SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

November 2024

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

| Results Report 3Q24 |

GOL announces

3Q24 Earnings Result

São

Paulo, November 13, 2024 – GOL Linhas Aéreas Inteligentes S.A. (B3:

GOLL4), one of the leading airlines in Brazil and part of the ABRA Group, announced today its consolidated results for the third quarter

of 2024 (3Q24). All information herein is presented in Brazilian Reais (R$), unless otherwise noted, in accordance with international

accounting standards (IFRS), with adjusted metrics made available to enable comparison of this quarter (3Q24) with the third quarter of

2023 (3Q23) and the first nine months of 2024 (9M24) to the same period of the previous year (9M23).

Highlights

GOL – Passenger Business

| · | #1 low-cost airline in the world in on-time performance

for the fourth consecutive month and, for the seventh consecutive month, the leader in on-time performance in Brazil. |

| · | 20.9% increase in capacity in the 3Q24, measured

in seat kilometers offered (ASK), compared to the previous quarter (+6.7% 3Q24 vs 3Q23), in line with our capacity recovery plan. |

| · | Folha Top of Mind 2024 award winner for the eighth

consecutive year, showcasing GOL as the airline most remembered by Brazilians. |

| · | GOL continues to expand its international footprint.

New international route Brasília-Bogotá scheduled to start in February 2025, in addition to the return of direct flights

between Rio de Janeiro and Montevideo and the launch of the Brasília-Buenos Aires route. |

Smiles – Loyalty Program

| · | The program celebrated its 30th year

with more than 1.1 million customers subscribed to the Smiles Club, GOL’s subscription service, a 9.3% growth (3Q24 vs 3Q23). |

| · | 14.4% growth in Smiles' total sales year-over-year

(3Q24 vs 3Q23) and 7.1% growth in the year-to-date 2024 compared to 2023 (9M24 vs 9M23). |

| · | Total customers reached 23.6 million, a 6.6% growth

(3Q24 vs 3Q23), reinforcing Smiles as the largest loyalty program among Brazilian airlines. |

| · | Smiles more than doubled the volume of miles redeemed

outside of air travel products in the 3Q24 vs 3Q23, reinforcing its strategy of being the most complete travel platform. |

GOLLOG – Cargo Business

| · | 33.7% increase in GOLLOG sales of the 9M24 (vs

9M23). |

| · | 38.4% growth in total tons transported in the

9M24 (vs 9M23). |

| · | 84.4% expansion in the Mercado Livre cargo operation

of the 9M24 (vs 9M23). |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 1 |

| Results Report 3Q24 |

GOL – Passenger

Business

GOL increased its total ASK offer by 6.7%

in the 3Q24, compared to the 3Q23. In the domestic market, GOL expanded its capacity 19% compared to the previous quarter (+1.5% 3Q24

vs 3Q23), focusing on the country's main high-demand markets, such as Galeão airport (GIG), which saw 220,000 seats added in the

period, a 29% growth in capacity.

In international markets, GOL continued

to strengthen its presence with a 57% increase in ASK (3Q24 vs 3Q23, +35% vs. 2Q24), driven by the expansion of current markets such as

Buenos Aires (up 70% YoY) and Miami (+53% YoY). The Company also resumed its international operations in several airports in Brazil (Natal,

Porto Seguro and Belo Horizonte-Confins), all with flights to Buenos Aires (BUE), in addition to the launch of the new base in Bogotá,

Colombia.

Ticket sales for the new route between Brasília

(BSB) and Bogotá (BOG), the newest international base, began in 3Q24, with the first flight scheduled for February 4, 2025. This

route will have three weekly frequencies on Tuesdays, Thursdays and Saturdays, meeting the growing demand for customer and cargo transportation

between Brazil and Colombia.

GOL also bolstered its international flight

offerings at the Brasília Airport, where the Company already operates flights to Miami (MIA) and Orlando (MCO), besides reinstating

direct flights to Cancun (CUN) starting December 2024. The company also resumed direct flights between Rio de Janeiro (GIG) and Montevideo

(MVD), with four weekly frequencies. This operation strengthens GOL’s footprint in Uruguay and adds capacity at Galeão (GIG),

ahead of the 2024/2025 summer peak season.

During 3Q24, the Company returned five aircraft

(one 737-700 and four 737-800s) and received two new 737-MAXs, ending the quarter with 138 aircraft in its total fleet. Despite significant

delays in the delivery of Boeing aircrafts, GOL managed to increase its operational passenger fleet by five aircraft compared to the prior

quarter (107 vs. 102 in 2Q24), mainly due to the fleet recovery plan within the Company’s restructuring process. This supported

GOL’s increase in the total supply of seats and markets served.

Underpinning our commitment to customer

service, GOL ended the 3Q24 as the top low-cost airline in the world in on-time performance for four consecutive months and, for the seventh

consecutive month, the most punctual airline in Brazil. The Company believes its consistent performance was a key factor in the 24% improvement

in its Net Promoter Score (NPS) compared to the previous year.

