false

0000895665

0000895665

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): February 22, 2024 (February 15, 2024)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

February 15, 2024, subsidiaries (collectively, the “Subsidiaries”) of Clearday, Inc. (“Clearday” or the “Company”)

entered into that certain First Amended and Restated Promissory Note (the “First Amended Note”) that modified and amended

the previously reported promissory note dated as of March 31, 2023 (the “Original Note”), that was issued in the original

face amount of $2,995,547.44, to the following affiliates of Invesque Inc.: (1) MHI-MC San Antonio, LP, a Delaware limited partnership

(“MHI San Antonio”); (2) MHI-MC New Braunfels, LP, a Delaware limited partnership (“MHI New Braunfels”); and

(3) MHI Little Rock, LP, a Delaware limited partnership (“MHI Little Rock” and together with MHI San Antonio and MHI New

Braunfels, individually and collectively, with their respective successors and assigns, “Lender”). The Original Note was

issued in connection with the previously reported Lease Transition Agreement, dated as of March 31, 2023 (together with all modifications,

amendments, restatements, renewals and/or extensions thereof including that certain First Amendment to Lease Transition Agreement, dated

as of July 31, 2023, and that Second Amendment to Lease Transition Agreement, dated as of December 15, 2023, collectively, the “Transition

Agreement”) to evidence Borrower’s obligation to pay to Lender (i) the Past Due Lease Amounts, and (ii) the Rent Differential

Amount (each as defined in the Transition Agreement). The Subsidiaries are obligated to Lender under the Transition Agreement for certain

additional amounts in excess of the Past Due Lease Amounts and the Rent Differential Amount including, without limitation, Critical Expenses

Advances (as defined in the Transition Agreement), the amount of which had not yet been ascertained at the time of the Original Note.

Such amounts have subsequently been determined and the First Amended Note was issued in replacement of the Original Note to the extent

such amounts are actually known by Lender as of the Date of this Note.

The

First Amended Note reflects the existing obligations of the Subsidiaries and provides for the increase of the face amount to $3,893,066.18

and continuation of the other terms of the Original Note. The First Amended Note is guaranteed by the Company under the existing guaranty

in favor of the Lender as previously reported.

The Company expects to negotiate with the Lender an extension,

waiver or modification of the obligations under the First Amended Note. However, there can be no assurance that the Company will

be able to consummate any such extension, waiver or modification on acceptable terms or at all.

The

foregoing description of our obligations under the First Amended Note is not complete and is qualified in its entirety by reference to

the full text of the First Amended Note which is filed as Exhibit 10.1 and is incorporated herein by reference.

Forward

Looking Statements

This

communication contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as amended) concerning the Company. These statements may discuss goals, intentions

and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs

of the management of the Company, as well as assumptions made by, and information currently available to, management. Forward-looking

statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include

words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,”

“plan,” “likely,” “believe,” “estimate,” “project,” “intend,”

and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are

based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without

limitation: the risks regarding the Company and its business, generally; risks related to the Company’s ability to correctly estimate

and manage its operating expenses and develop its innovate non-acute care businesses and the acceptance of its proposed products and

services, including with respect to future financial and operating results; the ability of the Company to protect its intellectual property

rights; competitive responses to the Company’s businesses including its innovative non-acute care business; unexpected costs, charges

or expenses; regulatory requirements or developments; changes in capital resource requirements; and legislative, regulatory, political

and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should

not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the

risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K filed with the SEC and the registration statement regarding the Company’s previously announced merger, that was filed

and declared effective. The Company can give no assurance that the actual results will not be materially different than those based on

the forward looking statements. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| No. |

|

Description |

| |

|

|

| 10.1 |

|

First Amended And Restated Promissory Note dated as of February 15, 2024 in the face amount of $3,893,066.18 by MCA Mainstreet Tenant, LLC, MCA Westover Hills Operating Company, LLC, MCA New Braunfels Operating Company, LLC, and Memory Care At Good Shepherd, LLC. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

Certain

schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit

will be furnished to the SEC upon request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEARDAY,

