true

--03-31

2024

FY

false

false

0001740797

0001740797

2023-04-01

2024-03-31

0001740797

2024-03-31

0001740797

2024-07-03

0001740797

2023-03-31

0001740797

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001740797

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001740797

2022-04-01

2023-03-31

0001740797

us-gaap:CommonStockMember

2022-03-31

0001740797

us-gaap:PreferredStockMember

2022-03-31

0001740797

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001740797

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001740797

us-gaap:RetainedEarningsMember

2022-03-31

0001740797

2022-03-31

0001740797

us-gaap:CommonStockMember

2023-03-31

0001740797

us-gaap:PreferredStockMember

2023-03-31

0001740797

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001740797

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001740797

us-gaap:RetainedEarningsMember

2023-03-31

0001740797

us-gaap:CommonStockMember

2022-04-01

2023-03-31

0001740797

us-gaap:PreferredStockMember

2022-04-01

2023-03-31

0001740797

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2023-03-31

0001740797

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2023-03-31

0001740797

us-gaap:RetainedEarningsMember

2022-04-01

2023-03-31

0001740797

us-gaap:CommonStockMember

2023-04-01

2024-03-31

0001740797

us-gaap:PreferredStockMember

2023-04-01

2024-03-31

0001740797

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2024-03-31

0001740797

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2024-03-31

0001740797

us-gaap:RetainedEarningsMember

2023-04-01

2024-03-31

0001740797

us-gaap:CommonStockMember

2024-03-31

0001740797

us-gaap:PreferredStockMember

2024-03-31

0001740797

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001740797

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001740797

us-gaap:RetainedEarningsMember

2024-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

[X] Annual Report pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the fiscal year ended March 31, 2024

[ ] Transition Report pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to __________

Commission file number: 333-225433

|

AVANT TECHNOLOGIES

INC.

|

| f/k/a

TREND INNOVATIONS HOLDING INC.) |

| (Exact name of small business issuer as specified in its charter) |

| |

|

|

| |

NV |

7370 |

38-4053064 |

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial

Classification Number)

|

(IRS Employer

Identification Number) |

|

| |

c/o Eastbiz.com, Inc

5348

Vegas Drive, Las Vegas, NV 89108

(Address of principal executive

offices and Zip Code)

(866) 533-0065

(Registrant’s telephone number, including area

code)

info@avanttechnologies.com

(Registrant’s email)

| Securities registered under Section 12(b) of the Exchange Act: |

| |

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

AVAI |

|

OTC Markets |

| |

|

|

|

|

| Securities registered under Section 12(g) of the Exchange Act: |

| None |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

[X] No [ ]

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act:

| |

|

|

|

| Large accelerated Filer |

[ ] |

Accelerated Filer |

[ ] |

| Non-accelerated Filer |

[X] |

Smaller reporting company |

[X] |

| (Do not check if a smaller reporting company) |

Emerging growth company |

[ ] |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of March 31, 2024, the market value of our common

stock held by non-affiliates was approximately $115,996,227 which is computed based upon the closing price on that date of the Common

Stock of the registrant on the OTC QB maintained by OTC Markets Group Inc. of $0.99. For purposes of this response, the registrant has

assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

State the number of shares outstanding of each of

the issuer's classes of common equity, as of the latest practicable date: 117,017,906 common shares issued and outstanding as of

July 3, 2024.

Documents incorporated by reference: None

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form

10-K (this “Amendment”) amends the Annual Report on Form 10-K of Avant Technologies Inc. (the “Company,” “we,”

and “our”) for the Annual ended March 31, 2024, which was originally filed with the Securities and Exchange Commission on

July 3, 2024 (the “Original Filing”).

The Company is filing this Amendment, Form

10-K/A for the purposes of correcting unintentional errors, including revisions to the dates in the Report of Independent Registered

Public Accounting Firm on page 24 and updated to the Section 302 certifications, include Exhibit 31.1, the Certification of the

Chief Executive Officer, and Exhibit 31.2, the Certification of the Chief Financial Officer, reflecting the correct titles and names

for the Chief Executive Officer and Chief Financial Officer. The previous filing mistakenly identified Vitalis Racius as the

Chief Executive Officer, and the certifying individuals’ titles have been revised to exclude titles, in compliance with Item

601(b)(31) of Regulation S-K and Rule 13a-14(a).

Except as described above or as otherwise expressly

provided by the terms of this Amendment, no other changes have been made to the Original Filing. Except as otherwise indicated herein,

this Amendment continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein

to reflect any events that occurred subsequent to the date of the Original Filing.

TABLE OF CONTENTS

| |

|

|

| |

|

Page |

| |

|

|

| PART I |

|

|

| |

|

|

| Item 1. |

Description of Business. |

5 |

| Item 1A. |

Risk Factors. |

8 |

| Item 1B. |

Unresolved Staff Comments. |

12 |

| Item 1C. |

Cybersecurity. |

12 |

| Item 2 |

Properties. |

13 |

| Item 3. |

Legal proceedings. |

13 |

| Item 4. |

Mine Safety Disclosures. |

13 |

| |

|

|

| PART II |

|

|

| |

|

|

| Item 5. |

Market for Common Equity and Related Stockholder Matters. |

13 |

| Item 6. |

Selected Financial Data. |

16 |

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

17 |

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk. |

22 |

| Item 8. |

Financial Statements and Supplementary Data. |

22 |

| Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure. |

47 |

| Item 9A |

Controls and Procedures. |

47 |

| Item 9B. |

Other Information. |

48 |

| Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

48 |

| |

|

|

| PART III |

|

|

| |

|

|

| Item 10 |

Directors, Executive Officers, Promoters and Control Persons of the Company. |

48 |

| Item 11. |

Executive Compensation. |

54 |

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

55 |

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

55 |

| Item 14. |

Principal Accounting Fees and Services. |

57 |

| |

|

|

| PART IV |

|

|

| |

|

|

| Item 15. |

Exhibits |

57 |

| |

|

|

| Signatures |

58 |

3

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

In this annual report, references to “AVANT”

“AVAI” “TREND”, “TREN”, or “the Company,” or “we,” or “us,” and

“our” refer to AVANT TECHNOLOGIES INC. (formerly TREND INNOVATIONS HOLDING INC.). Except for the historical information contained

herein, some of the statements in this report contain forward-looking statements that involve risks and uncertainties. These statements

are found in the sections entitled “Business,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk.” They include statements concerning:

our business strategy; expectations of market and customer response; liquidity and capital expenditures; future sources of revenues; expansion

of our proposed product line; and trends in industry activity generally. In some cases, you can identify forward-looking statements by

words such as “may,” “will,” “should,” “expect,” “plan,” “could,”

“anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,”

“goal,” or “continue” or similar terminology. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, including, but not limited to, the risks outlined under “Risk Factors,” that may cause

our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future

results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. For example, assumptions

that could cause actual results to vary materially from future results include, but are not limited to our ability to successfully develop

and market our products to customers; our ability to generate customer demand for our products in our target markets; the development

of our target markets and market opportunities; our ability to manufacture suitable products at a competitive cost; market pricing for

our products and for competing products; the extent of increasing competition; technological developments in our target markets and the

development of alternate, competing technologies in them; and sales of shares by existing shareholders. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any

forward-looking statements.

