0001134982false--12-31Q320240.000150000000010.00015000000000011349822024-01-012024-09-300001134982pvnc:CresDiscretionaryTrustMemberus-gaap:SubsequentEventMember2024-10-302024-11-010001134982pvnc:CresDiscretionaryTrustMemberus-gaap:SubsequentEventMember2024-11-010001134982pvnc:TwoTHousandTwentyFourStockPlanMemberus-gaap:SubsequentEventMember2024-10-302024-11-010001134982pvnc:TwoTHousandTwentyFourStockPlanMemberus-gaap:SubsequentEventMember2024-11-0100011349822024-05-012024-05-1700011349822023-06-2000011349822023-06-012023-06-2000011349822024-02-012024-02-1600011349822024-04-012024-04-2600011349822024-07-022024-07-2400011349822023-03-012023-03-2300011349822024-05-170001134982us-gaap:SubscriptionArrangementMember2024-05-012024-05-170001134982pvnc:AustraliaMember2024-01-012024-09-300001134982pvnc:UnitedStatesMember2024-01-012024-09-300001134982pvnc:MtWillsGoldMinesPtyMember2022-03-310001134982pvnc:UttiOcoPtyMember2022-03-310001134982pvnc:ABAInvestmentGroupPtyLtdMember2022-04-080001134982pvnc:AppleISportsInvestmentGroupPtyMember2022-04-080001134982pvnc:CresDiscretionaryTrustMember2019-05-300001134982pvnc:CresDiscretionaryTrustMember2023-07-012023-09-300001134982pvnc:CresDiscretionaryTrustMember2023-01-012023-09-300001134982pvnc:CresDiscretionaryTrustMember2024-01-012024-09-300001134982pvnc:CresDiscretionaryTrustMember2024-07-012024-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2024-01-012024-09-300001134982pvnc:AppleISportsInvestmentGroupPtyMember2024-01-012024-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2024-07-012024-09-300001134982pvnc:AppleISportsInvestmentGroupPtyMember2024-07-012024-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2023-07-012023-09-300001134982pvnc:AppleISportsInvestmentGroupPtyMember2023-07-012023-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2023-01-012023-09-300001134982pvnc:AppleISportsInvestmentGroupPtyMember2023-01-012023-09-300001134982pvnc:DueToDirectorMember2024-09-300001134982pvnc:DueToDirectorMember2023-12-310001134982pvnc:MtWillsGoldMinesPtyMember2024-09-300001134982pvnc:MtWillsGoldMinesPtyMember2023-12-310001134982pvnc:CresDiscretionaryTrustMember2023-12-310001134982pvnc:UttiOcoPtyMember2024-09-300001134982pvnc:UttiOcoPtyMember2023-12-310001134982pvnc:CresDiscretionaryTrustMember2024-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2024-09-300001134982pvnc:ABAInvestmentGroupPtyLtdMember2023-12-310001134982pvnc:AppleISportsInvestmentGroupPtyMember2024-09-300001134982pvnc:AppleISportsInvestmentGroupPtyMember2023-12-310001134982pvnc:SeaPortIncMemberpvnc:TopMember2024-07-012024-09-300001134982pvnc:SeaPortIncMember2024-07-012024-09-300001134982pvnc:SeaPortIncMemberpvnc:TopMember2024-03-060001134982pvnc:SeaPortIncMember2024-01-012024-09-300001134982pvnc:SeaPortIncMember2024-09-300001134982pvnc:UnitedStatesMember2024-09-300001134982pvnc:AustraliaMember2024-09-300001134982us-gaap:RetainedEarningsMember2024-09-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001134982pvnc:TreasuryStocksMember2024-09-300001134982us-gaap:AdditionalPaidInCapitalMember2024-09-300001134982us-gaap:CommonStockMember2024-09-300001134982us-gaap:RetainedEarningsMember2024-07-012024-09-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001134982pvnc:TreasuryStocksMember2024-07-012024-09-300001134982us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001134982us-gaap:CommonStockMember2024-07-012024-09-3000011349822024-06-300001134982us-gaap:RetainedEarningsMember2024-06-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001134982pvnc:TreasuryStocksMember2024-06-300001134982us-gaap:AdditionalPaidInCapitalMember2024-06-300001134982us-gaap:CommonStockMember2024-06-3000011349822024-04-012024-06-300001134982us-gaap:RetainedEarningsMember2024-04-012024-06-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001134982pvnc:TreasuryStocksMember2024-04-012024-06-300001134982us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001134982us-gaap:CommonStockMember2024-04-012024-06-3000011349822024-03-310001134982us-gaap:RetainedEarningsMember2024-03-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001134982pvnc:TreasuryStocksMember2024-03-310001134982us-gaap:AdditionalPaidInCapitalMember2024-03-310001134982us-gaap:CommonStockMember2024-03-3100011349822024-01-012024-03-310001134982us-gaap:RetainedEarningsMember2024-01-012024-03-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001134982pvnc:TreasuryStocksMember2024-01-012024-03-310001134982us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001134982us-gaap:CommonStockMember2024-01-012024-03-310001134982us-gaap:RetainedEarningsMember2023-12-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001134982pvnc:TreasuryStocksMember2023-12-310001134982us-gaap:AdditionalPaidInCapitalMember2023-12-310001134982us-gaap:CommonStockMember2023-12-3100011349822023-09-300001134982us-gaap:RetainedEarningsMember2023-09-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001134982pvnc:TreasuryStocksMember2023-09-300001134982us-gaap:AdditionalPaidInCapitalMember2023-09-300001134982us-gaap:CommonStockMember2023-09-300001134982us-gaap:RetainedEarningsMember2023-07-012023-09-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001134982pvnc:TreasuryStocksMember2023-07-012023-09-300001134982us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001134982us-gaap:CommonStockMember2023-07-012023-09-3000011349822023-06-300001134982us-gaap:RetainedEarningsMember2023-06-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001134982pvnc:TreasuryStocksMember2023-06-300001134982us-gaap:AdditionalPaidInCapitalMember2023-06-300001134982us-gaap:CommonStockMember2023-06-3000011349822023-04-012023-06-300001134982us-gaap:RetainedEarningsMember2023-04-012023-06-300001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001134982pvnc:TreasuryStocksMember2023-04-012023-06-300001134982us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001134982us-gaap:CommonStockMember2023-04-012023-06-3000011349822023-03-310001134982us-gaap:RetainedEarningsMember2023-03-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001134982pvnc:TreasuryStocksMember2023-03-310001134982us-gaap:AdditionalPaidInCapitalMember2023-03-310001134982us-gaap:CommonStockMember2023-03-3100011349822023-01-012023-03-310001134982us-gaap:RetainedEarningsMember2023-01-012023-03-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001134982pvnc:TreasuryStocksMember2023-01-012023-03-310001134982us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001134982us-gaap:CommonStockMember2023-01-012023-03-3100011349822022-12-310001134982us-gaap:RetainedEarningsMember2022-12-310001134982us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001134982pvnc:TreasuryStocksMember2022-12-310001134982us-gaap:AdditionalPaidInCapitalMember2022-12-310001134982us-gaap:CommonStockMember2022-12-3100011349822023-01-012023-09-3000011349822023-07-012023-09-3000011349822024-07-012024-09-3000011349822023-12-3100011349822024-09-3000011349822024-12-27iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureiso4217:AUD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

☐ TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission File Number: 000-32389

APPLE iSPORTS GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 88-0126444 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

100 Spectrum Center Drive, Suite 900 Irvine, California | | 92612 |

(Address of Principal Executive Offices) | | (Zip Code) |

(949) 247-4210

(Registrant’s telephone number, including area code)

(Former Name, former address, and former fiscal year, if changed since the last report)

Securities registered under Section 12(b) of the Exchange Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check all that apply):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☒ | | |

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of December 27, 2024, there were 208,484,211 shares of common stock, $0.0001 par value per share, outstanding.

