Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

☐ TRANSITION REPORT UNDER SECTION 13 OR

15 (d) OF THE EXCHANGE ACT

For the transition period from _________ to _________

Commission File Number: 000-12641

DALRADA FINANCIAL CORPORATION

(Name of Small Business Issuer in its charter)

| Wyoming |

38-3713274 |

| (state or other jurisdiction of incorporation or organization) |

(I.R.S. Employer ID. No.) |

600 La Terraza Blvd., Escondido, California 92025

(Address of principal executive offices)

858-283-1253

Issuer’s telephone number

Securities registered pursuant to Section 12(b) of

the Act: None

Securities registered pursuant to Section 12(g) of

the Act: None

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.005 par value per share |

|

DFCO |

|

None |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐

No ☒

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See

the definitions of “large accelerated filer”, “accelerated filer” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. Indicate by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ☐ No ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

State the aggregate market value of the voting and

non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average

bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter: $17,158,525.

As of January 8, 2025, the registrant’s outstanding stock consisted

of 120,157,113 common shares.

DALRADA FINANCIAL CORPORATION

Table of Contents

PART I

Item 1. Description of Business

Company Overview

Moving the world forward takes bold resolve that turns

ideas into actions and builds real-time solutions that positively impact people and the planet. Dalrada Financial Corporation (“Dalrada”

or the “Company”) accelerates positive change for current and future generations by harnessing true potential and developing

products and services that become transformative innovations.

Dalrada was incorporated in September 1982 under the

laws of the State of California. It was reincorporated in May 1983 under the laws of the State of Delaware and reincorporated again on

May 5, 2020, under the laws of the state of Wyoming. Dalrada Financial Corporation trades under the symbol, OTC: DFCO.

Dalrada has five business divisions: Genefic,

Dalrada Climate Technology, Dalrada Precision Manufacturing, Dalrada Technologies and Dalrada Corporate. Within

each of these divisions, the Company drives transformative innovation while creating solutions that are sustainable, accessible, and affordable.

Dalrada’s global solutions directly address climate change, gaps in the health care industry, and technology needs that facilitate

a new era of human behavior and interaction and ensure a bright future for the world around us.

Genefic

Genefic delivers advanced health care solutions with

dedicated products, services, and systems. From virus and disease screening capabilities to pharmaceutical goods and holistic wellness

clinics, When the world needs advanced health care, Genefic delivers with ingenuity, accessibility, and affordability. This specialized

division is committed to developing key health products, lifesaving medications and building comprehensive systems to increase capability,

strive to keep people healthy with the goals of improving their quality of life and increasing their longevity– on a global level.

Genefic Specialty Pharmacy

(“Genefic Pharmacy”)- Genefic Pharmacy (formerly Genefic Specialty Pharmacy Rx Solutions) is an Alabama-based pharmacy

with more than 30 years of experience in the retail medical and pharmaceutical industries. Genefic Pharmacy specializes in providing expert

care and managing disease states through comprehensive prescription management, education, nursing, and total health solutions. Genefic

Pharmacy maintains pharmacy licenses in all 50 States as well as Washington D.C.

Genefic Infusion Rx- Genefic

Infusion Rx is a Louisiana-based infusion pharmacy which handles all aspects of fluid and medication infusion, via intravenous or subcutaneous

application. Genefic Infusion Rx serves as an essential with healthcare systems, enhancing the infusion process through efficient authorization

and prescription management. Its state-of-the-art compounding facility is led by one of only eight pharmacists in Louisiana with a sterile

compounding board certification, ensuring top-tier precision and quality in medication preparation.

Boost Diagnostics- Boost

Diagnostics (formerly Empower Genomics and Genefic Diagnostics) is Dalrada’s wholly owned diagnostic laboratory subsidiary which

processes molecular diagnostic and antibody tests to support the diagnosis of COVID-19 and the detection of immune response to the virus.

Boost Diagnostics has built up and maintained the testing capacity to handle surges in COVID-19 testing demands. Boost Diagnostics also

offers genetic testing capabilities including Pharmacogenomics, Nutraceutical, Nutrition/Diet DNA and Exercise/Fitness DNA tests.

Pala Diagnostics (“Pala”)-

Pala was a joint venture diagnostic laboratory entity which processed both molecular diagnostic and antibody tests to support the diagnosis

of COVID-19 and the detection of immune response to the virus. Pala was no longer an operational entity as of June 30, 2023.

Dalrada Career Institute (“DCI”)

(aka International Health Group (“IHG”)) - IHG provides highly trained nursing and medical assistants for hospitals and

home health facilities since 2006. IHG Medical Assistant programs include Certified Nursing Assistant (“CNA") and Home Health

Aide (“HHA”) training and the fast-track 22-Day CNA Certification Program at its state-approved testing facility. DCI started

its first RN, nursing class in February of 2024 and this first class will be completed in February 2025. It is the intent of DCI to double

their class size when it begins its second class in 2025.

Dalrada Climate Technology (formerly Dalrada

Energy Services)

Dalrada Climate Technology (“DCT”) is

a segment which incapsulates energy services and state-of-the-art technology within the climate sustainability space. DCT employs next-generation

technology and services which enhances clean energy efforts while reducing the world’s carbon footprint. As a premier industrial

heat pump manufacturer, Dalrada delivers innovation and efficiency, building solutions that reduce energy consumption and minimize carbon

footprints, increase operational efficiencies, meet environmental, social, and governance (ESG) goals, and lower energy costs for clients.

Dalrada Technology Limited

(“DTL”) - DTL is a holding company for all United Kingdom and European based Dalrada Climate Technology entities.

Likido Ltd. (“Likido”)

- Likido is an international engineering company developing advanced solutions for the harvesting and recycling of energy. Using its novel,

heat pump systems (patent pending), Likido is working to revolutionize the renewable energy sector with the provision of innovative modular

process technologies to maximize the capture and reuse of thermal energy for integrated heating and cooling applications. With uses across

industrial, commercial and residential sectors, Likido provides cost savings and minimized carbon emissions across global supply chains.

Likido's technologies enable the effective recovery and recycling of process energy, mitigating against climate change and expected enhancement

of quality of life through the provision of low-carbon heating and cooling systems. Likido’s products currently include the

DCT One Heat Pumps (formerly Likido®ONE) and DCT Cryo Chiller. Likido also offers heat pump solutions specifically designed for residential

purposes.

During the prior year, the U.S.

Government selected DCT One Series high-performance, low-carbon heat pump for real-world testing in a prestigious clean energy program.

The implementation of the DCT One Series testing is still in process. The expected positive results should not only increase market acceleration

and adoption within the federal government acceptance of groundbreaking eco-friendly technology but should also accelerate adoption within

the commercial building industry.

Dalrada Technology Spain L.T.

(“DTS”)- DTS was established as a Spanish subsidiary of DTL for the expansion of the manufacturing and sale of the DCT

One Series and DCT Cryo Chiller throughout Europe.

Dalrada Energy Services (“DES”)-

DES provides end-to-end comprehensive energy service solutions in a robust commercial capacity. DES helps organizations meet ESG goals

and standards while mitigating negative environmental impacts.

Bothof Brothers Construction

(“Bothof”)- Bothof is a licensed general contractor which provides a wide range of development, construction and design

capabilities and expertise throughout the United States. Through Bothof’s extensive experience in construction and contracting,

the DES division can provide a myriad of additional services to its private and public works customers.

