|

OMB APPROVAL

|

OMB Number:

3235-0116

|

Expires:

May 31, 2017

|

Estimated average burden

|

hours per response. . . . . . . … 8.7

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of: June 2015

Commission File Number: 000-51848

Vanc Pharmaceuticals Inc.

(Translation of Registrant’s name into English)

#615 – 800 West Pender Street Vancouver, B C V6C 2V6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F þ Form 40-F o

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SEC 1815 (04-09)

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

1

Safe Harbor Statement

This Form 6-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 about the registrant and its business. Forward-looking statements are statements that are not historical facts and may be identified by the use of forward-looking terminology, including the words “believes,” “expects,” “intends,” “may,” “will,” “should” or comparable terminology. Such forward-looking statements are based upon the current beliefs and expectations of the registrant’s management and are subject to risks and uncertainties which could cause actual results to differ materially from the forward-looking statements.

Forward-looking statements are not guarantees of future performance and actual results of operations, financial condition and liquidity, and developments in the industry may differ materially from those made in or suggested by the forward-looking statements contained in this Form 6-K. These forward-looking statements are subject to numerous risks, uncertainties and assumptions. The forward-looking statements in this Form 6-K speak only as of the date of this report and might not occur in light of these risks, uncertainties, and assumptions. The registrant undertakes no obligation and disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Exhibits

The following exhibits are included in this Form 6-K:

99.1

News Release – June 5, 2015

99.2

Material Change Report – June 5, 2015

99.3

Cover letter – June 5, 2015

99.4

MD&A, amended – June 5.2015

99.5

Certification of Interim Filings, CEO, refiled – May 28, 2015

99.6

Certification of Interim Filings, CFO, refiled – May 28, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | | |

| Vanc Pharmaceuticals Inc.

|

|

|

|

|

|

Date: July 31, 2015

| By:

| Aman Parmar

|

|

|

| Aman Parmar, Chief Financial Officer

|

|

|

|

|

|

| | | |

2

Exhibit 99.1

![[ex991002.gif]](ex991002.gif)

VANC Pharmaceuticals Announces Appointment of Mr. Bob Rai to

its Board of Directors

June 05, 2015 – VANC Pharmaceuticals Inc. (“VANC” or the “Company”), a pharmaceutical company focused on the Canadian generic drug and over-the-counter (the “OTC”) markets, is pleased to announce that Mr.Bob Rai has been appointed to the Company’s Board of Directors effective immediately. Mr. Rai is a pharmacist with over 15 years of experience and is partner in a chain of The Medicine Shoppe Pharmacy (www.pharmacybc.com).

“We are excited to have someone with Mr. Rai’s industry experience, track record as an entrepreneur and global pedigree join our board. We welcome him to our growing team and eagerly await his input on the strategic direction of our Company,” said Arun Nayyar, CEO of VANC. “As we begin the commercialization of our product portfolio it is crucial that our team be optimized and Mr. Rai’s direct experience in the Canadian retail and institutional pharmacy business is going to be an immediate value add and impactful addition for the Company.”

Mr. Rai is a graduate of the University of British Columbia with Bachelor of Science Degrees in Biochemistry and Pharmaceutical Science. In addition to operating a chain of The Medicine Shoppe Pharmacies in Greater Vancouver for the past 15 years, he has had several successful entrepreneurial and charitable endeavors. In 1998 Mr. Rai and his partners pioneered and revolutionized the online pharmacy business to the United States. The online sales and distribution of prescription medicines saw unprecedented industry growth and as other operators followed suit, the unique business concept became a billion dollar industry across Canada.

Mr. Rai is also Chairman and CEO of Canada Pacific Global Pharmaceuticals and Chairman of its subsidiary, PharmaCanada Inc. (www.earlycancerdetect.com). He has served as President of the Philippines Canada Trade Council (PCTC) from 2006-2007 and held the position of Vice-President from 2004-2006. As President of PCTC, he led a successful Trade Mission to Manila with endorsements from His Excellency Canadian Prime Minister Stephen Harper, Honorable Premier Gordon Campbell of British Columbia and Minister of International Trade and Industry of Canada David Emerson.

In 2013 Mr. Rai was the recipient of the Queen’s Diamond Jubilee Medal for his over 18 years of community and volunteer work. His charitable and community volunteer activities include: Alumni UBC Advisory Council representing the Faculty of Pharmaceutical Science, Director of Tapestry Foundation for Health Care, Rotary Club of Vancouver Fraserview and cabinet member of “A Night of Miracles” for BC Children’s Hospital.

“I am impressed with how far VANC has come as a startup in a highly competitive industry and commend the existing team for building a product portfolio, registering it with Health Canada and rolling it out commercially in such a cost and time efficient manner. I look forward to working with the team and helping them with governance, technology, product acquisition and accelerating sales,” said Mr. Bob Rai.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The Company has also set aside 400,000 incentive stock options at $0.45 for a period of five years and 800,000 incentive stock options at $0.55 for a period of two years to Directors, Officers and Consultants.

On behalf of:

VANC Pharmaceuticals Inc.

Arun Nayar

President & CEO

anayar@vancpharm.com

Investor Relations: Kam Thindal at + 1 (604) 566-9233 or kam@htcapitalcorp.com

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves VANC’s expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. VANC generally uses words such as “outlook,” “will,” “could,” “would,” “might,” “remains,” “to be,” “plans,” “believes,” “may,” “expects,” “intends,” “anticipates,” “estimate,” “future,” “plan,” “positioned,” “potential,” “project,” “remain,” “scheduled,” “set to,” “subject to,” “upcoming,” and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to VANC as of the date of this release, and VANC assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of VANC and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Exhibit 99.2

Form 51-102F3

Material Change Report

Item 1 Name and Address of Company

VANC PHARMACEUTICALS INC.

615-800 West Pender Street

Vancouver, BC

V6C 2V6 (the “Company”)

Item 2 Date of Material Change

June 5, 2015

Item 3 News Release

The news release was disseminated on June 5, 2015 by way of the facilities of Stockwatch and Market News. Copies were also filed on SEDAR with the British Columbia Securities Commission and the Alberta Securities Commission.

Item 4 Summary of Material Change

The Company announced that Mr. Bob Rai has been appointed to the Company’s Board of Directors.

Item 5 Full Description of Material Change

5.1 Full Description of Material Change

The Company announced that Mr. Bob Rai has been appointed to the Company’s Board of Directors effective immediately.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6 Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

Not applicable.

