Radisson Mining Resources Inc. (TSX-V: RDS, OTCQB:

RMRDF) (“

Radisson” or the

“

Company”) is pleased to announce additional

results from eleven diamond drill holes completed at its 100% owned

O’Brien Gold Project (“

O’Brien” or the

“

Project”) located in the Abitibi region of Quebec

(see location). These results are part of Radisson’s ongoing and

fully-funded 35,000 metre drill program aimed at expanding the

scope of gold mineralization and Mineral Resources at the Project.

Gold mineralization at the O’Brien Project is

characterized by narrow and high-grade quartz-sulphide veins with

prolific visible gold developed within rocks of the Piché Group

adjacent to the Larder Lake-Cadillac Break (“LLCB”). The historic

O’Brien mine produced over half a million ounces of gold from such

veins at an average grade exceeding 15 grams per tonne (“g/t”), and

today’s results demonstrate the same characteristic narrow and very

high-grade vein intercepts.

Results Highlights:

-

OB-24-320 intersected 137.00 g/t gold (“Au”) over

1.0 metres within a mineralized interval of 24.74 g/t Au over 6.0

metres, and 7.60 g/t Au over 3.0 metres within a mineralized

interval of 4.61 g/t Au over 6.0 metres;

-

OB-24-316 intersected 74.40 g/t Au over 1.3 metres

within a mineralized interval of 42.31 g/t Au over 2.3 metres, and

8.76 g/t Au over 1.0 metres within a mineralized interval of 3.50

g/t Au over 6.1 metres;

-

OB-24-317 intersected 20.20 g/t Au over 1.0

metres; and

-

OB-24-313 intersected 6.47 g/t Au over 3.7

metres.

Matt Manson, President & CEO, commented:

“Today’s drill results further illustrate the type of vein

intercepts, very-high grades and abundant visible gold that the

O’Brien Gold Project is known for. These latest results are from

predominantly Trends 1 and 2, closer to the historic O’Brien mine,

where we are seeing, perhaps, the best examples of the extensive

high-grade near-vertical shoots that were so important for previous

gold production. This is illustrated by the new drill hole

OB-24-320 (137 g/t Au over 1.0 metres within a mineralized interval

of 24.74 g/t Au over 6.0 metres) which is 290 metres down plunge on

the same ‘Trend 1’ section and developed within the same Piche

Group S3p greywackes as the previously published drill hole

OB-23-284 (241 g/t Au over 1.0 metres within 81.83 g/t Au over 3.0

metres; Figures 2 & 3). Our drilling to date has been aimed at

in-filling gaps in the geological model in the 200-500 metre depth

range. Current drilling includes deeper step-out holes below Trends

0 and 1 and below the depth of the existing Mineral Resource. We

now have two rigs at O’Brien and are approximately half-way through

our fully-funded 35,000 metre drill program of resource expansion

and step-out exploration. We will be reporting additional drill

results on a regular basis as they become available.”

