NuLegacy Gold (the “

Company”) reports that on

account of the pending October 7th annual and special general

meeting (the “

AGM”) to authorize a

re-capitalization of the Company’s issued common shares it has

terminated the Company’s current 100,000,000-unit non-brokered

private placement announced on August 15 and 28, 2024 (the

“

Offering”). In total, the Company issued

45,200,000 units (“

Units”) at a price of $0.01 per

Unit for gross proceeds of $452,000, of which 40,000,000 Units were

purchased by Crescat Portfolio Management LLC

(“

Crescat”) together with various directors and

officers of the Company, for a total of $400,000.

Each Unit consisted of one common share and one

warrant (a “Warrant”) to purchase an additional

common share at a “nominal” pre-consolidated exercise price of

$0.05 per share. The net proceeds of the Offering have been

used/allocated to pay the annual BLM and county filing fees to

maintain the Company’s district scale Red Hill property in the

Cortez Gold trend of Nevada in good standing and for general and

administrative expenses.

At the upcoming AGM, the Company is seeking

shareholder approval for the reverse split/consolidation of the

Company’s issued common shares on a 25 old shares for one new share

basis as announced on August 15, 2024 (the

“Consolidation”). If the Consolidation is approved

by the shareholders and the TSX Venture Exchange (the

“TSXV”), the Company intends to apply to the TSXV

to have the post-Consolidation Warrant exercise price amended to an

exercise price of $0.50 per share (the “Price

Amendment”), or effectively $0.02 per share on a

pre-Consolidation basis. As a condition for acceptance of the Price

Amendment, the TSXV will require that if, for any 10 consecutive

trading days during the unexpired term of the Warrants (the

“Premium Trading Days”), the closing price of the

Company’s post-Consolidation shares as traded on the TSXV exceeds

the new exercise price by 25% or more (i.e., C$0.625 or more), then

the Warrants shall have a reduced exercise period of 30 days which

will begin no more than seven calendar days after the tenth Premium

Trading Day.

In conjunction with the Consolidation and

subject to acceptance of the TSXV, the Company intends to change

its name to “Preservation Gold Corporation” (the “Name

Change”).

All securities issued in connection with the

Offering are subject to a four month hold period expiring December

28, 2024. In addition, the Company relied upon the exemptions from

the valuation and minority shareholder approval requirements of

Multilateral Instrument 61-101 contained in sections 5.5(a) and

5.7(1)(a) thereof for the Units issued to Crescat and various

directors and officers of the Company under the Offering on the

basis that the fair market value of the consideration for such

Units did not exceed 25% of the Company’s market

capitalization.

The Company intends to re-assess potential

financing options following completion of the Consolidation and

Name Change.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the "U.S. Securities Act"),

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

About NuLegacy Gold:

Exploration: NuLegacy is focused on exploring for

high-grade Carlin-style gold deposits on its premier 108

sq. km (42 sq. mile) district scale Red Hill property. The Red Hill

is on trend/adjacentI to three of Nevada Gold Mines’ most

profitable multi-million ounce

Carlin-type gold mines; the Pipeline, Cortez and

GoldrushII with their massive 50+ million ounces gold endowment.

These are three of the world’s thirty largest, lowest cost, highest

grade, and politically safest gold mines, producing annually circa

3% of the world’s gold.

- The

similarity and proximity of these deposits in the Cortez Trend

including Goldrush are not necessarily indicative of the gold

mineralization in NuLegacy’s Red Hill Property.

- Currently structured as an

underground mine Goldrush contains P&P: 7.8 M oz @ 7.29 g/t;

M&I: 8.5 M oz @ 7.07 g/t (inclusive of P&P); and Inferred:

4.5 M oz @ 6.0 g/t (as of December 31, 2021). Source: Corporate

presentation of Nevada Gold Mines – Goldrush Underground dated

September 22, 2022.

On Behalf Of The Board Of NuLegacy Gold

Corporation

Albert J. Matter, Chief Executive Officer &

Cofounding Director Tel: +1 (604) 639-3640; Email:

albert@nuggold.com

For more information about NuLegacy visit: www.nulegacygold.com

or www.sedarplus.ca

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

Cautionary Statement on Forward-Looking

Information: This news release contains forward-looking

information and statements under applicable securities laws, which

information and/or statements relate to future events or future

performance (including, but not limited to, the use of proceeds

from the Offering, the Consolidation, Name Change and potential

future financing options and reflect management’s current

expectations and beliefs based on assumptions made by and

information currently available to the Company. Readers are

cautioned that such forward-looking information and statements are

neither promises nor guarantees, and are subject to risks and

uncertainties that may cause future results to differ materially

from those expected including, but not limited to, market

conditions, availability of financing, actual results of

exploration activities and drilling, unanticipated geological,

stratigraphic and structural formations, misinterpretation or

incorrect analysis of projected geological structures, alterations

and mineralization, environmental risks, operating risks, adverse

weather conditions, accidents, labour issues, delays in obtaining

governmental approvals and permits, inability to secure drilling

equipment and/or contractors on a timely basis or at all, delays in

receipt of assay results from third party laboratories, inflation,

future prices for gold, changes in personnel and other risks in the

mining industry. There are no assurances that the net proceeds from

the Offering will be sufficient to maintain the Company’s continued

operations through December 2025 as previously anticipated, that

the Consolidation will be approved by the Company’s shareholders

and the TSXV, that the Name Change will be accepted by the TSXV or

that the Warrant Price Amendment will be approved and affected on

the basis contemplated or at all. Furthermore, there are no known

mineral resources or reserves in the Red Hill Property and the

presence of gold resources on properties adjacent or near the Red

Hill Property including the Goldrush deposit is not necessarily

indicative of the gold mineralization on the Red Hill Property.

Future exploration programs on the Red Hill Property, if any, will

be exploratory searches for ore. There is also uncertainty

surrounding elevated inflation and high interest rates, the ongoing

war in Ukraine and conflict in Gaza and surrounding regions and the

continued spread and severity of COVID-19, and the impact they will

have on the NuLegacy’s operations, personnel, supply chains,

ability to raise capital, access properties or procure exploration

equipment, supplies, contractors, and other personnel on a timely

basis or at all and economic activity in general. All the

forward-looking information and statements made in this news

release are qualified by these cautionary statements and those in

our continuous disclosure filings available on SEDAR+ at

www.sedarplus.ca. The forward-looking information and statements in

this news release are made as of the date hereof and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances save as required by applicable law.

Accordingly, readers should not place undue reliance on

forward-looking information and statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

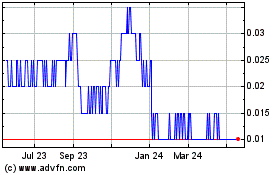

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

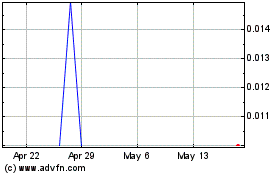

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Nov 2023 to Nov 2024