SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

November 2024

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

| Material Fact |

GOL and Abra

Enter Plan Support Agreement Including Approximately US$ 950 Million Abra Secured Debt Conversion into New GOL Equity

Enter

Agreement Alongside GOL Unsecured Creditors Committee

Financial Restructuring to Reduce

GOL's Prepetition Debt & Other

Obligations by Approximately US$

2.5 Billion

Agreement Allows for New

Exit Facility of Up to US$ 1.85 Billion

São

Paulo and London, November 06, 2024 – GOL Linhas Aéreas Inteligentes S.A. (B3: GOLL4), one of the leading airlines

in Brazil, and Abra Group Limited (“Abra”), GOL’s largest secured creditor and the majority investor of GOL and Avianca

Group International Limited, today announced that GOL, Abra and certain of their affiliates and the committee of unsecured creditors appointed

in GOL’s Chapter 11 cases (the “Committee”) have reached a Plan Support Agreement (the "PSA") in connection

with GOL’s Chapter 11 cases commenced in January 2024.

Pursuant to the PSA, GOL will

file a Chapter 11 plan of reorganization that will allow it to effectuate a significant deleveraging by converting into equity, or otherwise

extinguishing, up to US $1.7 billion of its prepetition funded debt and up to US$ 850 million of other obligations. Abra has asserted

US$ 2.8 billion in funded debt claims and has agreed to receive approximately US$ 950 million in new equity and possibly more, based upon

the resolution of certain unresolved issues, as well as US$ 850 million of take-back debt. Of the Abra take-back debt, US$ 250 million

is mandatorily convertible into new equity on or after the 30-month anniversary of GOL’s emergence from Chapter 11 based on GOL

achieving certain valuation metrics. GOL’s general unsecured creditors will also receive new equity valued up to approximately US$

235 million and possibly more, based upon the resolution of certain unresolved issues. With the PSA, GOL and its stakeholders benefit

from removal of cost and uncertainty of any litigation regarding these asserted claims and move to the next phase of the Chapter 11 cases.

GOL anticipates raising up to

US $1.85 billion of new capital in the form of an exit facility to repay GOL’s Debtor-in-Possession financing facility (the “DIP

Loan”) and provide incremental liquidity to support GOL’s go-forward strategy following its emergence from Chapter 11. Although

such capital will be raised principally in the form of long-term, senior secured debt, under the terms of the PSA, GOL may raise up to

US$ 330 million in the form of additional new equity. Abra and the Committee have agreed to support GOL and its advisors in arranging

the exit facility.

Since filing for Chapter 11

protection in January 2024, GOL obtained the DIP Loan in the amount of US$ 1.0 billion. The DIP Loan, along with approximately US$ 375

million of new financing from lessors, has allowed GOL to reinvest in its aircraft fleet. GOL has already returned a substantial portion

of its previously grounded 737 fleet back into active service and expects to be substantially completed with that rebuilding program as

it emerges from its Chapter 11 case. GOL continues to operate in the normal course during its court-supervised process.

Abra and the Committee agree

to support any request by GOL to extend GOL’s exclusive right to file and solicit votes on a Chapter 11 plan through the date on

which the Chapter 11 plan contemplated by the PSA takes effect. GOL expects to file its Chapter 11 plan of reorganization with the U.S.

Bankruptcy Court before the end of 2024 and currently expects to exit by late April 2025.

“Reaching this

agreement is another important step in our efforts to strengthen our financial position and drive GOL’s long-term

success,” said Celso Ferrer, Chief Executive Officer. “We are pleased to be moving forward with the support of our key

financial stakeholders, which reflects their confidence in our business plan and the significant opportunities ahead for GOL. With

this agreement, we now have most of the key terms of our restructuring plan in place. We look forward to arranging the necessary

capital commitments to emerge from this process better positioned than ever to execute

our long-term strategy, including improving travel affordability and experience as well as customer choice. We thank our employees for

their continued focus on serving our customers with excellence as we advance our mission of ‘Being First for All’.”

| Material Fact |

“GOL is slated to emerge

from its Chapter 11 process with a dramatically improved liquidity position and a deleveraged balance sheet with a very competitive unit

cost and strong network. We also see significant opportunities to build upon our efforts to capitalize on synergies among GOL, Avianca

and our other partner airlines,” said Adrian Neuhauser, CEO of Abra Group.