|

Table 1: Summary Assay Results from DDH OB-24-309

to 320 |

|

DDH |

Zone |

|

From (m) |

To (m) |

Core Length (m) |

Au g/t - Uncut |

Host lithology |

|

OB-24-309 |

Trend #3 |

|

25.50 |

27.00 |

1.50 |

4.82 |

PON-S3 |

|

OB-24-311 |

Trend #3 |

|

225.30 |

226.30 |

1.00 |

3.55 |

PON-S3 |

|

OB-24-313 |

Trend #2 |

|

305.00 |

308.70 |

3.70 |

6.47 |

V3-S |

|

|

|

354.20 |

355.20 |

1.00 |

7.09 |

POR-N |

|

OB-24-314 |

Trend #2 |

|

155.90 |

157.40 |

1.50 |

9.50 |

PON-S3 |

|

|

|

279.00 |

280.50 |

1.50 |

8.60 |

V3-S |

|

|

|

296.50 |

298.00 |

1.50 |

5.77 |

V3-S |

|

OB-24-315 |

Trend #2 |

|

270.20 |

271.20 |

1.00 |

4.66 |

POR-S |

|

|

|

319.70 |

320.90 |

1.20 |

8.55 |

POR-N |

|

OB-24-316 |

Trend #2 |

|

479.95 |

486.00 |

6.05 |

3.50 |

V3-S |

|

|

Including |

481.00 |

482.00 |

1.00 |

8.76 |

V3-S |

|

|

|

493.60 |

494.40 |

0.80 |

3.54 |

V3-S |

|

|

|

647.00 |

649.25 |

2.25 |

42.31 |

S3-p |

|

|

Including |

648.00 |

649.25 |

1.25 |

74.40 |

S3-p |

|

OB-24-317 |

Trend #2 |

|

421.80 |

423.70 |

1.90 |

3.65 |

V3-S |

|

|

|

479.40 |

480.40 |

1.00 |

20.20 |

POR-S |

|

OB-24-318 |

Trend #2 |

|

518.80 |

520.30 |

1.50 |

4.77 |

POR-N |

|

|

|

528.10 |

529.10 |

1.00 |

3.26 |

V3-N |

|

OB-24-319 |

Trend #1 |

|

487.20 |

488.40 |

1.20 |

3.19 |

V3-S |

|

|

|

609.40 |

610.90 |

1.50 |

6.36 |

V3-N |

|

|

|

619.00 |

620.00 |

1.00 |

5.07 |

S3-p |

|

OB-24-320 |

Trend #1 |

|

590.30 |

596.30 |

6.00 |

4.61 |

V3-N |

|

|

Including |

591.80 |

594.80 |

3.00 |

7.60 |

V3-N |

|

|

|

602.30 |

608.30 |

6.00 |

24.74 |

V3-N/S3p |

|

|

Including |

604.30 |

605.30 |

1.00 |

137.00 |

S3p |

|

DDH OB-24-312 returned no intercepts averaging >3 g/t Au. |

| |

|

|

|

|

|

|

|

Notes on Calculation of Drill

InterceptsThe O’Brien Gold Project March 2023 Mineral

Resource Estimate (“MRE”) utilizes a 4.50 g/t Au bottom cutoff, a

US$1600 gold price, a minimum mining width of 1.2 metres, and a 40

g/t Au upper cap on composites. Intercepts presented in Table 1 are

calculated with a 3.00 g/t Au bottom cut-off, representing the

lower limit of cut-off sensitivity presented in the March 2023 MRE.

This methodology differs from previous Radisson disclosure, and

intercepts reported in this release may not be directly comparable

to historical published intercepts. Sample grades are uncapped.

True widths, based on depth of intercept and drill hole

inclination, are estimated to be 40-80% of core length. Table 2

presents additional drill intercepts calculated with a 1.00 g/t

bottom cut-off over a minimum 1.0 metre core length so as to

illustrate the frequency and continuity of mineralized intervals

within which high-grade gold veins at O’Brien are developed.

Gold Mineralization at O’Brien

Gold mineralizing quartz-sulphide veins at

O’Brien occur within a thin band of interlayered mafic volcanic

rocks, conglomerates, and porphyric andesitic sills of the Piché

Group occurring adjacent to the east-west oriented LLCB. Gold,

along with pyrite and arsenopyrite, is typically associated with

shearing and a pervasive biotite alteration, and developed within

multiple Piché Group lithologies and, occasionally, the

hanging-wall Pontiac meta-sedimentary rocks.

Figure 1: Visible Gold in DDH OB-24-320 at 604.8 metres

depth (top), OB-24-316 at 648.1 metres depth (middle) and OB-24-317

at 479.5 metres depth (bottom).

