UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

———————

FORM 8-K

———————

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

March 5, 2009

———————

Dinewise, Inc.

(Exact Name of Registrant as Specified in Its Charter)

———————

|

|

|

|

|

|

|

333-100110

|

|

Nevada

|

|

01-0741042

|

|

(Commission

File Number)

|

|

(State or Other

Jurisdiction of Incorporation)

|

|

(IRS Employer

Identification No.)

|

500 Bi-Country Boulevard, Suite 400

Farmingdale, NY,11735

(Address of Principal Executive Offices, Zip Code)

(631) 694-1111

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement.

On March 5, 2009, Dinewise Inc. (the “Company”), entered into a waiver agreement with Dutchess Private Equities Fund, Ltd. (the “Lender”) with respect to its July 14, 2006 Debenture Agreement and its February 16, 2007 Debenture Agreement, as amended to date, (collectively, “Debentures”), its Subscription Agreement dated July 14, 2006, its Debenture Registration Rights Agreement dated July 14, 2006, and any and all other documents and agreements executed in connected with the transactions contemplated by the Debentures (collectively the “Transaction Documents”). The material changes are as follows:

1) The Lender waived all covenants and Events of Default, set forth in the Transaction Documents, in connection with the Company’s Listing and Reporting Obligations, including the below mentioned Event of Default and covenants.

(i) The Subscription Agreement requires the Company to file all reports required to be filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 (the “1934 Act”) and to maintain its status as a reporting company under the 1934 Act.

(ii) The Subscription Agreement requires the Company to file all reports required to be filed under the Sarbanes–Oxley Act (“S-OX”) and to remain compliant with S-OX and its rules and regulations.

(iii) The Subscription Agreement requires the Company to make available to the Lender certain financial information.

(iv) The Subscription Agreement requires the Company to maintain the listing of the Company’s Common Stock on a national securities exchange and an automated quotation system.

(v) The Debenture Registration Rights Agreement requires the Company to pay the Lender certain amounts in case of any suspension in the Lender’s right to sell securities under a registration statement , until such suspension ceases.

(vi) Under the Debentures, an Event of Default occurs upon the suspension or delisting of the Company’s Common Stock from any recognized exchange including electronic over-the-counter bulletin board.

2) The Company and the Lender further agreed as follows:

Effective with the quarter ended March 29, 2009, and each quarter thereafter, the Company shall provide the Lender with a quarterly income statement and balance sheet consistent with the format provided in previous Form 10Qs. The quarterly income statement and balance sheet shall be provided by the 45th day following the Company’s fiscal quarter end (next business day following the 45

th

day if on a weekend or Holiday).

If Lender requests, effective with the fiscal month ended May 3, 2009 , the Company shall provide a monthly income statement and balance sheet to the Lender by the 30th day following the fiscal month end (next business day following the 30

th

day if on a weekend or Holiday).

Effective for the Company’s fiscal year end December 27, 2009, should the Lender request an external accountant’s compilation report, that report shall be provided to the Lender by the 90th day following the fiscal year end (next business day following the 90

th

day if on a weekend or Holiday) and shall be provided at the Company’s own expense. The Lender shall provide the Company with at least 60 days written notice of this request.

3) The Company shall immediately issue to the Lender three hundred and seventy thousand (370,000) shares of the Company’s Common Stock.

Item 3.03

Material Modification to Rights of Security Holders.

See Item 1.01 above.

Item 8.01

Other Events.

As a result of the waiver agreement, the Company anticipates filing a Form 15 with the Securities and Exchange Commission to terminate its reporting obligations under the Exchange Act.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

10.1

Waiver, dated March 5, 2009, by and between the Company and Dutchess.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: March 6, 2009

|

Dinewise, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/S/ T

HOMAS

M

C

N

EILL

|

|

|

Name:

|

Thomas McNeill

|

|

|

Title:

|

Vice President and Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Waiver, dated March 5, 2009 by and between the Company and Dutchess.

|

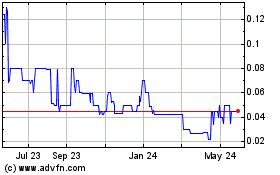

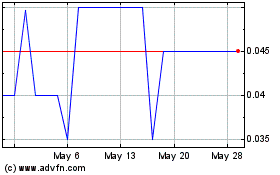

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Apr 2024 to May 2024

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From May 2023 to May 2024