false

0001817640

0001817640

2024-09-24

2024-09-24

0001817640

BRZH:CommonStockParValue0.0001PerShareMember

2024-09-24

2024-09-24

0001817640

BRZH:RightsExchangeableIntoOnetwentiethOfOneShareOfCommonStockMember

2024-09-24

2024-09-24

0001817640

BRZH:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50PerWholeShareMember

2024-09-24

2024-09-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 24, 2024

BREEZE HOLDINGS ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39718 |

|

85-1849315 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

955 W.

John Carpenter Freeway, Suite 100-929

Irving,

TX 75039

(Address of principal executive offices)

(619) 500-7747

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.0001 per share |

|

BRZH |

|

N/A |

| Rights exchangeable into one-twentieth of one share of common stock |

|

BRZHR |

|

N/A |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per whole share |

|

BRZHW

|

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

Merger Agreement

On

September 24, 2024, Breeze Holdings Acquisition Corp., a Delaware corporation (“Breeze”), entered into a Merger Agreement

and Plan of Reorganization (the “Merger Agreement”), by and among (i) Breeze, (ii) a Cayman Islands exempted company and wholly-owned

subsidiary of Parent expected to be named “YD Bio Limited,” which is in the process of being formed, and once formed will

enter into a joinder to the Merger Agreement (“Pubco”), (iii) Breeze Merger Sub, Inc., a Delaware corporation and which

will be a direct, wholly-owned subsidiary of Pubco (“Parent Merger Sub”), (iv) a Cayman Islands exempted company which will

be a wholly-owned subsidiary of Pubco, expected to be named “BH Biopharma Merger Sub Limited,” and once formed, will enter

into a joinder to the Merger Agreement (“Company Merger Sub,” with Company Merger Sub and Parent Merger Sub together referred

to herein as the “Merger Subs”), and (v) YD Biopharma Limited, a Cayman Islands exempted company (“YD Biopharma”).

Capitalized terms used herein and not defined shall have the meaning attributed to them in the Merger Agreement.

The

Merger Agreement and the transactions contemplated thereby were approved by the boards of directors of each of Breeze and YD Biopharma.

The Business Combination

Pursuant

to and in accordance with the terms set forth in the Merger Agreement, (a) Parent Merger Sub will merge with and into Breeze, with

Breeze continuing as the surviving entity (the “Parent Merger”), as a result of which, (i) Breeze will become a wholly-owned

subsidiary of Pubco, and (ii) each issued and outstanding security of Breeze immediately prior to the effective time of the Parent

Merger (the “Parent Merger Effective Time”) (other than shares of Breeze common stock that have been redeemed or are owned

by Breeze or any of its direct or indirect subsidiaries as treasury shares and any Dissenting Parent Shares (as defined in the Merger

Agreement)) shall no longer be outstanding and shall automatically be cancelled in exchange for the issuance to the holder thereof of

a substantially equivalent security of Pubco (other than the Parent Rights, which shall be automatically converted into ordinary shares

of Pubco), and, (b) immediately following the consummation of the Parent Merger but on the same day, Company Merger Sub will merge

with and into YD Biopharma, with YD Biopharma continuing as the surviving entity (the “Company Merger” and, together with

the Parent Merger, the “Mergers”), as a result of which, (i) YD Biopharma will become a wholly-owned subsidiary of Pubco,

and (ii) each issued and outstanding security of YD Biopharma immediately prior to the effective time of the Company Merger (the

“Company Merger Effective Time”) (other than any Cancelled Shares or Dissenting Shares) shall no longer be outstanding and

shall automatically be cancelled in exchange for the issuance to the holder thereof of a substantially equivalent security of Pubco. The

Mergers and the other transactions contemplated by the Merger Agreement are hereinafter referred to as the “Business Combination.”

The

Business Combination is expected to close in February 2025, subject to customary closing conditions, the receipt of certain governmental

approvals and the required approval by the stockholders of Breeze and YD Biopharma.

Business Combination

Consideration

Pursuant to and in accordance

with the terms set forth in the Merger Agreement, at the Parent Merger Effective Time, (a) each share of Breeze common stock, par value

$0.0001 per share (“Breeze Common Stock”) outstanding immediately prior to the Parent Merger Effective Time that has not been

redeemed, is not owned by Breeze or any of its direct or indirect subsidiaries as treasury shares and is not a Dissenting Parent Share

will automatically convert into one ordinary share of Pubco (each, a “Pubco Ordinary Share”), (b) each Breeze Warrant shall

automatically convert into one warrant to purchase a Pubco Ordinary Share (each, a “Pubco Warrant”) on substantially the same

terms and conditions; and (c) each Breeze Right will be automatically converted into the number of Pubco Ordinary Shares that would have

been received by the holder of such Breeze Right if it had been converted upon the consummation of a business combination in accordance

with Breeze’s organizational documents.

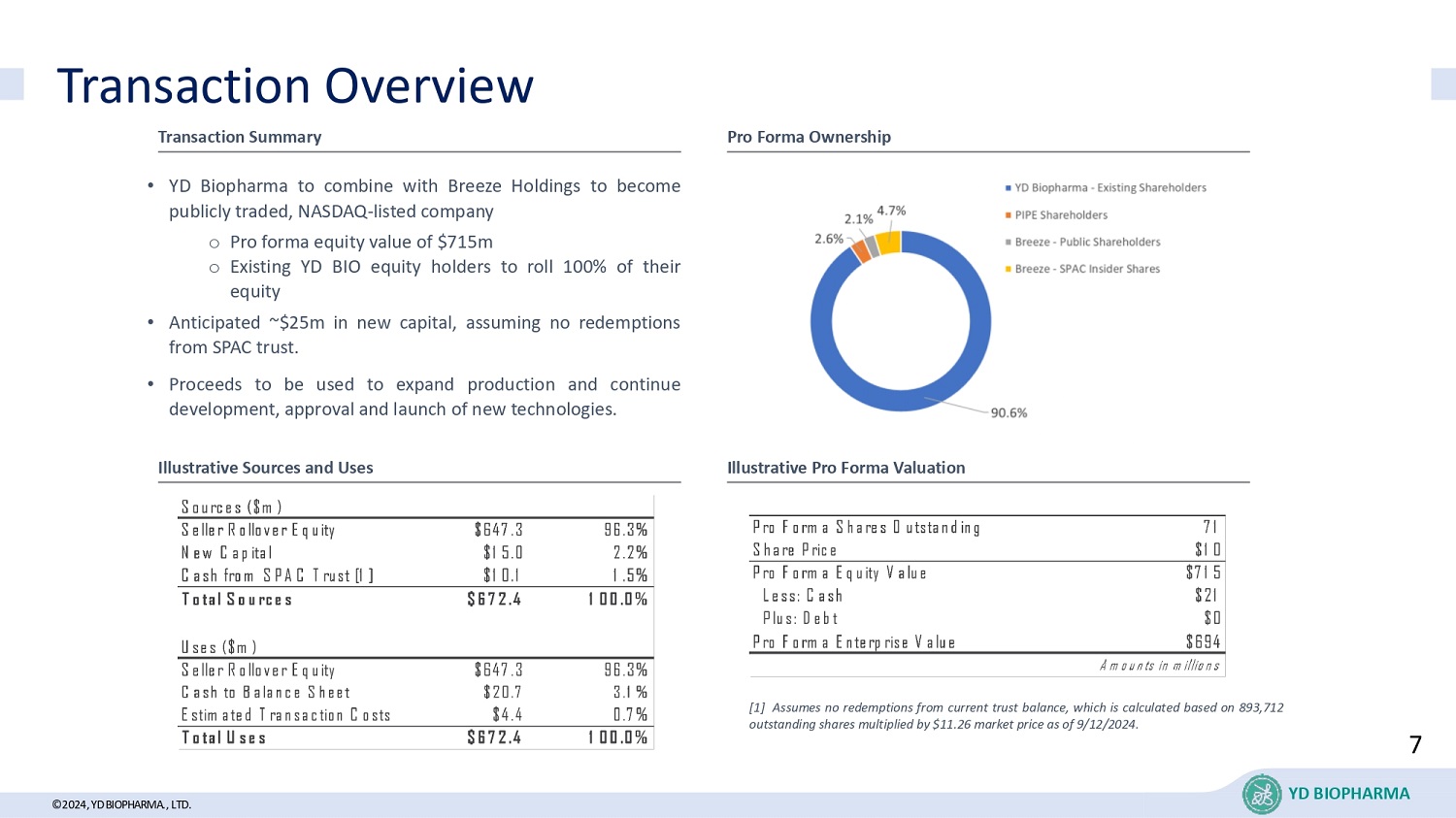

The aggregate consideration

to be received by the equity holders of YD Biopharma is based on a pre-transaction equity value of $647,304,110. In accordance with

the terms and subject to the conditions of the Merger Agreement, at the Company Merger Effective Time, each issued and outstanding

ordinary share of YD Biopharma shall be cancelled and converted into a number of Pubco Ordinary Shares based on that Exchange Ratio described

below. The Exchange Ratio will be equal to (i) $647,304,110, divided by (ii) the number of fully-diluted shares of YD Biopharma

Common Stock outstanding as of the Closing, further divided by (iii) an assumed value of Pubco Ordinary Shares of $10.00 per share.

Governance

The

parties have agreed to take actions such that, effective immediately after the Closing of the Business Combination, Pubco’s board

of directors shall consist of seven directors, consisting of two Breeze designees (at least one of whom shall be an “independent

director”), four YD Biopharma designees (at least three of whom shall be “independent directors”). Additionally, certain

current YD Biopharma management personnel will become officers of Pubco. To qualify as an “independent director” under the

Merger Agreement, a designee shall qualify as “independent” under the rules of the Nasdaq Stock Market.

Representations

and Warranties; Covenants

The Merger Agreement contains

representations, warranties and covenants of each of the parties thereto that are customary for transactions of this type, including,

among others, covenants providing for (i) certain limitations on the operation of the parties’ respective businesses prior to consummation

of the Business Combination, (ii) the parties’ efforts to satisfy conditions to consummation of the Business Combination, including

by obtaining any necessary approvals from governmental agencies (including U.S. federal antitrust authorities and under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, as amended (the “HSR Act”)), (iii) prohibitions on the parties soliciting alternative

transactions, (iv) Pubco preparing and filing a registration statement on Form F-4 with the Securities and Exchange Commission (the “SEC”)

and taking certain other actions to obtain the requisite approval of Breeze’s stockholders to vote in favor of certain matters,

including the adoption of the Merger Agreement and approval of the Business Combination, at a special meeting to be called for the approval

of such matters, and (v) the protection of, and access to, confidential information of the parties.

The representations, warranties

and covenants in the Merger Agreement were made solely for the benefit of the parties to the Merger Agreement and are subject to limitations

agreed upon by the contracting parties, including being qualified by confidential disclosures made the parties to the Merger Agreement

which are not filed publicly and which are subject to a contractual standard of materiality different from that generally applicable to

stockholders and were used for the purpose of allocating risk among the parties rather than establishing matters as facts. Breeze does

not believe that these schedules contain information that is material to an investment decision.

In

addition, Pubco has agreed to adopt an equity incentive plan, as described in the Merger Agreement.

Conditions to the

Closing

The

obligations of Breeze, Pubco, Parent Merger Sub and Company Merger Sub (the “Breeze Parties”) and YD Biopharma to consummate

the Business Combination are subject to certain closing conditions, including, but not limited to, (i) the approval of Breeze’s

stockholders, (ii) the approval of YD Biopharma’s stockholders, and (iii) Pubco’s Form F-4 registration statement

becoming effective.