In line with its plan to leverage digital

channels, GOL recorded a 2.0% increase in the quarter in direct sales through its digital channels (website and app) compared to the 3Q23.

This growth further reinforces GOL's presence and focus on digital.

On October 23, 2024, GOL was elected the

most remembered airline by Brazilians for the eighth consecutive year, achieving 30% of mentions in the most recent Folha Top of Mind

2024 survey. This recognition reflects the Company's commitment to deliver safe and reliable air travel.

| | |

GOL Linhas Aéreas Inteligentes S.A. | 2 |

| Results Report 3Q24 |

| Operational Indicators | Passengers |

|

3Q24 |

3Q23 |

Δ |

9M24 |

9M23 |

Δ |

| Average Dollar |

R$/US$ |

5.55 |

4.88 |

13.6% |

5.24 |

5.01 |

4.6% |

| Aviation Kerosene (QAV) Average |

R$/liter |

4.48 |

4.54 |

(1.3%) |

4.45 |

4.97 |

(10.4%) |

| Sales |

R$ billions |

4.4 |

4.5 |

(1.8%) |

11.6 |

12.2 |

(4.7%) |

| Punctuality |

% |

87.9 |

80.3 |

7.6 p.p. |

87.0 |

81.3 |

5.7 p.p. |

| Operational Fleet |

# |

107 |

108 |

(1) |

107 |

108 |

(1) |

| Operational Utilization Rate (Block Hours)¹ |

hours/day |

11.5 |

11.3 |

2.1% |

10.8 |

11.4 |

(4.7%) |

| Total ASK |

billions |

11.5 |

10.8 |

6.7% |

31.9 |

32.3 |

(1.4%) |

| Domestic ASK |

billions |

10.0 |

9.8 |

1.5% |

27.6 |

29.1 |

(5.2%) |

| International ASK |

billions |

1.6 |

1.0 |

57.0% |

4.3 |

3.2 |

32.4% |

| Departures |

thousand |

55.0 |

57.3 |

(4.0%) |

155.6 |

167.4 |

(7.0%) |

| Stage Lenght |

Km |

1,170 |

1,064 |

10.0% |

1,143 |

1,091 |

4.8% |

| Load Factor |

% |

83.3 |

83.7 |

(0.4 p.p.) |

82.4 |

81.4 |

1.0 p.p. |

| Domestic Load Factor |

% |

83.2 |

83.8 |

(0.6 p.p.) |

82.2 |

81.8 |

0.4 p.p. |

| International Load Factor |

% |

83.6 |

82.3 |

1.4 p.p. |

83.8 |

77.7 |

6.1 p.p. |

| Pax on board |

millions |

8.0 |

8.1 |

(1.6%) |

21.9 |

23.0 |

(4.8%) |

| Domestic Passengers |

millions |

7.5 |

7.8 |

(3.4%) |

20.6 |

22.0 |

(6.6%) |

| International Passengers |

millions |

0.5 |

0.3 |

39.8% |

1.3 |

1.0 |

36.8% |

(1) Calculated based on the number of

operational aircraft.

Smiles – Loyalty Program

In the third quarter of 2024, Smiles celebrated

its 30th anniversary, consolidating its position as one of the leading loyalty programs in Brazil. Over the course of these

three decades, Smiles has transformed the travel experience of millions of Brazilians, offering unique redemption opportunities and benefits,

reflecting its commitment to being a benchmark in customer loyalty and satisfaction.

In the third quarter, Smiles' customer base

grew by 6.6%, while the program's revenue increased by 14% compared to 3Q23. In addition, the number of Smiles Club customers reached

more than 1.1 million, an 9.3% increase when compared to 3Q23, demonstrating the success of initiatives to increase the value perceived

by Club members.

Continuing its strategy of being the most

complete travel platform, Smiles more than doubled the volume of miles redeemed outside of air travel products this quarter compared to

the previous period. This is due to the constant search for and implementation of new strategic partners, improvements in the shopping

experience and the creation of innovative products.

Operational Indicators | Smiles |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| Revenue |

R$ billions |

1.3 |

1.2 |

14.4% |

3.9 |

3.7 |

7.1% |

| Customers |

million |

23.6 |

22.2 |

6.6% |

23.6 |

22.2 |

6.6% |

| Miles Redemption Transactions |

million |

2.6 |

2.2 |

18.0% |

7.6 |

6.6 |

15.3% |

| Redeemed Miles |

billion |

68.4 |

55.8 |

22.6% |

189.2 |

173.3 |

9.2% |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 3 |

| Results Report 3Q24 |

GOLLOG – Cargo Unit

In the third quarter of 2024, GOLLOG recorded

notable growth in tons transported, with an 8.2% increase when compared to the same period in 2023. This performance was mainly driven

by the ramp-up of the Mercado Livre operation, where GOLLOG added an additional dedicated cargo aircraft in the period.