Dalrada Home Corporation (“Dalrada

Home”)- Dalrada Home Corporation was established in February of 2024. Dalrada Home’s cutting-edge sustainability solutions

are designed specifically for residential purposes. Our home heat pumps help us lead the way in providing innovative climate technology

products and services to residential customers.

Dalrada Precision Manufacturing

Dalrada Precision Manufacturing creates total manufacturing

solutions that start with the design and development of high-quality machine parts and components, and end with an efficient global supply

chain. This specialized business division can meet today’s high demands and solves industry challenges. Dalrada Precision Manufacturing

is confident that it redefines the critical quality of the world’s top components and responds with in-house research, design, engineering,

and distribution through a highly reliable global supply chain and improved time-to-market capabilities.

Dalrada Precision Parts (“Precision”)

- Precision extends the client its engineering and operations team by helping devise unique manufacturing solutions tailored to their

products. Dalrada Precision can enter at any stage of the product lifecycle from concept and design to mass production and logistics.

Deposition Technologies (“DepTec”)

- DepTec designs, develops, manufactures, and services chemical vapor and physical vapor deposition systems for the microchip and semiconductor

industries.

DepTec has built an impressive

catalogue of precision OEM parts for PVD (Physical vapor deposition) systems and the Company’s refurbished systems which allows

clients the option of purchasing the same model of system they’ve been using for decades –but with significant upgrades and

improved efficiencies. Older systems can now operate more reliably with additional control and monitoring plus longer lifespans. DepTec

also has its own PVD and CVD (Chemical Vapor Deposition) systems, EVOS-PVD and EVOS -CVD, which deposits metals and non-metals for microchips

used in almost every standard and specialized microdevices made today and in the future. These systems can produce a superior film layer

utilized in rugged high-stress environment designs.

Ignite I.T. (“Ignite”)

- Ignite is a manufacturer and seller of eco-friendly deep cleaners, parts washers and degreasers that are specially formulated to lift

hydrocarbon-based dirt and grease from virtually all surfaces with minimal effort. Ignite products are non-flammable, non-corrosive, non-toxic,

butyl-free, water-based, and leave a light citrus scent. Ignite is developed for all surfaces suitable for water and meets or exceed the

most stringent industry-testing specifications.

Dalrada Technologies

Dalrada Technologies has worked with some of the world’s

most recognizable companies, providing digital engineering for cutting-edge software systems and offering a host of robust digital services.

This business division connects the world with integrated technology and innovative solutions, delivering advanced capabilities and error-free

results. Dalrada Technologies creates digital products with expert computer information technology and software engineering services for

a variety of technical industries and clients in both B2B and B2C environments.

Prakat (“Prakat”)

- Prakat is an ISO 9001-certified company that provides end-to-end technology services across various industries, improving the value

chain. The Company specializes in test engineering, accessibility engineering, product engineering, application modernization, billing

and revenue management, CRM, and block chain. Prakat provides global customers with software and technology solutions specializing in

Test Engineering, Accessibility Engineering, Product Engineering and Application Modernization.

Dalrada Corporate

Dalrada Corporate covers the activities which support

the entire suite of Dalrada subsidiaries. Dalrada Corporate includes the areas of administration, finance, human resources, legal advice,

information technology, and marketing. It also contains executive management and shareholder-related services.

Research and Development

We spent $0 and $120,000 on research and development

activities during the years ended June 30, 2024, and 2023, respectively. We anticipate that we will incur additional expenses on research

and development over the next 12 months. Our planned expenditures on our operations or a business combination are summarized under the

section of this Annual Report on form 10-K entitled “Management’s Discussion and Analysis of Financial Position and Results

of Operations”.

Item 1A. Risk Factors

Not applicable to smaller reporting companies.

Item 1B. Unresolved Staff Comments

Not applicable to smaller reporting companies.

Item 1C. Cybersecurity

Risk management and strategy

The Information Technology “IT” environment

of the Company is critical in efforts to effectively perform day-to-day processes and expand on current opportunities and investments.

Our security policies and processes are based on best practices of the industry and are regularly reviewed by our management to ensure

the current technological capabilities are maintained. We review System and Organization Controls 1 (SOC 1 Type II) certifications where

relevant from third-party partners and service providers as needed.

Governance

The Board of Directors works directly with, and

is in frequent communication with, management and our third-party IT providers to protect the Company’s information systems from

cybersecurity threats. To date, there have not been any cybersecurity threats that have materially affected the Company.

Item 2. Description of Property

We currently lease 110,838 square feet of office,

medical, pharmacy and warehouse space in California, Alabama, Texas, Louisiana, Scotland, and India, with leases that expire through

2028.

| |

|

|

|

Square |

|

|

|

| |

|

|

|

Footage |

|

Lease |

|

| Location |

|

Type |

|

(approximate) |

|

Expiration |

|

| Escondido, California |

|

Corporate Headquarters |

|

|

49,530 |

|

|

6/30/2027 |

|

| San Diego, California |

|

Office |

|

|

8,228 |

|

|

3/14/2028 |

|

| Escondido, California |

|

Office |

|

|

2,992 |

|

|

6/30/2027 |

|

| Chula Vista, California |

|

Office, Medical Suite |

|

|

3,200 |

|

|

11/12/2024 |

|

| San Diego, California |

|

Office, Medical Suite |

|

|

9,016 |

|

|

8/31/2028 |

|

| Bengaluru, India |

|

Office |

|

|

3,300 |

|

|

4/1/2026 |

|

| Coronado, California |

|

Office, Medical Suite |

|

|

462 |

|

|

12/31/2024 |

|

| Florence, Alabama |

|

Pharmacy |

|

|

1,443 |

|

|

5/31/2025 |

|

| Livingston, Scotland |

|

Office, Warehouse |

|

|

4,500 |

|

|

8/27/2025 |

|

| Escondido, California |

|

Office |

|

|

167 |

|

|

12/31/2024 |

|

| Livingston, Scotland |

|

Office, Warehouse |

|

|

19,000 |

|

|

11/2/2027 |

|

| Bergondo, Spain |

|

Office, Warehouse |

|

|

9,000 |

|

|

5/31/2028 |

|

| Metairie, Louisiana |

|

Office, Medical Suite |

|

|

6,468 |

|

|

9/30/2025 |

|

Item 3. Legal Proceedings

Genefic Products (“Dalrada Health”), a

subsidiary of Dalrada Financial Corporation, formed a joint venture with Vivera Pharmaceuticals, Inc. (“Vivera”), whereby

Vivera is the minority member. As the managing member of the joint venture, Genefic Products, in December 2021, filed suit against Vivera

and Paul Edalat, Vivera’s Chairman and CEO, for misappropriation of funds on behalf of the joint venture in the amount of $2,104,509.

In addition to filing a cross-complaint against Genefic Products, Vivera filed a separate complaint against Dalrada Financial Corporation,

Empower Genomics (a subsidiary of Dalrada Financial Corporation), Dalrada Financial Corporation’s officers, and other unrelated

parties. The proceedings are being held at the Superior Court of the State of California, for the County of Orange – Central Justice

Center.

In September 2023, Kroger Specialty Pharmacy LLC (“Kroger”)

filed lawsuits/preliminary injunctions against Genefic Specialty Pharmacy and two of its employees who were former employees of Kroger.