In addition, the obligations

of the Breeze Parties to consummate the Business Combination are also subject to the fulfillment (or waiver) of other closing conditions,

including, but not limited to, (i) the representations and warranties of YD Biopharma being true and correct to the standards applicable

to such representations and warranties and each of the covenants of YD Biopharma having been performed or complied with in all material

respects, (ii) delivery of certain ancillary agreements required to be executed and delivered in connection with the Business Combination,

and (iii) no Material Adverse Effect having occurred.

The obligation of YD Biopharma

to consummate the Business Combination is also subject to the fulfillment (or waiver) of other closing conditions, including, but not

limited to, (i) the representations and warranties of the Breeze Parties being true and correct to the standards applicable to such

representations and warranties and each of the covenants of the Breeze Parties having been performed or complied with in all material

respects, and (ii) the shares of Pubco Common Stock issuable in connection with the Business Combination being listed on the Nasdaq

Stock Market.

Termination

The Merger Agreement may be

terminated under certain customary and limited circumstances prior to the Closing of the Business Combination, including, but not limited

to, (i) by mutual written consent of Breeze and YD Biopharma, (ii) by Breeze, on the one hand, or YD Biopharma, on the other

hand, if there is any breach of the representations, warranties, covenant or agreement of the other party as set forth in the Merger Agreement,

in each case, such that certain conditions to closing cannot be satisfied and the breach or breaches of such representations or warranties

or the failure to perform such covenant or agreement, as applicable, are not cured or cannot be cured within certain specified time periods,

(iii) by either Breeze or YD Biopharma if the Business Combination is not consummated by April 30, 2025 (which date may be extended

by mutual agreement of the parties to the Merger Agreement), (iv) by either Breeze or YD Biopharma if a meeting of Breeze’s

stockholders is held to vote on proposals relating to the Business Combination and the stockholders do not approve the proposals, and

(v) by Breeze if the YD Biopharma stockholders do not approve the Merger Agreement.

Under

certain circumstances as described further in the Merger Agreement, if the Merger Agreement is validly terminated by Breeze, YD Biopharma

will pay Breeze a fee equal to the trust extension payments made by on behalf of Breeze to the trust in connection with the Business Combination

of up to $150,000.

PIPE Investment

The

Merger Agreement contemplates that Breeze, Pubco and YD Biopharma shall use their commercially reasonable efforts to enter into and consummate

a subscription with investors related to a private placement of shares in the Company, Breeze and/or Pubco (the “PIPE Investment”).

Sponsor Support Agreement

Concurrently with the execution

of the Merger Agreement, Breeze, Pubco, YD Biopharma and the Parent Initial Stockholders (as defined in the Merger Agreement) entered

into an Sponsor Support Agreement (the “Sponsor Support Agreement”), pursuant to which, among other things, the Parent Initial

Stockholders: (a) agreed to vote all of their shares of Breeze Common Stock in favor of the Parent Proposals, including the adoption

of the Merger Agreement and the approval of the Transactions; (b) agreed to vote against any other matter, action, agreement, transaction

or proposal that would reasonably be expected to result in (i) a breach of any of the Breeze Parties’ representations, warranties,

covenants, agreements or obligations under the Merger Agreement or (ii) any of the mutual or YD Biopharma conditions to the Closing

in the Merger Agreement not being satisfied; (c) (i) waived, subject to and conditioned upon the Closing and to the fullest

extent permitted by applicable law and the Breeze organizational documents, and (ii) agreed not to assert or perfect, any rights

to adjustment or other anti-dilution protections to which such Breeze Initial Stockholder may be entitled in connection with the

Mergers or the other Transactions; (d) agreed to take, or cause to be taken, all actions and to do, or cause to be done, all things

reasonably necessary under applicable laws to consummate the Mergers and the other Transactions on the terms and subject to the conditions

set forth in the Merger Agreement prior to any valid termination of the Merger Agreement; (e) agreed not to transfer or pledge any

of their shares of Breeze Common Stock, or enter into any arrangement with respect thereto, after the execution of the Merger Agreement

and prior to the Closing Date, subject to certain customary conditions and exceptions; and (f) waived their rights to redeem any

of their shares of Breeze Common Stock in connection with the approval of the Parent Proposals.

The foregoing description

of the Sponsor Support Agreement is subject to and qualified in its entirety by reference to the full text of the Sponsor Support Agreement,

a copy of which is attached hereto as Exhibit 10.1, and the terms of which are incorporated herein by reference. Any capitalized terms

used in this section entitled “Sponsor Support Agreement” and not otherwise defined herein shall have the meanings

assigned to them in the Sponsor Support Agreement.

YD Biopharma Support

Agreement

Concurrently with the execution

of the Merger Agreement, Breeze, Pubco, YD Biopharma, and certain shareholders of YD Biopharma representing the requisite votes necessary

to approve the Merger Agreement (the “YD Biopharma Equity Holders”) entered into Shareholder Support Agreements (the “Shareholder

Support Agreement”), pursuant to which the YD Biopharma Equity Holders: (a) agreed to vote in favor of the adoption of the Merger

Agreement and approve the Mergers and the other Transactions to which YD Biopharma is a party; (b) agreed to waive any appraisal

or similar rights they may have pursuant to Cayman law with respect to the Mergers and the other Transactions; (d) agreed to vote

against any other matter, action, agreement, transaction or proposal that would reasonably be expected to result in (i) a breach

of any of YD Biopharma’s representations, warranties, covenants, agreements or obligations under the Merger Agreement or (ii) any

of the mutual or the Breeze Parties’ conditions to the Closing in the Merger Agreement not being satisfied; and (e) agreed

not to sell, assign, transfer or pledge any of their YD Biopharma ordinary shares (or enter into any arrangement with respect thereto)

after the execution of the Merger Agreement and prior to the Closing Date, subject to certain customary conditions and exceptions.

The

foregoing description of the Shareholder Support Agreement is subject to and qualified in its entirety by reference to the full text of

the Shareholder Support Agreement, a copy of which is attached hereto as Exhibit 10.2, and the terms of which are incorporated herein

by reference. Any capitalized terms used in this section entitled “Shareholder Support Agreement” and not otherwise

defined herein shall have the meanings assigned to them in the Shareholder Support Agreement.

Lock-Up Agreement

Concurrently with the execution

of the Merger Agreement, Breeze, Pubco, YD Biopharma, the Parent Initial Stockholders and certain YD Biopharma Equity Holders entered

into a Lock-Up Agreement (the “Lock-Up Agreement”), pursuant to which the Parent Initial Stockholders and such YD Biopharma

Equity Holders agreed, among other things, to refrain from selling or transferring their shares of Pubco Common Stock for a period of

eight (8) months following the Closing, subject to early release (a) of 10% of their shares of Pubco Common Stock if the daily

volume weighted average closing sale price of Pubco Common Stock quoted on the Nasdaq for any 20 trading days within any 30 consecutive trading

day period beginning on the four-month anniversary of the Closing exceeds $12.50 per share, (b) of an additional 10% of their shares

of Pubco Common Stock if the daily volume weighted average closing sale price of Pubco Common Stock quoted on the Nasdaq for any 20 trading

days within any 30 consecutive trading day period beginning on the four-month anniversary of the Closing exceeds $15.00 per share;

(c) of all of their shares of Pubco Common Stock upon the occurrence of a Subsequent Transaction; and (d) upon the determination

of the Pubco board of directors (including a majority of the independent directors) following the six month anniversary of the Closing

Date.

The

foregoing description of the Lock-Up Agreement is subject to and qualified in its entirety by reference to the full text of the Lock-Up

Agreement, a copy of which is attached hereto as Exhibit 10.3, and the terms of which are incorporated herein by reference. Any capitalized

terms used in this section entitled “Lock-Up Agreement” and not otherwise defined herein shall have the meanings assigned

to them in the Lock-Up Agreement.

Registration Rights Agreement

In accordance with the Merger

Agreement, within thirty (30) days after the execution of the Merger Agreement, Breeze, the Parent Initial Stockholders, Pubco, and certain

YD Biopharma Equity Holders are expected to enter into a registration rights agreement (the “Registration Rights Agreement”),

pursuant to which Pubco will, among other things, be obligated to file a registration statement to register the resale of certain securities

of Pubco held by the Parent Initial Stockholders and such YD Biopharma Equity Holders. The Registration Rights Agreement will also provide

the Parent Initial Stockholders and such YD Biopharma Equity Holders with “piggy-back” registration rights, subject to certain

requirements and customary conditions.

Item 7.01. Regulation FD Disclosure.

On

September 25, 2024, Breeze and YD Biopharma issued a joint press release announcing their entry into the Merger Agreement. The press release

is attached hereto as Exhibit 99.1 and incorporated by reference herein.

