Rugby Options Gold Project in Pilbara Region, Western Australia

March 24 2014 - 7:30AM

Marketwired Canada

Rugby Mining Limited ("Rugby" or the "Company") (TSX VENTURE:RUG) is pleased to

announce that it has, subject to regulatory approval, entered into an option

agreement (the "Agreement") with Australian listed company, De Grey Mining

Limited ("De Grey"), to acquire an 80% interest in the Great Northern Gold

Project.

The Agreement grants Rugby an option to earn an 80% interest in a 714 square

kilometre ("km") tenement package (the "Tenements") and an additional option to

purchase an 80% interest in a near surface historical resource at Wingina Well

(together with the Tenements, the "Great Northern Gold Project").

Rugby's CEO, Paul Joyce stated, "For two years the Company has been conducting a

comprehensive search to acquire a drill ready project, while it awaits

permitting for its prospective Cobrasco and Comita projects in Colombia and the

Mabuhay project in the Philippines. The Great Northern Gold Project satisfies

all parameters required by management including:

-- potential for discovering a high grade gold deposit;

-- favourable permitting regime within a highly rated investment

jurisdiction;

-- excellent infrastructure with many of Australia's largest iron mines in

the region;

-- year round exploration and mining access; and

-- reasonable drilling costs and drill rig availability.

"Previous drilling at Wingina Well encountered intervals of high grade gold

mineralization within a larger lower grade system. Our aim will be to test for

further high grade zones in the untested areas both down dip and along strike.

We also see excellent potential for additional discoveries in extensive areas of

surficial cover that are underlain by greenstones intersected by regional

shears. Previous exploration identified specific targets within 30 km along

strike."

The Great Northern Gold Project (previously Turner River Gold) is located in the

Pilbara district of Western Australia, 60 km south of Port Hedland (Figure 1

below). The region is home to a massive industrial base associated with oil,

natural gas, iron ore extraction and the Telfer gold mine operation (+10M oz of

gold produced since 1975 as reported on Newcrest Mining Limited's website(i)).

Infrastructure includes an international airport, seaport, railways, highways

and gas pipelines.

Previous exploration (Figure 2 below) within the project area includes

geophysical and geochemical surveys, geological mapping and drill programs

comprising 4,171 drill holes for 224,442 metres ("m"). Most of the holes were

shallow and were used for geochemical sampling below extensive areas of thin

cover. This exploration has provided a large technical data base that will

assist in the development of new drill targets.

(i) Source: http://www.newcrest.com.au/our-business/operations/telfer-wa

To date, most exploration was conducted at Wingina Well where 514 drill holes

and channel samples for a total of 40,967 m were completed. Drilling indicated

three higher-grade, parallel gold zones contained within lower grade envelopes

(Figures 3 and 4 below). Wingina Well has been subject to several historical

resource estimates however, they were not completed in compliance with National

Instrument 43-101 (NI 43-101) consequently the Company is not reporting any

resource estimates prior to further evaluation.

Metallurgical testwork indicates the gold is fine-grained and free-milling.

Carbon in leach test work achieved gold recoveries up to 93% with low reagent

consumption and easy grinding of weathered material that forms the bulk of the

currently estimated mineral resource. Column leach tests (heap leaching) of

-12mm material achieved a 70% gold recovery in preliminary test work.

To view Figures 1-4, please visit the following link:

http://media3.marketwire.com/docs/935036_F1-4.pdf.

Great Northern Project Agreement Terms

Pursuant to the Agreement, Rugby will pay De Grey AUD$100,000 within 5 days of

regulatory approval and will have two options as follows:

1. a three year option to acquire an 80% interest in the Tenements by

incurring a total of AUD$2 million in expenditures with a minimum

expenditure commitment of AUD$500,000; and

2. an option to purchase an 80% interest in the historic near surface

resource at Wingina Well for AUD$3 million, by paying AUD$2 million at

any time within 54 months of date of the Agreement and a further AUD$1

million within 30 days of a decision to mine any part of the historic

resource at Wingina Well.

Cisco Montes, the Company's Chief Geologist and a "qualified person" within the

definition of that term in NI 43-101, has supervised the preparation of the

technical information contained in this news release.

About Rugby

Rugby, with a treasury of $2.9 million, is an emerging mineral resource company

focussed on its exciting portfolio of projects having considerable potential for

significant mineral discoveries. Rugby benefits from the experience of its

directors and management who have either been directly responsible for

world-class mineral discoveries or have been on the management team of companies

having made such discoveries.

