November 9, 2021 -- InvestorsHub NewsWire -- via MarketWatch

-- Alternet Systems

(OTC

Other: ALYI) stock is consolidating ahead of potentially

transformative news. For those on the sidelines, investment

consideration is timely. And, at a roughly 90% discount from its

52-week high and legislative intent to pour billions into the EV

sector, it's a compelling one as well. In fact, with $2 million in

revenues expected by the end of next month and two planned

acquisitions by the end of 2021, investors could be part of a

breakout period of growth at ALYI.

That surge could happen sooner than many expect. Last week, ALYI

confirmed that it's close to finalizing two deals to help them

penetrate the East African EV products and services markets. Its

first is a planned acquisition in Nairobi to expedite ALYI's entry

into Kenya's existing motorcycle taxi market. The better news is

that upon closing, ALYI will immediately generate a new revenue

stream from the estimated $3.3 billion Kenya motorcycle taxi

market. Currently, more than one million motorcycle taxis provide

over 20 million rides per day. After initial delivery, ALYI should

be in an ideal position to accelerate market penetration and help

with the region's mission to transition from combustion engine

motorcycle taxis to electric motor-powered ones.

The second acquisition, which could close by the end of this

month, is a deal to accelerate ALYI's strategy to bring an annual

brand name EV race and symposium to Kenya. That deal also adds a

new revenue stream from a high-margin business model to capitalize

on several markets within a broader EV ecosystem. And that's not

all.

Those two deals are expected to add to a record-setting year of

revenues for the company. So, at about $0.02 per share, the

investment proposition ahead of those deals closing is indeed a

good one.

Record-Setting Revenue Expectations

Keep in mind, any new revenues would add to an expected breakout

year of receivables. Last month, ALYI announced it expects to reach

upwards of $2 million in revenues by the end of this year. Those

revenues should come from selling its innovative and stylish ReVolt

EV motorcycles into the African boda-boda motorcycle taxi market.

In fact, ALYI expects to deliver roughly 2000 of its EV bikes to a

market exploding in participation and revenue-generating

opportunities. Updates on delivery and service into the market are

imminent. And there's more good news expected.

ALYI is also expecting to generate substantial shareholder value

by tapping into the opportunities from a broader Electric Vehicle

Ecosystem. In other words, ALYI is targeting its initial markets as

much more than only an EV motorcycle provider. They are further

embedding themselves in aspects of perpetual design of

best-in-class vehicles, the mechanical and digital systems side of

the markets, and the charging and maintenance infrastructure to

support consumer and commercial vehicles.

The entirety of its interests takes advantage of global interest

to transition from combustion engines to electric-powered vehicles.

A more than $1.2 trillion bill that passed through the US

legislature last week also presents an opportunity for ALYI to earn

funding for its myriad of programs. Battery design and

state-of-the-art communications systems included. But, while grants

and awards can expedite growth, so can its financing commitment

from RevoltTOKEN.

Partnerships To Accelerate Growth

And that agreement can be a game-changer with RevoltTOKEN

(RVLT), suggesting it is willing to invest upwards of $200 million

into ALYI's business interests. Of course, as a security token,

ALYI will need to prove its ability to generate value for RVLT

token holders. But, with deals with several industry companies,

including one with iQSTEL, Inc., a $60 million telecom and Fintech

company, they should be able to show their worth. Moreover, upon

closing its two new deals in Africa in the next 45 days combined

with expected revenues of $2 million, they may prove to be an

excellent investment for RVLT and its investors. Looking at the

RVLT website, they intend to invest in many EV-related

opportunities. Hence, the potential from investment there is

developing as well.

The better news for investors either long or considering a

position is that ALYI is better positioned today than when its

shares traded at the $0.20 level. The decline came as COVID-19 took

a grip on most markets, with logistics channels virtually closed

for business. However, while slowed, ALYI didn't stop.

Instead, they entered development agreements for a potential

best-in-class and innovative EV battery design, partnered to make a

communications system ideally suited to EV motorcycle riders, and

started its plan to create what could become the most inclusive

annual EV symposium. It's a telling indicator that as the country

moves out of pandemic-related restrictions, ALYI shares are

trending higher. Since October, ALYI stock has been trading higher

by more than 47%. Still, while good news to investors, it's likely

a precursor of better things to come.

That's because ALYI has indeed laid the groundwork to accelerate

its business interests outside of the US markets. And by focusing

on demand left available by the EV behemoths, that strategy could

lead to exponential growth.

Massive Value In-Play From African EV Markets

And it's a strategy that has become a plan in motion. For the

past year, ALYI has worked on creating working partnerships and

advancing development deals to maximize the value of its EV and EV

Ecosystem assets. Now, as ALYI moves closer to initializing

business in the East African markets, the payday could be near as

the company positions its assets and expertise to earn a leadership

position in the Kenyan motorcycle taxi market.