Quarterly revenue also yielded notable results,

with a 23% increase in the 3Q24 vs 3Q23 (34% 9M24 vs 9M23). GOLLOG continues to expand its operations in the cargo market, consolidating

itself as a reliable and efficient option for transporting goods throughout Brazil.

| Operational Indicators | GOLLOG |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| Revenue |

R$ millions |

314 |

256 |

22.7% |

917 |

685 |

33.7% |

| Weight Carried |

# thousand |

33.4 |

30.9 |

8.2% |

108.9 |

78.7 |

38.4% |

| Cargo Aircraft |

# |

6 |

5 |

1 |

6 |

5 |

1 |

| 2. | Consolidated Financial Result |

Revenue

In 3Q24, GOL reported a 6.3% increase in

total net revenue (vs 3Q23), with a slight reduction of 0.3% in total net revenue per seat kilometer (RASK) and 1.0% in unit passenger

revenue (Yield) in the same period, mainly due a 10% increase in the average flight stage length compared to 3Q23. This result reflects

market conditions with an average fare increase insufficient to offset the BRLUSD depreciation in the period (over 13%).

The Smiles and GOLLOG business units had

a substantial contribution to the Company’s financial performance, supporting a 19.5% increase in Other Revenue compared to the

3Q23.

| Income Statement (Revenue) |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| Net Revenue |

R$ millions |

4,960 |

4,665 |

6.3% |

13,611 |

13,732 |

(0.9%) |

| Passenger |

R$ millions |

4,467 |

4,253 |

5.0% |

12,265 |

12,510 |

(2.0%) |

| Other Revenue |

R$ millions |

493 |

413 |

19.5% |

1,345 |

1,222 |

10.1% |

| Revenue Indicators |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| RASK |

R$ cents |

43.0 |

43.1 |

(0.3%) |

42.7 |

42.5 |

0.5% |

| PRASK |

R$ cents |

38.7 |

39.3 |

(1.5%) |

38.5 |

38.7 |

(0.5%) |

| Yield |

R$ cents |

46.5 |

47.0 |

(1.0%) |

46.7 |

47.6 |

(1.8%) |

| Average Fare |

R$ |

561.7 |

526.4 |

6.7% |

554.4 |

544.1 |

1.9% |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 4 |

| Results Report 3Q24 |

Cost

Year-to-date, total costs remained in line

despite a strong devaluation of the Brazilian Real in 2024. Unit cost per available seat kilometer (CASK) was impacted mostly by the stronger

dollar and the increase in average stage length. Maintenance costs exceeded expectations for the year due to higher-than-expected unforeseen

removals of LEAP engines. GOL continues to be in close dialogue with CFM to effectively resolve this situation.

| Income Statement (Recurring Costs) |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| Operating costs and expenses |

R$ millions |

4,256 |

3,840 |

10.8% |

11,584 |

11,528 |

0.5% |

| Personnel |

R$ millions |

675 |

614 |

10.0% |

2,045 |

1,789 |

14.3% |

| Aviation fuel |

R$ millions |

1,446 |

1,405 |

3.0% |

3,956 |

4,529 |

(12.7%) |

| Landing fees |

R$ millions |

264 |

231 |

14.4% |

742 |

685 |

8.4% |

| Passenger costs |

R$ millions |

217 |

191 |

13.9% |

591 |

675 |

(12.4%) |

| Services |

R$ millions |

315 |

301 |

4.9% |

875 |

850 |

3.0% |

| Sales and marketing |

R$ millions |

231 |

229 |

1.0% |

631 |

645 |

(2.1%) |

| Maintenance material and repairs |

R$ millions |

453 |

258 |

75.9% |

1,028 |

775 |

32.6% |

| Depreciation and amortization |

R$ millions |

488 |

424 |

15.0% |

1,337 |

1,231 |

8.7% |

| Other |

R$ millions |

165 |

189 |

(12.4%) |

378 |

349 |

8.3% |

| Recurring Cost Indicators |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| CASK |

R$ cents |

36.9 |

35.5 |

3.9% |

36.4 |

35.7 |

1.9% |

| CASK Ex-Cargo operation |

R$ cents |

36.1 |

34.8 |

3.7% |

35.4 |

35.1 |

1.0% |

| CASK Fuel¹ |

R$ cents |

12.1 |

12.6 |

(4.5%) |

11.9 |

13.7 |

(13.1%) |

| CASK Ex-Fuel¹ |

R$ cents |

24.0 |

22.1 |

8.5% |

23.5 |

21.4 |

10.0% |

(1)

Excluding the dedicated cargo operation

In 3Q24, GOL recorded R$700 million in non-recurring

costs, mainly related to the Chapter 11 process, which were adjusted to ensure comparability with previous results. The details of non-recurring

costs can be found in the Reconciliation of Non-Recurring Items section at the end of this document.

