Company’s

drug products having its intended benefits and effects; the Company

making progress through new partnerships and technologies to move

towards commercialization of their products; the Company’s

intellectual property and technology being novel and inventive; the

intellectual property having the intended impact on the Company and

its business; exosomes becoming an ideal and natural choice for

drug delivery; the Company making advancements in the manufacturing

process of exosomes; exosomes holding immense promise for

regenerative medicine; the Company’s production methods continuing

to be reliable; the Company will have flexibility in optimizing its

exosome production method; exosomes will serve as an excellent,

targeted system for drug delivery; the Company will pave the way to

regenerative medicine treatments for a variety of clinical

indications by the Company and with future collaboration partners;

the Company’s ExoPTEN nanodrug being a potential treatment for

acute spinal cord injuries and other central nerve system

indications; the Company will complete the Offering on the terms,

timeline and with the subscribers indicated herein; the Company

will be able to rely on the exemptions set out in MI 61-101; and

the NurExone platform technology offering novel solutions to drug

companies.

Forward-looking statements involve significant

risk, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to differ materially

from the results discussed or implied in the forward-looking

statements. These risks and uncertainties include, but are not

limited to risks related to the Company’s early stage of

development; lack of revenues to date; government regulation;

market acceptance for its products; rapid technological change;

dependence on key personnel; protection of the Company’s

intellectual property; dependence on the Company’s strategic

partners; the fact that preclinical drug development is uncertain,

and the drug product candidates of the Company may never advance to

clinical trials; the fact that results of preclinical studies and

early-stage clinical trials may not be predictive of the results of

later stage clinical trials; the uncertain outcome, cost, and

timing of product development activities, preclinical studies and

clinical trials of the Company; the uncertain clinical development

process, including the risk that clinical trials may not have an

effective design or generate positive results; the potential

inability to obtain or maintain regulatory approval of the drug

product candidates of the Company; the introduction of competing

drugs that are safer, more effective or less expensive than, or

otherwise superior to, the drug product candidates of the Company;

the initiation, conduct, and completion of preclinical studies and

clinical trials may be delayed, adversely affected or impacted by

unforeseen issues; the potential inability to obtain adequate

financing; the potential inability to obtain or maintain

intellectual property protection for the drug product candidates of

the Company; the NurExone platform technology being unable to offer

novel solutions to drug companies; risks that the Company’s

intellectual property and technology won’t have the intended impact

on the Company and/or its business; the Company’s inability to

realize upon partnerships; risk that the exosomes will not become

an ideal and/or natural choice for drug delivery; risk that the

company will be unable to make advancements in the manufacturing

process of exosomes; risk that exosomes will not be a viable option

in regenerative medicine; risk that the Company’s production

methods will become unreliable; risk that the Company will not have

flexibility in optimizing its exosome production method; risk that

exosomes will not serve as a targeted system for drug delivery;

risk that the Company will be unable to pave the way to

regenerative medicine treatments for a variety of clinical

indications by the Company and/or with future collaboration

partners; risk that the Company’s ExoPTEN nanodrug will not work as

a potential treatment for acute spinal cord injuries and/or other

central nerve system indications; the Company’s inability to

complete the Offering on the terms, timeline and/or with the

subscribers indicated herein or at all; the Company’s inability to

rely on the exemptions set out in MI 61-101; risk that the NurExone

platform technology will be unable to offer novel solutions to drug

companies interested in non-invasive targeted drug delivery for

other indications; and the risks discussed under the heading “Risk

Factors” on pages 29 to 36 of the Company’s Annual Information Form

dated March 30, 2023, a copy of which is available under the

Company’s SEDAR+ profile at www.sedarplus.ca. These factors should

be considered carefully, and readers should not place undue

reliance on the forward-looking statements. Although the

forward-looking statements contained in this press release are

based upon what management believes to be reasonable assumptions,

the Company cannot assure readers that actual results will be

consistent with these forward-looking statements. These

forward-looking statements are made as of the date of this press

release, and the Company assumes no obligation to update or revise

them to reflect new events or circumstances, except as required by

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

i https://www.novaoneadvisor.com/report/us-regenerative-medicine-market

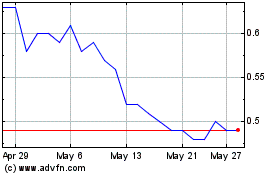

Nurexone Biologic (TSXV:NRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nurexone Biologic (TSXV:NRX)

Historical Stock Chart

From Feb 2024 to Feb 2025