TABLE OF CONTENTS

Part I

Item 1. Financial Statements.

APPLE iSPORTS GROUP, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED

SEPTEMBER 30, 2024 AND 2023 (UNAUDITED)

APPLE iSPORTS GROUP, INC.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

APPLE iSPORTS GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

SEPTEMBER 30, 2024 (UNAUDITED) AND DECEMBER 31, 2023

(AUDITED)

| | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

Assets | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 6,866 | | | $ | 673 | |

Goods and service tax receivable | | | 39,268 | | | | 61,798 | |

Marketable security | | | 100 | | | | 100 | |

Prepaid and other assets | | | 23,039 | | | | 6,812 | |

Total current assets | | | 69,273 | | | | 69,383 | |

| | | | | | | | |

Deposits | | | 41,513 | | | | - | |

Convertible notes receivable | | | 80,000 | | | | - | |

Accrued interest income | | | 1,990 | | | | - | |

Total assets | | $ | 192,776 | | | $ | 69,383 | |

| | | | | | | | |

Liabilities and Stockholders’ Deficit | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 2,308,740 | | | $ | 2,464,558 | |

Due to related party | | | 4,999 | | | | 4,999 | |

Loans payable - related parties | | | 3,390,044 | | | | 2,720,549 | |

Accrued interest - related parties | | | 142,890 | | | | 77,964 | |

Accrued payroll | | | 347,406 | | | | 108,487 | |

Total current liabilities | | | 6,194,079 | | | | 5,376,557 | |

| | | | | | | | |

Total liabilities | | | 6,194,079 | | | | 5,376,557 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | | |

Stockholders’ deficit: | | | | | | | | |

Common stock, $0.0001 par value, 500,000,000 shares authorized, 208,484,211 and 202,784,211 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | | | 20,848 | | | | 20,278 | |

Additional paid-in capital | | | 6,647,575 | | | | 5,223,245 | |

Treasury stock, 1 share, at cost | | | (52,954 | ) | | | (52,954 | ) |

Accumulated other comprehensive income | | | (166,685 | ) | | | (60,130 | ) |

Accumulated deficit | | | (12,450,087 | ) | | | (10,437,613 | ) |

Total stockholders’ deficit | | | (6,001,303 | ) | | | (5,307,174 | ) |

| | | | | | | | |

Total Liabilities and Stockholders’ Deficit | | $ | 192,776 | | | $ | 69,383 | |

See accompanying notes to condensed consolidated financial statements.

APPLE iSPORTS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

SEPTEMBER 30, 2024 AND 2023 (UNAUDITED)

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Net revenues | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Corporate expense | | | 185,410 | | | | 242,927 | | | | 546,019 | | | | 631,437 | |

Consulting and professional fees | | | 421,759 | | | | 166,021 | | | | 1,528,580 | | | | 507,785 | |

Selling, general and administrative | | | 116,760 | | | | 175,969 | | | | 527,792 | | | | 435,597 | |

Research and development | | | - | | | | - | | | | - | | | | 655,000 | |

Total operating expenses | | | 723,929 | | | | 584,917 | | | | 2,602,391 | | | | 2,229,819 | |

| | | | | | | | | | | | | | | | |

Loss from operations | | | (723,929 | ) | | | (584,917 | ) | | | (2,602,391 | ) | | | (2,229,819 | ) |

| | | | | | | | | | | | | | | | |

Other expenses (income): | | | | | | | | | | | | | | | | |

Forgiveness of debt | | | 600 | | | | - | | | | (658,533 | ) | | | - | |

Interest expense, net | | | 20,756 | | | | 14,108 | | | | 65,492 | | | | 35,630 | |

Foreign exchange loss (gain) | | | 3,475 | | | | (18,436 | ) | | | 3,124 | | | | 3,566 | |

Total other expenses (income) | | | 24,831 | | | | (4,328 | ) | | | (589,917 | ) | | | 39,196 | |

| | | | | | | | | | | | | | | | |

Operating loss before income taxes | | | (748,760 | ) | | | (580,589 | ) | | | (2,012,474 | ) | | | (2,269,015 | ) |

| | | | | | | | | | | | | | | | |

Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

Net loss | | $ | (748,760 | ) | | $ | (580,589 | ) | | $ | (2,012,474 | ) | | $ | (2,269,015 | ) |

| | | | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | (178,812 | ) | | | 45,421 | | | | (106,555 | ) | | | 79,885 | |

Comprehensive loss | | | (927,572 | ) | | | (535,168 | ) | | | (2,119,029 | ) | | | (2,189,130 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share - basic and diluted | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.02 | ) |

| | | | | | | | | | | | | | | | |

Weighted number of shares outstanding | | | | | | | | | | | | | | | | |

Basic and Diluted | | | 208,429,863 | | | | 202,784,211 | | | | 206,702,120 | | | | 144,143,464 | |

See accompanying notes to condensed consolidated financial statements.

APPLE iSPORTS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 (UNAUDITED)

| | | | | | | | | | | | | | Accumulated | | | | | | | |

| | | | | | | | Additional | | | | | | Other | | | | | | | |

| | Common | | | Paid-In | | | Treasury | | | Comprehensive | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Par Value | | | Capital | | | Stock | | | Income | | | Deficit | | | (Deficit) | |

Balance as of December 31, 2023 | | | 202,784,211 | | | $ | 20,278 | | | $ | 5,223,245 | | | $ | (52,954 | ) | | $ | (60,130 | ) | | $ | (10,437,613 | ) | | $ | (5,307,174 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock | | | 2,590,400 | | | | 259 | | | | 647,341 | | | | - | | | | - | | | | - | | | | 647,600 | |

Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 170,702 | | | | - | | | | 170,702 | |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (748,265 | ) | | | (748,265 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of March 31, 2024 | | | 205,374,611 | | | $ | 20,537 | | | $ | 5,870,586 | | | $ | (52,954 | ) | | $ | 110,572 | | | $ | (11,185,878 | ) | | $ | (5,237,137 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock | | | 2,589,600 | | | | 259 | | | | 647,041 | | | | - | | | | - | | | | - | | | | 647,300 | |

Stock issuance modification | | | 320,000 | | | | 32 | | | | 79,968 | | | | | | | | | | | | | | | | 80,000 | |

Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | (98,445 | ) | | | - | | | | (98,445 | ) |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (515,449 | ) | | | (515,449 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of June 30, 2024 | | | 208,284,211 | | | $ | 20,828 | | | $ | 6,597,595 | | | $ | (52,954 | ) | | $ | 12,127 | | | $ | (11,701,327 | ) | | $ | (5,123,731 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock | | | 200,000 | | | | 20 | | | | 49,980 | | | | - | | | | - | | | | - | | | | 50,000 | |

Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | (178,812 | ) | | | - | | | | (178,812 | ) |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (748,760 | ) | | | (748,760 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of September 30, 2024 | | | 208,484,211 | | | $ | 20,848 | | | $ | 6,567,575 | | | $ | (52,954 | ) | | $ | (166,685 | ) | | $ | (12,450,087 | ) | | $ | (6,001,303 | ) |

| | | | | | | | | | | | | | Accumulated | | | | | | | |

| | | | | | | | Additional | | | | | | Other | | | | | | | |

| | Common | | | Paid-In | | | Treasury | | | Comprehensive | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Par Value | | | Capital | | | Stock | | | Income | | | Deficit | | | (Deficit) | |

Balance as of December 31, 2022 | | | 7,642,211 | | | $ | 764 | | | $ | 5,142,759 | | | $ | (52,954 | ) | | $ | 26,958 | | | $ | (6,759,290 | ) | | $ | (1,641,763 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares issued with merger | | | 195,062,000 | | | | 19,506 | | | | (19,506 | ) | | | - | | | | - | | | | - | | | | - | |

Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 37,307 | | | | - | | | | 37,307 | |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,040,797 | ) | | | (1,040,797 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of March 31, 2023 | | | 202,704,211 | | | $ | 20,270 | | | $ | 5,123,253 | | | $ | (52,954 | ) | | $ | 64,265 | | | $ | (7,800,087 | ) | | $ | (2,645,253 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuance of common stock | | | 80,000 | | | | 8 | | | | 99,992 | | | | - | | | | - | | | | - | | | | 100,000 | |

Other comprehensive income | | | | | | | | | | | | | | | | | | | (2,843 | ) | | | | | | | (2,843 | ) |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (647,629 | ) | | | (647,629 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of June 30, 2023 | | | 202,784,211 | | | $ | 20,278 | | | $ | 5,223,245 | | | $ | (52,954 | ) | | $ | 61,422 | | | $ | (8,447,716 | ) | | $ | (3,195,725 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 45,421 | | | | - | | | | 45,421 | |

Net loss for period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (580,589 | ) | | | (580,589 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of September 30, 2023 | | | 202,784,211 | | | $ | 20,278 | | | $ | 5,223,245 | | | $ | (52,954 | ) | | $ | 106,843 | | | $ | (9,028,305 | ) | | $ | (3,730,893 | ) |

See accompanying notes to condensed consolidated financial statements.

APPLE iSPORTS GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

SEPTEMBER 30, 2024 AND 2023 (UNAUDITED)

| | Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Cash flows from operating activities | | | | | | |

Net loss | | $ | (2,012,474 | ) | | $ | (2,269,015 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| | | | | | | | |

Foreign exchange loss | | | 3,124 | | | | 15,466 | |

Forgiveness of debt | | | (658,533 | ) | | | - | |

Non cash expense from stock issuance modification | | | 80,000 | | | | - | |

| | | | | | | | |

Change in operating assets and liabilities: | | | | | | | | |

Good and services tax receivable | | | 22,369 | | | | (39,164 | ) |

Accrued interest income | | | (1,990 | ) | | | - | |

Accounts payable and accrued expenses | | | 415,675 | | | | 725,685 | |

Accrued interest – related party | | | 60,701 | | | | 34,084 | |

Accrued payroll | | | 236,924 | | | | 387,299 | |

Prepaid and other assets | | | (16,120 | ) | | | - | |

Deposits | | | (39,512 | ) | | | - | |

Net cash used in operating activities | | | (1,909,836 | ) | | | (1,145,645 | ) |

| | | | | | | | |

Cash flows from investing activities | | | | | | | | |

Convertible notes receivable | | | (80,000 | ) | | | - | |

Net cash used in investing activities | | | (80,000 | ) | | | - | |

| | | | | | | | |

Cash flows from financing activities | | | | | | | | |

Advances to related party | | | - | | | | 300 | |

Proceeds from loans payable from related parties, net | | | 599,371 | | | | 970,729 | |

Proceeds from issuance of common stock | | | 1,344,900 | | | | 100,000 | |

Net cash provided by financing activities | | | 1,944,271 | | | | 1,071,029 | |

| | | | | | | | |

Effect of changes in exchange rates on cash and cash equivalents | | | 51,758 | | | | 64,755 | |

| | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 6,193 | | | | (9,861 | ) |

| | | | | | | | |

Cash and cash equivalents, beginning of period | | | 673 | | | | 19,857 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 6,866 | | | $ | 9,996 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid for interest | | $ | - | | | $ | - | |

Cash paid for income tax | | $ | - | | | $ | - | |

See accompanying notes to condensed consolidated financial statements.

APPLE iSPORTS GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. COMPANY HISTORY AND NATURE OF BUSINESS

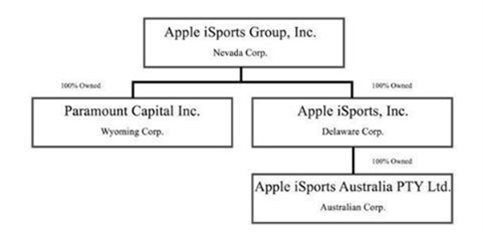

Apple iSports Group, Inc. (the “Company”) was incorporated under the laws of the State of Nevada in 1975 as Vita Plus Industries, Inc. In March 1999, the Company sold its remaining inventory and changed its name to Prevention Insurance.com and effective August 31, 2023, changed its name to Apple iSports Group, Inc. Effective March 23, 2023, the Company closed a share exchange pursuant to a Stock Exchange Agreement (the “Stock Exchange Agreement”), with Apple iSports, Inc. (“AiS”), a Delaware corporation and the stockholders of AiS. Pursuant to the Stock Exchange Agreement, the Company issued to the AiS stockholders 195,062,000 shares of its common stock, par value $0.0001 per share in exchange for all of the issued and outstanding capital stock (195,062,000 shares of common stock) of AiS. AiS became a wholly-owned subsidiary of the Company. In connection with this transaction, the Company elected to change its fiscal year end from April 30 to December 31. For financial reporting purposes, the transaction is considered a combination of businesses under common control, as the Company and AiS were commonly controlled. Thus, the Company retroactively combined the results of operations and related assets and liabilities of the Company and AiS for all periods presented.

AiS, formed on May 29, 2019, in the State of Delaware, has been engaged in the development of an online sports portal that will include racing and sports betting, fantasy sports, and sports content. On November 9, 2021, AiS incorporated Apple iSports Pty Ltd (“AIS Australia”) as a wholly owned subsidiary of AiS.

Paramount Capital Inc., was formed on September 19, 2019, in the State of Wyoming. It is a wholly-owned subsidiary of the Company and since inception, it has had limited operating activity. Effective September 19, 2024, the Company amended Paramount Capital Inc.’s name to AiSportsTek, Inc.

