false

0000895665

0000895665

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): February 9, 2024 (February 5, 2024)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

As

previously disclosed, certain subsidiaries (the “Naples Subsidiaries”) of Clearday, Inc. (the “Company” or “we”)

and James Walesa, the Company’s Chief Executive Officer, are parties to litigation regarding the Company’s residential community

in Naples, Florida. This litigation was referred to as the Benworth Action that was summarized in the Company’s Quarterly Report

on Form 10-Q for the Quarterly Period ended September 30, 2023 that was filed by the Company with the Securities Exchange Commission

on January 16, 2024 (the “Recent Quarterly Report”) in footnote 7 to the financial statements of the Company included in

the Recent Quarterly Report. The Benworth Action arises from a default in the mortgage loan that was previously disclosed by the Company.

On

February 5, a Final Judgement of Foreclosure (the “Judgement”) was entered in the Benworth Action. The Judgement provides

for the total amounts due in favor of the plaintiff of $6,177,863.28, additional interest at the annual rate of 9.09% from the date of

the Judgement, a lien on the property, and the scheduled date for a foreclosure sale of the property on April 4, 2024.

The

Company is assessing its alternatives regarding this Judgement, including raising capital sufficient to redeem the property through a

negotiated transaction. There can be no assurance that any transaction that would result in the Company raising sufficient capital or

being able to redeem the property will be consummated on acceptable terms or at all.

This

Current Report on Form 8-K contains only a brief description of the material terms of the Judgement entered into against the Naples Subsidiaries

and Mr. Walesa, and does not purport to be a complete description of the rights and obligations of the parties thereunder, and such description

is qualified in its entirety by reference to the full text of the Judgement which is attached as Exhibit 10.1 to this Current Report

on Form 8-K, and is incorporated herein by reference.

Forward

Looking Statements

This

communication contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as amended) concerning the Company. These statements may discuss goals, intentions

and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs

of the management of the Company, as well as assumptions made by, and information currently available to, management. Forward-looking

statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include

words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,”

“plan,” “likely,” “believe,” “estimate,” “project,” “intend,”

and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are

based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without

limitation: the risks regarding the Company and its business, generally; risks related to the Company’s ability to correctly estimate

and manage its operating expenses and develop its innovate non-acute care businesses and the acceptance of its proposed products and

services, including with respect to future financial and operating results; the ability of the Company to protect its intellectual property

rights; competitive responses to the Company’s businesses including its innovative non-acute care business; unexpected costs, charges

or expenses; regulatory requirements or developments; changes in capital resource requirements; and legislative, regulatory, political

and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should

not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the

risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K filed with the SEC and the registration statement regarding the Company’s previously announced merger, that was filed

and declared effective. The Company can give no assurance that the actual results will not be materially different than those based on

the forward looking statements. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*

Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or

exhibit will be furnished to the SEC upon request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEARDAY,

INC. |

| |

|

|

| |

By: |

/s/

James Walesa |

| |

Name:

|

James

Walesa |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| Dated:

February 9, 2024 |

|

|

Exhibit

10.1

IN

THE CIRCUIT COURT IN AND FOR COLLIER COUNTY, FLORIDA

A.A.D.A,

INC., et. al.

| Plaintiff, |

CIRCUIT

CIVIL DIVISION |

| |

|

| V. |

CASE

NUMBER: 11-2023-CA-000243-000I-XX |

| MCA

NAPLES, LLC, A TENNESSEE LIMITED LIABILITY COMPANY; JAMES WALESA; JOHN DOE AND ALL OTHERS

IN POSSESSION, and MCA NAPLES OPERATING COMPANY, LLC, |

|

| A

TENNESSEE LIMITED LIABILITY COMPANY |

|

Defendants.

______________________________________________/

FINAL

JUDGMENT OF FORECLOSURE

TIDS

ACTION was heard before the Court on January 30, 2024 via Zoom hearing on Plaintiff’s Motion for Final Judgment of Foreclosure

of Mortgage Non-Homestead Property, Docket Number 62. On the evidence presented, IT IS ORDERED AND ADJUDGED that:

The

Plaintiff’s Motion for Final Judgment of Foreclosure is GRANTED against defendants MCA NAPLES, LLC, A TENNESSEE LIMITED LIABILITY

COMPANY, JAMES WALESA, and JOHN DOE AND ALL OTHERS IN POSSESSION.

