false

0001566243

0001566243

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): February 12, 2025

ARAX

HOLDINGS CORP.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

333-185928 |

|

99-0376721 |

| (State or other

jurisdiction of incorporation or organization) |

|

(Commission File

Number) |

|

(IRS employer

identification no.) |

820

E Park Ave, Bld. F Ste. 100

Tallahassee, Florida |

|

32301 |

| (Address of principal

executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code:

850

254 1161

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| None |

|

|

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant

under any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure

Arax

Holdings Corp. (“Registrant”) issued a press release today, a copy of which is attached to this current report as

Exhibit 99.1

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

Arax Holdings Corp. |

| |

|

|

| Dated: February

12, 2025 |

By: |

/s/

Christopher D. Strachan |

| |

|

Christopher D.

Strachan |

| |

|

Chief Financial

Officer |

Exhibit

99.1

Arax

Holdings Corp.

The

Next Evolution of Ping Exchange

ARAX

Holdings Corp. Announces the Next Evolution of Ping Exchange: The Most Compliant Digital Asset Trading Platform in the World

Unrivaled

Compliance, Seamless Transactions, and the Future of Digital Identity Management

New

York, February 12, 2025, ARAX Holdings Corp. proudly announces a groundbreaking technological milestone in its Ping Exchange

Software Platform, positioning it as the world’s most compliant, secure, and advanced digital asset trading platform. This

latest update integrates cutting-edge compliance mechanisms, the AML 6 Directive, FATF Travel Rule regulations, and the seamless

integration of digital identity management through CorePass.

With

these innovations, the Ping Exchange Software Platform is redefining regulatory standards in DeFi and centralized exchange trading,

ensuring an unmatched level of security and transparency using blockchain technology as the singular source of trust.

Key

Technical Advancements in Ping Exchange Software

Frontend

Enhancements: A Seamless, User-Centric Experience

| ● | Full

On-Ramp & Off-Ramp Flow: Users can now transition between fiat and crypto effortlessly,

with a streamlined, fully integrated UI experience. |

| ● | Verified

Wallets for Major Assets: BTC, ETH, and LTC now feature enhanced ownership verification,

including QR-code signing and secure address validation. |

| ● | Address

Book Security & Functionality: Integrated Verified Wallets, ensuring enhanced security

and compliance while improving ease of access. |

| ● | Enhanced

Order Book & Swap Execution: Real-time conversion rates, a hover mechanism for better

navigation, and aggregated popovers for improved interaction. |

Backend

Advancements: Unmatched Compliance & Security

| ● | FATF

& AML 6 Compliance: Adhering to global financial security standards, making Ping

Exchange one of the most legally compliant platforms in the world. |

| ● | Advanced

Price Stability: TWAP (Time-Weighted Average Price) & VWAP (Volume-Weighted

Average Price) algorithms provide accurate market pricing and reduce manipulation risks. |

| ● | Integrated

MoonPay for Fiat-to-Crypto Transactions: Enabling a frictionless fiat on-ramp, enhancing

global user accessibility. |

| ● | LTC

Ownership Verification via PDF Declaration: Introducing a secure, document-based ownership

verification method, raising industry standards for security and transparency. |

CorePass:

Digital Identity & Attribute Management at the Core

A

pivotal component of this evolution is the CorePass Digital Identity framework, which seamlessly links user identity with digital

attributes, providing unprecedented security, regulatory compliance, and trust.

“This

is more than just a technology update; it is the foundation for secure, regulated digital asset trading. ARAX, through Ping Exchange

and CorePass, is setting a new global standard for compliance, security, and seamless user experience. We are not just building

an exchange; we are building the infrastructure for the future of decentralized and trade finance.”