NOTE 2. GOING CONCERN

The Company’s condensed consolidated financial statements are prepared on a going concern basis of accounting, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues and cash flows sufficient to cover its operating costs and allow it to continue as a going concern. For the nine months ended September 30, 2024, the Company reported a net loss of $2,012,474, negative working capital of $6,124,806, and an accumulated deficit of $12,450,087. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s ability to continue as a going concern for the next 12 months from the date of this Quarterly Report is dependent upon its ability to develop additional sources of debt and, or equity to fund the continued development of its multi-faceted sports betting platform and ultimately achieve profitable operations. The Company plans to obtain such resources by relying upon continued advances from significant stockholders sufficient to meet its minimal operating expenses and seeking third-party equity and/or debt financing. However, the Company cannot provide any assurances that it will be successful in accomplishing any of its plans. These condensed consolidated financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

Certain prior-year amounts have been reclassified to conform to the current year's presentation. These reclassifications had no effect on the reported results of operations.

These condensed consolidated financial statements incorporate the financial statements of the Company and its wholly owned subsidiary, AiS, AIS Australia, and AiSportsTek, Inc. All significant intercompany transactions and balances have been eliminated in consolidation. The Company’s activities are subject to significant risks and uncertainties, including failing to secure additional financing needed to execute its business plan.

The Company is an emerging growth company, as the term is used in The Jumpstart Our Business Startups Act, enacted on April 5, 2021, and has elected to comply with certain reduced public company reporting requirements.

Unaudited Interim Financial Information

The unaudited interim condensed consolidated financial statements and related notes have been prepared in accordance with U.S. GAAP for interim financial information within the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). Certain information and disclosures normally included in the annual financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. The unaudited interim condensed consolidated financial statements have been prepared on a basis consistent with the audited financial statements and in the opinion of management, reflect all adjustments, consisting of only normal recurring adjustments, necessary for the fair presentation of the consolidated results for the interim periods presented and of the consolidated financial condition as of the date of the interim condensed consolidated balance sheet. The financial data and the other information disclosed in these notes to the interim condensed consolidated financial statements are unaudited. Unaudited interim results are not necessarily indicative of the results for the full fiscal year. These unaudited interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company for the year ended December 31, 2023, and notes thereto.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions.

Intellectual property rights

The Company depends in part upon proprietary technology and is actively looking to increase and enhance its proprietary technology through the acquisition of third-party intellectual property. As such, in 2022, the Company entered into an agreement to transfer 1,000,000 AUD (U.S. $664,011) in the Company’s shares to a third-party in exchange for certain intellectual property. During the first quarter of 2023, the Company took possession of the intellectual property and commenced a trial period to review the intellectual property; however, the Company determined that the intellectual property was not viable for their operations and returned the intellectual property to the third-party. Since the Company took possession of the intellectual property, it recognized the related expense during the first quarter of 2023; however, in April 2024, the Company and the third-party entered into a binding recission agreement and reversed 1,000,000 AUD of accounts payable and recognized forgiveness of debt income of 1,000,000 AUD ($658,133).

Foreign Currency Transactions and Translation

The Company’s functional currency is the United States Dollar (“US $”). The Company’s wholly owned subsidiary, AIS Australia, functional currency in which it operates is Australian Dollars (“AUD”).

For the purpose of presenting these condensed consolidated financial statements, the reporting currency is US$. AIS Australia’s assets and liabilities are expressed in US $ at the exchange rate on the balance sheet date, stockholder’s equity accounts are translated at historical rates, and income and expense items are translated at the average exchange rate during the period. The resulting translation adjustments are reported under accumulated other comprehensive loss in the stockholder’s equity section of the balance sheets.

Transactions in currencies other than the entity’s functional currency are recorded at the rates of exchange prevailing on the date of the transaction. Gains or losses resulting from transactions in currencies other than the functional currencies are recognized as part of operating expenses in the condensed consolidated statement of comprehensive loss.

Exchange rates used for the translations are as follows:

AUD to US $ | | Period End | | | Average | |

December 31, 2023 | | | 0.6812 | | | | 0.6640 | |

September 30, 2024 | | | 0.6919 | | | | 0.6585 | |

September 30, 2023 | | | 0.6431 | | | | 0.6550 | |

Fair Values of Financial Instruments

The Company adopted Accounting Standards Codification (“ASC”) 820 Fair Value Measurements, which defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement, and enhances disclosure requirements for fair value measures. Current assets and current liabilities qualified as financial instruments and management believes their carrying amounts are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and if applicable, their current interest rate is equivalent to interest rates currently available. The three levels are defined as follow:

| · | Level 1 — inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| | |

| · | Level 2 — inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| | |

| · | Level 3 — inputs to the valuation methodology are unobservable and significant to the fair value. |

As of the balance sheet date, the estimated fair values of accounts payable, accrued expenses, loan payable – related parties, and due to related party approximated their fair values due to the short-term nature of these instruments. The fair value of the Company’s recently issued notes receivable approximates its carrying value due to the recency of its issuance relative to September 30, 2024, which was otherwise issued at market terms that the Company believes would be currently available for similar loan issuances. Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates the hierarchy of disclosures each reporting period.

Related Party Transactions

The Company adopted ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions. See Note 4 below for details of related party transactions in the period presented.

Cash and Cash Equivalents

The Company maintains cash balances in a non-interest-bearing account that currently does not exceed federally insured limits. Australian bank accounts are insured with deposit protection of up to 250,000 AUD. U.S. bank accounts are insured with deposit protection up to $250,000. The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Deposits

In April 2024, the Company entered into a term sheet agreement for the proposed purchase of a customer database and web domain from an Australian proprietary limited company. The completion of the proposed purchase of these certain assets is subject to, among other things, the completion of due diligence, the negotiation of definitive agreements (including an asset purchase agreement), the satisfaction of the conditions negotiated therein, approval of the transaction by the board and stockholders of both companies, as well as regulatory approvals and other customary conditions. There can be no assurance that the definitive agreements will be entered into or that the proposed purchase of these certain assets will be consummated on the terms or timeframe currently contemplated or at all. As of September 30, 2024, the Company has not yet executed the definitive agreements. Concurrent with the term sheet, the Company paid a deposit of 60,000 AUD (U.S. $41,513), which is included in deposits on the consolidated balance sheet as of September 30, 2024.

Convertible Notes Receivable

Convertible notes receivable are classified as held-for-investment based on the Company’s intent and ability to hold the loans for the foreseeable future or until maturity. Convertible notes receivable are carried at amortized cost and are reduced by loan origination costs and the allowance for estimated credit losses, as necessary.

Provisions for credit losses are charged to operations in amounts sufficient to maintain the allowance for credit losses at levels considered adequate to cover expected credit losses on the loans. In determining expected credit losses, the Company considers its historical level of credit losses, current economic trends, and reasonable and supportable forecasts that affect the collectability of future cash flows.