INC. |

| |

|

|

| |

By: |

/s/

James Walesa |

| |

Name:

|

James

Walesa |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| Dated

February 22, 2024 |

|

|

Exhibit

10.1

FIRST

AMENDED AND RESTATED PROMISSORY NOTE

| $3,893,066.18 |

Fishers, Indiana |

February

15, 2024 (the “Date of this Note”)

R

E C I T A L S

WHEREAS,

Borrower (defined below) and Lender (defined below) are parties to that certain Lease Transition Agreement, dated as of March 31, 2023

(together with all modifications, amendments, restatements, renewals and/or extensions thereof including that certain First Amendment

to Lease Transition Agreement, dated as of July 31, 2023, and that Second Amendment to Lease Transition Agreement, dated as of December

15, 2023, collectively, the “Transition Agreement”), whereby, among other things, Borrower and Lender agreed to the

manner in which Borrower would pay to Lender certain obligations of Borrower arising as a result of Borrower’s default of its obligations

arising under the Leases; and

WHEREAS,

pursuant to the terms of the Transition Agreement, Borrower made and entered into that certain promissory note dated as of March 31,

2023 (the “Original Note”), in the original face principal amount of $2,995,547.44, to evidence Borrower’s obligation

to pay to Lender (i) the Past Due Lease Amounts, and (ii) the Rent Differential Amount; and

Whereas,

Borrower is obligated to Lender under the Transition Agreement for certain additional amounts in excess of the Past Due Lease Amounts

and the Rent Differential Amount including, without limitation, Critical Expenses Advances, the amount of which had not yet been ascertained

at the time of Borrower making the Original Note to Lender; and

WHEREAS,

pursuant to the terms of the Transition Agreement, Borrower agreed to make and enter into this First Amended and Restated Promissory

Note (this “Note”) in replacement of the Original Note to evidence Borrower’s obligations with respect to, among

other things, Borrower’s payment to Lender of the Repayment Amount to the extent such amounts are actually known by Lender as of

the Date of this Note.

NOW

THEREFORE, FOR VALUE RECEIVED, each of the entities executing this Note as “Borrower” (individually and collectively,

“Borrower”), having an address of c/o Clearday, Inc., 8800 Village Drive, 2nd Floor, San Antonio, Texas

78217, hereby, jointly and severally, promise and agree to pay to the order of MHI-MC San Antonio, LP, a Delaware limited partnership

(“MHI San Antonio”); MHI-MC New Braunfels, LP, a Delaware limited partnership (“MHI New Braunfels”);

and MHI Little Rock, LP, a Delaware limited partnership (“MHI Little Rock” and together with MHI San Antonio

and MHI New Braunfels, individually and collectively, with their respective successors and assigns, “Lender”), having

an address of 8701 E. 116th Street, Suite 260, Fishers, Indiana 46038, or such other place as the holder(s) of this Note may

designate in writing, the principal sum of Three Million Eight Hundred Ninety- three Thousand

Sixty-six & 18/100 Dollars ($3,893,066.18), or so much thereof as shall from time to time be outstanding hereunder and/or

under the Transition Agreement, together with all accrued interest thereon computed and payable in the manner set forth below.

1.

DEFINED TERMS. All capitalized terms not defined in this Note shall have the same meaning as given them in the Transition Agreement.

2.

MATURITY DATE. The unpaid principal balance of, and all accrued interest on, this Note, unless sooner paid or demanded by Lender,

shall be due and payable in full on July 31, 2025 (the “Maturity Date”).

3.

INTEREST RATE.

3.1

Interest Rate. The outstanding principal balance of this Note, as the same shall exist from time to time (including any increases

thereof as additional amounts comprising a part of the Repayment Amount become known to Lender), shall bear interest from and after the

Effective Date until this Note is fully paid, at the per annum rate of ten percent (10%), subject to the default interest provisions

contained in this Note. Effective immediately upon the occurrence and during the continuance of any Event of Default, the outstanding

principal balance of the Note and all other amounts then due under this Note shall bear interest at the per annum rate of 18% (the “Default

Rate”). In addition, all other amounts due Lender (whether directly or for reimbursement) under this Note, if not paid when

due or, in the event no time period is expressly provided in this Note, if not paid within five days after notice from Lender that the

same has become due, shall also bear interest thereafter at the Default Rate.

