Subaru Expects More Growth In U.S.

November 17 2015 - 6:46AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/17/15)

By Yoko Kubota and Eric Pfanner

Subaru, headed for its seventh consecutive year of record U.S.

sales, expects further growth and plans to offer a new seven-seat

sport-utility vehicle to ensure it keeps up with strong demand, its

chief executive said.

Fuji Heavy Industries Ltd., the parent of Subaru, is the

smallest of Japan's seven passenger-car makers by global vehicle

sales volume, but in recent years has become the fourth-most

profitable, after Toyota Motor Corp., Nissan Motor Co. and Honda

Motor Co.

Yasuyuki Yoshinaga, CEO of Fuji Heavy, said Subaru has

established a brand position that attracts customers regardless of

the market cycle. "Usually, even if a specific model is very

popular shortly after it's launched, it slows down after a while.

But now, all kinds of models are selling well," he said. "It's

Subaru itself that is in high demand."

Much of the company's revenue and profit originate in the U.S.,

where its vehicle sales volume has tripled over the past eight

years. More than 60% of Subaru's revenue comes from North America,

backing the company's outlook of record profit for the fourth year

in a row for its fiscal year through March 2016.

A number of global auto makers are similarly optimistic on

demand in the U.S., where car sales are surging on strong consumer

confidence and low fuel prices, putting the market on track for

what could be its strongest annual showing in history. General

Motors Co. last month posted record third-quarter operating profit

in its core North American unit, on strong demand for profitable

trucks and SUVs. Toyota, the world's best-selling auto maker, this

month said it expected the U.S. market to stay strong for the

foreseeable future, as it reported record quarterly profit, though

it trimmed its sales outlook on expected weakness in emerging

markets.

Subaru expects to sell 570,000 vehicles in the U.S. this year,

up 11% from 2014. Subaru sales have increased steadily since 2007,

when it sold around 187,000 vehicles, in part because the company

expanded the size of its vehicles to match U.S. demand. The

export-reliant auto maker has also been buoyed by a weak yen and

the popularity of its driver-assist system called EyeSight that

includes precollision braking.

Karl Brauer, senior analyst at Kelley Blue Book, said Subaru as

a brand has become more widely accepted over the last decade.

"Subaru has extended its following beyond a core, dedicated group

of buyers into mainstream consumer awareness and nearly universal

affinity," he said.

To stoke demand, Mr. Yoshinaga said, Subaru plans to introduce

by 2018 an SUV that can seat as many as seven people, a successor

to its Tribeca model, which ceased production in 2014. The company

is also nearly doubling vehicle production capacity at its Indiana

plant by the end of 2016 to 394,000 vehicles, he said.

Subaru's focus on the U.S. has limited its exposure to emerging

markets like China and Russia, where demand for autos has been

slowing or declining, prompting overcapacity concerns. Subaru

hasn't been able to obtain permission from the Chinese government

to start local production.

"Auto makers are in a competition to undersell one another in

these markets. Until that calms down, we are not going to pursue

sales volume in China and Russia," he said.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

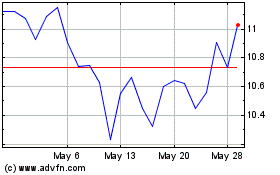

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

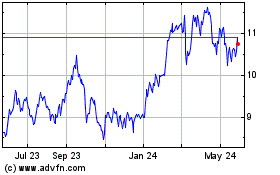

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Dec 2023 to Dec 2024