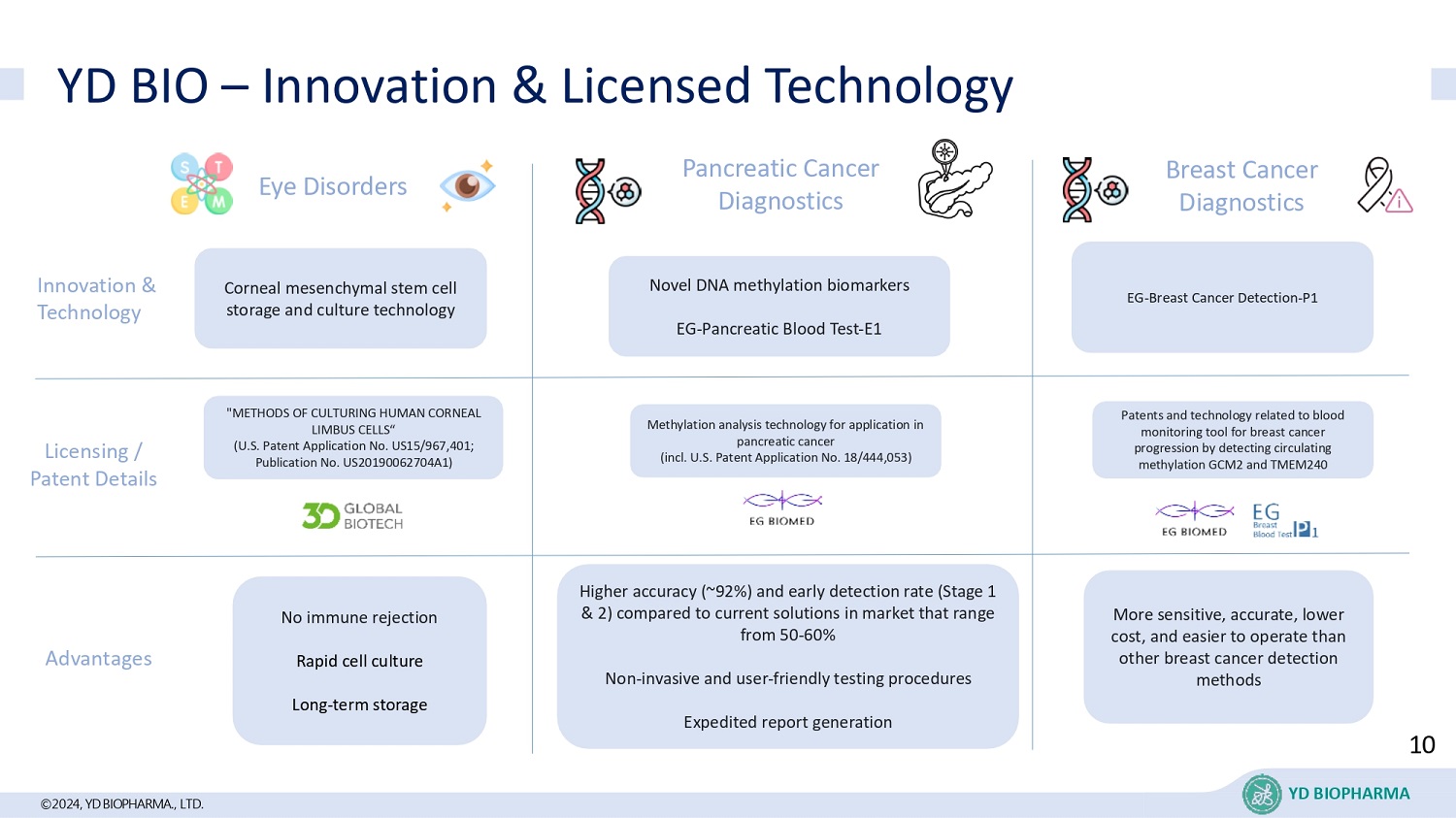

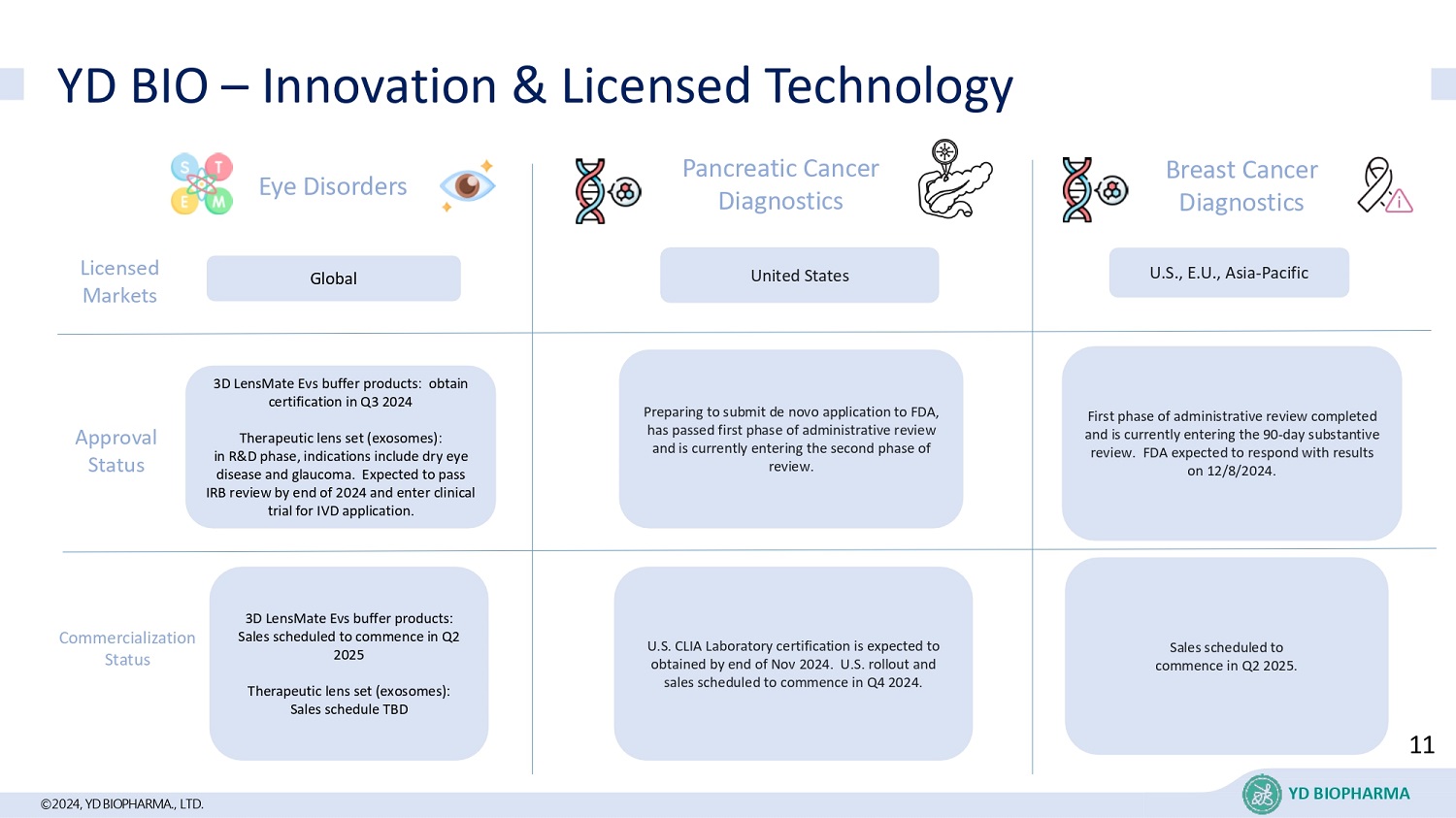

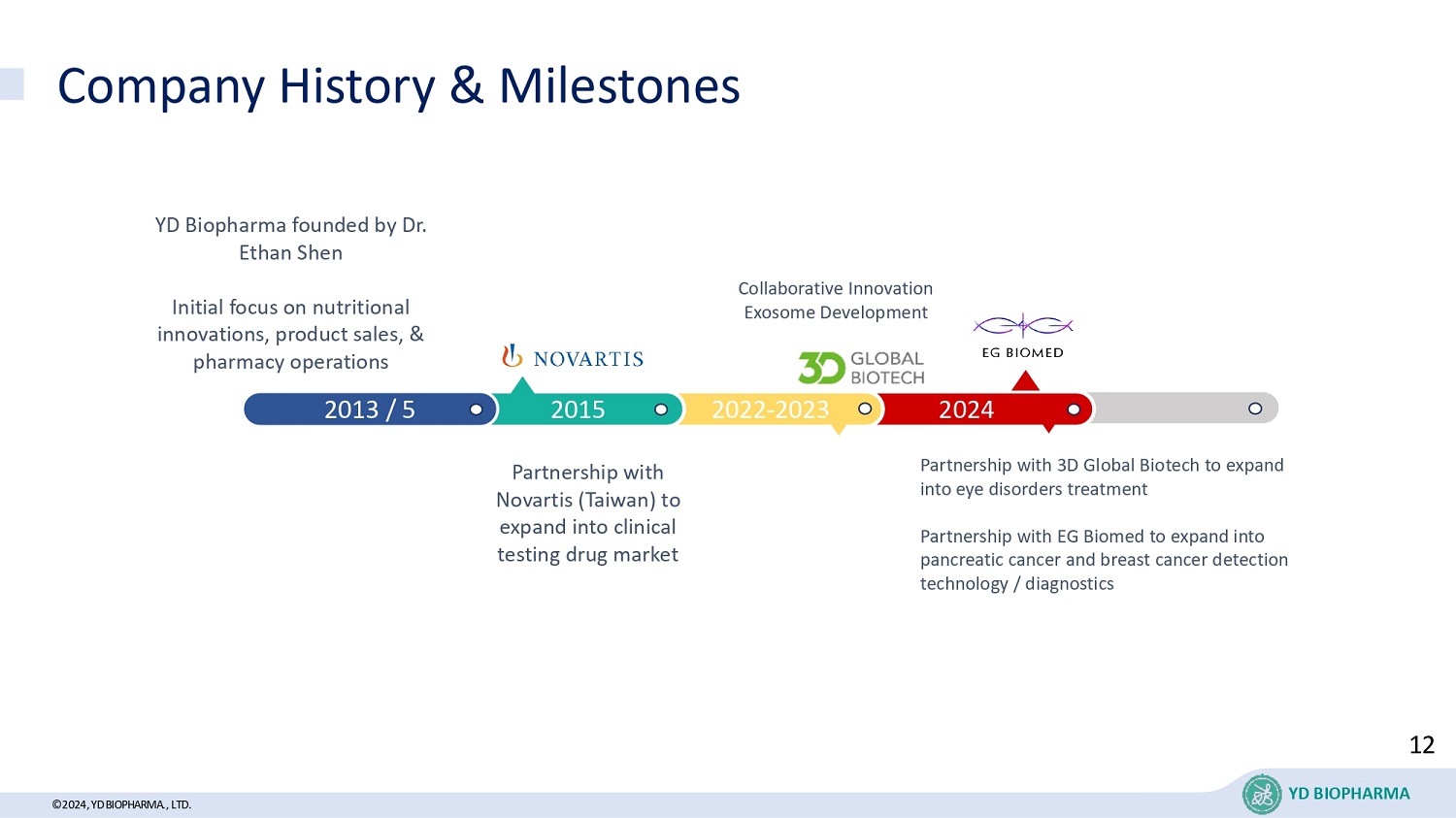

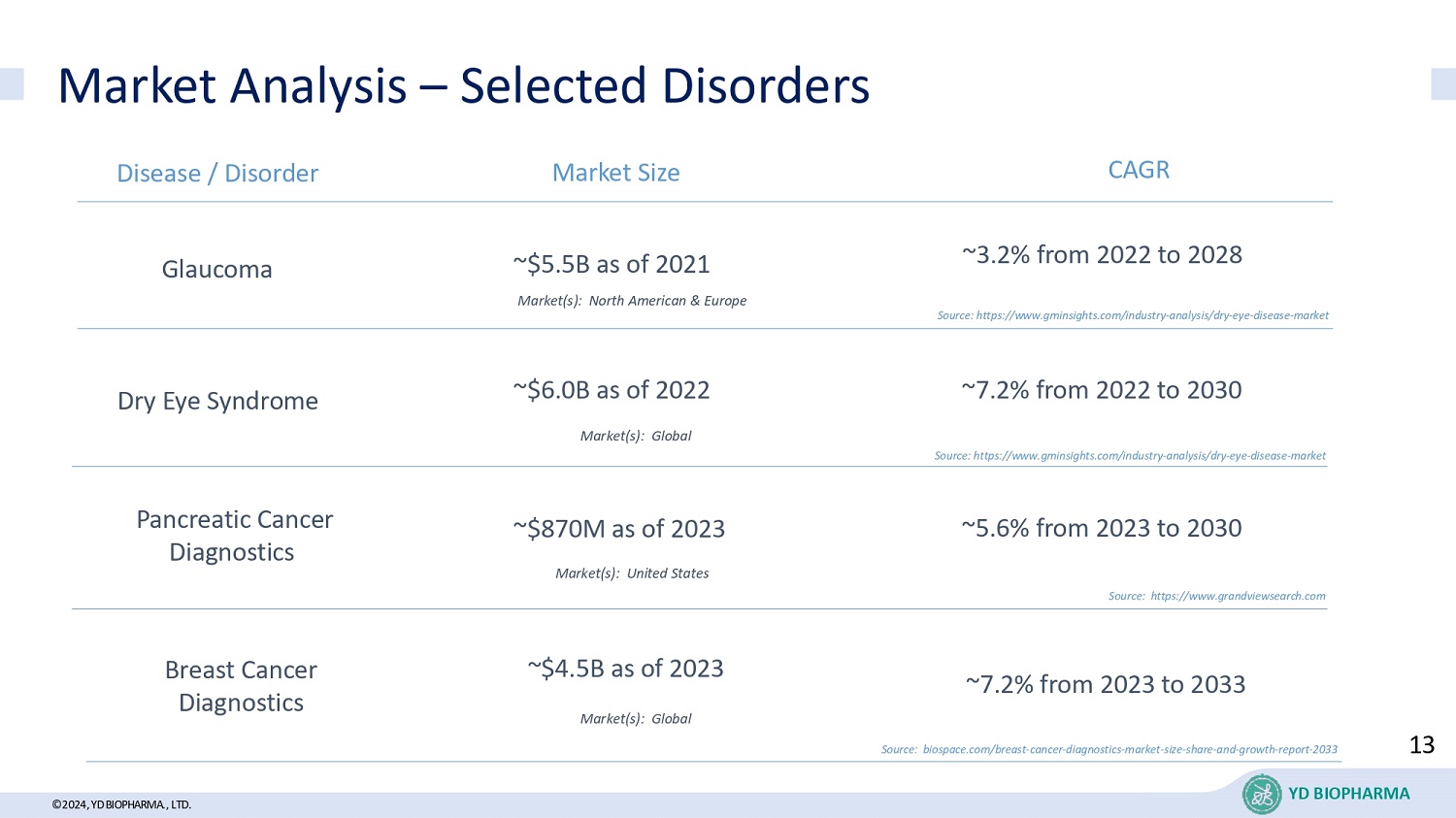

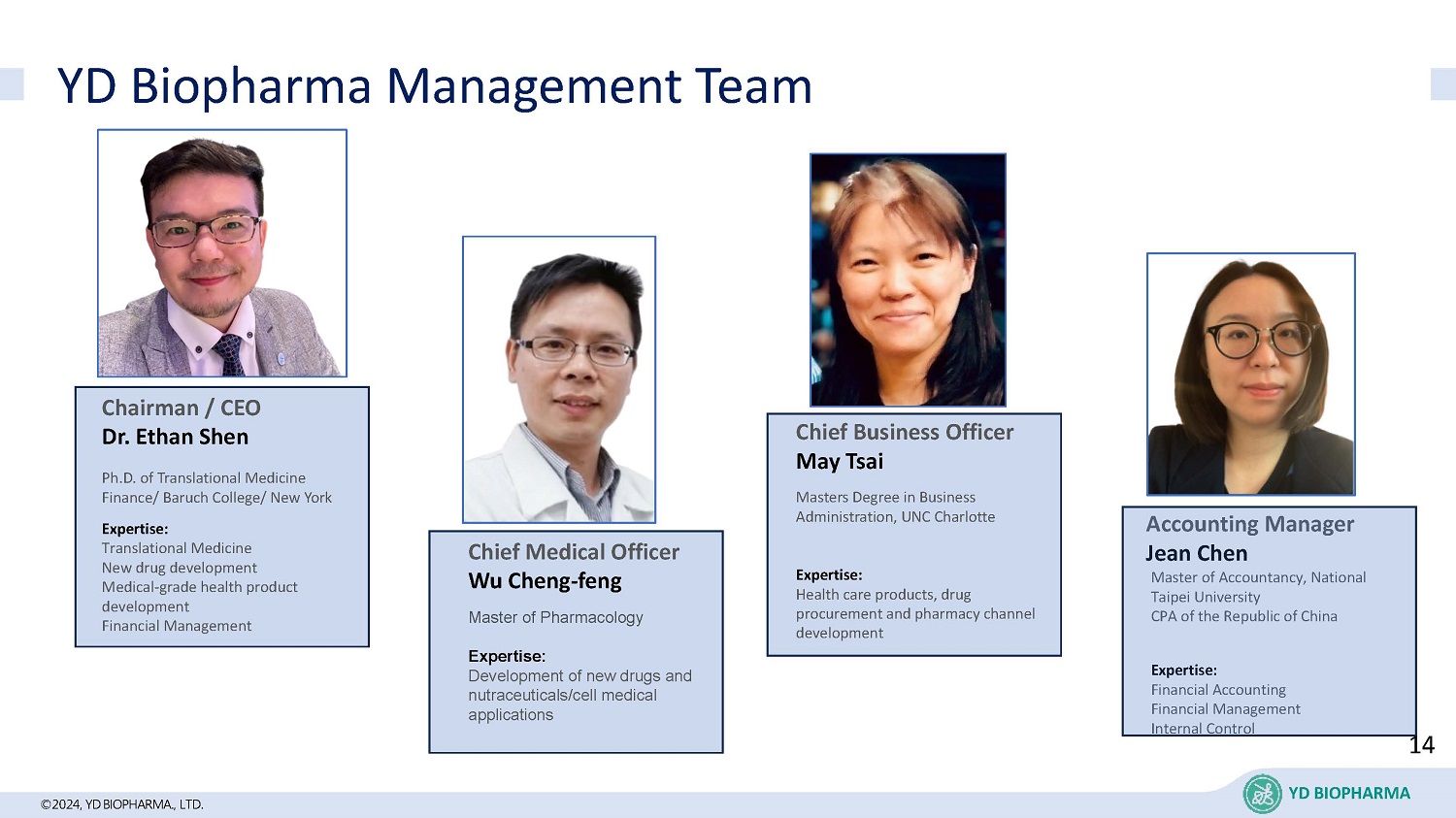

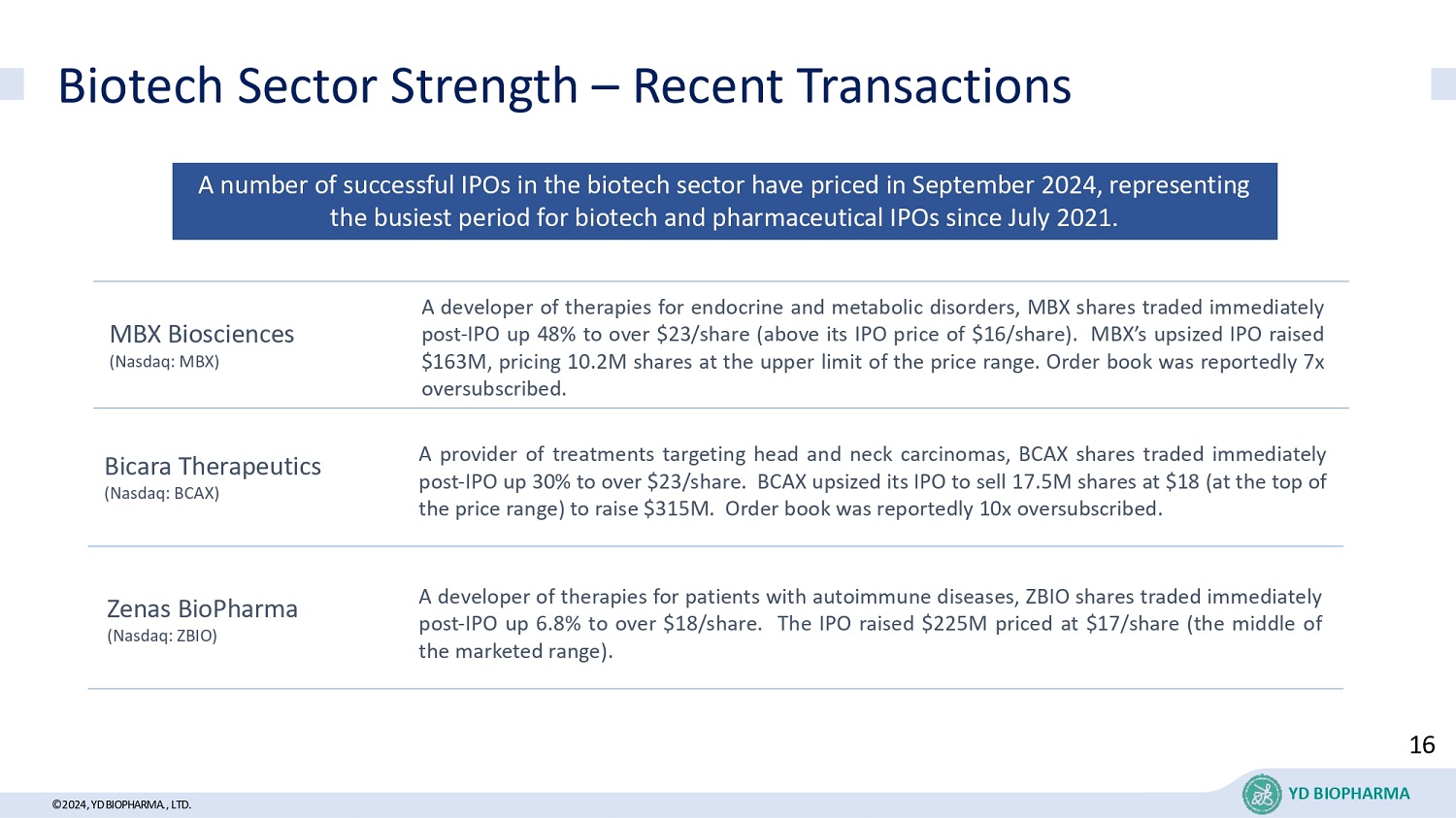

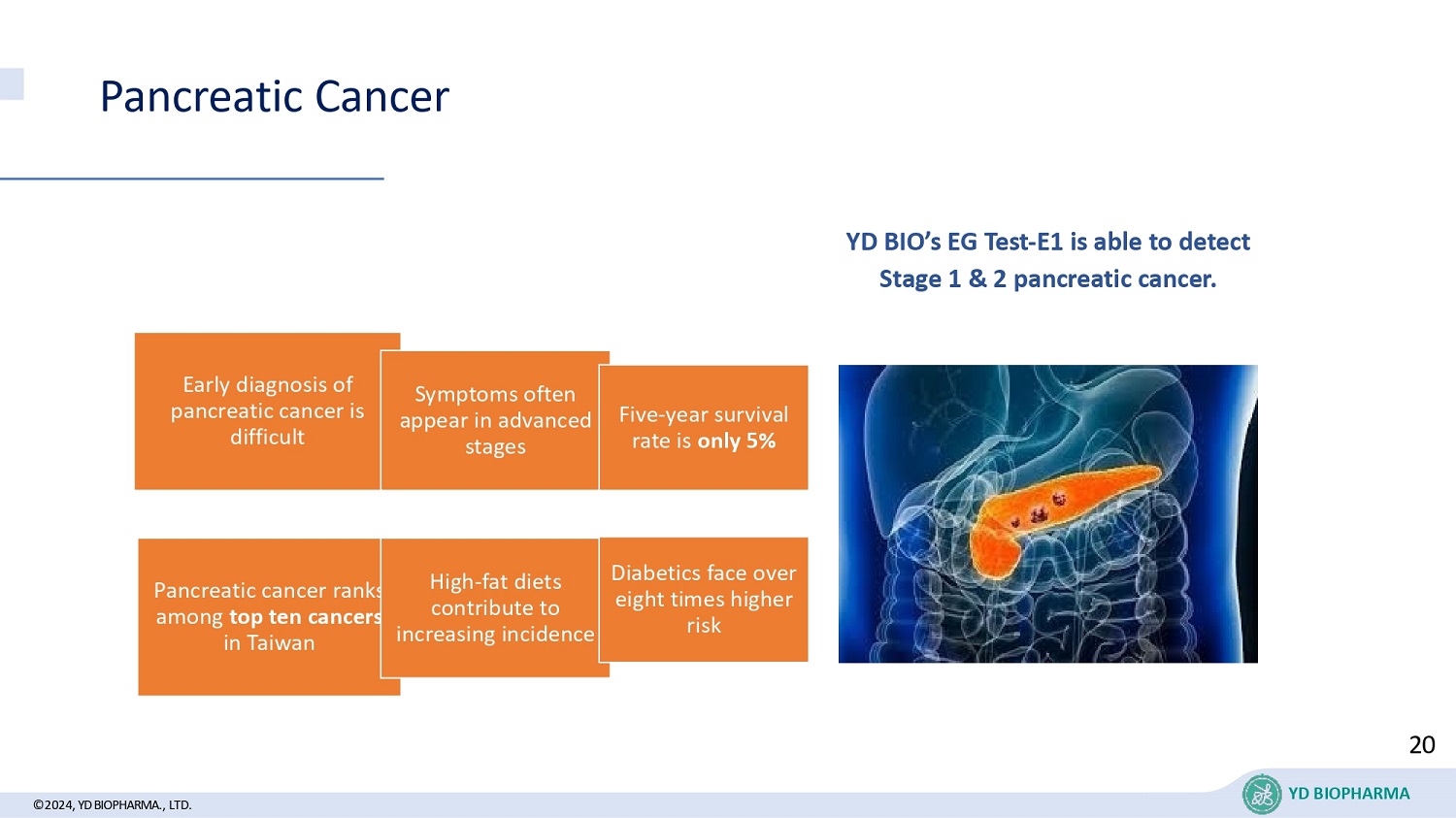

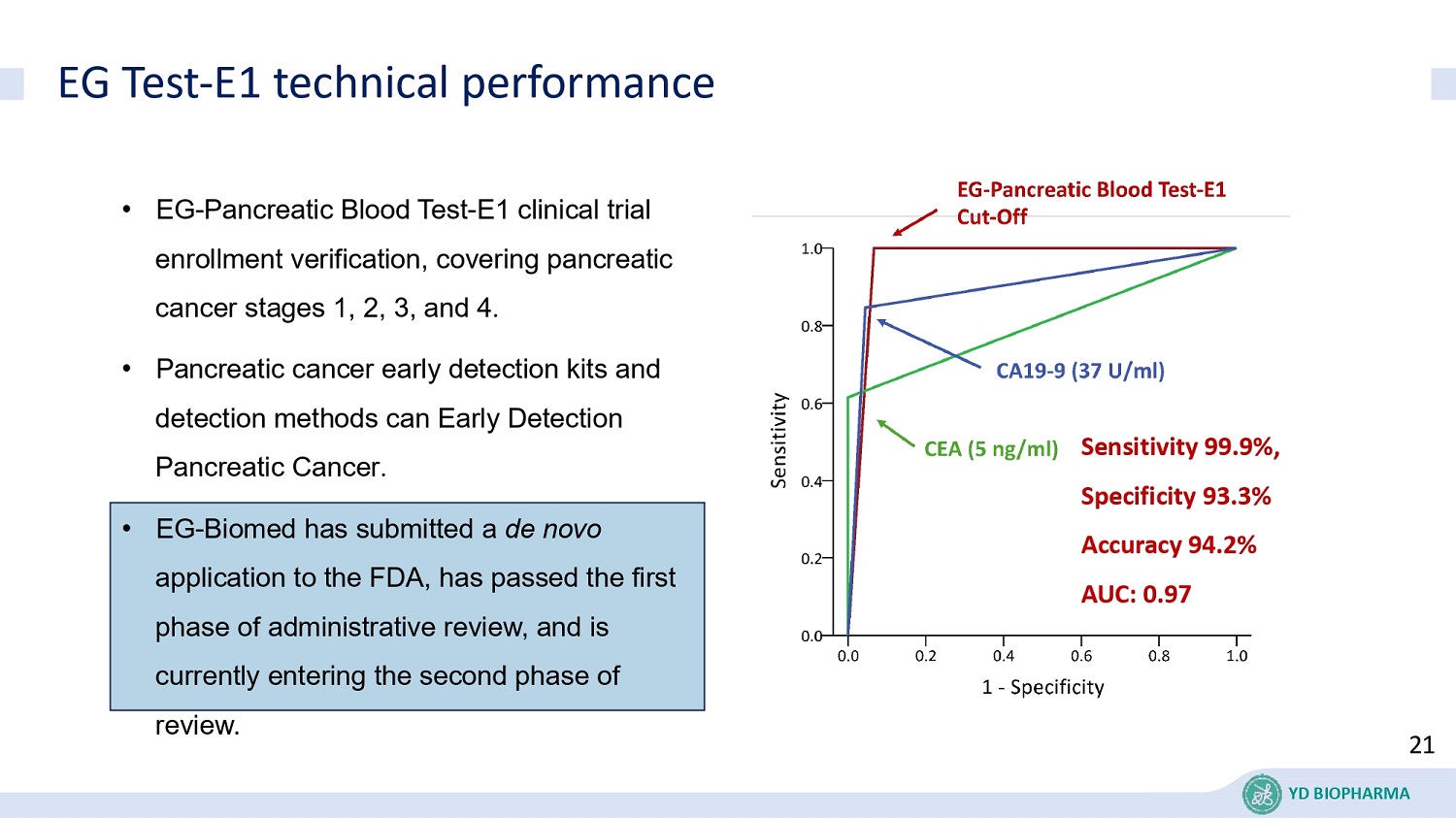

Furnished

as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference is the investor presentation that Breeze and YD Biopharma have

prepared for use in connection with the announcement of the Business Combination.

The

foregoing (including Exhibits 99.1 and 99.2) is being furnished pursuant to Item 7.01 of Form 8-K and will not be deemed to be filed for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to

the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange

Act.

Additional Information

and Where to Find It

This

Current Report relates to a proposed business combination transaction among Breeze, Pubco, and YD Biopharma pursuant to which Breeze and

YD Biopharma would become wholly-owned subsidiaries of Pubco. In connection with the proposed transaction, Pubco intends to file with

the SEC a registration statement/proxy statement on Form F-4 that will that also will constitute a proxy statement of Breeze with respect

to the Breeze Common Stock to be issued in the proposed transaction (the “proxy statement/prospectus”). This Current Report

is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus (if and when available) will be delivered

to Breeze’s and YD Biopharma’s stockholders. Pubco and/or Breeze may also file other relevant documents regarding the proposed

transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF BREEZE AND YD BIOPHARMA AND

OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT

ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BREEZE, YD

BIOPHARMA, THE PROPOSED TRANSACTION AND RELATED MATTERS.

Investors

and security holders may obtain free copies of the proxy statement/prospectus (if and when available) and other documents that are filed

or will be filed with the SEC by Breeze through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the

SEC by Breeze will be available free of charge at Breeze Holdings Acquisition Corp., 955 W. John Carpenter Fwy., Suite 100-929, Irving,

TX 75039, attention: J. Douglas Ramsey, Ph.D.

Participants in the Solicitation

Breeze,

YD Biopharma and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from the stockholders of Breeze and YD Biopharma in respect of the proposed transaction. Information about Breeze’s directors

and executive officers and their ownership of Breeze common stock is set forth in Breeze’s filings with the SEC, including its Annual

Report on Form 10-K/A for the year ended December 31, 2023 filed with the SEC on April 25, 2024 (as amended, the “Annual Report”).

To the extent that holdings of Breeze’s securities have changed since the amounts included in the Annual Report, such changes have

been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants

in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained

in the Proxy Statement/Prospectus and other relevant materials to be filed with the SEC in respect of the proposed transaction when they

become available. You may obtain free copies of these documents as described in the preceding paragraph.

Cautionary Note Regarding Forward-Looking Statements

This

Current Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, among other things, statements regarding the anticipated benefits and impact of the proposed transaction on the combined