3.2

Computation of Interest. Interest shall be computed on the basis of the actual number of days elapsed in the period during which

interest accrued and a year of 360 days. In computing interest, the date of funding and the date of payment shall be included.

4.

PAYMENT.

4.1

Payments of Principal and Interest. Borrower shall pay the entire outstanding principal balance of this Note as set forth in

the Transition Agreement (including Section 2.4 thereof). The terms and provisions of the Transition Agreement are hereby incorporated

herein in their entirety and form a part of this Note as if fully set forth herein. Specifically, Borrower shall pay to Lender the entire

principal balance of this Note together with accrued and accruing interest thereon at the applicable interest rate set forth in this

Note (with all payments applied first to interest and then to principal), as follows:

(a)

Borrower shall make and pay the Down Payment to Lender as follows:

(1)

in the event of any merger between Clearday and Viveon prior to the Outside Down Payment Date (as same may have been extended

in accordance with and subject to the terms of the Transition Agreement), the Down Payment shall be due within one business day of such

merger and shall be in the amount that is the greater of (i) $300,000 or (ii) 10% of the amount of new money raised and/or invested with

Clearday and/or Successor Entity in connection with the merger and that closes in connection with the merger (regardless of whether such

closing occurs on the same date as the merger), provided however that in no event shall the Down Payment be more than $500,000; and

(2)

in the event there has not been a merger between Clearday and Viveon prior to the Outside Down Payment Date (as same may have

been extended in accordance with and subject to the terms of the Transition Agreement), the Down Payment shall be due on the Outside

Down Payment Date (as same may have been extended in accordance with and subject to the terms of the Transition Agreement) in the amount

of $300,000.

(b)

Borrower shall pay to Lender the sum of $50,000.00 representing the “Extension Fee” as provided for in the Second

Amendment to Lease Transition Agreement, dated as of December 15, 2023, on the date that the Down Payment is due.

(c)

Borrower shall pay the Remaining Amount together with accrued and accruing interest thereon at the applicable interest rate set

forth in this Note, as follows:

(1)

Borrower shall pay to Lender $400,000 on or before the end of each calendar quarter (i.e. March 31, June 30, September 30, and

December 31) beginning with the calendar quarter ending December 31, 2023 and continuing each successive calendar quarter thereafter

until the Maturity Date; and

(2)

beginning with the calendar quarter ending December 31, 2023 and continuing each successive calendar quarter thereafter, Borrower

shall pay to Lender 10% of the Excess Cash Flow, which payments shall be due contemporaneous with the delivery of financial information

of Clearday or Successor Entity pursuant to Section 2.8 of the Transition Agreement; and

(3)

on or before the Maturity Date, Borrower shall pay, in full and as a lump sum payment, the entire remaining outstanding principal

balance of this Note together with all interest accrued thereon through the date of such payment.

(d)

Lender may apply payments made to it hereunder to the outstanding balance of the Repayment Amount in any order it decides in

its sole discretion which Borrower acknowledges may not result in a reduction of the outstanding principal balance of this Note. The

principal amount outstanding under this Note from time to time shall be recorded by Lender in its records. The aggregate unpaid principal

balance of this Note, and accrued but unpaid interest thereon, as shown in the records of the Lender shall be prima facie evidence

of the principal and interest owing and unpaid on this Note. Notwithstanding anything in this Note or the Transition Agreement which

may be interpreted to the contrary, the entire unpaid principal balance of this Note, the entirety of the Repayment Amount (including

portions thereof not reflected as part of the principal balance of this Note) together, in each case, with all accrued interest thereon

shall be finally due and payable, in full, on the Maturity Date. Notwithstanding anything contained herein to the contrary, Borrower

agrees to execute any further updated replacement of this Note within 5 business days of Lender’s request for same to evidence

the correct amount due and owing taking into account the Past Due Lease Amounts, Rent Differential Amount, Critical Expenses Advances,

and amounts due under Section 2.3(iv) of the Transition Agreement.