Item 8 Executive Officer

Arun Nayyar, Chief Executive Officer

Business Telephone: 604.687-2038

Facsimile: 604.687-3141

Item 9 Date of Report

June 5, 2015

Exhibit 99.3

![[ex993002.gif]](ex993002.gif)

June 5, 2015

TO: British Columbia Securities Commission VIA SEDAR

Alberta Securities Commission

TSX Venture Exchange

Dear Sirs/Mesdames:

Re: VANC Pharmaceuticals Inc. (the “Company”) – Re-filed Management’s Discussion and Analysis

The Company has re-filed its March 31, 2015, MD&A to amend the disclosure under Section 1.02 Overall Performance to include the statement:

The Company is no longer maintaining patents for the T3/6 product except in Canada and China. The Company is not proceeding with a Joint Venture Agreement in China for the marketing of this product.

Yours truly,

VANC PHARMACEUTICALS INC.

Signed: “Aman Parmar”

Aman Parmar

Director and Chief Financial Officer

Exhibit 99.4

![[ex994002.jpg]](ex994002.jpg)

VANC Pharmaceuticals Inc.

(Formerly Nuva Pharmaceuticals Inc.)

Management’s Discussion & Analysis

For the Three and Nine Month Period Ended

March 31, 2015

| | |

Section

| Description

| Page

|

1.01

| Date

| 2

|

1.02

| Overall Performance

| 2

|

1.03

| Selected Annual Information

| 5

|

1.04

| Summary of Quarterly Results

| 7

|

1.05

| Result of Operations

| 7

|

1.06

| Liquidity

| 8

|

1.07

| Capital Resources

| 8

|

1.08

| Commitments and Agreements

| 11

|

1.09

| Off Balance Sheet Arrangements

| 12

|

1.10

| Transactions with Related Parties

| 12

|

1.11

| Subsequent Events

| 13

|

1.12

| Critical Accounting Estimates

| 13

|

1.13

| Recent Accounting Pronouncements

| 14

|

1.14

| Financial Instruments

| 16

|

1.15

| Other MDA Requirements

| 19

|

![[ex994003.gif]](ex994003.gif)

1.01

DATE

This Management Discussion and Analysis (“MD&A”) is dated May 27, 2015 and should be read in conjunction with the condensed interim consolidated financial statements of VANC Pharmaceuticals Inc. (Formerly Nuva Pharmaceuticals Inc.) (“VANC” or the “Company”) for the three and nine month period ended March 31, 2015 and the annual audited financial statements for the year ended June 30, 2014. All financial information is expressed in Canadian dollars and is prepared using accounting policies in compliance with International Financial Reporting Standards (“IFRS”).

The condensed interim consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern which assumes that the Company will continue in operations for the foreseeable future and be able to realize assets and satisfy liabilities in the normal course of business. The Company has yet to achieve revenues however it anticipates commercializing products during its fourth quarter of operations in 2015. The application of the going concern assumption is dependent on management’s ability to successfully execute its business plan and to develop profitable operations. The Company does not foresee any additional equity financing requirements as sufficient funds were raised in the Quarter to fund the current business operations.

1.02

OVERALL PERFORMANCE

During the year ended June 30, 2014, the Company announced that it had signed Cross Referencing Agreements (“CRA”) for 48 generic products to be sold within the Canadian market. During Q2 and Q3 of fiscal 2015, the Company had received Notice of Compliance (NOC) from Health Canada for 30 of the 48 products with an additional 5 products expected in Q4 of 2015.

The Company also continued towards the development of its Over the Counter (OTC) product line. There are currently 4 products in the portfolio which the Company is targeting to commercialize in fiscal 2016 with additional products in the pipeline. The Company is no longer maintaining patents for the T3/6 product except in Canada and China. The Company is not proceeding with a Joint Venture Agreement in China for the marketing of this product.

Sales

There have been no sales during the nine month period ended March 31, 2015 (March 31, 2014 - $nil).

Manufacturing

On April 16th, 2014 the Company announced that it had signed CRAs with three large pharmaceutical companies for multiple products in the prescription generic drug lines. The suppliers will manufacture and VANC will market and sell these new product lines under its own label.

The Company is currently reviewing agreements with manufacturers on its 4 OTC products to manufacture, package and deliver the products to the Company.

Notice of Compliance (NOC)

The Company announced that it has received Notice of Compliance (NOC) from Health Canada for 22 generic molecules. These 22 molecules will comprise of 51 dosage forms across various therapeutic categories; including both chronic (long term) therapy and acute (short term) therapy. The Notice of Compliance from Health Canada provides the authorization for VANC to market and sell the generic molecules in Canada.

Page 2

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.02

OVERALL PERFORMANCE (continued)

