Radisson Mining Resources Inc. (TSX-V: RDS, OTCQB:

RMRDF) (“

Radisson” or the

“

Company”) is pleased to announce that, due to

continuing strong demand, its previously announced and

oversubscribed private placement (the “

Offering”)

has been upsized for aggregate gross proceeds of C$7,000,000. The

proceeds of the Offering will be used to advance the exploration

and development of the Company’s O'Brien Gold Project

(“

O’Brien” or the “

Project”)

located in the Abitibi region of Québec.

Matt Manson, President and CEO, commented: “We

are very grateful for the strong support shown by our existing

shareholders and new institutional shareholders for this

non-brokered private placement, which was well over-subscribed and

upsized twice. During September, we reported very encouraging

high-grade drill results from depth at the O’Brien Gold Project,

with implications for future project growth below the level of the

current Mineral Resource. We also entered into a Memorandum of

Understanding with IAMGOLD Corporation to assess the design

criteria for processing mined material from O’Brien at the nearby

Doyon gold mill. The proceeds from this financing will allow for a

vigorous exploration program in 2025, as well as important programs

of metallurgical, engineering, and economic evaluation, all with a

view to future Project development. Currently, two drill rigs are

active at the Project, and ongoing drill results will be reported

as they become available.”

The Offering will include the sale of the

following securities (collectively, the

“Securities”):

- Units of the Company (the

“Units”) consisting of one Class A common share

(“Common Share”) and one-half of one Common Share

purchase warrant (each whole warrant, a “Warrant”)

at a price of C$0.27 per Unit; each Warrant will be exercisable for

a period of 24 months following the closing date at a price of

C$0.37 per underlying Class A common share.

- Class A shares of

the Company (the “QFT Shares”) which shall each

qualify as a "flow-through share" as defined in subsection 66(15)

of the Income Tax Act (Canada) (“ITA”) and section

359.1 of the Taxation Act (Québec) (the “Québec Tax

Act”), at a price of C$0.36 per QFT Share.

- Units of the Company (the

“Charity FT Units”) consisting of one Charity

flow-through share and (the “CFT Shares”) one-half

of one Warrant to be sold on a charitable flow-through basis at a

price of C$0.47 per Charity FT Unit; each Warrant will be

exercisable for a period of 24 months following the closing date at

a price of C$0.37 per underlying Class A common share.

- Class A shares of

the Company (the “NFT Shares”) which shall each

qualify as a "flow-through share" as defined in subsection 66(15)

of the Income Tax Act (Canada) (“ITA”), at a price

of C$0.32 per NFT Share.

The gross proceeds received by the Corporation

from the sale of the QFT Shares, CFT Shares and NFT Shares,

together the (“FT Shares”) will be used to incur

Canadian Exploration Expenses (“CEE”) that are

“flow-through mining expenditures” (as such terms are defined in

the Income Tax Act (Canada)) on the O’Brien gold project in the

Province of Québec, which will be renounced to the subscribers with

an effective date no later than December 31, 2024, in the aggregate

amount of not less than the total amount of the gross proceeds

raised from the issue of FT Shares. For purchasers of QFT Shares

and CFT Shares resident in the Province of Québec, 10% of the

amount of CEE will be eligible for inclusion in the deductible

“exploration base relating to certain Québec exploration expenses”

and 10% of the amount of the expenses will be eligible for

inclusion in the deductible “exploration base relating to certain

Québec surface mining exploration expenses” (as such terms are

defined in the Taxation Act (Québec), respectively) giving rise to

an additional 20% deduction for Québec tax purposes.

A finder’s fee may apply to a portion of the

proceeds raised under the Offering in the amount of up to 6% cash

and 6% finders’ warrants.

Closing of the Offering

The closing of the Offering is expected to occur

on or about October 17, 2024 and is subject to receipt of all

necessary regulatory approvals including the acceptance of the

Offering by the TSX Venture Exchange. All securities issued

pursuant to the Offering will be subject to a four month hold

period from the date of issue.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy the securities

described herein in the United States. The securities described

herein have not been and will not be registered under the United

States Securities Act of 1933, as amended, and may not be offered

or sold in the United States or to the account or benefit of a U.S.

person absent an exemption from the registration requirements of

such Act.