The Company recognizes interest income on loans, including the amortization of discounts and premiums, using the effective interest method. The effective interest method is applied on a loan-by-loan basis when the collectability of future payments is reasonably assured. Interest income is accrued on the unpaid principal balance unless the collectability of the loan is in doubt. Loans are placed on non-accrual status if the collection of principal and interest is considered doubtful, which is typically 90 days after the loan becomes delinquent.

Revenue Recognition

The Company determines revenue recognition through the following steps:

Step 1: Identify the contract(s) with customers

Step 2: Identify the performance obligations in the contract

Step 3: Determine the transaction price

Step 4: Allocate the transaction price to performance obligations in the contract

Step 5: Recognize revenue when the entity satisfies a performance obligation

Revenue is recognized when performance obligations are satisfied through the transfer of control of promised goods or services to the Company’s customers in an amount that reflects the consideration expected to be received in exchange for transferring goods or services to customers. Control transfers once a customer has the ability to direct the use of, and obtain substantially all of the benefits from, the product. This includes the transfer of legal title, physical possession, the risks and rewards of ownership, and customer acceptance.

Comprehensive income (loss)

The Company follows ASC 220 in reporting comprehensive income (loss). Comprehensive income (loss) is a more inclusive financial reporting methodology that includes disclosure of certain financial information that historically has not been recognized in the calculation of net income (loss).

Earnings (Loss) Per Share

The Company follows ASC 260 when reporting earnings (loss) per share (“EPS”) resulting in the presentation of basic and diluted earnings (loss) per share. Basic EPS is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period. Diluted EPS is computed by dividing net income (loss) by the weighted average shares outstanding, assuming all dilutive potential common shares were issued. Diluted EPS is not presented when its effect is anti-dilutive. Because the Company does not have any common stock equivalents, such as stock options and warrants, the amounts reported for basic and diluted net loss per share were the same.

Income Taxes

The Company accounts for income taxes pursuant to ASC 740. Deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s condensed consolidated financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carry-forward period under the Federal tax laws. Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about the realizability of the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimates.

The Company evaluates tax positions in a two-step process. The Company first determines whether it is more likely than not that a tax position will be sustained upon examination based on the technical merits of the position. If a tax position meets the more-likely-than-not recognition threshold, it is then measured to determine the amount of benefit to recognize in the financial statements. The tax position is measured as the largest amount of benefit that is greater than 50% likely to be realized upon ultimate settlement. The Company classifies gross interest and penalties and unrecognized tax benefits that are not expected to result in payment or receipt of cash within one year as long-term liabilities in the financial statements.

Accounting Pronouncements Not Yet Adopted

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (ASU 2023-07), which requires an enhanced disclosure of significant segment expenses on an annual and interim basis. This guidance will be effective for the annual periods beginning the year ended December 31, 2024, and for interim periods beginning January 1, 2025. Early adoption is permitted. Upon adoption, the guidance should be applied retrospectively to all prior periods presented in the financial statements. The Company is currently evaluating the impact of this accounting standard on its condensed consolidated financial statements.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which improves the transparency of income tax disclosures by requiring consistent categories and greater disaggregation of information in the effective tax rate reconciliation and income taxes paid disaggregated by jurisdiction. It also includes certain other amendments to improve the effectiveness of income tax disclosures. This guidance will be effective for the annual periods beginning the year ended December 31, 2025. Early adoption is permitted. Upon adoption, the guidance can be applied prospectively or retrospectively. The Company is currently evaluating the impact of this accounting standard on its condensed consolidated financial statements.

NOTE 4. CONVERTIBLE NOTES RECEIVABLE

On March 6, 2024, the Company entered into a Convertible Promissory Note Purchase Agreement with SeaPort Inc., whereas the Company agreed to loan a maximum of $1,000,000 to SeaPort, Inc. The note is convertible into common shares of Seaport, Inc. at a conversion price equal to the pre-money investment (as defined in the agreement) divided by the aggregate number of fully diluted shares of Seaport Inc.’s common stock as of the conversion date. As of September 30, 2024, the Company had loaned $80,000 to SeaPort, Inc. with an annual interest rate of 5% per year. The loan is structured with several maturity dates of March 6, 2027, April 29, 2027, and May 28, 2027. During the three and nine months ended September 30, 2024, the Company recorded $1,008 and $1,990 in interest income related to the loan respectively. As of September 30, 2024, the Company has accrued $1,990 of interest income related to the loan. During the three months ended September 30, 2024, the company has accrued $1,008 of interest income related to the loan.

NOTE 5. RELATED PARTIES

Related Party Payables and loans

Related Party | | Note | | September 30, 2024 | | | December 31, 2023 | |

Cres Discretionary Trust No. 2 | | (a) | | $ | 2,807,760 | | | $ | 2,145,875 | |

Apple iSports Investment Group Pty | | (b) | | | 180,208 | | | | 177,420 | |

ABA Investment Group Pty Ltd | | (c) | | | 311,556 | | | | 306,734 | |

Utti Oco Pty Ltd | | (d) | | | 68,970 | | | | 68,970 | |

Mt. Wills Gold Mines Pty Ltd | | (e) | | | 21,550 | | | | 21,550 | |

Total loan payable | | | | | 3,390,044 | | | | 2,720,549 | |

| | | | | | | | | | |

Cres Discretionary Trust No. 2 | | (a) | | | 114,373 | | | | 60,752 | |

Apple iSports Investment Group Pty | | (b) | | | 12,425 | | | | 8,251 | |

ABA Investment Group Pty Ltd | | (c) | | | 16,092 | | | | 8,961 | |

Total accrued interest | | | | | 142,890 | | | | 77,964 | |

| | | | | | | | | | |

Due to Director | | (f) | | | 4,999 | | | | 4,999 | |

Total Due to related party | | | | $ | 4,999 | | | $ | 4,999 | |

| | | | | Three Months Ended | | | Nine Months Ended | |

| | | | | September 30, | | | September 30, | |

| | | | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Related party interest expenses: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cres Discretionary Trust No. 2 | | (a) | | | | 18,262 | | | | 10,914 | | | | 51,106 | | | | 27,974 | |

Apple iSports Investment Group Pty | | (b) | | | | 1,283 | | | | 1,897 | | | | 3,235 | | | | 3,807 | |

ABA Investment Group Pty Ltd | | (c) | | | | 2,218 | | | | 1,297 | | | | 6,654 | | | | 3,849 | |

Total related party interest expenses | | | | | | | 21,762 | | | | 14,108 | | | | 60,995 | | | | 35,630 | |

a) On May 30, 2019, the Company entered into a loan agreement with Cres Discretionary Trust No.2 (the “Lender”). The Company’s director is the sole officer and controlling stockholder of the Lender. The Lender also is the Company’s majority shareholder. The loan is unsecured, has a 3% annualized interest rate, and is payable on demand by the Lender.

b) On April 8, 2022, the Company’s second-tier subsidiary, AIS Australia entered into a loan agreement with Apple iSports Investment Group Pty Ltd (the “Subsidiary Lender”). The Subsidiary Lender is 100% owned by the director of the Company. The loan is unsecured, has a 3% annualized interest rate, and is payable on demand by the Subsidiary Lender.

c) On April 8, 2022, the Company’s second-tier subsidiary, AIS Australia entered into a loan agreement with ABA Investment Group Ltd (the “Subsidiary Lender 2”). The Subsidiary Lender 2 is 100% owned by the director of the Company. The loan is unsecured, has a 3% annualized interest rate, and is payable on demand by the Subsidiary Lender 2.

d) On March 31, 2022, the Company entered into a loan agreement with Utti Pty Ltd (“Utti”). Utti is owned by a director of the Company. The loan is unsecured, bears interest at a rate of 3%, and is payable upon demand.

e) On March 31, 2022, the Company entered into a loan agreement with Mt. Wills Gold Mines Pty Ltd (“Mt. Wills”). The Company’s director also is a director and shareholder of Mt. Wills. The loan is unsecured, bears interest at a rate of 3%, and is payable upon demand.

f) A director of the Company has advanced cash to the Company. The advances were unsecured and interest-free.