The commercial negotiations

that led to the finalization of the PSA were primarily conducted by GOL’s Special Independent Committee, consisting solely of independent

directors. This committee, ensuring a rigorous and impartial assessment, spearheaded the entire negotiation process, culminating in approval

by GOL’s Board of Directors. Notably, directors affiliated with Abra that serve on GOL’s Board of Directors recused themselves

from all stages of the discussion, review, and voting on the PSA, to avoid any actual or perceived conflicts of interest and to maintain

the integrity of the negotiation process.

As stated above, the PSA contemplates

a conversion of a significant portion of GOL’s debt and other obligations into equity. This conversion, structured to reflect the

economic value of GOL’s shares as mandated by law, is expected to result in significant dilution of GOL’s existing equity.

Throughout the restructuring process, all shareholder rights will be fully preserved, including preemptive rights, as stipulated under

Article 171 of Brazilian Law No. 6,404 (1976).

Advisors

In connection with its restructuring

efforts, GOL is working with Milbank LLP as legal counsel, Seabury Securities, LLC as investment banker and restructuring advisor, and

AlixPartners, LLP as financial advisor. In addition, Lefosse Advogados is serving as GOL’s Brazilian counsel.

Abra is working with Wachtell,

Lipton, Rosen & Katz as legal counsel and Rothschild & Co as financial advisor

in connection with the restructuring. In addition, Pinheiro Guimarães is serving as Abra’s Brazilian counsel.

In connection with the restructuring,

the Committee is working with Willkie Farr & Gallagher LLP as legal counsel, Jefferies LLC as investment banker, Alvarez & Marsal

North America, LLC as financial advisor, and Alton Aviation Consultancy LLC as aviation advisor. Additionally, Stocche, Forbes, Filizzola,

Clapis e Cursino de Moura Sociedade de Advogados is serving as the Committee’s Brazilian counsel.

About GOL

Linhas Aéreas Inteligentes S.A

GOL is Brazil's largest airline, a leader

in the corporate and leisure segments. Since it was founded in 2001, it has been the lowest unit cost company in Latin America, which

has made it possible to democratize air transport. The company has alliances with American Airlines and Air France-KLM, and offers its

customers various codeshare and interline agreements, making connections to any place served by these partnerships more convenient and

easier. With the purpose of “Being the First for All”, GOL offers the best travel experience to its passengers and the best

loyalty program, SMILES. In cargo transportation, GOLLOG makes it possible to deliver parcels to various regions in Brazil and abroad.

The company has a team of 14,000 highly qualified aviation professionals focused on safety, GOL's number one value, and operates a standardized

fleet of 138 Boeing 737 aircraft. For further information, visit www.voegol.com.br/ir.

About Abra Group

Abra Group, a UK-based company, is one of the largest and

most competitive air transport groups in Latin America. It brings together the iconic Avianca and Gol brands under a single leadership,

and a strategic investment in Wamos Air, anchoring an airline network that has one of the lowest unit costs in their respective markets,

leading loyalty programs across the region (LifeMiles and Smiles) and other synergistic businesses. The Group consolidates a team of close

to 30,000 highly qualified aviation professionals and a fleet of more than 300 aircraft serving 25 countries and more than 130 destinations.

For more information www.abragroup.net.

| Material Fact |

|

GOL Media Contacts

U.S.

Joele Frank, Wilkinson Brimmer Katcher:

Leigh Parrish / Jed Repko

lparrish@joelefrank.com / jrepko@joelefrank.com

|

South America

In Press Porter Novelli

gol@inpresspni.com.br

|

Investor Relations

ir@voegol.com.br

www.voegol.com.br/ir

Abra Investor Relations

Maria Cristina Ricardo

Head of Investor Relations

ir@abragroup.net

| Material Fact |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: November 6, 2024

| GOL LINHAS AÉREAS INTELIGENTES S.A. |

| |

|

| |

|

| By: |

/s/ Eduardo Guardiano Leme Gotilla |

|

| |

Name: Eduardo Guardiano Leme Gotilla

Title: Chief Financial and IR Officer |

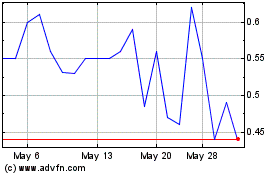

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Jan 2024 to Jan 2025