The lawsuits were filed in Tennessee and Alabama, respectively. The basis for the injunction arose from a non-compete clause in the contract

between the two employees and a company which was later acquired by Kroger. In April 2024, the Court in the Tennessee case granted the

preliminary injunction on the Tennessee employee, which is due to expire in April 2025. The case against the Tennessee employee is under

appeal. No injunction has yet been issued against the Alabama employee.

In September 2023, Asset Group, Inc. (“Asset”)

filed a breach of contract with Dalrada Health Products (“DHP”) in the Superior Court of San Diego. The case arises out of

a Purchase Order wherein Asset agreed to pay DHP the sum of $3,240,000 for the purchase of 1,800,000 IRIS Ear Loop Face Masks during the

COVID-19 pandemic. Asset filed a complaint alleging DHP did not have authority to sell the masks. However, DHP have provided their counsel

with proof of authority and are preparing a Cross-Complaint for Asset’s material breach of the contract. This matter is currently

set for trial January 31, 2025.

In March 2024, MDIQ filed a breach of contract with

Dalrada Financial Corporation (“DFCO”) in Collin County Texas Superior Court. MDIQ was hired to process insurance claims for

COVID-19 testing performed by Empower Genomics. MDIQ failed to perform yet filed a civil collection case against DFCO for failure to pay

the invoices. DFCO is now in the process of counter suing for approximately $2,000,000 of unpaid claims that we would have benefitted

from had MDIQ performed according to the contract.

A former consultant, Simon Gray, and distribution

representative, DePrey Company, acted in concert with supplier Zhongshan Mide Hardware Products Co., Ltd. (“Mide”) to steal

Fastenal Company purchase orders and effectively try to cut Dalrada Manufacturing out of its contractual relationship. DFCO has filed

a lawsuit against DePrey Company and Simon Gray in July for a breach of contract and intentional interference with contractual relationships

in the California Southern District Court.

In June 2024, Dalrada Financial Corporation (“DFCO”)

filed a case in the California Southern District Court alleging, among other causes of action, fraud, breach of contract, unjust enrichment

following DFCO purchasing Likido company from Stuart Cox and his failure to disclose pertinent financial liabilities he had incurred prior

to the sale of the company to DFCO. Mr. Cox resides in the Philippines and service of the summons and complaint is pending.

Item 4. Mine Safety Disclosures

Not applicable to our Company.

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small

Business Issuer Purchases of Equity Securities

Market Information

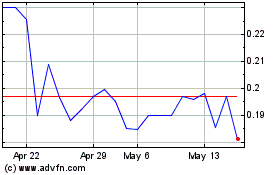

Our shares of common stock are quoted on the OTC Markets

Group’s Pink® Open Market under the symbol DFCO. Set forth below are high and low bid prices for our common stock

for each quarterly period in the two most recent fiscal years. Such quotations reflect inter-dealer prices, without retail mark-up, markdown

or commissions and may not necessarily represent actual transactions in the common stock.

| Period |

|

High |

|

|

Low |

|

| Fiscal 2024 |

|

|

|

|

|

|

|

|

| First Quarter ended September 30, 2023 |

|

$ |

0.2375 |

|

|

$ |

0.2100 |

|

| Second Quarter ended December 31, 2023 |

|

$ |

0.4600 |

|

|

$ |

0.1850 |

|

| Third Quarter ended March 31, 2024 |

|

$ |

0.2070 |

|

|

$ |

0.1450 |

|

| Fourth Quarter ended June 30, 2024 |

|

$ |

0.2325 |

|

|

$ |

0.1535 |

|

| |

|

|

|

|

|

|

|

|

| Fiscal 2023 |

|

|

|

|

|

|

|

|

| First Quarter ended September 30, 2022 |

|

$ |

0.3700 |

|

|

$ |

0.0900 |

|

| Second Quarter ended December 31, 2022 |

|

$ |

0.1700 |

|

|

$ |

0.0700 |

|

| Third Quarter ended March 31, 2023 |

|

$ |

0.0200 |

|

|

$ |

0.0800 |

|

| Fourth Quarter ended June 30, 2023 |

|

$ |

0.1900 |

|

|

$ |

0.0600 |

|

Number of Holders

As of January 8, 2025, there were 120,157,113 issued

and outstanding shares of common stock held by a total of 605 shareholders of record.

Dividends

No cash dividends were paid on our shares of common

stock during the fiscal years ended June 30, 2024, and 2023. We have not paid any cash dividends since our inception and do not foresee

declaring any dividends on our common stock in the foreseeable future.

Recent Sales of Unregistered Securities

In July 2023, the Company issued 500,000 shares of

common stock in connection with a fee for a third-party loan in the amount of 1,200,000. The company ascribed $60,000 to those shares

recorded as a debt discount. The Company issued these shares of common stock pursuant to the exemption from registration provided by Section

4(a)(2) of the Act in that such issuance did not constitute a public offering.

In July 2023, the Company issued 109,637 shares of

common stock pursuant to the Stock Purchase Agreement with Prakat Solutions Inc. for $14,413. This issuance was a follow on with certain

legacy stockholders of Prakat to the 2020 purchase by the Company of 72% of Prakat. The Company issued these shares of common stock pursuant

to the exemption from registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute a public offering.

In September and December 2023, April and May 2024,

the Company issued a total of 500,000 shares of common stock related to earn-out payments in the acquisition of Genefic Specialty Pharmacy.

The company ascribed $106,250 to those shares recorded at the value of the shares upon issuance. The Company issued these shares of common

stock pursuant to the exemption from registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute a public

offering.

In October 2023 the company issued 500,000 shares

of common stock pursuant to a loan agreement for $173,000. The Company issued these shares of common stock pursuant to the exemption from

registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute a public offering.

In December 2023 and April 2024, the Company issued

a total of 1,000,002 shares of common stock related to the acquisition of DepTec (SSCe) for $200,947. The Company issued these shares

of common stock pursuant to the exemption from registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute

a public offering.

In February 2024, the Company issued 4,666,665 shares

of common stock related to a Company conducted private placement for aggregate proceeds of $604,001, or $0.13 per share. The Company used

the proceeds for operating capital. The Company issued these shares of common stock pursuant to the exemption from registration abiding

by Rule 506 under Regulation D.

In February 2024, the Company issued 1,200,000 shares

of common stock pursuant to consulting agreements resulting in $241,200 in consultancy fees. The Company issued these shares of common

stock pursuant to the exemption from registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute a public

offering.

Preferred Stock:

On March 29, 2024, the Company converted $13,318,943

of related party debt principal and interest into 15,951 shares (effective price of $835 per share) of Series I Convertible Preferred

Stock (“Series I Stock”). The Series I Stock shall convert at one share of Series I Stock to 5,000 shares of common stock

(equivalent to converting the related dollars into common shares at $0.167 per share). The Company issued these shares of common stock

pursuant to the exemption from registration provided by Section 3(a)(9) of the Act in that such issuance did not constitute a public offering.