As mapped at the Historic O’Brien mine, and now

replicated in the modern drilling, individual veins are generally

narrow, ranging from several centimetres up to several metres in

thickness. Multiple veins occur sub-parallel to each other, as well

as sub-parallel to the Piché lithologies and the LLCB. Individual

veins have well established lateral continuity, with high-grade

near-vertical grade shoots developed over significant lengths.

Historic gold production was derived predominantly from one such

grade shoot, over a vertical extent of at least 1,000 metres and

with a reported average recovered grade of over 15 g/t.

The Project has estimated Indicated Mineral

Resources of 0.50 million ounces (1.52 million tonnes at 10.26 g/t

Au), with additional Inferred Mineral Resources of 0.45 million

ounces (1.62 million tonnes at 8.64 g/t Au). Mineral Resources that

are not Mineral Reserves do not have demonstrated economic

viability.

Current exploration is focussed on delineating

well developed vein mineralization to the east of the historic

mine, with additional high-grade shoots becoming evident in the

exploration data over what has been described as a series of

repeating trends (“Trends 0 to 5”, Table 1 and Figures 1 and

2).

Today’s Drill Results

Today’s results are from eleven drill holes over

5,622 metres in Trends 1, 2 and 3. Visible gold was observed in

eight holes, including impressive examples in holes

OB-24-320 and OB-24-317 (see Figure 1). Holes were

drilled on northerly declinations at inclinations of between -50

and -75 degrees, providing a high angle of incidence with the

southerly dip of the Piché Group rocks and the vein mineralization.

Each drill hole was targeted at gaps within the existing geological

model, between depths of -200 and -500 metres where, on the basis

of previous drilling, Mineral Resources were absent or of lower

confidence.

QA/QC

All drill cores in this campaign are NQ in size.

Assays were completed on sawn half-cores, with the second half kept

for future reference. The samples were analyzed using standard fire

assay procedures with Atomic Absorption (AA) finish at ALS

Laboratory Ltd, in Val-d’Or, Quebec. Samples yielding a grade

higher than 5 g/t Au were analyzed a second time by fire assay with

gravimetric finish at the same laboratory. Mineralized zones

containing visible gold were analyzed with metallic sieve

procedure. Standard reference materials, blank samples and

duplicates were inserted prior to shipment for quality assurance

and quality control (QA/QC) program.

Qualified Person

Disclosure of a scientific or technical nature

in this news release was prepared under the supervision of Mr.

Richard Nieminen, P.Geo, (QC), a geological consultant for Radisson

and a Qualified Person for purposes of NI 43-101. Mr. Nieminen is

independent of Radisson and the O’Brien Gold Project.

Radisson Mining Resources

Inc.

Radisson is a gold exploration company focused

on its 100% owned O’Brien Gold Project, located in the

Bousquet-Cadillac mining camp along the world-renowned

Larder-Lake-Cadillac Break in Abitibi, Québec. The

Bousquet-Cadillac mining camp has produced over 25 million ounces

of gold over the last 100 years. The Project hosts the former

O’Brien Mine, considered to have been Québec’s highest-grade gold

producer during its production. Indicated Mineral Resources are

estimated at 0.50 million ounces (1.52 million tonnes at 10.26 g/t

Au), with additional Inferred Mineral Resources estimated at 0.45

million ounces (1.62 million tonnes at 8.64 g/t Au). Please see the

NI 43-101 “Technical Report on the O’Brien Project, Northwestern

Québec, Canada” effective March 2, 2023, Radisson’s Annual

Information Form for the year ended December 31, 2023 and other

filings made with Canadian securities regulatory authorities

available at www.sedar.com for further details and assumptions

relating to the O’Brien Gold Project.

Figure 2: Long Section and Plan View of Gold Vein

Mineralization and Mineral Resources at the O’Brien Gold Project,

with DDH OB-24-309 to 320 illustrated.