company’s business and future financial and operating results, the anticipated timing of closing of the proposed transaction, the

anticipated growth of the industries and markets in which YD Biopharma competes, the success and customer acceptance of YD Biopharma’s

product and service offerings and other aspects of YD Biopharma’s operations, plans, objectives, opportunities, expectations or

operating results, the expected ownership structure of the combined company and the likelihood and ability of the parties to successfully

consummate the proposed transaction. Words such as “may,” “should,” “will,” “believe,”

“expect,” “anticipate,” “intend,” “estimated,” “target,” “project,”

and similar phrases or words of similar meaning that denote future expectations or intent regarding the combined company’s financial

results, operations and other matters are intended to identify forward-looking statements. You should not rely upon forward-looking statements

as predictions of future events. Such forward-looking statements are based upon the current beliefs and expectations of management and

are inherently subject to significant business, economic and competitive risks, uncertainties and other factors, both known and unknown,

which are difficult to predict and generally beyond our control and that may cause actual results and the timing of future events to differ

materially from the results and timing of future events anticipated by the forward-looking statements in this Current Report, including

but not limited to: (i) the ability of the parties to complete the proposed transaction within the time frame anticipated or at all, which

may adversely impact the price of Breeze’s securities; (ii) the failure to realize the anticipated benefits of the proposed transaction

or those benefits taking longer than anticipated to be realized; (iii) the risk that the proposed transaction may not be completed by

Breeze’s business combination deadline; (iv) the failure to satisfy the conditions to the consummation of the proposed transaction,

including the adoption of the definitive merger agreement by the stockholders of Breeze or YD Biopharma, the receipt of any required governmental

or regulatory approvals or the failure to meet the Nasdaq listing standards in connection with the closing of the proposed transaction;

(v) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement;

(vi) the effect of the announcement or pendency of the proposed transaction on YD Biopharma’s business relationships, performance

and business generally; (vii) risks that the proposed transaction disrupts current plans and operations of YD Biopharma and any potential

difficulties in YD Biopharma employee retention as a result of the proposed transaction; (viii) the outcome of any legal proceedings that

may be instituted against YD Biopharma or Breeze related to the definitive merger agreement or the proposed transaction or any product

liability or regulatory lawsuits or proceedings relating to YD Biopharma’s products or services; (ix) the ability to maintain the

listing of Pubco’s securities on the Nasdaq Capital Market after the closing; (x) potential volatility in the price of Breeze’s

securities due to a variety of factors, including changes in the competitive and highly regulated industries in which YD Biopharma operates,

variations in performance across competitors, changes in laws and regulations affecting YD Biopharma’s business, and changes in