EBITDA

Even with the lower cost dilution resulting

from the ASK reduction in 2024 compared to 2023 and the 13% exchange rate depreciation, the Company presented a recurring EBITDA margin

of 24.0%. This performance demonstrates the resilience of GOL's business model in the face of a challenging environment.

| |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| Recurring EBITDA |

R$ millions |

1,192 |

1,250 |

(4.6%) |

3,364 |

3,435 |

(2.1%) |

| Recurring EBITDA Margin |

% |

24.0% |

26.8% |

(2.8 p.p.) |

24.7% |

25.0% |

(0.3 p.p.) |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 5 |

| Results Report 3Q24 |

In the third quarter of 2024, the Company

generated R$697 million in cash from its operations, mainly reflecting the decision to temporarily reduce the amount of receivables factoring.

Accounts receivable grew by R$442 million in the quarter (R$2.5 billion YTD), illustrating the impact of the reduction in factoring. GOL

invested R$461 million in CAPEX, the largest portion related to engine repairs to rebuild fleet capacity. This was the main driver for

the five aircraft increase in operational aircraft despite the reduction in the total fleet. Finally, the Company's financial cash flow

used R$903 million in the quarter, due to the amortization of financial debts, interest payments and lease payments.

| Cash Flow (R$ millions) |

|

3Q24 |

3Q23 |

D |

9M24 |

9M23 |

D |

| (+) Recurring EBITDA |

|

1,192 |

1,250 |

(4.6%) |

3,364 |

3,435 |

(2.1%) |

| (+) Non-Cash and Other Effects |

|

489 |

(1,082) |

NM |

321 |

(1,032) |

NM |

| (+) Non-Recurring Adjustments |

|

(700) |

- |

NM |

(1,226) |

(45) |

NM |

| (+) Working Capital Variation |

|

(284) |

695 |

NM |

(2,924) |

50 |

NM |

| Accounts Receivable |

|

(442) |

(200) |

NM |

(2,554) |

(155) |

NM |

| Other Working Capital Accounts |

|

159 |

895 |

(82.3%) |

(371) |

204 |

NM |

| (=) Operating Cash Flow |

|

697 |

863 |

(19.2%) |

(465) |

2,407 |

NM |

| (+) CAPEX |

|

(461) |

(205) |

NM |

(1,218) |

(615) |

97.9% |

| (+) Financial Flow |

|

(903) |

(354) |

NM |

2,559 |

(1,329) |

NM |

| New Funding & Amortization |

|

(147) |

257 |

NM |

4,781 |

967 |

NM |

| Leasing |

|

(632) |

(545) |

16.1% |

(1,883) |

(1,709) |

7.3% |

| Interest and Others |

|

(124) |

(66) |

87.4% |

(390) |

(587) |

(33.6%) |

| (=) Cash Generation/Consumption (w/o Δ cambial) |

|

(668) |

303 |

NM |

876 |

463 |

89.2% |

| (+) Exchange Variation on Cash Balance |

|

(27) |

(23) |

15.0% |

240 |

(62) |

NM |

| (=) Cash Generation/Consumption |

|

(694) |

280 |

NM |

1,117 |

401 |

NM |

| Initial Cash of the Period |

|

2,593 |

714 |

NM |

782 |

592 |

32.1% |

| Final Cash of the Period |

|

1,899 |

994 |

91.1% |

1,899 |

994 |

91.1% |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 6 |

| Results Report 3Q24 |

4. Capital Structure

The Company's total cash (which includes

cash, cash equivalents and financial investments) reached R$1.9 billion in the 3Q24. Cash plus accounts receivable totaled R$5.3 billion,

representing 28.3% of last twelve months’ revenues.

As of September 30, 2024, GOL's recorded

R$19.3 billion under financial debt, of which R$5.5 billion were related to the DIP Loan. Total lease liabilities amounted to an additional

R$10.2 billion.

Total gross debt in 3Q24 was R$29.5 billion,

representing a 46% increase when compared to 3Q23 mainly due to FX devaluation and the DIP Loan. The adjusted net debt/LTM EBITDA ratio

reached 5.5x on September 30, 2024.

| Debt (R$ millions) |

|

|

3Q24 |

3Q23 |

D 3Q23 |

2Q24 |

D 2Q24 |

| Loans and Financing |

|

|

19,297 |

10,419 |

85.2% |

19,050 |

1.3% |

| Leases Payable |

|

|

10,184 |

9,808 |

3.8% |

10,170 |

0.1% |

| Gross Debt |

|

|

29,481 |

20,227 |

45.7% |

29,220 |

0.9% |

| Cash and Equivalents |

|

|

(1,899) |

(994) |

91.1% |

(2,593) |

(26.8%) |

| Net Debt¹ |

|

|

27,582 |

19,324 |

43.4% |

26,627 |

3.6% |

| Net Debt/EBITDA LTM² |

|

|

5.5x |

4.2x |

1.3x |

5.3x |

0.2x |

(1) Excludes total cash.

(2) Excludes effects of non-recurring items.

