true

FY

0001568969

0001568969

2023-01-01

2023-12-31

0001568969

2024-03-31

0001568969

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2023

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from __________ to _____________

Commission

file number 000-55403

APPYEA,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-1496846 |

State

or other jurisdiction of

incorporation

or organization |

|

(I.R.S.

Employer

Identification No.) |

16

Natan Alterman St, Gan Yavne Israel

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (800) 674-3561

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, $0.0001 per share

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The

registrant had 416,697,257 shares of common stock outstanding as of March 31, 2024. The aggregate market value of the common stock held

by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter

(June 30, 2023) was $643,483, as computed by reference to the closing price of $0.0090 of such common stock on the OTC Markets on such

date.

| Auditor

Name |

|

Auditor

Location |

|

Auditor

Firm ID |

| BARZILY

AND CO., CPA’s |

|

Jerusalem, Israel, |

|

2015 |

EXPLANATORY

NOTE

We

are filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to our annual report on Form 10-K for the fiscal year ended

December 31, 2023 (the “Original Filing” or “Form 10-K”), which was originally filed with the Securities and

Exchange Commission (the “SEC”) on April 1, 2024, to amend in its entirety Item 9A: CONTROLS AND PROCEDURES of Part II of

the Original Filing.

As

required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are also filing new

certifications of our principal executive officer and principal financial officer as exhibits to this Amendment. This Amendment should

be read in conjunction with the Original Filing, which continues to speak as of the date of the Original Filing.

Except

as described above, no other information in the Form 10-K has been changed or updated and this Amendment No. 1 continues to speak as

of the date of the Original Filing. This Amendment is part of the Original Filing and should be read in conjunction with the Form 10-K.

Other events occurring after the filing of the Original Filing or other disclosures necessary to reflect subsequent events have been

or will be addressed in other reports filed with or furnished to the SEC subsequent to the date of the Original Filing.

ITEM

9A. CONTROLS AND PROCEDURES

Evaluation

of Disclosure Controls and Procedures

Our

management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our

disclosure controls and procedures (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act and regulations promulgated thereunder)

as of December 31, 2023, or the Evaluation Date. Based on such evaluation, our Chief Executive Officer and Chief Financial Officer have

concluded that, as of the Evaluation Date, our disclosure controls and procedures were not effective for the reasons set forth below.

The

Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as such

term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). Internal control over financial reporting refers to the process designed

by, or under the supervision of, our Chief Executive Officer and Chief Financial Officer, and affected by our Board, management and other

personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles.

Management’s

Report on Internal Control over Financial Reporting

Internal

control over financial reporting cannot provide absolute assurance of achieving their objectives. Internal control over financial reporting

is a process that involves human diligence and compliance and is subject to lapses in judgement and breakdowns resulting from human failures.

Due to their inherent limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by

internal control over financial reporting. It is possible to design safeguards to reduce, but not eliminate, this risk. Management is

responsible for establishing and maintaining adequate internal control over financial reporting for the Company.

Management

has used the framework set forth in the report entitled Internal Control—Integrated Framework published by the Committee of Sponsoring

Organizations of the Treadway Commission (2013 framework), known as COSO, to evaluate the effectiveness of our internal control over

financial reporting.

A

material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is

a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented

or detected on a timely basis. Based on such evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of

December 31, 2023, our internal controls over financial reporting were not effective.

As

a result of our evaluation, we identified a material weakness in our controls related to segregation of duties and other immaterial weaknesses

in several areas of data management and documentation.

Our

management is composed of a small number of professionals resulting in a situation where limitations on segregation of duties exist.

Accordingly, and as a result of the material weakness identified above, we have concluded that the control deficiencies result in a reasonable

possibility that a material misstatement of the annual or interim financial statements may not be prevented on a timely basis by the

Company’s internal controls. We continue to employ and refine a structure in which critical accounting policies, issues and estimates

are identified, and together with other complex areas, are subject to multiple reviews by executives. In addition, we evaluate and assess

our internal controls and procedures regarding our financial reporting, utilizing standards incorporating applicable portions of the

Public Company Accounting Oversight Board’s 2009 Guidance for Smaller Public Companies in Auditing Internal Controls Over Financial

Reporting as necessary on an on-going basis.

While

the material weakness set forth above was the result of the scale of the Company’s operations and is intrinsic to its small size,

the Company believes the risk of material misstatements relative to financial reporting are minimal.

This

annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial

reporting. Management’s report was not subject to attestation by its registered public accounting firm pursuant to the Dodd-Frank

Wall Street Reform and Consumer Protection Act, which permits the Company to provide only management’s report in this annual report.

Changes

in Internal Control Over Financial Reporting

Except

as noted above, there were no changes in our internal control over financial reporting that occurred during the year ended December 31,

2023 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM

15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

The

financial statement schedules and exhibits filed as part of this Amendment are as follows:

(a)(3)

Exhibits

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Boris Molchadsky |

|

Chairman

of the Board, Director |

|

May

17, 2024 |

| Boris

Molchadsky |

|

|

|

|

| |

|

|

|

|

| /s/

Adi Shemer |

|

Chief

Executive Officer |

|

|

| Adi

Shemer |

|

(Principal

Executive Officer) |

|

May

17, 2024 |

| |

|

|

|

|

| /s/

Asaf Porat |

|

Chief

Financial Officer |

|

May

17, 2024 |

| Asaf

Porat |

|

(Principal

Financial and Accounting Officer), Director |

|

|

| |

|

|

|

|

| /s/

Ron Mekler |

|

Director |

|

May

17, 2024 |

| Ron

Mekler |

|

|

|

|

Exhibit

31.1

AppYea,

Inc.