the combined company’s capital structure; (xi) the ability to implement business plans, identify and realize additional opportunities

and achieve forecasts and other expectations after the completion of the proposed transaction; (xii) the risk of downturns and the possibility

of rapid change in the highly competitive industries in which YD Biopharma operates or the markets that YD Biopharma targets; (xiii) the

inability of YD Biopharma and its current and future collaborators to successfully develop and commercialize YD Biopharma’s products

and services in the expected time frame or at all; (xiv) the risk that the combined company may never achieve or sustain profitability

or may need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; and (xv)

the costs of the proposed transaction. The forward-looking statements contained in this Current Report are also subject to additional

risks, uncertainties and factors, including those described in Breeze’s most recent Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q and other documents filed or to be filed with the SEC by Pubco and/or Breeze from time to time. You are cautioned not to

place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information

are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many

of which are beyond our control. The forward-looking statements included in this Current Report are made only as of the date hereof, and

we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date

hereof.

No Offer or Solicitation

This

Current Report is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or to buy any securities

or a solicitation of any vote or approval and is not a substitute for the proxy statement/prospectus or any other document that Breeze

may file with the SEC or send to Breeze’s, Pubco’s or YD Biopharma’s stockholders in connection with the proposed transaction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| † |

Certain of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Registrant agrees to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BREEZE HOLDINGS ACQUISITION CORP. |

| |

|

|

| Date: September 25, 2024 |

By: |

/s/ J. Douglas Ramsey |

| |

Name: |

J. Douglas Ramsey, Ph.D. |

| |

Title: |

Chief Executive Officer and

Chief Financial Officer |

Exhibit 2.1

Execution Version

MERGER AGREEMENT AND PLAN OF REORGANIZATION

BY AND AMONG

BREEZE HOLDINGS ACQUISITION CORP.,

BREEZE MERGER SUB, INC.,

AND

YD BIOPHARMA LIMITED

DATED AS OF SEPTEMBER 24, 2024

Table of Contents

| |

|

|

Page |

| |

|

|

|

| ARTICLE I DEFINITIONS |

3 |

| |

Section 1.01 |

Certain Definitions |

3 |

| |

Section 1.02 |

Further Definitions |

15 |

| |

Section 1.03 |

Construction |

17 |

| |

|

|

|

| ARTICLE II AGREEMENT AND PLAN OF MERGER |

18 |

| |

Section 2.01 |

The Mergers |

18 |

| |

Section 2.02 |

Effective Time; Closing |

18 |

| |

Section 2.03 |

Effect of the Mergers |

19 |

| |

Section 2.04 |

Governing Documents |

19 |

| |

Section 2.05 |

Directors and Officers |

20 |

| |

Section 2.06 |

Closing Deliverables |

20 |

| |

|

|

|

| ARTICLE III CONVERSION and exchange OF SECURITIES |

21 |

| |

Section 3.01 |

Conversion of Company Securities |

21 |

| |

Section 3.02 |

Effect of Parent Merger on Issued and Outstanding Securities of Parent |

22 |

| |

Section 3.03 |

Effect of Parent Merger on Issued and Outstanding Securities of Parent Merger Sub and Pubco |