| | | |

| Molecule Name

| Presentations

| Brand Reference

|

1

| VAN-Rizatriptan

| 5 MG and 10 MG Tab

| Maxalt™

|

2

| VAN-Irbesartan

| 75 MG, 150 MG and 300 MG Tab

| Avapro™

|

3

| VAN-Irbesartan-HCTZ

| 150+12.5 MG, 300+12.5 MG and 300+25 MG Tab

| Avalide™

|

4

| VAN-Donepezil

| 5 MG and 10 MG Tab

| Aricept™

|

5

| VAN-Amlodipine

| 5 MG and 10 MG Tab

| Norvasc™

|

6

| VAN-Losartan

| 25 MG, 50 MG and 100 MG Tab

| Cozaar™

|

7

| VAN-Losartan-HCTZ

| 50+12.5 MG and 100+25 MG Tab

| Hyzaar™

|

8

| VAN-Levetiracetam

| 250 MG, 500 MG and 750 MG Tab

| Keppra™

|

9

| VAN-Gabapentin

| 600 MG and 800 MG Tab

| Neurontin™

|

10

| VAN-Omeperazole

| 20 MG DR Tab

| Losec™

|

11

| VAN-Finasteride

| 5 MG Tab

| Proscar™

|

12

| VAN-Alendronate

| 5 MG, 10 MG and 70 MG Tab

| Fosamax™

|

13

| VAN-Bicalutamide

| 50 MG Tab

| Casodex™

|

14

| VAN-Letrozole

| 2.5 MG Tab

| Femara™

|

15

| VAN-Olanzapine

| 2.5 MG, 5 MG, 7.5 MG, 10 MG and 15 MG Tab

| Zyprexa™

|

16

| VAN-Sertraline cap

| 25 MG, 50 MG and 100 MG Cap

| Zoloft™

|

17

| VAN-Anastrozole

| 1 MG Tab

| Arimidex™

|

18

| VAN-Pantoprazole

| 40 MG Tab

| Pantoloc™

|

19

| VAN-Gabapentin

| 100 MG, 300 MG and 400 MG Cap

| Neurontin™

|

20

| VAN-Ciprofloxacin

| 250 MG, 500 MG and 750 MG Tab

| Cipro™

|

21

| VAN-Montelukast

| 4 MG and 5 MG Chew Tabs, 10 MG Tab

| Singulair™

|

22

| VAN-Sildenafil

| 25 MG, 50 MG and 100 MG Tab

| Viagra™

|

23

| VAN-Fluoxetine

| 5 MG and 20 MG Tab

| Prozac™

|

24

| VAN-Mycophenolate

| 250 MG Tab

| CellCept™

|

25

| VAN-Mycophenolate

| 500 MG Cap

| CellCept™

|

26

| VAN- Quetiapine

| 25 MG, 100 MG, 200 MG, 300 MG Tab

| Seroquel™

|

27

| VAN- Telmisartan-HCTZ

| 80+12.5 MG, 80 +25 MG Tab

| Micardis Plus™

|

28

| VAN- Telmisartan

| 40 MG, 80 MG Tab

| Micardis™

|

29

| VAN- Pioglitazone

| 15 MG, 30 MG, 45 MG Tab

| Actos™

|

30

| VAN-Fluoxetine

| 5 MG and 20 MG Tab

| Prozac™

|

Page 3

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.02

OVERALL PERFORMANCE (continued)

Risk Factors

Limited Operating History

There is no assurance that VANC will earn profits in the future, or that profitability, if achieved, will be sustained. Operating in the pharmaceutical and biotechnology industry requires substantial financial resources, and there is no assurance that future revenues will be sufficient to generate the funds required to continue VANC business development and marketing activities. If VANC does not have sufficient capital to fund its operations, the Company may be required to reduce sales and marketing efforts or forego certain business opportunities.

Development of Technological Capabilities

The market for VANC’s products is characterized by changing technology and continuing process development. The future success of VANC’s business will depend in large part upon our ability to maintain and enhance the Company’s technological capabilities, develop and market products and services which meet changing customer needs and successfully anticipate or respond to technological changes on a cost effective and timely basis. Although we believe that VANC’s operations provide the products and services currently required by our customers, there can be no assurance that VANC’s process development efforts will be successful or that the emergence of new technologies, industry standards or customer requirements will not render VANC’s products or services uncompetitive. If VANC needs new technologies and equipment to remain competitive, the development, acquisition and implementation of those technologies and equipment may require us to make significant capital investments.

1.03

SELECTED ANNUAL FINANCIAL INFORMATION

| | | |

For the twelve month period ended

| June 30, 2014

| June 30, 2013

| June 30, 2012

|

| $

| $

| $

|

Revenue

| Nil

| Nil

| 83,361

|

Comprehensive Income/(Loss)

| (733,946)

| 283,432

| (306,565)

|

Basic and Diluted Loss Per Share

| (0.03)

| 0.02 and 0.01

| (0.05)

|

Total Assets

| 820,418

| 800,991

| 19,571

|

Accounts Payable and Accrued Liabilities

| 124,343

| 215,785

| 347,235

|

Sponsorship Liability

| Nil

| Nil

| 875,000

|

Short Term Loans

| Nil

| 35,907

| Nil

|

Promissory Notes

| 32,978

| 112,611

| 118,500

|

Page 4

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.03

SELECTED ANNUAL FINANCIAL INFORMATION (continued)

| | | |

Expenses

| June 30, 2014

| June 30, 2013

| June 30, 2012

|

| $

| $

| $

|

Advertising & Promotion

| -

| -

| 1,639

|

Amortization-Furniture and Equipment

| 948

| -

| 1,881

|

Changes in inventory

| -

| -

| 77,993

|

Filling Fees and Transfer Agent

| 39,567

| 32,393

| 43,701

|

Foreign exchange

| 759

| -

| -

|

Interest and Bank Charges

| 2,631

| 1,140

| 928

|

Investor Relations

| 32,500

| -

| 18,196

|

Legal and Audit

| 48,862

| 22,547

| 29,915

|

Management & Consulting Fees

| 204,333

| 65,778

| 152,302

|

Office and Miscellaneous

| 34,306

| 9,519

| 20,635

|

Product Registration & Development

| 5,156

| 10,162

| 31,886

|

Professional Fees

| 50,004

| 12,089

| -

|

Rent

| 18,530

| 38,667

| 28,187

|

Recovery/write down of inventory

| -

| -

| 34,506

|

Research

| 29,573

| -

| -

|

Stock Based Compensation

| 291,355

| -

| -

|

Travel

| 16,109

| 800

| 137

|

Wages and Benefits

| -

| -

| 63,017

|

Total Expenses

| 774,633

| 193,095

| |

| | | |

Net Loss before Other Items

| (774,633)

| (193,095)

| (421,562)

|

| | | |

Other Items

| | | |

Finance Expense

| -

| (590)

| 12,810

|

Other Income

| -

| 2,110

| -

|

Net Gain on Liabilities Settled

| 40,687

| 475,007

| (127,806)

|

| 40,687

| 476,527

| (114,996)

|

| | | |

Comprehensive Income/(Loss) for the Year

| (733,946)

| 283,432

| (306,565)

|

| | | |

The year ending June 30, 2014 saw an increase in expenses, especially with regards to: management fees, research, stock based compensation and travel. The management fee increase is due to the company hiring a full time CEO in November 2013. The increase in travel was due to business meetings in Toronto/India to meet with potential customers/manufacturers of company products.

The Company also signed a consultant as a regulatory analyst to help with Health Canada filings and other product registration issues. The company expects its expenses to continue increasing as it registers more products with Health Canada and heads towards commercialization of its products.