Pursuant to the acquisition agreement dated April

6, 2022 between the Company and Silicon Services Consortium Ltd. (“SSCe”), the sellers of SSCe were to be issued 3,000,000

shares of its common stock evenly every quarter for 24 months with the initial distribution to take place on the effective date (the “Share

Consideration”). If at the end of the 24-month stock distribution period, beginning on the effective date of April 7, 2022 (the

“Distribution Period”), the value of common stock consideration does not equate to 4,000,000 GBP (the “Target Amount”)

in value, then the Company shall issue additional stock equal to the shortfall between the value of the Share Consideration and the Target

Amount (the “Valuation Shortfall”). At the end of the Distribution Period, the sellers of SSCe were to be issued an additional

$4,440,000 in stock as a result of the Valuation Shortfall. The Company share price at the end of the Distribution Period was $0.20, creating

an additional 22,200,000 shares of common stock due to the sellers of SSCe. Pursuant to board resolution dated May 22, 2024, Valuation

Shortfall shares were issued into 4,440 shares of Series I Convertible Preferred Stock (“Series I Stock”) as opposed to common

stock. The Series I Stock shall convert at one share of Series I Stock to 5,000 shares of common stock (equivalent to converting the related

dollars into common shares at $0.167 per share). The Series I Stock does not have voting rights. The Company issued these shares of common

stock pursuant to the exemption from registration provided by Section 4(a)(2) of the Act in that such issuance did not constitute a public

offering.

On June 30, 2024, the Company converted $3,924,499

of related party debt principal and interest into 4,700 shares (effective price of $835 per share) of Series I Convertible Preferred Stock

(“Series I Stock”). The Series I Stock shall convert at one share of Series I Stock to 5,000 shares of common stock (equivalent

to converting the related dollars into common shares at $0.167 per share). The Series I Stock does not have voting rights. The Company

issued these shares of common stock pursuant to the exemption from registration provided by Section 3(a)(9) of the Act in that such issuance

did not constitute a public offering.

Other Stockholder Matters

None.

Item 6. Selected Financial Data

Not applicable to smaller reporting companies.

Item 7. Management's Discussion and Analysis of Financial Condition

and Results of Operations

You should read the following discussion and analysis

in conjunction with our financial statements, including the notes thereto, included in this Report. Some of the information contained

in this Report may contain forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933, as amended

(the “Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information

may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, or achievements

to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking

statements which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by the use

of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,”

“believe,” “intend” or “project” or the negative of these words or other variations on these words

or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance

that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those

expressed or implied by the forward-looking statements as a result of various factors. We undertake no obligation to update publicly any

forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Our Independent Registered Public Accounting Firm’s

report contains a statement that our net loss and limited working capital raise substantial doubt about our ability to continue as a going

concern. Our independent registered public accountants have stated in their report (included in Item 8 of the Financial Statements) that

our significant operating losses and working capital deficit raise substantial doubt about our ability to continue as a going concern.

We incurred a net loss of $23,250,181 and 20,627,896, respectively, for the years ended June 30, 2024 and 2023. Although the Company continues

to rely on equity and debt investors to finance its losses, it is implementing plans to achieve cost savings and other strategic objectives

to address Company profitability. In addition to raising debt and equity financing, the Company continues to focus on growing the subsidiaries

anticipated to be most profitable while reducing investments in areas that are not expected to have long-term benefits. The Company will

continue to pursue synergistic opportunities to enhance its business portfolio.

Acquisitions

During the year ended June 30, 2024, the Company acquired

a business to complement the Genefic segment.

Refer to “Note 4. Business Combinations and

Asset Acquisition” to the Condensed Consolidated Financial Statements for discussion regarding the Company’s acquisitions.

RESULTS OF OPERATIONS

The following table sets forth the results of our

operations for the years ended June 30, 2024, and 2023:

| | |

Year Ended June 30, 2024 | |

| | |

Genefic | | |

Dalrada Climate Technology | | |

Dalrada Precision Manufacturing | | |

Dalrada Technologies | | |

Corporate | | |

Consolidated | |

| Revenues | |

$ | 17,684,765 | | |

$ | 3,674,697 | | |

$ | 2,447,148 | | |

$ | 1,373,136 | | |

$ | – | | |

$ | 25,179,746 | |

| Income (Loss) from Operations | |

| (1,825,270 | ) | |

| (5,956,460 | ) | |

| (1,349,321 | ) | |

| (235,104 | ) | |

| (11,409,690 | ) | |

| (20,775,845 | ) |

| | |

Year Ended June 30, 2023 | |

| | |

Genefic | | |

Dalrada Energy | | |

Dalrada Precision Manufacturing | | |

Dalrada Technologies | | |

Corporate | | |

Consolidated | |

| Revenues | |

$ | 15,740,919 | | |

$ | 7,075,414 | | |

$ | 4,873,225 | | |

$ | 2,049,411 | | |

$ | – | | |

$ | 29,738,969 | |

| Income (Loss) from Operations | |

| (5,783,441 | ) | |

| (1,065,221 | ) | |

| (2,461,219 | ) | |

| 10,634 | | |

| (11,660,710 | ) | |

| (20,959,957 | ) |

Dalrada Financial Corporation manages five primary

segments: 1) Genefic (formerly Dalrada Health); 2) Dalrada Climate Technology; 3) Dalrada Precision Manufacturing; 4) Dalrada Technologies;

and 5) Dalrada Corporate. The business segment data (see “Note 13. Segment Reporting”) should be read in conjunction with

this discussion.

Revenues and Cost of Revenues

Genefic

Total Revenues for Genefic increased to $17,684,765,

or 12.3% from last year’s revenue of $15,740,919.

Genefic Specialty Pharmacy (formerly ‘Watson’)

revenue increased $13,049,089, or 453.8% compared to $2,875,326 in the prior year. The increase was a result of obtaining additional accreditations

including the Healthcare Merchant Accreditation from the National Association of Boards of Pharmacy (NABP) where it can be listed on the

official Accredited Merchants’ list along with larger pharmacy retailers CVS, Walgreens, and Walmart, among others. With Healthcare

merchant Accreditation, Genefic Specialty Pharmacy has proven its standards and practices to be in line with the requirements set by large

online advertising platforms such as Google and Bing. Genefic Specialty Pharmacy also obtained the Specialty Pharmacy Accreditation and

Mail Service Pharmacy Accreditation from the Utilization Review Accreditation Commission (URAC). NABP’s Specialty Pharmacy Accreditation

signifies to patients, payers, and providers that the pharmacy organization is recognized for providing an advanced level of pharmacy

services and disease management for patients taking medications that meet special handling, storage and distribution requirements. NABP’s

Digital Pharmacy Accreditation signifies to patients, payers, and providers that the pharmacy organization is recognized for its commitment

to the highest quality health care and safe pharmacy practices over the internet. The specific Digital Pharmacy Accreditation was created

to recognize safe and legitimate pharmacies with an internet presence that stands out against the ever-growing list of rogue pharmacy

websites. These accreditations allowed Genefic Specialty Pharmacy to ramp up a sales team in conjunction with the ability to fill specialty

medications. Lastly, Genefic Specialty Pharmacy was granted a number of hemophilia contracts throughout the year. The cost of revenue

was $10,612,296.

Pala Diagnostics (“Pala”) and Empower

Genomics (“Empower”) generated $27,910 of the total revenue for Genefic through its complexity CLIA diagnostic laboratories

compared with $10,338,768 in the prior year. The decrease in revenue was a result of the closure of the CLIA diagnostic laboratories,

which focused primarily on COVID-19 testing services with validated PCR and Rapid antigen testing.

