|

OMB APPROVAL

|

OMB Number:

3235-0116

|

Expires:

May 31, 2017

|

Estimated average burden

|

hours per response. . . . . . . … 8.7

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of: December 2014

Commission File Number: 000-51848

Vanc Pharmaceuticals Inc.

(Translation of Registrant’s name into English)

#615 – 800 West Pender Street Vancouver, B C V6C 2V6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F þ Form 40-F o

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SEC 1815 (04-09)

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

1

Safe Harbor Statement

This Form 6-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 about the registrant and its business. Forward-looking statements are statements that are not historical facts and may be identified by the use of forward-looking terminology, including the words “believes,” “expects,” “intends,” “may,” “will,” “should” or comparable terminology. Such forward-looking statements are based upon the current beliefs and expectations of the registrant’s management and are subject to risks and uncertainties which could cause actual results to differ materially from the forward-looking statements.

Forward-looking statements are not guarantees of future performance and actual results of operations, financial condition and liquidity, and developments in the industry may differ materially from those made in or suggested by the forward-looking statements contained in this Form 6-K. These forward-looking statements are subject to numerous risks, uncertainties and assumptions. The forward-looking statements in this Form 6-K speak only as of the date of this report and might not occur in light of these risks, uncertainties, and assumptions. The registrant undertakes no obligation and disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Exhibits

The following exhibits are included in this Form 6-K:

99.1

News Release – New Director and CFO

99.2

Material Change Report – New Director and CFO

99.3

News Release – Conditional Approval of Private Placement

99.4

News Release – Drug Establishment License Issued

99.5

News Release – Private Placement Closes

99.6

Material Change Report – Private Placement Closes

99.7

News Release – Seven Generic Molecules Approved

99.8

News Release – Stock Options Granted

99.9

Material Change Report – Stock Options Granted

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | | |

| NUVA Pharmaceuticals Inc.

|

|

|

|

|

|

Date: February 03, 2015

| By:

| Aman Parmar

|

|

|

| Aman Parmar, Chief Financial Officer

|

|

|

|

|

|

| | | |

2

Exhibit 99.1

![[ex991002.gif]](ex991002.gif)

VANC Pharmaceuticals Appoints New CFO and Director

December 3, 2014 – VANC Pharmaceuticals Inc. (“VANC” or the “Company”) is pleased to announce that Mr. Aman Parmar has joined the Company as Chief Financial Officer (“CFO”) and Director. Mr. Parmar joins the Company as a key part of its growth plan to launch into the Canadian generic drug market in 2015.

Mr. Parmar’s corporate experience includes ten years working with both public and private companies in the Health Care, Resource, Manufacturing and Real Estate sectors. For the past two years, he has been the CFO of a Vancouver based real estate development company focused on multi-family housing throughout the Lower Mainland. Mr. Parmar has raised capital and has been directly involved in structuring financings either through public offerings and/or bank debt for both public and private companies. He obtained a Chartered Accountant designation in 2012 and holds a Bachelor of Technology in Accounting from the British Columbia Institute of Technology.

“I look forward to working with the team at VANC Pharmaceuticals and am impressed by how far they have progressed with limited capital,” said Mr. Parmar. “Capital efficiency and creating shareholder value will be my primary focus at VANC.”

Mr. Jamie Lewin has resigned as Director and CFO of the Company and the Management and Directors would like to thank him for his efforts.

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.2

Form 51-102F3

Material Change Report

Item 1

Name and Address of Company

VANC PHARMACEUTICALS INC.

615-800 West Pender Street Vancouver, BC

V6C 2V6 (the “Company”)

Item 2

Date of Material Change

December 3, 2014

Item 3

News Release

The news release was disseminated on December 3, 2014 by way of the facilities of Stockwatch and Market News. Copies were also filed on SEDAR with the British Columbia Securities Commission and the Alberta Securities Commission.

Item 4

Summary of Material Change

The Company announced the resignation of Mr. Jamie Lewin as Director and Chief Financial Officer and appointed Mr. Aman Parmar Director and Chief Financial Officer.

Item 5

Full Description of Material Change

5.1

Full Description of Material Change

The Company announced that Mr. Aman Parmar has joined the Company as Chief Financial Officer (“CFO”) and Director.

Mr. Jamie Lewin has resigned as Director and CFO of the Company.

5.2

Disclosure for Restructuring Transactions

Not applicable.

Item 6

Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7

Omitted Information

Not applicable.