Page 5

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.04 SUMMARY OF QUARTERLY RESULTS

The Company has been using the IFRS reporting standards since July 1, 2011.

| | | | | | | | |

Period

Ended

|

Mar/15

|

Dec/14

|

Sept/14

|

June/14

|

Mar/14

|

Dec/13

|

Sept/13

|

June/13

|

| $

| $

| $

| $

| $

| $

| $

| $

|

Revenue

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

|

Net Income/Loss

| (461,098)

| (410,118)

| (157,608)

| (236,640)

| (234,488)

| (111,126)

| (150,333)

| (195,434)

|

Loss/Share

| (0.01)

| (0.01)

| (0.01)

| (0.03)

| (0.01)

| (0.01)

| (0.01)

| (0.01)

|

Total Assets

| 3,515,365

| 1,479,565

| 614,264

| 820,418

| 888,043

| 826,174

| 954,536

| 800,991

|

The Company has seen significant improvement in its Total Assets over the last 8 quarters which is primarily made up of cash and prepaid inventory balances. As expected, the Company experienced a net loss from operations which is analyzed below:

| | | | |

| Three Months Ended

| Nine Months Ended

|

| March 31, 2015

| March 31,

2014

| March 31,

2015

| March 31,

2014

|

| $

| $

| $

| $

|

Expenses

| | | | |

Amortization

| 5,009

| 368

| 6,955

| 368

|

Bank service charges

| 465

| 672

| 1,102

| 2,278

|

Filling fees and transfer agent

| 28,955

| 15,236

| 63,242

| 31,087

|

Foreign exchange

| -

| 219

| 1,542

| 501

|

Investor relations

| 15,000

| 5,000

| 40,000

| 5,000

|

Insurance

| 6,558

| 1,250

| 9,058

| 1,250

|

Legal and audit

| 1,250

| 12,313

| 5,665

| 31,036

|

Management & consulting fees

| 67,234

| 64,000

| 214,833

| 140,333

|

Office and miscellaneous

| 16,310

| 2,629

| 36,435

| 9,581

|

Product registration & development

| 4,027

| -

| 20,887

| 9,936

|

Professional fees

| 28,329

| 9,840

| 46,036

| 30,142

|

Rent

| 22,810

| 1,080

| 40,810

| 5,030

|

Stock based compensation

| 258,097

| 120,000

| 530,671

| 241,800

|

Travel

| 7,180

| 1,780

| 15,331

| 8,066

|

Total Expenses

| 461,224

| 234,488

| 1,032,567

| 516,417

|

| | | | |

Net Loss before Other Items

| (461,224)

| (234,488)

| (1,032,567)

| (516,417)

|

| | | | |

Other Items

| | | | |

Other income

| 126

| -

| 126

| -

|

Net gain on liabilities settled

| -

| -

| -

| 19,110

|

| -

| -

| 126

| 19,110

|

| | | | |

Comprehensive Loss for the Period

| (461,098)

| (234,488)

| (1,032,441)

| (497,306)

|

| | | | |

| | | | |

Basis Earnings/(Loss) Per Share

| (0.01)

| (0.01)

| (0.03)

| (0.02)

|

Diluted Earnings/(Loss) Per Share

| (0.01)

| (0.01)

| (0.03)

| (0.02)

|

Weighted Average of Shares Outstanding

| 46,388,439

| 23,596,575

| 40,555,155

| 23,596,575

|

| | | | |

Page 6

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.05 RESULTS OF OPERATIONS

For the Three Month Period Ended March 31, 2015

Consulting & Management

Consulting and management fees for the three month period ended March 31, 2015 were $67,234 compared to $64,000 for the three month period ended March 31, 2014. This small increase is a result of the addition of a fulltime CFO.

Filing and Transfer Agent Fees

Fees amounted to $28,955 for the three month period ended March 31, 2015 compared to $15,236 for the same period ended March 31, 2014. The difference was a result of an increase in press release filing fees. The Company also had a significant amount of share capital transactions in the quarter which resulted in additional TSX Venture fees.

Legal and Accounting Fees

Legal and accounting fees were $1,250 for the three month period ended March 31, 2015 compared to $12,313 for the same period ended March 31, 2014. This decrease is due to no legal fees in the current quarter.

Product Registration and Development Costs

Total costs incurred in this category for the three month period ended March 31, 2015 were $4,027, compared to $nil for the period ended March 31, 2014. Costs incurred in this category consist primarily of fees paid to maintain the Company’s trademarks as well as the costs incurred to file products with Health Canada.

Stock Based Compensation

Stock based Compensation expenses were $258,096 for the three month period ended March 31, 2015, compared to $120,000 for the period ended March 31, 2014. This increase is as expected due to the increase in options granted and options vesting.

Comprehensive Loss from Operations

The Comprehensive loss from operations was $461,098 for the three month period ended March 31, 2015 compared to a loss of $234,488 during the same three month period ended March 31, 2014. This increase is as expected due to significant increase in stock based compensation expense, increase in rent due to new office space and additional filing and transfer agent fees.

For the Nine Month Period Ended March 31, 2015

Consulting & Management

Consulting and management fees for the nine month period ended March 31, 2015 were $214,833 compared to $140,333 for the nine month period ended March 31, 2014. The significant increase is due to an increase in Executive compensation as well as the addition of a full time CFO.

Filing and Transfer Agent Fees

Fees amounted to 63,242 for the nine month period ended March 31, 2015 compared to $31,087 for the same period ended March 31, 2014. This was due to significant increase in public news releases and capital transactions which resulted in filing fees with the TSX Exchange.

Legal and Accounting Fees

Legal and accounting fees were $5,665 for the nine month period ended March 31, 2015 compared to $31,036 for the same period ended March 31, 2014. This difference was due to legal fees which were charged in 2014 for due diligence on products the company was in-licensing.

Page 7

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.05 RESULTS OF OPERATIONS (continued)

Product Registration and Development Costs

Total costs incurred in this category for the nine month period ended March 31, 2015 were $20,887 compared to 9,936 for the same period ended March 31, 2014. Costs incurred in this category consist primarily of fees paid to maintain the Company’s trademarks as well as the costs incurred to file products with Health Canada.

Stock Based Compensation

Stock based Compensation expenses were 530,671 for the three month period ended March 31, 2015, compared to 241,800 for the period ended March 31, 2014. This increase was expected due to the significant amount of stock based transaction in the third quarter of 2015.

Comprehensive (Gain)/Loss from Operations

The Comprehensive (loss) from operations was $(1,032,441) for the nine month period ended March 31, 2015 compared to a loss of $(497,306) during the same period ended March 31, 2014.

1.06 LIQUIDITY

As at March 31, 2015, the Company had working capital of $2,964,983 ($156,185 – June 30, 2014).

| | |

| Mar 31, 2015

| June 30, 2014

|

| $

| $

|

Current Assets

| 3,015,408

| 313,506

|

Current Liabilities

| (50,425)

| (157,321)

|

Working Capital

| 2,964,983

| 156,185

|

Management has raised sufficient cash from warrant and option exercises in the third quarter to fund the current business operations. Management does not anticipate any additional financings or capital requirements to fund the current operations.

1.07

CAPITAL RESOURCES

During the nine month period ended March 31, 2015, no options or warrants expired or were canceled. During the year ended June 30, 2014 a total of 250,000 warrants and 950,000 options were cancelled.