4.2

Late Charge. If any payment of principal or interest required under this Note is not received by Lender on or before the fifth

day following the due date therefor, Borrower shall pay to Lender a late charge equal to 10% of the amount of such unpaid payment to

defray part of the increased cost of collecting late payments and the opportunity costs incurred by Lender because of the unavailability

of the funds.

4.3

Prepayments. In addition to all scheduled payments of principal and interest, Borrower may prepay this Note, in whole or in part;

except that no partial prepayment will postpone the due date of any installment of interest due under this Note. Lender shall have no

obligation to re-disburse any Loan proceeds that have been repaid by Borrower.

4.4

Manner and Time of Payment. All payments of principal, interest and fees payable to Lender under this Note shall be made without

condition or reservation of right and free of set-off or counterclaim, and in U.S. dollars. Funds received by Lender after 2:00 p.m.

(Central Time) shall be deemed to have been paid on the next succeeding Business Day (defined below). Lender may, by notice to Borrower

at any time and from time to time, elect to require that Borrower pay all amounts due under this Note (or portions thereof designated

by Lender) (a) by wire transfer and pursuant to wiring instructions that Lender provides to Borrower from time to time, (b) at such place

or to such Person(s) as Lender from time to time may designate in writing, or (c) to a lock box.

4.5

Payments on Non-Business Days. Whenever any payment to be made by Borrower under this Note shall be stated to be due on a day

that is not a Business Day, payments shall be made on the immediately preceding Business Day and such reduction of time shall be accounted

for in the computation of the payment of interest hereunder. As used in this Note, “Business Day” means any day except

any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the

State of Indiana are authorized or required by law or other governmental action to close.

4.6

Application of Payments. At Lender’s sole and absolute discretion all payments received by Lender on account of Borrower’s

liabilities under this Note shall be applied as follows: (a) first, to payment of all unpaid fees and expenses owing under this Note;

(b) second, to the payment of all accrued and unpaid interest owing under this Note; and (c) third, to the payment of the outstanding

principal amount of this Note.

5.

DEFAULT. The occurrence of any of the following shall be deemed to be an event of default (“Event of Default”)

under this Note:

(a)

Borrower fails to make any payment due under this Note (whether for principal, interest, late charges or otherwise) on or before

the date when it is due;

(b)

Borrower fails to observe or comply with any agreement, condition, covenant or other provision of this Note not specifically

set forth in the other subsections of this Section 5 and the same is not fully corrected to the complete satisfaction of Lender

within 10 days after Lender has given Borrower written notice thereof;

(c)

the occurrence of a default (beyond any applicable cure or notice period) under any deed of trust, mortgage, security agreement,

pledge agreement, lease assignment, guaranty or other agreement (including any amendment, modification or extension thereof), in each

case, now or hereafter securing this Note or the Transition Agreement; or

(d)

the occurrence of an “Event of Default” under the Transition Agreement.

6.

DEFAULT REMEDIES; FORBEARANCE.

6.1

Remedies after Default. Upon the occurrence of any Event of Default, Lender or any subsequent holder of this Note may declare

all sums of principal and interest evidenced by this Note to be accelerated and immediately due and payable without demand or notice

of any kind, and Lender may thereupon exercise all rights and remedies granted or available to it at law or in equity. Further, upon

the occurrence of an Event of Default, Lender may, as to any of the Collateral, exercise all rights and remedies available to Lender

with respect thereto. If there is any Event of Default and this Note is placed in the hands of any attorney for collection, or is collected

through any court, including any bankruptcy court, Borrower promises and agrees to pay Lender its reasonable attorneys’ fees, court

costs and all other expenses incurred in collecting or attempting to collect or securing or attempting to secure this Note or in connection

with any of the foregoing, providing the same is legally allowed by the laws of the State of Indiana.