2

Item 8

Executive Officer

Arun Nayyar, Chief Executive Officer

Business Telephone:

604.687-2038

Facsimile:

604.687-3141

Item 9

Date of Report

December 3, 2014

Exhibit 99.3

![[ex993002.gif]](ex993002.gif)

VANC Pharmaceuticals Announces Conditional Approval of Previously Announced Private Placement

December 8, 2014 – VANC Pharmaceuticals Inc. (“VANC” or the “Company”), a pharmaceutical company focused on the Canadian generic drug and over-the-counter (“OTC”) markets, is pleased to announce that the TSX Venture Exchange (the “TSXV”) has confirmed its conditional acceptance of the private placement announced November 27, 2014 of 7,333,333 units of the Company at a price of $0.15. The Company anticipates the private placement will be oversubscribed. As a result, the Company expects to close the private placement on or about December 10, 2014.

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.4

![[ex994002.gif]](ex994002.gif)

VANC Pharmaceuticals Announces Drug Establishment License Issued by Health Canada

December 10, 2014 – VANC Pharmaceuticals Inc. (“VANC” or the “Company”), a pharmaceutical company focused on the Canadian generic drug and over-the-counter (“OTC”) markets, is pleased to announce that the Company has been issued a Drug Establishment License (“DEL”) (license number 102220-A) by Health Canada. The license allows the Company to import pharmaceutical products and distribute them within Canada. The import activity covered by the license includes manufacturing pharmaceuticals at the Company’s Good Manufacturing Practices (“GMP”) compliant foreign site.

“The issuance of a Drug Establishment License along with the approval of our partner’s GMP manufacturing site is a key step towards the commercialization of our generic drug portfolio,” said Arun Nayyar, CEO of VANC. “We have partnered with leading global generics manufacturers and look forward to providing Canadians with quality, safe and affordable generic drugs by way of our GMP manufacturing facilities.”

The Company plans to launch sales of the generic drug portfolio in Q2-2015. Further updates on additional products and growth of the generic drug portfolio will be provided over the next several weeks.

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.5

![[ex995002.gif]](ex995002.gif)

VANC Pharmaceuticals Closes

Oversubscribed Non Brokered Private Placement

December 11, 2014 – VANC Pharmaceuticals Inc. (the “VANC” or “Company”) (TSXV: NPH, OTCQB: NUVPF), a pharmaceutical company focused on the Canadian generic drug and over- the-counter (“OTC”) markets, is pleased to announce that on December 10, 2014 it closed the oversubscribed non brokered private placement of 7,607,332 Units (the “Units”) of VANC at a price of

$0.15 per Unit for gross proceeds of $1,141,000.00.

Each Unit each consists of one (1) common share (the “Common Share”) and one half (1/2) transferrable share purchase warrant. Each warrant entitles the holder thereof to purchase one (1) additional Common Share on or before December 10, 2015 at a price of CDN$0.25 per Common Share.

In accordance with the policies of the TSX Venture Exchange, the Company paid a Finders’ Fee of an aggregate of $91,287.00 and issued an aggregate of 608,586 Warrants.

The securities issued are subject to the statutory 4 month hold period that expires on April 11, 2015.

Proceeds from the Private Placement will be used by VANC for commercialization of the generic drug and OTC products portfolios and general ongoing corporate and working capital purposes.

“This round of funding enables us to move our portfolio of generic drugs and OTC products into commercialization,” said Arun Nayyar, CEO of VANC. “Specifically we will be acquiring generic drug inventory and building our sales team to target pharmacy customers.”

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.6

Form 51-102F3

Material Change Report

Item 1

Name and Address of Company

VANC Pharmaceuticals Inc. Suite 615-800 West Pender Street Vancouver, BC

V6C 2V6 (the “Company”)

Item 2

Date of Material Change

December 10, 2014

Item 3

News Release

The news release was disseminated on December 11, 2014 by way of the facilities of Marketwired. Copies were also filed on SEDAR with the British Columbia Securities Commission and the Alberta Securities Commission.

Item 4

Summary of Material Change

The Company announced the Closing of a Non Brokered Private Placement.

Item 5

Full Description of Material Change

5.1

Full Description of Material Change

The Company announced that on December 10, 2014 it closed the oversubscribed non brokered private placement of 7,607,332 Units (the “Units”) of VANC at a price of $0.15 per Unit for gross proceeds of

$1,141,000.00.

Each Unit each consists of one (1) common share (the “Common Share”) and one half (1/2) transferrable share purchase warrant. Each warrant entitles the holder thereof to purchase one (1) additional Common Share on or before December 10, 2015 at a price of CDN$0.25 per Common Share.

In accordance with the policies of the TSX Venture Exchange, the Company paid a Finders’ Fee of an aggregate of $91,287.00 and issued an aggregate of 608,586 Warrants.

The securities issued are subject to the statutory 4 month hold period that expires on April 11, 2015.

Proceeds from the Private Placement will be used by VANC for commercialization of the generic drug and OTC products portfolios and general ongoing corporate and working capital purposes.