| 1. | Amounts

Due: There is due and owing to the Plaintiff the following: |

| Principal due on the note secured

by the mortgage foreclosed: | |

$ | 4,550,000.00 | |

| Default Interest 9/1/22 to 1/30/24 (516 days) | |

$ | 1,608,083.04 | |

| Unpaid Late Charges | |

$ | 11,318.13 | |

| 4/11/22 NSF Payment Charge | |

$ | 2,886.88 | |

| 8/10/22 NSF Payment Charge | |

$ | 2,886.88 | |

| 9/12/22 NSF Payment Charge | |

$ | 2,886.88 | |

| 10/13/22 NSF Payment Charge | |

$ | 2,886.88 | |

| 1/14/23 Certified Mail | |

$ | 4.78 | |

| Demand Fee | |

$ | 50.00 | |

| Wire Transfer Fee | |

$ | 15.00 | |

| Recording Fee | |

$ | 206.50 | |

| Attorney’s Fees | |

$ | 25,635.00 | |

| Costs | |

$ | 3,398.68 | |

| (Less Trust Account Balance | |

$ | 32,395.37 | ) |

| TOTAL | |

$ | 6,177,863.28 | |

| 2. | Interest.

The grand total amount referenced in Paragraph 1 must bear interest from this date forward

at the rate of 9.09% per annum, pursuant to the current judgment interest rates as

the prevailing legal rate of interest. |

| 3. | Lien

on Property. Plaintiff, whose address is c/o 7400 SW 57th Court,

Suite 202, South Miami, FL 33143, holds a lien for the grand total sum specified in Paragraph

1 herein. The lien of the plaintiff is superior in dignity to any right, title, interest

or claim of the defendants and all persons, corporations, or other entities claiming by,

through, or under the defendants or any of them and the property will be sold free and clear

of all claims of the defendants. The plaintiff’s lien encumbers the subject property

located in Collier County, Florida and described as: |

PARCEL

1:

A

FEE INTEREST IN A PORTION OF LOTS 13, 14, AND 15, NAPLES IMPROVEMENT CO’S LITTLE FARMS, MORE PARTICULARLY DESCRIBED AS FOLLOWS:

FROM

THE SOUTHWEST CORNER OF LOT 12, NAPLES IMPROVEMENT CO’S LITTLE FARMS, AS RECORDED IN PLAT BOOK 2, PAGE 2, PUBLIC RECORDS OF COLLIER

COUNTY, FLORIDA, RUN N. 89 DEGREES 26’ 51” E., ALONG THE SOUTH LINE OF SAID LOT 12, FOR 20.00 FEET TO A POINT ON THE EAST

RIGHT OF WAY LINE OF GOODLETTE-FRANK ROAD; THENCE RUN N. 00 DEGREES 39’ 49” W., PARALLEL WITH THE WEST LINE OF SAID LOT 12

FOR 10.00 FEET ALONG SAID EAST LINE OF GOODLETTE-FRANK ROAD; THENCE RUN N. 00 DEGREES 39’ 49” W., FOR 580.00 FEET ALONG SAID

EAST LINE OF GOODLETTE-FRANK ROAD TO THE POINT OF BEGINNING OF THE TRACT HEREIN DESCRIBED; THENCE CONTINUE N. 00 DEGREES 39’ 49”

W., FOR 420.00 FEET ALONG SAID EAST LINE OF GOODLETTE-FRANK ROAD; THENCE RUN N. 89 DEGREES 20’ 11” E., FOR 196.54 FEET; THENCE

RUN S. 30 DEGREES 28’ 42” E., FOR 396.02 FEET; THENCE RUNS.

59 DEGREES 31’ 18” W., FOR 153.66 FEET; THENCE RUNS. 89 DEGREES 20’ 11”

W. FOR 260.12 FEET TO THE POINT OF BEGINNING.

PARCEL

2:

AN

EASEMENT INTEREST IN AP ARCEL OF LAND LYING IN AND BEING PARTS OF LOTS 12 AND 13, NAPLES IMPROVEMENT CO’S LITTLE FARMS, AS RECORDED

IN PLAT BOOK 2, PAGE 2, OF THE PUBLIC RECORDS OF COLLIER COUNTY, FLORIDA, BEING MORE PARTICULARLY DESCRIBED AS FOLLOWS:

COMMENCING

AT THE SOUTHWEST CORNER OF LOT 12, NAPLES IMPROVEMENT CO’S LITTLE FARMS, AS RECORDED IN PLAT BOOK 2, PAGE 2, OF THE PUBLIC RECORDS

OF COLLIER COUNTY, FLORIDA; THENCE RUN ALONG THE SOUTH LINE OF SAID LOT 12, NORTH 89 DEGREES 26’ 51” EAST, 20.00 FEET; THENCE