Cobrasco and Comita Projects, Colombia: Rugby owns 100% of the Cobrasco project,

subject to a 1% NSR and has an option to earn up to 60% of the adjacent Comita

project in western Colombia. Both projects host undrilled large scale porphyry

copper-gold targets which were recognised during a joint German-Colombian

government sponsored exploration program over 20 years ago. No systematic

exploration has been conducted since that time. The Rugby team is now in talks

with local drilling companies with a view to initiating a drilling campaign at

Cobrasco in the second half of the year, subject to obtaining the necessary

permits.

Mabuhay Project, Philippines: The Company holds an option to acquire up to 80%

of the Mabuhay project in Surigao Province. The Company considers the project to

have excellent potential for the discovery of both epithermal gold deposits and

gold-copper porphyry systems. An application for an Exploration Permit ("EP") is

currently being processed, however to minimise expenditures, the project will

remain under care and maintenance until the EP is granted.

Hawkwood Project, Australia: The Hawkwood Project is located in Queensland

Australia and covers 427 km2 of prospective gold, copper-gold and iron targets.

In January 2010, the Company entered into an agreement with Eastern Iron Limited

wherein Eastern Iron Limited can earn an 80% interest in iron ore targets in the

project area. To date Eastern Iron has conducted several programs, including

geophysical surveys and drilling.

For additional information you are invited to visit the Rugby Mining Limited

website at www.rugbymining.com.

RUGBY MINING LIMITED

Paul Joyce, President and CEO

CAUTIONARY STATEMENT

Certain of the statements made and information contained herein is

"forward-looking information" within the meaning of the British Columbia,

Alberta and Ontario Securities Acts. This includes statements concerning the

Company's plans at its projects including the expected approval of permits

required for exploration, timing of drilling programs, high grade potential at

the Great Northern Gold Project and drilling costs which involve known and

unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company, or industry results, to be

materially different from any future results, performance or achievements

expressed or implied by such forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties

which could cause actual events or results to differ from those reflected in the

forward-looking information, including, without limitation, the effect on prices

of major mineral commodities such as copper, gold and iron by factors beyond the

control of the Company; events which cannot be accurately predicted such as

political and economic instability, terrorism, environmental factors and changes

in government regulations and taxes; the shortage of personnel with the

requisite knowledge and skills to design and execute exploration programs;

difficulties in arranging contracts for drilling and other exploration services;

the Company's dependency on equity market financings to fund its exploration

programs and maintain its mineral exploration properties in good standing;

political risk that a government will change, interpret or enforce mineral

tenure, environmental regulations, taxes or mineral royalties in a manner that

could have an adverse effect on the Company's assets or financial condition and

impair its ability to advance its mineral exploration projects or raise further

funds for exploration; risks associated with title to resource properties due to

the difficulties of determining the validity of certain claims as well as the

potential for problems arising from the interpretation of laws regarding

ownership of mineral properties in the Philippines and in the sometimes

ambiguous conveyancing characteristic of many resource properties, currency

risks associated with foreign operations, the timing of obtaining permits to

conduct exploration activities, the ability to conclude agreements with local

communities and other risks and uncertainties, including those described in each

of the Company's management discussion and analysis including those contained in

its year-end financial statements for the year ended February 28, 2013 filed

with the Canadian Securities Administrators and available at www.sedar.com.

In addition, forward-looking information is based on various assumptions

including, without limitation, assumptions associated with exploration results

and costs and the availability of materials and skilled labour. Should one or

more of these risks and uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those

described in forward-looking statements. Accordingly, readers are advised not to

place undue reliance on forward-looking information. Except as required under

applicable securities legislation, the Company undertakes no obligation to

publicly update or revise forward-looking information, whether as a result of

new information, future events or otherwise.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM

IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY

FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FOR FURTHER INFORMATION PLEASE CONTACT:

Rugby Mining Limited

Paul Joyce

President and CEO

604.688.4941 or Toll-free: 1.855.688.4941

604.688.9532 (FAX)

info@rugbymining.com

www.rugbymining.com

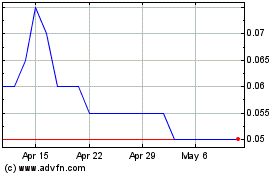

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From Apr 2024 to May 2024

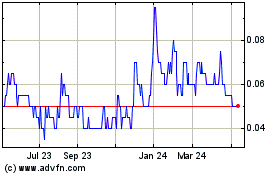

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From May 2023 to May 2024