Below

is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address

all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary,

as well as other risks and uncertainties that we face, can be found under ‘Risk Factors’ in Part I, Item 1A of this Annual

Report on Form 10-K. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties.

You should consider carefully the risks and uncertainties described under ‘Risk Factors’ in Part I, Item 1A of this Annual

Report on Form 10-K as part of your evaluation of an investment in our securities.

| |

- |

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| |

- |

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance. |

| |

- |

The COVID-19 outbreak caused disruptions in our development operations, which have resulted in delays in existing projects and may have additional negative impacts on our operations. |

| |

- |

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward. |

| |

- |

We have not generated positive cash flow from operations and our ability to generate positive cash flow is uncertain. If we are unable to generate positive cash flow or obtain sufficient capital when needed, our business and future prospects will be adversely affected and we could be forced to suspend or discontinue operations. |

| |

- |

We will require additional capital to support business growth and this capital might not be available on acceptable terms, if at all. |

| |

- |

We depend upon key personnel and need additional personnel. |

| |

- |

Our business requires substantial capital and if we are unable to maintain adequate cash flows from operations our profitability and financial condition will suffer and jeopardize our ability to continue operations. |

4

| |

- |

There is currently a limited public market for our common stock. Failure to further develop or maintain a trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your stock. |

| |

- |

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock. |

| |

- |

Because we are quoted on the OTC QB marketplace instead of a national securities exchange, our investors may experience significant volatility in the market price of our stock and have difficulty selling their shares. |

| |

- |

Our stock price and trading volume may be volatile, which could result in substantial losses for our stockholders. |

| |

- |

We have not paid dividends in the past and have no immediate plans to pay cash dividends. |

| |

- |

Shares eligible for future sale may adversely affect the market for our Common Stock. |

| |

- |

You may experience future dilution as a result of future equity offerings. |

| |

- |

Our charter documents and Nevada law may inhibit a takeover that stockholders consider favorable. |

| |

- |

There are limitations on director/officer liability. |

| |

- |

Penny stock regulations may impose certain restrictions on marketability of our securities. |

| |

- |

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock. |

PART I

Item 1. Description of Business

Overview

Avant Technologies Inc. (formerly

Trend Innovations Holding Inc.) is a technology company specializing in acquiring, creating, and developing innovative and advanced technologies

utilizing artificial intelligence (AI) as well as providing a host of information technology consulting services. The Company considers

itself a native expert in the field of information technology based on artificial intelligence. Recently, the Company acquired Avant!

AI and InstantFAME as well as the assets of Wired4Health, Inc., pertaining to certain technology

assets providing full-stack software development, database management, data integration, project management and cloud services resources.

Utilize its latest assets acquisitions, Avant mission is to provide innovative and effective AI solutions that transform

businesses and positively impact society. Avant strive to push the boundaries of AI technology and empower organizations to achieve their

full potential. We believe that our technology can provide a self-sustained system that prepares its data from unlabeled information

(Unsupervised Clustering), and then analyzes it using various, proprietary, supervised learning techniques, Improved data efficiency:

Unsupervised learning pre-processes and extracts meaningful features from raw or unlabeled data, preparing them as inputs for the supervised

learning model. This improves data efficiency and preparations. Our technology deployed over the acquired assets (in sum or as a

whole) potentially provides True Learning from Experience - Unsupervised learning is utilized to learn relevant information from many

source domains. This knowledge is then evaluated and applied to a related or different domain(s), where information might be in short

supply. This feature is a true learning capability. Avant! can leverage the knowledge learned from the source domain to improve performance

in the other domains, as well as Factual discovery/conclusion by learning data - Avant! Unsupervised learning techniques, like clustering,

help identify groups or patterns in the data, reaching conclusions. Then its supervised learning mechanism can create new

datasets (information), which are used for further domains, improving classification and regression tasks. This feature is a true

reasoning mechanism.

Until the above acquisitions,

the Company's "Thy News" application was one of the Company's key projects. Thy News is a worldwide application used for processing

news from multiple sources. Thy News was created for users who value their time but want to keep up with the latest in world news. The

app offers the user the opportunity to create their own news feeds solely from those sources that are of interest to them, as well as

creating additional news feeds segmented by topic.

5

In summer 2018, the Company started operations with

development of a trading platform for users who cook at home and want to sell their food on the Internet and home-cooked food lovers.

On June 28, 2019, the Company acquired Thy News LLC,

an owner of a news application with feed from various sources that users can choose and customize. It is available for free download in

Apple AppStore and Google Play Market. Users also will be able to subscribe for additional paid features that extend the functionality

of the original app. At the moment of the first release, the app’s news database consisted of 24,000 processed news sources, and

as of December 31, 2019 this amount increased for more 75,000 processed sources to a total of 99,000 processed sources. From January 1,

2020 to September 30, 2023 the Company acquired additional 50,000 processed sources. As of March 31, 2024, the users of the app have an

opportunity to choose interesting and relevant news feeds from 149,000 processed sources.

On March 30, 2020, the Company acquired Itnia Co.

LLC, a Wyoming limited liability company, an owner of MB Lemalike Innovations. Itnia Co. LLC provides services in the field of IT consulting

using artificial intelligence technologies. Itnia Co. LLC, on behalf of Lemalike Innovations, provides IT consulting services including:

i) Project Management and Software Administration; ii) Financial and Asset Management for IT; iii) Service Management for IT; and iv)

Event Management for IT.

Recent Developments

On March 6, 2023, the Company filed a Certificate

of Amendment to its Articles of Incorporation, as amended, with the Secretary of State of the State of Nevada to increase the number of

authorized shares of the Company’s common stock from 255,000,000 to 520,000,000 shares (the “Charter Amendment”) of

which 500,000,000 shall be common stock, $0.001 par value per share, and 20,000,000 shall be blank check preferred stock, $0.001 par value

per share. The term "blank check" refers to preferred stock, the creation and issuance of which is authorized in advance by

the stockholders and the terms, rights and features of which are determined by the Board upon issuance. The authorization of such blank

check preferred stock would permit the Board to authorize and issue preferred stock from time to time in one or more series.