NOTE 6. INCOME TAXES

The Company utilized the asset and liability method of accounting for income taxes in accordance with ASC 740-10. If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized.

a. United States (U.S.)

The Company is subject to U.S. tax laws at a tax rate of 21%. No provision for US federal income taxes or state of Delaware taxes have been made as the Company had no taxable income for the three and nine months ended September 30, 2024 and 2023. The Company’s subsidiary is subject to the State of Delaware tax laws at a tax rate of 8.7%.

b. Australia (AU)

Apple iSports Pty Ltd, a second-tier subsidiary of the Company, was incorporated in Australia in November 2021 and maybe subject to a corporate income tax on its activities conducted in Australia and income arising in or from Australia. No provision for income tax has been made as the subsidiary had no taxable income for the three and nine months ended September 30, 2024 and 2023. The applicable statutory tax rate is 25%.

Significant components of the Company’s net deferred income tax assets as of the nine months ended September 30, 2024, and the year ended December 31, 2023, consist of net operating loss carryforwards. The net operating loss forward for U.S. federal tax and Australian tax purposes is available for carryforward indefinitely for use in offsetting taxable income. The U.S. federal net operating loss carry forward offset is limited to up to 80% of the taxable income. The State of Delaware net operating loss carryforwards are available for carry forward for 20 years for use in offsetting taxable income. Realization of the future tax benefits is dependent on the Company’s ability to generate sufficient taxable income within the carry-forward period.

There is no income tax benefit for the losses for the three and nine months ended September 30, 2024 and 2023, since management has determined that the realization of the net tax deferred asset is not assured and has created a valuation allowance for the entire amount of such benefits.

NOTE 7. STOCKHOLDERS’ DEFICIT

Preferred Stock

As of September 30, 2024, and December 31, 2023, the Company was authorized to issue 50,000,000 shares of preferred stock with a par value of $0.0001.

No shares of preferred stock were issued or outstanding as of and during the nine months ended September 30, 2024, and the year ended December 31, 2023, respectively.

Common Stock

As of September 30, 2024 and December 31, 2023, the Company was authorized to issue 500,000,000 shares of common stock with a par value of $0.0001. As of September 30, 2024 and December 31, 2023, the Company had 208,484,211 and 202,784,211 shares issued and outstanding, respectively.

On July 24, 2024, the Company entered into a subscription agreement with an unaffiliated third-party pursuant to which the Company received $50,000 in proceeds in exchange for the issuance of 200,000 shares of common stock

On May 17, 2024, the Company modified its 2023 subscription agreement with a subscriber and issued an additional 320,000 shares of common stock for total of 400,000 shares at a price of $0.25. The modification resulted in an incremental fair value of $80,000 calculated as the difference between the fair value of the original issuance and the fair value of modified issuance on the modification date. The incremental fair value of $80,000 is fully expensed on date of modification.

On April 26, 2024, the Company entered into a subscription agreement with unaffiliated third parties pursuant to which the Company received $647,300 in proceeds in exchange for the issuance of 2,589,600 shares of common stock.

On February 16, 2024, the Company entered into a subscription agreement with unaffiliated third parties pursuant to which the Company received $647,600 in proceeds in exchange for the issuance of 2,590,400 shares of common stock.

On March 23, 2023, pursuant to the Stock Exchange Agreement with AiS, the Company issued 195,062,000 shares of its common stock. Along with the Stock Exchange Agreement, the Company also reissued 31,000 stock purchase warrants that had been previously issued by AiS.

On June 20, 2023, the Company received a subscription agreement for the purchase of 80,000 shares at a price of $1.25 for total proceeds of $100,000.

Treasury Stock

The Company’s treasury stock comprised one share of common stock acquired at a cost of $52,954.

NOTE 8. COMMITMENTS AND CONTINGENCIES

In the ordinary course of business, the Company or its subsidiaries may be named a party to claims and/or legal proceedings. Neither the Company nor its subsidiaries have been named in and are not aware of any matters which management believes will result, either individually or in the aggregate, in a material adverse effect to its financial condition or results of operations.

As of September 30, 2024, the Company leased short-term office spaces (12 months or less), and as an accounting policy election, the Company has excluded all short-term leases from the presentation on the balance sheet.

NOTE 9. SUBSEQUENT EVENTS

On November 1, 2024, the Board of Directors approved the conversion of the related party loan principal balance of $4,223,346 AUD (U.S. $2,922,133) with Cres Discretionary Trust No. 2 (“Cres”) into 11,688,532 shares of the Company’s common stock at a price of $0.25 per share, which was based on the subscription price of the Company’s recent private placement offering. As of the date of this filing, a formal agreement has not been entered into and the issuance of the shares and cancellation of the loan has not yet occurred.

On that same date, the Board of Directors of the Company approved the creation of the 2024 Stock Incentive Plan (“2024 Stock Plan”). The maximum number of common stock authorized and available for issuance under the 2024 Stock Plan is 15,000,000 shares of common stock. It also approved the stock option grant of a total of 10,275,000, under the 2024 Stock Plan, to the employees, officers, directors and consultants of the company. The options have an exercise price of $0.25 per share, which was based on the subscription price of the Company’s current private placement offering. A formal plan is to be established by the Board of Directors.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

Certain statements made in this quarterly report on Form 10-Q are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) in regard to the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this quarterly report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the registrant or any other person that the objectives and plans of the registrant will be achieved.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events, or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates, and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

| · | Market acceptance of our products and services; |

| · | Competition from existing products or new products that may emerge; |

| · | The implementation of our business model and strategic plans for our business and our products; |

| · | Estimates of our future revenue, expenses, capital requirements and our need for financing; |

| · | Our financial performance; |

| · | Current and future government regulations regarding the sports betting industry; |

| · | Developments relating to our competitors; and |

| · | Other risks and uncertainties. |

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents that we may file from time to time with the SEC.

The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include but are not limited to those discussed below and elsewhere in this quarterly report.

Our audited and unaudited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Overview

AiS has been engaged in the development of a digital sports betting and gaming platform. When completed, our platform will provide users with sports content, racing and sports betting, fantasy sports, and sports streaming solutions. We aim to create excitement and engagement and deliver the best experiences that enhance sports fandom. Users can access our products via multiple devices, including the web and mobile devices.

