false000175639000017563902024-07-152024-07-150001756390dei:FormerAddressMember2024-07-152024-07-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(D) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 15, 2024

__________________________

ASCEND WELLNESS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-254800 | | 83-0602006 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

44 Whippany Road

Suite 101

Morristown, NJ 07960

| | | | | | | | | | | | | | |

| | (Address of principal executive offices) | | |

(646) 661-7600

| | | | | | | | | | | | | | |

| | (Registrant’s telephone number, including area code) | | |

1411 Broadway

16th Floor

New York, NY 10018

| | | | | | | | | | | | | | |

| | (Former name or former address, if changed since last report) | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below).

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On July 15, 2024, Ascend Wellness Holdings, Inc. (the “Company”) issued a news release announcing that it has received commitments for a private placement of 12.75% Senior Secured Notes due 2029 (the “Notes”) for aggregate gross proceeds of $235.0 million (the “Offering”). The Notes, which will be issued at 94.75% of face value, will be senior secured obligations of the Company and will bear interest at a rate of 12.75% per annum, payable semi-annually in arrears until the maturity date, unless earlier redeemed or repurchased in accordance with their terms. The Notes will mature on July 16, 2029. At any time and from time to time after the closing of the Offering, the Company may redeem all or a part of the Notes at certain specified redemption prices. The Notes will be irrevocably and unconditionally guaranteed, jointly and severally, on a senior secured basis, by certain of the Company’s subsidiaries (the “Guarantees”). The Notes and the Guarantees will be (i) secured, on a first lien basis, by substantially all assets of the Company and the guarantors of the Notes, subject to certain carveouts, and (ii) issued under and governed by an indenture to be entered into on closing of the Offering (the “Indenture”).

The net proceeds from the Offering, after deducting related fees and expenses, are expected to be approximately $213.3 million. The Company intends to use the net proceeds from the Offering, together with cash on hand, to prepay $215.0 million of principal amounts outstanding under the Credit Agreement dated as of August 27, 2021 (the “2021 Credit Facility”) (plus prepayment fees and accrued and unpaid interest). In addition, subject to certain limitations, the Indenture will permit the Company to issue additional notes thereunder, including up to an additional $60.0 million in aggregate principal amount of Notes in the future, with the proceeds therefrom to be used to prepay the remaining outstanding balance under, and to terminate, the 2021 Credit Facility. The Company entered into an amendment agreement with the required lenders under the 2021 Credit Facility, pursuant to which certain terms of the 2021 Credit Facility were amended to, among other things, permit the issuance of the Notes.

The offering and sale of the Notes have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or the laws of any other jurisdiction, and the Notes are being offered only to, or for the account or benefit of (1) persons in the “United States” (as such term is defined in Rule 902(l) of Regulation S (“Regulation S”) under the Securities Act) and “U.S. persons” (as such term is defined in Rule 902(k) of Regulation S under the Securities Act) who are either (A) an “accredited investor,” as such term is defined in Rule 501(a) of Regulation D (“Regulation D”) under the Securities Act (each, an “Accredited Investor”), or (B) a “qualified institutional buyer” as such term is defined in Rule 144A under the Securities Act, who is also an Accredited Investor; or (2) to, or for the account or benefit of, persons not in the United States that are not U.S. persons in accordance with the requirements set forth in Regulation S.

This Current Report on Form 8-K does not constitute an offer to sell, or the solicitation of an offer to buy, the Notes, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such offer, solicitation or sale would be unlawful.

A copy of the press release announcing the Company’s receipt of commitments in the Offering is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Ascend Wellness Holdings, Inc. | |

| | | |

| July 15, 2024 | | /s/ John Hartmann | |

| | John Hartmann

Chief Executive Officer

(Principal Executive Officer) | |

Ascend Wellness Holdings Signs Definitive Agreements to Issue

$235 Million of Senior Secured Notes

~ Secures funding with 12.75% coupon and a 5-year term ~

~ Net Proceeds to refinance existing Term Loan ~

NEW YORK, July 15, 2024 — Ascend Wellness Holdings, Inc. (“AWH,” “Ascend,” or the “Company”) (CSE: AAWH-U.CN) (OTCQX: AAWH), a multi-state, vertically integrated cannabis operator, is pleased to announce it has received commitments for a private placement of $235 million of its 12.75% Senior Secured Notes due 2029 (the “Notes”). The Notes are expected to be issued at a price of 94.75% of face value (the “Offering”). The Company intends to use the net proceeds of the Notes, together with cash on hand, to prepay $215 million of principal amounts outstanding under its existing term loan (the “Term Loan”). The partial refinancing of the Term Loan through the issuance of new senior secured notes is a strategic move expected to enhance the Company’s financial flexibility and strengthen its balance sheet. The Offering is expected to close on or about July 16, 2024, subject to customary closing conditions.

John Hartmann, CEO of Ascend, commented on the Offering: “We are thrilled to refinance $215 million of our existing term loan 13 months before its maturity. This refinancing marks a significant milestone for Ascend. The 5 year notes financing reflects the confidence our lenders have in our business and growth prospects, while enhancing our financial stability and flexibility. The support from a majority of our existing term loan lenders, including all of our four largest lenders, highlights their trust in our strategic vision. The diversification of the new institutional noteholders reflects the significant progress Ascend has made in broadening its investor base and in expanding the prospective audience of future stakeholders. We remain committed to driving value for our shareholders and expanding our footprint.”