Acquiring Avant! AI Assets

On April 3, 2023, the Company, entered into an Asset

Purchase Agreement (“APA”) along with GBT Tokenize Corp. (“Seller”), which Seller developed and owns a proprietary

system and method named Avant-Ai, which is a text-generation, deep learning self-training model that is working based on an innovative,

unique concept which learns on its own and constantly enhances its information database with the advantage of unsupervised learning capabilities

(the “System”).

At closing, in consideration of acquiring the System,

the Company issued to the Seller 26,000,000 common shares of the Company (the “Shares”). The Shares will be restricted per

Rule 144 as promulgated under the Securities Act of 1933, as amended (the “1933 Act”) and Seller agreed to a lock-up period

of nine (9) months following closing (the “Lock Up Term”). In the event the Company is unable to up-list to Nasdaq either

through a business combination or otherwise prior to the expiration of the Lock Up Term, the Seller may request within three (3) business

days of the expiration of the Lock-Up Term, that all transactions contemplated by the APA be unwound.

In addition, the Company and Seller entered into a

license agreement regarding the System, granting the Seller a perpetual, irrevocable, non-exclusive, non-transferable license for using

the System enabling everyday users to have the experience of trading nft/crypto and become famous according to their artwork creations,

without actually performing an actual trade while monetizing on their artwork creations.

Acquiring Instant Fame Assets

On April 3, 2023, the Company, entered into an

Asset Purchase Agreement (“Treasure APA”) with Treasure Drive Ltd. (“TD”) pursuant to which the Company agreed

to acquire a technology portfolio including certain source codes and pending patent applications which have applications in a variety

of areas including creating systems and methods of facilitating digital rating and secured sales of digital works as well as core virtual

reality platforms known as digital auction systems, rating and secure sales via open bid auctions (“Instant Fame Assets”).

6

At closing, in consideration of the Instant Fame Assets,

the Company issued TD 5,000 shares of Series A Preferred Stock of the Company with a stated valued at $5,000 per share each (the “Preferred

Shares Series A”). The Preferred Shares Series A may be converted at the option of TD into the Company shares of common stock at

a conversion price equal to a 5% discount to the weighted average closing price during the five (5) days prior of such conversion, and

will include a 4.99% beneficial ownership limitation. The Preferred Shares Series A will have no voting rights and will be entitled to

a payment equal to the stated value of the Preferred Shares Series A in the event of the Company liquidation only. In the event the Company

is unable to up-list to Nasdaq either through a business combination or otherwise prior to the expiration of the Lock Up Term,

TD may request within three (3) business days of the expiration of the Lock-Up Term, that all transactions contemplated by the Treasure

APA be unwound.

In addition, the Company and Elentina Group,

LLC (“Elentina”) entered into a Service Agreements in which Elentina, was engaged to provide certain capital markets services

for a flat quarterly fee of $75,000 paid in shares of common stock (the “Elentina Common Stock”). The Elentina Common Stock

to be issued within five days of the first day of quarter during the term (ie January 1, April 1, July 1 and October 1). The Elentina

Common Stock shall be fully earned upon issuance. The number of shares of Elentina Common Stock to be issued will be determined by dividing

the quarterly fee of $75,000 by the Company’s ten (10) day VWAP, which shall at no point be less than $0.10 per share.

In connection with the offering, the Company filed

a Certificate of Designation to its Articles of Incorporation designating 5,000 shares of its Preferred Stock of Series A.

Acquiring Wired4Health Assets

On April 5, 2024, the Company, entered into an Asset

Purchase Agreement (“W4H APA”) with Wired4Health, Inc. (“Seller” or “W4H”), pertaining to certain

technology assets, providing full-stack software development, database management, data integration, project management and cloud services

resources. The assets being acquired include an agreement and amendments between W4H and Sentry Data Systems/Craneware, an agreement between

W4H and Respec, Inc., agreements between W4H and all of its employees and contractors assigned to Sentry Data Systems/Craneware and Respec,

Inc. customer accounts, Website and Internet Domain Name, Wired4Health.com and all of its content (the “Website“), and any

other rights associated with the Website, including, without limitation, any intellectual property rights, all related domains, logos,

customer lists and agreements, email lists, passwords, usernames and trade names, and all of the related social media accounts, if any,

and any other associated rights, etc. (the “W4H Assets”).

At closing, in consideration of acquiring the Assets,

the Company issued Seller an amortizing secured promissory note in the principal amount of $1,200,000 (“Secured Note”) of

the Company’s Series B Convertible Preferred Stock with a stated value of $1,000,000 (the “Preferred Stock”)

The Secured Note is payable by the Company to the

Seller in 24 equal monthly installments of principal and interest in the amount of $52,427.22 on the first day of each month, beginning

on the first day of the month following the closing of the transaction and continuing on the first day of each consecutive month thereafter

until the note is fully paid, but in no case less than two billing cycles of W4H activity. The Secured Note bears interest of five percent

(5%) per annum accrued monthly (0.42% per month on the outstanding principal balance).

The Preferred Stock Series B has an aggregate stated

value of $1,000,000, where the conversion price is equal to the lesser of $1.00 per share each, on a fully diluted basis, or the volume-weighted

average market price (VWAP) of the Company’s common stock as traded on the OTC Markets for the most recent 30 days prior to deal

closure (the “Conversion Price”). Conversion will include a 4.99% beneficial ownership limitation and a leak out agreement

allowing daily sales to not exceed 25% of the total daily volume.

The Secured Note is

secured by the Assets pursuant to the terms of a Security Agreement which, among other things, will authorize the Seller to file a UCC1

Financing Statement in the State of Nevada. As of the date hereof, the Company is obligated

on approximately $1,200,000 face amount of Secured Notes issued to the Seller. The Secured Note is a debt obligation arising other than

in the ordinary course of business which constitute a direct financial obligation of the Company. Effective May 7, 2024, in

connection with the offering, the Company filed a Certificate of Designation to its Articles of Incorporation designating 1,000,000 shares

of its preferred stock.

7

Employees Identification of Certain Significant

Employees.