ALONG A LINE LYING 20.00 FEET EAST OF AND PARALLEL WITH THE WEST LINE OF LOTS 12 AND 13 OF SAID NAPLES IMPROVEMENT CO’S LITTLE

FARMS, NORTH 00 DEGREES 39’ 49” WEST, 10.00 FEET TO THE POINT OF BEGINNING OF THE HEREIN DESCRIBED PARCEL OF LAND; THENCE

CONTINUE NORTH 00 DEGREES 39’ 49” EAST 580.00 FEET; THENCE SOUTH 89 DEGREES 20’ 11” WEST FOR 55.00 FEET TO THE

POINT OF BEGINNING.

(BEARINGS

ARE BASED ON THE WEST LINE OF LOT 12, NAPLES IMPROVEMENT CO’S LITTLE FARMS AS BEING NORTH 00 DEGREES 39’ 49”WEST.)

PARCEL

3:

TOGETHER

WITH EASEMENT AS SET FORTH IN DRAINAGE EASEMENT RECORDED IN OFFICIAL RECORDS BOOK 2213, PAGE 1291, OF THE PUBLIC RECORDS OF COLLIER COUNTY,

FLORIDA.

NK/A:

2626 GOODLETTE-FRANK RD, NAPLES, FL 34105

| 4. | Sale

of Property. If the grand total amount with interest at the rate described in Paragraph

2 and all costs accrued subsequent to this judgment are not paid, the Clerk of the Court

shall sell the subject property at public sale on April 4, 2024 at 11 A.M.,

to the highest bidder for cash, except as prescribed in Paragraph 6, in the lobby on the

3rd Floor of the Courthouse Annex in the Collier County Courthouse, 3315 Tamiami Trail East,

Naples, FL 34112-5324, in accordance with Chapter 45 Florida Statutes, after having first

given notice as required by Section 45.031, Florida Statutes. The Clerk shall not conduct

the sale in the absence of the plaintiff or its representative. There shall be no allowable

cancellations of sale. |

| 5. | Costs.

Plaintiff shall advance all subsequent costs of this action and shall be reimbursed for

them by the Clerk if plaintiff is not the purchaser of the property for sale. If plaintiff

is the purchaser, the Clerk shall credit plaintiff’s bid with the total sum with interest

and costs accruing subsequent to this judgment, or such part of it, as is necessary to pay

the bid in full. The Clerk shall receive the service

charge imposed in Section 45.031, Florida Statutes, for services in making, recording,

and certifying the sale and title that shall be assessed as costs. |

| 6. | Right

of Redemption. On filing of the Certificate of Sale, defendant’s right of redemption

as proscribed by Florida Statutes, Section 45.0315 shall be terminated. |

|

7. | Distribution

of Proceeds. On filing the Certificate of Title, the Clerk shall distribute the proceeds

of the sale, so far as they are sufficient, by paying: first, all of the plaintiff’s

costs; second, documentary stamps affixed to the Certificate; third, plaintiff’s attorneys’

fees; fourth, the total sum due to the plaintiff, less the items paid, plus interest at the

rate prescribed in paragraph 2 from this date to the date of the sale. During the sixty (60)

days after the Clerk issues the certificate of disbursements, the Clerk shall hold the surplus

pending further Order of this Court. |

| 8. | Right

of Possession. Upon filing of the Certificate of Title, defendants and all persons claiming

under or against defendants since the filing of the Notice of Lis Pendens shall be foreclosed

of all estate or claim in the property and the purchaser at sale shall be let into possession

of the property, subject to the provisions of the “Protecting Tenant At Foreclosure

Act of 2009.” A Writ of Possession shall be issued upon Order of the Court. |

| 9. | Attorney

Fees. The Court finds, based upon the affidavits presented and upon inquiry of counsel

for the plaintiff that 43.4 hours have been reasonably expended by Daniel J. Mendez, 4.9

hours have been reasonably expended by Sergio L. Mendez, and 7.1 hours have been reasonable

expended by the Paralegal in this cause and is appropriate. PLAINTIFF’S COUNSEL REPRESENTS

THAT THE ATTORNEY FEE AWARDED DOES NOT EXCEED ITS CONTRACT FEE WITH THE PLAINTIFF. The Court

finds that there are no reduction or enhancement factors for consideration by the Court pursuant

to Florida Patient’s Compensation Fund v. Rowe, 472 So.2d 1145 (Fla. 1985). |

| 10. | NOTICE

PURSUANT TO AMENDMENT TO SECTION, 45.031, FLA. ST. {2006) |

IF

TIDS PROPERTY IS SOLD AT PUBLIC AUCTION, THERE MAY BE ADDITIONAL MONEY FROM THE SALE AFTER PAYMENT OF PERSONS WHO ARE ENTITLED TO BE

PAID FROM THE SALE PROCEEDS PURSUANT TO TIDS FINAL JUDGMENT.