5. Fleet

This

quarter, GOL added two new Boeing 737-MAX 8 aircraft to its fleet. In addition, as part of its fleet renewal and operational efficiency

recovery plan, the Company returned five Boeing 737-NG aircraft. Despite the significant impacts caused by the delayed delivery of Boeing

aircrafts, GOL managed to increase its operational fleet by five aircraft compared to the last quarter (107 vs. 102 in 2Q24), mainly due

to the fleet recovery plan within the Chapter 11 process, which reduced the number of aircraft out of operation.

As of September 30, 2024, GOL had a total

fleet of 138 Boeing aircraft, of which 49 were 737-MAX, 83 were 737-NG and 6 were 737-800BCF freighters. The Company's fleet is 100% composed

of narrowbody aircraft from the Boeing 737 family, of which 97% are financed through operating leases and 3% are financed through finance

leases.

| | |

GOL Linhas Aéreas Inteligentes S.A. | 7 |

| Results Report 3Q24 |

The Company expects that any proposed plan

of reorganization will address, among other things, mechanisms to resolve claims by shareholders and current creditors against the Company.

Any proposed plan of reorganization will be

subject to negotiations prior to submission to the Bankruptcy Court, based on discussions with the Company's creditors and other

interested parties, and thereafter in response to objections from them and the confirmation requirements of the Bankruptcy Code

and the Bankruptcy Court's confirmation. There can be no assurance that the Bankruptcy Court will confirm the Company's

proposed plan of reorganization.

In June 2024, the Company began signing

some contractual amendments with aircraft lessors, which involved, among other things, changes in lease payment flows, supplementary leases

(maintenance reserve, maintenance deposits, guarantee deposits, among others), engine exchanges, engine rejections and the negotiation

of unsecured aircraft and engine liabilities, as detailed in explanatory notes 17 and 18 of the quarterly financial information.

On June 3, 2024, the Bankruptcy Court approved

an extension of the Company's deadline to file a plan of reorganization until October 21, 2024, and to request votes on that plan until

December 20, 2024. The Company may request additional extensions of time before emerging from Chapter 11.

On August 2, 2024, the Bankruptcy Court

approved a negotiation with Banco Santander S.A. (Brazil), Banco do Brasil S.A. and Banco Bradesco S.A., which provides, among other things,

a guaranteed line for the assignment of receivables.

In September 2024, the Company has concluded

commercial negotiations with its remaining aircraft and engine lessors and all restructuring agreements have been approved by the Bankruptcy

Court. In total, restructuring agreements were approved for 139 aircraft and 58 spare engines, whose signatures of definitive contracts

are in progress.

On November 6, 2024, the Company entered

into a Plan of Reorganization Support Agreement (PSA) with Abra Group Limited and the Committee of Unsecured Creditors, in the context

of Chapter 11. This agreement sets out the guidelines for the submission of a financial reorganization plan for the Company.

Under the PSA, the Company has committed

to convert a portion of its pre-Chapter 11 debt into equity and/or otherwise extinguish up to $1.7 billion of its debt. In addition, the

Company will also reduce its other obligations by up to US$850 million.

The Company plans to submit this reorganization

plan to the Court before the end of 2024, with the expectation of completing the restructuring process by the end of April 2025. The Company's

management believes that the successful implementation of this reorganization plan will strengthen the Company's capital structure, allowing

for a renewed focus on its operations and future growth strategies.