Remember, too, ALYI has expanded its business reach,

transforming from a single product company at its start to one that

has interests in multiple segments that can capitalize on the EV

boom. Thus, while investors liked ALYI for only its ReVolt EV

Motorcycle sales, they should like them more with the company

enhancing its revenue-generating opportunities by tapping into an

infrastructure built to generate revenues from the service and

products side as well. Most importantly, there's no shortage of

demand.

In fact, ALYI appears to be in the exact right place at the

right time. And with growth in the African motorcycle-taxi markets

surging, ALYI's flagship motorcycle could be in demand. That's

especially likely with players like Tesla (NASDAQ: TSLA) General Motors (NYSE: GM) not targeting the market with their

high-end products. But keep in mind that while small in their

standards, the Kenya market, and surrounding areas provide the

tremendous billion-dollar market potential for smaller and more

agile companies. It's an opportunity that ALYI intends to

exploit.

Taking Advantage Of Booming But Underserved Markets

Also, it's important to know that Africa (Kenya) is just ALYI's

starting point. They can expand quickly by targeting opportunities

created from a market that has one of the world's lowest per capita

transportation ratios in the world at about 44 vehicles per 1,000

inhabitants. Compared to global averages, it's well below the 180

vehicles per 1,000 inhabitants in most countries and significantly

less than the 800 vehicles per 1,000 inhabitants in the United

States.

The better news is that ALYI's mission is not complicated. They

want to take advantage of relatively unchallenged markets and

increase the number of vehicles per 1,000 inhabitants from 44 to

100. And based on the reception of its ReVolt EV motorcycle,

combined with funding from RVLT, it's a goal that is attainable

over the coming years. Still, while it's a long-term plan, revenue

milestones would be met along the way. Thus, shareholder value

should follow accordingly. Best of all, meeting that goal could get

a boost from one of the world's largest ride-share companies.

Earlier this year, UBER (NYSE: UBER) announced expanding its ride-share

service into Africa. For ALYI, UBER's ambition can translate into a

catalyst of its own. Remember, UBER develops the service side and

doesn't supply the vehicles. So, as noted, ALYI is in the right

market at the right time to capitalize on filling the needs on the

product side. Better still, by providing efficient, cost-effective,

and affordable EV motorcycles that perfectly meet the requirement,

they are in the sweet spot of opportunity.

An Opportunity At Ground Floor Prices

Moreover, it looks as though investors are starting to take

notice. Yes, shares have been beaten down. But that's true of

almost every micro-cap over the past 18-months. Still, while times

have been challenging, markets were thinned out, leaving survivors

in a better position to capitalize on valuation

disconnects.

ALYI is one to watch. Moreover, with ALYI better positioned

today than when shares were at the $0.20 level, a more than 1170%

surge from today's price could be in play. Posting the expected $2

million in revenues and closing its planned acquisitions could

ignite the fuse back to those levels.

Hence, with ALYI stock often moving significantly higher on

news, investment consideration at current levels could be wise.

Indeed, while micro-caps come with risk, they also can generate

substantial returns. And with ALYI assembling the right team,

having the right products, and targeting a market in need, it could

very well be transformed into a revenue-generating juggernaut in

2022. Time will tell. But at current levels, the move higher has

the potential to be electrifying.

Disclaimers: Hawk Point Media is responsible for the

production and distribution of this content. Hawk Point Media is

not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our reports/releases are

a commercial advertisement and are for general information purposes

ONLY. We are engaged in the business of marketing and advertising

companies for monetary compensation. Never invest in any stock

featured on our site or emails unless you can afford to lose your

entire investment. The information made available by Hawk Point

Media is not intended to be, nor does it constitute, investment

advice or recommendations. The contributors may buy and sell

securities before and after any particular article, report and

publication. In no event shall Hawk Point Media be liable to any

member, guest or third party for any damages of any kind arising

out of the use of any content or other material published or made

available by Hawk Point Media, including, without limitation, any

investment losses, lost profits, lost opportunity, special,

incidental, indirect, consequential or punitive damages. Past

performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you conduct a

complete and independent investigation of the respective companies

and consideration of all pertinent risks. For some content, Hawk

Point Media, its authors, contributors, or its agents, may be

compensated for preparing research, video graphics, and editorial

content. Hawk Point Media was compensated up to

five-thousand-dollars by a third-party to research, prepare, and

syndicate written and visual content about Alternet Systems, Inc.

Readers are advised to review SEC periodic reports: Forms 10-Q,

10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule

13D.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Kellis

Email: Send Email

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Website: https://goalternet.com/

Source - https://www.marketwatch.com/press-release/with-three-catalysts-expected-by-eoy-2021-alternet-systems-inc-stock-is-a-compelling-consideration-otc-alyi-2021-11-09

Other stocks on the move include IGEX,

AABB,

and MJWL.

Source: pennymillions

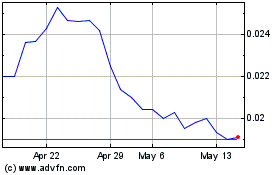

Asia Broadband (PK) (USOTC:AABB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Asia Broadband (PK) (USOTC:AABB)

Historical Stock Chart

From Dec 2023 to Dec 2024