6.2

Cross-Default. Any default by Borrower in the performance or observance of any covenant or condition hereof shall be deemed a

default under each of the Transition Agreement and any Related Document (defined below) entitling Lender to exercise all remedies available

to Lender under the terms of this Note, the Transition Agreement and/or any Related Document, and any Default under the Transition Agreement

or any Related Document shall be deemed a default under this Note entitling Lender to exercise any or all remedies provided for herein.

6.3

Cross-Collateral. The security interests, liens, and other rights and interests in and relative to any Collateral now or hereafter

granted to Lender by any Lien Party as security for Borrower’s obligations arising under the Transition Agreement, and any guaranty

of any Guarantor that guarantees Borrower’s payment and performance of any obligation of Borrower under the Transition Agreement,

shall extend to and secure and/or guarantee, as applicable, Borrower’s obligations under this Note, and, for the repayment thereof,

Lender may resort to any security held by it in such order and manner as it may elect.

6.4

Forbearance. Lender may, at its sole discretion, grant an extension of time for payment of any amount due under the terms of

this Note or the Transition Agreement or any other indulgence or forbearance, without affecting the liability of Borrower under this

Note or the Transition Agreement and without waiving any rights Lender may have under this Note, the Transition Agreement or under the

laws of the United States, the State of Indiana, or any other state.

7.

AMENDED AND RESTATED NOTE; NO NOVATION. This Note has been executed and delivered by Borrower to Lender in amendment and restatement

of and in substitution and replacement for the Original Note. This Note (i) evidences Borrower’s continuing obligations relative

to the payment and performance of Borrower’s obligations to Lender under the Transition Agreement and the Original Note and (ii)

reflects the principal amount of all obligations owed by Borrower to Lender under the Transition Agreement that are currently actually

known by Lender. This Note amends, restates, replaces and supersedes the Original Note, and all collateral security for the obligations

under or related to the Transition Agreement and/or the Original Note shall continue to secure this Note with the same and continuing

priority. Further, the execution and delivery of this Note does not, and shall not be deemed to, effect (i) a novation of the Transition

Agreement and/or the Original Note or of Borrower’s obligations to Lender under the Transition Agreement and/or the Original Note,

or (ii) an accord and satisfaction of Borrower’s obligations under the Transition Agreement and/or the Original Note. Borrower

shall remain liable for all obligations arising under or accruing under the Transition Agreement and the Original Note prior to the Date

of this Note, and any “Event of Default” under the Transition Agreement and/or the Original Note arising or occurring prior

to the Date of this Note shall constitute an Event of Default under this Note. For the avoidance of doubt, Borrower expressly acknowledges

and agrees that, (i) as of the Date of this Note, Borrower is in default of its obligations under the Transition Agreement, the Original

Note (as amended and restated by this Note), and this Note as a result of, among other things, Borrower’s failure to pay the indebtedness

evidenced hereby strictly in accordance with the terms of the Transition Agreement, the Original Note (as amended and restated by this

Note) and such Event of Default, and Borrower’s obligation to pay the indebtedness evidenced hereby strictly in accordance with

the terms of this Note, remains continuing as of the Date of this Note, and (ii) Lender’s acceptance of this Note is not intended

to and shall not be deemed, in any way, to limit, release, relinquish or waive any right or remedy available to Lender under the Original

Note, this Note, the Transition Agreement, at law or in equity, including without limitation the right of Lender to accelerate the indebtedness

evidenced hereby and declare same to be immediately due and payable in full and/or to impose interest at the Default Rate as provided

in this Note, and all such rights and remedies are hereby expressly reserved by Lender and Lender does not waive any of them.

8.

MISCELLANEOUS PROVISIONS.

8.1

Waiver of Presentment, Protest and Notice of Dishonor. Borrower hereby expressly waives presentment, demand, notice of dishonor,

protest, notice of protest and nonpayment and further waives all exemptions to which it may now or hereafter be entitled under the laws

of the State of Indiana or any other state or of the United States. The liability of Borrower under this Note shall not in any way be

diminished, released, voided or adversely affected as a result of the invalidity of any document relating to the Note, including the

Transition Agreement or any document or instrument purporting to secure the indebtedness evidenced by this Note, or by the release of

any or all of the security for the indebtedness evidenced by this Note or as a result of Lender not requiring any documents related to

this Note to be executed or properly perfected and filed or as a result of any other defect in the lien or security interest of Lender

on any or all of the security for this Note even if through the fault or negligence of Lender. Borrower hereby waives any and all claims

and defenses arising out of, or in any way relating to, such failure on the part of Lender to perfect its security interest in, or lien

on, all, or any portion, of any collateral intended to secure this Note. This Note is a full recourse obligation of Borrower.