| | |

GOL Linhas Aéreas Inteligentes S.A. | 8 |

| Results Report 3Q24 |

Income Statement

| Income Statements in IFRS (R$ Millions) |

3Q24 |

3Q23 |

% Var. |

9M24 |

9M23 |

% Var. |

| Net Revenue |

4,960 |

4,665 |

6.3% |

13,611 |

13,732 |

(0.9%) |

| Passenger net revenue |

4,467 |

4,253 |

5.0% |

12,265 |

12,510 |

(2.0%) |

| Ancillary net revenue |

493 |

413 |

19.5% |

1,345 |

1,222 |

10.1% |

| Total Operating Costs and Expenses |

(4,956) |

(3,840) |

29.1% |

(12,810) |

(11,573) |

10.7% |

| Personnel costs |

(783) |

(614) |

27.6% |

(2,159) |

(1,789) |

20.7% |

| Fuel costs |

(1,446) |

(1,405) |

3.0% |

(3,956) |

(4,529) |

(12.7%) |

| Landing fees costs |

(264) |

(231) |

14.4% |

(742) |

(685) |

8.4% |

| Passenger costs |

(248) |

(191) |

30.0% |

(622) |

(675) |

(7.8%) |

| Services costs |

(697) |

(301) |

NM |

(1,580) |

(850) |

86.0% |

| Sales and marketing costs |

(231) |

(229) |

1.0% |

(631) |

(645) |

(2.1%) |

| Maintenance material and repairs |

(506) |

(258) |

96.4% |

(1,212) |

(820) |

47.8% |

| Depreciation and amortization costs (D&A) |

(488) |

(424) |

15.0% |

(1,337) |

(1,231) |

8.7% |

| Others |

(292) |

(189) |

54.8% |

(570) |

(349) |

(63.3%) |

| Operating Results (EBIT) |

3 |

825 |

(99.6%) |

801 |

2,159 |

(62.9%) |

| Operating Margin |

0.1% |

17.7% |

(17.6 p.p.) |

5.9% |

15.7% |

(9.8 p.p.) |

| Other Financial Income (Expenses) |

(832) |

(2,081) |

NM |

(1,713) |

(2,243) |

(23.6%) |

| Interest on loans and financing |

(1,346) |

(976) |

37.9% |

(3,740) |

(2,765) |

35.2% |

| Gains from financial investments |

29 |

40.3 |

(28.9%) |

116 |

117 |

(1.2%) |

| Monetary and foreign exchange variation |

549 |

(1,002) |

NM |

(2,912) |

477 |

NM |

| Net result from derivatives |

(6) |

12 |

NM |

(16) |

(12) |

27.5% |

| ESN and capped calls results |

(21) |

(11) |

89.9% |

5,020 |

9 |

NM |

| Other net expense (income) |

(37) |

(144) |

(74.0%) |

(181) |

(68) |

NM |

| Profit (Loss) Before IR/CS |

(829) |

(1,256) |

(34.0%) |

(912) |

(83) |

NM |

| Income Tax |

(1) |

(45) |

(97.7%) |

(39) |

(41) |

(4.4%) |

| Current income tax |

(8) |

(20) |

(60.5%) |

(9) |

(36) |

(75.5%) |

| Deferred income tax |

7 |

(25) |

NM |

(30) |

(5) |

NM |

| Profit (Loss) for the Period |

(830) |

(1,300) |

(36.2%) |

(951) |

(124) |

NM |

| Net margin |

(16.7%) |

(27.9%) |

(39.9%) |

(7.0%) |

(0.9%) |

NM |

| EBITDA |

491 |

1,250 |

(60.7%) |

2,138 |

3,390 |

(36.9%) |

| EBITDA margin |

9.9% |

26.8% |

(16.9 p.p.) |

15.7% |

24.7% |

(9.0 p.p.) |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 9 |

| Results Report 3Q24 |

Non-recurring items reconciliation

The table below provides a reconciliation of

our reported amounts with adjusted amounts, excluding non-recurring items:

| (R$ millions) |

Reported |

Non Recurring

3Q24 |

Recurring

3Q24 |

Reported |

Non Recurring

9M24 |

Recurring

9M24 |

| Net revenue |

4,960 |

- |

4,960 |

13,611 |

- |

13,611 |

| Operating costs and expenses |

4,956 |

700 |

4,256 |

12,810 |

1,226 |

11,584 |

| Personnel |

783 |

108 |

675 |

2,159 |

114 |

2,045 |

| Maintenance material and Repairs |

506 |

53 |

453 |

1,212 |

184 |

1,028 |

| Passengers |

248 |

31 |

217 |

622 |

31 |

591 |

| Services |

697 |

382 |

315 |

1,580 |

705 |

875 |

| Others |

292 |

127 |

165 |

570 |

192 |

378 |

| EBITDA |

491 |

700 |

1,192 |

2,138 |

1,226 |

3,364 |

| EBITDA Margin |

9.9% |

14.1 p.p. |

24.0% |

15.7% |

9.0 p.p. |

24.7% |

Glossary

https://ri.voegol.com.br/en/information-for-investors/glossary/

| | |

GOL Linhas Aéreas Inteligentes S.A. | 10 |

| Results Report 3Q24 |

Balance Sheet – IFRS

| (R$ millions) |

3Q24 |

3Q23 |

% Var. |

| Assets |

21,829 |

17,191 |

27.0% |

| Current Assets |

7,046 |

3,539 |

99.1% |

| Cash and Cash Equivalents |

1,523 |

523 |

NM |

| Investments |

215 |

382 |

(43.6%) |

| Trade Receivables |

3,375 |

1,045 |

NM |

| Inventories |

421 |

439 |

(4.2%) |

| Deposits |

492 |

278 |

77.1% |

| Advance to Suppliers and Third Parties |

525 |

387 |

35.5% |

| Recoverable Taxes |

78 |

231 |

(66.1%) |

| Rights from Derivative Transactions |

13 |

16 |

(21.5%) |

| Other Credits |

405 |

238 |

70.1% |

| Non-Current Assets |

14,783 |

13,652 |

8.3% |

| Long Term Investments |

161 |

89 |

81.7% |

| Deposits |

2,707 |

2,413 |

12.2% |

| Advance to Suppliers and Third Parties |

25 |

100 |

(75.3%) |

| Taxes to Recover |

15 |

15 |

0.7% |

| Deferred Taxes |

0 |

76 |

(99.8%) |

| Other Credits |

14 |

22 |

(35.8%) |

| Fixed Assets |

9,845 |

9,036 |

8.9% |

| Intangible Assets |

2,016 |

1,901 |

6.1% |

| Liabilities and Equity |

45,861 |

17,191 |

NM |

| Current Liabilities |

23,206 |

13,996 |

64.6% |

| Loans and Financing |

9,719 |

1,152 |

NM |

| Leases to Pay |

1,953 |

1,803 |

8.3% |

| Suppliers |

2,395 |

2,159 |

3.1% |

| Labor Obligations |

757 |

670 |

12.9% |

| Taxes and Contributions to Collect |

193 |

186 |

4.1% |

| Airport Fees |

1,098 |

1,553 |

(29.3%) |

| Advance Ticket Sales |

3,278 |

3,637 |

(9.9%) |

| Frequent-Flyer Program |

2,023 |

1,592 |

27.1% |

| Advances from Ticket Sales |

23 |

374 |

(93.8%) |

| Provisions |

1,241 |

538 |

NM |

| Liabilities with Derivative Transactions |

18 |

0 |

NM |

| Other Liabilities |

507 |

332 |

52.6% |

| Non-Current Liabilities |

22,654 |

25,224 |

(10.2%) |

| Loans and Financing |

9,578 |

9,267 |

3.4% |

| Leases to Pay |

8,231 |

8,005 |

2.8% |

| Taxes and Contributions to Collect |

296 |

161 |

(84.0%) |

| Frequent-Flyer Program |

155 |

172 |

(10.1%) |

| Lp Provisions |

2,922 |

2,892 |

(1.1%) |

| Deferred Taxes |

229 |

40 |

NM |

| Obligations with Derivative Transactions |

80 |

3,409 |

(97.6%) |

| Other Liabilities |

1,164 |

1,278 |

(8.9%) |

| Equity |

(24,031) |

(22,029) |

8.3% |

| Share Capital |

4,045 |

4,041 |

0.1% |

| Shares to be issued |

26 |

- |

NM |

| Treasury Shares |

- |

(18) |

(100.0%) |

| Capital Reserve |

399 |

441 |

(9.7%) |

| Equity Valuation Adjustments |

(533) |

(601) |

(11.2%) |

| Accumulated losses |

(27,942) |

(25,893) |

7.3% |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 11 |

| Results Report 3Q24 |

Cash Flow – IFRS

| (R$ millions) |

3Q24 |

3Q23 |

% Var. |

9M24 |

9M23 |

% Var. |

| Net profit (loss) for the period |

(830) |

(1.300) |

(36.2%) |

(951) |

(124) |

NM |

| Depreciation - aeronautical right of use |

248 |

228 |

8.6% |

707 |

677 |

4.4% |

| Depreciation and amortization - other |

240 |

197 |

21.8% |

630 |

555 |

13.6% |

| Provision for doubtful accounts |

(1) |

(0) |

NM |

0 |

(3) |

NM |

| Constitution (reversal) of provision |

537 |

178 |

NM |

1,012 |

665 |

52.3% |

| Provision for inventory obsolescence |

0 |

0 |

(47.9%) |

1 |

0 |

70.7% |

| Provision for impairment of deposits |

25 |

- |

NM |

30 |

- |

NM |

| Provision for loss on advance from suppliers |

(2) |

- |

NM |

(2) |

- |

NM |

| Adjustment to present value of provisions |

76 |

45 |

71.4% |

211 |

142 |

48.9% |

| Deferred taxes |

(7) |

25 |

NM |

30 |

5 |

NM |

| Write-off of fixed and intangible assets |

- |

- |

NM |

- |

- |

NM |

| Sale-leaseback - Retroleases |

(48) |

(43) |

11.0% |

(167) |

(116) |

44.8% |

| Contractual changes to leases |

(8) |

- |

NM |

(56) |

(68) |

(17.1%) |

| Exchange and monetary variations, net |

(554) |

(67) |

NM |

2.631 |

(1,634) |

NM |

| Financial results on debt |

0 |

- |

NM |

90 |

- |

NM |

| Interest on loans and leases and amortization of costs, premiums and goodwill |