AiS is licensed in Australia via a provisional Northern Territory Online Bookmaking License which allows for racing, sports betting, and fantasy sports throughout Australia, which is one of the most mature legal betting markets in the world. In addition, we are licensed in North Dakota as an (ADW) provider, subject to completion of TRPB examination, which will allow us to provide pari-mutuel betting on racing in North Dakota and up to an additional 20 states that do not have specific regulations. NFL and other sports bets in the US are regulated separately from racing wagering and we will seek market access licenses for a number of states offering sports betting licenses over a 3-year timeline.

Our two primary markets are the U.S. (in select states where we are licensed) and Australia. We will have separate websites for both markets, namely www.appleisports.com in the U.S. and www.appleisports.com.au in Australia.

We have achieved the following milestones:

| · | Since the inception of AiS through September 30, 2024, we (i) established a core team with the industry skills and experience to manage the Company and (ii) we received approximately $3,064,900 in private placement funding and received loans from related parties in excess of $2,720,549 |

| · | From December 2021 to October 2022, we developed our Go to Market outline and marketing strategy, including identifying preferred suppliers for each product and initiating relationships with key suppliers and consultants; |

| · | In February 2022, we re-launched a content-rich blog site on the appleisports.com and appleisports.com.au domains and initiated search engine optimization activities to increase the search performance of our site on Google search; |

| · | In April 2022, we reached an agreement with a leading provider of Australian racing data and form information for use on our racing platform; |

| · | In April 2022, we completed and submitted our application for a Northern Territory (NT) Online Bookmaking license. We appeared before the NT Racing Commission in May 2022 to present our application for approval. We expect the license to be issued in Q1 2025; |

| · | In June 2022, we submitted our application to the North Dakota Racing Commission for an (ADW) license, subject to the approval of the Thoroughbred Racing Protective Bureau. In parallel, we initiated a Thoroughbred Racing Protective Bureau (TRPB) examination process. The TRPB provides integrity reporting to regulators administering ADW licenses. We expect the TRPB examination to be completed in Q3 2024. Completion of the TRPB examination is required to receive a state-issued ADW; |

| · | In October 2022, we engaged a leading provider of white-label sportsbook platforms and began customization and integration with key components (KYC, payments, CRM, credit card verification) and data feeds. The expected completion and product launch is September 2024; |

| · | In May 2023, we began brand awareness and user harvesting actives by advertising around Australia on SEN Radio, the largest sports radio network in Australia. Advertising continued sporadically through August of 2024; |

| · | In June 2023, we began User Acceptance Testing of our racing and sport betting platform with the NT Racing Commission. The expected completion date is Q2 2024; |

| · | In July 2023, we entered into a licensing agreement with Seaport, Inc., a technology company, to incorporate their unique firmware and software called “IPK.” The objective is to incorporate the IPK technology into our gaming platform and “Casino in a Box” offerings that will improve performance by minimizing latency and will incorporate a state-of-the-art algorithm that will provide unprecedented security in the industry This is especially critical for the delivery of services in remote communities throughout the USA, including the underserved Native American Nations. The license agreement allows us to use the technology on our own platform with the ability to make the product available to other operators in the gaming space. We also will make the technology available to other iGaming companies that provide wireless iGaming. We expect to launch “Casino in a Box” in Q1 2025; |

| · | In August 2023, we began engaging with connectivity and communications optimization with third parties and Native American-led service providers to develop a Class II online iGaming platform for the tribal casino market in the United States. This technology focus has led to the development of partnerships and offerings for gaming operators, both brick-and-mortar and online. The expected product launch for the tribal casino market is Q1 2025, and |

| · | In January 2024, we began engaging with an establish ISP and networking technologies group regarding provision of broadband services to Native American tribal land. This capability, along with the IPK technology, will allow us to deliver the infrastructure needed to deploy broadband services that will enable “Casino in a Box” to operate in a sufficiently secure and fast manner, anywhere in North America. The expected launch date is Q1 2025. |

| · | In March 2024 we began negotiations with an existing sportsbook operator with a well-established user base. A Letter of Intent has been agreed and final sale and purchase agreement in intended to be signed in Q4 2024. |

Effective March 23, 2023, we completed a change of control transaction pursuant to a Stock Exchange Agreement (the “Stock Exchange Agreement”), with AiS and the shareholders of AiS. The stock exchange was accounted for under the business combination under common control of accounting. Consequently, the assets and liabilities and the historical operations that are reflected in the financial statements prior to the stock exchange are those of AiS and the Company combined. They are recorded at the historical cost basis, and the condensed consolidated financial statements after completion of the stock exchange include the combined assets and liabilities of AiS and the Company from the closing date of the stock exchange. As a result of the issuance of the shares of our common stock pursuant to the stock exchange, a change in control of the Company occurred as of the date of consummation of the transaction.

Our address is 100 Spectrum Center Dr. Suite 900, Irvine, CA 92612, and our phone number is (949) 247-4210. We also maintain satellite offices at offices at Level 1, Paspalis Centrepoint, 48-50 Smith Street Mall, Darwin NT 0800 Australia and Lonsdale Street, Level 7, Melbourne, Australia 3000. In addition, as mentioned, we have two websites (which do not form a part of this filing): www.appleisports.com in the U.S. and www.appleisports.com.au in Australia.

Our corporate structure is depicted below:

Results of Operations

For the Nine Months Ended September 30, 2024 Compared to the Nine Months Ended September 30, 2023

Revenues

During nine months ended September 30, 2024 and 2023, the Company had no revenues.

Operating Expenses

During the nine months ended September 30, 2024, the Company had total operating expenses of $2,602,391 compared with $2,229,819 for the nine months ended September 30, 2023.

During the nine months ended September 30, 2024, operating expenses consisted of corporate expenses of $546,019, consulting and professional fees of $1,528,580 and selling, general and administrative expenses of $527,792. During the nine months ended September 30, 2023, operating expenses consisted of corporate expenses of $631,437, consulting and professional fees of $507,785, research and development costs of $655,000, and selling, general and administrative expenses of $435,597. The 16.71% increase in operating expenses for the nine months ended September 30, 2024 as compared to the same period in 2023 is primarily due to a significant increase in consulting and professional fees and an increase in selling, general and administrative expenses partially offset by the reversal of research and development costs during 2024 and decreases in corporate expenses. The significant increase in consulting and professional fees is due to the continued development of the Company’s digital sports betting and gaming platform.

During the nine months ended September 30, 2024, we had $65,492 in interest expense, net primarily attributable to related party debt, compared with $35,630 in interest expense attributable to related party debt for the nine months ended September 30, 2023. The increase in interest expense, net for the nine months ended September 30, 2024 as compared to the same period in 2023 was due to the increase principal balance on the related party debt.

During the nine months ended September 30, 2024, the Company had total $658,533 related to forgiveness of debt. During the nine months ended September 30, 2023 the company had no forgiveness of debt. This was related to the Company rescinding of the third-party intellectual property and reversal of 1,000,000 AUD of accounts payable and recognized forgiveness of debt income of 1,000,000 AUD ($658,533).

For the nine months ended September 30, 2024, and 2023, we had net losses of $2,012,474 and $2,269,015, respectively, for the reasons discussed above.