Figure 3: Cross Section of Trend 1

locating drill hole OB-24-320 and the previously published

OB-23-283 and 284 drill holes.

|

Table 2: Detailed Assay Results (see “Notes

on Calculation of Drill Intercepts”) |

|

DDH |

Zone |

|

From (m) |

To (m) |

Core Length (m) |

Au g/t - Uncut |

Host lithology |

|

OB-24-309 |

Trend #3 |

|

25.50 |

27.00 |

1.50 |

4.82 |

PON-S3 |

|

|

|

|

281.80 |

282.80 |

1.00 |

2.82 |

V3-S |

|

|

|

|

335.80 |

336.80 |

1.00 |

1.33 |

POR-S |

|

OB-24-311 |

Trend #3 |

|

55.00 |

56.00 |

1.00 |

1.02 |

PON-S3 |

|

|

|

|

225.30 |

226.30 |

1.00 |

3.55 |

PON-S3 |

|

|

|

|

308.20 |

309.00 |

0.80 |

2.70 |

V3-S |

|

|

|

|

363.20 |

364.20 |

1.00 |

1.31 |

V3-CEN |

|

|

|

|

369.30 |

377.20 |

7.90 |

1.14 |

S1P |

|

|

|

|

382.60 |

385.10 |

2.50 |

2.83 |

V3-N |

|

OB-24-312 |

Trend #3 |

|

336.90 |

338.90 |

2.00 |

1.05 |

V3-S |

|

|

|

|

391.20 |

395.70 |

4.50 |

1.56 |

S1P |

|

|

|

|

409.80 |

412.00 |

2.20 |

2.11 |

V3-N |

|

OB-24-313 |

Trend #2 |

|

305.00 |

308.70 |

3.70 |

6.47 |

V3-S |

|

|

|

|

335.80 |

337.10 |

1.30 |

2.43 |

POR-S |

|

|

|

|

353.10 |

363.70 |

10.60 |

1.87 |

POR-N/V3-N |

|

|

|

Including |

354.20 |

355.20 |

1.00 |

7.09 |

POR-N |

|

OB-24-314 |

Trend #2 |

|

127.50 |

129.00 |

1.50 |

2.25 |

PON-S3 |

|

|

|

|

142.40 |

143.90 |

1.50 |

2.86 |

PON-S3 |

|

|

|

|

155.90 |

157.40 |

1.50 |

9.50 |

PON-S3 |

|

|

|

|

279.00 |

280.50 |

1.50 |

8.60 |

V3-S |

|

|

|

|

296.50 |

298.00 |

1.50 |

5.77 |

V3-S |

|

|

|

|

334.30 |

335.80 |

1.50 |

1.52 |

V3-CEN |

|

|

|

|

356.60 |

357.90 |

1.30 |

1.66 |

POR-N |

|

|

|

|

367.30 |

368.40 |

1.10 |

1.46 |

V3-N |

|

OB-24-315 |

Trend #2 |

|

147.10 |

148.30 |

1.20 |

1.91 |

PON-S3 |

|

|

|

|

245.00 |

246.30 |

1.30 |

1.66 |

V3-S |

|

|

|

|

261.80 |

263.00 |

1.20 |

2.62 |

V3-S |

|

|

|

|

270.20 |

271.20 |

1.00 |

4.66 |

V3-S |

|

|

|

|

312.10 |

313.30 |

1.20 |

1.08 |

POR-N |

|

|

|

|

315.30 |

320.90 |

5.60 |

2.66 |

POR-N |

|

|

|

Including |

319.70 |

320.90 |

1.20 |

8.55 |

POR-N |

|

OB-24-316 |

Trend #2 |

|

342.00 |

343.50 |

1.50 |

2.90 |

PON-S3 |

|

|

|

|

444.50 |

446.00 |

1.50 |

2.79 |

V3-S |

|

|

|

|

479.95 |

486.00 |

6.05 |

3.50 |

V3-S |

|

|

|

Including |

481.00 |

482.00 |

1.00 |

8.76 |

V3-S |

|

|

|

|

493.60 |

494.40 |

0.80 |

3.54 |

V3-S |

|

|

|

|

518.25 |

519.10 |

0.85 |

1.40 |

POR-S |

|

|

|

|

532.40 |

533.75 |

1.35 |

1.18 |

POR-S |

|

|

|

|

558.50 |

559.50 |

1.00 |

1.06 |

S1P |

|

|

|

|

575.00 |

579.00 |

4.00 |

1.44 |

POR-N/V3-N |

|

|

|

|

647.00 |

649.25 |

2.25 |

42.31 |

S3p |

|

|

|

Including |

648.00 |

649.25 |

1.25 |

74.40 |

S3p |

|

OB-24-317 |

Trend #2 |

|

271.60 |

274.60 |

3.00 |

2.66 |

PON-S3 |

|

|

|

|

421.80 |

423.70 |

1.90 |

3.65 |

V3-S |

|

|

|

|

479.40 |

480.40 |

1.00 |

20.20 |

POR-S |

|

|

|

|

534.60 |