During the three month period ended March 31 2015, a total of 1,425,000 options and 6,134,000 warrants were exercised resulting in total cash flow to the Company of $2,253,800.

During the nine month period ended March 31, 2015, the Company completed the following private placement:

On December 10, 2014 the Company closed a non-brokered private placement of 7,607,332 units at a price of $0.15 per unit for gross proceeds of $1,141,100.

Each Unit consists of one (1) common share and one half (1/2) transferrable share purchase warrant. Each Warrant will entitle the holder thereof to purchase one (1) additional Common Share on or before December 10, 2015 at a price of $0.25 per Common Share.

Page 8

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.07

CAPITAL RESOURCES (continued)

In accordance with the policies of the TSX Venture Exchange, Finder’s fees of $91,287 cash were paid in addition to the issuance of 608,586 warrants.

Securities are subject to a 4 month hold period that expires on April 11, 2015. Proceeds from the Offering will be used by the Company for commercialization of the generic and OTC products and for general ongoing corporate and working capital purposes.

The fair value of the warrants issued as a part of the placement unit and as finders fees to agents were estimated using the Black-Scholes option pricing model and totalled $489,739.

During the year ended June 30, 2014, the Company completed the following private placements:

i)

April 08, 2014 the Company closed a non-brokered Private Placement of up to 1,750,000 units of the Company at a price of $0.10 per unit for gross proceeds of up to $175,000.

Each Unit will consist of one (1) common share and one (1) transferrable share purchase warrant. Each Warrant will entitle the holder thereof to purchase one (1) additional Common Share for a period of twenty four (24) months from the Closing Date of the Offering at a price of CDN$0.30 per Common Share.

The Warrants will be subject to an accelerated exercise provision in the event the shares trade more than

$0.10 above the exercise price for ten (10) consecutive days.

ii)

April 08, 2014 the Company closed a non-brokered Private Placement of up to 2,000,000 units of the Company at a price of $0.10 per unit for gross proceeds of up to $200,000.

Each Unit will consist of one (1) common share and one (1) transferrable share purchase warrant. Each warrant will entitle the holder thereof to purchase one (1) additional Common Share for a period of twenty four (24) months from the Closing Date of the Offering at a price of CDN$0.13 per Common Share.

Finder’s fees of $12,000 were paid in addition to the issuance of 300,000 warrants. 120,000 warrants have a life of 2 years and are exercisable at $0.13. The remaining 180,000 warrants have a life of one year and are exercisable at $0.30.

Proceeds from the Offering will be used by VANC for general ongoing corporate and working capital purposes.

On June 12, 2013 the Company closed a non-brokered private placement of 8,000,000 units of the Company’s common shares at a price of $0.10 per unit, for proceeds of $800,000. Each Unit is exchangeable for one common share of the Company and one share purchase warrant. Each warrant will entitle the holder to purchase one additional common share of the Company for a period of 36 months at a price of $0.30 per common share in the first year, $0.40 in the second year and $0.50 in the third year. The Units cannot be exchanged for shares and warrants during the first year unless the holder either simultaneously exercises or forgoes the warrants. The warrants are subject to an accelerated exercise provision if the shares trade more than $0.10 above the exercise price for ten consecutive trading days.

The private placement was subject to a TSX-V hold period expiring on October 12, 2013. Legal fees of $850 and finders’ fees of $ 57,600 were charged against share capital in connection with the private placement. Warrants were valued at $663,834 using the Black Scholes Valuation method.

Page 9

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.07

CAPITAL RESOURCES (continued)

On April 27, 2012, the Company closed a non-brokered private placement of 560,000 units of the Company’s common shares at a price of 10 cents per unit, for proceeds of $560,000. Each unit consists of one common share of the Company and one share purchase warrant, which will entitle the holder thereof to purchase one additional common share of the Company for a period of 24 months from the closing date of the offering at an exercise price of 15 cents for the first 12 months and 20 cents during the next 12 months. The Company has paid a finder’s fee of $4,100 pursuant to the policies of the TSX Venture Exchange.

On January 12, 2011, the Company completed a private placement of 200,000 units of the Company at a consolidated price of $1.00 per unit for gross proceeds of $200,000. Each unit consists of one common share of the Company and one share purchase warrant. Each warrant entitles the holder to acquire one additional common share at a price of $2.00 per share until January 12, 2013 with a forced exercise provision attached to each warrant. Legal fees of $5,626 were charged against share capital in connection with the private placement. Warrants were valued at $18,676.

Options

As at March 31, 2015 the Company has 750,000 stock options granted and outstanding to employees and consultants of the Company and 2,700,000 stock options granted and outstanding to Officers and Directors of the Company.

Additional Financing

Per management estimates, the Company has adequate cash flows to fulfill its current business objectives. Additional financing is not required at this time.

Management also expects to fund future growth organically through cash flows generated by current operations. However as there is no guaranteed assurance that the current business plan will be profitable, management is maintaining flexibility with any future equity or debt financing requirements.

1.08

COMMITMENTS AND AGREEMENTS

1.

The Company has a consulting agreement with the CEO for a monthly expense of $13,333. The Company also has a consulting agreement with the CFO for a monthly expense of $5,000.

2.

On May 01, 2014 the Company signed an Investor Relations and Communications Agreement with Pure Advertising and Marketing for $5,000 per month.

3.

On April 16, 2014 – the Company announced that it has signed Cross Referencing Agreements (the “CRAs”) for prescription generic products for Canadian markets. These agreements cover 49 prescription generic products and are for acute and chronic diseases.

4.

The Company has a lease agreement for its current office space for $3,835 per month.

1.09

OFF-BALANCE SHEET ARRANGEMENTS

The Company is not aware of any off-balance sheet transactions requiring disclosure.

Page 10

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.10

TRANSACTIONS WITH RELATED PARTIES

Related party transactions and balances for the nine month period ended March 31, 2015 and year ended June 30, 2014 as follows:

| | |

| March 31,

| June 30,

|

| 2015

| 2014

|

| $

| $

|

Accounts payable

| -

| 26,375

|

Promissory note

| -

| 32,978

|

Expenditures

| | |

Management & consulting fees

| 135,493

| 140,333

|

Stock-based compensation

| 300,050

| 252,466

|

Rent

| 4,500

| 9,530

|

Travel

| 1,500

| 2,647

|

| | |

Amounts payable and promissory note balances at June 30, 2014 consist of unpaid balance of CEO fees owed by the Company for services rendered and a short term loan that was settled during the nine month period ended March 31, 2015.