DCI generated $1,338,960, or 7.6% of the total revenue

for Genefic. DCI’s revenue increased by $247,026 from the prior year, or 22.6%. The increase in revenue was a result of obtaining

Licensed Vocational Nursing (“LVN”) accreditation along with a rising number of students entering and graduating from DCI’s

Certified Nursing Assistant (“CNA”), Medical Assistant and Home Health Aid (“HHA”) Certification programs.

Dalrada Precision Manufacturing

Total Revenues for Dalrada Precision Manufacturing

decreased to $2,447,148, or 49.8% from last year’s revenue of $4,873,225.

Dalrada Precision Parts generated $1,130,905, or 46.2%

of the total revenue for Dalrada Precision Manufacturing. Revenue for Dalrada Precision Parts decreased by $1,550,001, or 57.8% from the

prior year. The decrease in revenue was due to the loss of its primary customer in precision parts manufacturing. The cost of revenue

was $427,364, or 37.8% of revenue.

DepTec generated $1,242,642, or 50.8% of the total

revenue for Dalrada Precision Manufacturing. Revenue for DepTec decreased by $49,661, or 3.8% from the prior year. DepTec records its

revenue using a cost-based input method, by which we use actual costs incurred relative to the total estimated contract costs to determine,

as a percentage, progress toward contract completion. The cost of revenues was $1,279,752, or 103.0% of revenue.

Ignite’s cleaners, parts washers and degreaser

products generated $73,601, or 3.0% of total revenue for Dalrada Precision Manufacturing. Revenue for Ignite decreased by $231,657, or

75.9% from the prior year. The decrease in revenue was due to ramping down operations of the company. The cost of revenue was $77,536,

or 105.3% of revenue, and includes inventory adjustments.

Dalrada Climate Technology (Formerly Dalrada Energy

Services)

Total Revenues for Dalrada Climate Technology decreased

to $3,674,697, or 48.1% from last year’s revenue of $7,075,414.

Dalrada Energy Services generated $567,930, or 15.5%

of the total revenue for the Dalrada Climate Technology segment. Revenue for Dalrada Energy Services decreased by $3,943,603, or 87.4%

from the prior year. The decrease in revenue was a result of nearing completion of the Averett University project.

Bothof Brothers Construction (“Bothof”) generated $2,796,199,

or 76.1% of the total revenue for the Dalrada Climate Technology segment. Bothof revenue increased by $232,318, or 9.1% from last year.

Bothof generated revenue in its construction and contracting services throughout the United States. Bothof Brothers’ customers include

both residential and commercial projects in the private and public sectors. During the year, $1,697,485 of revenue was generated through

related parties. The cost of revenue was $3,176,886, or 113.6% of revenue

Dalrada Technologies

Total Revenue for Dalrada Technologies” sole

subsidiary, Prakat, decreased to $1,373,136, or 33.0% from the prior year’s revenue of $2,049,411. The decrease in revenue was a

result of several contracts ending their terms during the year.

Operating Expenses

Total Operating Expenses decreased to $26,584,681,

or 11.4%, compared to last year’s expenses of $30,019,876.

Corporate

Total Corporate expenses decreased to $11,377,290,

or 2.4%, compared to last year’s expenses of $11,660,710.

The Corporate segment’s Selling, general and

administrative (“SG&A”) expenses consist of the following:

| |

· |

Employee compensation and benefits decreased by $522,450, or 12.2% from the prior year and is a result of a reduction in corporate employees. |

| |

|

|

| |

· |

Legal and professional fees increased by $396,486, or 39.2% from the prior year and is a result of an increase in corporate litigation as well as audit related costs. |

| |

|

|

| |

· |

Sales and marketing costs increased by $27,326, or 36.9% from the prior year due to increased costs associated with third party investor relations, paid media, and content creation expenses. |

| |

|

|

| |

· |

Other general and administrative costs for general corporate expenses, including information technology, rent, travel, and insurance decreased by $256,222, or 13.5% from the prior year and is a result of decreased in travel expenses, computer software expenses, and management fees. |

Interest Expense decreased by $1,354,290 or 53.0%

from the prior year as a result of increases in related party debt as well as PPP loans and convertible debt issued in prior years. See

“Note 7. Notes Payable” to our audited condensed consolidated financial statements included in this Annual Report on Form

10-K for more information regarding our outstanding debt.

Stock-based compensation includes expenses related

to equity awards issued to employees and non-employee directors. Stock-based compensation increased by $221,440, or 5.5% from the prior

year. See “Note 12. Stock-Based Compensation” to our audited condensed consolidated financial statements included in this

Annual Report on Form 10-K for more information regarding our stock-based compensation.

Genefic

Total Genefic expenses decreased to $7,266,439, or 36.6%, compared to last

year’s expenses of $11,468,627.

The Genefic segment’s Selling, general and administrative

(“SG&A”) expenses consist of the following:

| |

· |

Employee compensation and benefits increased by $1,255,151, or 52.4% from the prior year and a result of growth of the pharmacy business. |

| |

|

|

| |

· |

Legal and Professional Fees decreased by $1,764,960, or 71.8% from the prior year and primarily a result of a reduction in professional fees associated with COVID-19 testing services with validated PCR and Rapid antigen testing. |

| |

|

|

| |

· |

Sales and marketing costs decreased by $16,314, or 34.8% from the prior year due to reduced costs associated with third party advertising, paid media, and content creation expenses. |

| |

|

|

| |

· |

Other general and administrative costs decreased by $3,242,509, or 52.9% from the prior year and is a result of bad debt expense recorded in the prior fiscal year for Boost, Pala, and Genefic Wellness in the amounts of $1,648,562, $1,296,825, and $1,100,675, respectively. |

Dalrada Precision Manufacturing

Total Dalrada Precision Manufacturing expenses decreased

to $2,011,817, or 51.4%, compared to last year’s expenses of $4,136,885.

The Dalrada Precision Manufacturing Segment’s

Selling, general and administrative (“SG&A”) expenses consist of the following:

| |

· |

Employee compensation and benefits decreased by $1,035,630 or 70.4% from the prior year as a reduced activity in the segment. |

| |

|

|

| |

· |

Legal and Professional Fees decreased by $1,019,258, or 89.2% from the prior year. The decrease in legal fees was primarily a result of the settlement Likido Ltd.’s lawsuit with MAPtech Packaging, Inc. Pursuant to the settlement, the Company shall pay the sum of $558,252 in damages, legal costs, and reimbursement for arbitration fees and expenses paid on account by MAPtech recognized in the prior year. |

| |

|

|

| |

· |

Sales and marketing costs decreased by $2,246, or 13.3% from the prior year due to reduced costs associated with third party advertising, paid media, and content creation expenses. |

| |

|

|

| |

· |

Other general and administrative costs decreased by $67,934, or 4.5% from the prior year and is a result of a decrease in travel, trade shows and other overhead expenses required for the expansion in the Precision Parts and Ignite businesses. |

Dalrada Climate Technology

Total Dalrada Climate Technology expenses increased

to $5,204,881, or 164.2%, compared to last year’s expenses of $1,969,829.

