true

This Current Report on Form 8-K/A, Amendment Number One, (Amended Form 8-K) is being filed by Capstone Companies, Inc., a Florida corporation, (Company) to: (1) disclose Amendment Number One, dated November 6, 2024, to the Management Transition Agreement between Capstone Companies, Inc. and Coppermine Ventures, LLC (MTA), which MTA was dated October 28, 2024 and signed on October 31, 2024, and was disclosed and filed as an exhibit to the Current Report on Form 8-K filed by the Company with the Commission on November 5, 2024 (Initial Form 8-K); (2) to correct the XBRL link designations and exhibit numbering for Exhibit 10.1 and Exhibit 10.2 to the Initial Form 8-K; and (3) to correct corrupted text in the MTA as filed as an exhibit to the Initial Form 8-K. Other than as set forth in this Explanatory Note, this Amended Form 8-K does not amend any other disclosures in the Initial Form 8-K.

0000814926

0000814926

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report: November 7, 2024

(Earliest Event Date requiring this Report: November

6, 2024)

CAPSTONE

COMPANIES, INC.

(EXACT

NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Florida |

0-28331 |

84-1047159 |

| (State

of Incorporation or Organization) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

Number

144-V, 10 Fairway Drive Suite

100

Deerfield

Beach, Florida 33441

(Address of principal executive offices)

(954) 570-8889,

ext. 313

(Registrant’s telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Class of Securities. |

Trading

Symbol(s). |

Name

of exchange on which registered |

| N/A |

N/A |

N/A |

The

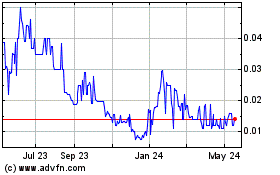

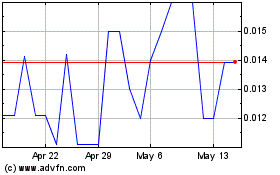

Registrant’s Common Stock is quoted on the OTCQB Venture Market of the OTC Markets Group, Inc. under the trading symbol “CAPC.”

EXPLANATORY NOTE

This Current Report on Form 8-K/A, Amendment Number

One, (“Amended Form 8-K”) is being filed by Capstone Companies, Inc., a Florida corporation, (“Company”) to: (1)

disclose Amendment Number One, dated November 6, 2024, to the Management Transition Agreement between Capstone Companies, Inc. and Coppermine

Ventures, LLC (“MTA”), which MTA was dated October 28, 2024 and signed on October 31, 2024, and was disclosed and filed as

an exhibit to the Current Report on Form 8-K filed by the Company with the Commission on November 5, 2024 (“Initial Form 8-K”);

(2) to correct the XBRL link designations and exhibit numbering for Exhibit 10.1 and Exhibit 10.2 to the Initial Form 8-K; and (3) to

correct corrupted text in the MTA as filed as an exhibit to the Initial Form 8-K. Other than as set forth in this Explanatory Note, this

Amended Form 8-K does not amend any other disclosures in the Initial Form 8-K.

Item 1.01 Entry into Material Definitive Agreement.

On November 6, 2024, Capstone Companies, Inc., a Florida corporation, (“Company”) and Coppermine Ventures, LLC, a private

Maryland limited liability company, (“Coppermine”) entered into an Amendment Number One (“Amendment”) to the Management

Transition Agreement, signed on October 31, 2024 and dated October 28, 2024, by the Company and Coppermine (“MTA”). The Amendment

amended the MTA as follows:

(1) Section 1 of the Agreement was amended and restated

to provide, in part, that:

(a) Coppermine would submit names of one or two nominees

(“Nominees”) for appointment to the Company’s Board of Directors by November 30, 2024, which deadline could be unilaterally

extended by Coppermine to December 31, 2024, and the Company Board of Directors (“Company Board”) would appoint the Nominees

submitted to fill vacancies on the Company Board; and

(b) Coppermine would submit the name of a nominee

to serve as Chief Executive Officer and President of the Company (“CEO Nominee”) by November 30, 2024, which deadline can

be unilaterally extended by Coppermine to December 31, 2024, and the Company would appoint the CEO Nominee as Chief Executive Officer

and President of the Company upon resignation of the incumbent Chief Executive Officer of the Company, which resignation would be tendered

to the Company Board upon receipt of the notice of the CEO Nominee; and

(c) Appointment of Nominees and CEO Nominee to their

respective positions with the Company would be subject to verification by the Company Board of all nominees’ eligibility and qualification

to serve in their respective positions with the Company.

(2) Section 2 of the Agreement was amended and restated

to provide, in part, that:

(a) Company would appoint the Nominees and CEO Nominee

to their respective positions with the Company, subject to conditions in amended and restated Section 1 of the Agreement; and

(b) Incumbent Chief Executive Officer of the Company

would resign upon submission of the CEO Nominee by Coppermine to allow appointment of the CEO Nominee as Company’s Chief Executive

Officer and President, but the incumbent Chief Executive Officer would remain a director of the Company.

(3) Section 3 of the Agreement was amended and restated

to provide, in part, that:

(a) The fulfillment of all obligations by the Company

under Section 2 of the Agreement is a condition precedent to Coppermine’s obligations under Section 1 of the Agreement, and the

fulfillment of all obligations by Coppermine under Section 1 of the Agreement is a condition precedent to Company’s obligations

under Section 2 of the Agreement. Any breach of Section 2 of the Agreement by the Company that is not promptly remedied within twenty

(20) days after receipt of a written demand from Coppermine will constitute a breach of the Promissory Note, dated October 31, 2024, issued

to Coppermine by the Company (“Note”), causing the principal amount and accrued interest thereon under the Note to become

immediately due and payable in full.

Since the current Chief Executive Officer of the Company

will remain as a director after the appointment of the CEO Nominee, the amended and restated Section 2 deleted the provision in the original

Section 2 for the current Chief Executive Officer providing advisory services to the Company Board. Further, the signing of a proxy by

certain Company shareholders for the election of Nominees to the Company Board was not retained in the amended and restated Section 3.

The intent of the Company and Coppermine is that any such proxy would be provided to Coppermine when a Nominee is appointed to the Company

Board.

The above summary of the Amendment is qualified in

its entirety by reference to the Amendment as filed as Exhibit 10.3 to this Amended Form 8-K.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. The names of the Nominees and CEO

Nominee have not been submitted to the Company, and no resignations or appointments contemplated under the Amendment have occurred, as

of the date of the filing of this Amended Form 8-K.

Item 9.01. Financials and Exhibits

(d) Exhibits. The following documents are filed as

exhibits to this Amended Form 8-K. The exhibit numbers stated on the documents filed as Exhibit 10.1 and Exhibit 10.2 to the initial Form

8-K, and XBRL Links listed for those exhibits in the exhibit index of the Initial Form 8-K, do not conform to the exhibit index in the

Initial Form 8-K Those exhibits are filed with this Amended Form 8-K to correct that inadvertent error. Further, the MTA is filed as Exhibit

10.2 to this Amended Form 8-K to correct the inadvertent corruption of three words in the version filed as an exhibit to the Initial Form

8-K.

| Exhibit Number |

Exhibit Description |

| 10.1 |

Unsecured Promissory Note, dated 31 October 2024, issued by Capstone Companies, Inc. to Coppermine Ventures, LLC |

| 10.2 |

Management Transition Agreement, dated 31 October 2024, by Capstone Companies, Inc. and Coppermine Ventures, LLC

|

| 10.3 |

Amendment Number One to the Management Transition Agreement, dated November 6, 2024, by Capstone Companies, Inc. and Coppermine Ventures, LLC

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CAPSTONE

COMPANIES, INC., A FLORIDA CORPORATION

By:

/s/ Stewart Wallach

Stewart

Wallach, Chief Executive Officer

Dated:

November 7, 2024

Exhibit

Index

| Exhibit Number |

Exhibit Description |

| 10.1 |

Unsecured Promissory Note, dated 31 October 2024, issued by Capstone Companies, Inc. to Coppermine Ventures, LLC |

| 10.2 |

Management Transition Agreement, dated 31 October 2024, by Capstone Companies, Inc. and Coppermine Ventures, LLC

|

| 10.3 |

Amendment Number One to the Management Transition Agreement, dated November 6, 2024, by Capstone Companies, Inc. and Coppermine Ventures, LLC

|

Exhibit 10.1

THIS PROMISSORY NOTE

PROVIDES FOR A LUMP SUM PAYMENT OF PRINCIPAL AND ACCRUED INTEREST, WHICH OBLIGATION MAY IMPOSE A SUBSTANTIAL FINANCIAL OBLIGATION ON

THE MAKER.

UNSECURED PROMISSORY

NOTE (the “Note”)

October 31, 2024

Principal Amount:

USD$125,914.00 Deerfield Beach, Florida

FOR VALUE RECEIVED,

Capstone Companies, Inc., a Florida corporation, (the “Maker”) promises to pay to the order of Coppermine Ventures, LLC,

a Maryland limited liability company, (“Payee”), or Payee’s registered assigns or successors in interest, the principal

sum of ONE HUNDRED TWENTY FIVE THOUSAND NINE HUNDRED FOURTEEN DOLLARS AND NO CENTS ($125,914.00) (“Principal”) in lawful

money of the United States of America and on the terms and conditions described below. The Note evidences a loan of the Principal made

to Maker by Payee in good funds on deposit, which Principal amount shall be wired to Maker by Payee on October 31, 2024, or within one

(1) Business Day thereafter, to the Maker’s bank account set forth in a signed written notice by Maker to the Payee, which signed

written notice has been provided to Payee prior to October 31, 2024. Exhibit One hereto sets forth the principal business address of

Payee. Maker and Payee may also be referred to individually as a “party” and collectively as the “parties” below.

1. Principal. The

Principal balance of this Note shall be payable by the Maker on the earlier to occur of: (i) July 31, 2025 (“Maturity Date”);

(ii) the date that the Maker ceases to be subject to the reporting requirements of Section 13 or 15(d) of the Securities Exchange Act

of 1934 or ceases to have shares of its Common Stock, $0.0001 par value per share, (“Common Stock”) quoted on any tier of

The OTC Markets Group, Inc. (“OTC”); or (iii) the date that Maker’s board of directors approves a plan of complete

liquidation of the Maker (the foregoing triggering date being

referred to as the

“Maturity Date”). The Principal may be prepaid at any time at the election of Maker without penalty. Under no circumstances

shall any individual, including, but not limited to, any executive officer, director, employee or stockholder of the Maker, be obligated

personally for any obligations or liabilities of the Maker under this Note. All amounts due on this Note shall be due and payable without

set-off, counterclaim or any other deduction whatsoever.

2. Interest. Simple

annual interest shall accrue on the unpaid Principal balance of this Note at SEVEN PERCENT (7%) (“Interest”). All accrued

Interest shall be added to and become part of the Principal amount outstanding under this Note and all unpaid Principal and unpaid accrued

Interest thereon shall be due and payable in full and in a lump sum payment due on the Maturity Date. Interest shall be computed on the

basis of a three hundred sixty-five (365) day year, with any calculation based on actual days elapsed.

3. Application of

Payments. (a) Order. All payments made hereunder shall be made in name of the Payee and shall be applied first to payment in full of

any costs incurred in the collection of any sum due under this Note, including (without limitation) reasonable attorney’s fees,

then to the payment in full of any late charges, then to the reduction of the unpaid Principal balance of this Note and then finally

applied to the Interest accrued on the Principal.

(b) Next Business

Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on

the next succeeding Business Day. “Business Day” means any day, except: (i) any Saturday; (ii) any Sunday; (iii) any other

day which is a federal legal holiday in the United States; or (iv) any day on which commercial banking institutions in the Broward County,

Florida are authorized or required by law or other governmental action to close.

4. Events of Default.

The following shall constitute an event of default of this Note (“Event of Default”):

(a) Failure to Make

Required Payments. Failure by Maker to pay any payment of Principal or accrued Interest thereon on the Maturity Date, provided, that

the Maker will have five (5) days after the Maturity Date to cure the late payment by payment in full of all sums due under this Note.

(b) Voluntary Bankruptcy.

The commencement by the Maker of a voluntary case under any applicable bankruptcy, insolvency or other similar law, or the consent by

Maker to the appointment of or taking possession by a receiver, liquidator, assignee, trustee, custodian, sequestrator (or other similar

official) of the Maker or for any substantial part of its property, or the taking of corporate action by Maker in furtherance of any

of the foregoing.

(c) Involuntary Bankruptcy.

The entry of a decree or order for relief by a court having jurisdiction in respect of Maker in an involuntary case under any applicable

bankruptcy, insolvency or other similar law, or appointing a receiver, liquidator, assignee, custodian, trustee, sequestrator (or similar

official) of Maker or for any substantial part of its property, or ordering the winding-up or liquidation of its affairs, and the continuance

of any such decree or order unstayed and in effect for a period of sixty (60) consecutive days.

(d) Maker breaches

Section 6(a) or Section 6(b) of this Note, which breach is not cured within five (5) days after the date of the breach.

(e) Maker breaches

Section 1 of a certain Management Transition Agreement dated same date as this Note or thereabouts, by the Maker and Payee (“MT

Agreement”), which breach is not timely remedied in accordance with the terms of the MT Agreement.

5. Remedies. Upon

the occurrence and during the continuance of an Event of Default specified in Section 4(a) (b), (c), (d) or (e) above, and expiration

of any cure period without the Event of Default being cured in full, then the unpaid Principal amount of this Note and unpaid Interest

accrued thereon, as well as all other sums due under this Note, shall become immediately due and payable without presentment, demand,

protest or other notice of any kind, all of which are hereby expressly waived, anything contained herein or in the documents evidencing

the same to the contrary notwithstanding.

6. Senior Debt; Use

of Proceeds. (a) Senior Debt. This Note is not secured by any collateral or secured interest. The debt evidenced by this Note is unsecured,

but that debt shall be senior to any debt owed by Maker to Stewart Wallach, a director and officer of the Maker, Jeffrey Postal, a director

of the Maker, or any entity owned or controlled by the aforesaid persons (excepting the Maker) (individually, an “Insider Obligee”

and collectively, “Insider Obligees”). Maker shall not make any payment on, or settle or make an accord of, any debts owed

to any Insider Obligee as long as any sum is owed under this Note to the Payee and without the prior written consent of the Payee.

(b) Use of Proceeds.

Payee will loan in full the Principal to Maker in good funds on deposit, (“Loan”) by wire transfer to Maker’s specified

corporate bank account and will do so on or before October 31, 2024, or within one (1) Business Day thereafter. The Principal shall be

used by the Maker solely to pay the debt obligations listed in Exhibit Two hereto (the “Approved Payments”). Payee will pay

wire transfer fees for wire transfer of the Principal to Maker and Payee will not add the wire transfer fees to the Principal or other

sums due under this Note. The making of the Loan by Payee to Maker is a condition to the obligations of Maker under this Note.

7. Waivers. Except

as required for a breach of Section 1 of the MT Agreement, the Maker, and any endorsers and guarantors of and any sureties for, this

Note, each waive: (a) presentment for payment, demand, notice of dishonor, protest, and notice of protest with regard to the Note; (b)

all errors, defects and imperfections in any proceedings instituted by Payee under the terms of this Note; or (c) all benefits that might

accrue to Maker by virtue of any present or future laws exempting any property, real or personal, or any part of the proceeds arising

from any sale of any such property, from attachment, levy or sale under execution, or providing for any stay of execution, exemption

from civil process, or extension of time for payment.

8. Unconditional

Liability. Maker agrees that its liability under this Note shall be unconditional, without regard to the liability of any other person

or entity, and shall not be affected in any manner by any indulgence, extension of time, renewal, waiver or modification granted or consented

to by Payee, and consents to any and all extensions of time, renewals, waivers, or modifications that may be granted by Payee with respect

to the payment or other provisions of this Note.

9. Notices. All notices,

statements or other documents which are required or contemplated by this Note shall be made in writing and delivered: (i) personally

by hand courier or sent by first class registered or certified mail, or recognized national overnight courier service to the principal

executive address of record of the Maker, or to the address set forth in Exhibit One hereto for Payee, (ii) by facsimile to the telephone

number most recently provided to such party or the facsimile telephone number as may be designated in writing by such party, or (iii)

by electronic mail, to the electronic mail address most recently provided to such party or such other electronic mail address as may

be designated in writing by such party. Any notice or other communication so transmitted shall be deemed to have been given on the day

of delivery, if delivered personally; or on the Business Day following receipt of written confirmation, if sent by facsimile or electronic

transmission; or one (1) Business Day after delivery by a nationally recognized overnight courier service; or seven (7) days after date

of certified or registered mail mailing through the U.S Postal Service.

10. Construction.

THIS NOTE SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF FLORIDA WITHOUT REGARD TO ITS CONFLICT OF LAW PROVISIONS

THEREOF.

11. Severability.

Any provision contained in this Note, which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective

to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition

or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

12. Entire Agreement;

Amendment; Waiver. This Note sets forth the entire agreement of the Maker and Payee in respect of the Loan. Exhibit One hereto and Exhibit

Two hereto are incorporated herein by reference. Any amendment of this Note or waiver of any provision hereof may be made with, and only

with, the written consent of the Maker and the Payee. This Note is not conditioned upon, and does not obligate either party to negotiate,

enter into or consummate any other agreement or transaction with the other party. This Note supersedes all prior agreements, instruments,

commitments, obligations and undertaking of the parties or by a party, whether oral or written or electronic transmission, excepting

the Mutual Non-Disclosure Agreement between the parties, dated October 8, 2024, and the MT Agreement (if and when signed).

13. Assignment. No

assignment or transfer of this Note or any rights or obligations hereunder may be made by the Maker (by operation of law or otherwise)

without the prior written consent of the Payee and any attempted assignment without the required written consent shall be void.

14. Acknowledgment.

Payee is acquiring this Note for investment for its own account, not as a nominee or agent, and not with a view to, or for resale in

connection with, any distribution thereof. Payee understands that the acquisition of this Note involves substantial risk due to the Maker’s

lack of revenue producing operations, debts and minimal cash resources. Payee acknowledges that it is able to fend for itself, can bear

the economic risk of making the Loan, and has such knowledge and experience in financial and business matters that it is capable of evaluating

the merits and risks of making the Loan and protecting its own interests in connection with this Loan. Prior to receipt of this Note,

the Payee has had a reasonable opportunity to review the business and financial reports and filings of the Maker with the U.S. Securities

and Exchange Commission or “SEC” as well as ask questions about the Maker and its business and financial affairs and receive

answers to those questions. Maker and Payee have each had a reasonable opportunity to consult its own legal counsel and its own financial

advisors about this Note and the Loan prior to execution of this Note. The Loan is a standalone commercial transaction and is not conditioned

upon, made in reliance upon, or requiring consummation of any other agreement or transaction between the parties. Parties have only relied

on the representations expressly stated in this Note in deciding to execute this Note and, for Payee, in making the Loan under this Note.

15. Successors. The

rights and obligations of the Maker and Payee hereunder shall be binding upon and benefit their respective successors, assigns, heirs,

administrators and transferees.

16. Valid Corporate

Debt. The debt evidenced by this Note is a valid corporate debt of the Maker.

17. Lost or Mutilated

Note. If this Note shall be mutilated, lost, stolen or destroyed, the Maker shall execute and deliver: (a) in exchange and substitution

for and upon cancellation of a mutilated Note, a New Note for the unpaid Principal of the Note; or (b) or in lieu of or in substitution

for a lost, stolen or destroyed Note, a new Note for the unpaid Principal amount of this Note so lost, stolen or destroyed, but only

upon receipt of evidence of the loss, theft or destruction of the Note that is reasonably satisfactory to the Maker.

18. Execution and

Counterparts. This Note may be executed in two or more counterparts, all of which when taken together shall be considered one and the

same agreement and instrument and shall become effective when counterparts have been signed by Maker and Payee and exchanged by the Maker

and Payee. It is understood that both Maker and Payee need not sign the same counterpart and may sign on separate signature pages. In

the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such

a signature shall create a valid and binding obligation of the Maker or Payee, as the case may be, executing (or on whose behalf such

signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page was an original thereof.

19. Remedies and

Other Obligations. The remedies provided in this Note shall be cumulative and in addition to all other remedies available under this

Note at law or in equity (including a decree of specific performance or other injunctive relief). Amounts set forth or provided for herein

with respect to payments, (and the computation thereof) shall be the amounts to be received by the Payee and shall not, except as expressly

provided herein, be subject to any other obligation of the Maker (or the performance thereof). The Maker shall provide all information

and documentation to the Payee that is reasonably requested by the Payee to enable the Payee to confirm the Maker’s compliance

with the terms and conditions of this Note.

20. Headings. The

headings contained herein are for convenience only, do not constitute a part of this Note and shall not be deemed to limit or affect

any of the provisions hereof.

IN WITNESS WHEREOF,

Maker, intending to be legally bound hereby, has caused this Note to be duly executed by the undersigned as of the day and year first

above written.

CAPSTONE COMPANIES,

INC., a Florida corporation

By: /s/Stewart

Wallach Date: October 31, 2024

Stewart

Wallach, Chief Executive Officer

SEEN AND AGREED BY:

PAYEE: Coppermine

Ventures, LLC, a Maryland limited liability company

By: /s/Alexander

Jacobs Date: October 31, 2024

Alexander

Jacobs, Managing Member/Manager

Exhibit One: Payee

Name and Principal Business Address

Payee is (print full

legal name and, if an entity, state or jurisdiction of organization or incorporation):

Coppermine Ventures,

LLC, a Maryland limited liability company

13100 Beaver Dam

Rd.

Hunt Valley, Maryland

21030

Email:

Attn: Alexander Jacobs

Exhibit Two

Capstone Companies,

Inc.

Projected Future Expenses

through Sept 30, 2024

Use of Proceeds

Capstone Companies,

Inc.

Projected Future Expenses

through Sept. 30, 2024

All amounts in U.S.

Dollars

1. Public Company

Compliance/Regulatory Expenses [1]: $43,140

2. Legal/Accounting

Expenses [2]: $34,934

3. Insurance Expense

[3]: $17,286

4. Consulting and

Compliance Expenses [4]: $19,372

5. Software/Operating

Expenses [5]: $11,182

Total Projected Operating

Costs through

Sept. 30, 2024,

$125,914

Footnotes:

[1] SEC Fees; OTC

Market Fees; Shareholder Services; Investor Relations; Audit fees

[2] Tax, Accounting,

and Legal Services

[3] Directors and

Officers Insurance premium

[4] Technical consultant

and product compliance services

[5] General Operating

costs: software licenses, phones, bank fees, etc.

Additional Notes:

{A}There is no provision

for payroll costs for Stewart Wallach and George Wolf as their salaries have been deferred through 2024

{B} Capstone currently

maintains a remote work environment, there are no Lease/Rent/CAM expenses or Travel/Entertainment expense included in the above projection.

Exhibit 10.2

MANAGEMENT TRANSITION

AGREEMENT

This Management Transition

Agreement, dated October 28, 2024 [signed October 31, 2024] (“Effective Date”), (“Agreement”) is made by Capstone

Companies, Inc., a Florida corporation subject to the reporting requirements of the Securities Exchange Act of 1934 and with shares of

its Common Stock, $0.0001 par value, (“Common Stock”) quoted on The OTC Markets Group, Inc. QB Venture Market (“OTCQB”),

(“CCI”) and the person or entity identified in Exhibit One hereto (“Other Signatory” or “OS”). OS

and CCI may also be referred to individually as a “party” and collectively as the “parties”.

Background

A.

CCI is a “fallen angel” public shell company, being a former public operating company that no longer has revenue generating

operations and with nominal assets consisting primarily of cash.

B.

Since 2023, CCI has relied upon funding by its chief executive officer, a non-employee director and a third party to fund its essential

working capital needs, but such funding will not be available in any significant amount after September 30, 2024, and CCI has no other

source of funding all of its essential working capital needs. For purposes of this Agreement, “essential working capital needs”

means corporate expenses that are necessary to: (1) maintain the quotation of the Common Stock on the OTCQB; (2) pay for accounting and

legal professional services and filing fees required to meet legal compliance requirements of CCI under the Securities Exchange Act of

1934 (“1934 Act”), including annual audit work for Annual Report on Form 10-K, and accounting work for Quarterly Reports

on Form 10-Q and other 1934 Act filings with the U.S. Securities and Exchange Commission (“SEC”); (3) expenses required to

comply with State of Florida corporate compliance requirements; (4) maintenance of corporate directors’ and officers’ liability

insurance; (5) pay federal, state and local taxes and make tax filings; and (6) other miscellaneous corporate expenses deemed by CCI

senior management as necessary to maintain CCI’s status as an active corporation in good standing under federal and state laws.

C.

OS is willing to provide timely funding for the essential working capital needs of CCI under a promissory note shall be issued by CCI

to OS concurrently with the signing of this Agreement, which promissory note is attached hereto as Attachment One (“Note”).

The proceeds of the Note will pay for essential working capital needs that were due as of September 30, 2024.

D.

Further, OS is willing under this Agreement to provide additional, future essential working capital for CCI as described in Attachment

Two hereto (the “Commitment”), subject to the terms and conditions of this Agreement.

E.

For purposes of this Agreement, “business day” means any day on which the banks in Baltimore County, Maryland are open for

business on regular operating hours; “qualified person” means a natural person who meets the legal requirements for serving

as a director of a Florida corporation, excluding persons who are deemed “bad actors” under Rule 506(d) of Regulation D under

the Securities Act of 1933 (“1933 Act”) or are barred by a court order or administrative order or applicable laws from serving

as a director or officer of a public company; and “significant corporate transaction” means a merger, other business combination,

asset sale, stock exchange, stock issuance, or similar transaction.

Intending to be legally bound, the parties

agree:

1.

OS Actions. On the Effective Date or within two (2) business days thereafter, OS will do the following: (a) execute or cause OS’

affiliate to execute the Note and fully fund the principal amount of the Note in good funds on deposit for CCI, which loan will be wired

to CCI’s designated corporate bank account in accordance with the terms of the Note; (b) provide CCI with a written nomination

specifying two (2) qualified persons as OS’ nominees to be appointed to and serve as directors on the CCI Board of Directors (“Nominees”),

which Nominees will be appointed to fill vacancies on the CCI Board of Directors; (c) specify a qualified person as OS’ nominee

to serve as chief executive officer of CCI (“CEO Nominee”); (d) execute and tender this completed Agreement to CCI; (e) provide

CCI with written certification of financial ability of payee under the Note to fund the Commitment, which written certification is attached

hereto as Attachment Two (“Certification”)); and (f) take all other actions and sign all additional agreements and instruments

that are reasonably necessary to timely complete the actions set forth in Sections 1(a), (b), (c), (d) and (e) above.

2.

CCI Actions. On the Effective Date or within two (2) business days thereafter, CCI will do or cause the occurrence of the following:

(a) CCI Board of Directors will appoint the Nominees to serve as directors on the CCI Board of Directors, subject to each Nominee accepting

the terms and conditions of service set forth in Exhibit Two hereto; (b) CCI Board of Directors will accept the resignation of the incumbent

chief executive officer of CCI and appoint the CEO Nominee as the chief executive officer of CCI, subject to the CEO Nominee accepting

the terms and conditions of service set forth in Exhibit Two hereto; (c) two (2) incumbent directors of CCI will resign as directors

of the CCI Board of Directors; (d) execute an advisory agreement with Stewart Wallach whereby Mr. Wallach will provide corporate governance

and business advisory services to the CCI Board of Directors and do so as requested for a set number of hours per month and without cash

compensation; (e) execute and deliver a complete Agreement to OS; (f) CCI will sign the Note and tender it to OS; and (g) CCI will take

all actions and sign all additional agreements and instruments that are reasonably necessary to timely consummate the actions in Sections

2(a), (b), (c), (d), (e) and (f) above. Appointment of each of the Nominees and the CEO Nominee are subject to acceptance of the appointment

by CCI hereunder.

3. Conditions Precedent.

(a) The fulfillment of all obligations by CCI under Section 2 is a condition precedent to OS’ obligations under Section 1 above,

and the fulfillment of all obligations by OS under Section 1 above is a condition precedent to CCI's obligations under Section 2. Any

breach of Section 1 above by CCI that is not promptly remedied in accordance with Section 5 will constitute a breach of the Note, causing

the principal amount and accrued interest thereon under the Note to become immediately due and payable in full. Additionally, Stewart

Wallach and Jeffrey Postal must sign an irrevocable proxy for voting their respective shares of Common Stock in favor of the Nominees’

election to the CCI Board of Directors and tender the proxy to OS simultaneously with the submission of CCI’s signed version of

this Agreement (the “Proxy”).

4. Confidentiality.

(a) Definitions. The following terms are defined as follows: (i) “Disclosing Party” means the party who owns or controls

“Protected Information” (as defined herein) disclosed or made available to the other party; (ii) “Non-public material

information” means information that is not public and is information that a reasonable investor would consider important in making

a decision to hold, sell or buy any securities of a company; (iii) “Recipient” means the party receiving Protected Information

of the Disclosing Party (either directly from the Disclosing Party, or through an officer, director, shareholder, employee, agent, or

attorney of the Disclosing Party, or from a third party); and (iv) “Protected Information” shall mean all confidential information

and non-public material information, in whatever form or format, of a Disclosing Party and all information provided to Recipient by third

parties that Disclosing Party is obligated to keep confidential. Without limiting the foregoing, Recipient agrees that any and all information

to which Recipient has access concerning non-public material information of or about the Disclosing Party is Protected Information, whether

in verbal form, machine-readable form, written or other tangible form, and whether designated or marked as confidential or not so designated

or marked. Protected Information also includes trade secrets (as defined under applicable state laws) of the Disclosing Party.

(b) Excluded Information.

Notwithstanding Section 4(a) above, Protected Information excludes any information that is or becomes part of the public domain through

no act or failure to act on the part of the Recipient or any person or entity acting under the direction or control of Recipient; or

is required by court order, government agency order to be publicly disclosed; or any information that is required to be publicly disclosed

in order to comply with applicable laws or regulations, including federal, state or foreign securities laws and regulations. OS agrees,

understands and acknowledges that federal and state securities laws and regulations will require CCI and OS to make public disclosures

of information that would otherwise be deemed Protected Information in filings with the SEC and that this Section 4 shall not be construed

or enforced so as to bar or prevent such required public disclosures or to make such required public disclosures a breach of this Section

4.

(c) Duration. From

the Effective Date until one year after the expiration or termination of this Agreement, Recipient shall hold in confidence and protect

all Protected Information of Disclosing Party. Recipient shall also take reasonable security precautions, and such other actions as may

be reasonably necessary, to ensure that there is no use or disclosure, intentional or inadvertent, of Protected Information in violation

of this Agreement. OS agrees, acknowledges and understands that trading in CCI securities based on non-public material information violates

federal and state laws and regulations and is prohibited.

(d) Return

of Protected Information. At the request of Disclosing Party at any time, and in any event, upon expiration or termination of this Agreement,

Recipient shall immediately return to Disclosing Party all Protected Information in whatever form, including tapes, notebooks, drawings,

digital files or other media containing Protected Information, and all copies thereof, then in Recipient’s possession or under

Recipient’s control. Notwithstanding the foregoing, a Recipient shall be entitled to retain Protected Information that is reasonably

necessary to permit the Recipient to comply with applicable laws or regulations, including documenting the basis for public disclosures

by or about the Recipient in any filings with the SEC or any other governmental authority.

(e) Public Disclosure

- Form 8-K Filing. CCI and OS will fully, diligently cooperate in causing the filing of a Current Report on Form 8-K and amendments thereto

with the SEC by CCI (“8-K”), which 8-K and amendments thereto will report the actions taken this Agreement, the Note and

the Proxy as well as have a complete copy of this Agreement, Note and Proxy as exhibits thereto. As the company responsible for filing

the 8-K and its amendments, CCI retains all rights and authority as to the contents, exhibits and filing of the 8-K and its amendments

as well as being responsible for the contents and exhibits of the 8-K and its amendments, and the costs of filing the 8-K and amendments

with the SEC. Required disclosures in the 8-K and amendments shall not be governed by this Section 4.

5.

Standalone Agreement/Instrument and Transactions. This Agreement and the Note are standalone agreements, instruments and transactions.

Neither party is obligated under this Agreement or the Note to pursue, negotiate, enter into an agreement or commitment, or consummate

any other transaction or agreement for, any significant corporate transaction or action and no agreement or commitment exists as of the

Effective Date. No agreement for a significant corporate transaction exists between the parties.

6. No Employment

Agreement. Neither this Agreement nor any provisions herein are an employment or engagement agreement for any Nominee or CEO Nominee.

Any employment or engagement agreement between CCI and any Nominee or CEO Nominee will be a separate agreement.

7. Term; Termination.

(a) Term. The term of this Agreement shall commence on the Effective Date and expire at 11:59 p.m., local Miami, Florida time, on September

30, 2025 (“expiration date”), unless terminated sooner in accordance with Section 7(b) below.

(b) Termination.

A party may terminate this Agreement upon ten (10) days’ prior written notice to the other party upon occurrence of any of the

following events: (i) a party breaches any material provision of this Agreement and fails to remedy that breach within ten (10) days

after receipt of a written demand from the non-breaching party, which written demand shall describe the breach of this Agreement; (ii)

a party’s board of directors or similar governing body approves a plan of complete dissolution under the laws of that party’s

domicile state or files for protection from creditors under any federal or state bankruptcy laws; (iii) a party’s charter is revoked

by its domicile state and not timely reinstated; (iv) a party is convicted of violating a federal or state felony law and there is no

available right of appeal of that conviction; or (v) a party ceases conducting operations for ninety (90) consecutive days.

8. Representations

and Warranties.

(a) CCI. CCI

hereby represents and warrants to OS that:

(i) CCI is duly

incorporated, validly existing and in good standing under the laws of the State of Florida; (ii) this Agreement has been duly authorized,

executed and delivered by CCI and CCI has the legal authority to enter into and perform this Agreement; and

(iii) As of August

13, 2024, CCI had 48,826,864 shares of Common Stock issued and outstanding and CCI has not authorized or caused to be issued

any additional shares of CCI Common Stock since August 13, 2024.

(b) OS. OS hereby

represents and warrants to CCI that: (i) if an entity, then OS is duly incorporated, organized, validly existing and in good standing

under the laws of its domicile state or jurisdiction; and (ii) this Agreement has been duly authorized, executed and delivered by

OS and OS has the legal authority to enter into and perform this Agreement; and (iii) OS understands that CCI files public business and

financial disclosures under the 1934 Act with the SEC and OS has had a reasonable opportunity to review those public disclosures prior

to signing this Agreement and the Note, which public disclosures can be accessed by OS at www.sec.gov.

(c) Each party has

relied solely upon the representations expressly contained in this Agreement and its own investigation of the other party in deciding

to enter into this Agreement and the Note.

9. Indemnification.

Each party (“Indemnitor”) shall indemnify, defend and hold harmless to the fullest extent permitted under applicable laws

and the Indemnitor’s charter, bylaw or similar organization documents in effect as of the date of this Agreement the other party

and its respective officers, directors, employees, managers, members and agents (individually, an “Indemnitee” and collectively

the “Indemnitees”) against any costs or expenses (including reasonable attorneys’ fees), judgments, settlements, fines,

losses, claims, damages or liabilities (collectively, “Losses”) incurred in connection with any legal proceeding or investigation,

whether civil, criminal, administrative or investigative, whenever asserted, arising out of or pertaining to or based upon a breach of

this Agreement or the Note by the Indemnitor, which indemnification excludes Losses which are caused in whole or in part by the bad faith

misconduct, gross negligence or violation of laws or regulations by an Indemnitee. Indemnification under this Section 9 shall survive

the termination or expiration of this Agreement by one (1) year.

10. Successors.

This Agreement shall be binding upon and inure to the benefit of each party and its successors and permitted assigns.

11. Assignment. Neither

this Agreement, nor any right, obligation or interest hereunder, may be assigned by a party without the prior written consent of the

other party.

12. Waiver of

Breach. The waiver by a party of a breach of any provision of this Agreement by the other party shall not be construed as a waiver of

any continuing or subsequent breach of the same provision or of any other provision of this Agreement. It is also understood and agreed

that no failure or delay by a party in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor shall

any single or partial exercise thereof preclude any other or future exercise thereof or the exercise of any other right, power or privilege

hereunder.

13. Counterparts.

This Agreement may be executed in any number of counterparts and by the parties in separate counterparts (including by facsimile, PDF

or electronic mail transmission), each of which when so executed shall be deemed to be an original and all of which when taken together

shall constitute one and the same agreement. This Agreement shall be valid, binding, and enforceable against a party when executed and

delivered by an authorized individual on behalf of the party by means of (a) an original manual signature; (b) a faxed, scanned, or photocopied

manual signature, or (c) any other electronic signature permitted by the federal Electronic Signatures in Global and National Commerce

Act, state enactments of the Uniform Electronic Transactions Act, or any other relevant electronic signatures law, including any relevant

provisions of the UCC (collectively, “Signature Law”), in each case to the extent applicable. Each faxed, scanned, or photocopied

manual signature, or other electronic signature, shall for all purposes have the same validity, legal effect, and admissibility in evidence

as an original manual signature. Each party shall be entitled to conclusively rely upon, and shall have no liability with respect to,

any faxed, scanned, or photocopied manual signature, or other electronic signature, of any other party and shall have no duty to investigate,

confirm or otherwise verify the validity or authenticity thereof. For the avoidance of doubt, original manual signatures shall be used

for execution or indorsement of writings when required under the UCC or other Signature Law due to the character or intended character

of the writings.

14. Governing

Law; Litigation. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Florida

without regard to principles of choice or conflicts of laws. Any action brought by either party against the other concerning the transactions

contemplated by this Agreement shall be brought exclusively in the United States District Court for the Southern District of Florida,

Ft. Lauderdale division, or the state courts for Broward County, Florida. The parties hereby irrevocably waive any objection to jurisdiction

and venue of any action instituted hereunder and shall not assert any objection or defense based on lack of jurisdiction or of venue

based upon forum non conveniens. Each party knowingly, voluntarily waives trial by jury. A party who prevails in any legal proceeding

shall be entitled to recover its reasonable attorney’s fees and costs incurred in connection with or related to a breach of this

Agreement by the other party. Each party hereby irrevocably waives personal service of process and consents to process being served in

any suit, action or proceeding in connection with this Agreement or any related document or agreement by mailing a copy thereof via registered

or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this

Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained

herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law.

15. Expenses.

All costs and expenses (including attorneys’ fees) incurred in connection with the negotiation and preparation of, or any claim,

dispute or litigation pertaining to, this Agreement, shall be paid by the party incurring such expenses, except as provided in Section

14 above.

16. Entire Agreement;

Amendment. This Agreement contains the entire agreement of the parties and their affiliates relating to the subject matter hereof and

thereof and supersedes all prior agreements, representations, warranties and understandings, written or oral, with respect thereto, excluding

the Mutual Non-Disclosure Agreement, dated 8 October 2024 or thereabouts, between CCI and an affiliate of OS. Neither this Agreement,

nor any term hereof, may be changed, waived, discharged or terminated except by an instrument in writing signed by the party against

which such change, waiver, discharge or termination is sought to be enforced. Exhibit One hereto, Exhibit Two hereto, Attachment One

hereto and Attachment Two hereto are incorporated herein by reference as if set forth verbatim herein.

17. Severability.

If any term or provision of this Agreement or the application thereof to any person, property or circumstance shall to any extent be

invalid or unenforceable, the remainder of this Agreement, or the application of such term or provision to persons, property or circumstances

other than those as to which it is invalid or unenforceable, shall not be affected thereby, and each term and provision of this Agreement

shall be valid and enforceable to the fullest extent permitted by law.

18. Remedies. Injunctive

Relief; Cumulative Remedies. Each party acknowledges and agrees that the covenants and obligations of the other party under this Agreement

relate to special, unique and extraordinary matters and are reasonable and necessary to protect the legitimate interests of the party

and that a breach of any of the terms of such covenants and obligations will cause the party irreparable injury for which adequate remedies

at law are not available. Each party agrees that the other party shall be entitled to an injunction, restraining order, or other equitable

relief from any court of competent jurisdiction restraining the party from any breach of this Agreement. A party’s rights and remedies

under this Section 18 are cumulative and are in addition to any other rights and remedies the party may have at law or in equity.

19. Headings. The headings contained

in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

20. Construction.

The parties agree that the terms and conditions of this Agreement are the result of negotiations between the parties and that this Agreement

shall not be construed in favor of or against either party by reason of the extent to which either party or its legal counsel participated

in the drafting of this Agreement.

21. Notices. All

notices, requests, claims, demands and other communications hereunder shall be in writing and shall be deemed given if delivered personally

or sent by a national overnight courier (providing proof of delivery) to the parties at the following addresses (or at such other address

for a party as shall be specified by like notice):

Capstone Companies,

Inc.

144-10 Fairway Drive, Suite

200, Deerfield Beach, Florida 33441

Telephone: (703)

216-8606

Email: jeff@jeffguzy.com

ATTN: Jeffrey Guzy,

Director

OS: As set forth in Exhibit One hereto.

IN WITNESS WHEREOF, the parties have duly

executed and delivered this Agreement as of the Effective Date.

CAPSTONE COMPANIES, INC., a Florida corporation

By: /s/ Stewart Wallach

Stewart Wallach, Chief

Executive Officer

OS: Coppermine Ventures, LLC

By: /s/Alexander Jacobs

Alexander Jacobs,

Manager/Member

Exhibit One:

Other Signatory

Name (print): Coppermine

Ventures, LLC, a Maryland limited liability company, located at 13100 Beaver Dam Rd., Hunt Valley, Maryland 21030;

Exhibit Two:

Terms of Service

- For Nominees serving as directors of

CCI Board of Directors, the terms of service as a director are:

| (1) | Standards

of conduct are governed by the CCI By-laws and published codes and policies; any agreement

between the director and CCI; and the requirements of applicable federal and state laws and

regulations and applicable public policy; and |

| (2) | Compensation.

Until CCI has sufficient cash flow from operations or sufficient cash reserves not needed

to pay working capital needs that are essential to sustaining CCI business operations, accounting

functions and systems, and compliance with corporate obligations under federal, state and

local laws and regulations, each CCI director will not receive cash compensation. Any future

cash compensation, if any, will be determined by the CCI Board of Director’s Compensation

Committee and subject to a written agreement signed by CCI and the director. Director may

participate in any stock option, stock grants and other incentive compensation plan for CCI

directors and officers that the director is an eligible participant, and any incentive compensation

issued under any such incentive compensation plan will constitute compensation to the director

for services as a director. CCI will reimburse any business expenses incurred by the director

as a sole result of services as a director of CCI, provided, that all such business expenses

must be eligible for reimbursement under CCI’s then current business expense policy

(as developed by the CCI Board of Directors). |

- For CEO Nominee

serving as chief executive officer of CCI, the terms of service are:

| (1) | Standards

of Conduct shall be determined by applicable federal and state laws and regulations; any

written agreement between the person and CCI; CCI published policies and codes; and directives

and resolutions of the CCI Board of Directors; and |

| (2) | Compensation:

Until CCI has sufficient cash flow from operations or sufficient cash reserves not needed

to pay working capital needs that are essential to sustaining CCI business operations, accounting

functions and systems, and compliance with corporate obligations under federal, state and

local laws and regulations, the CEO will not receive cash compensation. Any future cash compensation,

if any, will be determined by the CCI Board of Director’s Compensation Committee and

subject to a written agreement signed by CCI and the CEO. CEO may participate in any stock

option, stock grants and other incentive compensation plan for CCI officers that CEO is an

eligible participant, and any incentive compensation issued under any such incentive compensation

plan will constitute compensation to the CEO for services as CCI chief executive officer.

CCI will reimburse any business expenses incurred by the CEO as a sole result of services

as a chief executive officer of CCI, provided, that all such business expenses must be eligible

for reimbursement under CCI’s then current business expense policy (as developed by

the CCI Board of Directors). |

ATTACHMENT ONE: PROMISSORY

NOTE

Signed and dated Promissory Note is appended

hereto.

ATTACHMENT TWO: CERTIFICATION

Coppermine Ventures,

LLC, a Maryland limited liability company (“OS”) agrees and covenants to timely pay or fund the following working capital

expenditures of Capstone Companies, Inc., a Florida corporation and public company, (“CCI”) for the period from the Effective

Date to and through March 31, 2025, and to do so when each such working capital expenditure becomes due and payable by CCI in the specified

period or date. OS agrees, understands and acknowledges that the payment or funding of these working capital expenses by OS is a material

inducement for CCI to enter into the Management Transition Agreement between CCI and OS to which this Attachment Two is appended (“Agreement”)

and any breach of this Certification is a material breach of the Agreement between CCI and OS. Terms used in this Certification shall

have the meaning set forth in the Agreement if not defined in this Attachment Two.

| Capstone

Companies |

| Projected

Future Expenses through March 31, 2025 |

| |

Due

9-30-2024 |

Due

10-1-2024 to 12-31-2024 |

Due

1-01-2025 to 3-31-2025 |

TOTAL |

| Public

Company Compliance/Regulatory Expenses |

$43,140 |

$21,700 |

$66,700 |

$131,540 |

| Accounting/Legal |

$34,934 |

$20,300 |

$50,800 |

$106,034 |

| Insurance

Expenses |

$17,286 |

$17,286 |

$17,286 |

$51,858 |

| Consulting

and Compliance Expenses |

$11,182 |

$7,284 |

$7,284 |

$25,750 |

| Software/Operating

Expenses |

$19,372 |

- |

- |

$19,372 |

| Total

Projected Operating Costs |

$125,914 |

$66,570 |

$142,070 |

$344,554 |

Does not include

any costs for private company two-year audits and related audit preparation & bookkeeping, etc, estimated at approximately $30,000

- $40,000.

IN WITNESS WHEREOF, the parties have duly

executed and delivered this Certification as of the Effective Date of the Agreement.

CAPSTONE COMPANIES, INC., a Florida corporation

By: /s/Stewart Wallach

Stewart Wallach, Chief

Executive Officer

OS: /s/Alexander Jacobs

Alexander Jacobs,

Manager/Member

Exhibit 10.3

AMENDMENT NUMBER

ONE TO THE MANAGEMENT TRANSITION AGREEMENT

This Amendment Number

One, dated November 6, 2024, (“Amendment”) amends a certain Management Transition Agreement, dated October 28, 2024 (signed

by the parties on October 31, 2024, being the Effective Date), (“Agreement”) made by Capstone Companies, Inc., a Florida

corporation subject to the reporting requirements of the Securities Exchange Act of 1934 and with shares of its Common Stock, $0.0001

par value, (“Common Stock”) quoted on The OTC Markets Group, Inc. QB Venture Market (“OTCQB”), (“CCI”)

and Coppermine Ventures, LLC, a private Maryland limited liability company, (“OS”). OS and CCI may also be referred to individually

as a “party” and collectively as the “parties”. Any capitalized term used herein that is not defined in this

Amendment shall have the meaning set forth in the Agreement.

Background: Parties

have entered into this Amendment to amend or correct certain provisions of the Agreement.

Intending to be legally

bound, the parties agree:

1. Amendment of Agreement.

The Agreement is amended as follows:

(a) Section 1 of

the Agreement. Section 1 of the Agreement is amended by deleting the existing text of Section 1 of the Agreement in its entirety and

replacing the deleted Section 1 text with the following new Section 1 text, which reads in its entirety as follows:

1. OS Actions. When

specified in this Section 1, OS will take the following actions: (a) on the Effective Date, fully fund the principal amount of the Note

in good funds on deposit for CCI, which principal amount will be wired to CCI's designated corporate bank account in accordance with

the terms of the Note; (b) on or before November 30, 2024, OS will provide CCI with a written notice specifying one (1) or two (2) persons

as OS' nominees to be appointed to and serve as directors on the CCI Board of Directors ("Nominees"), which Nominees will be

appointed to fill vacancies on the CCI Board of Directors upon submission of the Nominees’ names and profiles to CCI Board of Directors.

OS may extend the period for submitting the names of the Nominees to CCI to December 31, 2024, by a written notice to CCI received prior

to November 30, 2024; (c) on or before November 30, 2024, specify a person as OS' nominee to serve as Chief Executive Officer of CCI

(“CEO Nominee”) in a written notice to CCI Board of Directors, who will be appointed as CCI Chief Executive Officer and President

upon the resignation of the incumbent CCI Chief Executive Officer, which resignation shall occur upon receipt of the written notice naming

the CEO Nominee to CCI Board of Directors. OS may extend the period for submitting the name of the CEO Nominee to CCI to December 31,

2024, by a written notice to CCI received prior to November 30, 2024; (d) on the Effective Date, execute and tender this completed Agreement

to CCI along with a signed written certification for the funding of the Commitment attached hereto as Attachment Two ("Certification"));

and (e) promptly take all other actions and sign all additional agreements and instruments that are reasonably necessary to timely complete

the actions set forth in Sections 1 (a), (b), (c) and (d) above. Appointment of the Nominees and CEO Nominee will be subject to CCI Board

of Directors’ verification of the Nominees’ and CEO Nominee’s eligibility and qualifications to serve in their respective

positions with CCI and subject to each nominee accepting the terms and conditions of service set forth in Exhibit Two to this Agreement.

(b) Section 2 of

the Agreement. Section 2 of the Agreement is amended by deleting existing text of Section 2 in its entirety and replacing the deleted

Section 2 text with following new Section 2 text, which reads in its entirety as follows:

2. CCI Actions.

CCI will do or cause the occurrence of the following actions when specified in this Section 2: (a) On or prior to the Effective Date,

CCI will sign and tender the Note to OS; (b) CCI Board of Directors will appoint the Nominees and CEO Nominee in accordance with and

subject to the conditions set forth in Section 1 above; (c) on or within two (2) business days after the appointment of a Nominee to

the CCI Board of Directors in accordance with Section 1 above, the CCI Board of Directors will request and accept the resignation of

two (2) incumbent directors; (d) upon submission of the CEO Nominee to CCI Board of Directors, CCI Board of Directors will accept the

resignation of the incumbent CCI Chief Executive Officer, who will remain as a director of the CCI Board of Directors; (e) upon appointment

of CEO Nominee as CCI Chief Executive Officer and President, CCI Board of Directors will appoint the CEO Nominee as a director of CCI,

which appointment will fill a vacancy on the CCI Board of Directors; and (f) CCI will take all actions and sign all additional agreements

and instruments that are reasonably necessary to timely consummate the actions in Sections 2(a), (b), (c), (d) and (e) herein.

(c) Section 3 of

the Agreement. Section 3 of the Agreement is amended by deleting Section 3 in its entirety and inserting following new Section 3, which

reads in its entirety as follows:

3.

Conditions Precedent. (a) The fulfillment of all obligations by CCI under Section 2 is a condition precedent to OS' obligations under

Section 1 above, and the fulfillment of all obligations by OS under Section 1 above is a condition precedent to CCI's obligations under

Section 2. Any breach of Section 2 above by CCI that is not promptly remedied within twenty (20) days after receipt of a written demand

from OS will constitute a breach of the Note, causing the principal amount and accrued interest thereon under the Note to become immediately

due and payable in full. Upon appointment of the CEO Nominee as CCI Chief Executive Officer and President, CCI has been advised that

Stewart Wallach and Jeffrey Postal, holders of shares of CCI Common Stock, (collectively, the “Shareholders”) will

each grant OS an irrevocable proxy to vote the Shareholders’ shares of CCI Common Stock for the election of Nominees and CEO Nominee

to the CCI Board of Directors until September 30, 2025.

2. Integration. This

Amendment and the Agreement will be read and construed as a single agreement and instrument with any conflict or ambiguity between the

Amendment and Agreement being resolved by reference to this Amendment.

3. Entire Agreement.

This Amendment is the entire agreement of the parties concerning the subject matters referenced above and may only be amended by a writing

signed by the parties.

4. Counterparts.

Counterparts. This Agreement may be executed in any number of counterparts and by the parties in separate counterparts (including by

facsimile, PDF or electronic mail transmission), each of which when so executed shall be deemed to be an original and all of which when

taken together shall constitute one and the same agreement. This Agreement shall be valid, binding, and enforceable against a party when

executed and delivered by an authorized individual on behalf of the party by means of (a) an original manual signature; (b) a faxed,

scanned, or photocopied manual signature, or (c) any other electronic signature permitted by the federal Electronic Signatures in Global

and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, or any other relevant electronic signatures law,

including any relevant provisions of the UCC (collectively, “Signature Law”), in each case to the extent applicable. Each

faxed, scanned, or photocopied manual signature, or other electronic signature, shall for all purposes have the same validity, legal

effect, and admissibility in evidence as an original manual signature. Each party shall be entitled to conclusively rely upon, and shall

have no liability with respect to, any faxed, scanned, or photocopied manual signature, or other electronic signature, of any other party

and shall have no duty to investigate, confirm or otherwise verify the validity or authenticity thereof.

5. Governing

Law. This Amendment shall be governed by and construed in accordance with the laws of the State of Florida without regard to principles

of choice or conflicts of laws and subject to the requirements of Section 13 of the Agreement.

6. Headings. The headings contained in

this Amendment are for reference purposes only and shall not affect in any way the meaning or interpretation of this Amendment.

7. Construction.

The parties agree that the terms and conditions of this Amendment are the result of negotiations between the parties and that this Amendment

shall not be construed in favor of or against either party by reason of the extent to which either party or its legal counsel participated

in the drafting of this Amendment.

IN WITNESS WHEREOF, the parties have duly

executed and delivered this Amendment as of November 6, 2024.

CAPSTONE COMPANIES, INC., a Florida corporation

By: /s/ Stewart Wallach

Stewart Wallach, Chief

Executive Officer

COPPERMINE VENTURES, LLC, A MARYLAND LIMITED

LIABILITY COMPANY

By: /s/ Alexander Jacobs

Alexander Jacobs, Managing Member/Manager

v3.24.3

Cover

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This Current Report on Form 8-K/A, Amendment Number One, (Amended Form 8-K) is being filed by Capstone Companies, Inc., a Florida corporation, (Company) to: (1) disclose Amendment Number One, dated November 6, 2024, to the Management Transition Agreement between Capstone Companies, Inc. and Coppermine Ventures, LLC (MTA), which MTA was dated October 28, 2024 and signed on October 31, 2024, and was disclosed and filed as an exhibit to the Current Report on Form 8-K filed by the Company with the Commission on November 5, 2024 (Initial Form 8-K); (2) to correct the XBRL link designations and exhibit numbering for Exhibit 10.1 and Exhibit 10.2 to the Initial Form 8-K; and (3) to correct corrupted text in the MTA as filed as an exhibit to the Initial Form 8-K. Other than as set forth in this Explanatory Note, this Amended Form 8-K does not amend any other disclosures in the Initial Form 8-K.

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity File Number |

0-28331

|

| Entity Registrant Name |

CAPSTONE

COMPANIES, INC.

|

| Entity Central Index Key |

0000814926

|

| Entity Tax Identification Number |

84-1047159

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Number

144-V

|

| Entity Address, Address Line Two |

Suite

100

|

| Entity Address, City or Town |

Deerfield

Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33441

|

| City Area Code |

954

|

| Local Phone Number |

570-8889

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|