The FTSE 100 on Thursday closed up 0.3% despite the European

Central Bank raising interest rates, says Chris Beauchamp, chief

market analyst at online trading platform IG. The ECB has put

investors on notice that the new policy of sharp interest-rate

hikes is here to stay for a while, Beauchamp says. The FTSE 100's

top risers were Antofagasta PLC, Pershing Square Holdings Ltd. and

Standard Chartered PLC, while the session's top fallers were

Melrose Industries PLC, Associated British Foods PLC and B&M

European Value Retail SA.

FTSE 100 Gains Ahead of European Central Bank Decision

0828 GMT - The FTSE 100 Index gains 0.3%, or 21 points to 7259

as oil, mining and financial stocks rise ahead of the European

Central Bank's rate-setting decision at 1215 GMT. BHP, Antofagasta

and Rio Tinto advance as metal prices mostly increase, while BP and

Shell climb as Brent crude advances 0.4% to $88.36 a barrel. Banks

and insurers also gain amid speculation that the ECB will boost

eurozone interest rates by 75 basis points. Still, Primark owner

Associated British Foods drops 7% and rivals fall after ABF said it

now expected Primark's profit margin for next year to be lower than

the operating profit margin of 8.0% forecast for the second half of

this financial year, which ends on Sept. 17.

(philip.waller@wsj.com)

Companies News:

Thoma Bravo Doesn't Plan to Make an Offer for Darktrace

Thoma Bravo LLC said Thursday that it doesn't plan to make a

formal offer for Darktrace PLC, without providing any explanation

as to why.

---

DCC To Buy Medi-Globe Technologies

DCC said Thursday that its healthcare division has agreed to

acquire the medical devices business Medi-Globe Technologies

GmbH.

---

Darktrace Swung to FY 2022 Pretax Profit, Revenue Rose on

Growth

Darktrace PLC said Thursday that it swung to a pretax profit for

fiscal 2022 on increased revenue as it saw a rise in customer

numbers.

---

Associated British Foods Sees FY 2022 Adjusted Profit Rising on

Sales Growth

Associated British Foods PLC said Thursday that its fiscal 2022

adjusted operating profit and adjusted earnings per share are

expected to surpass the previous year's on strong sales growth, and

that it anticipates rising sales, but declining profit, in fiscal

2023.

---

Vistry 1H Pretax Profit Slipped on Cladding Costs; Backs FY 2022

Profit View

Vistry Group PLC said Thursday that pretax profit slipped for

the first half of 2022 on exceptional costs related to building

safety remediation, though revenue rose and it backed its full year

expectations.

---

Melrose Industries 1H Pretax Loss Widened, Missed Forecast; To

Demerge Two Businesses

Melrose Industries PLC said Thursday that its first-half pretax

loss widened and missed a forecast after it booked higher costs,

and that it intends to separate the GKN automotive and GKN powder

metallurgy businesses via a demerger.

---

Funding Circle 1H Pretax Profit Fell, Cuts 2H Income Outlook

Funding Circle Holdings PLC said Thursday that pretax profit

sharply fell in the first half 2022 and downgraded its income

outlook for the second half, citing macro uncertainties.

---

Restaurant Group 1H Pretax Loss Narrowed as Revenue

Increased

Restaurant Group PLC said Thursday that its pretax loss for the

first half of 2022 narrowed as revenue rose significantly.

---

Warpaint London Raises 2022 Views on Strong Performance

Warpaint London PLC said Thursday that strong first-half trading

has continued into the second half of 2022 and it now expects

full-year results to be ahead of market expectations.

---

National Express Names Helen Weir as Next Chairwoman, James

Stamp as Interim CFO

National Express Group PLC said Thursday that Helen Weir will be

its next chairwoman, replacing current chairman John Armitt, and

that James Stamp will be appointed interim chief financial officer

on Nov. 1.

Market Talk:

Darktrace Hit by Thoma Bravo Talks Ending

0905 GMT - Thoma Bravo's decision not to make a bid for

Darktrace is clearly an outcome that will weigh on the U.K.

cybersecurity company as the bidder is a reasonably well-respected

enterprise software investor, Davy Research's David Reynolds and

Alex Short say in a research note. Darktrace's full-year results

were solid, but a revenue recognition issue that took around $3.8

million in fiscal 2022 revenue into the prior year is probably not

a positive in terms of investor confidence, Reynolds and Short say.

This is though perhaps trivial when compared with the talks ending,

they add. Shares are down 30% at 358.00 pence.

(kyle.morris@dowjones.com)

Vistry's 1H Sparks Cheer, But Market Clouds Gather

0904 GMT - Vistry Group rises 1% and other U.K. house builders

gain after the company formerly known as Bovis Homes reported

higher first-half adjusted pretax profit and backed its full-year

expectations. Still, news elsewhere in the sector were more

downbeat, with a Royal Institution of Chartered Surveyors market

survey showing a balance of 53 respondents reporting higher house

prices in August, down from 62 in July and representing the weakest

reading since January 2021, Interactive Investor says. "Fears of an

upcoming recession, spiraling inflation, rising interest rates and

the cost-of-living crisis are starting to impact the housing

market, with buyers and sellers potentially holding off amid the

uncertainty," Interactive head of investment Victoria Scholar says

in a note. (philip.waller@wsj.com)

GSK's Uncertainty Overhangs Are Persisting

0900 GMT - GSK shares reflect the worst-case scenario around the

litigation over Zantac, a recalled heartburn drug, Jefferies

analysts say in a note. That scenario, however, can't be excluded

as unreasonable, and the company's uncertainty overhang is

persisting, perhaps until the second half of 2023, they say as they

downgrade the stock to hold from buy. If a settlement is reached

over Zantac, plaintiffs would negotiate between themselves to agree

the proportion owed by each company involved in the case, and GSK

is likely to be the most exposed company, the analysts say. The

British major's share of the settlement might reach 30% or 50%,

according to Jefferies. (cecilia.butini@wsj.com)

Melrose Business Demerger Will Deliver Significant Upside

0835 GMT - Melrose Industries demerging its automotive and

powder metallurgy businesses will allow both independent groups to

benefit from a simpler, focused structure and deliver significant

upside in both revenue and margins, J.P. Morgan Cazenove analysts

Andrew Wilson and Chitrita Sinha say in a note. The turnaround

specialist's timing is appropriate, allowing for suitable capital

structures for both groups, while a restructuring of the automotive

business is already complete, they say. "The rationale is clear;

Melrose Group will be able to actively pursue its 'Buy, Improve,

Sell' model in Aerospace or broader industrial opportunities, while

Automotive Group will be able to take advantages of auto-specific

opportunities, potentially acting as a consolidator in the

industry," the analysts say.

(anthony.orunagoriainoff@dowjones.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

September 08, 2022 12:09 ET (16:09 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

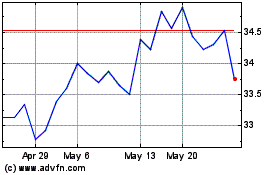

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

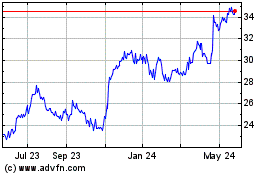

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jan 2024 to Jan 2025