— Ockert Loubser, COO, ARAX Holdings

Why

This Matters: The Future of DeFi and TradeFi Compliance

With

regulatory scrutiny increasing worldwide, the Ping Exchange Software Platform is now the most compliant exchange available, seamlessly

integrating AML, KYC, and FATF guidelines into an intuitive, high-performance digital trading experience. This revolutionary integration

is a game-changer for institutional and retail investors alike, bridging the gap between traditional finance, trade finance, and decentralized

finance (DeFi).

Introducing the Carbon Credit Exchange, Settlement, and Offsetting Platform coming later in 2025

ARAX’s

Ping Exchange Software Platform is actively enhancing its offerings by developing a state-of-the-art platform for Carbon Credit

Exchange, Settlement, and Offsetting. This groundbreaking solution revolutionizes the trading and management of verified mandatory

and voluntary carbon credits, along with carbon credit certificates. It facilitates seamless, compliant settlement of carbon credit digital

assets while promoting greater environmental accountability.

The

platform will empower both enterprises and individuals to actively participate in the carbon credit market. Notably, ARAX is developing

specialized solutions for the logistics, transport, and e-commerce sectors. These integrations will allow businesses to seamlessly

incorporate carbon offsetting into their operations.

Stay

tuned for more updates, with additional developments expected in 2025 as we approach the EURO 7 regulatory deadlines.

“The

transition to a global carbon-conscious economy requires innovative financial solutions that bridge compliance, transparency,

and accessibility. With our Carbon Credit Exchange and Offsetting Platform to be released later this year, ARAX is pioneering

a scalable, blockchain-driven infrastructure that enables seamless carbon credit transactions for businesses and individuals alike.

This is not just about trading; it’s about creating a verifiable path toward a more sustainable future.” –

Michael Loubser, CEO, ARAX Holdings.

Join

the Future of Secure Digital Trading

ARAX

Holdings Corp. continues to push the boundaries of blockchain innovation, regulatory compliance, and financial security. The latest

advancements in its Ping Exchange, CorePass, and the Core Ecosystem Software Platforms position ARAX as the global leader

in compliant and decentralized financial trading. Additionally, with the integration of the Carbon Credit Exchange, Settlement,

and Offsetting Platform, ARAX is pioneering sustainability-driven financial solutions, providing a seamless way for businesses

and individuals to participate in the Defi, Trade Finance, and digital asset settlement markets.

Explore

white-label solutions for Ping Exchange Software, DeFi platforms, and digital asset settlement systems, including support for

assets like carbon credit certificates. Contact us at contact@arax.cc to learn more.

Safe

Harbor Statement Under the Private Securities Litigation Reform Act of 1995

Certain statements contained in this report may be construed as “forward-looking statements” as defined in the Private

Securities Litigation Reform Act of 1995 (the “Act”). All statements that are not historical facts are “forward-looking

statements.” The words “estimate,” “project,” “intends,” “expects,” “anticipates,”

“believes” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements

are made based on management’s beliefs, as well as assumptions made by, and information currently available to, management

pursuant to the “safe harbor” provisions of the Act. These statements are subject to certain risks and uncertainties

that may cause actual results to differ materially from those projected on the basis of these statements. Investors should consider

this cautionary statement and furthermore, no assurance can be made that the transaction described in this Report will be consummated.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The

Company also undertakes no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances

after the date made or to reflect the occurrence of unanticipated events.

Press

Contact:

ARAX Holdings Corp.

Email Address: investor@ara.cc

Phone Number: +1 (850) 254 1161

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

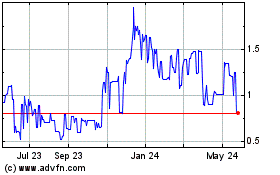

Arax (CE) (USOTC:ARAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

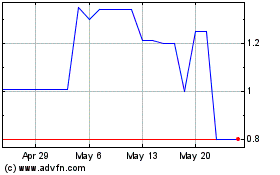

Arax (CE) (USOTC:ARAT)

Historical Stock Chart

From Feb 2024 to Feb 2025