The Company’s Board Members include: Natalija

Tunevic, Secretary; Ivan Lunegov, President & Director; Vitalis Racius, CFO, Director &Treasurer. Independent Contractors which

are not directors and members of the Board: William Hisey, CEO, Danny Rittman, CISO; Percy Kwong, Technology Advisor.

Government Regulation

We will be required to comply with all regulations,

rules, and directives of governmental authorities including the US Securities and Exchange Commission and agencies applicable to our business

in any jurisdiction with which we would conduct activities. We do not believe that governmental regulations will have a material impact

on the way we conduct our business.

Item 1A. Risk Factors

As a Smaller Reporting Company, the Company

is not required to include the disclosure under this Item 1A. Risk Factors. Despite the fact that we are not required to provide risk

factors, we consider the following factors to be risks to our continued growth and development:

WE HAVE A LIMITED OPERATING HISTORY IN AN EVOLVING

INDUSTRY, WHICH MAKES IT DIFFICULT TO EVALUATE OUR FUTURE PROSPECTS AND MAY INCREASE THE RISK THAT WE WILL NOT BE SUCCESSFUL.

We have a limited operating history in an evolving

industry that may not develop as expected. Assessing our business and future prospects is challenging in light of the risks and difficulties

we may encounter. These risks and difficulties include our ability to:

| |

- |

accurately forecast our revenues and plan our operating expenses; |

| |

- |

successfully expand our business; |

| |

- |

assimilate our acquisitions; |

| |

- |

adapt to rapidly evolving trends in the ways consumers and businesses interact with technology; |

| |

- |

avoid interruptions or disruptions in the offering of our products and our services; |

| |

- |

develop a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased usage, as well as the deployment of new features and products; |

| |

- |

hire, integrate and retain talented sales, customer service, technology and other personnel; and |

| |

- |

effectively manage rapid growth in personnel and operations; and |

| |

- |

global COVID-19 pandemic |

If the demand for our services and/or platforms/products

offered or our products under development are not finalized, our business will be harmed. We may not be able to successfully address these

risks and difficulties, which could harm our business and results of operations.

OUR LIMITED OPERATING HISTORY MAKES IT DIFFICULT

FOR US TO EVALUATE OUR FUTURE BUSINESS PROSPECTS AND MAKE DECISIONS BASED ON THOSE ESTIMATES OF OUR FUTURE PERFORMANCE.

We have a limited operating history and, as a

consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Reliance on the historical

results may not be representative of the results we will achieve. Because of the uncertainties related to our limited historical operations,

we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary

decisions as a result of unreliable historical data, we could be less profitable or continue to incur losses.

8

OUR RESULTS OF OPERATIONS HAVE NOT RESULTED IN

PROFITABILITY AND WE MAY NOT BE ABLE TO ACHIEVE PROFITABILITY GOING FORWARD

The Company does not accrue or capitalize development

costs (or any costs to this effect) and expense it to its profit and loss statements as required by US GAAP. As such, the Company incurred

a net loss of $2,128,475 for the year ended March 31, 2024 and net loss of $348,933 for the year ended March 31, 2023. If we incur additional

significant operating losses, our stock price,

may decline, perhaps significantly. Our management

is developing plans to alleviate the negative trends and conditions described above. Our business plan is speculative and unproven. There

is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan,

that we will be able to curtail our losses now or in the future. Further, as we are an emerging enterprise, we expect that net losses

will continue, and our working capital deficiency will increase.

WE HAVE NOT GENERATED POSITIVE CASH FLOW FROM OPERATIONS,

AND OUR ABILITY TO GENERATE POSITIVE CASH FLOW IS UNCERTAIN. IF WE ARE UNABLE TO GENERATE POSITIVE CASH FLOW OR OBTAIN SUFFICIENT CAPITAL

WHEN NEEDED, OUR BUSINESS AND FUTURE PROSPECTS WILL BE ADVERSELY AFFECTED AND WE COULD BE FORCED TO SUSPEND OR DISCONTINUE OPERATIONS.

Our operations have not generated positive cash flow

for any period since our inception, and we have funded our operations primarily through the issuance of common stock and short-term and

long-term debt and convertible debt. Our limited operating history makes an evaluation of our future prospects difficult. The actual amount

of funds that we will need to meet our operating needs will be determined by a number of factors, many of which are beyond our control.

These factors include the timing and volume of sales transactions, the success of our marketing strategy, market acceptance of our products,

the success of our manufacturing and research and development efforts (including any unanticipated delays), our manufacturing and labor

costs, the costs associated with obtaining and enforcing our intellectual property rights, regulatory changes, competition, technological

developments in the market, evolving industry standards and the amount of working capital investments we are required to make.

Our ability to continue to operate until we are able

to generate sufficient our cash flow from operations will depend on our ability to generate sufficient positive cash flow from our operations.

If we are unable to generate sufficient cash flow from our operations, our business and future prospects will be adversely affected and

we could be forced to suspend or discontinue operations.

The Company had a stockholders’ deficit of $1,466,566

and an accumulated deficit of $2,976,395 at March 31, 2024.

WE WILL REQUIRE ADDITIONAL CAPITAL TO SUPPORT BUSINESS

GROWTH, AND THIS CAPITAL MIGHT NOT BE AVAILABLE ON ACCEPTABLE TERMS, IF AT ALL.

We intend to continue to make investments to support

our business growth and we will require additional funds to respond to business challenges, including the need to develop new features

and products or enhance our existing products, improve our operating infrastructure or acquire complementary businesses and technologies.

Further, we need additional capital to continue operations. Accordingly, we need to engage in equity or debt financings to secure additional

funds. We expect that we have sufficient capital to maintain operations through the year of 2023/4. In order to fully implement our business

plan, we will need to raise about $10,000,000 If we raise additional funds through future issuances of equity or convertible debt securities,

our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and

privileges superior to those of holders of our common stock. Any debt financing that we secure in the future could involve restrictive

covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for

us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional

financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us

when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and

our business may be harmed.

WE DEPEND UPON KEY PERSONNEL AND NEED ADDITIONAL

PERSONNEL

Our success depends on our inability to attract and

retain key personnel including our existing personal, and our inability to do so may materially and adversely affect our business operations. The

loss of qualified personnel could have a material and adverse effect on our business operations. Additionally, the success of the Company’s

operations will largely depend upon its ability to successfully attract and maintain competent and qualified key management personnel.

As with any company with limited resources, there can be no guaranty that the Company will be able to attract such individuals or that

the presence of such individuals will necessarily translate into profitability for the Company.

