Maersk Launches New Buyback After 1Q Earnings Soared -- Earnings Review

May 05 2021 - 7:48AM

Dow Jones News

By Dominic Chopping

Denmark's A.P. Moeller-Maersk AS reported results for the first

quarter on Wednesday. Here's what we watched:

REVENUE: Maersk confirmed the preliminary first-quarter data it

released last week, with revenue rising to $12.44 billion, as

surging demand led to bottlenecks in the supply chain and a

shortage of containers. Revenue in the same quarter last year

totaled $9.57 billion.

EARNINGS: Maersk also confirmed its pre-released first-quarter

underlying earnings before interest, tax, depreciation and

amortization of $4.04 billion and underlying earnings before tax of

$3.1 billion. Underlying Ebitda in the prior-year quarter stood at

$1.52 billion, with underlying EBIT of $540 million. The company

posted a quarterly net profit attributable of $2.7 billion, up from

$197 million in the same period the previous year, and compared

with $2.38 billion seen in a FactSet analyst forecast.

WHAT WE WATCHED:

-VOLUMES AND RATES: Maersk confirmed that shipping volumes rose

5.7% in the quarter and that average freight rates were 35% higher,

as expected. It said it has signed up more long-term contracts in

the quarter, with volumes secured on long-term contracts expected

to rise 20% on the year in 2021 to around 6 million standard

40-foot containers with around 1 million standard 40-foot

containers on multi-year contracts, providing predictability and

stability for its earnings.

-BUYBACKS: The company completed the first 3.3 billion Danish

kroner ($533.6 million) of its DKK10-billion buyback program last

month and will close the remaining DKK6.7 billion between mid-May

and the end of September 2021. It announced Wednesday a new share

buyback program of up to DKK31 billion, to be executed over a

period of two years from when the current program is finalized.

-GUIDANCE: Maersk backed its most recent guidance, expecting

full-year 2021 underlying Ebitda of $13 billion-$15 billion and

underlying EBIT of $9 billion-$11 billion. Free cash flow for 2021

is still expected to be at least $7 billion while cumulative capex

for 2021-2022 is seen at around $7 billion. The 2021 outlook for

global market demand growth is still expected at 5%-7%.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 05, 2021 08:33 ET (12:33 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

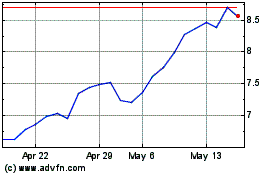

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

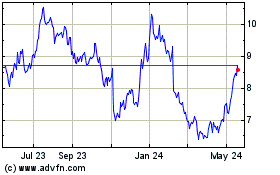

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about AP Moller Maersk AS (PK) (OTCMarkets): 0 recent articles

More AP Moller Maersk AS (PK) News Articles