false

0001829966

0001829966

2024-07-15

2024-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): July 15,

2024

___________________________

EBET, Inc.

(Exact name of registrant as specified in its

charter)

___________________________

| Nevada |

001-40334 |

85-3201309 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

3960

Howard Hughes Parkway, Suite 500, Las

Vegas, NV 89169

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (888) 411-2726

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

___________________________

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act: None

Item 2.04. Triggering

Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The

disclosure set forth in Item 8.01 below is incorporated herein by reference.

Item 8.01. Other Events.

As previously reported, on June 30, 2023, EBET,

Inc. (the “Company”), the subsidiaries of the Company and CP BF Lending, LLC (“Lender”), entered into a forbearance

agreement (the “Forbearance Agreement”) with respect to the credit agreement between the Company and the Lender (“Credit

Agreement”). Pursuant to the Forbearance Agreement, the Company acknowledged, among other items, that, as of June 30, 2023, it was

in default under the Credit Agreement. Pursuant to the Forbearance Agreement, the Lender agreed to forbear from exercising its rights

and remedies against the Company and the guarantors under the Credit Agreement. On April 12, 2024, the parties entered into a fourth amendment

to Credit Agreement (“Amendment”) pursuant to which the Company acknowledged that due to the issuance of an arbitration award

against the Company on or about January 5, 2024, a Termination Event (“Termination Event”) had occurred under the Credit Agreement

and Forbearance Agreement and whereon the Lender agreed that that the effective date of such Termination Event date would not take effect

until June 17, 2024.

On May 2, 2024, the Company,

the subsidiaries of the Company and the Lender entered into Forbearance Agreement Amendment No. 3 whereby among other items, the parties

confirmed the date of effectiveness of the Termination Event to be the earlier to occur of June 17, 2024 or the occurrence of another

event of default.

On June 17, 2024, the Termination

Event took effect and the Lender’s agreement to forbear from exercising its rights and remedies under the Credit Agreement ceased.

As of June 17, 2024, the Company’s total obligations to the Lender were $37,117,573.56, consisting of principal (inclusive of PIK

interest) and any and all other accrued but unpaid interest to date, but not including fees, costs and expenses now or in the future due

either directly or by way of reimbursement, all of which is immediately due and payable. The Company does not have sufficient funds to

repay the Lender and does not have any commitments for additional funds. On June 18, 2024, the Lender sent the Company and its subsidiaries

that guaranteed the debt obligations notice of termination and reservation of all rights under the Credit Agreement.

On July 15, 2024, the Company

received a notice of public foreclosure auction sale under Section 9-610 and 9-611 of the Uniform Commercial Code from the Lender (the

“Notice”). The Company has been informed that a public auction of certain Company assets will occur on August 1, 2024. The

assets include the equity and business operations contained in EBET’s subsidiary Karamba Limited, which materially includes the

Company’s websites www.karamba.com, www.generationvip.com, www.hopa.com, www.scratch2cash.com, www.griffoncasino.com, www.bettarget.com,

and www.dansk777.com (“Sites”) and other assets of EBET (including any and all litigation claims) and equity of certain other

of EBET subsidiaries. The sale of the assets is being effected via a statutory procedure under Article 9 of the Uniform Commercial Code,

which permits a creditor to exercise its right of foreclosure subsequent to a borrower’s loan default, take control of collateral

assets of a borrower and sell them while reserving rights to credit bid.

If the auction is completed,

the Sites and other assets and certain of EBET subsidiary equity holdings will be sold, and while it is expected that the Sites will continue

to operate without change, the EBET, Inc. entity itself will cease to have any further business operations.

The Form of Sale Advertisement

included in the Notice is attached as Exhibit 99.1.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

EBET, INC. |

| |

|

| |

|

| Date: July 18, 2024 |

|

| |

By: /s/

Matthew

Lourie |

| |

Matthew Lourie |

| |

Chief Financial Officer |

Exhibit 99.1

Annex B

FORM OF SALE ADVERTISEMENT

Uniform

Commercial Code Public Sale Notice Related to Assets of One or More of the Following Entities: EBET, Inc. f/k/a Esports Technologies,

Inc., Global E-Sports Entertainment Group LLC, Esportsbook Technologies Limited, EBET Curacao, N.V., ESEG Limited, Esports Product Technologies

Malta Limited, Esports Marketing Technologies Limited, Esports Technologies (Israel) Limited, Gogawi Entertainment Group Limited, Karamba