The Dalrada Climate Technology Segment’s Selling,

general and administrative (“SG&A”) expenses consist of the following:

| |

· |

Employee compensation and benefits increased to $2,878,201, compared to $484,719 in the prior year as the energy segment continued to grow during the year. The employee resources were focused on the development of the current projects and building a future pipeline. |

| |

|

|

| |

· |

Legal and Professional Fees decreased by $292,415, or 51.0% from the prior year and is a result of the growth of the energy segment throughout the prior year. Professional fees included services for management fees and other services specific to the energy industry. |

| |

|

|

| |

· |

Sales and marketing costs increased to $19,988, a 58.6% increase from the prior year. The Company’s internal marketing generates most of the sales and marketing services which is included in the Corporate segment employee compensation and benefits expenses. |

| |

|

|

| |

· |

Other general and administrative costs increased to $2,026,225, a 125.2% increase from the prior year and is a result of management fees, travel and other general overhead costs associated with Dalrada Climate Technology’s energy upgrade business and Bothof Brothers Contracting. |

Dalrada Technologies

Total Dalrada Technologies expenses decreased to $724,254,

or 7.6%, compared to last year’s expenses of $783,825.

The Dalrada Technologies segment’s Selling,

general and administrative (“SG&A”) expenses consist of the following:

| |

· |

Employee compensation and benefits decreased by $51,363, or 15.1% from the prior year and is a result of employee wage fluctuations. |

| |

|

|

| |

· |

Legal and Professional Fees increased by $51,158, or 37.2% from the prior year and is a result of increased third-party engineering fees related to its projects. |

| |

|

|

| |

· |

Sales and marketing costs increased by $15,844, or 1,039.0% from the prior year and is a result of increased third-party advertising and marketing costs. |

| |

|

|

| |

· |

Other general and administrative costs decreased by $75,210, or 24.7% and is a result of decreases in information technology, rent, travel, and insurance costs. |

Other (Expense) Income

Other (Expense) Income increased by $2,806,572 or

844.8% from a $332,236 in Other Income in the prior year to a $2,474,336 Other Expense in the current year. The change in Other Expense

was a result of $2,090,978 of “Gain on expiration of accrued payroll taxes” due to quarterly tax liabilities that expiring

during fiscal 2023, $500,000 related to the sale of the Dalrada Energy Services intellectual property, and a $585,411 change in the fair

value of contingent liability all incurred in the prior year. Other expenses incurred for the fiscal year ended June 30, 2024 consisted

of interest expense of $1,213,441 and a change in fair value of the contingent liability of $511,892.

Net Income (Loss)

Net loss for the year ended June 30, 2024, was $23,250,181

compared to a Net loss of $20,627,721 during the year ended June 30, 2023.

Liquidity and Capital Resources

As of June 30, 2024, the Company had current assets

of $13,145,412 and current liabilities of $13,844,784 compared with current assets of $9,817,045 and current liabilities of $10,019,465

at June 30, 2023. The continuation of the Company as a going concern is dependent upon successful financing through equity and/or debt

investors and growing the subsidiaries anticipated to be profitable while reducing investments in areas that are not expected to have

long-term benefits.

The Company anticipates an increase in sales of Likido’s

Likido®ONE heat pump through its current and future customer base. Furthermore, the United States General Services Administration

(GSA) and the Department of Energy (DOE) have chosen the Company’s Likido®ONE heat pump to help reduce greenhouse emissions

from commercial buildings through high performance, low-carbon solutions set forth by the Green Proving Ground (GPG) program.

Cash Flows

| | |

Year Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| Net cash used in operating activities | |

$ | (7,925,238 | ) | |

$ | (4,612,798 | ) |

| Net cash used in investing activities | |

| (552,658 | ) | |

| (1,063,427 | ) |

| Net cash provided by financing activities | |

| 8,117,078 | | |

| 5,717,144 | |

| Net change in cash during the period, before effects of foreign currency | |

$ | (360,818 | ) | |

$ | 40,919 | |

Cash flow from Operating Activities

During the year ended June 30, 2024, the Company used

$7,925,238 of cash for operating activities compared to $4,612,798 used during the year ended June 30, 2023. The increase in the use of

cash for operating activities was primarily due to an overall increase in funding from related parties.

Cash flow from Investing Activities

During the year ended June 30, 2024, the Company used

$552,658 of cash for investing activities compared to $1,063,427 used during the year ended June 30, 2023. The decrease in the use of

cash for investing activities was due to the purchase of property plant and equipment in the prior year.

Cash flow from Financing Activities

During the year ended June 30, 2024, the Company received

$8,117,078 of cash for financing activities compared to $5,717,144 received during the year ended June 30, 2023. The increase in financing

activities was primarily due to the draw down of various note payables to fund the company.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have

or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, Revenues or expenses,

results of operations, liquidity, capital expenditures or capital resources.

Subsequent Events

On July 10, 2024, the Company entered into a promissory

note with 1800 Diagonal Lending, LLC for $87,975. The promissory note includes a one-time interest charge of 14%, which was applied on

the issuance date, and matures on May 15, 2025. There are 4 monthly payments of $10,029 and one payment of $60,175 for a total payback

of $100,291.

On July 18, 2024, the Company executed a cash advance

agreement with Cali Flower Capital Inc. with a total advance of $200,00 and payback of $299,800.

On July 25, 2024, the Company executed a revenue purchase

agreement with 24 Capital with a total advance of $125,000 and payback of $187,375.

On July 29, 2024, the Company executed a revenue purchase

agreement with Tycoon Capital Group with a total advance of $125,000 and payback of $187,375.

On August 12, 2024, the Company entered into an Exclusive

Master Distribution Agreement (the “Agreement”) with Applied Technologies of NY, Inc. (“ATI”). The Agreement establishes

the sales goals of 50 commercial heat pumps and 25 residential heat pumps in the first 18 months followed by a total of 600 heat pumps

(combined commercial and residential heat pumps) in the following 12-month period.

On August 15, 2024, the Company signed a lease for

5,650 square feet of manufacturing and office space in Portland, Oregon related to the deposition technology business. The base monthly

lease cost is $5,254 per month and expires on April 30, 2027.

On August 19, 2024, the Company acquired Grand Entrances

for the consideration of $100 in cash, including its current liabilities and assuming its lease, which includes a monthly lease cost of

$10,291 and expires on April 11, 2030.

On August 23, 2024, the Company executed a revenue

purchase agreement with Quick Funding with a total advance of $170,000 and payback of $254,150.

On September 20, 2024, the Company executed a revenue

purchase agreement with QFS Capital, LLC with a total advance of up to $1,573,781 and payback of $2,359,097.

On October 11, 2024, Vince Monteparte resigned as

a member of the Company’s Board of Directors.

On October 12, 2024, Assurance Dimensions resigned

as the Company’s auditor.

On October 15, 2024, Heather McMahon resigned as member

of the Company’s Board of Directors.

On October 18, 2024, the Company engaged CM3 Advisory

as its new auditor for the fiscal year ended June 30, 2024.

On October 23, 2024, the Company nominated Roger Campos

as a member of the Company’s Board of Directors.

Critical Accounting Policies

Our condensed consolidated financial statements and

accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America and

applied on a consistent basis. The preparation of financial statements in conformity with accounting principles generally accepted in

the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting periods.