Management & consulting fees include payments to officers and directors of the Company for services rendered, and include payments to the CEO, CFO and the corporate secretary.

Rent and travel expenses consist of fees paid to the CEO.

These transactions were measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties. All related party transactions were in the normal course of business operations.

1.11

SUBSEQUENT EVENTS

Subsequent to the nine month period ending March 31, 2015, a total of $441,573 was raised pursuant to exercising 300,000 warrants at an exercise price of $0.40 per warrant and 1,286,293 warrants at an exercise price of $0.25 per warrant. As a result, 1,586,293 common shares were issued.

On April 2, 2015 the Company announced that it had adopted an advanced notice policy providing a clear framework for nominating directors of the Company. This is to ensure that all shareholders receive adequate notice of director nominations and sufficient information regarding all director nominees.

On May 4, 2015 the Company announced that it had received 5 additional Drug Identification Number’s (DIN) comprising of 14 dosages across various therapeutic categories.

Page 11

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.11

SUBSEQUENT EVENTS (continued)

| | | |

| Molecule Name

| Presentations

| Brand Reference

|

1

| VAN-Citalopram

| 10 MG, 20 MG and 40 MG Tab

| Celexa™

|

2

| VAN- Olanzapine ODT

| 5 MG, 10 MG, 15 MG and 20 MG Tab

| Zyprexa Zydis™

|

3

| VAN- Ramipril Cap

| 1.25 MG, 2.5 MG, 5 MG, 10 MG and 15 MG Tab

| Altace™

|

4

| VAN- Zolmitriptan

| 2.5 MG Tab

| Zomig™

|

5

| VAN- Zolmitriptan ODT

| 2.5 MG Tab

| Zomig Rapimelt™

|

The company also announced that they had received initial orders placed with manufacturers earlier in 2015.

1.12

CRITICAL ACCOUNTING ESTIMATES

The Company’s significant accounting policies are presented in Note 3 of the audited consolidated financial statements for the year ended June 30, 2014. The preparation of financial statements using accounting policies in compliance with IFRS requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Such estimates may have a significant impact on the consolidated financial statements. Actual amounts could differ materially from the estimates used and, accordingly, affect the results of the operations.

The preparation of the consolidated financial statements also requires management to exercise judgment in the process of applying the accounting policies.

Significant estimates used in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements are as follows:

i)

Recoverability of the carrying value of Intangible Assets:

The Company is required to review the carrying value of its intangible assets for potential impairment. Impairment is indicated if the carrying value of the Company’s intangible assets is not recoverable. If impairment is indicated, the amount by which the carrying value of intangible assets exceeds the estimated fair value is charged to the statement of loss and comprehensive loss.

Evaluating the recoverability requires judgments in determining whether future economic benefits from sale or otherwise are likely. Evaluation may be more complex where activities have not reached a stage which permits a reasonable assessment of the viability of the asset. Management must make certain estimates and assumptions about future events or circumstances including, but not limited to, the interpretation of marketing and sales data as well as the Company’s financial ability to continue marketing and sales activities and operations.

Management has determined that there are no indicators of impairment over its intangible asset.

Page 12

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.12

CRITICAL ACCOUNTING ESTIMATES (continued)

ii)

Inputs used in Black Scholes valuation model (volatility; interest rate; expected life and dividend yield in accounting for Share Purchase Warrant transactions and Options granted:

Estimating the fair value of granted share purchase warrants required determining the most appropriate valuation model which is dependent on the terms and conditions of the grant. The estimate of warrant and option valuation also requires determining the most appropriate inputs to the valuation model including the volatility, expected life of warrants and options, risk free interest rate and dividend yield.

During the nine month period ending March 31, 2015 and the year ended June 30, 2014, management measured and recorded the following fair values relating to warrants and options issued and granted using the Black Sholes valuation model:

| | | | |

| | | March 31,

| June 30,

|

| | | 2015

| 2014

|

| | | $

| $

|

Options

| | | 530,671

| 241,800

|

Warrants

| | | 422,206

| 375,000

|

Agent warrants

| | | 67,533

| 47,567

|

| | | | |

iii)

Provision for Contingent Liabilities

Management must estimate the likelihood of a financial obligation arising from a contingent liability if it is deemed more likely than not, that there will be a future cash outflow due to a past event involving the Company. For this estimate, a provision must be made if the amount of the outflow can be reasonably determined. There have been no contingent liabilities.

iv)

Useful Life of Equipment

The useful life of equipment is based on management estimates at the time of acquisition. The Company amortizes assets, using declining balance method, over the useful life of the asset. Estimates of residual values, useful lives and amortization methods are reviewed periodically by management. Any changes that arise from periodic reviews are accounted for and adjusted prospectively.

Amortization is calculated on a declining balance method over their estimated useful lives. The Company’s equipment, which consists of computer, furniture equipment and leasehold, is amortized at 30% and for the nine month period ended March 31, 2015, resulted in amortization expense of $6,955 (March 31, 2014 - $nil).

Significant judgments used in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements are as follows:

i)

Going Concern

The assessment of the Company’s ability to execute its strategy by funding future working capital requirements involves judgment. Estimates and assumptions are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

Page 13

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.12

CRITICAL ACCOUNTING ESTIMATES (continued)

The condensed interim consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern which assumes that the Company will continue in operations for the foreseeable future and be able to realize assets and satisfy liabilities in the normal course of business.

ii)

Deferred Taxes

Tax interpretations, regulations, and legislation in the various jurisdictions operates are subject to change. The determination of income tax expense and deferred tax involves judgment and estimates as to the future taxable earnings, expected timing of reversals of deferred tax assets and liabilities, and interpretations of laws in the countries in which the Company operates. The Company is subject to assessments by tax authorities who may interpret the tax law differently. Changes in these estimates may materially affect the final amount of deferred taxes or the timing of tax payments.

The deferred tax assets have not been recognized because at this stage of the Company’s development, it is not determinable that future taxable profit will be available against which the Company can utilize such deferred tax assets.

Segment reporting

A reportable segment, as defined by IFRS 8 Operating Segments, is a distinguishable business or geographical component of the Company, which are subject to risks and rewards that are different from those of other segments. The Company considers its primary reporting format to be business segments. The Company considers that it has only one reportable segment, being its operations in Canada.