9

OUR BUSINESS REQUIRES SUBSTANTIAL CAPITAL, AND

IF WE ARE UNABLE TO MAINTAIN ADEQUATE CASH FLOWS FROM OPERATIONS OUR PROFITABILITY AND FINANCIAL CONDITION WILL SUFFER AND JEOPARDIZE

OUR ABILITY TO CONTINUE OPERATIONS

We require substantial capital to support our operations. If we are unable

to generate adequate cash flows from our operations,

maintain adequate financing or other sources of capital

are not available, we could be forced to suspend, curtail or reduce our operations, which could harm our revenues, profitability, financial

condition and business prospects.

THERE IS CURRENTLY A LIMITED PUBLIC MARKET FOR

OUR COMMON STOCK. FAILURE TO FURTHER DEVELOP OR MAINTAIN A TRADING MARKET COULD NEGATIVELY AFFECT THE VALUE OF OUR COMMON STOCK AND MAKE

IT DIFFICULT OR IMPOSSIBLE FOR YOU TO SELL YOUR STOCK.

There is a limited public market for our Common Stock,

which is traded on the OTC QB under the symbol AVAI. We cannot give any assurances that there will ever be a mature, developed market

for our common stock. Failure to further develop or maintain an active trading market could negatively affect the value of our shares

and make it difficult for you to sell your shares or recover any part of your investment in us. Even if a market for our common stock

does develop in a material way, the market price of our common stock may be highly volatile. In addition to the uncertainties relating

to our future operating performance and the profitability of our operations, factors such as variations in our interim financial results,

or various, as yet unpredictable factors, many of which are beyond our control, may have a negative effect on the market price of our

common stock.

IF WE FAIL TO MAINTAIN

AN EFFECTIVE SYSTEM OF INTERNAL CONTROLS, WE MAY NOT BE ABLE TO ACCURATELY REPORT OUR FINANCIAL RESULTS OR PREVENT FRAUD. AS A RESULT,

CURRENT AND POTENTIAL STOCKHOLDERS COULD LOSE CONFIDENCE IN OUR FINANCIAL REPORTING, WHICH WOULD HARM OUR BUSINESS AND THE TRADING PRICE

OF OUR STOCK.

Effective internal controls

are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports

or prevent fraud, our brand and operating results could be harmed. We have in the past discovered, and may in the future discover, areas

of our internal controls that need improvement. For example, for the years ended March 31, 2024 and 2023, we reported that our disclosure

controls and procedures were not effective due to the lack of resources and the reliance on outside consultants. We intend to increase

management’s review of our financials. We cannot be certain that these measures will ensure that we implement and maintain adequate

controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties

encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Inferior

internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect

on the trading price of our stock.

Additional Risks Related to Our Common Stock

Because we are quoted on the OTC QB marketplace

instead of a national securities exchange, our investors may experience significant volatility in the market price of our stock and have

difficulty selling their shares.

Our Common Stock is currently quoted on the OTC Market

Group’s OTC QB marketplace under the ticker symbol “AVAI”. The OTC is a regulated quotation service that displays real-time

quotes and last sale prices in over-the-counter securities. Trading in shares quoted on the OTC QB is often thin and characterized by

volatility. This volatility may be caused by a variety of factors, including the lack of readily available price quotations, the absence

of consistent administrative supervision of bid and ask quotations, lower trading volume and market conditions. As a result, there may

be wide fluctuations in the market price of the shares of our Common Stock for reasons unrelated to operating performance, and this volatility,

when it occurs, may have a negative effect on the market price for our securities. Moreover, the OTC QB is not a stock exchange, and trading

of securities on this platform is more sporadic than the trading of securities listed on a national quotation system or stock exchange.

Accordingly, our stockholders may not be able to realize a fair price from their shares when they determine to sell them or may have to

hold them for a substantial period of time until the market for our Common Stock improves.

Our stock price and trading volume may be volatile,

which could result in substantial losses for our stockholders.

The equity trading markets may experience periods

of volatility, which could result in highly variable and unpredictable pricing of equity securities. The market price of our Common Stock

could change in ways that may or may not be related to our business, our industry or our operating performance and financial condition.

In addition, the trading volume in our Common Stock has been low and may fluctuate and cause significant price variations to occur. We

have experienced significant volatility in the price of our stock. In addition, the stock markets in general can experience considerable

price and volume fluctuations.

10

We have not paid dividends in the past and have

no immediate plans to pay cash dividends.

We plan to reinvest all of our earnings, to the extent

we have earnings, to develop and deliver our products and cover operating costs and to otherwise become and remain competitive. We do

not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure you that we would, at any

time, generate sufficient surplus cash that would be available for distribution to the holders of our Common Stock as a dividend. Therefore,

you should not expect to receive cash dividends on our Common Stock.

Shares eligible for future sale may adversely affect

the market for our Common Stock.

Of the 117,167,906 shares of our Common Stock outstanding

as of the date of this Annual Report, approximately 78,959,044 are restricted and 38,208,862shares are freely tradable without restriction

pursuant to Rule 144. Any substantial sale of our Common Stock pursuant to Rule 144 or pursuant to any resale prospectus may have a material

adverse effect on the market price of our Common Stock.

You may experience future dilution as a result

of future equity offerings.

To raise additional capital, we may in the future

offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices that may

not be the same as the price per share in this offering. We may sell shares or other securities in any future offering at a price per

share that is lower than the price per share paid by investors in this offering, which would result in those newly issued shares being

dilutive. In addition, investors purchasing shares or other securities in the future could have rights superior to existing stockholders,

which could impair the value of your shares. The price per share at which we sell additional shares of our Common Stock, or securities

convertible or exchangeable into shares of our Common Stock, in future transactions may be higher or lower than the price per share paid

by investors in this offering.

Our charter documents and Nevada law may inhibit

a takeover that stockholders consider favorable.

Provisions of our certificate of incorporation and

bylaws and applicable provisions of Nevada law may delay or discourage transactions involving an actual or potential change in control

or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares, or transactions

that our stockholders might otherwise deem to be in their best interests. The provisions in our certificate of incorporation and bylaws:

| |

- |

limit who may call stockholder meetings; |

| |

- |

do not provide for cumulative voting rights; and |

| |

- |

provide that all vacancies may be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum. |

There are limitations on director/officer liability.

As permitted by Nevada law, our certificate of incorporation

limits the liability of our directors for monetary damages for breach of a director’s fiduciary duty except for liability in certain

instances. As a result of our charter provision and Nevada law, shareholders may have limited rights to recover against directors for

breach of fiduciary duty. In addition, our certificate of incorporation provides that we shall indemnify our directors and officers to

the fullest extent permitted by law.