23 |

| |

Section 3.04 |

Exchange of Company Securities |

23 |

| |

Section 3.05 |

Stock Transfer Books |

25 |

| |

Section 3.06 |

Payment of Expenses |

25 |

| |

Section 3.07 |

Dissenters’ Rights |

26 |

| |

|

|

|

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

27 |

| |

Section 4.01 |

Organization and Qualification; Subsidiaries |

27 |

| |

Section 4.02 |

Organizational Documents |

28 |

| |

Section 4.03 |

Capitalization |

28 |

| |

Section 4.04 |

Authority Relative to This Agreement |

29 |

| |

Section 4.05 |

No Conflict; Required Filings and Consents |

30 |

| |

Section 4.06 |

Permits; Compliance |

30 |

| |

Section 4.07 |

Financial Statements |

31 |

| |

Section 4.08 |

Absence of Certain Changes or Events |

33 |

| |

Section 4.09 |

Absence of Litigation |

33 |

| |

Section 4.10 |

Employee Benefit Plans |

34 |

| |

Section 4.11 |

Labor and Employment Matters |

36 |

| |

Section 4.12 |

Real Property; Title to Assets |

36 |

| |

Section 4.13 |

Intellectual Property |

37 |

| |

Section 4.14 |

Taxes |

41 |

| |

Section 4.15 |

Environmental Matters |

43 |

| |

Section 4.16 |

Material Contracts |

44 |

| |

Section 4.17 |

Insurance |

46 |

| |

Section 4.18 |

Vote Required |

47 |

| |

Section 4.19 |

Certain Business Practices |

47 |

| |

Section 4.20 |

Interested Party Transactions |

47 |

| |

Section 4.21 |

Brokers |

48 |

| |

Section 4.22 |

FDA |

48 |

| |

Section 4.23 |

Exclusivity of Representations and Warranties |

49 |

| |

|

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF Parent Parties |

49 |

| |

Section 5.01 |

Corporate Organization |

49 |

| |

Section 5.02 |

Governing Documents |

49 |

| |

Section 5.03 |

Capitalization |

50 |

| |

Section 5.04 |

Authority Relative to this Agreement |

50 |

| |

Section 5.05 |

No Conflict; Required Filings and Consents |

51 |

| |

Section 5.06 |

Compliance |

52 |

| |

Section 5.07 |

SEC Filings; Financial Statements; Sarbanes-Oxley |

52 |

| |

Section 5.08 |

Absence of Certain Changes or Events |

54 |

| |

Section 5.09 |

Absence of Litigation |

54 |

| |

Section 5.10 |

Board Approval; Vote Required |

54 |

| |

Section 5.11 |

No Prior Operations of Pubco and the Merger Subs |

55 |

| |

Section 5.12 |

Brokers |

55 |

| |

Section 5.13 |

Parent Trust Fund |

55 |

| |

Section 5.14 |

Employees |

56 |

| |

Section 5.15 |

Taxes |

56 |

| |

Section 5.16 |

Registration and Listing |

58 |

| |

Section 5.17 |

Prior Business Operations |

58 |

| |

Section 5.18 |

Parent Material Contracts |

58 |

| |

Section 5.19 |

Proxy Statement and Registration Statement |

59 |

| |

Section 5.20 |

Investment Company Act |

59 |

| |

Section 5.21 |

Transactions with Affiliates |

59 |

| |

Section 5.22 |

Legacy Parent Transaction Expenses |

59 |

| |

Section 5.23 |

The Parent Parties’ Investigation and Reliance |

60 |

| |

|

|

|

| ARTICLE VI CONDUCT OF BUSINESS PENDING THE Company MERGER |

60 |

| |

Section 6.01 |

Conduct of Business by the Company Pending the Company Merger |

60 |

| |

Section 6.02 |

Conduct of Business by the Parent Parties Pending the Mergers |

64 |

| |

Section 6.03 |

Claims Against Trust Account |

66 |

| ARTICLE VII ADDITIONAL AGREEMENTS |

67 |

| |

Section 7.01 |

Proxy Statement; Registration Statement |

67 |

| |

Section 7.02 |

Parent Stockholders’ Meeting; Pubco and Merger Subs Stockholder’s Approval |

69 |

| |

Section 7.03 |

Requisite Approval |

69 |

| |

Section 7.04 |

Access to Information; Confidentiality |

70 |

| |

Section 7.05 |

Non-Solicitation |

71 |

| |

Section 7.06 |

Exclusivity |

72 |

| |

Section 7.07 |

Employee Benefits Matters |

73 |

| |

Section 7.08 |

Directors’ and Officers’ Indemnification |

74 |

| |

Section 7.09 |

Notification of Certain Matters |

75 |

| |

Section 7.10 |

Further Action; Reasonable Best Efforts |

75 |

| |

Section 7.11 |

Public Announcements |

76 |

| |

Section 7.12 |

Tax Matters |

76 |

| |

Section 7.13 |

Stock Exchange Listing |

76 |

| |

Section 7.14 |

Antitrust |

77 |

| |

Section 7.15 |

Trust Account |

78 |

| |

Section 7.16 |

Directors |

79 |

| |

Section 7.17 |

Equity Incentive Plan |

79 |

| |

Section 7.18 |

Related Party Agreements |

79 |

| |

Section 7.19 |

Assignment of Legacy Parent Transaction Expenses |

79 |

| |

Section 7.20 |

PIPE Investment |

79 |

| |

|

|

|

| ARTICLE VIII CONDITIONS TO THE MERGERs |

80 |

| |

Section 8.01 |

Conditions to the Obligations of Each Party |

80 |

| |

Section 8.02 |

Conditions to the Obligations of the Parent Parties |

81 |

| |

Section 8.03 |

Conditions to the Obligations of the Company |

82 |

| |

|

|

|

| ARTICLE IX TERMINATION, AMENDMENT AND WAIVER |

83 |

| |

Section 9.01 |

Termination |

83 |

| |

Section 9.02 |

Effect of Termination |

85 |

| |

Section 9.03 |

Amendment |

85 |

| |

Section 9.04 |

Waiver |

85 |

| |

|

|

|

| ARTICLE X GENERAL PROVISIONS |

86 |

| |

Section 10.01 |

Notices |

86 |

| |

Section 10.02 |

Nonsurvival of Representations, Warranties and Covenants |

87 |

| |

Section 10.03 |

Severability |

87 |

| |

Section 10.04 |

Entire Agreement; Assignment |

87 |

| |

Section 10.05 |

Parties in Interest |

88 |

| |

Section 10.06 |

Governing Law |

88 |

| |

Section 10.07 |

Waiver of Jury Trial |

88 |

| |

Section 10.08 |

Headings |

88 |

| |

Section 10.09 |

Counterparts; Electronic Delivery |

89 |

| |

Section 10.10 |

Specific Performance |

89 |

| |

Section 10.11 |

No Recourse |

89 |

| |

Section 10.12 |

Conflicts and Privilege |

90 |

| |

|

|

|

| Schedule A |

Key Employees |

|

| Schedule B |

Transaction Expenses Example |

|

MERGER AGREEMENT AND PLAN OF REORGANIZATION

This MERGER AGREEMENT AND

PLAN OF REORGANIZATION (this “Agreement”), dated as of September 24, 2024 (the “Effective Date”),

is made by and among Breeze Holdings Acquisition Corp., a Delaware corporation (“Parent”), a Cayman Islands

exempted company and a wholly-owned subsidiary of Parent, expected to be named “YD Bio Limited,” which is in the process of

being formed by Parent, and once formed, Parent shall cause it to enter into a joinder to this Agreement (“Pubco”),

Breeze Merger Sub, Inc., a Delaware corporation which will be a direct, wholly owned Subsidiary of Pubco (“Parent Merger Sub”),

a Cayman Islands exempted company that will be a wholly-owned subsidiary of Pubco, expected to be named “BH Biopharma Merger Sub

Limited,” which is in the process of being formed by Parent, and once formed, Parent shall cause it to enter into a joinder to this

Agreement (“Company Merger Sub,” Company Merger Sub and Parent Merger Sub are together referred to herein as

the “Merger Subs”), and YD Biopharma Limited, a Cayman Islands exempted company (the “Company”).

Certain terms used herein are defined in ARTICLE I.

RECITALS

WHEREAS, upon the terms and

subject to the conditions of this Agreement, the parties hereto desire and intend to effect a business combination transaction pursuant

to which (a) Parent Merger Sub will merge with and into Parent, with Parent continuing as the surviving corporation (the “Parent

Merger”), and (b) immediately following the consummation of the Parent Merger but on the same day, Company Merger Sub

will merge with and into the Company (the “Company Merger,” the Company Merger and the Parent Merger are together

referred to herein as the “Mergers”), with the Company continuing as the surviving corporation;

WHEREAS, as a result of the

Mergers, Parent and the Company will become wholly owned Subsidiaries of Pubco, and Pubco will become a publicly traded company listed

on Nasdaq;

WHEREAS, the Board of Directors

of the Company (the “Company Board”) has unanimously (a) determined that this Agreement, the Ancillary

Agreements to which the Company is a party, the Company Merger and the other Transactions to which the Company is a party are fair to,

and in the best interests of, the Company and its stockholders, and declared their advisability, (b) approved this Agreement, the

Ancillary Agreements to which the Company is a party, the Company Merger and the other Transactions to which the Company is a party, and

(c) recommended the adoption of this Agreement and the approval of the Company Merger and the other Transactions to which the Company

is a party by the stockholders of the Company;

WHEREAS, the Board of

Directors of Parent (the “Parent Board”) has (a) determined that (i) this Agreement, the

Ancillary Agreements to which Parent is a party, the Mergers and the other Transactions are fair to, and in the best interests of,

Parent and its stockholders, and declared their advisability and (ii) the fair market value of the Company is equal to at least

eighty percent (80%) of the balance of the Trust Fund, (b) approved this Agreement, the Ancillary Agreements to which Parent is

a party, the Mergers and the other Transactions to which Parent is a party, and (c) adopted a resolution recommending that the

stockholders of Parent vote in favor of all Parent Proposals, including, without limitation, adoption of this Agreement and approval

of the Transactions, and directing that this Agreement and the Mergers and the other Transactions to which Parent is a party be

submitted for consideration by the stockholders of Parent at the Parent Stockholders’ Meeting;

WHEREAS, the Board of Directors

of Parent Merger Sub (the “Parent Merger Sub Board”) has (a) determined that this Agreement, the Ancillary

Agreements to which Parent Merger Sub is a party, the Parent Merger and the other Transactions to which Parent Merger Sub is a party are

fair to, and in the best interests of, Parent Merger Sub and Pubco as its sole stockholder, and declared their advisability, (b) adopted

this Agreement and approved the Parent Merger and the other Transactions to which Parent Merger Sub is a party, and (c) recommended the

adoption of this Agreement and the approval of the Parent Merger and the other Transactions to which Parent Merger Sub is a party by Pubco

as the sole stockholder of Parent Merger Sub and directed that this Agreement, the Parent Merger and the other Transactions to which Parent

Merger Sub is a party be submitted for consideration by Pubco as the sole stockholder of Parent Merger Sub;

WHEREAS, immediately following

the execution of this Agreement (and in any event within twenty-four (24) hours herefrom), Pubco will submit this Agreement and the Transactions

to Parent for adoption and approval as the sole stockholder of Pubco, and Parent will so adopt this Agreement and approve the Transactions

in such capacity by irrevocable written consent;

WHEREAS, immediately following

the execution of this Agreement (and in any event within twenty-four (24) hours herefrom), Parent Merger Sub will submit this Agreement

and the Transactions to Pubco for adoption and approval as the sole stockholder of Parent Merger Sub, and Pubco will so adopt this Agreement

and approve the Transactions in such capacity by irrevocable written consent;