1,219 |

785 |

55.2% |

3,263 |

2,176 |

49.9% |

| Goodwill on financing operations |

71 |

27 |

NM |

124 |

48 |

NM |

| Result of transactions with fixed and intangible assets |

- |

85 |

(100.0%) |

- |

(99) |

(100.0%) |

| Results of derivatives recognized in profit or loss |

27 |

2 |

NM |

(5,004) |

94 |

NM |

| Share-based remuneration |

1 |

3 |

(57.2%) |

6 |

11 |

(40.0%) |

| Other provisions |

(6) |

(6) |

(3.2%) |

(14) |

(18) |

(23.7%) |

| Adjusted net income (loss) |

990 |

157 |

NM |

2,541 |

2,311 |

9.2% |

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| Financial investments |

17 |

901 |

(98.2%) |

254 |

788 |

(67.7%) |

| Accounts receivable |

(442) |

(200) |

NM |

(2,554) |

(155) |

NM |

| Inventories |

(8) |

(47) |

(83.4%) |

(59) |

(1) |

NM |

| Deposits |

(56) |

(95) |

(41.6%) |

(382) |

(45) |

NM |

| Advances to suppliers and third parties |

85 |

(60) |

NM |

(28) |

(116) |

(75.7%) |

| Recoverable taxes |

34 |

(85) |

NM |

86 |

3 |

NM |

| Variable leases |

1 |

(3) |

NM |

13 |

1 |

NM |

| Suppliers |

(33) |

(174) |

(80.9%) |

197 |

(167) |

NM |

| Suppliers - Drawn risk |

- |

20 |

(100.0%) |

(21) |

10 |

NM |

| Transportation to be conducted |

322 |

401 |

(19.7%) |

147 |

135 |

9.4% |

| Mileage program |

(5) |

(12) |

(59.0%) |

174 |

(105) |

NM |

| Customer advances |

(39) |

(90) |

(56.5%) |

(126) |

(29) |

NM |

| Labor obligations |

58 |

161 |

(63.9%) |

(10) |

316 |

NM |

| Airport taxes and fees |

27 |

161 |

(83.5%) |

2 |

323 |

(99.5%) |

| Taxes payable |

9 |

78 |

(88.6%) |

(54) |

22 |

NM |

| Obligations with derivative operations |

8 |

(0) |

NM |

67 |

(2) |

NM |

| Provisions |

(323) |

(195) |

65.1% |

(717) |

(815) |

(12.0%) |

| Other credits (obligations) |

61 |

(66) |

NM |

86 |

(114) |

NM |

| Interest paid |

(124) |

(162) |

(23.4%) |

(390) |

(683) |

(42.9%) |

| Net cash generated by operating activities |

582 |

691 |

(18.4%) |

(772) |

1,678 |

NM |

| Advance for acquisition of fixed assets, net |

- |

- |

NM |

- |

- |

NM |

| Acquisition of fixed assets |

(428) |

(171) |

NM |

(1,116) |

(511) |

NM |

| Acquisition of intangible assets |

(66) |

(34) |

95.0% |

(134) |

(105) |

27.8% |

| Receipts from sale-leaseback operations |

33 |

- |

NM |

33 |

0 |

NM |

| Net cash used in investment activities |

(461) |

(205) |

NM |

(1,218) |

(616) |

97.8% |

| Borrowings from loans and financing |

(40) |

450 |

NM |

5,032 |

1,409 |

NM |

| Loan repayments |

(106) |

(193) |

(44.9%) |

(254) |

(443) |

(42.6%) |

| Lease payments - aeronautical |

(619) |

(535) |

15.6% |

(1,795) |

(1,677) |

7.0% |

| Lease payments - other |

(14) |

(9) |

44.5% |

(37) |

(32) |

18.8% |

| Capital increase |

- |

0 |

(100.0%) |

3 |

0 |

NM |

| Shares to issue |

- |

96 |

(100.0%) |

- |

96 |

(100.0%) |

| Net cash used in financing activities |

(779) |

(192) |

NM |

2,948 |

(646) |

NM |

| Exchange variation in cash of subsidiaries abroad |

(27) |

(23) |

15.0% |

240 |

(62) |

NM |

| Cash and cash equivalents at the beginning of the period |

2,207 |

253 |

NM |

324 |

169 |

92.0% |

| Cash and cash equivalents at the end of the period |

1,523 |

523 |

NM |

1,523 |

523 |

NM |

| | |

GOL Linhas Aéreas Inteligentes S.A. | 12 |

| Results Report 3Q24 |

About GOL Linhas Aéreas Inteligentes

S.A

GOL is a leading

domestic airline in Brazil and part of Abra Group. Since it was founded in 2001, the Company has the lowest unit cost in Latin America,

democratizing air transportation. The Company has alliances with American Airlines and Air France-KLM and provides eighteen codeshares

and interline agreements to its Customers, bringing more convenience and simple connections to any place served by these partnerships.

With the purpose of “Being the First for All,” GOL offers the best travel experience to its passengers and the best frequent-flyer

program, Smiles. In cargo transportation, Gollog delivers orders to different regions in Brazil and abroad. The Company has a team of

13,900 highly qualified aviation professionals focused on Safety. GOL’s #1 value and operates a standardized fleet of 138 Boeing

737 aircraft. The Company's shares are traded on the B3 (GOLL4). For further information, go to www.voegol.com.br/ir.

Investor Relations

ri@voegol.com.br

www.voegol.com.br/ri

| | |

GOL Linhas Aéreas Inteligentes S.A. | 13 |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: November 13, 2024

| GOL LINHAS AÉREAS INTELIGENTES S.A. |

| |

|

| |

|

| By: |

/s/ Eduardo Guardiano Leme Gotilla |

|

| |

Name: Eduardo Guardiano Leme Gotilla

Title: Chief Financial and IR Officer |

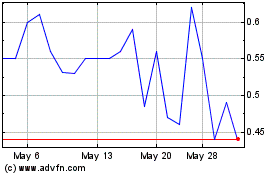

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

GOL Linhas Aereas Inteli... (PK) (USOTC:GOLLQ)

Historical Stock Chart

From Jan 2024 to Jan 2025