Penny stock regulations may impose certain restrictions on marketability

of our securities.

The SEC adopted regulations which generally define

a “penny stock” to be any equity security that has a market price of less than $5 per share or an exercise price of less than

$5 per share, subject to certain exceptions. A security listed on a national securities exchange is exempt from the definition of a penny

stock. Our Common Stock is not currently listed on a national security exchange. Our Common Stock is therefore subject to rules that impose

additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited

investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 together with their spouse).

For transactions covered by such rules, the broker-dealer must make a special suitability determination for the purchase of such securities

and have received the purchaser’s written consent to the transaction prior to the purchase.

11

Additionally, for any transaction involving a penny

stock, unless exempt, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating

to the penny stock market. The broker-dealer must also disclose the commission payable to both the broker-dealer and the registered representative,

current quotations for the securities and, if the broker-dealer is the sole market maker, the broker dealer must disclose this fact and

the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information

for the penny stock held in the account and information on the limited market in penny stocks. Broker-dealers must wait two business days

after providing buyers with disclosure materials regarding a security before effecting a transaction in such security. Consequently, the

“penny stock” rules restrict the ability of broker-dealers to sell our securities and affect the ability of investors to sell

our securities in the secondary market and the price at which such purchasers can sell any such securities, thereby affecting the liquidity

of the market for our Common Stock.

Stockholders should also be aware that, according

to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| |

- |

control of the market for the security by one or more broker-dealers that are often related to the promoter or issuer; |

| |

- |

manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| |

- |

“boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; |

| |

- |

excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| |

- |

the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

FINRA sales practice requirements may limit a stockholder’s

ability to buy and sell our stock.

The Financial Industry Regulatory Authority (referred

to as FINRA) has rules requiring that, in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing

that the investment is suitable for that customer. Prior to recommending speculative or low-priced securities to their non-institutional

customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status,

investment objectives and other information. Under interpretations of these rules, FINRA has indicated its belief that there is a high

probability that speculative or low-priced securities will not be suitable for at least some customers. If these FINRA requirements are

applicable to us or our securities, they may make it more difficult for broker-dealers to recommend that at least some of their customers

buy our Common Stock, which may limit the ability of our stockholders to buy and sell our common stock and could have an adverse effect

on the market for and price of our common stock.

Item 1B. Unresolved Staff Comments

As a Smaller Reporting Company, the Company is not

required to include the disclosure under this Item 1B. Unresolved Staff Comments. At this time, there are no unresolved staff comments.

Item 1C. Cybersecurity

Cybersecurity and Data Privacy Risks

We are subject to cybersecurity and data privacy risks. Cyberattacks and

security vulnerabilities could lead to increased costs, liability claims, or harm to our competitive position.

Cybersecurity Risks

Our operations and the operations of our and partners involve the storage,

transmission, and processing of third parties’ and our data, including personal, confidential, or proprietary information. This

data is subject to privacy and security laws, regulations, and customer-imposed controls. Cybercriminals use a variety of methods to exploit

potential vulnerabilities in our systems, products, and services. Sophisticated attacks could result in unauthorized access, loss, misuse,

disclosure, modification, or destruction of this data.

12

We are committed to protecting our third parties’ and our data. Despite

efforts, our systems, products, and services remain vulnerable to attacks.

Data Privacy

Data privacy issues are becoming increasingly significant due to the rapidly

changing legal and regulatory landscape. Compliance with global and local data privacy laws requires ongoing investment in our information

technology and employee training, and will continue to impact our business.

Governance and Oversight

We should have a formal risk management program that addresses cybersecurity

and data privacy risks. This program should include regular reporting to our senior management and Board of Directors, who provide oversight

and direction. We have not established an enterprise risk management framework to assess and prioritize these risks.

Incident Response

We maintain an incident response plan that includes policies and procedures

for notifying affected third parties and complying with applicable laws.

Investments in Cybersecurity

We will continually invest in our cybersecurity capabilities to protect

our assets and those of our third parties. This potentially will include investment in advanced threat detection, encryption, and other

security measures.

Recent Cybersecurity Incidents

During the last fiscal year, we did not experienced cybersecurity incidents.

Item 2. Description of Property

We do not own any real estate or other properties.

The Company rents a virtual office at c/o Eastbiz.com, Inc 5348 Vegas Drive, Las Vegas, NV 89108

Item 3. Legal Proceedings

From time to time, the Company may be involved in

various litigation matters, which arise in the ordinary course of business. There is currently no litigation that management believes

will have a material impact on the financial position of the Company.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Common Equity and Related Stockholder Matters

On March 6, 2023, the Company filed a Certificate

of Amendment to its Articles of Incorporation, as amended, with the Secretary of State of the State of Nevada to increase the number of

authorized shares of the Company’s common stock from 255,000,000 to 520,000,000 shares (the “Charter Amendment”) of

which 500,000,000 shall be common stock, $0.001 par value per share, and 20,000,000 shall be blank check preferred stock, $0.001 par value

per share. The term "blank check" refers to preferred stock, the creation and issuance of which is authorized in advance by

the stockholders and the terms, rights and features of which are determined by the Board upon issuance. The authorization of such blank

check preferred stock would permit the Board to authorize and issue preferred stock from time to time in one or more series.

13

Preferred Stock

The Company has 20,000,000 shares, $0.001 par value

of preferred stock authorized as of March 31, 2024. There were 10,000,000 shares of preferred stock issued and outstanding as of March

31, 2024.

Common Stock

The Company has 500,000,000 shares, $0.001 par value

of common stock as of March 31, 2024. There were 117,167,906 shares of common stock issued and outstanding as of March 31, 2024.

Warrants

No warrants were issued or outstanding as of March

31, 2024.

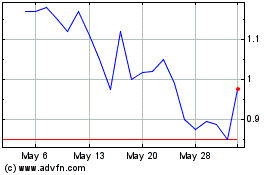

Market Information

The common shares of the Company are traded on OTC

QB Markets under the ticker symbol of AVAI.

Record Holders

The number of holders of record for our common stock

as of March 31, 2024 was 130.

Dividends

No cash dividends were paid on our shares of common

stock during the fiscal years ended March 31, 2024 and 2023.

Securities Authorized for Issuance Under Equity

Compensation Plans

We presently do not have equity compensation plans authorized.

Transfer agent change

The Company transfer agent is ClearTrust LLC with

a business address at 16540 Pointe Village Drive Suite 205

Lutz, Florida 3355850; ClearTrust LLC ’s website is www.cleartrustonline.com, and their phone number is (813) 235-4490.

