Pender Growth Fund and Pender Private Investments Inc. Announce Execution of Letter of Intent to Acquire Remaining PPI Legacy Shares

May 24 2023 - 5:22PM

Pender Growth Fund Inc. (“

PGF”;

TSXV:

PTF) and Pender Private Investments Inc.

(“

PPI”) today announce that they have signed a

non-binding letter of intent (the “

Letter of

Intent”) to acquire all Legacy Shares of PPI not currently

owned by PGF (the “

Proposed Transaction”).

PGF currently holds approximately 98% of the

outstanding Legacy Shares of PPI. Pursuant to the terms of the

Letter of Intent, PGF proposes to acquire the remaining Legacy

Shares at a cash purchase price equal to 100% of the Net Asset

Value (“NAV”) of PPI’s portfolio, determined in

accordance with past practice of the manager of PPI, PenderFund

Capital Management Ltd. (the “Purchase Price”),

pursuant to a statutory plan of arrangement under the Business

Corporations Act (British Columbia). The Letter of Intent provides

that the Purchase Price will be determined based on a calculation

of NAV as of five business days prior to the signing of the

definitive agreement for the Proposed Transaction, subject to

adjustment to a maximum of five percent up or down based on an

updated calculation of NAV as of five business days prior to the

closing of Proposed Transaction.

The board of directors of PPI has formed a

special committee (the “Special Committee”),

composed of independent directors, to consider and evaluate the

terms of the Proposed Transaction, to determine whether the

Proposed Transaction is in the best interests of PPI and to

recommend whether shareholders should vote in favour of the

Proposed Transaction. In furtherance of their evaluation, the

Special Committee has engaged independent legal counsel and will

procure an opinion from an independent financial advisor as to the

fairness, from a financial point of view, of the Proposed

Transaction to the shareholders of the Legacy Shares, other than

PGF (a “Fairness Opinion”).

The terms of the Proposed Transaction set out in

the Letter of Intent, including the Purchase Price, are non-binding

and are therefore subject to change. Completion of the Proposed

Transaction remains subject to, among other things, the negotiation

of a definitive agreement, approval of the PPI shareholders

(including majority of the minority approval), receipt of a

satisfactory Fairness Opinion and court approval.

PPI shareholders, other than PGF, are able to

request annual retraction of their shares and are currently

entitled to request retraction of their shares up to June 10, 2023,

at $2.82 per share, which represents 40% of NAV per share on

December 31, 2022. Those shareholders who exercise their retraction

right will instead receive 100% of the NAV per share under the

Proposed Transaction.

About PGF

PGF’s objective is to achieve long-term capital

appreciation for its investors. PGF utilizes its small capital base

and long-term horizon to invest in unique situations; primarily

small cap, special situations, and illiquid public and private

companies. PGF trades on the TSX Venture Exchange under the symbol

“PTF”.

Please visit www.pendergrowthfund.com.

For further information, please contact:

Tony RautavaPenderFund Capital

Management Ltd.(604) 653-9625Toll Free: (866) 377-4743

About PPI

Pender Private Investments Inc. is an investment

entity with a portfolio of technology companies that was acquired

by PGF through the acquisition of another venture capital fund.

Please visit www.pendergrowthfund.com.

For further information, please contact:

Tony RautavaPenderFund Capital

Management Ltd.(604) 653-9625Toll Free: (866) 377-4743

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains certain “forward

looking statements” and certain “forward-looking information” as

defined under applicable Canadian and U.S. securities laws

(together, “forward-looking statements”). Forward looking

statements can generally be identified by the use of

forward-looking terminology such as “may”, “will”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”,

“proposed” “potential” or similar terminology. Forward-looking

statements in this news release include, but are not limited to,

statements and information related to completion of the Proposed

Transaction. In making the forward-looking statements in this news

release, PGF and PPI have applied several material assumptions,

including, without limitation, the assumptions that the parties

will be able to negotiate a definitive agreement and satisfy the

conditions to closing of the Proposed Transaction, including

agreement as to the Purchase Price and the receipt of a Fairness

Opinion and requisite shareholder and court approvals.

Forward-looking statements and information are not historical facts

and are made as of the date of this news release. These

forward-looking statements involve numerous risks and uncertainties

and actual results may vary. Important factors that may cause

actual results to vary include, without limitation, risks related

to the ability of the parties to negotiate and execute a definitive

agreement and satisfy the conditions of closing of the Proposed

Transaction, including agreement as to the Purchase Price and the

receipt of a Fairness Opinion and requisite shareholder and court

approvals. The actual results or performance by PGF and PPI could

differ materially from those expressed in, or implied by, any

forward-looking statements relating to those matters. Accordingly,

no assurances can be given that any of the events anticipated by

the forward-looking statements will transpire or occur. Except as

required by law, neither PGF nor PPI is under any obligation, and

expressly disclaim any obligation, to update, alter or otherwise

revise any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

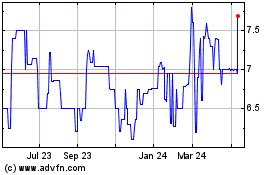

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Oct 2024 to Nov 2024

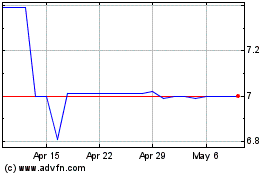

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Nov 2023 to Nov 2024