“This round of funding enables us to move our portfolio of generic drugs and OTC products into commercialization,” said Arun Nayyar, CEO of VANC. “Specifically we will be acquiring generic drug inventory and building our sales team to target pharmacy customers.”

2

5.2

Disclosure for Restructuring Transactions

Not applicable.

Item 6

Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7

Omitted Information

Not applicable.

Item 8

Executive Officer

| |

Jamie Lewin, Director

| |

Business Telephone:

| 604-710-9461

|

Facsimile:

| 604- 739-3052

|

Item 9

Date of Report

December 11, 2014

Exhibit 99.7

![[ex997002.gif]](ex997002.gif)

VANC Pharmaceuticals Receives Health Canada Approval for 7 Additional Generic Molecules

December 16, 2014 – VANC Pharmaceuticals Inc. (“Vanc” or the “Company”) is pleased to announce that it has received Notice of Compliance (NOC) from Health Canada for 7 additional generic molecules, bringing the Company’s generic portfolio to a total 30 molecules. The Notice of Compliance from Health Canada provides the authorization for Vanc to market and sell the generic molecules in Canada.

These 7 additional molecules will comprise of 15 dosage forms across various therapeutic categories; including both chronic (long term) therapy and acute (short term) therapy. The current aggregate annual Canadian sales of these 7 products is estimated to be approximately CAD $90 million.

“We are excited to be growing our generics portfolio and product offering for pharmacy customers with the addition of these 7 molecules which represent important disease areas for Canadians,” said Arun Nayyar, CEO of Vanc. “There is an established demand in Canada for these molecules and with them our portfolio will now represent a $1 billion market opportunity.”

The Company will be launching sales and marketing of the generics portfolio in Q2-2015. Further updates will be provided over the coming weeks.

Table 1.0 provides details on each of the molecules.

| | | |

| Molecule Name

| Presentations

| Brand Reference

|

1

| VAN-Fluoxetine

| 5 MG and 20 MG Tab

| Prozac™

|

2

| VAN-Mycophenolate

| 250 MG Tab

| CellCept™

|

3

| VAN-Mycophenolate

| 500 MG Cap

| CellCept™

|

4

| VAN- Quetiapine

| 25 MG, 100 MG, 200 MG, 300 MG Tab

| Seroquel™

|

5

| VAN- Telmisartan-HCTZ

| 80+12.5 MG, 80 +25 MG Tab

| Micardis Plus™

|

6

| VAN- Telmisartan

| 40 MG, 80 MG Tab

| Micardis™

|

7

| VAN- Pioglitazone

| 15 MG, 30 MG, 45 MG Tab

| Actos™

|

Table 1.0

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Vanc Pharmaceuticals Inc.

December 16, 2014

News Release

Page 2 of 2

On behalf of:

Vanc Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward- looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward- looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.8

![[ex998002.gif]](ex998002.gif)

VANC Pharmaceuticals Grants Incentive Stock Options

December 18, 2014 – VANC Pharmaceuticals Inc. (“VANC” or the “Company”) announces it has set aside an aggregate of 1,200,000 incentive stock options to its Directors, Officers and Consultants to purchase shares of the Company at an exercise price of $0.16 per share for a period of five years.

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayyar,

President and CEO

anayyar@vancpharm.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward- looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward- looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Form 51-102F3

Material Change Report

Item 1

Name and Address of Company

VANC PHARMACEUTICALS INC.

615-800 West Pender Street Vancouver, BC

V6C 2V6 (the “Company”)

Item 2

Date of Material Change

December 18, 2014

Item 3

News Release

The news release was disseminated on December 18, 2014 by way of the facilities of Stockwatch and Market News. Copies were also filed on SEDAR with the British Columbia Securities Commission and the Alberta Securities Commission.

Item 4

Summary of Material Change

The Company announced it has granted 1,200,000 incentive stock options to its Directors, Officers and Consultants of the Company.

Item 5

Full Description of Material Change

5.1

Full Description of Material Change

The Company announced it has set aside an aggregate of 1,200,000 incentive stock options to its Directors, Officers and Consultants to purchase shares of the Company at an exercise price of $0.16 per share for a period of five years.

5.2

Disclosure for Restructuring Transactions

Not applicable.

Item 6

Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7

Omitted Information

Not applicable.

Item 8

Executive Officer Arun Nayyar, Chief Executive Officer Business Telephone:

604.687-2038

Facsimile:

604.687-3141

Item 9

Date of Report

November 18, 2014

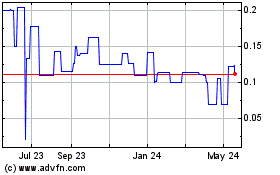

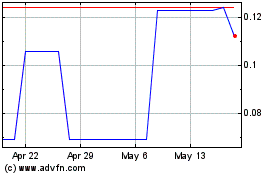

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Feb 2024 to Feb 2025