We regularly evaluate the accounting policies and

estimates that we use to prepare our condensed consolidated financial statements. A complete summary of these policies is included in

Note 2. Summary of Significant Accounting Policies of the notes to our condensed consolidated financial statements. In general, management's

estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are

believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Accrued Payroll Taxes

The total balance for Federal Accrued Payroll Taxes

is accumulated on a quarterly basis beginning on their respective quarterly filing dates. Accrued Interest is compounded daily at an Effective

Annual Interest Rate of approximately seven percent. The individual quarterly sub-totals have a calculated expiration date of ten years

according to the Internal Revenue Service (“IRS”) statute of limitations. This timeline can be extended because of bankruptcy

or other legal action that is filed by the Company (Code 520 per IRS Federal Account Transcripts). Code 520 effectively stops the clock

for the Statute of limitations until the bankruptcy or other legal action has been removed (Code 521 per IRS Federal Account Transcripts).

In addition to the number of days between Code 520 and 521, every Code 520 automatically extends the IRS Statute of limitations by 30

days. As the quarterly sub-totals surpass their respective “Calculated Expiration Date” the Company removes the liability

from the Condensed Consolidated Balance Sheets and an equivalent amount is recognized as “Gain on expiration of accrued payroll

taxes” on the Condensed Consolidated Statements of Operations and Comprehensive Loss. The amount owing may be subject to additional

late filing fees and penalties that are not quantifiable as at the date of these condensed consolidated financial statements.

Revenue Recognition

The Company recognizes and accounts for revenue in

accordance with Accounting Standards Codification (“ASC”) 606 as a principal on the sale of goods and services. Pursuant to

ASC 606, revenue is measured based on a consideration specified in a contract with a customer, and excludes any sales incentives and amounts

collected on behalf of third parties. The Company recognizes revenue when it satisfies its performance obligation by transferring control

over a product or service to a customer.

Use of Estimates

Our condensed consolidated financial statements and

accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America and

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses

during the reporting period. The Company regularly evaluates estimates and assumptions related to the revenue, valuation of inventory,

valuation of acquired assets and liabilities, variables used in the computation of share-based compensation, litigation, and evaluation

of goodwill and intangible assets for impairment.

The Company bases its estimates and assumptions on

current facts, historical experience, and various other factors that it believes to be reasonable under the circumstances, the results

of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses

that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from

the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results

of operations will be affected.

Stock-Based Compensation

The Company records stock-based compensation in accordance

with ASC 718, Compensation – Stock Compensation, using the fair value method. All transactions in which goods or services

are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received

or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the

cost of the services received as consideration are measured and recognized based on the fair value using quoted market prices of the equity

instruments issued.

Business

Combination

ASC 805, Business

Combinations (“ASC 805”), applies the acquisition method of accounting for business combinations to all acquisitions where

the acquirer gains a controlling interest, regardless of whether consideration was exchanged. ASC 805 establishes principles and requirements

for how the acquirer: a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed,

and any non-controlling interest in the acquiree; b) recognizes and measures the goodwill acquired in the business combination or a gain

from a bargain purchase; and c) determines what information to disclose to enable users of the financial statements to evaluate the nature

and financial effects of the business combination. Accounting for acquisitions requires the Company to recognize, separately

from goodwill, the assets acquired, and the liabilities assumed at their acquisition-date fair values. Goodwill as of the acquisition

date is measured as the excess of consideration transferred and the net of the acquisition-date fair values of the assets acquired and

the liabilities assumed. While the Company uses its best estimates and assumptions to accurately value assets acquired and liabilities

assumed at the acquisition date, the estimates are inherently uncertain and subject to refinement. As a result, during the measurement

period, which may be up to one year from the acquisition date, the Company may record adjustments to the assets acquired and liabilities

assumed with the corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the values

of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded with a corresponding gain or

loss being recognized in the Condensed Consolidated Statements of Operations and Comprehensive Loss.

Goodwill and Intangible Assets

The Company accounts for goodwill and intangible assets

in accordance with ASC 350, Intangibles – Goodwill and Other (“ASC 350”). ASC 350 requires that goodwill and other intangibles

with indefinite lives should be tested for impairment annually or on an interim basis if events or circumstances indicate that the fair

value of an asset has decreased below its carrying value.

Goodwill is tested for impairment at the reporting

unit level (operating segment or one level below an operating segment) on an annual basis (June 30 for the Company) and between annual

tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying

value. The Company considers its market capitalization and the carrying value of its assets and liabilities, including goodwill, when

performing its goodwill impairment test. When conducting its annual goodwill impairment assessment, the Company initially performs a qualitative

evaluation of whether it is more likely than not that goodwill is impaired. If it is determined by a qualitative evaluation that it is

more likely than not that goodwill is impaired, the Company then applies a two-step impairment test. The two-step impairment test first

compares the fair value of the Company's reporting unit to its carrying or book value. If the fair value of the reporting unit exceeds

its carrying value, goodwill is not impaired and the Company is not required to perform further testing. If the carrying value of the

reporting unit exceeds its fair value, the Company determines the implied fair value of the reporting unit's goodwill and if the carrying

value of the reporting unit's goodwill exceeds its implied fair value, then an impairment loss equal to the difference is recorded in

the Condensed Consolidated Statements of Operations and Comprehensive Loss. The Company recorded an impairment of goodwill in the amount

of $0 and $433,556 during the years ended June 30, 2024 and 2023, respectively.

An intangible asset is an identifiable non-monetary

asset without physical substance. Such an asset is identifiable when it is separable, or when it arises from contractual or other legal

rights. Separable assets can be sold, transferred, licensed, etc. Examples of intangible assets include computer software, licenses, trademarks,

patents, films and copyrights. The Company’s intangible assets are finite lived assets and are amortized on a straight-line basis

over the estimated useful lives of the assets.

Purchase Price Allocation

Upon the completion of a business combination, the

consideration transferred as well as the assets and liabilities acquired must be recorded at their acquisition date fair values. Upon

identification of the acquirer and determination of the acquisition date, business combinations are accounted for through the preparation

of a Purchase Price Allocation (PPA). We take into consideration the five steps when completing a PPA:

Step 1: Determine the fair value of consideration

paid;

Step 2: Revalue all existing assets and liabilities

(excluding intangible assets and goodwill which are addressed in step 3 to 5 below) to their acquisition date fair values;

Step 3: Identify the intangible assets acquired;

Step 4: Determine the fair value of identifiable intangible

assets acquired; and,

Step 5: Allocate the remaining consideration to goodwill

and assess the reasonableness of the overall conclusion

Related Party Transactions

Related party transactions are conducted with parties

with which the Company has a close association, such as majority owned subsidiaries, its executive, managers, and their families. The

types of transactions that can be conducted between related parties are many, such as sales, asset transfers, leases, lending arrangements,

guarantees, allocations of common costs, and the filing of consolidated tax returns. The Company discloses any transaction that would

impact the decision making of the users of its condensed consolidated financial statements. This involves the following disclosures:

| |

· |

General. The Company discloses all material related party transactions, including the nature of the relationship, the nature of the transactions, the dollar amounts of the transactions, the amounts due to or from related parties. |

| |

· |

Receivables. The Company separately discloses any receivables from officers, employees, or affiliated entities. |

Recently Issued Accounting Pronouncements

In November 2023, the Financial Accounting Standards

Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Improvements to Reportable Segment Disclosures

(Topic 280). This ASU updates reportable segment disclosure requirements by requiring disclosures of significant reportable segment expenses

that are regularly provided to the Chief Operating Decision Maker (“CODM”) and included within each reported measure of a

segment's profit or loss. This ASU also requires disclosure of the title and position of the individual identified as the CODM and an

explanation of how the CODM uses the reported measures of a segment’s profit or loss in assessing segment performance and deciding

how to allocate resources. The ASU is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal

years beginning after December 15, 2024. Adoption of the ASU should be applied retrospectively to all prior periods presented in the financial

statements. Early adoption is also permitted. This ASU will likely result in us including the additional required disclosures when adopted.