Penny Stock

Our common stock is considered “penny stock”

under the rules of the SEC under the Securities Exchange Act of 1934. The SEC adopted rules that regulate broker-dealer practices in connection

with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5, other than securities registered

on certain national securities exchanges or quoted on the NASDAQ Stock Market System, provided that current price and volume information

with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer,

prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that:

| - |

contains a description of the nature and level of risks in the market for penny stocks in both public offerings and secondary trading; |

| - |

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| - |

contains a toll-free telephone number for inquiries on disciplinary actions; |

| |

|

| - |

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| - |

contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

14

The broker-dealer also must provide, prior to effecting any transaction

in a penny stock, the customer with:

| - |

bid and offer quotations for the penny stock; |

| - |

the compensation of the broker-dealer and its salesperson in the transaction; |

| - |

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the marker for such stock; and |

| - |

monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules that require that

prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgement of the receipt

of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably

statement.

These disclosure requirements may have the effect

of reducing the trading activity in the secondary market for our stock.

Recent Sales of Unregistered Securities

Preferred Stock

The Company has 20,000,000 shares, $0.001 par value

of preferred stock authorized as of March 31, 2024.

On November 21, 2023, the Company issued 3,000,000

shares of preferred stock in exchange for 3,000,000 shares of common stock.

On December 1, 2023, the Company issued 2,000,000

shares of preferred stock as bonuses to officers of the Company.

There were 10,000,000 shares of preferred stock issued

and outstanding as of March 31, 2024.

Preferred Stock Series A

The Company has 5,000 shares, $0.001 par value of

preferred stock series A authorized as of March 31, 2024.

In April 2023, the Company issued 5,000 shares of

preferred stock series A for InstantFAME acquisition.

On November 27, 2023, the Company converted 1,950

series A preferred stock shares into 26,973,528 shares of Common Stock.

There were 3,050 shares of preferred stock series

A issued and outstanding as of March 31, 2024.

Common Stock

The Company has 500,000,000 shares, $0.001 par value

of common stock as of March 31, 2024.

On April 25, 2023, the Company issued 26,000,000 common shares for Avant!

AI acquisition.

On June 1, 2023, the Company issued 5,250,000 common

shares in exchange for convertible notes in the amount of $94,500.

On July 27, 2023, the Company issued 213,243 common

shares for cancelation of $287,500 payroll debt.

On August 17, 2023, the Company issued 9,550,000 common

shares for cancelation of $114,600 payroll debt.

On October 20, 2023, the Company issued 3,000,000

common shares for cancelation of $54,000 related party loan.

On November 20, 2023, the Company issued 3,000,000

shares of preferred stock, featuring a 1:5 voting right, in exchange for 3,000,000 shares of common stock issued on October 20, 2023.

15

On November 27, 2023, the Company converted 1,950

series A preferred stock shares into 26,973,528 shares of Common Stock.

As of March 31, 2024, the Company issued 8,477,324

common shares for cancelation of $604,318 payroll debt and 2,050,000 common shares as bonuses to officers of the Company.

On March 22, 2024, the Company issued 150,000 common

shares for consulting services that were cancelled on May 29, 2024.

There were 117,167,906 shares of common stock issued

and outstanding as of March 31, 2024.

Warrants

No warrants were issued or outstanding as of March

31, 2024.

Convertible Debentures

On March 27, 2023, the Company entered into a Securities

Purchase Agreement with 1800 Diagonal Lending LLC (“DL”) pursuant to which the Company issued to DL a Convertible Promissory

Note (the “DL Convertible Note”) in the aggregate principal amount of $125,100 for a purchase price of $104,250. The DL Convertible

Note has a maturity date of June 27, 2024 and the Company has agreed to pay interest on the unpaid principal balance of the DL Convertible

Note at the rate of eight percent (8.0%) per annum from the date on which the DL Convertible Note is issued until the same becomes due

and payable, whether at maturity or upon acceleration or by prepayment or otherwise. The Company shall have the right to prepay the DL

Convertible Note, provided it makes a payment including a prepayment to DL as set forth in the DL Convertible Note. The outstanding principal

amount of the DL Convertible Note may not be converted prior to the period beginning on the date that is 180 days following the date the

DL Convertible Note is issued. Following the 180th day, DL may convert the DL Convertible Note into shares of the Company’s common

stock at a conversion price equal to 85% of the lowest trading price during the 20-day period preceding the date of conversion. In

addition, upon the occurrence and during the continuation of an event of default (as defined in the DL Convertible Note), the DL Convertible

Note shall become immediately due and payable and the Company shall pay to DL, in full satisfaction of its obligations hereunder, additional

amounts as set forth in the DL Convertible Note. In no event shall DL be allowed to effect a conversion if such conversion, along with

all other shares of Company common stock beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of the

common stock of the Company. On September 26, 2023 the Company paid off the DL Convertible Note, in cash for $136,393.

On October 2, 2023, the Company entered into a Securities

Purchase Agreement with DL pursuant to which the Company issued to DL a Convertible Promissory Note (the “October 2023 DL Convertible

Note”) in the aggregate principal amount of $126,000 for a purchase price of $105,000. The October 2023 DL Convertible Note has

a maturity date of March 2, 2025 and the Company has agreed to pay interest on the unpaid principal balance of the DL Convertible Note

at the rate of eight percent (8.0%) per annum from the date on which the October 2023 DL Convertible Note is issued until the same becomes

due and payable, whether at maturity or upon acceleration or by prepayment or otherwise. The Company shall have the right to prepay the

October 2023 DL Convertible Note, provided it makes a payment including a prepayment to DL as set forth in the DL Convertible Note. The

outstanding principal amount of the October 2023 DL Convertible Note may not be converted prior to the period beginning on the date that

is 180 days following the date the DL Convertible Note is issued. Following the 180th day, DL may convert the October 2023 DL Convertible

Note into shares of the Company’s common stock at a conversion price equal to 85% of the lowest trading price during

the 20-day period preceding the date of conversion. In addition, upon the occurrence and during the continuation of an event of default

(as defined in the October 2023 DL Convertible Note), the October 2023 DL Convertible Note shall become immediately due and payable and

the Company shall pay to DL, in full satisfaction of its obligations hereunder, additional amounts as set forth in the October 2023 DL

Convertible Note. In no event shall DL be allowed to effect a conversion if such conversion, along with all other shares of Company common

stock beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of the common stock of the Company. On

April 2, 2024, the Company paid off the October 2023 DL Convertible Note, in cash for $137,549.