For the Three Months Ended September 30, 2024 Compared to the Three Months Ended September 30, 2023

Revenues

During the three months ended September 30, 2024, and 2023, the Company had no revenues.

Operating Expenses

During the three months ended September 30, 2024, the Company had total operating expenses of $723,929 compared with $584,917 for the three months ended September 30, 2023.

During the three months ended September 30, 2024, operating expenses consisted of corporate expenses of $185,410 consulting and professional fees of $421,759 and selling, general and administrative expenses of $116,760. During the three months ended September 30, 2023, operating expenses consisted of corporate expenses of $242,927, consulting and professional fees of $166,021 and selling, general and administrative expenses of $175,969. The 23.77% increase in operating expenses for the three months ended September 30, 2024 as compared to the same period in 2023 is primarily due to the increases in consulting and professional fees from the continued development of the Company’s digital sports betting and gaming platform partially offset by decreases in corporate expenses from the cost containment measures the Company has implemented.

During the three months ended September 30, 2024, we had $20,756 of interest expense, net primarily attributable to related party debt compared with $14,108 of interest expense, net attributable to related party debt for the three months ended September 30, 2023. The increase in interest expense, net for the three months ended September 30, 2024 as compared to the same period in 2023 was due to the increase principal balance on the related party debt.

During the three months ended September 30, 2024 and 2023, we had net losses of $748,760 and $580,589 respectively, for the reasons discussed above.

Liquidity and Capital Resources

As of September 30, 2024, the Company had a working capital deficit of $6,124,806 compared with a working capital deficit of $5,307,174 as of December 31, 2023. The increase in working capital deficit is primarily a result of an increase of accounts payable and accrued expenses during the nine months ended September 30, 2024. The Company received funds from private placements (See Net Cash Provided By Financing Activities below) during the nine months ended September 30, 2024 which enabled the reduction of these expenses.

The Company can provide no assurance that it can continue to satisfy its cash requirements for at least the next twelve months. The following is a summary of the Company’s cash flows provided by (used in) operating, investing, and financing activities for the nine months ended September 30, 2024 and 2023:

| | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | |

Net cash used in operating activities | | $ | (1,909,836 | ) | | $ | (1,145,645 | ) |

Net cash used in investing activities | | | (80,000 | ) | | | - | |

Net cash provided by financing activities | | | 1,944,271 | | | | 1,071,029 | |

Effect of changes in exchange rate on cash and cash equivalents | | | 51,758 | | | | 64,755 | |

Net change in cash and cash equivalents | | $ | 6,193 | | | $ | (9,861 | ) |

Operating Activities

During the nine months ended September 30, 2024, the Company incurred a net loss of $2,012,474 which after adjusting for decreases goods and services tax receivable of $22,369, along with increases in accounts payable and accrued expenses of $415,675, accrued payroll of $236,924, accrued interest to related party of $60,701, accrued interest income of $1,990, prepaid and other assets of $16,120, and deposits of $39,512 along with foreign exchange loss of $3,124, forgiveness of debt of $658,533 and non cash expenses from stock issuance modification $80,000 resulted in net cash of $1,909,836 being used in operating activities during the period. By comparison, during the nine months ended September 30, 2023, the Company incurred a net loss of $2,269,015 which after adjusting for increases in goods and services tax receivable of $39,164, accounts payable and accrued expenses of $725,685, accrued interest to related party of $34,084, and accrued payroll of $387,299 along with foreign exchange loss of $15,466, resulted in net cash of $1,145,645 being used in operating activities during the period.

Investing Activities

During the nine months ended September 30, 2024, the Company loaned $80,000 to SeaPort, Inc. By comparison, during the nine months ended September 30, 2023, the Company had no cash flows from investing activities.

Financing Activities

During the nine months ended September 30, 2024, the Company received $1,944,271 from financing activities by way of $599,371 of net proceeds from related parties loans and $1,344,900 of proceeds from common stock issuances. By comparison, during the nine months ended September 30, 2023, the Company received $1,071,029 from financing activities by way of $970,729 of net proceeds from related parties loans and $100,000 from common stock issuances, and $300 from advances to related party.

The Company is dependent upon receiving capital investment or other financing to fund its ongoing operations and to execute its business plan of seeking a combination with a private operating company. In addition, the Company is dependent upon certain related parties to provide continued funding and capital resources. No assurances can be given that the Company will be successful in locating or negotiating with any target company or that the related parties will continue to fund the Company’s working capital needs. As a result, there is substantial doubt about the Company’s ability to continue as a going concern.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Contractual Obligations

None.

Critical Accounting Estimates

The preparation of financial statements in conformity with generally accepted accounting principles of the United States (“GAAP”) requires estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses in the financial statements and accompanying notes. Critical accounting estimates are those estimates made in accordance with GAAP that involve a significant level of estimation uncertainty and have had or are likely to have a material impact on the financial condition or results of operations of the Company. Based on this definition, we have not identified any critical accounting estimates. We also have other key accounting policies, which involve the use of estimates, judgments, and assumptions that are significant to understanding our results which are found in Note 3 – Summary of Significant Accounting Policies and Basis of Presentation of the accompanying condensed consolidated financial statements. Although we believe that our estimates, assumptions, and judgments are reasonable, they are based upon information presently available. Actual results may differ significantly from these estimates under different assumptions, judgments, or conditions.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this quarterly report, an evaluation was carried out by the Company’s management, with the participation of the principal executive officer and the principal financial officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act (“Exchange Act”) as September 30, 2024. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Commission’s rules and forms, and that such information is accumulated and communicated to management, including the principal executive officer and the principal financial officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in the Commission’s rules and forms, and that such information was not accumulated and communicated to management, including the principal executive officer and the principal financial officer, to allow timely decisions regarding required disclosures. Due to this material weakness, the Company’s accounting for research and development expense for 2023 was not accurately accounted for and led to the restatement of the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023, and September 30, 2023. In addition to the remediation steps discussed below, the Company has added additional steps to its internal financial review process in order to provide reasonable assurance that a reoccurrence of a material misstatement of any item in our financial statements will not occur.

Effective disclosure controls and internal controls are necessary for us to provide reliable financial reports and prevent fraud. We continue to evaluate steps to remediate the material weaknesses. These remediation measures may be time consuming and costly and there is no assurance that these initiatives will ultimately have the intended effects.

Management has implemented remediation steps to improve our disclosure controls and procedures and our internal control over financial reporting. By enhancing access to accounting literature, identification of third-party professionals with whom to consult regarding complex accounting applications and consideration of additional staff with the requisite experience and training to supplement existing accounting professionals.

If we identify any new material weakness in the future, any such newly identified material weakness could limit our ability to prevent or detect a misstatement of our accounts or disclosures that could result in a material misstatement of our annual or interim financial statements. In such case, we may be unable to maintain compliance with securities law requirements regarding the timely filing of periodic reports in addition to applicable stock exchange listing requirements, investors may lose confidence in our financial reporting, and our stock price may decline as a result. We cannot assure you that the measures we have taken to date, or any measures we may take in the future, will be sufficient to avoid potential future material weaknesses.