London Stock Exchange Eyes $15 Billion Bet for Refinitiv--Update

July 27 2019 - 8:44AM

Dow Jones News

By Ben Dummett

London Stock Exchange Group PLC said early Saturday it is in

advanced talks to buy financial-information and terminal business

Refinitiv Holdings Ltd. from a Blackstone Group Inc.-led consortium

for almost $15 billion, in one of the biggest bets yet on data as a

new source of growth for global exchange operators.

Stock-exchange operators face growing pressure on fees they

generate from the buying and selling of stocks amid new competition

and computerized trading. That has historically pushed exchange

businesses to buy up rivals to boost revenue and cut costs. But the

European Union's decision in 2017 to block the LSE's $30 billion

merger plan with Germany's Deutsche Börse AG -- one of several big

exchange deals to be upended in recent years -- shows this

consolidation strategy can be difficult to execute.

The acquisition of Refinitiv is meant to help the LSE meet that

challenge by further expanding its business as a data provider to

investors and companies. Last year, the LSE's information-services

business grew revenue by 9% to GBP841 million ($1.04 billion) from

the year-earlier period, benefiting from strong growth in

subscription-renewal rates and data sales for its

exchange-traded-fund products. That growth rate was more than

double the LSE's more traditional capital-markets business.

Refinitiv, already a supplier of fixed-income data to LSE's

index business, would give the U.K.-based exchange operator access

to its array of data and analytical tools such as the Eikon

financial-data terminal and other products that are used by more

than 40,000 customers, including brokerage firms, institutional

investors, governments and corporations. Refinitiv also operates

the Tradeweb, FXAll and Matching platforms among others that handle

on average daily trading volume of over $400 billion in foreign

exchange and $500 billion in fixed income.

The LSE is negotiating to acquire Refinitiv from Blackstone,

which together with its partners Canada Pension Plan Investment

Board and Singapore's GIC Pte own about 55% of the financial-data

company, and Thomson Reuters Corp., a holder of a 45% stake in the

business. The deal would represent a quick turnaround for

Blackstone, which agreed to acquire control of the business less

than two years ago in a deal that valued the new firm at $20

billion, including debt.

The LSE, with a market value of about $24.5 billion, said

Saturday it expects to value Refinitiv at $27 billion, including

debt, if the acquisition goes ahead. Excluding the data provider's

debt of $12.2 billion at the end of December, the LSE would be

paying about $14.8 billion for the business.

The leverage LSE would take on from the deal is "high but

acceptable," Exane BNP Paribas said in a research note.

The exchange operator cautioned that the talks could still

collapse. But if an agreement is reached, the deal would create a

company with combined annual revenue of more than GBP6 billion,

more than triple the revenue that the exchange operator generated

last year. The LSE also said the deal would generate annual cost

savings exceeding GBP350 million that would be achieved in the five

years after the deal's completion.

Still, the acquisition would represent a risky bet for the LSE's

newly appointed chief executive, David Schwimmer, an ex- Goldman

Sachs Group Inc. banker who has been in the top job for just under

a year. The size alone would dwarf some of the recent data-related

transactions in the exchange space, such as Nasdaq Inc.'s $220

million acquisition earlier this year of Swedish

financial-technology provider Cinnober. The deal would also stand

out among some of the sector's larger transactions including

Intercontinental Exchange Inc.'s $5.2 billion bid for Interactive

Data Corp. in 2015 and the LSE's $2.7 billion purchase in 2014 of

index-service provider Frank Russell Co.

By pursuing Refinitiv, LSE management would likely face a

monthslong regulatory review of the transaction and a complex

integration process as it seeks to achieve the deal's revenue and

cost-cutting benefits. Furthermore, if the deal's benefits fall

short of expectations, it could prove dilutive to shareholders as

the LSE said that it would use stock to help fund the takeover.

The LSE's stock price has surged roughly 42% since the middle of

December, allowing the company to more easily contemplate a stock

deal for Refinitiv. Still, the deal's inherent risk could spur

shareholder opposition if the bet jeopardizes that stock-price

gain.

In a deal with Refinitiv, LSE indicated that it would own about

63% of the enlarged company, which would continue to be based in

London. That is key to U.K. support for the deal since London is

fighting to hold on to its role as a financial center once the

country carries out its divorce from the EU as early as this

October.

Refinitiv's shareholders would own about 37% of the enlarged LSE

and hold less than 30% of the total voting rights.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

July 27, 2019 09:29 ET (13:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

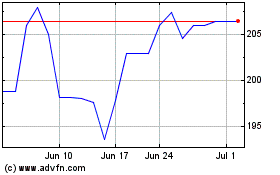

Deutsche Boerse Ag Namen... (PK) (USOTC:DBOEF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Deutsche Boerse Ag Namen... (PK) (USOTC:DBOEF)

Historical Stock Chart

From Nov 2023 to Nov 2024