IF

YOU ARE A SUBORDINATE LIENHOLDER CLAIMING A RIGHT TO FUNDS REMAINING AFTER THE SALE, YOU MUST FILE A CLAIM WITH THE CLERK NO LATER THAN

60 DAYS AFTER THE SALE. IF YOU FAIL TO FILE A CLAIM, YOU WILL NOT BE ENTITLED TO ANY REMAINING FUNDS.

IF

YOU ARE THE PROPERTY OWNER, YOU MAY CLAIM THESE FUNDS YOURSELF. YOU ARE NOT REQUIRED TO HAVE A LAWYER OR ANY OTHER REPSENTATION AND YOU

DO NOT HAVE TO ASSIGN YOUR RIGHTS TO ANYONE ELSE IN ORDER FOR YOU TO CLAIM ANY MONEY TO WHICH YOU ARE ENTITLED. PLEASE CHECK WITH THE

CLERK OF THE COURT, COLLIER COUNTY COURTHOUSE, 3315 TAMIAMI TRAIL EAST, STE.102 NAPLES, FL 34112-5324, WITHIN TEN (10) DAYS AFTER THE

SALE TO SEE IF THERE IS ADDITIONAL MONEY FROM THE FORECLOSURE SALE THAT THE CLERK HAS IN THE REGISTRY OF THE COURT.

IF

YOU DECIDED TO SELL YOUR HOME OR HIRE SOMEONE TO HELP YOU CLAIM THE ADDITIONAL MONEY, YOU SHOULD READ VERY CARFULLY ALL PAPERS YOU ARE

REQUIRED TO SIGN, ASK SOMEONE ELSE, PREFERABLY AN ATTORNEY WHO IS NOT RELATED TO THE PERSON OFFERING TO HELP YOU, TO MAKE SURE THAT YOU

UNDERSTAND WHAT YOU ARE SIGNING AND THAT YOU ARE OT TRANSFERRING YOUR PROEPRTY OF THE EQUITY IN YOUR PROPERTY WITHOUT THE PROPER

INFORMATION. IF YOU CANNOT AFFORD TO PAY FOR AN ATTORNEY, YOU MAY CONTACT LEGAL SERVICES OF COLLIER COUNTY, (239) 775- 4555, TO

SEE IF YOU QUALIFY FINANCIALLY FOR THEIR SERVICES. IF THEY CANNOT ASSIST YOU, THEY MAY BE ABLE TO REFER YOU TO A LOCAL BAR REFERRAL AGENCY

OR SUGGEST OTHER OPTIONS. IF YOU CHOOSE TO CONTACT LEGAL SERVICES OF GREATER COLLIER COUNTY FOR ASSISTANCE, YOU SHOULD DO SO AS SOON

AS POSSIBLE AFTER RECEIPT OF TIDS NOTICE.

| |

11. |

Jurisdiction. The

Court retains jurisdiction of this action to enter further orders that are proper, including, without limitation, writs of possession

and deficiency judgments. |

Electronic

Service List

Daniel

Joseph Mendez <daniel@mendezandmendezlaw.com>

Daniel

Joseph Mendez <service@mendezandmendezlaw.com>

Michael

D. Randolph <michael.randolph@gray-robinson.com>

Michael

D. Randolph <nadine.diamond@gray-robinson.com>

v3.24.0.1

Cover

|

Feb. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity File Number |

0-21074

|

| Entity Registrant Name |

Clearday,

Inc.

|

| Entity Central Index Key |

0000895665

|

| Entity Tax Identification Number |

77-0158076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8800

Village Drive

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

San Antonio

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78217

|

| City Area Code |

(210)

|

| Local Phone Number |

451-0839

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

CLRD

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

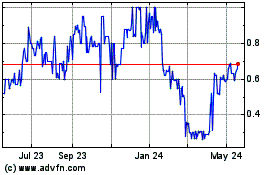

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Jan 2025 to Feb 2025

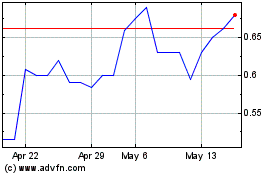

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Feb 2024 to Feb 2025