8.2

Remedies Not Exclusive. No remedy conferred by this Note upon or reserved to Lender is intended to be exclusive of any other

remedy or remedies available to Lender under this Note, at law, in equity or by statute, and each and every such remedy shall be cumulative

and in addition to every other remedy given hereunder or now or hereafter existing at law, in equity or by statute.

8.3

No Waivers by Lender. No delay or omission of Lender in exercising any right or power accruing upon any default under this Note

shall impair any such right or power or shall be construed to be a waiver or any acquiescence of any default under this Note, nor shall

any single or partial exercise of any such right or power or any abandonment or discontinuance of steps to enforce such right or power,

preclude any other or further exercise of any other right or power. Acceptance of any payment after the occurrence of an Event of Default

shall not be deemed to waive or cure such Event of Default; and every power and remedy given by this Note to Lender may be exercised

from time to time as often as may be deemed expedient by Lender. Borrower hereby waives any right to require Lender at any time to pursue

any remedy in Lender’s power whatsoever.

8.4

Severability. The invalidity or unenforceability of any provision of this Note in general or in any particular circumstance shall

not affect the validity or enforceability of any one or more of the other provisions of this Note or the validity of such provision as

applied to any other circumstance. Borrower agrees that this Note and all provisions hereof shall be interpreted so as to give effect

and validity to all the provisions hereof to the fullest extent permitted by law.

8.5

Time of the Essence. TIME SHALL BE OF THE ESSENCE IN THE PERFORMANCE OF ALL OBLIGATIONS OF BORROWER UNDER THIS NOTE.

8.6

Governing Law; Venue. This Note is executed and delivered in and shall be construed and enforced in accordance with, and all

disputes arising out of or related to this Note shall be governed by, the laws of the State of Indiana, without giving effect to any

conflict of law rule or principle that might require the application of the laws of another jurisdiction. Borrower hereby (a) consents

and submits to the jurisdiction of the courts of the State of Indiana and the federal courts sitting in the State of Indiana with respect

to any dispute arising, directly or indirectly, out of this Note, (b) waives any objections which Borrower may have to the laying of

venue in any such suit, action or proceeding in either such court and (c) agrees to join Lender in any petition for removal to either

such court.

8.7

Savings Clause. It is the intention of the parties to comply strictly with applicable usury laws. Accordingly, notwithstanding

any provision to the contrary in this Note, or in any contract, instrument or document evidencing or securing the payment of this Note

or otherwise relating to this Note (each, a “Related Document”), in no event shall this Note or any Related Document

require the payment or permit the payment, taking, reserving, receiving, collection or charging of any sums constituting interest under

applicable laws that exceed the maximum amount permitted by such laws, as the same may be amended or modified from time to time (the

“Maximum Rate”). If any such excess interest is called for, contracted for, charged, taken, reserved or received in

connection with this Note or any Related Document, or in any communication by Lender or any other person to Borrower or any other person,

or in the event that all or part of the principal or interest hereof or thereof shall be prepaid or accelerated, so that under any of

such circumstances or under any other circumstance whatsoever the amount of interest contracted for, charged, taken, reserved or received

on the amount of principal actually outstanding from time to time under this Note shall exceed the Maximum Rate, then in such event it

is agreed that: (a) the provisions of this paragraph shall govern and control; (b) neither Borrower nor any other Person now or hereafter

liable for the payment of this Note or any Related Document shall be obligated to pay the amount of such interest to the extent it is

in excess of the Maximum Rate; (c) any such excess interest which is or has been received by Lender, notwithstanding this paragraph,

shall be credited against the then unpaid principal balance hereof or thereof, or if this Note or any Related Document has been or would

be paid in full by such credit, refunded to Borrower; and (d) the provisions of this Note and each Related Document, and any other communication

to Borrower, shall immediately be deemed reformed and such excess interest reduced, without the necessity of executing any other document,

to the Maximum Rate. The right to accelerate the maturity of this Note or any Related Document does not include the right to accelerate,

collect or charge unearned interest, but only such interest that has otherwise accrued as of the date of acceleration. Without limiting

the foregoing, all calculations of the rate of interest contracted for, charged, taken, reserved or received in connection with this