WHEREAS, immediately following

the execution of this Agreement (and in any event within twenty-four (24) hours herefrom), Company Merger Sub will submit this Agreement

and the Transactions to Pubco for adoption and approval as the sole stockholder of Company Merger Sub, and Pubco will so adopt this Agreement

and approve the Transactions in such capacity by irrevocable written consent;

WHEREAS, as promptly as practicable

following the execution of this Agreement (and in any event within thirty (30) days thereafter), Pubco, Parent, the Company and the Specified

Stockholders shall enter into a Stockholder Support Agreement (the “Stockholder Support Agreement”), providing

that, among other things, the Specified Stockholders will provide their written consent to (a) adopt this Agreement and approve the Company

Merger and the other Transactions to which the Company is a party, and (b) waive any appraisal or similar rights they may have pursuant

to the Companies Act of the Cayman Islands (Revised), as amended (the “Cayman Act”) with respect to the Company

Merger and the other Transactions;

WHEREAS, as promptly as

practicable following the execution of this Agreement (and in any event within thirty (30) days thereafter), Pubco, Parent, Breeze

Sponsor, LLC, a Delaware limited liability company (the “Sponsor”), each of the directors and officers of

Parent (together with the Sponsor, the “Parent Initial Stockholders”) and the Specified Stockholders shall

enter into a Registration Rights Agreement (the “Registration Rights Agreement”), providing that, among

other things, Pubco will grant to the Parent Initial Stockholders and the Specified Stockholders certain demand and piggyback

registration rights with respect to Pubco Ordinary Shares (or any securities convertible into or exercisable for Pubco Ordinary

Shares) to be held by such Persons immediately following the Closing;

WHEREAS, as promptly as practicable

following the execution of this Agreement (and in any event within thirty (30) days thereafter), Pubco, Parent, the Parent Initial Stockholders,

the Company and the Specified Stockholders shall enter into a Lock-Up Agreement (the “Lock-Up Agreement”) providing

that, among other things, certain Pubco Ordinary Shares held by the Parent Initial Stockholders and the Specified Stockholders will be

subject to the limitations on disposition as set forth therein;

WHEREAS, concurrently with

the execution and delivery of this Agreement, Pubco, Parent, the Company and the Parent Initial Stockholders entered into a Sponsor Support

Agreement (the “Sponsor Support Agreement”), pursuant to which, among other things, (a) the Parent Initial

Stockholders agreed to (i) vote all of their shares of Parent Common Stock in favor of the Parent Proposals, including the adoption

of this Agreement and approval of the Transactions, and if necessary and applicable, any Extension Proposal, and (ii) abstain from

exercising any Redemption Rights in connection with the Parent Merger or the other Transactions, and (b) the Sponsor has agreed to

assume and pay all of the Legacy Parent Transaction Expenses in full and indemnify Parent and its Subsidiaries (including, following the

Effective Time, the Company) from any and all liabilities related thereto;

WHEREAS, each individual listed

on Schedule A (each, a “Key Employee”) has entered into an employment agreement with the Company

(collectively, the “Employment Agreements”), which Employment Agreements shall continue in effect at and which

shall be assigned to, and assumed by, Pubco at the Closing; and

WHEREAS, for U.S. federal

and applicable state income Tax purposes, the parties hereto intend that, (a) taken together, the Mergers and any PIPE Investment will

qualify as a transaction under Section 351 of the Code and the Treasury Regulations promulgated thereunder, (b) the Company Merger will

qualify as a “reorganization” within the meaning of Section 368(a) of the Code and the Treasury Regulations promulgated thereunder

and (c) that this Agreement be, and hereby is adopted as, a “plan of reorganization” (within the meaning of Section 368(a)

of the Code and Treasury Regulations Sections 1.368-2(g) and 1.368-3) to which each of Pubco, Company Merger Sub, and the Company are

parties under Section 368(b) of the Code (the “Intended Tax Treatment”).

NOW, THEREFORE, in consideration

of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto

hereby agree as follows:

ARTICLE

I

DEFINITIONS

Section 1.01

Certain Definitions. For purposes of this Agreement:

“Action”

means any litigation, suit, claim, action, proceeding, audit, or investigation by or before any Governmental Authority.

“Affiliate”

of a specified Person means a Person who, directly or indirectly through one or more intermediaries, controls, is controlled by, or is

under common control with, such specified Person.

“Aggregate Company

Merger Consideration” means the aggregate Per Share Company Merger Consideration payable pursuant to this Agreement to the

Participating Securityholders.

“Ancillary Agreements”

means the Stockholder Support Agreement, the Sponsor Support Agreement, the Registration Rights Agreement, the Lock-Up Agreement, the

Employment Agreements and all other agreements, certificates and instruments executed and delivered by Parent, Pubco, the Merger Subs

or the Company in connection with the Transactions and specifically contemplated by this Agreement.

“Anti-Corruption

Laws” means, as applicable (i) the U.S. Foreign Corrupt Practices Act of 1977, as amended, (ii) the UK Bribery

Act 2010, (iii) anti-bribery legislation promulgated by the European Union and implemented by its member states, (iv) legislation

implementing the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, and (v) similar

legislation applicable to the Company or any Company Subsidiary from time to time.

“Business Data”

means all business information and data, including Personal Information (whether of employees, contractors, consultants, customers, consumers,

or other Persons and whether in electronic or any other form or medium) that is accessed, collected, used, stored, shared, distributed,

transferred, disclosed, destroyed, disposed of or otherwise processed by any of the Business Systems or otherwise in the course of the

conduct of the business of the Company or any Company Subsidiaries.

“Business Day”

means any day on which the principal offices of the SEC in Washington, D.C. are open to accept filings, or, in the case of determining

a date when any payment is due, any day on which banks are not required or authorized to close in New York, NY; provided that banks

shall not be deemed to be required or authorized to be closed due to a “shelter in place”, “non-essential

employee” or similar closure of physical branch locations at the direction of any Governmental Authority if such banks’

electronic funds transfer systems (including for wire transfers) are open for use by customers on such day.

“Business Systems”

means all Software, firmware, middleware, equipment, workstations, routers, hubs, computer hardware (whether general or special purpose),

electronic data processors, databases, communications, telecommunications, networks, interfaces, platforms, servers, peripherals, and

computer systems, including any outsourced systems and processes, and any Software and systems provided via the cloud or “as

a service,” that are owned or used in the conduct of the business of the Company or any Company Subsidiaries.

“Capital Stock”

means the Company Ordinary Shares.

“Cayman Registrar”

means the Registrar of Companies of the Cayman Islands.

“Code”

means the Internal Revenue Code of 1986, as amended.

“Company Convertible

Securities” means, collectively, all options, warrants or rights to subscribe for or purchase any ordinary shares of the

Company or securities convertible into or exchangeable for, or otherwise confer on the holder any right to acquire any ordinary shares

of the Company.

“Company Equity

Value” means $647,304,110.

“Company IP”

means, collectively, all Company Owned IP and Company Licensed IP.

“Company Licensed

IP” means all Intellectual Property rights owned or purported to be owned by a third party that are licensed to the Company

or any Company Subsidiary or that the Company or any Company Subsidiary otherwise has a right to use.

“Company

Material Adverse Effect” means any event, circumstance, change or effect that, individually or in the aggregate with

any one or more other events, circumstances, changes and effects, (i) is or would reasonably be expected to be materially

adverse to the business, financial condition, assets and liabilities or results of operations of the Company and the Company

Subsidiaries taken as a whole or (ii) would prevent, materially delay or materially impede the performance by the Company of

its obligations under this Agreement or the consummation of the Merger or any of the other Transactions; provided, however,

that none of the following shall be deemed to constitute, alone or in combination, or be taken into account in the determination of

whether, there has been or will be a Company Material Adverse Effect: (a) any change or proposed change in or change in the

interpretation of any Law or GAAP; (b) events or conditions generally affecting the industries or geographic areas in which the

Company and the Company Subsidiaries operate; (c) any downturn in general economic conditions, including changes in the credit,

debt, securities, financial or capital markets (including changes in interest or exchange rates, prices of any security or market

index or commodity or any disruption of such markets); (d) any geopolitical conditions, outbreak of hostilities, acts of war,

sabotage, civil unrest, cyberterrorism, terrorism, military actions, earthquakes, volcanic activity, hurricanes, tsunamis,

tornadoes, floods, mudslides, wild fires or other natural disasters, weather conditions, epidemics, pandemics or other outbreaks of

illness or public health events and other force majeure events (including any escalation or general worsening of any of the

foregoing); (e) any actions taken or not taken by the Company or the Company Subsidiaries as required by this Agreement or any

Ancillary Agreement; (f) any event, circumstance, change or effect attributable to the announcement or execution, pendency,

negotiation or consummation of the Merger or any of the other Transactions (including the impact thereof on relationships with

customers, suppliers, employees or Governmental Authorities); (g) any failure to meet any projections, forecasts, guidance,

estimates, milestones, budgets or financial or operating predictions of revenue, earnings, cash flow or cash position

(provided that this clause (g) shall not prevent a determination that any event, circumstance, change or effect

which is the underlying cause of such failure has resulted in a Company Material Adverse Effect to the extent not excluded by

another exception herein); or (h) any actions taken, or failures to take action, or such other changes or events, in each case,

which Parent has requested or to which it has consented, except in the cases of clauses (a) through (d), to the

extent that the Company and the Company Subsidiaries, taken as a whole, are disproportionately and adversely affected thereby as

compared with other participants in the industries in which the Company and the Company Subsidiaries operate.

“Company Memorandum

and Articles” means the Company’s memorandum and articles of association filed with the Cayman Registrar on March

14, 2024 and as they may be amended and/or restated from time to time.

“Company Merger

Sub Ordinary Shares” means the ordinary shares of Company Merger Sub designated as ordinary shares in the Company Merger

Sub memorandum and articles of association filed with the Cayman Registrar.

“Company Merger

Sub Organizational Documents” means the memorandum and articles of association filed with the Cayman Registrar of Company

Merger Sub, as amended, modified or supplemented from time to time.

“Company Ordinary

Shares” means ordinary shares, par value $0.10 per share, of the Company.

“Company Organizational

Documents” means the Company Memorandum and Articles as amended, modified or supplemented from time to time.

“Company Owned

IP” means all Intellectual Property rights owned or purported to be owned by the Company or any of the Company Subsidiaries.

“Company Reference

Share Value” means a dollar amount equal to (i) the sum of the Company Equity Value, divided by (ii) the number of

Fully Diluted Company Shares.

“Company Securities”

means the Company Ordinary Shares and the Company Convertible Securities.

“Confidential

Information” means any information, knowledge or data concerning the businesses and affairs of the Company, the Company

Subsidiaries, or any Suppliers or customers of the Company or any Company Subsidiaries or Parent or its subsidiaries (as applicable) that

is not already generally available to the public, including any Intellectual Property rights.

“Consent Solicitation

Statement” means the consent solicitation statement included as part of the Registration Statement with respect to the solicitation

by the Company of the Company Stockholder Approval.

“Contracts”

means any legally binding contracts, agreements, subcontracts, instruments, conditional sales contracts, indentures, notes, bonds, loans,

credit agreements, licenses, sublicenses, mortgages, deeds of trust, powers of attorney, guaranties, leases and subleases and all amendments,

modifications, supplements, schedules, annexes and exhibits thereto.

“control”

(including the terms “controlled by” and “under common control with”) means the possession,

directly or indirectly, or as trustee or executor, of the power to direct or cause the direction of the management and policies of a Person,

whether through the ownership of voting securities, as trustee or executor, by contract or otherwise.