1.13 RECENT ACCOUNTING PRONOUNCEMENTS

Accounting standards recently adopted

The Company has applied the following standards in these condensed consolidated interim financial statements which were effective for the Company beginning July 1, 2014:

Recoverable Amount Disclosures for Non-Financial Assets (Amendments to IAS 36) Amends IAS 36 Impairment of Assets to reduce the circumstances in which the recoverable amount of assets or cash-generating units is required to be disclosed, clarify the disclosures required, and to introduce an explicit requirement to disclose the discount rate used in determining impairment (or reversals) where recoverable amount (based on fair value less costs of disposal) is determined using a present value technique. The application of this standard did not have a significant impact on the Company’s unaudited condensed consolidated interim financial statements.

Future accounting policy changes issued but not yet in effect

Pronouncements that are not applicable or that do not have a significant impact to the Company have not been included in these consolidated financial statements.

In May 2013, the IASB issued IFRIC 21, Levies (“IFRIC 21”), an interpretation of IAS 37, Provisions, Contingent Liabilities and Contingent Assets (“IAS 37”), on the accounting for levies imposed by governments. IAS 37 sets out criteria for the recognition of a liability, one of which is the requirement for the entity to have a present obligation as a result of a past event (“obligating event”). IFRIC 21 clarifies that the obligating event that gives rise to a liability to pay a levy is the activity described in the relevant legislation that triggers the payment of the levy. IFRIC 21 is effective for annual periods commencing on or after January 1, 2014. The Company is currently evaluating the impact of applying IFRIC 21, however it does not expect the implementation of this standard to have a material impact on its consolidated financial statements.

Page 14

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.13 RECENT ACCOUNTING PRONOUNCEMENTS (continued)

The IASB intends to replace IAS 39, Financial Instruments: Recognition and Measurement in its entirety with IFRS 9, Financial Instruments (“IFRS 9”) and to reduce the complexity in the classification and measurement of financial instruments. The completed version of IFRS 9 will include classification and measurement, impairment and hedge accounting requirements and the IASB has tentatively decided that the mandatory effective date of this new standard will be for annual periods beginning on or after January 1, 2018. The Company is currently monitoring the phases of this IASB project with a view to evaluating the impact of the standard when it is issued in its final form, which is expected in calendar 2015.

1.14 FINANCIAL INSTRUMENTS

The Company’s financial instruments include cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, short term loans and promissory notes. The carrying values of these financial instruments approximate their fair values due to their relatively short periods to maturity. The Company’s risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to market conditions and the Company’s activities. The Company has exposure to credit risk, liquidity risk and market risk as a result of its use of financial instruments.

This note presents information about the Company’s exposure to each of the above risks and the Company’s objectives, policies and processes for measuring and managing these risks. Further quantitative disclosures are included throughout these financial statements. The Board of Directors has overall responsibility for the establishment and oversight of the Company’s risk management framework. The Board has implemented and monitors compliance with risk management policies

a) Credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises primarily from the Company’s cash and cash equivalents and accounts receivables. The Company’s cash and cash equivalents are held through a large Canadian financial institution. The cash equivalent is composed of a guaranteed investment certificate and is issued by a Canadian bank with high investment-grade ratings. The Company does not have financial assets that are invested in asset backed commercial paper.

The Company monitors the concentration of exposure and where possible, if necessary, takes steps to limit exposure to any counterparty. The Company views credit risk on cash deposits and accounts receivables as minimal.

b) Liquidity risk

Liquidity risk is the risk that the Company will incur difficulties meeting its financial obligations as they are due. The Company’s approach to managing liquidity is to ensure, as far as possible, that it will have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions without incurring unacceptable losses or risking harm to the Company’s reputation.

The Company monitors its spending plans, repayment obligations and cash resources and takes actions with the objective of ensuring that there is sufficient capital in order to meet short-term business requirements. To facilitate its expenditure program, the Company raises funds primarily through public equity financing. The Company anticipates it will have adequate liquidity to fund its financial liabilities through future equity contributions.

As at March 31, 2015, the Company’s financial liabilities were comprised of accounts payable of $50,425.

Page 15

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.14 FINANCIAL INSTRUMENTS (continued)

c) Market risk

Market risk for the Company consists of currency risk, and interest rate risk. The objective of market risk management is to manage and control market risk exposures within acceptable limits, while maximizing returns.

i)

Currency risk

Foreign currency exchange rate risk is the risk that the fair value or future cash flows will fluctuate as a result of changes in foreign exchange rates. As all of the Company’s purchases are denominated in Canadian dollars, and has no significant cash balances denominated in foreign currencies, the Company is not exposed to foreign currency exchange risk at this time.

ii)

Interest rate risk

Interest rate risk is the risk that fair values or future cash flows will fluctuate as a result of changes in market interest rates. In respect of financial assets, the Company’s policy is to invest cash at floating interest rates and cash reserves are to be maintained in cash equivalents in order to maintain liquidity, while achieving a satisfactory return for shareholders. Fluctuations in interest rates impact marginally on the value of cash and equivalents.

The Company is not exposed to interest rate risk on its short term liabilities, and does not have any long-term liabilities as of March 31, 2015.

d) Determination of Fair Value

The fair values of financial assets and financial liabilities are determined as follows:

i)

Cash and cash equivalents are measured at fair value. For accounts receivable, accounts payable and accrued liabilities, carrying amounts approximate fair value due to their short-term maturity;

ii)

The fair value of promissory notes payable approximate their carrying value as their effective interest rates approximate current market rates;

iii)

The fair value of derivative financial instruments is determined based on fair market valuation methods.

| | | |

| Fair Value at March 31, 2015

|

| Level 1

| Level 2

| Level 3

|

| $

| $

| $

|

Financial Assets

| | | |

Cash and cash equivalents

| 2,476,988

| -

| -

|

| | | |

| Fair Value at June 30, 2014

|

| Level 1

| Level 2

| Level 3

|

| $

| $

| $

|

Financial Assets

| | | |

Cash and cash equivalents

| 295,377

| -

| -

|

The fair value hierarchy establishes three levels to classify the inputs to valuation techniques used to measure fair value. The three levels of the fair value hierarchy are described below:

Page 16

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.14 FINANCIAL INSTRUMENTS (continued)

Level 1:

Unadjusted quoted prices in active markets that are accessible at the measurement date for identical assets or liabilities and amounts resulting from direct arm’s length transactions.

Cash and cash equivalents are valued using quoted market prices or from amounts resulting from direct arm’s length transactions. As a result, these financial assets and liabilities have been included in Level 1 of the fair value hierarchy.

Level 2:

Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly, for substantially the full contractual term. Derivatives are included in Level 2 of the fair value hierarchy as they are valued using price models. These models require a variety of inputs, including, but not limited to, contractual terms, market prices, forward price curves, yield curves and credit spreads. The Company has no financial instruments at this level

Level 3:

Inputs for the asset or liability are not based on observable market data. Currently the Company has no financial instruments at this level.