Note and any Related Document which are made for the purpose of determining whether such rate exceeds the Maximum Rate shall be made

to the extent permitted by applicable laws by amortizing, prorating, allocating and spreading during the period of the full term of this

Note or such Related Document, including all prior and subsequent renewals and extensions hereof or thereof, all interest at any time

contracted for, charged, taken, reserved or received by Lender. The terms of this paragraph shall be deemed to be incorporated into each

Related Document.

8.8

Notices. All notices and demands, consents, approvals, requests or other commitments required or permitted to be to be given

under this Note shall be in writing (and if not in writing shall not be deemed effective) and shall be given to Lender and Borrower as

set forth in the Transition Agreement.

8.9

Joint and Several. The obligations of each entity comprising Borrower under this Note shall be joint and several, and each Borrower

shall be primarily and directly liable for the full and entire payment and performance of the liabilities and obligations under or in

connection with this Note. The full joint and several liability of each Borrower for the liabilities and obligations of Borrower shall

not be affected or diminished by the bankruptcy or insolvency of any of them, or by the unenforceability of any such liability or obligation

against any of them.

8.10

Assignment. Lender may assign its rights and obligations under this Note without notice to or the consent of Borrower. Borrower

may not directly or indirectly assign its rights or obligations under this Note without the prior consent of Lender, which consent may

be given or withheld in Lender’s sole discretion.

8.11

Recitals. The above recitals are true and correct in all material respects and are incorporated into and shall constitute a part

of this Note.

8.12

Interpretation. Section titles or captions in this Note are included for purposes of convenience only and shall not be considered

a part of the Agreement in construing or interpreting any of its provisions. All references in this Note to Sections shall refer to Sections

of this Note unless the context clearly otherwise requires. Unless the context otherwise requires, when used in this Note, the singular

shall include the plural, the plural shall include the singular, and all pronouns shall be deemed to refer to the masculine, feminine

or neuter, as the identity of the person or persons may require. When used in this Note the term “including” shall have the

commonly accepted meaning associated with such word and shall be interpreted as if the words “without limitation” immediately

followed.

8.13

Waiver of Jury Trial. BORROWER AND LENDER HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE ANY RIGHT THAT THEY MAY HAVE

TO A TRIAL BY JURY IN ANY LITIGATION ARISING IN ANY WAY IN CONNECTION WITH THIS NOTE. BORROWER ACKNOWLEDGES THAT IT HAS BEEN REPRESENTED

IN THE SIGNING OF THIS NOTE AND IN THE MAKING OF THIS WAIVER BY INDEPENDENT LEGAL COUNSEL SELECTED OF ITS OWN FREE WILL, AND THAT IT

HAS DISCUSSED THIS WAIVER WITH SUCH LEGAL COUNSEL. BORROWER FURTHER ACKNOWLEDGES THAT IT HAS READ AND UNDERSTANDS THE MEANING AND RAMIFICATIONS

OF THIS WAIVER, THIS WAIVER HAS BEEN REVIEWED BY BORROWER AND BORROWER’S COUNSEL AND IS A MATERIAL INDUCEMENT FOR LENDER TO ACCEPT

THIS NOTE FROM BORROWER.

8.14

Electronic Delivery. This Note may be executed and delivered by Borrower electronically (including via email or facsimile transmission),

which shall be deemed to be the execution and delivery of an original.

