Divestment of Procon Investment in Lincoln Mining Required as a Result of US Regulatory Review

June 18 2013 - 7:24AM

Marketwired Canada

Lincoln Mining Corporation (TSX VENTURE:LMG) ("Lincoln" or the "Company")

announces that further to its news releases dated November 22, 2012 and November

28, 2012, the US regulatory authority has completed its review of the Company's

United States mineral properties and the previously announced financing

transactions involving Procon Mining and Tunnelling Ltd. ("PM&T") and certain of

its affiliates, including China National Machinery Industry Corporation

("Sinomach"). Sinomach is a state owned entity of the government of China.

As a result of the regulatory review, the Company, Sinomach, PM&T and its

affiliate Procon Resources Inc. ("PRI", and collectively with Sinomach and PM&T,

"Procon") are withdrawing a Joint Voluntary Notice filed on April 1, 2013 with

the Committee on Foreign Investment in the United States ("CFIUS"), and have

transmitted a letter of commitment (the "Letter") to CFIUS.

Pursuant to the Letter, Lincoln and Procon have committed to CFIUS that Procon

will, within 120 days after the date of the Order, divest its entire investment

in Lincoln to a third party investor that is acceptable to CFIUS. If Procon,

after making best efforts to divest its interest in Lincoln, is unable to divest

all of its interest within 120 days, Lincoln and Procon can apply for an

extension of up to 60 additional days, subject to approval by CFIUS. The Company

understands that the terms of the Letter will form the basis of an order to be

issued by CFIUS (the "Order").

Sinomach, through its 61% ownership of China CAMCE Engineering Co., Limited

("CAMCE"), indirectly owns 60% of PRI's outstanding common shares. PRI currently

holds 46,000,000 common shares (the "Procon Shares") of Lincoln and a

convertible debenture in the principal amount of C$2,300,000 (the "Procon

Debenture") which is due and payable on November 22, 2015. The Procon Debenture

is convertible at any time, in whole or in part at the election of the holder,

into up to 23,000,000 common shares of the Company on the basis of one common

share for each C$0.10 of principal. The Procon Debenture bears interest at the

rate of 6% per annum, calculated and payable monthly, on the outstanding

principal amount, and is secured by a general security agreement granted by the

Company. The Procon Shares and Procon Debenture were acquired by Procon pursuant

to various financings completed by the Company in September and November 2012

(see Lincoln's news releases dated November 22, 2012 and September 13, 2012).

The Letter also provides, among other things, that:

-- Lincoln must give CFIUS advance notice of the intended purchaser(s) of

the Procon Shares and the Procon Debenture and the structure of the

proposed sale transaction, which will be subject to review and approval

by CFIUS; and

-- until the divestment has been approved and completed, access to the

Company's Bell Mountain, Pine Grove and Oro Cruz properties

(collectively, the "US Properties") will be limited and will be subject

to the prior approval of specified United States government agencies.

The Company will work diligently with such agencies to obtain the

necessary approvals so that the Company's US personnel and contractors

will be permitted to continue accessing the US Properties to enable the

Company to continue its current and planned exploration and development

work programs on the properties.

Lincoln remains committed to advancing its exploration and development programs

on the US Properties and will work with Procon to comply with the requirements

of the Letter and to cooperate in facilitating PRI's divestment of the Procon

Shares and Procon Debenture to a third party, subject to the requirements of

applicable securities laws and the Order. At this time, the Company is not aware

of any such third party purchaser and there can be no assurances that a third

party purchaser acceptable to CFIUS will be identified, and that the divestment

will be completed, within the time required by the Order.

Director Resignation

With the resignation of Robert Cruickshank as a director effective June 17,

2013, the Company is now reviewing potential director candidates. Until such

time as an additional independent director is appointed to the board, the

Company's audit committee will be comprised of Andrew Milligan, James Dales and

Paul Saxton.

Loan from Prairie Enterprises

Lincoln also announces that it has received a C$300,000, unsecured demand loan

from Prairie Enterprises (Alberta) Inc. ("PE") to fund Lincoln's current working

capital requirements. PE is owned and controlled by Edward Yurkowski, who is a

director of the Company.

Lincoln Mining Corp. is a Canadian precious metals exploration and development

company with several projects in various stages of exploration and development

which include the Pine Grove and the Bell Mountain gold properties in Nevada,

the Oro Cruz gold property in California and the La Bufa gold-silver property in

Mexico. In the United States, the Company operates through its Nevada

subsidiaries, Lincoln Gold US Corp. and Lincoln Resource Group Corp.

On behalf of Lincoln Mining Corporation

Paul Saxton, President & CEO

This press release includes forward-looking statements or information. All

statements other than statements of historical fact included in this release,

including without limitation, statements regarding the potential sale of PRI's

investment in the Company to a third party in compliance with CFIUS requirements

and statements regarding the Company's ability to have continued access to its

US Properties, and other future plans, objectives or expectations of the

Company, involve various risks and uncertainties. The Company has made numerous

assumptions about the material forward-looking statements and information

contained in this news release. Even though our management believes that the

assumptions made and the expectations represented by such statements or

information are reasonable, there can be no assurance that the forward-looking

statement or information will prove to be accurate. Forward-looking statements

and information by their nature involve known and unknown risks, uncertainties

and other factors which may cause the actual results to be materially different

from any future results expressed or implied by such forward-looking statements

or information. Important factors that could cause actual results to differ

materially from the Company's plans or expectations include risks relating to:

PRI may be unable to divest its investment in the Company in compliance with the

Letter which may result in adverse actions taken by US regulatory authorities in

relation to the Company and/or the US Properties; restricted or limited access

to the Company's US Properties resulting from the Letter may impede or delay

planned exploration and development programs and could result in the impairment

or loss of the Company's rights in respect of those properties; availability of

capital and financing required to maintain the Company's properties and to fund

the Company's planned exploration and development programs in the prevailing

difficult market conditions; general economic, market or business conditions;

the actual results of current and planned exploration activities; the geology,

grade and continuity of any mineral deposits; fluctuating gold prices; risks

associated with property option agreements, leases, joint ventures and the

ability to conclude joint venture agreements on favourable terms; possibility of

accidents, equipment breakdowns and delays during exploration; exploration cost

overruns or unanticipated costs and expenses; regulatory changes and

restrictions including in relation to environmental liability; timeliness of

government or regulatory approvals and other risks detailed herein and from time

to time in the filings made by the Company with securities regulators. Should

one or more of these risks, uncertainties or other factors materialize, or

should underlying assumptions prove incorrect, actual results may vary

materially from those described in forward-looking statements and information.

Although we have attempted to identify factors that would cause actual results

to differ materially from those described in forward-looking statements and

information, there may be other factors that cause actual results, performances,

achievements or events to not be as anticipated, estimated or intended. Also,

many of the factors are beyond our control. Accordingly, you should not place

undue reliance on forward-looking statements or information. The Company

expressly disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information, future events

or otherwise except as otherwise required by applicable securities legislation.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lincoln Mining Corporation

Paul Saxton

President & CEO

604-688-7377

604-688-7307 (FAX)

www.lincolnmining.com

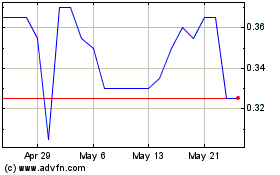

Pure Energy Minerals (TSXV:PE)

Historical Stock Chart

From Apr 2024 to May 2024

Pure Energy Minerals (TSXV:PE)

Historical Stock Chart

From May 2023 to May 2024