536.00 |

1.40 |

2.28 |

S3p |

|

OB-24-318 |

Trend #2 |

|

463.00 |

464.50 |

1.50 |

1.65 |

V3-S |

|

|

|

|

499.20 |

500.20 |

1.00 |

2.99 |

POR-S |

|

|

|

|

518.80 |

525.60 |

6.80 |

1.99 |

POR-N/V3-N |

|

|

|

Including |

518.80 |

520.30 |

1.50 |

4.77 |

POR-N |

|

|

|

|

528.10 |

529.10 |

1.00 |

3.26 |

V3-N |

|

OB-24-319 |

Trend #1 |

|

487.20 |

488.40 |

1.20 |

3.19 |

V3-S |

|

|

|

|

557.30 |

558.70 |

1.40 |

1.97 |

S1P |

|

|

|

|

567.80 |

568.85 |

1.05 |

1.37 |

S1P |

|

|

|

|

572.50 |

573.70 |

1.20 |

1.08 |

POR-N |

|

|

|

|

597.50 |

598.90 |

1.40 |

2.14 |

V3-N |

|

|

|

|

609.40 |

610.90 |

1.50 |

6.36 |

V3-N |

|

|

|

|

619.00 |

620.00 |

1.00 |

5.07 |

S3p |

|

OB-24-320 |

Trend #1 |

|

231.50 |

233.00 |

1.50 |

1.00 |

PON-S3 |

|

|

|

|

434.80 |

436.30 |

1.50 |

1.73 |

V3-S |

|

|

|

|

484.00 |

485.00 |

1.00 |

1.66 |

V3-S |

|

|

|

|

557.60 |

560.00 |

2.40 |

2.30 |

S1P |

|

|

|

|

565.80 |

567.30 |

1.50 |

1.06 |

POR-N |

|

|

|

|

590.30 |

596.30 |

6.00 |

4.61 |

V3-N |

|

|

|

Including |

591.80 |

594.80 |

3.00 |

7.60 |

V3-N |

|

|

|

|

602.30 |

608.30 |

6.00 |

24.74 |

V3-N/S3p |

|

|

|

Including |

604.30 |

605.30 |

1.00 |

137.00 |

S3p |

| |

|

|

|

|

|

|

|

|

Table 3: Drill Hole Collar Information for

Holes contained in this News Release |

|

DDH |

Zone |

Easting |

Northing |

Azimuth |

Dip |

Hole Length (m) |

|

OB-24-309 |

Trend #3 |

694761 |

5345428 |

349 |

-57 |

446 |

|

OB-24-311 |

Trend #3 |

694654 |

5345389 |

352 |

-55 |

461 |

|

OB-24-312 |

Trend #3 |

694633 |

5345340 |

351 |

-50 |

464 |

|

OB-24-313 |

Trend #2 |

694455 |

5345392 |

355 |

-57 |

381 |

|

OB-24-314 |

Trend #2 |

694298 |

5345446 |

357 |

-68 |

407 |

|

OB-24-315 |

Trend #2 |

694298 |

5345446 |

354 |

-66 |

363 |

|

OB-24-316 |

Trend #2 |

694213 |

5345396 |

356 |

-76 |

668 |

|

OB-24-317 |

Trend #2 |

694213 |

5345396 |

354 |

-72 |

571 |

|

OB-24-318 |

Trend #2 |

694286 |

5345224 |

355 |

-59 |

614 |

|

OB-24-319 |

Trend #1 |

693953 |

5345410 |

0 |

-72 |

632 |

|

OB-24-320 |

Trend #1 |

693953 |

5345410 |

10 |

-73 |

615 |

For more information on Radisson, visit our website

at www.radissonmining.com or contact:

Matt MansonPresident and

CEO416.618.5885mmanson@radissonmining.com

Kristina PillonManager, Investor

Relations604.908.1695kpillon@radissonmining.com

Forward-Looking Statements

This news release contains "forward-looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections, and interpretations as at the date of this news

release. Forward-looking statements including, but are not limited

to, statements with respect to planned and ongoing drilling, the

significance of drill results, the ability to continue drilling,

the impact of drilling on the definition of any resource, the

ability to incorporate new drilling in an updated technical report

and resource modelling, the Company's ability to grow the O’Brien