8.15

Entire Agreement; Conflict. This Note and the Transition Agreement, read as a whole, set forth the parties’ rights, responsibilities

and liabilities with respect to Borrower’s obligations contemplated by this Note. For the avoidance of doubt, this Note is not

intended to and does not define the full liability of Borrower with respect to its obligations under the Transition Agreement and this

Note, and Borrower’s performance of its obligations hereunder, shall not be construed to limit the liability of Borrower under

the Transition Agreement. In the event of a conflict between this Note and the Transition Agreement, the Transition Agreement shall control

with respect to any such conflict.

[Signature

page follows]

IN

WITNESS WHEREOF, Borrower has executed this Note on and as of the date first above written.

| |

BORROWER: |

| |

|

| |

MCA

Mainstreet Tenant, LLC, |

| |

a

Tennessee limited liability company |

| |

|

|

| |

By: |

|

| |

Name: |

B.J.

Parrish |

| |

Title: |

Authorized

Person |

| |

MCA

Westover Hills Operating Company, LLC, |

| |

a Tennessee

limited liability company |

| |

|

|

| |

By: |

|

| |

Name:

|

B.J.

Parrish |

| |

Title: |

Authorized

Person |

| |

MCA

New Braunfels Operating Company, LLC, |

| |

a Tennessee

limited liability company |

| |

|

|

| |

By: |

|

| |

Name:

|

B.J.

Parrish |

| |

Title: |

Authorized

Person |

| |

Memory

Care at Good Shepherd, LLC, |

| |

an

Arkansas limited liability company |

| |

|

|

| |

By: |

|

| |

Name:

|

B.J.

Parrish |

| |

Title: |

Authorized

Person |

[Lender

acknowledgment and agreement follows]

Acknowledged

and Agreed to by Lender:

| MHI-MC

SAN ANTONIO, LP, |

|

| MHI-MC

NEW BRAUNFELS, LP, and |

|

| MHI

LITTLE ROCK, LP, |

|

| each

a Delaware limited partnership |

|

| |

|

|

| By:

|

|

|

| Name: |

Adlai

Chester |

|

| Title: |

Chief

Financial Officer |

|

[Joinder

by Guarantor follows]

JOINDER

TO NOTE

The

undersigned guarantor, Clearday, Inc., a Delaware corporation (“Guarantor”), hereby joins this Note for the purpose

of ratifying and affirming, and hereby does ratify and affirm, in full, all of Guarantor’s obligations arising under that certain

Guaranty executed by Guarantor in favor of Lender, dated as of March 31, 2023 (the “Guaranty”), whereby, among other

things, Guarantor absolutely and unconditionally, jointly and severally, guaranteed certain Obligations (as defined in the Guaranty)

including, without limitation, full payment and performance of the Original Note. Guarantor agrees that (i) this Note is given in replacement

of and in substitution for the Original Note, and (ii) Guarantor’s guarantee of the Obligations extends to, and Guarantor irrevocably

and unconditionally guarantees, Borrower’s prompt and full payment and performance of all amounts which are or shall become due

and payable under this Note and all obligations of Borrower under this Note.

In

Witness Whereof, Guarantor has executed this Joinder

to Note on and as of the date first above written.

| |

GUARANTOR: |

| |

|

| |

Clearday,

Inc., |

| |

a

Delaware corporation |

| |

|

|

| |

By: |

|

| |

Name:

|

B.J.

Parrish |

| |

Title:

|

Authorized

Person |

v3.24.0.1

Cover

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity File Number |

0-21074

|

| Entity Registrant Name |

Clearday,

Inc.

|

| Entity Central Index Key |

0000895665

|

| Entity Tax Identification Number |

77-0158076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8800

Village Drive

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78217

|

| City Area Code |

(210)

|

| Local Phone Number |

451-0839

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

CLRD

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

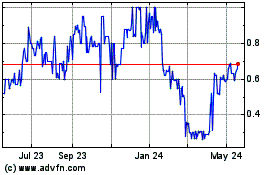

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Dec 2024 to Jan 2025

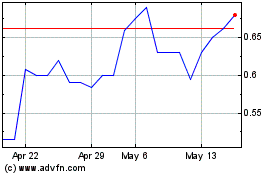

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Jan 2024 to Jan 2025