Limited, and Esports Product Trading Malta Limited

Please take notice

that CP BF Lending, LLC or its assignee (the "Secured Party"), as a secured party, offers for sale at a public

auction, pursuant to Section 9-610 of the Uniform Commercial Code of the State of New York, certain of the tangible and intangible

assets of the applicable Obligors (as defined below) pledged to it, including, without limitation, equity interests in other

entities owned by one or more Obligors, contract rights, accounts receivable, intellectual property and intellectual property rights

(including patents, copyrights, trade names, domain names), contract rights, general intangibles, payment intangibles, litigation

claims and proceeds of all of the foregoing (collectively, the "Collateral"). The Obligors are a global provider of

advanced wagering products which operate seven iGaming /online casino and sports betting brands with large European player-bases. The

virtual public auction will be held on August 1, 2024 at 7 A.M. PDT |

10 A.M. EDT | 3 P.M. GMT and will be held via Zoom

video conference. The deadline to submit a bid is July 30, 2024 at 9:00 A.M. PDT |12 P.M. PDT | 5 P.M. GMT. Information on how

to participate in the virtual auction is available upon request from the undersigned advisors to the Secured Party. The Secured

Party reserves the right to continue the UCC public sale from time to time without further publication notice.

Under certain

financial obligations and security interest instruments, the Secured Party holds claims against and security interests in the assets of

each of EBET, Inc. f/k/a Esports Technologies, Inc., an entity formed under the laws of the State of Nevada ("EBET'), Global

E-Sports Entertainment Group LLC, an entity formed under the laws of the State of Nevada ("Global"), Esportsbook Technologies

Limited, an entity formed under the laws of Ireland ("Technologies{Ireland)"), EBET Curacao, N.V., an entity formed under

the laws of Curacao ("EBET Curacao"), ESEG Limited, an entity formed under the laws of Belize ("ESEG"),

Esports Product Technologies Malta Limited, an entity formed under the laws of Malta ("Product Technologies"), Esports

Marketing Technologies Limited, an entity formed under the laws of Gibraltar ("Marketing Technologies"), Esports Technologies

(Israel) Limited, an entity formed under the laws of Israel ("Technologies (Israel)"), Gogawi Entertainment Group Limited,

an entity formed under the laws of Cyprus ("Gogawi"), Karamba Limited, an entity formed under the laws of Malta ("Karamba"),

and Esports Product Trading Malta Limited, an entity formed under the laws of Malta ("Product Trading" and together with

EBET, Global, Technologies (Ireland), EBET Curacao, ESEG, Product Technologies, Marketing Technologies, Technologies (Israel), Gogawi,

and Karamba, collectively, the "Obligors"), each as a pledgor and a debtor.

The

Collateral is comprised of the following: (i) the equity interests of Marketing Technologies pledged by Technologies (Ireland) to

the Secured Party to secure certain obligations of EBET and Technologies (Ireland) to the Secured Party, (ii) the equity interests

ofKaramba pledged by Product Technologies to the Secured Party to secure certain obligations of EBET and Product Technologies to the

Secured Party, (iii) the equity interests of Product Trading pledged by Product Technologies to the Secured Party to secure certain

obligations of EBET and Product Technologies to the Secured Party, (iv) the equity interests of EBET Curacao pledged by Global to

the Secured Party to secure certain obligations of EBET and Global to the Secured Party, subject to judicial confirmation in

Curacao, (v) all receivables and payment intangibles of certain Obligors, (vi) trade names, trademarks, patents, copyrights, domain

names and other intellectual property and intellectual property rights of EBET and all related goodwill, (vii) all contract rights

and other intangible assets of certain Obligors, and (viii) all rights and claims, whether asserted or unasserted and regardless of

the jurisdiction where such claims may be asserted, including, but not by way of limitation, all contract claims and commercial tort

claims and all possible common law, civil law, equitable or statutory claims related thereto, held by EBET, Product Technologies or

Karamba in connection with, asserted under, described in, or arising out of litigation styled EBET, Inc., Plaintiff, v Aspire

Global International Limited, a Malta Corporation; AG Communications Limited, a Malta Corporation; Aspire Global 7 Limited, a Malta

Corporation; Aspire Global PLC, a Malta Corporation; Neogames S.A.,, a Luxembourg Corporation; NeoGames Connect S.a.r.l., a

Luxembourg corporation, NeoGames Connect Limited, a Malta Corporation; and DOES I through X,., Case Number 2:23-CV-

01830-GMN-DJA, pending in the United States District Court for the District of Nevada together with all such rights and claims of

EBET, Product Technologies or Karamba which could in the future be asserted under the law and in the courts of Malta. Potential

bidders may bid on some or all of the Collateral.