project and the ability to convert inferred mineral resources to

indicated mineral resources. Any statement that involves

discussions with respect to predictions, expectations,

interpretations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often but not always

using phrases such as "expects", or "does not expect", "is

expected", "interpreted", "management's view", "anticipates" or

"does not anticipate", "plans", "budget", "scheduled", "forecasts",

"estimates", "believes" or "intends" or variations of such words

and phrases or stating that certain actions, events or results

"may" or "could", "would", "might" or "will" be taken to occur or

be achieved) are not statements of historical fact and may be

forward-looking information and are intended to identify

forward-looking information. Except for statements of historical

fact relating to the Company, certain information contained herein

constitutes forward-looking statements Forward-looking information

is based on estimates of management of the Company, at the time it

was made, involves known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the companies to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to the drill results at O’Brien; the

significance of drill results; the ability of drill results to

accurately predict mineralization; the ability of any material to

be mined in a matter that is economic. Although the forward-looking

information contained in this news release is based upon what

management believes, or believed at the time, to be reasonable

assumptions, the parties cannot assure shareholders and prospective

purchasers of securities that actual results will be consistent

with such forward-looking information, as there may be other

factors that cause results not to be as anticipated, estimated or

intended, and neither the Company nor any other person assumes

responsibility for the accuracy and completeness of any such

forward-looking information. The Company believes that this

forward-looking information is based on reasonable assumptions, but

no assurance can be given that these expectations will prove to be

correct and such forward-looking statements included in this press

release should not be unduly relied upon. The Company does not

undertake, and assumes no obligation, to update or revise any such

forward-looking statements or forward-looking information contained

herein to reflect new events or circumstances, except as may be

required by law. These statements speak only as of the date of this

news release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3022f833-aaa9-48b6-b065-85632c09b1b6https://www.globenewswire.com/NewsRoom/AttachmentNg/ed8af9b8-43c2-49fb-ad70-2167624e5d0fhttps://www.globenewswire.com/NewsRoom/AttachmentNg/63f630fb-f3af-42cb-9f0a-a1cec1eef495

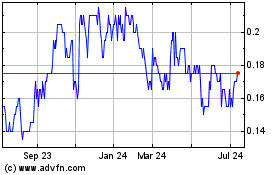

Radisson Mining Resources (TSXV:RDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

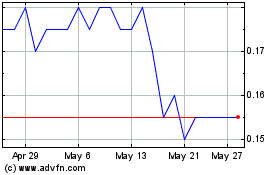

Radisson Mining Resources (TSXV:RDS)

Historical Stock Chart

From Jan 2024 to Jan 2025