“Disabling Devices”

means Software, viruses, time bombs, logic bombs, trojan horses, trap doors, back doors, spyware, malware, worms, other computer instructions,

intentional devices, techniques, other technology, disabling codes, instructions, or other similar code or software routines or components

that are designed to threaten, infect, assault, vandalize, defraud, disrupt, damage, disable, delete, maliciously encumber, hack into,

incapacitate, perform unauthorized modifications, infiltrate or slow or shut down a computer system or data, software, system, network,

other device, or any component of such computer system, including any such device affecting system security or compromising or disclosing

user data in an unauthorized manner, other than those incorporated by the Company or the applicable third party intentionally to protect

Company Owned IP or Business Systems from misuse.

“Employee Benefit

Plan” means each “employee benefit plan,” as defined in Section 3(3) of ERISA (whether

or not subject to ERISA), any nonqualified deferred compensation plan subject to Section 409A of the Code, and each other retirement,

health, welfare, cafeteria, bonus, commission, stock option, stock purchase, restricted stock, other equity or equity-based compensation,

performance award, incentive, deferred compensation, retiree medical or life insurance, death or disability benefit, supplemental retirement,

severance, retention, change in control, employment, consulting, fringe benefit, sick pay, vacation, and similar plan, program, policy,

practice, agreement, or arrangement, whether written or unwritten.

“Environmental

Laws” means any United States federal, state or local or non-United States Laws relating to: (i) releases or threatened

releases of, or exposure of any Person to, Hazardous Substances or materials containing Hazardous Substances; (ii) the manufacture,

handling, transport, use, treatment, storage or disposal of Hazardous Substances or materials containing Hazardous Substances; or (iii) pollution

or protection of the environment, natural resources or human health and safety.

“ERISA”

means the Employee Retirement Income Security Act of 1974.

“Ex-Im Laws”

means all applicable Laws relating to export, re-export, transfer, and import controls, including the U.S. Export Administration

Regulations, the customs and import Laws administered by U.S. Customs and Border Protection, and the EU Dual Use Regulation.

“Exchange Act”

means the Securities Exchange Act of 1934, as amended.

“Exchange Ratio”

means the following ratio: the quotient obtained by dividing (i) the Company Reference Share Value by (ii) the Pubco Per Share

Value.

“Fully Diluted

Company Shares” means, as of the Company Merger Effective Time, the sum of: (i) the number of Company Ordinary Shares

outstanding immediately prior to the Effective Time; and (ii) the number of Company Ordinary Shares issuable in respect of all issued

and outstanding Company Convertible Securities.

“Fraud”

means actual and intentional common law fraud committed by a party to the Agreement with respect to the making of the representations

and warranties by such party set forth in ARTICLE IV or ARTICLE V as applicable. Under no circumstances shall “Fraud”

include any equitable fraud, constructive fraud, negligent misrepresentation, unfair dealings, or any other fraud or torts based on recklessness

or negligence.

“Hazardous Substance(s)”

means: (i) any substances, wastes, or materials defined, identified or regulated as hazardous or toxic or as a pollutant or a contaminant

under any Environmental Law; (ii) petroleum and petroleum products, including crude oil and any fractions thereof; (iii) natural

gas, synthetic gas, and any mixtures thereof; (iv) polychlorinated biphenyls, per- and polyfluoroalkyl substances, asbestos and radon;

and (v) any other substance, material or waste regulated by, or for which standards of care may be imposed under any Environmental

Law.

“HIPAA”

means the Health Insurance Portability and Accountability Act of 1996 and its implementing regulations, including as amended by the Health

Information Technology for Economic and Clinical Health Act provisions of the American Recovery and Reinvestment Act of 2009, Pub. Law

No. 111-5 and its implementing regulations.

“HSR Act”

means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“Incentive Sponsor

Shares” means the aggregate shares of Parent Common Stock held by the Sponsor.

“Intellectual

Property” means (i) issued patents and pending patent applications (including provisional and non-provisional

applications), design patents, certificates of invention and patent disclosures, together with all reissues, continuations,

continuations-in-part, divisionals, renewals, substitutions, revisions, extensions (including supplementary protection certificates)

or reexaminations thereof, as well as any other applications worldwide claiming priority to any of the foregoing

(“Patents”), (ii) trademarks and service marks, trade dress, logos, trade names, corporate names, brands,

slogans, and other source identifiers together with all translations, adaptations, derivations, combinations and other variants of

the foregoing, and all applications, registrations, and renewals in connection therewith, together with all of the goodwill

associated with the foregoing, (iii) copyrights, and other works of authorship (whether or not copyrightable), and moral rights, and

registrations and applications for registration, renewals and extensions thereof, (iv) trade secrets, know-how (including ideas,

formulas, compositions, inventions (whether or not patentable or reduced to practice)), customer and supplier lists, improvements,

protocols, processes, methods and techniques, research and development information, industry analyses, algorithms, architectures,

layouts, drawings, specifications, designs, plans, methodologies, proposals, industrial models, technical data, financial and

accounting and all other data, databases, database rights, including rights to use any Personal Information, pricing and cost

information, business and marketing plans and proposals, and customer and supplier lists (including lists of prospects) and related

information (“Trade Secrets”), (v) rights in Software, Internet domain names and social media accounts,

(vi) rights of publicity and all other intellectual property or proprietary rights of any kind or description, (vii) copies and

tangible embodiments of any of the foregoing, in whatever form or medium, including all Software, and (viii) all legal rights

arising from items (i) through (vi), including the right to prosecute, enforce and perfect such interests and rights to sue, oppose,

cancel, interfere, enjoin and collect damages based upon such interests, including such rights based on past infringement, if any,

in connection with any of the foregoing.

“IRS”

means the Internal Revenue Service of the United States.

“Knowledge”

or “to the Knowledge” of a Person means in the case of the Company, the actual knowledge of the individuals

listed on Section 1.01(A) of the Company Disclosure Schedule after reasonable inquiry (and for all purposes of Section 4.13

hereof, “reasonable inquiry” shall not require Company to have conducted patent clearance or similar freedom

to operate searches, or other Intellectual Property searches), and in the case of Parent, the actual knowledge of the individuals listed

on Section 1.01(A) of the Parent Disclosure Schedule after reasonable inquiry.

“Leased Real Property”

means the real property leased by the Company or Company Subsidiaries as tenant, together with, to the extent leased by the Company or

Company Subsidiaries, all buildings and other structures, facilities or improvements located thereon and all easements, licenses, rights

and appurtenances of the Company or Company Subsidiaries relating to the foregoing.

“Legacy Parent

Transaction Expenses” means all liabilities reflected on Parent’s financial statements as of and for the period ended

June 30, 2024.

“Lien”

means any lien, security interest, mortgage, deed of trust, defect of title, easement, right of way, pledge, adverse claim or other encumbrance

of any kind that secures the payment or performance of an obligation (other than those created under applicable securities Laws).

“Off-the-Shelf

Software” means any commercially available, off-the-shelf Software that is licensed other than through a written agreement

executed by the licensee (such as via clickwrap, browsewrap, or shrinkwrap licenses) or that has license or user-fees less than $50,000

per year.

“Open Source Software”

means any Software in source code form that is licensed pursuant to (i) any license that is a license now or in the future approved

by the open source initiative and listed at http://www.opensource.org/licenses, which licenses include all versions of the GNU

General Public License (GPL), the GNU Lesser General Public License (LGPL), the GNU Affero GPL, the MIT license, the Eclipse Public License,

the Common Public License, the CDDL, the Mozilla Public License (MPL), the Artistic License, the Netscape Public License, the Sun Community

Source License (SCSL), and the Sun Industry Standards License (SISL), (ii) any license to Software that is considered “free”

or “open source software” by the open source foundation or the free software foundation, (iii) the Server Side

Public License, or (iv) any Reciprocal License.

“Parent Bylaws”

means the Bylaws of Parent, adopted as of June 11, 2020.

“Parent Certificate

of Incorporation” means the Amended and Restated Certificate of Incorporation of Parent, dated as of June 11, 2020.

“Parent Common

Stock” means the common stock of the Parent, par value of $0.0001 per share, designated as Common Stock in the Parent Certificate

of Incorporation.

“Parent Material

Adverse Effect” means any event, circumstance, change or effect that, individually or in the aggregate with any one or more

other events, circumstances, changes and effects, (i) is or would reasonably be expected to be materially adverse to the business,

financial condition, assets and liabilities or results of operations of the Parent Parties; or (ii) would prevent, materially delay

or materially impede the performance by any Parent Party of its respective obligations under this Agreement or the consummation of the

Mergers or any of the other Transactions; provided, however, that none of the following shall be deemed to constitute, alone

or in combination, or be taken into account in the determination of whether, there has been or will be a Parent Material Adverse Effect:

(a) any change or proposed change in or change in the interpretation of any Law or GAAP; (b) events or conditions generally

affecting the industries or geographic areas in which Parent operates; (c) any downturn in general economic conditions, including

changes in the credit, debt, securities, financial or capital markets (including changes in interest or exchange rates, prices of any

security or market index or commodity or any disruption of such markets); (d) any geopolitical conditions, outbreak of hostilities,

acts of war, sabotage, civil unrest, cyberterrorism, terrorism, military actions, earthquakes, volcanic activity, hurricanes, tsunamis,

tornadoes, floods, mudslides, wild fires or other natural disasters, weather conditions, epidemics, pandemics or other outbreaks of illness

or public health events and other force majeure events (including any escalation or general worsening of any of the foregoing); (e) any

actions taken or not taken by any Parent Party as required by this Agreement or any Ancillary Agreement; (f) any event, circumstance

change or effect attributable to the announcement or execution, pendency, negotiation or consummation of the Mergers or any of the other

Transactions or (g) any actions taken, or failures to take action, or such other changes or events, in each case, which the Company

has requested or to which it has consented, except in the cases of clauses (a) through (d), to the extent that any

Parent Party is disproportionately and adversely affected thereby as compared with other participants in the industry in which such Parent

Party operates.

“Parent Merger

Sub Common Stock” means the common stock of Parent Merger Sub, par value of $0.001 per share, designated as Common Stock

in the Parent Merger Sub certificate of incorporation.

“Parent Merger

Sub Organizational Documents” means the certificate of incorporation and bylaws of Parent Merger Sub, as amended, modified

or supplemented from time to time.

“Parent Organizational

Documents” means the Parent Certificate of Incorporation and the Parent Bylaws, in each case, as amended, modified or supplemented

from time to time.

“Parent Parties”

means Parent, Pubco and the Merger Subs.

“Parent Preferred

Stock” means the preferred stock of the Parent, par value of $0.0001 per share, designated as Preferred Stock in the Parent

Certificate of Incorporation.

“Parent Right”

means a right to acquire 1/20th of a share of Parent Common Stock as set forth in the Amended and Restated Rights Agreement, dated January

26, 2022, between Parent and the Trustee.

“Parent Units”

means the units issued in the IPO or the overallotment consisting of one (1) share of Parent Common Stock, one (1) Parent Right, and one

(1) Parent Warrant.

“Parent Stockholder

Approval” means the approval of the Parent Proposals by an affirmative vote of the holders of the requisite number of shares

of Parent Common Stock (as determined in accordance with applicable Law and the Parent Governing Documents) at a Parent Stockholders’

Meeting duly called by the Parent Board and held for such purpose.

“Parent Warrants”

means the warrants to purchase Parent Common Stock that are outstanding immediately prior to the Closing.

“Participating

Securityholders” means, as of immediately prior to the Closing, each holder of Company Ordinary Shares.

“PCAOB”

means the United States Public Company Accounting Oversight Board and any division or subdivision thereof.

“PCI DSS”

means the Payment Card Industry Data Security Standard, issued by the Payment Card Industry Security Standards Council.

“Permitted Financing

Securities” means any equity securities or debt securities of the Company (or any securities convertible into or exercisable

for equity securities of the Company) issued in any Permitted Financing, notes that are convertible into shares of Capital Stock and warrants

exercisable for shares of Capital Stock.

“Permitted Liens”