It is anticipated that one or more directors

will acquire Securities under the Offering. Any such participation

will be considered a “related party transaction” as defined under

Multilateral Instrument 61-101 (“MI 61-101”). It

is anticipated that the transaction will be exempt from the formal

valuation and minority shareholder approval requirements of MI

61-101 based on a determination that the securities of the Company

are listed on the TSXV and that the fair market value of the

Offering, insofar as it involves interested parties, will not

exceed 25% of the market capitalization of the Company.

Radisson Mining Resources Inc.

Radisson is a gold exploration company focused

on its 100% owned O’Brien Gold Project, located in the

Bousquet-Cadillac mining camp along the world-renowned

Larder-Lake-Cadillac Break in Abitibi, Québec. The

Bousquet-Cadillac mining camp has produced over 25 million ounces

of gold over the last 100 years. The Project hosts the former

O’Brien Mine, considered to have been Québec’s highest-grade gold

producer during its production. Indicated Mineral Resources are

estimated at 0.50 million ounces (1.52 million tonnes at 10.26 g/t

Au), with additional Inferred Mineral Resources estimated at 0.45

million ounces (1.62 million tonnes at 8.64 g/t Au). Please see the

NI 43-101 “Technical Report on the O’Brien Project, Northwestern

Québec, Canada” effective March 2, 2023, Radisson’s Annual

Information Form for the year ended December 31, 2023 and other

filings made with Canadian securities regulatory authorities

available at www.sedar.com for further details and assumptions

relating to the O’Brien Gold Project.

For more information on Radisson, visit our website at

www.radissonmining.com or contact:

Matt MansonPresident and

CEO416.618.5885mmanson@radissonmining.com

Kristina PillonManager, Investor

Relations604.908.1695kpillon@radissonmining.com

Forward-Looking Statements

This news release contains "forward-looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections, and interpretations as at the date of this news

release. Forward-looking statements including, but are not limited

to, statements with respect to the closing of the Offering, the

planned and ongoing drilling, the significance of drill results,

the ability to continue drilling, the impact of drilling on the

definition of any resource, the ability to incorporate new drilling

in an updated technical report and resource modelling, the

Company's ability to grow the O’Brien project and the ability to

convert inferred mineral resources to indicated mineral resources.

Any statement that involves discussions with respect to

predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

(often but not always using phrases such as "expects", or "does not

expect", "is expected", "interpreted", "management's view",

"anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "believes" or "intends" or

variations of such words and phrases or stating that certain

actions, events or results "may" or "could", "would", "might" or

"will" be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking information and are

intended to identify forward-looking information. Except for

statements of historical fact relating to the Company, certain

information contained herein constitutes forward-looking statements

Forward-looking information is based on estimates of management of

the Company, at the time it was made, involves known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the companies to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information. Such factors include, among others, risks relating to

the drill results at O’Brien; the significance of drill results;

the ability of drill results to accurately predict mineralization;

the ability of any material to be mined in a matter that is

economic. Although the forward-looking information contained in

this news release is based upon what management believes, or

believed at the time, to be reasonable assumptions, the parties

cannot assure shareholders and prospective purchasers of securities

that actual results will be consistent with such forward-looking

information, as there may be other factors that cause results not

to be as anticipated, estimated or intended, and neither the

Company nor any other person assumes responsibility for the

accuracy and completeness of any such forward-looking information.

The Company believes that this forward-looking information is based

on reasonable assumptions, but no assurance can be given that these

expectations will prove to be correct and such forward-looking

statements included in this press release should not be unduly

relied upon. The Company does not undertake, and assumes no

obligation, to update or revise any such forward-looking statements

or forward-looking information contained herein to reflect new

events or circumstances, except as may be required by law. These

statements speak only as of the date of this news release.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

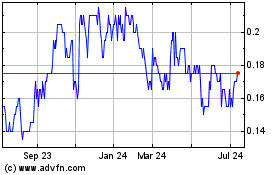

Radisson Mining Resources (TSXV:RDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

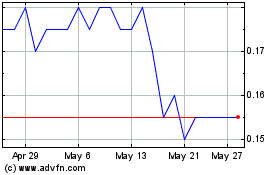

Radisson Mining Resources (TSXV:RDS)

Historical Stock Chart

From Jan 2024 to Jan 2025