Other Stockholder Matters

None.

Item 6. Selected Financial Data

Not applicable to smaller reporting companies.

16

Item 7. Management's Discussion and Analysis of

Financial Condition and Results of Operations

The following discussion should be read in conjunction

with our financial statements and related notes included elsewhere in this report. In addition to historical information, this discussion

includes forward-looking information that involves risks and assumptions, which could cause actual results to differ materially from management’s

expectations. See “Forward-Looking Statements” included in this report.

Forward-looking statements

Statements made in this Form 10-K that are not historical

or current facts are "forward-looking statements" made pursuant to the safe harbor provisions of Section 27A of the Securities

Act of 1933 (the "Act") and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by

the use of terms such as "may," "will," "expect," "believe," "anticipate," "estimate,"

"approximate" or "continue," or the negative thereof. We intend that such forward-looking statements be subject to

the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which

speak only as of the date made. Any forward-looking statements represent management's best judgment as to what may occur in the future.

However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual

results and events to differ materially from historical results of operations and events and those presently anticipated or projected.

We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of

such statement or to reflect the occurrence of anticipated or unanticipated events.

Financial information contained in this report and

in our financial statements is stated in United States dollars and are prepared in accordance with United States generally accepted accounting

principles.

The following discussion and analysis of our financial

condition and results of operations for the years ended March 31, 2024 and 2023 should be read in conjunction with the Financial Statements

and corresponding notes included in this Annual Report on Form 10-K. Our discussion includes forward-looking statements based upon current

expectations that involve risks and uncertainties, such as our plans, objectives, expectations, and intentions. Actual results and the

timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors,

including those set forth under the Risk Factors and Special Note Regarding Forward-Looking Statements in this report. We use words such

as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,”

“expect,” “believe,” “intend,” “may,” “will,” “should,” “could,”

“target”, “forecast” and similar expressions to identify forward-looking statements.

General Overview

Avant Technologies Inc. (formerly Trend Innovations

Holding Inc.) is a technology company specializing in acquiring, creating, and developing innovative and advanced technologies utilizing

artificial intelligence (AI) as well as providing a host of information technology consulting services. The Company considers itself a

native expert in the field of information technology based on artificial intelligence. Recently, the Company acquired Avant! AI and InstantFAME

as well as the assets of Wired4Health, Inc., pertaining to certain technology assets providing full-stack

software development, database management, data integration, project management and cloud services resources. Utilize its latest

assets acquisitions, Avant mission is to provide innovative and effective AI solutions that transform businesses and positively

impact society. Avant strive to push the boundaries of AI technology and empower organizations to achieve their full potential. We believe

that our technology can provide a self-sustained system that prepares its data from unlabeled information (Unsupervised Clustering),

and then analyzes it using various, proprietary, supervised learning techniques, Improved data efficiency: Unsupervised learning pre-processes

and extracts meaningful features from raw or unlabeled data, preparing them as inputs for the supervised learning model. This improves

data efficiency and preparations. Our technology deployed over the acquired assets (in sum or as a whole) potentially provides True Learning

from Experience - Unsupervised learning is utilized to learn relevant information from many source domains. This knowledge is then evaluated

and applied to a related or different domain(s), where information might be in short supply. This feature is a true learning capability.

Avant! can leverage the knowledge learned from the source domain to improve performance in the other domains, as well as Factual discovery/conclusion

by learning data - Avant! Unsupervised learning techniques, like clustering, help identify groups or patterns in the data, reaching

conclusions. Then its supervised learning mechanism can create new datasets (information), which are used for further domains, improving

classification and regression tasks. This feature is a true reasoning mechanism.

17

COVID-19 Pandemic

Our company may be subject to the risks arising from

COVID-19's impacts on the IT industry. Our management believes that these impacts, which include but are not limited to the following,

may have a negative effect on our financial position, results of operations, and cash flows: (i) prohibitions or limitations on in-person

activities associated with meetings; (ii) lack of consumer desire for incurring additional expenses during these times; and (iii) deteriorating

economic conditions, such as increased unemployment rates. In addition, we have considered the impacts and uncertainties of COVID-19 in

our use of estimates in preparation of our consolidated financial statements. These estimates include, but are not limited to, likelihood

of achieving performance conditions under performance-based equity awards, net realizable value of inventory, and the fair value of reporting

units and goodwill for impairment.

In Spring of 2020, a lot of governments around the

world issued lockdown orders prohibiting their respective citizens from working in the offices and arranging face-to-face meetings. There

also were instances of reducing number of hours available to each employee. These actions were taken in response to the economic impact

of COVID-19 on business areas resulted in a reduction of productivity for the year 2020. Due to the online nature of the company’s

operations, our regular course of business did not incur significant changes. However, the company’s clients and third parties had

to adjust their operations which resulted in a decreased number of agreements.

Risks and Uncertainties

Management is currently evaluating

the impact of the COVID-19 pandemic on the Company and has concluded that while it is reasonably possible that the virus could have a

negative effect on the Company’s financial position, results of its operations, and/or search for a target company, the specific

impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

In February 2022, the Russian

Federation and Belarus commenced a military action with the country of Ukraine. As a result of this action, various nations, including

the United States, have instituted economic sanctions against the Russian Federation and Belarus. Further, the impact of this action and

related sanctions on the world economy are not determinable as of the date of these financial statements. The specific impact on the Company’s

financial condition, results of operations, and cash flows is also not determinable as of the date of these financial statements.

Consideration of Inflation

Reduction Act Excise Tax

On August 16, 2022, the Inflation

Reduction Act of 2022 (the “IR Act”) was signed into federal law. The IR Act provides for, among other things, a new U.S.

federal 1% excise tax on certain repurchases of stock by publicly traded U.S. domestic corporations and certain U.S. domestic subsidiaries

of publicly traded foreign corporations occurring on or after January 1, 2023. The excise tax is imposed on the repurchasing corporation

itself, not its shareholders from which shares are repurchased. The amount of the excise tax is generally 1% of the fair market value

of the shares repurchased at the time of the repurchase. However, for purposes of calculating the excise tax, repurchasing corporations

are permitted to net the fair market value of certain new stock issuances against the fair market value of stock repurchases during the

same taxable year. In addition, certain exceptions apply to the excise tax. The U.S. Department of the Treasury (the “Treasury”)

has been given authority to provide regulations and other guidance to carry out and prevent the abuse or avoidance of the excise tax.

RESULTS OF OPERATIONS

We have incurred recurring losses to date. Our

financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments