Amended Statement of Beneficial Ownership (sc 13d/a)

January 03 2023 - 7:18AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

Clearday,

Inc.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

184791

101

(CUSIP

Number)

James

T. Walesa, 8800 Village Drive, Suite 106, San Antonio, TX 78217 (210) 451-0839

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

December

30, 2022

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a

prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 184791 101 |

|

13D |

|

Page

2 of 4 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

James

T. Walesa |

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see

instructions)

(a)

☐

(b)

☐ |

| 3. |

|

SEC

USE ONLY

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY

EACH

REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

5,861,389 |

| 8. |

SHARED

VOTING POWER

|

| 9. |

SOLE

DISPOSITIVE POWER

5,861,389 |

| 10. |

SHARED

DISPOSITIVE POWER

|

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,861,389

|

| 12. |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see

instructions) ☐

|

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.0 |

| 14. |

|

TYPE

OF REPORTING PERSON (see instructions)

|

| CUSIP

No. 184791 101 |

|

13D |

|

Page

3 of 4 Pages |

This Amendment No. 2 amends and supplements

the statement on Schedule 13D (the “Original Schedule 13D”) filed by the reporting person with the Securities and Exchange

Commission (the “SEC”) on September 10, 2021, as amended by Amendment No. 1 filed by the reporting person with the SEC on

December 9, 2021. This amendment amends the disclosures provided in a prior cover page as set forth above. This Amendment

No. 2 also amends Item 4 of the Original Schedule 13D, as amended, and Item 5 of the Original Schedule 13D, as amended, in each

case, as set forth below.

Item

4. Purpose of Transaction.

Additional

shares of common stock of the issuer (“Common Stock”) were purchased as conversion of accrued debt or other cash obligations

owed by the Company to the reporting person of an aggregate amount of $1,000,000 and additional shares of Common Stock issued as equity-based

compensation in an aggregate amount of $200,000 in lieu of cash compensation of such amount during 2022. The shares were issued

at a price per share of 0.67551, which is greater than the 20 day volume average price per share or the closing price per share as of

December 31, 2022 (which closing price was $0.56). The reporting person has agreed to provide price protection for the Company.

In the event that the Company enters into a transaction or agreement that is material to the Company during January 2023 (a “Specified

Transaction”) and the closing price per share of Common Stock, on the first full trading day after the disclosure of such Specified

Transaction by the Company, is greater than the Issuance Price, then the Issuance Price will be adjusted to such greater price. To effect

such adjustment, Walesa will promptly transfer and assign shares of Common Stock to the Company.

Item

5. Purpose of Transaction.

Share

and percentage of the beneficial ownership of the common stock of the issuer is based on the following:

(1)

Ownership of 3,053,827 shares of the common stock of the issuer, plus

(2)

Ownership of the following convertible securities that may be exchanged for shares of common stock of the issuer:

(3.1)

681,972 shares of Series F Preferred Stock (including shares issuable as dividend or payment in kind), which security is the Issuer’s

6.75% Series F Cumulative Convertible Preferred Stock, par value $0.001 per share. No exercise price is payable. Shares of this security

may be exchanged for shares of common stock at a ratio of 1 share of preferred stock to 2.384656 shares of common stock. There is no

expiration date for such conversion right.

(3.2)

Ownership of 242,412 shares of common stock of the Issuer that may be purchased upon the exercise of warrants at a price per share of

$5.00.

(3.3)

$1,009,743 aggregate investment (including accrual of dividends that are payable in kind) of 10.25% Series I Cumulative Convertible Preferred

Stock, par value $0.01 per share (the “Clearday Care Preferred”), issued by AIU Alternative Care, Inc., a Delaware corporation

and a subsidiary of the Issuer; and

(3.3)

$214,952 aggregate investment of units of limited partnership interests (“Clearday OZ LP Interests”) (including accrual of

distributions that are payable in kind) issued by Clearday OZ Fund LP, a Delaware limited partnership that is a subsidiary of the issuer.

The

Clearday Care Preferred and Clearday OZ LP Interests may be exchanged by the holder of such securities for shares of common stock of

the issuer at a price per share that is equal to 80% of the 20 day weighted average price per share of such common stock. The computation

of the beneficial ownership of the common stock of the issuer is based on a price per share that is equal to $10.00. The actual number

of shares of common stock that may be acquired will change based on the market price of the shares of the common stock of the issuer.

The

percentage interest of the reporting person is based on the total outstanding shares of common stock after giving effect to the additional

issuance of shares of common stock to the reporting person and the conversion or exchange in full of the Series F Preferred Stock, Clearday

Care Preferred and Clearday OZ LP Interests outstanding as of December 30, 2022, including payment in kind of accrued dividends or distributions

of such securities of 58,691,421: Common Stock: 20,794,045; Common Stock equivalents of Series F Preferred Stock: 12,062,038; Common

Stock equivalents of Clearday Care Preferred: 10,005,567; Common Stock equivalents of Clearday OZ LP Interests: 15,829,772

| CUSIP

No. 184791 101 |

|

13D |

|

Page

4 of 4 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

/s/

James T. Walesa |

| |

James

T. Walesa |

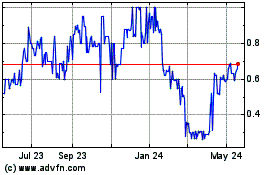

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

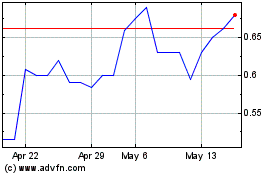

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Nov 2023 to Nov 2024