(TSXV: PTF) -- Pender Growth Fund Inc. (the

“Company”) today announced its financial and operational results

for the three months ended March 31, 2024.

Financial Highlights

- Net income was $12,262,927 for the

three months ended March 31, 2024 (March 31, 2023 – Net loss

$3,293,058) due to positive investment performance in the

quarter.

- Net income per Class C common share

(“Share”) was $1.67 for the three months ended March 31, 2024

(March 31, 2023 – Net loss per share $0.44).

- The Company’s total shareholders’

equity increased by $12,079,730 from $69,886,178 at December 31,

2023 to $81,965,908 as at March 31, 2024, due to net income from

positive investment performance of $12,262,927 during the quarter,

offset by share repurchases of $183,197 under the Company’s Normal

Course Issuer Bid (“NCIB”).

- Shareholders’ equity was $11.16 per

Share as at March 31, 2024 (December 31, 2023 – $9.48).

- 7,343,129 shares were outstanding

as at March 31, 2024 (December 31, 2023 – 7,368,229), a decrease of

25,100 shares as a result of share repurchases under the NCIB,

which was renewed on February 15, 2024.

- At March 31, 2024, 80.7% of the

investment portfolio was made up of public companies and 19.3% of

private companies.

- Management Expense Ratio (“MER”)

before performance fees was 3.13% for the quarter ended March 31,

2024, up 0.69% compared to 2.44% in the first quarter of 2023.

|

PERFORMANCE(Based onShareholders’

Equity) |

3 Month |

1 Year |

3 Year |

5 Year |

SinceInception |

|

Class C |

17.7% |

26.2% |

22.1% |

21.4% |

18.8% |

The Company’s portfolio is materially

concentrated in the shares of one publicly listed Portfolio

Company, Copperleaf Technologies Inc. (“Copperleaf”). As at March

31, 2024, the Company held 6,739,883 shares of Copperleaf with a

value of $48,190,163, which was 58.8% of the Company’s total

shareholders’ equity of $81,968,955 (December 31, 2023 – 6,889,883

shares with a value of $41,614,893 which was 59.5% of the Company’s

total shareholders’ equity). There can be no assurance that the

Company will be able to realize the value of this investment.

Portfolio Highlights

With the general trend in inflation continuing

to slow, central banks are taking the opportunity to pause their

rate increase campaigns and signal that the next rate move is

likely to be lower. The timing of any interest rate cuts, however,

remains elusive. With the potential for volatility as the market

adjusts to new incoming data, we will continue to monitor these

macro events and assess their impact on the Company and our

Portfolio Companies. Our goal remains to target businesses with

durability and balance sheet strength to weather a variety of

economic environments.

We believe that the Company continues to be

well-positioned today to pursue its investment objectives and we

continue to find attractive investments opportunities as valuations

in micro and small cap stocks in North America remain attractive

despite the recent rally this year.

Investment results may be affected by future

developments and new information that may emerge about inflation

and the impact of central bank measures on the economy, the state

of M&A markets, geopolitical and other global events, factors

that are beyond the Company’s control.

While macro events have driven investor

sentiment, we have remained focused on our bottom-up fundamental

research to identify companies that can thrive in a wide range of

economic scenarios. We believe that this environment provides

compelling opportunities for long-term focused investors and that

the Company is well-positioned to continue to pursue its investment

objectives.

As always, this quarter we worked closely with

our private portfolio companies and certain of our public portfolio

companies.

Significant Equity Investments & Recent

Developments

Copperleaf Technologies Inc.

At March 31, 2024, the Company held 9.1% of

Copperleaf’s issued and outstanding shares. The value of the

Company’s holdings of Copperleaf was $48.2 million at March 31,

2024, which was 58.8% of the Company’s total shareholders’

equity.

Other Highlights

We continued to acquire shares of the Company in

the market under our NCIB because we believe the shares are trading

at a discount to their intrinsic value. On February 15, 2024, the

Company launched a new NCIB, under which the Company may purchase a

maximum of 630,188 shares, or 10% of the Company’s public float on

launch date, during the one-year period ending February 14,

2025.

We encourage you to refer to the Company’s

MD&A and quarterly unaudited financial statements for March 31,

2024, the annual audited financial statements for the year-ended

December 31, 2023, and other disclosures available under the

Company’s profile at www.sedarplus.ca for additional

information.

About the Company

Pender Growth Fund Inc is an investment firm.

Its investment objective is to achieve long-term capital growth.

The Company utilizes its small capital base and long-term horizon

to invest in unique situations, primarily small cap, special

situations, and illiquid public and private companies. The firm

invests in public and private companies based primarily in Canada

and the U.S., principally in the technology sector. It trades on

the TSX Venture Exchange under the symbol “PTF” and posts its NAV

on its website, generally within five business days of each month

end.

Please visit www.pendergrowthfund.com.

For further information, please contact:

Tony Rautava

Corporate Secretary Pender Growth Fund Inc.

(604) 653-9625Toll Free: (866) 377-4743Neither the TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified by

words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may”, “estimate” and other similar

expressions. These statements are based on the Company's

expectations, estimates, forecasts and projections and include,

without limitation, statements regarding the Company’s decreased

portfolio risk and future investment opportunities. The

forward-looking statements in this news release are based on

certain assumptions; they are not guarantees of future performance

and involve risks and uncertainties that are difficult to control

or predict. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements, including, but not limited to, the factors discussed

under the heading “Risk Factors” in the Company's annual

information form available at www.sedarplus.ca. There can be no

assurance that forward-looking statements will prove to be accurate

as actual outcomes and results may differ materially from those

expressed in these forward-looking statements. Readers, therefore,

should not place undue reliance on any such forward-looking

statements. Further, these forward-looking statements are made as

of the date of this news release and, except as expressly required

by applicable law, the Company assumes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

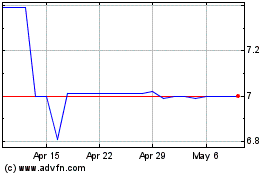

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Nov 2024 to Dec 2024

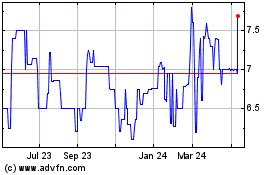

Pender Growth (TSXV:PTF)

Historical Stock Chart

From Dec 2023 to Dec 2024