Certification

Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I,

Adi Shemer, certify that:

1.

I have reviewed this annual report on Form 10-K/A of AppYea, Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared;

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles;

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

5.

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial

reporting, to the registrant’s auditors and the registrant’s Board of Directors (or persons performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting.

| By: |

/s/

Adi Shemer |

|

| |

Adi

Shemer, Chief Executive Officer

(Principal

Executive Officer) |

|

| |

|

|

| Date:

May 17, 2024 |

|

Exhibit

31.2

AppYea,

Inc.

Certification

Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I,

Asaf Porat, certify that:

1.

I have reviewed this annual report on Form 10-K/A of AppYea, Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report;

4.

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act

Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared;

(b)

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles;

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d)

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

5.

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial

reporting, to the registrant’s auditors and the registrant’s Board of Directors (or persons performing the equivalent functions):

(a)

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and

(b)

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting.

| By: |

/s/

Asaf Porat |

|

| |

Asaf

Porat, Chief Financial Officer

(Principal

Financial and Principal Accounting Officer) |

|

| |

|

|

| Date:

May 17, 2024 |

|

Exhibit

32.1

ERTIFICATION

OF CHIEF EXECUTIVE OFFICER

PURSUANT

TO 18 U.S.C. SECTION 1350,

AS

ADOPTED PURSUANT TO

SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

I,

Adi Shemer, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that the

annual report of AppYea, Inc. on Form 10-K/A for the year ended December 31, 2023 fully complies with the requirements of Section 13(a)

or 15(d) of the Securities Exchange Act of 1934 and that information contained in such annual report on Form 10-K fairly presents in

all material respects the financial condition and results of operations of AppYea, Inc. as of and for the year ended December 31, 2023.

This written statement is being furnished to the Securities and Exchange Commission as an exhibit accompanying such annual report and

shall not be deemed filed pursuant to the Securities Exchange Act of 1934.

| By: |

/s/

Adi Shemer |

|

| |

Adi

Shemer, Chief Executive Officer

(Principal

Executive Officer) |

|

| |

|

|

| Date:

May 17, 2024 |

|

Exhibit

32.2

CERTIFICATION

OF CHIEF FINANCIAL OFFICER

PURSUANT

TO 18 U.S.C. SECTION 1350,

AS

ADOPTED PURSUANT TO

SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

I,

Asaf Porat, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that the

annual report of AppYea, Inc. on Form 10-K/A for the year ended December 31, 2023 fully complies with the requirements of Section 13(a)

or 15(d) of the Securities Exchange Act of 1934 and that information contained in such annual report on Form 10-K fairly presents in

all material respects the financial condition and results of operations of AppYea, Inc. as of and for the year ended December 31, 2023.

This written statement is being furnished to the Securities and Exchange Commission as an exhibit accompanying such annual report and

shall not be deemed filed pursuant to the Securities Exchange Act of 1934.

| By: |

/s/

Asaf Porat |

|

| |

Asaf

Porat, Chief Financial Officer

(Principal

Financial and Principal Accounting Officer) |

|

| |

|

|

| Date:

May 17, 2024 |

|

v3.24.1.1.u2

Cover - USD ($)

|

12 Months Ended |

|

|

Dec. 31, 2023 |

Mar. 31, 2024 |

Jun. 30, 2023 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

We

are filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to our annual report on Form 10-K for the fiscal year ended

December 31, 2023 (the “Original Filing” or “Form 10-K”), which was originally filed with the Securities and

Exchange Commission (the “SEC”) on April 1, 2024, to amend in its entirety Item 9A: CONTROLS AND PROCEDURES of Part II of

the Original Filing.

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Dec. 31, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity File Number |

000-55403

|

|

|

| Entity Registrant Name |

APPYEA,

INC.

|

|

|

| Entity Central Index Key |

0001568969

|

|

|

| Entity Tax Identification Number |

46-1496846

|

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

|

| Entity Address, Address Line One |

16

Natan Alterman St

|

|

|

| Entity Address, City or Town |

Gan Yavne

|

|

|

| Entity Address, Country |

IL

|

|

|

| City Area Code |

(800)

|

|

|

| Local Phone Number |

674-3561

|

|

|

| Title of 12(g) Security |

Common

Stock, $0.0001 per share

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 643,483

|

| Entity Common Stock, Shares Outstanding |

|

416,697,257

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Name |

BARZILY

AND CO., CPA’s

|

|

|

| Auditor Location |

Jerusalem, Israel

|

|

|

| Auditor Firm ID |

2015

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

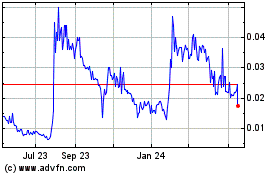

Appyea (QB) (USOTC:APYP)

Historical Stock Chart

From Dec 2024 to Jan 2025

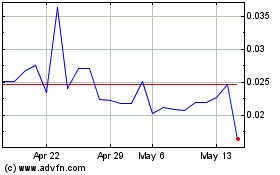

Appyea (QB) (USOTC:APYP)

Historical Stock Chart

From Jan 2024 to Jan 2025