We are currently evaluating the provisions of this ASU and expect to adopt them for the year ending June 30, 2025.

Contractual Obligations

We are a smaller reporting company as defined by Rule

12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 7A. Quantitative and Qualitative Disclosures

about Market Risk

Not applicable to smaller reporting companies.

Item 8. Financial Statements

DALRADA FINANCIAL CORPORATION

Consolidated Financial Statements

For the Years Ended June 30, 2024 and 2023

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

[EXPLANATORY NOTE]

The financial statements contained in this Annual Report on Form 10-K meet

the Alternative Reporting Standards of the OTC Markets Group Inc. and are believed by management to fairly present the financial statements

of the Company as at June 30, 2024 and for the 12 months then ended. However, they are deficient as an annual report filed under Section

13 of the Securities Exchange Act of 1934 because such financial statements do not contain a report of the Company’s PCAOB registered

independent public accounting firm. As of the date of this filing, that firm had not completed its audit procedures in respect of the

Company’s financial statements for the fiscal year ended June 30, 2024; hence, no report was included in this filing. The Company

plan to remedy this deficiency through the filing of an amended Annual Report on Form 10-K as promptly as possible, which amendment will

include an audit report and a footnote to the Company’s financial statements that will explain in tabular form any variances between

this filing and the amended filing.

DALRADA FINANCIAL CORPORATION

Condensed Consolidated Balance Sheets

| | |

| | |

| |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 501,927 | | |

$ | 812,806 | |

| Accounts receivable, net | |

| 7,403,933 | | |

| 4,453,104 | |

| Accounts receivable, net - related parties | |

| 1,236,484 | | |

| 752,348 | |

| Other receivables | |

| 680,598 | | |

| 376,604 | |

| Inventories | |

| 2,647,652 | | |

| 2,078,692 | |

| Prepaid expenses and other current assets | |

| 674,818 | | |

| 1,343,491 | |

| Total current assets | |

| 13,145,412 | | |

| 9,817,045 | |

| Noncurrent receivables | |

| 20,742 | | |

| 41,722 | |

| Noncurrent receivables - related parties | |

| 1,136,508 | | |

| 1,173,893 | |

| Property and equipment, net | |

| 1,452,282 | | |

| 1,476,082 | |

| Goodwill | |

| 4,175,758 | | |

| 3,803,147 | |

| Intangible assets, net | |

| 3,547,266 | | |

| 3,858,086 | |

| Right-of-use asset, net | |

| 2,437,034 | | |

| 2,771,854 | |

| Right-of-use asset, net - related party | |

| 1,689,806 | | |

| 2,227,286 | |

| Total assets | |

$ | 27,604,808 | | |

$ | 25,169,115 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 6,382,691 | | |

$ | 5,178,897 | |

| Accrued liabilities | |

| 1,023,286 | | |

| 1,084,008 | |

| Accounts payable and accrued liabilities – related parties | |

| 136,976 | | |

| 547,949 | |

| Deferred revenue | |

| 452,411 | | |

| 1,337,259 | |

| Notes payable, current portion | |

| 4,468,760 | | |

| 439,562 | |

| Notes payable, current portion – related parties | |

| – | | |

| 251,605 | |

| Lease liability, current portion | |

| 832,142 | | |

| 660,394 | |

| Lease liability, current portion - related party | |

| 548,518 | | |

| 519,791 | |

| Total current liabilities | |

| 13,844,784 | | |

| 10,019,465 | |

| Noncurrent payables | |

| – | | |

| 48,888 | |

| Notes payable, net of current portion | |

| 2,332,003 | | |

| 1,011,395 | |

| Notes payable, net of current portion – related parties | |

| 53,957 | | |

| 1,648,478 | |

| Contingent consideration | |

| 47,343 | | |

| 4,285,389 | |

| Lease liability, net of current portion | |

| 1,694,804 | | |

| 2,160,834 | |

| Lease liability, net of current portion - related party | |

| 1,193,312 | | |

| 1,741,830 | |

| Total liabilities | |

| 19,166,203 | | |

| 20,916,279 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 13) | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value, 100,000 shares authorized: | |

| – | | |

| – | |

| Series I preferred stock, $0.01 par value, 51,059 and 35,108 shares authorized, issued and outstanding as of June 30, 2024 and June 30, 2023, respectively | |

| 351 | | |

| 351 | |

| Series H preferred stock, $0.01 par value, 15,002 shares authorized, issued and outstanding as of June 30, 2024 and June 30, 2023, respectively | |

| 150 | | |

| 150 | |

| Series G preferred stock, $0.01 par value, 10,002 shares authorized, issued and outstanding as of both June 30, 2024 and June 30, 2023, respectively | |

| 100 | | |

| 100 | |

| Series F preferred stock, $0.01 par value, 5,000 shares authorized, issued and outstanding as of both June 30, 2024 and June 30, 2023, respectively | |

| 50 | | |

| 50 | |

| Common stock, $0.005 par value, 500,000,000 shares authorized, 97,175,443 and 88,699,139 shares issued and outstanding at June 30, 2024 and June 30, 2023, respectively | |

| 485,877 | | |

| 443,478 | |

| Common stock to be issued | |

| – | | |

| 192,925 | |

| Preferred stock to be issued | |

| 21,839,776 | | |

| – | |

| Additional paid-in capital | |

| 150,948,583 | | |

| 145,251,822 | |

| Accumulated deficit | |

| (164,741,349 | ) | |

| (141,729,009 | ) |

| Accumulated other comprehensive loss | |

| (909 | ) | |

| (50,848 | ) |

| Total Dalrada Financial Corp's stockholders' equity | |

| 8,532,629 | | |

| 4,109,019 | |

| Noncontrolling interests | |

| (94,024 | ) | |

| 143,817 | |

| Total stockholders' equity | |

| 8,438,605 | | |

| 4,252,836 | |

| Total liabilities and stockholders' equity | |

$ | 27,604,808 | | |

$ | 25,169,115 | |

(The accompanying notes are an integral part of these

condensed consolidated financial statements)

DALRADA FINANCIAL CORPORATION

Condensed Consolidated Statements of Operations and

Comprehensive Loss

| | |

| | | |

| | |

| | |

Year Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| Revenues | |

$ | 23,461,914 | | |

$ | 27,456,223 | |

| Revenues - related party | |

| 1,717,832 | | |

| 2,282,746 | |

| Total revenues | |

| 25,179,746 | | |

| 29,738,969 | |

| Cost of revenues | |

| 19,370,910 | | |

| 20,679,050 | |

| Gross profit | |

| 5,808,836 | | |

| 9,059,919 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative | |

| 26,584,681 | | |