In connection with the Offering, on June 28, 2024, the Company entered into an amendment agreement with the required lenders under its Term Loan, pursuant to which certain terms of the Term Loan were amended to, among other things, permit the issuance of the Notes. The $60 million of principal remaining outstanding under the Term Loan may be carried through to the existing maturity at 9.5% interest.

The Notes will be senior secured obligations of the Company and will bear interest at a rate of 12.75% per annum, payable semi-annually in arrears until their maturity date, unless earlier redeemed or repurchased in accordance with their terms. The Notes will mature on July 16, 2029. At any time and from time to time after the closing of the Offering, the Company may redeem all or a part of the Notes at certain specified redemption prices, including for the first two years at par. The Notes will be irrevocably and unconditionally guaranteed, jointly and severally, on a senior secured basis, by certain of the Company’s subsidiaries (the “Guarantees”). The Notes and the Guarantees will be secured, on a first lien basis, by substantially all assets of the Company and certain of its subsidiaries, subject to certain carveouts. The Notes and the Guarantees will be issued under and governed by an indenture to be entered into on closing of the Offering.

This Offering and related partial refinancing comes on the heels of the Company’s fifth consecutive quarter of generating cash from operations, which the Company announced in their Q1 2024 results. For more information about Ascend, visit www.awholdings.com.

The Notes are being offered on a private placement basis in certain provinces and territories of Canada pursuant to applicable exemptions from the prospectus requirements of Canadian securities laws. The Notes may also be sold in the United States to or for the account or benefit of “U.S. persons” (as defined in the United States Securities Act of 1933, as amended (the “U.S. Securities Act”)), on a private placement basis to “qualified institutional buyers” and “accredited investors” pursuant to an exemption from the registration requirements of the U.S. Securities Act, and in such jurisdictions outside of Canada and the United States as may be agreed upon by the Agent and the Company, in each case in accordance with applicable laws. The Notes to be issued will be subject to a customary four-month hold period under Canadian securities laws.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The Notes have not been and will not be registered under the U.S. Securities Act or any state securities laws. Accordingly, the Notes may not be offered or sold within the United States or to or for the account or benefit of “U.S. persons” unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to exemptions from the registration requirements of the U.S. Securities Act and applicable state securities laws. This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Seaport Global Securities LLC (the “Agent”) acted as lead financial advisor and sole placement agent for the Notes.

About Ascend Wellness Holdings, Inc.

AWH is a vertically integrated operator with assets in Illinois, Maryland, Massachusetts, Michigan, Ohio, New Jersey, and Pennsylvania. AWH owns and operates state-of-the-art cultivation facilities, growing award-winning strains and producing a curated selection of products for retail and wholesale customers. AWH produces and distributes its in-house Common Goods, Simply Herb, Ozone, Ozone Reserve, Tunnel Vision, and Royale branded products. For more information, visit www.awholdings.com.

Cautionary Note Regarding Forward-Looking Information

This news release includes forward-looking information and statements (together, “forward-looking statements”), which may include, but are not limited to, the plans, intentions, expectations, estimates, and beliefs of the Company. Words such as “expects”, “continue”, “will”, “anticipates” and “intends” or similar expressions are intended to identify forward-looking statements. Without limiting the generality of the preceding statement, this news release contains forward-looking statements concerning the anticipated issue price of the Notes and closing date for the Offering, and the intended use of proceeds. We caution investors that any such forward-looking statements are based on certain assumptions and analyses made by the Company in light of the experience of the Company and its perception of historical trends, current conditions and expected future developments, and other factors management believes are appropriate.

Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein. Such factors include, among others, the risks and uncertainties identified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s other reports and filings with the applicable Canadian securities regulators on its profile on SEDAR+ at www.sedarplus.ca and with the SEC on its profile on EDGAR at www.sec.gov. Although the Company believes that any forward-looking statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such forward-looking statements, there can be no assurance that any such forward-looking statements will

prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking statements. Any forward-looking statements herein are made as of the date hereof, and except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking statements herein, whether as a result of new information, future events or results, or otherwise, except as required by applicable laws.

The Canadian Securities Exchange has not reviewed, approved or disapproved the content of this news release.

Contact

EVP, Investor Relations & Strategy

Rebecca Koar

IR@awholdings.com

(617) 453-4042 ext. 90102

v3.24.2

Cover

|

Jul. 15, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 15, 2024

|

| Entity Registrant Name |

ASCEND WELLNESS HOLDINGS, INC.

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001756390

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-254800

|

| Entity Tax Identification Number |

83-0602006

|

| Entity Address, Address Line One |

44 Whippany Road

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Morristown

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07960

|

| City Area Code |

646

|

| Local Phone Number |

661-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Former Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

1411 Broadway

|

| Entity Address, Address Line Two |

16th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

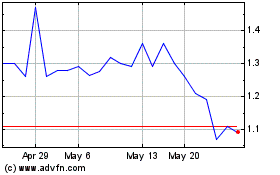

Ascend Wellness (QX) (USOTC:AAWH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ascend Wellness (QX) (USOTC:AAWH)

Historical Stock Chart

From Feb 2024 to Feb 2025