The sale

will be on an "as-is, where-is" basis, with no express or implied warranties, representations, statements or conditions of any

kind made by the Secured Party or any person acting foror on behalf of the Secured Party with respect to the Collateral, the financial

condition of the Obligors or otherwise and without any recourse whatsoever to the Secured Party or any other person acting for or on behalf

of the Secured Party. The Secured Party reserves the right to exclude certain Collateral at the sale or designate bidding lots.

The Secured Party reserves the right

to credit bid, set a minimum reserve price, reject any or all bids (including without limitation any bid that it deems to have been made

by a bidder that is unable to satisfy the requirements imposed by the Secured Party upon prospective bidders in connection with the sale,

or to whom in the Secured Party's sole judgment a sale may not lawfully be made), purchase the Collateral and to credit the purchase price

therefrom against the respective obligations owing to the Secured Party and any costs of the sale, and terminate or adjourn the sale to

another time, at the sale or at any other time without further notice.

The equity interests

of Marketing Technologies, Karamba, Product Trading and EBET Curacao (the "Equity Interests") may be securities.

The Equity Interests have not been registered for sale under any federal or state securities laws and, as such, if the Equity

Interests are securities, may not be sold or otherwise transferred by or a purchaser of the Equity Interests except in accordance

with applicable law. Accordingly, each bidder will be required to execute an investment intent letter providing that: (a) the Equity

Interests are being acquired by the bidder for investment purposes only and not with a view towards the sale or distribution

thereof; (b) the bidder will be acquiring the Equity Interests only for its own account; (c) the bidder has sufficient knowledge and

experience in financial and business matters so as to be capable of evaluating the risks and merits associated with purchasing and

owning the Equity Interests; (d) the bidder has sufficient financial means to afford the risk associated with purchasing and owning

the Equity Interests; (e) bidder acknowledges that the Equity Interests have not been registered under any federal or state

securities laws and, if the Equity Interests are securities, may not be resold unless registered or, in the absence of registration,

pursuant to an available exemption from registration; (f) if the Equity Interests are represented in the form of securities

certificates, such certificates shall bear applicable restrictive selling legends; (g) the bidder has been provided with sufficient

opportunity to review and evaluate all financial information about the Equity Interests provided by Secured Party , and (h) the

bidder is an "accredited investor" as defined in Rule 501 under the Securities Act of 1933, as amended.

The closing

of a transaction involving the purchase or sale of the Equity Interests may require notification, review, and/or approval of governmental

or regulatory bodies, including but not limited to the U.S. Securities and Exchange Commission.

The Equity

Interests shall be sold for cash at such price or prices and on such other commercially reasonable terms as Secured Party may determine

in its sole discretion. Secured Party is deemed to be a qualified bidder and may credit bid for the Equity Interests.

All bids

(other than credit bids of the Secured Party) must be for cash, and the successful bidder must be prepared to deliver immediately available

good funds within two (2) business days after the sale (unless otherwise agreed in writing by the Secured Party) and otherwise comply

with the bidding requirements. Further information concerning the Collateral and the requirements for obtaining information and bidding

on the Collateral can be obtained from the advisors to the Secured Party listed below. Potential bidders may email Project+7(a)HilcoGlobal.com

or call Richelle Kalnit at 212-993-7214 or Stella Silverstein at 646-651-1953.

| Richelle Kalnit |

Stella Silverstein |

| Chief Commercial Officer & SVP |

Analyst |

| 212.993.7214 |

646.651.1953 |

v3.24.2

Cover

|

Jul. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 15, 2024

|

| Entity File Number |

001-40334

|

| Entity Registrant Name |

EBET, Inc.

|

| Entity Central Index Key |

0001829966

|

| Entity Tax Identification Number |

85-3201309

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

3960

Howard Hughes Parkway, Suite 500,

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Las

Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89169

|

| City Area Code |

(888)

|

| Local Phone Number |

411-2726

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

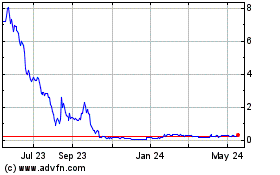

EBET (CE) (USOTC:EBET)

Historical Stock Chart

From Feb 2025 to Mar 2025

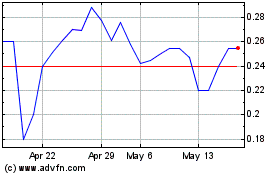

EBET (CE) (USOTC:EBET)

Historical Stock Chart

From Mar 2024 to Mar 2025