1.15

OTHER MD&A REQUIRMENTS

(a)

Additional Information

Additional information relating to the Company can be found on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) database at www.sedar.com.

Additional relevant disclosure, such as expensed research and development costs, general and administration expenses, material costs, whether capitalized, deferred or expensed are disclosed in the accompanying financial statements for the for the year ended June 30, 2014 as allowed in NI 51-102, Section 5.3 (3).

(b) Disclosure of Outstanding Share Data

The following table summarizes the Company’s outstanding share capital as at report date:

Page 17

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.15

OTHER MD&A REQUIRMENTS (continued)

| | |

Security in Number

|

March 31, 2015

|

Reporting Date

|

Each class and series of voting or equity securities for which there are securities outstanding:

Common Shares

| 51,933,406

|

54,170,099

|

Each class and series of securities for which there are securities outstanding if the securities are convertible into, or exercisable or exchangeable for, voting or equity securities

Stock Options

Warrants

Convertible Debentures

| 3,450,000

10,078,252

-

| 3,780,000

7,792,059

-

|

Each class and series of voting or equity securities that are issuable on the conversion, exercise or exchange of outstanding securities above Options and Warrants.

Fully diluted

| 13,528,252

65,461,658

| 11,572,059

65,742,158

|

(c)

Disclosure Controls and Procedures

Disclosure controls and procedures are designed to ensure that information required to be disclosed by the Company is accumulated and communicated to management as appropriate to allow timely decision-making regarding required disclosures. The Company’s CEO and CFO have concluded that information required to be disclosed in the Company’s consolidated financial statements and MD&A (the “filings”) have been disclosed and fairly presented in the filings and that processes are in place to provide them with sufficient knowledge to support such representation. However, a control system, no matter how well conceived, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

(d)

Internal Control Over Financial Reporting

The management of VANC is responsible for establishing and maintaining adequate internal controls over financial reporting (“ICFR”) to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

Management has evaluated the design of its ICFR as defined in Regulation 52-109 – Certification of Disclosure in Issuer’s annual and Interim Filings. The evaluation was based on the criteria established in the “Internal Control –Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission (1992) (“COSO”). This evaluation was performed by the CEO and CFO of the Company. Based on this evaluation, CEO and CFO concluded that the ICFR were effectively designed as at March 31, 2015.

ICFR cannot provide absolute assurance of achieving financial reporting objectives due to its inherent limitations. ICFR is a process that involves human diligence and compliance and is subject to error, collusion, or improper override. Due to such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis. It is possible to design into the Company’s financial reporting process safeguards to reduce, though not eliminate, this risk.

Page 18

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![[ex994003.gif]](ex994003.gif)

1.15

OTHER MD&A REQUIRMENTS (continued)

Forward Looking Statements

The statements contained in this report that are not purely historical are forward-looking statements. “Forward looking statements” include statements regarding our expectations, hopes, intentions or strategies regarding the future. Forward looking statements include: statements regarding future products or products or product development; statements regarding future selling, general and administrative costs and research and development spending; and our product development strategy; statements regarding future capital expenditures and financing requirements; and similar forward looking statements. It is important to note that our actual results could differ materially from those in such forward-looking statements.

| |

Officers and Directors

Arun Nayyar, CEO

Aman Parmar, CFO, Director

Eugene Beukman, Secretary, Director

Sina Pirooz, Director

| Contact

VANC Pharmaceuticals Inc.

Suite 615 – 800 West Pender St

Vancouver, BC V6C 2V6

Tel: 604-687-2038 Fax: 604-687-3141

|

Page 19

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Exhibit 99.5

This is an unofficial consolidation of Form 52-109F2R Certification of Refiled Interim Filings reflecting amendments made effective January 1, 2011 in connection with Canada’s changeover to IFRS. The amendments apply for financial periods relating to financial years beginning on or after January 1, 2011. This document is for reference purposes only and is not an official statement of the law.

Form 52-109F2R

Certification of Refiled Interim Filings

This certificate is being filed on the same date that VANC Pharmaceuticals Inc. (the “issuer”) has refiled the Issuer’s Management Discussion and Analysis for the third period ended March 31, 2015.

I, Arun Nayyar, Chief Executive Officer of VANC Pharmaceuticals Inc. certify the following:

1.

Review: I have reviewed the interim financial report and interim MD&A (together, the “interim filings”) of the issuer for the interim period ended March 31, 2015.

2

No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

3.

Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial report together with the other financial information included in the interim filings fairly present in all material respects the financial condition, financial performance and cash flows of the Issuer, as of the date of and for the periods presented in the interim filings.

Date: June 5, 2015

Signed: “Arun Nayyar”

_______________________

Arun Nayyar

Chief Executive Officer

NOTE TO READER

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of

i) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

ii) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP.

The issuer’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate. Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

Exhibit 99.6

This is an unofficial consolidation of Form 52-109F2R Certification of Refiled Interim Filings reflecting amendments made effective January 1, 2011 in connection with Canada’s changeover to IFRS. The amendments apply for financial periods relating to financial years beginning on or after January 1, 2011. This document is for reference purposes only and is not an official statement of the law.

Form 52-109F2R

Certification of Refiled Interim Filings

This certificate is being filed on the same date that VANC Pharmaceuticals Inc. (the “issuer”) has refiled the Issuer’s Management Discussion and Analysis for the third period ended March 31, 2015.

I, Aman Parmar, Chief Financial Officer of VANC Pharmaceuticals Inc. certify the following:

1.

Review: I have reviewed the interim financial report and interim MD&A (together, the “interim filings”) of the issuer for the interim period ended March 31, 2015.

2,

No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

3.

Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial report together with the other financial information included in the interim filings fairly present in all material respects the financial condition, financial performance and cash flows of the Issuer, as of the date of and for the periods presented in the interim filings.

Date: June 5, 2015

Signed: “Aman Parmar”

_______________________

Aman Parmar

Chief Financial Officer

NOTE TO READER

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of

i) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

ii) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP.

The issuer’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate. Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

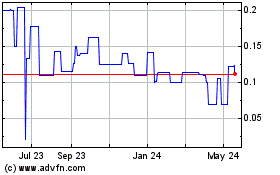

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Jan 2025 to Feb 2025

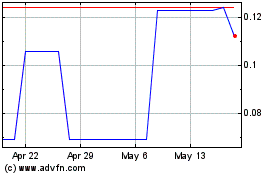

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Feb 2024 to Feb 2025